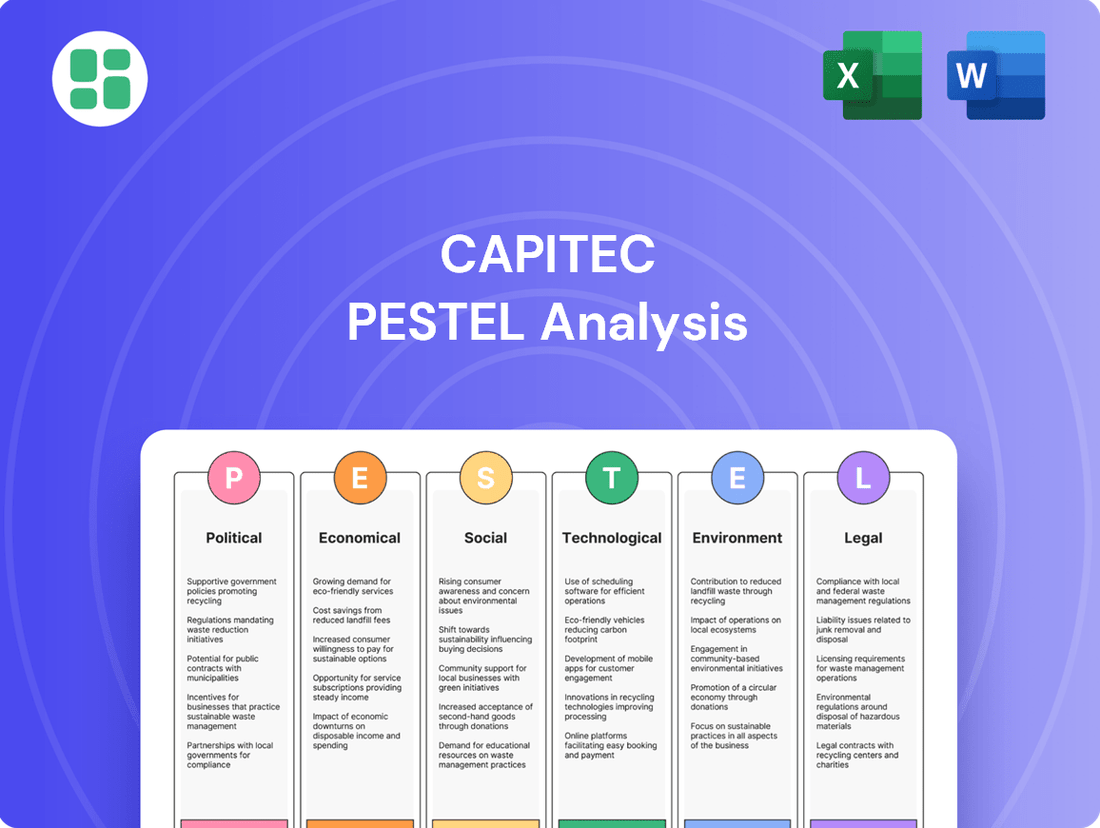

CAPITEC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAPITEC Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Capitec's trajectory. This comprehensive PESTLE analysis offers actionable intelligence to anticipate market shifts and capitalize on opportunities. Download the full version to gain a strategic advantage.

Political factors

Capitec Bank's operating environment is significantly shaped by South Africa's political landscape, particularly following the May 2024 general elections which resulted in the formation of a coalition government. This new political configuration is being closely watched for its impact on economic policy and stability.

The prevailing sentiment suggests that a stable Government of National Unity could foster greater economic confidence, which is vital for Capitec's growth prospects. The bank's leadership, including its CEO, has highlighted the critical need for political actors to champion policies that stimulate economic expansion and tackle persistent challenges such as the nation's high unemployment rate, which stood at 32.9% in the first quarter of 2024.

The South African Reserve Bank (SARB) and the Prudential Authority (PA) are the primary watchdogs for banks like Capitec. These bodies enforce rules designed to keep the financial system stable and protect consumers. Capitec must navigate these regulations, including those under the Financial Intelligence Centre Act (FIC Act), which targets financial crime.

In December 2024, the PA issued administrative sanctions against Capitec for not fully complying with certain FIC Act requirements. This action underscores the strictness of the regulatory landscape and the critical need for banks to consistently meet these obligations. Such compliance is crucial for maintaining operational integrity and avoiding penalties.

South Africa's commitment to exiting the Financial Action Task Force (FATF) grey list, a status it entered in early 2023, significantly influences financial institutions like Capitec. The government's proactive stance includes the introduction of an AML and CTF Amendment Bill in December 2024, designed to bolster compliance and rectify identified shortcomings.

Banks are now tasked with implementing more rigorous due diligence and enhanced risk management frameworks, particularly for novel product offerings. This heightened scrutiny is in preparation for an anticipated FATF evaluation scheduled for early 2025, which will assess the nation's progress in combating financial crime.

Consumer Protection Legislation

Government policies and legislation designed to protect consumers significantly shape how financial institutions, like Capitec, develop and deliver their services. These regulations aim to ensure fairness, transparency, and security for customers. The upcoming Conduct of Financial Institutions (COFI) Bill, though not tabled before the May 2024 elections, signals a trend towards more comprehensive regulatory oversight for all financial service providers, including those offering innovative, non-traditional banking solutions.

This evolving regulatory landscape means banks must adapt their product offerings and operational procedures to comply with new consumer protection standards. For instance, enhanced disclosure requirements or stricter rules on fees and charges could impact profitability and operational costs. The focus on a single standard of industry conduct under COFI suggests a leveling of the playing field, requiring all players to meet a baseline of consumer protection, which could benefit established institutions by increasing trust.

- Regulatory Focus: The COFI Bill aims to consolidate financial legislation, creating a unified standard for industry conduct.

- Post-Election Impact: While not tabled before the May 2024 elections, the Bill's principles indicate a future of increased regulatory scrutiny.

- Industry-Wide Application: The legislation is intended to apply to all financial service providers, including non-traditional entities.

- Consumer Trust: Stricter consumer protection measures can bolster public confidence in the financial sector.

Political Interventions and Economic Growth Initiatives

Government initiatives aimed at stimulating economic growth, particularly in tackling South Africa's persistent unemployment and skills gaps, present a significant political backdrop for Capitec. These policies can either foster an environment conducive to expansion or introduce regulatory hurdles.

Capitec's strategic push into business banking, with a specific focus on small and medium-sized enterprises (SMEs), directly supports national objectives to invigorate economic activity and broaden financial inclusion. For instance, the South African government has pledged significant investment in SME development programs, aiming to create jobs and foster innovation. In 2024, the Department of Small Business Development announced plans to disburse R5 billion to support SMEs, a move that directly benefits banks like Capitec that serve this sector.

- Government commitment to SME growth: Policies designed to boost entrepreneurship and job creation within the SME sector.

- Financial inclusion targets: National agendas promoting access to banking services for previously underserved populations and businesses.

- Skills development programs: Government-backed initiatives to upskill the workforce, potentially reducing operational costs and increasing customer base for financial institutions.

- Regulatory environment: The political stability and the nature of financial regulations enacted by the government directly impact Capitec's operational landscape and expansion strategies.

The formation of a coalition government after the May 2024 general elections introduces a new political dynamic for Capitec, with economic policy and stability under close observation.

A stable government is crucial for fostering economic confidence, essential for Capitec's growth, especially in addressing South Africa's high unemployment rate, which was 32.9% in Q1 2024.

Capitec must navigate stringent regulations from the SARB and PA, including compliance with the FIC Act, as evidenced by administrative sanctions in December 2024 for non-compliance.

South Africa's efforts to exit the FATF grey list by early 2025, supported by measures like the AML and CTF Amendment Bill, necessitate enhanced due diligence from Capitec.

What is included in the product

This CAPITEC PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a comprehensive overview of its external landscape.

A CAPITEC PESTLE analysis, presented in a clear, summarized format, alleviates the pain point of information overload, enabling stakeholders to grasp key external factors impacting the business efficiently during strategic discussions.

Economic factors

South Africa's elevated interest rate environment, with the repurchase rate standing at 8.25% as of May 2024, continues to exert pressure on household disposable income and the financial health of small and medium-sized enterprises. This high cost of borrowing directly impacts the affordability of credit for consumers and businesses alike.

Despite the South African Reserve Bank (SARB) implementing a cumulative 75 basis point reduction in the policy rate since September 2024, which has eased interest expenses for banks on their deposits, the persistent challenge of high food prices, coupled with these interest rates, is anticipated to maintain elevated loan impairment levels for Capitec throughout FY2025.

A sluggish domestic economy and a high unemployment rate, which stood at 33.5% in early 2024, present significant headwinds for Capitec. These conditions directly impact consumer spending power and, consequently, the credit quality of its loan book, potentially leading to higher default rates.

Despite these economic challenges, Capitec demonstrated resilience. The bank reported a strong first-half profit increase in 2024, partly fueled by an expansion in its lending activities. This growth is underpinned by optimism surrounding a potential economic revival following the establishment of the Government of National Unity, suggesting a belief in future economic improvement.

Household leverage is projected to hold steady around 62% through 2025. However, this stability masks underlying pressures, with banks anticipating higher impairment charges. This is largely attributed to the persistent impact of elevated food prices and increased interest rates on consumers' ability to manage their debt.

Capitec's operational data reflects these shifting consumer behaviors. The bank has observed a notable transition from cash transactions to digital payment methods. This is evidenced by a significant surge in card usage and a substantial increase in interactions with its banking app, underscoring a growing reliance on digital channels for financial activities.

Credit Quality and Non-Performing Loans (NPLs)

Capitec's emphasis on unsecured retail lending means its asset quality could face ongoing challenges, potentially resulting in higher credit losses compared to competitors. This segment of lending is inherently more sensitive to economic downturns and borrower financial stress.

Projections indicate a rise in non-performing loans (NPLs) to around 26% of gross loans for the fiscal year 2024. This metric is a key indicator of the health of a lender's loan portfolio.

Despite the projected NPL increase, the group's credit loss ratio showed a positive trend, decreasing from 8.7% in FY24 to 6.9% in FY25, when excluding the impact of AvaFin. This suggests some improvement in managing existing credit risks.

- Asset Quality Focus: Capitec's core business in unsecured retail lending presents a higher risk profile for asset quality.

- NPL Projections: Expected NPLs to reach approximately 26% of gross loans in FY2024 highlight potential credit risk.

- Credit Loss Ratio Improvement: A reduction in the credit loss ratio from 8.7% (FY24) to 6.9% (FY25, excluding AvaFin) indicates better risk management.

Diversification of Income Streams

Capitec is strategically broadening its income sources, moving beyond its core lending and transaction fees. This diversification includes targeting higher-income individuals, expanding into business banking services, and developing its retail insurance offerings. The acquisition of Avafin is a key part of this strategy, designed to create a more balanced earnings profile and lessen dependence on unsecured retail credit.

This approach is proving effective in navigating economic headwinds. For instance, in the first half of fiscal year 2025, Capitec reported a notable increase in its net transaction and processing fees, indicating growth in its banking services segment. This expansion into new markets and products is contributing to robust financial performance.

- Revenue Growth: Capitec aims to achieve sustained revenue growth by tapping into new customer segments and product lines.

- Risk Mitigation: Diversification reduces the company's vulnerability to fluctuations in the unsecured lending market.

- Market Expansion: Entry into business banking and insurance opens up significant new revenue opportunities.

- Acquisition Impact: The Avafin acquisition is expected to bolster fee-based income and expand the customer base.

South Africa's economic landscape in 2024 and 2025 presents a mixed bag for Capitec. While the South African Reserve Bank has begun to ease interest rates, the repurchase rate remains at 8.25% as of May 2024, impacting consumer affordability. High food inflation continues to strain household budgets, a factor that, combined with interest rates, is expected to keep loan impairments elevated for Capitec through FY2025.

| Economic Factor | Data Point | Implication for Capitec |

|---|---|---|

| Interest Rate (Repurchase Rate) | 8.25% (May 2024) | Increases borrowing costs for consumers and businesses, potentially impacting loan demand and repayment capacity. |

| Unemployment Rate | 33.5% (Early 2024) | High unemployment signifies reduced consumer spending power and increased risk of loan defaults. |

| Projected Non-Performing Loans (NPLs) | ~26% of gross loans (FY2024) | Indicates a significant portion of the loan book may be at risk of default, requiring higher provisioning. |

| Credit Loss Ratio | 6.9% (FY2025, excl. AvaFin) vs. 8.7% (FY24) | Shows an improvement in managing credit risk despite economic pressures. |

What You See Is What You Get

CAPITEC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CAPITEC PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed understanding of the external forces shaping Capitec's strategic landscape.

Sociological factors

Capitec's fundamental aim to offer straightforward, low-cost banking solutions directly addresses the growing societal demand for financial inclusion across South Africa. This focus resonates strongly as many individuals previously underserved by traditional banks seek accessible financial services.

The bank's impressive reach, with over 24 million clients, means it now serves more than half of South Africa's adult population, a clear indicator of its success in breaking down barriers to banking access.

South African consumers are rapidly moving away from cash, embracing digital payment methods. This shift is a significant trend Capitec has capitalized on.

Capitec reported a substantial increase in active banking app clients, reaching 12.3 million by the end of February 2024. This highlights the growing reliance on digital platforms for financial management and transactions.

The bank also saw a significant surge in digital and card payment volumes, with digital transactions up 29% and card transactions up 19% year-on-year for the fiscal year ending February 2024. This demonstrates strong consumer adoption of Capitec's digital channels for everyday banking and accessing value-added services.

Capitec's demographic focus is shifting, with significant growth observed in the 36-60 age bracket, where its market share now stands at an impressive 54.4%. This indicates a successful strategy in capturing a more mature and potentially higher-earning customer base.

Beyond individual consumers, Capitec is actively expanding its reach by strategically targeting small and medium-sized businesses (SMEs). This diversification is a key move to broaden its revenue streams and customer base.

Furthermore, the bank is building a robust insurance business, a clear effort to diversify its offerings and deepen customer relationships. This move aims to capture more of the financial needs of its growing customer segments.

Financial Literacy and Empowerment

Capitec's core mission revolves around fostering financial literacy and empowering its clients. By offering simple, affordable, and accessible financial solutions, the bank aims to equip individuals and businesses with the tools needed for effective financial management and security. This societal focus directly addresses the growing demand for greater financial control and understanding.

This commitment to empowerment is evident in Capitec's digital ecosystem and diverse product suite, which are designed to simplify complex financial processes. For instance, in the 2024 financial year, Capitec reported a 15% increase in active clients, reaching over 22 million, demonstrating a strong uptake of their accessible banking model.

The drive for financial empowerment is a significant sociological trend, particularly in emerging markets. Capitec's approach resonates with a population increasingly seeking financial independence and the ability to build wealth.

- Increased Digital Adoption: Capitec's digital platform saw a 20% year-on-year growth in app usage in 2024, highlighting a societal shift towards digital financial management.

- Focus on Affordability: The bank's commitment to low fees, with an average transaction cost significantly below industry averages, appeals to a broad segment of the population seeking cost-effective financial services.

- Financial Education Initiatives: Capitec actively promotes financial wellness through educational content, aiming to improve the financial literacy rates among its customer base.

- Business Support: The bank's offerings for small and medium-sized enterprises (SMEs) directly support entrepreneurial aspirations and business growth, a key sociological driver in many economies.

Social Impact and Community Engagement

Capitec's role as a significant financial player directly influences job creation and economic contribution. For instance, in the financial year ending February 2024, Capitec reported employing over 15,000 individuals, underscoring its substantial impact on employment within South Africa.

The bank's focus on generating long-term value for its diverse stakeholders, including clients, employees, and business partners, reflects a commitment to corporate social responsibility. This approach is increasingly vital as societal expectations for ethical business practices and positive community impact grow.

- Job Creation: Capitec's operations directly support thousands of jobs, contributing to economic stability and individual livelihoods.

- Economic Contribution: Through its services and employment, Capitec fuels economic activity and supports broader financial inclusion initiatives.

- Stakeholder Value: The bank's strategy prioritizes creating sustainable value for clients, employees, and suppliers, aligning with responsible business principles.

- Corporate Responsibility: Capitec's commitment to social impact is a key factor in meeting evolving societal expectations for corporate citizenship.

Societal trends toward digital engagement and financial inclusion are profoundly shaping Capitec's strategy. The bank's commitment to offering accessible, low-cost banking resonates with a population increasingly seeking financial independence.

Capitec's digital transformation is evident in its user base; by February 2024, over 12.3 million clients actively used its banking app, reflecting a significant societal shift towards digital financial management.

The bank's focus on financial literacy and empowerment directly addresses a growing demand for greater control over personal finances, a key sociological driver in emerging markets.

Capitec's expansion into serving SMEs also taps into the strong entrepreneurial spirit prevalent in South Africa, supporting business growth and economic participation.

| Sociological Factor | Capitec's Response/Impact | Supporting Data (FYE Feb 2024 unless stated) |

|---|---|---|

| Demand for Financial Inclusion | Capitec's core offering of simple, low-cost banking | Over 24 million clients, serving >50% of SA's adult population |

| Digitalization of Services | High adoption of banking app and digital transactions | 12.3 million active banking app clients; Digital transactions up 29% |

| Financial Literacy & Empowerment | Focus on education and accessible financial tools | 15% increase in active clients (over 22 million) |

| Entrepreneurial Growth (SMEs) | Targeted offerings for small and medium businesses | Active expansion into SME market |

Technological factors

Capitec's commitment to digital banking is evident in its rapidly expanding active banking app client base, which now surpasses half of its total customers. This strong mobile adoption highlights a significant shift in consumer behavior towards digital financial services in South Africa.

The bank's digital transformation is further validated by the substantial growth in digital and card payment volumes. Capitec's mobile app is the primary channel for these transactions, processing a vast majority of all digital payments, demonstrating its effectiveness as a digital platform.

Capitec's commitment to innovation in payment solutions is evident with Capitec Pay, an API-based system facilitating secure, card-free online transactions. This platform has handled a significant volume of payments, underscoring its adoption and efficiency.

Furthermore, Capitec's substantial involvement in PayShap transactions highlights its leadership in the evolving digital payment ecosystem. This participation actively supports the broader societal move away from cash-based commerce.

Capitec's commitment to technological advancement is evident in its substantial investments in data and AI. The bank processes trillions of data points, a testament to its strategy of using granular information to tailor client solutions and drive value creation.

This focus is further underscored by Capitec's aggressive recruitment of 500 data specialists and technologists. This hiring spree signals a clear intent to bolster its capabilities in advanced analytics and artificial intelligence, positioning the bank for future innovation and operational efficiencies.

Cybersecurity and Data Protection Technologies

Capitec, like all financial institutions, faces evolving cybersecurity threats. The company invests heavily in advanced technologies to protect customer data and maintain operational integrity. This focus is crucial given the increasing sophistication of cyberattacks globally and within South Africa.

The South African financial sector is implementing stricter regulations to bolster cyber resilience. A key development is the Joint Standard on Cybersecurity and Cyber Resilience, which becomes effective in June 2025. This standard mandates that financial institutions, including Capitec, report significant cyber incidents and maintain comprehensive cybersecurity strategies to mitigate risks.

The technological landscape demands continuous adaptation. Capitec's commitment to cybersecurity is underscored by its ongoing efforts to integrate cutting-edge data protection solutions. These include:

- Advanced Encryption Protocols: Ensuring data remains confidential during transmission and storage.

- Threat Detection and Prevention Systems: Utilizing AI and machine learning to identify and neutralize malicious activities in real-time.

- Regular Security Audits and Penetration Testing: Proactively identifying vulnerabilities within systems and networks.

- Employee Training and Awareness Programs: Educating staff on best practices to prevent human-error-related breaches.

Technological Infrastructure and Cloud Adoption

Capitec is making significant strides in its technological infrastructure, particularly with its focus on cloud adoption. This strategic move is designed to support the bank's ambitious growth plans and to continuously improve its customer offerings.

A prime example of this commitment is Capitec's ongoing work on a rapid payments project. This initiative leverages cloud-specific technology to enable immediate payments, showcasing the bank's dedication to modernizing its systems and harnessing the power of the cloud for enhanced efficiency and future scalability.

- Cloud Investment: Capitec's strategic investments in cloud services are crucial for scaling operations and improving service delivery.

- Rapid Payments Project: The bank's development of immediate payment capabilities through cloud technology highlights its focus on modernizing financial transactions.

- Future Growth: By embracing cloud capabilities, Capitec is positioning itself for sustained growth and innovation in the digital banking landscape.

Capitec's aggressive recruitment of 500 data specialists and technologists in 2024 underscores its commitment to leveraging data and AI for enhanced client solutions and operational efficiency. The bank processes trillions of data points, fueling its data-driven strategy.

The bank's digital transformation is further solidified by over half of its customers actively using its banking app, processing a vast majority of digital payments. Capitec Pay, an API-based system, facilitates secure, card-free online transactions, handling significant payment volumes.

Capitec's participation in PayShap transactions demonstrates its leadership in the evolving digital payment ecosystem, supporting the move away from cash. The bank's investment in cloud adoption, particularly for its rapid payments project, aims to enhance efficiency and scalability.

Capitec is actively enhancing its cybersecurity measures, investing in advanced encryption, AI-driven threat detection, and regular security audits to protect customer data. This focus aligns with the upcoming Joint Standard on Cybersecurity and Cyber Resilience effective June 2025, mandating stricter reporting and mitigation strategies for financial institutions.

Legal factors

Capitec has encountered administrative sanctions from the Prudential Authority (PA) due to non-compliance with specific sections of the FIC Act. These issues primarily revolved around customer due diligence, transaction monitoring, and reporting duties. This situation underscores the rigorous legal framework governing anti-money laundering and counter-terrorism financing, demanding constant attention and strong internal systems.

The Protection of Personal Information Act (POPIA) is a cornerstone of South Africa's legal framework for data privacy. It dictates how organizations like Capitec must handle customer information, ensuring it's processed lawfully and securely. This is crucial for maintaining customer trust and avoiding significant penalties.

Recent updates to POPIA, effective April 2025, are particularly impactful for Capitec. These amendments enhance enforcement mechanisms and broaden data subject rights, including new avenues for objecting to data processing across various channels. Furthermore, stricter rules around marketing consent mean Capitec must be more diligent in obtaining explicit permission before engaging customers for promotional purposes.

The South African Reserve Bank (SARB) and the Prudential Authority (PA) are key regulators for banks like Capitec, issuing crucial guidance and standards. These directives cover areas such as climate-related governance, risk management practices, and disclosure requirements, ensuring a robust and responsible banking system. For instance, the upcoming Joint Standard on Cybersecurity and Cyber Resilience, effective June 2025, will impose detailed obligations on banks to manage and mitigate cyber risks, a critical area for financial institutions.

Consumer Credit Legislation

Consumer credit legislation is a cornerstone for Capitec, directly shaping its lending and credit provision operations. Adherence to these regulations is non-negotiable, particularly for a bank with a substantial unsecured retail lending book. For instance, in South Africa, the National Credit Act (NCA) governs credit agreements, credit providers, and credit bureaux, aiming to promote responsible credit granting and use.

Capitec's commitment to compliance ensures it operates within the legal framework designed to protect consumers. This includes adhering to rules around affordability assessments, disclosure requirements, and interest rate caps. For example, the NCA mandates that credit providers conduct thorough affordability assessments to prevent over-indebtedness, a critical factor given Capitec's focus on the mass market.

- Compliance with the National Credit Act (NCA) is central to Capitec's operations, ensuring fair lending practices.

- Regulations dictate affordability assessments, protecting consumers from excessive debt.

- Disclosure requirements under consumer credit laws build trust and transparency in Capitec's offerings.

- The South African Reserve Bank (SARB) oversees the financial sector, including credit providers like Capitec, to maintain stability and consumer protection.

Competition Law and Market Conduct

Competition law in South Africa's financial sector is designed to foster a fair and dynamic marketplace. Recent trends, including the proposed Conduct of Financial Institutions (COFI) Bill, signal a move towards more unified regulation. This bill aims to level the playing field by ensuring that similar activities are regulated consistently, whether undertaken by financial or non-financial entities, potentially spurring greater competition and innovation.

The COFI Bill, expected to be a significant piece of legislation, is anticipated to enhance market conduct and consumer protection. Its framework seeks to address potential anti-competitive practices and promote transparency. For instance, in 2024, the Competition Commission actively investigated several sectors for potential collusion and abuse of dominance, highlighting the ongoing enforcement of these principles.

- Regulatory Focus: The South African Competition Act and sector-specific financial regulations are key to ensuring fair market practices.

- COFI Bill Impact: This proposed legislation is expected to introduce a more harmonized regulatory approach, encouraging competition.

- Enforcement Actions: The Competition Commission's ongoing investigations in 2024 demonstrate a commitment to upholding competitive market conduct.

- Market Dynamics: Stricter enforcement and new regulations can influence market entry, pricing, and product development within financial services.

Capitec's legal landscape is heavily influenced by the FIC Act, with recent administrative sanctions from the Prudential Authority highlighting the critical need for robust customer due diligence and transaction monitoring systems. The POPIA, particularly its April 2025 amendments, imposes stricter data privacy obligations and consent requirements for marketing, demanding greater diligence in handling customer information.

The SARB and PA set stringent standards, including upcoming cybersecurity regulations effective June 2025, which will necessitate detailed risk management for financial institutions like Capitec. Consumer credit laws, such as the National Credit Act, are fundamental to Capitec's lending operations, mandating fair practices like affordability assessments to prevent consumer over-indebtedness.

Competition law, bolstered by the proposed COFI Bill, aims to create a more unified and equitable financial services market. The Competition Commission's active investigations in 2024 underscore the enforcement of fair market conduct, influencing Capitec's strategic pricing and product development.

| Regulatory Area | Key Legislation/Guidance | Impact on Capitec | Effective Date/Period |

|---|---|---|---|

| Anti-Money Laundering | FIC Act | Sanctions for non-compliance in CDD, monitoring, reporting. | Ongoing (recent sanctions) |

| Data Privacy | POPIA | Enhanced enforcement, broader data subject rights, stricter marketing consent. | Amendments effective April 2025 |

| Cybersecurity | Joint Standard on Cybersecurity and Cyber Resilience | Detailed obligations for cyber risk management. | Effective June 2025 |

| Consumer Credit | National Credit Act (NCA) | Mandatory affordability assessments, disclosure, interest rate caps. | Ongoing |

| Market Conduct | COFI Bill, Competition Act | Unified regulation, focus on fair practices, potential impact on competition. | COFI Bill pending; Commission investigations ongoing in 2024 |

Environmental factors

South African banks are stepping up their focus on climate risks, with the Prudential Authority (PA) releasing new guidance in May 2024. This guidance covers how banks should manage climate-related governance, risks, and reporting.

This move aligns the local financial sector with global standards, specifically the Task Force on Climate-Related Financial Disclosures and the International Sustainability Standards Board. The aim is to ensure greater transparency and better management of environmental impacts within the financial system.

Capitec is actively embedding sustainability into its core business, leveraging the ESG framework to identify and address both environmental risks and emerging opportunities. This commitment is demonstrated through its regular publication of Sustainability and Environmental Reports.

The 2025 Sustainability Report highlights significant strides in Capitec's environmental strategy. It details progress in reducing the bank's carbon footprint, with a target of a 30% reduction in Scope 1 and 2 emissions by 2027 compared to a 2022 baseline. Furthermore, the report outlines the expansion of circular economy initiatives, including a 15% increase in the use of recycled materials in its branches and a pilot program for e-waste recycling which processed over 5 tonnes of electronic waste in 2024.

Capitec is actively working to reduce its environmental impact. The bank is focused on improving energy efficiency and managing waste responsibly across its operations.

Their 2025 Sustainability Report details significant progress. This includes a 16% reduction in their overall carbon footprint and a 14% decrease in purchased electricity and heating since 2022. These improvements stem from investments in renewable energy sources and upgrades to more energy-efficient technologies.

Waste Management and Circular Economy Initiatives

Capitec is actively advancing its circular economy principles, notably within its Workspace division. This involves refurbishing office furniture and IT equipment, a strategy that significantly contributes to reducing carbon emissions. In 2024, the bank reported on waste management for approximately 90% of its branches.

The company achieved an impressive waste diversion rate of 95% from landfills. This success is attributed to robust recycling programs, reuse initiatives, and effective energy recovery processes.

- Circular Economy Focus: Workspace brand refurbishes furniture and IT equipment to cut CO2e emissions.

- Waste Reporting: Formal reporting on waste generation covered 90% of Capitec branches in 2024.

- Diversion Success: 95% of waste was diverted from landfills through recycling, reuse, and energy recovery.

Regulatory Alignment with Sustainable Finance Frameworks

South Africa is actively shaping its sustainable finance landscape, with the Financial Sector Conduct Authority (FSCA) leading efforts to harmonize the financial sector with international Environmental, Social, and Governance (ESG) benchmarks and domestic climate objectives. This proactive stance is crucial for financial institutions like Capitec.

Key initiatives include a pilot program for South Africa's Green Finance Taxonomy, designed to categorize and promote environmentally sustainable economic activities. Furthermore, there's a clear intention to implement mandatory corporate sustainability disclosure requirements, which will significantly impact how companies report on their environmental and social performance.

- FSCA's Green Finance Taxonomy Pilot: Aims to standardize definitions for green investments.

- Mandatory ESG Disclosures: Expected to increase transparency and comparability in sustainability reporting.

- Alignment with Global Standards: South Africa's framework seeks to integrate with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD).

- Impact on Financial Institutions: Capitec will need to adapt its reporting and potentially its product offerings to meet these evolving regulatory expectations.

Capitec's environmental strategy is progressing well, with significant reductions in its carbon footprint. The bank achieved a 16% reduction in its overall carbon footprint and a 14% decrease in purchased electricity and heating since 2022, as detailed in their 2025 Sustainability Report. This progress is driven by investments in renewable energy and energy-efficient technologies.

The bank is also advancing circular economy principles, particularly within its Workspace division, by refurbishing furniture and IT equipment to cut emissions. In 2024, Capitec reported on waste management for approximately 90% of its branches, achieving an impressive 95% waste diversion rate from landfills through robust recycling and reuse programs.

South Africa's financial sector is increasingly focused on sustainability, with regulatory bodies like the Prudential Authority and Financial Sector Conduct Authority (FSCA) introducing new guidance and initiatives. These include climate risk management for banks and a pilot program for South Africa's Green Finance Taxonomy, aiming to standardize green investments and promote environmentally sustainable activities.

These regulatory developments, including the expected implementation of mandatory corporate sustainability disclosure requirements, will necessitate Capitec's continued adaptation in reporting and potentially its product offerings to align with evolving ESG benchmarks and global standards.

| Environmental Metric | 2022 Baseline | 2024/2025 Progress | Target (by 2027) |

|---|---|---|---|

| Overall Carbon Footprint Reduction | N/A | 16% reduction | N/A |

| Purchased Electricity & Heating Reduction | N/A | 14% decrease | N/A |

| Scope 1 & 2 Emissions Reduction | N/A | N/A | 30% reduction |

| Waste Diversion Rate | N/A | 95% | N/A |

| E-waste Processed (Pilot Program) | N/A | Over 5 tonnes | N/A |

PESTLE Analysis Data Sources

Our CAPITEC PESTLE Analysis is built on a robust foundation of data sourced from official financial regulatory bodies, economic intelligence reports, and reputable industry publications. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible and current information.