CAPITEC Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAPITEC Bundle

CAPITEC's marketing success hinges on a masterful blend of its 4Ps. Their innovative product offerings, like accessible banking solutions, are strategically priced to attract a broad customer base. Discover how their widespread distribution and targeted promotions create a powerful market presence.

Ready to unlock the secrets behind CAPITEC's customer-centric approach? Gain instant access to a comprehensive, editable 4Ps Marketing Mix Analysis, detailing their product innovation, pricing strategies, distribution channels, and promotional campaigns. Elevate your understanding and apply these insights to your own business.

Product

Capitec's Simplified Business Banking Account is the core product offering, a single, transparent transactional account built to demystify business banking. This account is engineered for businesses of all scales, from the smallest sole trader to more established franchises, streamlining daily financial operations.

The focus is on reducing the complexity typically found in traditional business banking. This simplified approach provides essential tools for efficient transaction management, payment processing, and robust cash flow control, directly addressing a key pain point for many entrepreneurs.

For instance, Capitec reported a significant increase in its business client base in early 2024, with many citing the ease of use and transparent fee structure of this account as a primary driver for switching. This reflects the product's success in delivering on its promise of simplicity and efficiency.

Capitec's product strategy for business clients centers on comprehensive payment solutions designed to streamline transactions. This includes offering both physical card machines, like the Pro and Print models available for outright purchase, and digital options such as Capitec Pay. This approach aims to reduce upfront costs for merchants compared to traditional rental models, a significant differentiator in the market.

These payment solutions are crucial for businesses looking to accept a wide range of customer payments, thereby boosting convenience and operational efficiency. By providing competitive commission rates on merchant services, Capitec directly challenges established players, making it more attractive for businesses seeking cost-effective payment processing.

Capitec Business offers a range of adaptable credit and lending solutions designed to fuel business expansion and smooth out cash flow challenges. These include versatile business credit lines, accessible overdraft facilities, and tailored franchise finance, specifically structured for acquiring, establishing, renovating, or growing business outlets.

The application journey for these financial products is streamlined, frequently enabling rapid fund disbursement directly via the Capitec mobile application. This swift access is particularly crucial for small and medium-sized enterprises (SMEs) that require immediate working capital to maintain operational momentum. For instance, Capitec reported a significant increase in its business loan book in the first half of 2024, reflecting strong demand from SMEs seeking growth capital.

Business Savings and Insurance

Capitec Business extends its value proposition beyond basic banking by offering straightforward savings and investment options. These products are designed with competitive interest rates to actively assist businesses in boosting their profitability and building a more secure financial foundation for the future.

Complementing its savings solutions, Capitec Business also provides accessible insurance products. These include both short-term and long-term coverage, strategically priced to shield businesses from a range of potential risks. This allows business owners to concentrate on their core operations and expansion strategies, unburdened by significant financial anxieties.

For instance, Capitec's savings accounts in 2024 offered interest rates that were competitive within the South African market, with some business savings accounts reaching up to 7.25% per annum, depending on the balance and term. Their insurance offerings, such as business property insurance, were noted for their affordability, with premiums often starting below R200 per month for basic coverage, making financial protection more attainable for small to medium-sized enterprises.

- Savings Growth: Capitec's business savings accounts aim to enhance profitability through competitive interest rates, supporting business expansion.

- Risk Mitigation: Affordable short and long-term insurance solutions protect businesses from various financial threats.

- Operational Focus: By securing financial futures, Capitec allows business owners to concentrate on core operations and growth.

- Market Competitiveness: In 2024, business savings rates approached 7.25% annually, with insurance premiums starting affordably for SMEs.

Integrated Digital Tools and Services

Capitec's product suite is fundamentally built on a robust technological foundation, delivering a seamless digital banking experience through its intuitive app and online platform. This digital-first approach empowers users with comprehensive tools for managing their finances, including real-time account monitoring, detailed transaction histories, and easy statement downloads. By prioritizing accessibility and control, Capitec ensures clients can manage their money efficiently, anytime and anywhere.

The platform's capabilities extend to secure messaging and crucial integrations with popular accounting software, streamlining financial management for businesses. This technological integration is a key differentiator, allowing for enhanced convenience and operational efficiency. For instance, Capitec reported a significant increase in digital transactions, with over 1.7 billion digital transactions processed in the financial year ending February 2024, highlighting the widespread adoption and reliance on these integrated tools.

- Digital Platform Accessibility: Users can access a full suite of banking services via the Capitec app and online banking.

- Financial Management Features: Includes account monitoring, transaction history, statement downloads, and secure messaging.

- Business Integration: Seamless integration with accounting software platforms simplifies financial management for businesses.

- Anytime, Anywhere Access: Empowers clients with the convenience and control to manage finances remotely.

Capitec's product strategy for business clients is centered on a simplified, digital-first banking experience. This includes a transparent transactional account, accessible payment solutions like card machines and Capitec Pay, and adaptable credit facilities. The focus is on reducing complexity and cost, making financial management more straightforward for businesses of all sizes.

| Product Category | Key Offerings | Key Features/Benefits | 2024/2025 Data Point |

|---|---|---|---|

| Transactional Accounts | Simplified Business Banking Account | Single, transparent account; demystifies banking; essential tools for transactions, payments, cash flow. | Significant increase in business client base in early 2024, driven by ease of use and transparent fees. |

| Payment Solutions | Physical Card Machines (Pro, Print), Capitec Pay | Outright purchase model reduces upfront costs; competitive commission rates; wide range of payment acceptance. | Over 1.7 billion digital transactions processed in FY ending Feb 2024, indicating strong digital adoption. |

| Lending & Credit | Business Credit Lines, Overdrafts, Franchise Finance | Adaptable solutions for expansion and cash flow; streamlined application; rapid fund disbursement via app. | Significant increase in business loan book in H1 2024, reflecting strong SME demand for growth capital. |

| Savings & Investments | Business Savings Accounts | Competitive interest rates to boost profitability and build financial security. | Business savings accounts offered rates up to 7.25% per annum in 2024. |

| Insurance | Short-term and Long-term Coverage | Strategically priced to shield businesses from risks; allows focus on core operations. | Business property insurance premiums noted for affordability, starting below R200/month for basic coverage. |

What is included in the product

This analysis offers a comprehensive review of Capitec's marketing strategies, detailing its product offerings, pricing models, distribution channels, and promotional activities. It's designed for professionals seeking to understand Capitec's market positioning and competitive advantages.

Condenses Capitec's 4Ps into a clear, actionable framework that highlights how their product, price, place, and promotion strategies directly address customer pain points in banking.

Acts as a quick reference to understand Capitec's customer-centric approach, demonstrating how each element of their marketing mix alleviates common financial frustrations.

Place

Capitec Business complements its strong digital offerings with access to Capitec Bank's extensive physical branch network. With over 1,200 branches across South Africa as of early 2024, businesses can find convenient locations for in-person banking needs.

These branches, strategically situated in transport hubs and shopping centers, offer more than just transactions; they provide a crucial support system for business clients. This physical presence ensures that companies requiring face-to-face assistance or complex service can receive it, bridging the gap between digital efficiency and traditional support.

Capitec Business has established dedicated Business Centres throughout South Africa, alongside a specialized Relationship Suite in Johannesburg. This infrastructure houses over 100 bankers, all focused on delivering expert support and tailored financial solutions for businesses.

These centres provide a personalized banking experience, with highly experienced business bankers who possess a deep understanding of various business models, especially those of SMEs and franchisees. This specialized knowledge ensures that clients receive banking services and advice that are precisely aligned with their unique operational needs and growth objectives.

Capitec's primary 'place' for business services is its comprehensive digital ecosystem, featuring the Capitec banking app and online portal. These platforms provide businesses with 24/7 remote access for account management, payments, and credit solutions, reflecting the demand for efficient, mobile financial tools.

Remote Onboarding and Account Opening

Capitec Business offers a fully digital onboarding experience, allowing sole proprietors and companies with up to two directors to establish accounts remotely. This process, completable in about 30 minutes, eliminates the need for physical branch visits, making it incredibly convenient for time-pressed entrepreneurs. By removing geographical limitations, Capitec ensures a seamless and accessible entry point for new business clients.

This approach directly addresses the 'Place' element of the marketing mix by prioritizing digital accessibility and convenience. The ability to open an account entirely online in under an hour is a significant differentiator, catering to the modern business owner's need for speed and efficiency.

- Digital First: Accounts can be opened entirely online, no branch visits required.

- Speed: The onboarding process typically takes around 30 minutes.

- Accessibility: Available for sole proprietors and companies with up to two directors.

- Efficiency: Removes geographical barriers and streamlines account setup.

Strategic Presence in Emerging Markets and SMEs

Capitec Business actively targets Small, Micro, and Medium-sized Enterprises (SMEs), along with the informal sector, recognizing their significant economic contribution. This strategic placement aims to serve businesses in townships and rural areas, often excluded by conventional banking models. By offering tailored financial products, Capitec fosters financial inclusion for these previously underserved enterprises.

This approach is crucial given the substantial role of SMEs in economies like South Africa. For instance, SMEs are estimated to contribute significantly to job creation and GDP. Capitec's focus on these segments directly addresses a market gap, providing essential banking services that enable growth and formalization.

- Targeting Underserved Segments: Capitec Business prioritizes SMEs and the informal market, including businesses in townships and rural areas.

- Inclusive Banking Solutions: The bank offers financial products designed to meet the specific needs of these often-overlooked business segments.

- Market Gap Addressing: This strategy aims to bank previously unbanked or underbanked businesses, fostering financial inclusion.

- Economic Impact: SMEs are vital for job creation and economic growth, making Capitec's focus on them strategically important.

Capitec Business leverages both a robust digital platform and an extensive physical network to serve its clients. The bank's digital ecosystem, including its banking app and online portal, provides 24/7 access for account management and payments. This digital-first approach is complemented by over 1,200 physical branches across South Africa as of early 2024, offering convenient locations for in-person banking needs.

Dedicated Business Centres and a specialized Relationship Suite in Johannesburg further enhance this offering, housing over 100 bankers focused on tailored financial solutions. Capitec's digital onboarding process, completable in about 30 minutes for sole proprietors and small companies, underscores its commitment to accessibility and efficiency, removing geographical barriers for new clients.

| Aspect | Description | Key Features |

|---|---|---|

| Digital Channels | Capitec banking app & online portal | 24/7 account management, payments, credit solutions |

| Physical Presence | Over 1,200 branches (early 2024) | Convenient locations, face-to-face support |

| Specialized Support | Business Centres & Relationship Suite | Dedicated bankers, tailored solutions for SMEs |

| Digital Onboarding | Online account opening | ~30 minutes, for sole proprietors & companies (up to 2 directors) |

What You See Is What You Get

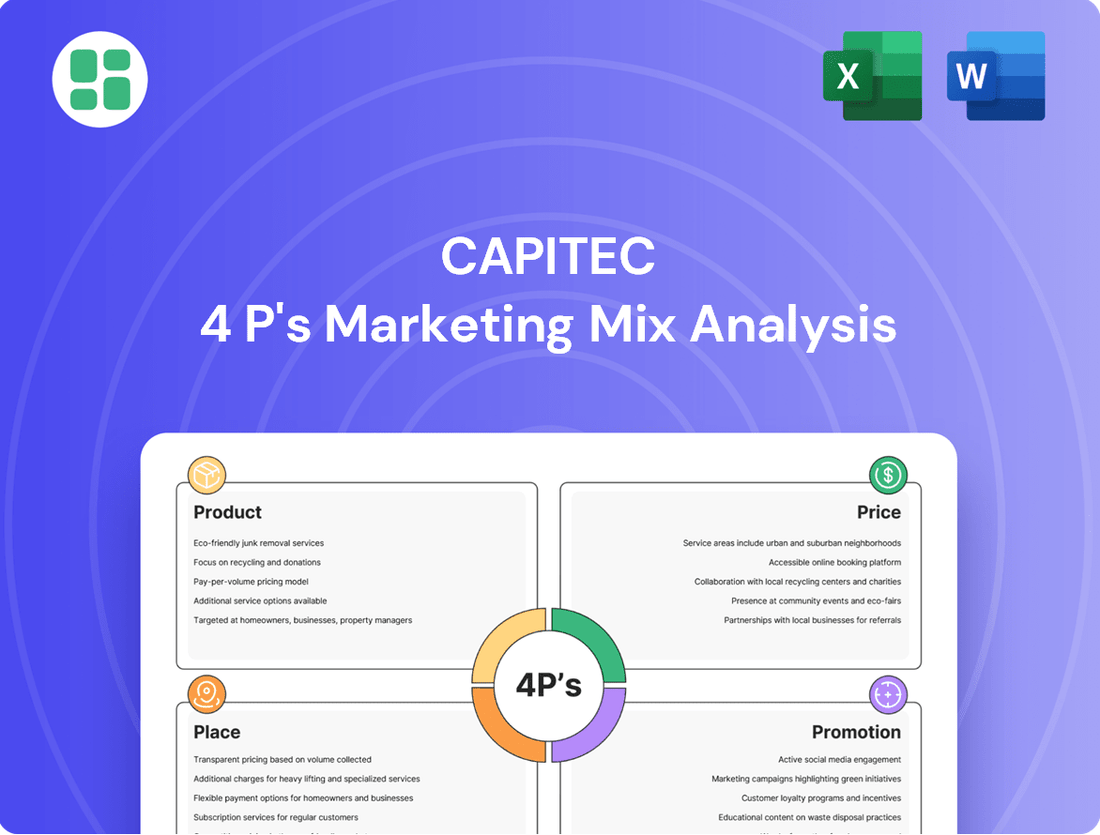

CAPITEC 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CAPITEC 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies in detail. You'll gain valuable insights into how Capitec effectively leverages these elements to serve its customer base and maintain its competitive edge in the financial sector.

Promotion

Capitec Business champions simplicity and transparency, making it a cornerstone of their marketing. Their messaging consistently emphasizes easy-to-understand products and clear fee structures, directly addressing the often-complex and opaque nature of traditional banking. This commitment aims to foster trust and appeal to businesses actively seeking a straightforward banking relationship.

Capitec's promotional strategy heavily emphasizes affordability, a core element of its marketing mix. A key message highlights potential savings of up to 50% on banking fees when compared to other institutions. This focus on cost reduction directly appeals to entrepreneurs and small to medium-sized enterprises (SMEs) who are particularly sensitive to banking expenses.

The bank consistently communicates its low monthly account fees and a simplified, harmonized fee structure that applies to both personal and business accounts. This transparent and competitive pricing is a significant draw, positioning Capitec as a financially accessible banking solution for a broad range of customers.

Capitec Business champions entrepreneurship by offering accessible banking and credit solutions, particularly for SMEs. Their messaging highlights how these services enable business owners to transform concepts into tangible opportunities, fostering economic inclusion and job creation. This focus aligns with Capitec's role in South Africa's economic development, with their business accounts seeing a significant increase in adoption by small and medium enterprises throughout 2024.

Digital-First Communication and Engagement

Capitec's promotion strategy is deeply rooted in digital-first communication, utilizing technology to foster client engagement and enhance their experience. This approach includes data-driven content, nimble campaigns, and strategic retargeting across various online platforms. By meeting their audience where they are most active online, Capitec delivers personalized financial tips and information, simplifying money management and promoting the adoption of their digital tools.

This digital focus is crucial for reaching Capitec's diverse customer base. For instance, in the financial year ending February 2024, Capitec reported a significant increase in digital active clients, with approximately 9.5 million clients actively using their digital channels. This demonstrates the effectiveness of their promotion in driving digital engagement.

- Digital Channel Dominance: Capitec prioritizes online platforms for its promotional activities, reflecting a shift towards digital engagement.

- Data-Informed Campaigns: The use of data analytics allows for tailored content and agile marketing efforts, improving relevance and impact.

- Client-Centric Approach: Promotion aims to simplify financial lives and encourage digital tool usage through personalized tips and information.

- Measurable Digital Adoption: Over 9.5 million clients actively using digital channels (FY2024) highlights the success of their digital-first promotion strategy.

Leveraging Success from Retail Banking Model

Capitec Business effectively leverages the robust brand reputation and extensive client base cultivated by its retail banking arm. This synergy allows the business division to tap into existing customer trust and loyalty, making it easier to attract new clients.

Marketing efforts for Capitec Business consistently echo the principles that have driven the success of their personal banking model: simplicity, affordability, and accessibility. This consistent brand messaging reinforces familiarity and reduces perceived risk for potential business clients.

The strategy encourages existing Capitec personal banking clients who also operate businesses to transition their business accounts. This cross-selling approach capitalizes on established relationships and the convenience of managing both personal and business finances within the same trusted institution.

- Brand Equity Transfer: Capitec Business benefits from the strong brand recognition and positive customer perception built by Capitec's retail operations.

- Client Base Overlap: Existing personal banking clients who are entrepreneurs or small business owners represent a readily available market for Capitec Business.

- Marketing Alignment: The consistent application of simplicity, affordability, and accessibility across both retail and business offerings creates a unified and understandable value proposition.

- Customer Acquisition Cost: Leveraging the existing retail client base likely reduces the cost of acquiring new business customers compared to building awareness from scratch.

Capitec's promotional activities for its business segment heavily lean on digital channels, emphasizing ease of use and cost savings. By highlighting their simplified fee structures and potential for significant savings, they attract SMEs sensitive to banking costs. Their digital-first approach, evidenced by over 9.5 million active digital clients in FY2024, ensures targeted and engaging communication.

The bank effectively leverages its strong retail brand reputation to build trust for Capitec Business, encouraging cross-selling to existing personal clients. This strategy capitalizes on established relationships and the convenience of a unified banking experience, making it easier to onboard new business customers.

Capitec Business actively promotes its role in empowering entrepreneurs and SMEs, offering accessible banking and credit solutions. This focus on fostering economic inclusion and job creation is a key part of their messaging, resonating with the entrepreneurial spirit and driving adoption among small businesses throughout 2024.

| Promotional Focus | Key Messaging | Supporting Data/Evidence |

|---|---|---|

| Simplicity & Transparency | Easy-to-understand products, clear fee structures | Core brand principle, addresses traditional banking complexity |

| Affordability | Potential savings up to 50% on fees, low monthly fees | Appeals to cost-sensitive SMEs |

| Digital Engagement | Data-driven content, nimble campaigns, personalized tips | 9.5 million+ digital active clients (FY2024) |

| Entrepreneurial Support | Accessible banking & credit for SMEs, fostering opportunities | Increased adoption by SMEs in 2024 |

| Brand Leverage | Utilizing retail brand trust and client base | Cross-selling to existing personal banking clients |

Price

Capitec Business offers a low, transparent monthly service fee of R50 for its business accounts. This competitive pricing is a cornerstone of their strategy to attract small and medium-sized enterprises (SMEs). This fixed fee covers a robust set of business banking tools and a dedicated relationship management offering, aiming to simplify banking costs for businesses.

Capitec Business is shaking up the market with a major pricing change: harmonized transactional fees. This means business clients get the same simple, low rates previously only available for personal banking. For instance, payments between Capitec accounts are just R1, sending money to other banks costs R2, and debit orders are a flat R3. This clear, tiered structure makes managing expenses much easier for entrepreneurs.

Capitec Business is making waves with its merchant commission rates, often undercutting traditional banks. This is a key part of their strategy to win over businesses. For instance, they’ve been seen offering rates as low as 0.6% on debit card transactions and 1.6% on credit card transactions for businesses with substantial sales volumes. This aggressive pricing is designed to directly appeal to businesses focused on trimming their payment processing expenses.

Once-Off Card Machine Purchase Model

Capitec Business differentiates itself by offering a once-off purchase model for its card machines, a stark contrast to the typical rental agreements prevalent in the banking sector. For instance, the Pro machine is available for R699 and the Print model for R1399, providing businesses with a clear upfront investment rather than ongoing monthly fees.

This direct purchase option offers significant advantages for small and medium-sized enterprises. By eliminating recurring rental costs, businesses can achieve substantial long-term savings, making payment processing more predictable and budget-friendly.

- Cost Savings: Eliminates monthly rental fees, leading to lower operational expenses over time.

- Asset Ownership: Businesses own the card machine outright, avoiding continuous payments.

- Pricing Clarity: A single, upfront cost provides budget certainty.

- Competitive Edge: Challenges traditional banking models by offering a more cost-effective solution.

Focus on Value and Affordability for SMEs

Capitec's pricing strategy for its business offerings is fundamentally built around delivering exceptional value and affordability, specifically targeting Small and Medium-sized Enterprises (SMEs), including those operating within the informal economy. This approach is designed to dismantle the financial hurdles that often impede smaller businesses, particularly those previously subjected to exorbitant fees by traditional banking institutions. Capitec's commitment to transparent and low-fee structures directly supports its mission of fostering financial inclusion and stimulating broader economic development.

This focus on affordability is a cornerstone of Capitec Business's appeal. For instance, in 2024, Capitec continued to offer competitive transaction fees, significantly lower than many established competitors, making it an attractive option for SMEs managing tight budgets. This strategy is not just about low prices; it's about providing cost-saving solutions that empower businesses to retain more capital for growth and operational needs.

- Low Transaction Fees: Capitec Business accounts typically feature significantly lower per-transaction costs compared to traditional banks, a key differentiator for high-volume SMEs.

- Transparent Fee Structure: All fees are clearly communicated, eliminating hidden charges and allowing SMEs to accurately forecast their banking expenses.

- Cost-Saving Solutions: Beyond basic accounts, Capitec offers integrated services designed to reduce overall operational costs for businesses.

- Financial Inclusion: The pricing model actively aims to serve underserved sectors, including informal businesses, by making essential banking services accessible and affordable.

Capitec Business's pricing strategy is centered on affordability and transparency, directly challenging traditional banking models. By offering significantly lower transactional fees, such as R1 for inter-Capitec payments and R2 for external bank transfers, they attract SMEs seeking cost-effective solutions. This clear, tiered fee structure, combined with a low monthly service fee of R50, provides budget certainty for entrepreneurs.

Their merchant commission rates are also highly competitive, often undercutting established players. For example, rates as low as 0.6% on debit card transactions and 1.6% on credit card transactions were observed in 2024 for high-volume businesses. Furthermore, the option to purchase card machines outright, like the R699 Pro model, eliminates recurring rental costs, offering substantial long-term savings and asset ownership for businesses.

| Service | Capitec Business Fee (2024) | Typical Traditional Bank Fee (Estimate) |

|---|---|---|

| Monthly Service Fee | R50 | R100 - R250+ |

| Inter-Capitec Payment | R1 | R1.50 - R3 |

| Payment to Other Banks | R2 | R3 - R5 |

| Debit Order | R3 | R4 - R7 |

| Merchant Debit Card Commission | ~0.6% (Volume Dependent) | ~1.0% - 1.5% |

| Merchant Credit Card Commission | ~1.6% (Volume Dependent) | ~2.0% - 2.5% |

| Card Machine Purchase (Pro) | R699 (Once-off) | R100 - R300+ (Monthly Rental) |

4P's Marketing Mix Analysis Data Sources

Our CAPITEC 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and detailed industry analyses. We leverage information on their product offerings, pricing structures, distribution channels, and promotional activities to provide an accurate overview.