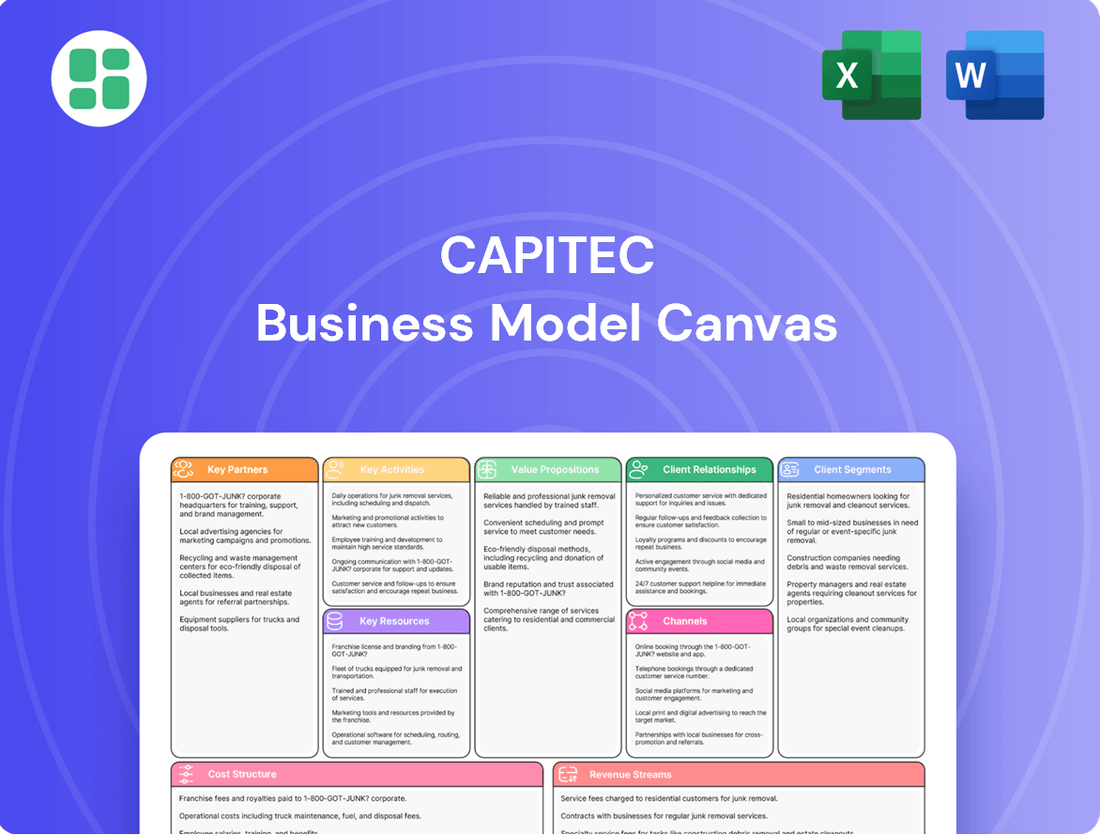

CAPITEC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAPITEC Bundle

Unlock the strategic core of CAPITEC's success with our comprehensive Business Model Canvas. This in-depth analysis dissects how CAPITEC innovates its value proposition and customer relationships to dominate the banking sector. Dive into the actionable insights that drive their market leadership and discover how you can adapt these winning strategies.

Partnerships

Capitec actively collaborates with technology and cloud providers, notably Amazon Web Services (AWS). This partnership is fundamental to their digital-first strategy, enabling enhanced operational efficiency and system resilience. For instance, AWS's robust infrastructure supports Capitec's rapid deployment of new digital banking features, a critical component of their customer-centric approach.

Capitec's strategic alliances with global payment networks like Visa and Mastercard are fundamental to its operations, enabling card payments at points of sale and online. These critical partnerships ensure that Capitec clients can transact smoothly, both within South Africa and across international borders. As of the first half of 2024, Capitec reported a significant increase in transaction volumes, underscoring the vital role these networks play in facilitating customer activity.

Capitec strategically partners with a wide array of retail establishments and specialized cash-in/cash-out providers. This network is crucial for serving clients who still rely on cash, extending Capitec's service footprint far beyond its physical branches across South Africa and enhancing customer convenience.

These partnerships allow Capitec to offer accessible cash deposit and withdrawal points, integrating financial services into everyday shopping experiences. For instance, in 2024, Capitec continued to leverage its extensive network of over 1,000 retail partners, enabling millions of transactions for clients who prefer over-the-counter services.

International Online Lending Partners

Capitec's strategic move to acquire a controlling stake in AvaFin, a European online lending platform, significantly broadens its international reach. This partnership is key to diversifying Capitec's lending offerings and tapping into new consumer markets.

Through AvaFin, Capitec is actively expanding into markets such as Poland, Latvia, Czechia, Spain, and Mexico. This international collaboration allows for the exploration and development of online consumer lending models beyond its core South African operations.

- International Expansion: Capitec's acquisition of a controlling interest in AvaFin facilitates entry into new European and Latin American markets.

- Diversified Lending Portfolio: This partnership enables Capitec to offer online consumer lending solutions in countries like Poland, Latvia, Czechia, Spain, and Mexico.

- Market Penetration: By leveraging AvaFin's existing infrastructure and customer base, Capitec aims to gain a foothold in these diverse lending environments.

Insurance Underwriters and Brokers

While Capitec has established its own life insurance license, enabling direct management of its insurance products, strategic collaborations with external insurance underwriters and brokers remain a possibility. These partnerships could be leveraged for specialized product lines or to tap into new distribution networks, thereby expanding Capitec's insurance market penetration. This approach allows for a flexible and comprehensive insurance offering that caters to a wider customer base.

Capitec's commitment to its insurance segment is evident in its substantial growth. Since May 2024, the bank has seen significant uptake in its funeral and life cover policies issued under its own license. For instance, by the end of the 2024 financial year, Capitec reported a notable increase in its insurance customer base, with active funeral policies reaching over 1.5 million and life cover policies exceeding 500,000. This demonstrates a successful internal expansion of its insurance offerings.

- Continued Partner Engagement: Capitec may still engage with underwriters and brokers for niche insurance products or to supplement its existing portfolio, ensuring a broad range of customer needs are met.

- Distribution Channel Enhancement: Partnerships can provide access to alternative distribution channels, increasing the visibility and accessibility of Capitec's insurance products beyond its primary banking customer base.

- Portfolio Diversification: Collaborating with specialized insurers can help Capitec diversify its insurance product range, offering more tailored solutions and potentially attracting new customer segments.

- Operational Efficiency: Outsourcing certain underwriting or claims processing functions to specialized partners can enhance operational efficiency and reduce the capital burden on Capitec.

Capitec's key partnerships are foundational to its digital-first strategy and broad service offering. Collaborations with AWS ensure robust technological infrastructure, while alliances with Visa and Mastercard enable seamless payment processing. The extensive network of retail and cash-in/cash-out providers is vital for financial inclusion. Furthermore, the strategic acquisition of AvaFin is expanding its international lending footprint into markets like Poland and Spain.

| Partner Type | Key Partners | Strategic Importance | 2024 Impact/Data |

|---|---|---|---|

| Technology & Cloud | Amazon Web Services (AWS) | Enables digital-first strategy, operational efficiency, system resilience. | Supports rapid deployment of new digital banking features. |

| Payment Networks | Visa, Mastercard | Facilitates card payments domestically and internationally. | Significant increase in transaction volumes in H1 2024. |

| Retail & Cash Services | Various Retailers, Cash-in/Cash-out providers | Extends service footprint, enhances customer convenience for cash transactions. | Leveraged over 1,000 retail partners for millions of transactions in 2024. |

| International Lending | AvaFin (acquired stake) | Diversifies lending, taps into new consumer markets (Poland, Spain, Mexico). | Expansion into new European and Latin American markets. |

What is included in the product

A comprehensive, pre-written business model tailored to Capitec's strategy, focusing on accessible banking for the mass market through digital channels and low-cost operations.

Organized into 9 classic BMC blocks, it details customer segments, value propositions, and revenue streams, reflecting Capitec's disruptive approach to retail banking.

The CAPITEC Business Model Canvas offers a structured approach to pinpointing and addressing customer pain points by clearly defining value propositions and customer relationships.

It serves as a powerful tool to visualize how CAPITEC alleviates customer frustrations through tailored solutions and efficient service delivery.

Activities

Capitec's core banking operations are built around efficiently managing millions of transactional accounts. This means handling everything from daily deposits and withdrawals to processing a vast number of payments. Their model thrives on a high volume of these low-margin transactions, making affordability a cornerstone of their service.

In 2024, Capitec continued to demonstrate the success of this high-volume strategy. The bank reported processing an average of over 1.5 billion transactions annually, a testament to the scale of their core operations. This sheer volume allows them to maintain low fees, a key differentiator that attracts and retains a broad customer base.

Capitec’s core activity involves the continuous development and refinement of its financial product suite. This includes everything from everyday transactional accounts and flexible savings options to accessible credit solutions. They also focus on enhancing their offerings with value-added services, such as their mobile virtual network operator, Capitec Connect, and international payment capabilities, all designed to meet evolving client needs.

This product innovation is heavily data-driven. Capitec utilizes client data and technological advancements to identify opportunities and create tailored financial solutions. For instance, their focus on digital channels and user-friendly interfaces is a direct result of understanding client preferences for convenience and simplicity in banking. This approach ensures their products remain relevant and competitive in the fast-paced financial services market.

Capitec's key activities heavily involve managing and improving its digital platforms, especially the Capitec app and online banking. This ensures a seamless and intuitive experience for users, encouraging them to engage more with digital services.

A significant portion of resources is dedicated to the continuous development and maintenance of these digital channels. This includes rolling out new functionalities, guaranteeing system reliability, and refining the user interface to boost digital adoption rates.

For instance, in the first half of its 2025 financial year, Capitec reported a substantial increase in digital transactions, with over 1.3 billion transactions processed through its digital channels. This highlights the critical role of effective digital platform management in their business model.

Credit and Lending Services

Capitec's credit and lending services are a cornerstone of its business model, offering a diverse range of credit solutions tailored to individual and business needs. This includes personal loans, credit cards, and specialized business loans, all designed to be accessible and affordable.

The process involves rigorous credit assessment to ensure responsible lending, followed by efficient disbursement and ongoing management of loan portfolios. Capitec consistently reviews and adjusts its lending criteria to adapt to market dynamics and serve specific customer segments more effectively, aiming for a balance between growth and risk management.

- Personal Loans: Offering flexible personal loan options to meet various consumer needs.

- Credit Cards: Providing credit card facilities with competitive interest rates and rewards programs.

- Business Loans: Supporting small and medium-sized enterprises with tailored financing solutions.

- Portfolio Management: Actively managing and monitoring loan portfolios to mitigate risk and optimize returns.

Value-Added Service Provision

Capitec's strategy heavily relies on expanding and managing its value-added services (VAS). These offerings, including prepaid airtime, data, electricity, and bill payments, are crucial for generating non-interest revenue. For instance, in the fiscal year ending February 2024, Capitec reported a substantial increase in transaction and commission income, largely driven by these VAS, which reached R5.9 billion, up 14% year-on-year.

These services are not just revenue generators; they also deepen client engagement and create a more comprehensive banking ecosystem. By offering convenience through services like vehicle license renewals, Capitec strengthens its client relationships and encourages greater utilization of its core banking products. This integrated approach is a cornerstone of their business model, aiming to provide a one-stop financial solution.

- Prepaid Airtime and Data: Facilitating seamless top-ups and purchases for clients.

- Electricity and Bill Payments: Offering a convenient platform for essential utility payments.

- Vehicle License Renewals: Streamlining a common administrative task for customers.

- Growing Non-Interest Revenue: VAS are a significant contributor to overall profitability.

Capitec's key activities revolve around managing transactional accounts, developing financial products, enhancing digital platforms, and offering credit and value-added services. These activities are designed to provide affordable and accessible financial solutions, driving high transaction volumes and deepening customer engagement.

In 2024, Capitec's focus on these core activities yielded significant results. The bank processed over 1.5 billion transactions annually, underscoring the scale of its transactional banking. Furthermore, value-added services contributed R5.9 billion in commission income, a 14% increase year-on-year, highlighting their growing importance.

The continuous improvement of digital platforms, such as the Capitec app, is central to their strategy. In the first half of the 2025 financial year, digital channels facilitated over 1.3 billion transactions, demonstrating the effectiveness of their digital-first approach in driving customer interaction and convenience.

| Key Activity | Description | 2024 Data/Impact |

| Transactional Banking | Efficiently managing millions of daily transactions. | Over 1.5 billion transactions processed annually. |

| Product Development | Creating and refining financial products like loans and savings. | Focus on accessible and affordable credit solutions. |

| Digital Platform Enhancement | Improving app and online banking for user experience. | 1.3 billion+ digital transactions in H1 FY25. |

| Credit & Lending | Offering personal loans, credit cards, and business loans. | Rigorous credit assessment and efficient disbursement. |

| Value-Added Services (VAS) | Providing services like airtime, data, and bill payments. | R5.9 billion in commission income (up 14% YoY). |

Full Version Awaits

Business Model Canvas

The Business Model Canvas preview you are currently viewing is an exact replica of the document you will receive upon purchase. This is not a mockup or a sample; it is a direct snapshot from the actual, complete file. Once your order is processed, you will gain full access to this professionally structured and ready-to-use Business Model Canvas, identical to what you see here.

Resources

Capitec's advanced technology infrastructure, including its significant investment in cloud computing platforms like Amazon Web Services (AWS), underpins its entire digital banking ecosystem. This robust IT backbone is essential for processing millions of transactions daily, powering its sophisticated data analytics capabilities, and enabling rapid product development and innovation. For instance, in fiscal year 2024, Capitec continued to enhance its cloud-native architecture, aiming for greater agility and cost-efficiency in its operations.

This reliance on cutting-edge technology is not just about maintaining current operations; it's a strategic imperative for scalability and efficiency. As Capitec expands its customer base and introduces new digital services, its infrastructure must seamlessly handle increased demand. The company's commitment to technology ensures it can offer a competitive and user-friendly digital banking experience, a key differentiator in the South African market.

Capitec's business model hinges on its skilled workforce, a critical resource encompassing IT specialists, financial advisors, customer service representatives, and management. This human capital is foundational to delivering efficient digital banking and personalized financial advice.

The bank's commitment to attracting and retaining top talent, especially in technology, is evident. In 2024, Capitec continued its focus on building its digital capabilities, recognizing that a highly skilled IT team is paramount for innovation and operational excellence in the competitive financial sector.

Employee development is a key investment area, ensuring staff are equipped with the latest knowledge and skills. This focus on continuous learning empowers employees to provide superior customer service and contribute to the bank's strategic growth objectives.

Capitec, while known for its digital innovation, operates an extensive physical network. As of early 2024, they boast over 1,100 branches and more than 1,500 ATMs across South Africa. This physical presence ensures accessibility for a broad customer base, catering to those who prefer face-to-face banking or require cash services.

Brand Reputation and Trust

Capitec's brand reputation is a cornerstone of its business model, built on a foundation of simplicity, affordability, and transparency. This has cultivated a deep sense of trust among its customer base, a crucial intangible asset. In 2024, Capitec continued to leverage this trust, with customer satisfaction scores consistently high, reflecting their commitment to accessible banking solutions.

This strong brand equity directly translates into customer loyalty and serves as a powerful magnet for attracting new clients seeking straightforward financial services. The bank’s consistent focus on user-friendly interfaces and transparent fee structures has solidified its position as a trusted provider in the market.

- Brand Equity: Capitec's reputation for trust and simplicity is a significant intangible asset, driving customer loyalty.

- Customer Acquisition: The strong brand reputation attracts new clients seeking affordable and transparent banking.

- Market Perception: Consistently high customer satisfaction in 2024 underscores the effectiveness of their brand strategy.

Vast Customer Data and Analytics Capabilities

Capitec's extensive customer data, exceeding 2 trillion data points, forms a cornerstone of its business model. This vast dataset allows for deep insights into client behavior and preferences, enabling the bank to tailor its services effectively.

Leveraging advanced analytics, Capitec can anticipate market shifts and proactively address evolving customer needs. This data-driven approach is crucial for personalizing product offerings and fostering stronger client relationships.

- 2 Trillion+ Data Points: The sheer volume of customer information collected.

- Advanced Analytics: Sophisticated tools used to process and interpret data.

- Client-Centric Approach: Using data to understand and serve customers better.

- Strategic Decision-Making: Data insights guiding business strategy and product development.

Capitec's key resources include its robust technology infrastructure, a highly skilled workforce, an extensive physical network, strong brand equity, and a vast repository of customer data. These elements collectively enable the bank to deliver its unique value proposition of accessible, affordable, and transparent banking services.

| Resource Category | Specific Resource | Description | 2024 Data/Impact |

|---|---|---|---|

| Technology Infrastructure | Cloud Computing (AWS) | Underpins digital banking, transaction processing, and data analytics. | Continued enhancement of cloud-native architecture for agility and cost-efficiency. |

| Human Capital | Skilled Workforce | IT specialists, financial advisors, customer service, management. | Focus on building digital capabilities and continuous employee development. |

| Physical Network | Branches & ATMs | Ensures accessibility for diverse customer needs. | Over 1,100 branches and 1,500+ ATMs across South Africa. |

| Intangible Assets | Brand Equity | Reputation for simplicity, affordability, and transparency builds trust and loyalty. | Consistently high customer satisfaction scores. |

| Customer Data | Data Points | Over 2 trillion data points for deep client behavior insights. | Enables personalized services and proactive market anticipation. |

Value Propositions

Capitec champions a banking experience built on clarity and simplicity. They've streamlined their pricing, consolidating over 30 original price points into just five accessible tiers. This makes understanding costs incredibly straightforward for their clients.

This transparent approach fosters trust and predictability. For instance, in their 2024 financial year, Capitec reported a significant increase in active clients, demonstrating the appeal of their simplified banking model. Their focus on clear fee structures directly addresses a common pain point in traditional banking.

Capitec’s commitment to affordable banking fees is a cornerstone of its value proposition, offering significantly lower costs for essential services compared to traditional banks. For instance, inter-Capitec payments, EFTs, debit orders, and cash withdrawals are all priced competitively, directly supporting their mission of financial inclusion.

This focus on affordability translates into tangible savings for small businesses and individuals. In 2024, Capitec continued to differentiate itself by maintaining a fee structure that makes everyday banking accessible, a key factor for many South African consumers and entrepreneurs seeking cost-effective financial solutions.

Capitec’s value proposition, Accessible Banking for All, directly addresses a critical need in South Africa. By offering banking services through an extensive network of over 800 branches and a robust digital platform, they reach millions, including those in previously underserved communities. This broad accessibility is a cornerstone of their strategy to foster economic inclusion.

In 2024, Capitec continued to demonstrate its commitment to accessibility. The bank reported a significant increase in active clients, reaching over 22 million by the first half of the year, highlighting the broad adoption of their simplified banking model. This growth underscores their success in making financial services available to a wide demographic.

Convenient Digital Ecosystem

Capitec's digital ecosystem, centered around its intuitive app, provides clients with a seamless and comprehensive banking experience. This platform consolidates transactional banking with a suite of value-added services, making everyday financial management incredibly convenient.

Clients can effortlessly manage their accounts, make payments, and even purchase essential services like airtime and data directly through the app. This integrated approach streamlines operations and enhances customer satisfaction by offering a one-stop digital solution.

- One-Stop Digital Hub The Capitec app serves as a central platform for all banking needs, from basic transactions to purchasing airtime and data.

- Enhanced Convenience Clients benefit from the ease of managing their finances and accessing essential services anytime, anywhere.

- Integrated Value-Added Services Beyond banking, the app allows for bill payments and other lifestyle services, further embedding it into daily life.

- User-Friendly Interface The design prioritizes simplicity, ensuring a low learning curve for all user demographics.

Personalized Financial Solutions

Capitec stands out by using data and advanced technology to craft financial solutions that truly fit each customer. This means personalized credit offers, insurance plans, and financial advice designed to help individuals and businesses thrive.

For example, in 2024, Capitec continued to leverage its digital platform to offer a more streamlined and personalized banking experience. Their focus on data analytics allows them to understand customer needs deeply, leading to relevant product recommendations and proactive financial guidance.

- Tailored Credit: Offering credit products based on individual financial profiles, ensuring responsible lending and better accessibility.

- Personalized Insurance: Providing insurance policies that match specific life stages and risk appetites, avoiding one-size-fits-all approaches.

- Proactive Financial Guidance: Utilizing insights from customer behavior to offer timely advice on saving, budgeting, and investment opportunities.

Capitec's value proposition centers on providing banking that is both affordable and exceptionally easy to understand. They've significantly simplified their fee structures, moving from over 30 pricing points to a mere five, making it transparent for clients to know exactly what they're paying for. This clarity builds trust and predictability, a key differentiator in the banking sector.

This commitment to affordability is evident in their competitive pricing for everyday banking services. For instance, their fee structure makes inter-Capitec payments, EFTs, and debit orders significantly cheaper than many traditional banks, directly supporting their goal of financial inclusion. By 2024, Capitec had solidified its position as a cost-effective option for millions of South Africans.

Capitec's extensive network of over 800 branches, coupled with a powerful digital app, ensures banking is accessible to a broad demographic. By the first half of 2024, they had surpassed 22 million active clients, a testament to their success in reaching underserved communities and making financial services readily available.

The Capitec app acts as a comprehensive digital hub, allowing clients to manage all their banking needs, from transactions to purchasing airtime and data, with ease. This integrated approach enhances convenience, offering a seamless and user-friendly experience for everyday financial management.

Capitec leverages data analytics to offer personalized financial solutions, including credit and insurance products tailored to individual needs. This data-driven approach allows them to provide proactive financial guidance, helping clients make more informed decisions about their money.

| Value Proposition Aspect | Description | Key Data Point (2024) |

|---|---|---|

| Clarity & Simplicity | Streamlined fee structures for easy understanding. | Consolidated over 30 price points into 5 tiers. |

| Affordability | Competitive pricing for essential banking services. | Significantly lower fees for common transactions compared to traditional banks. |

| Accessibility | Extensive branch network and robust digital platform. | Over 22 million active clients by H1 2024. |

| Digital Ecosystem | Intuitive app for seamless banking and value-added services. | App facilitates transactions, airtime purchases, and bill payments. |

| Personalization | Data-driven financial solutions and guidance. | Leverages customer data for tailored credit and insurance offers. |

Customer Relationships

Capitec's digital self-service, primarily through its banking app, is central to its customer relationships. This app allows clients to handle the vast majority of their banking needs, from checking balances to making payments, fostering a sense of autonomy and immediate access to services. By empowering clients to manage their finances independently, Capitec builds strong, low-touch relationships.

In 2024, Capitec reported that over 90% of its transactions were conducted digitally, highlighting the app's critical role in customer engagement. This high adoption rate means that for many clients, the app is their primary, and often only, point of interaction with the bank, reinforcing the importance of its user-friendly design and comprehensive functionality for maintaining customer loyalty.

Capitec champions personalized support, even while leaning into digital. For its business clients, this means dedicated relationship suites and a branch network offering face-to-face assistance. This hybrid model ensures tailored financial advice, acknowledging that some prefer direct interaction for their banking needs.

Capitec fosters trust through crystal-clear communication about all fees, product terms, and financial guidance. This open approach ensures clients fully understand their banking relationships, empowering them to make informed decisions with confidence.

Community and Financial Literacy Initiatives

Capitec actively cultivates strong customer relationships by fostering financial literacy. Their MoneyUp Academy offers practical financial education, aiming to equip individuals with the knowledge to manage their money effectively. This commitment extends beyond their direct customer base, demonstrating a dedication to community upliftment.

These initiatives are crucial for building trust and loyalty. By investing in the financial well-being of their customers and communities, Capitec positions itself as a partner in their financial journey. This approach helps demystify banking and empowers individuals to make informed decisions.

- Financial Education Programs: Capitec's MoneyUp Academy provides accessible financial learning resources.

- Community Partnerships: Collaborations with non-profit organizations amplify the reach of financial literacy efforts.

- Customer Empowerment: The focus is on equipping individuals with skills for better financial management.

Efficient Problem Resolution

Capitec prioritizes swift and effective problem resolution as a cornerstone of its customer relationships. This is achieved through a multi-channel support system designed for immediate client engagement.

The bank leverages digital platforms, notably WhatsApp chat, to offer accessible and responsive customer service. This allows for quick query handling and issue resolution, fostering a sense of trust and reliability.

- Digital Channels: WhatsApp chat and in-app support provide immediate avenues for customer assistance.

- Responsiveness: Capitec aims for rapid response times to queries, minimizing customer wait periods.

- Issue Resolution: The focus is on efficiently solving customer problems, enhancing satisfaction and retention.

- Customer Loyalty: By consistently delivering excellent support, Capitec cultivates strong customer loyalty.

Capitec's customer relationships are heavily digitized, with its app serving as the primary interaction point for most users. This digital-first approach, supported by a commitment to financial education and responsive support, builds trust and loyalty.

In 2024, Capitec's digital engagement remained exceptionally high, with over 90% of transactions occurring through its app. This underscores the app's role as the core of how customers interact with the bank, driving efficiency and accessibility.

Beyond digital, Capitec offers personalized support for business clients through dedicated relationship managers and branches, ensuring a hybrid model that caters to diverse banking needs.

The bank's focus on transparent fee structures and financial literacy programs, like MoneyUp Academy, further solidifies customer trust and empowers individuals to manage their finances effectively.

| Aspect | Description | 2024 Data/Focus |

|---|---|---|

| Digital Interaction | Primary engagement through a user-friendly banking app. | Over 90% of transactions were digital. |

| Personalized Support | Dedicated relationship suites for business clients. | Continued investment in hybrid service models. |

| Financial Literacy | Empowering customers through education. | Expansion of MoneyUp Academy resources. |

| Customer Service | Responsive, multi-channel support including WhatsApp. | Focus on swift issue resolution to enhance loyalty. |

Channels

The Capitec mobile banking application serves as the primary digital channel, allowing clients to conduct a wide range of transactions, access various services, and manage their finances directly from their smartphones. This app is central to Capitec's digital-first approach, reflecting its commitment to providing convenient and accessible banking solutions.

As of early 2024, Capitec reported that over 10 million clients actively use its mobile app, underscoring its significant role in customer engagement and service delivery. This high adoption rate demonstrates the app's effectiveness in meeting the evolving digital needs of its user base, facilitating everything from account management to loan applications.

Capitec maintains a robust nationwide network of physical branches, acting as crucial hubs for customer interaction. These locations facilitate essential services such as account opening, complex transactions, and personalized financial advice, bridging the gap between digital convenience and tangible support.

As of the first half of 2024, Capitec reported having over 1,100 branches across South Africa. This extensive physical footprint ensures accessibility for a broad customer base, particularly those who prefer or require in-person assistance, thereby reinforcing their hybrid banking model.

Capitec's extensive ATM network, a crucial channel, enables clients to conduct essential banking tasks like cash withdrawals and deposits conveniently across South Africa. This network ensures broad accessibility to cash services, a core offering for many users.

By the end of February 2024, Capitec reported having 1,368 ATMs, a testament to its commitment to physical accessibility. These machines are strategically placed to serve a large customer base, facilitating everyday financial management.

Online Banking Portal

Capitec's online banking portal serves as a crucial digital touchpoint, complementing its popular mobile app. This platform allows clients to manage their finances, execute transactions, and access a full suite of banking services directly through a web browser, catering to users who prefer or require desktop access for certain tasks.

This channel is particularly important for business clients and individuals who may need to perform more complex operations or review detailed statements. In 2024, Capitec continued to enhance its digital offerings, with a significant portion of its customer base actively utilizing both the mobile app and the online portal for their daily banking needs, reflecting a strong digital adoption trend.

- Accessibility: Provides an alternative to the mobile app for users who prefer or need desktop access.

- Functionality: Enables comprehensive account management, payments, and service access.

- Digital Adoption: Supports Capitec's strategy of offering robust digital channels for all client segments.

Contact Centers and Digital Chat

Contact centers and digital chat, including platforms like WhatsApp, are crucial for Capitec's customer support. These channels enable clients to receive assistance and resolve queries remotely, enhancing accessibility and convenience.

This focus on digital interaction aligns with the trend of customers preferring self-service and immediate responses. In 2024, digital channels are increasingly becoming the primary touchpoint for banking services, driving efficiency for both the customer and the institution.

- Customer Support: Capitec leverages contact centers and digital chat, including WhatsApp, for remote client assistance.

- Efficiency Focus: These channels are designed for quick issue resolution and streamlined customer interactions.

- Digital Preference: Meeting customers on their preferred digital platforms enhances engagement and accessibility.

- 2024 Trend: Digital channels are becoming the dominant method for customer service in the banking sector.

Capitec's channel strategy is multi-faceted, combining a strong digital presence with essential physical touchpoints. The mobile app is the cornerstone, boasting over 10 million active users by early 2024, facilitating seamless transactions and account management. This digital-first approach is complemented by an extensive network of over 1,100 branches as of the first half of 2024, providing crucial in-person support for account opening and complex queries. Furthermore, 1,368 ATMs available by February 2024 ensure widespread access to cash services, supporting everyday banking needs.

| Channel | Description | Key Metric (as of early/mid-2024) | Role in Business Model |

|---|---|---|---|

| Mobile App | Primary digital platform for transactions and services | 10+ million active users | Customer engagement, self-service, convenience |

| Physical Branches | In-person service hubs | 1,100+ branches | Account opening, complex transactions, personalized advice |

| ATMs | Cash withdrawal and deposit points | 1,368 ATMs | Accessibility to cash services |

| Online Banking Portal | Web-based platform for account management | Significant user base | Desktop access for complex tasks, detailed statements |

| Contact Centers & Digital Chat | Remote customer support | N/A (focus on digital interaction) | Issue resolution, customer assistance |

Customer Segments

Capitec's core customer segment is the mass market in South Africa, encompassing individuals from various income brackets who seek straightforward and cost-effective banking solutions. They prioritize ease of access, clear fee structures, and overall affordability in their financial dealings.

In 2024, Capitec continued to solidify its position as a dominant player in this segment, boasting over 22 million clients. This vast customer base highlights the company's success in meeting the fundamental banking needs of a significant portion of the South African population.

Digitally savvy clients represent a substantial and expanding portion of Capitec's customer base. These individuals actively embrace and prefer managing their finances through the bank's mobile application and online portals, reflecting a clear preference for convenience and self-service banking solutions.

Capitec's strategic emphasis on a digital-first model directly addresses the needs and expectations of this segment. For instance, in the first half of 2024, Capitec reported that over 1.7 million active clients were using its digital channels, highlighting the significant adoption of its digital offerings.

Capitec Business actively courts Small and Medium Enterprises (SMEs), recognizing their crucial role in the economy. These businesses often require specialized transactional services and access to financing that larger banks may overlook.

The bank's approach focuses on providing practical, cost-effective banking solutions. For instance, in 2024, Capitec continued to emphasize digital tools that simplify cash management and payments for SMEs, a segment that historically faced higher fees and less accessible services from traditional institutions.

By tailoring offerings to the specific needs of SMEs, including those in underserved sectors, Capitec aims to foster growth and financial inclusion. This strategy is reflected in their ongoing efforts to simplify account opening and provide transparent pricing structures, making banking more accessible.

Clients Seeking Value-Added Services

Capitec serves clients who actively engage with its broad suite of value-added services. These customers leverage the bank's platform for everyday needs beyond traditional banking, finding significant convenience in accessing prepaid utilities, airtime, and even funeral plans directly through their accounts. This segment represents a core group that benefits from the integrated ecosystem, fostering loyalty and driving transaction volumes.

The utilization of these ancillary services not only enhances customer stickiness but also contributes to Capitec's diversified revenue streams. For instance, in the fiscal year 2024, Capitec reported a substantial increase in transaction-based revenue, partly fueled by the uptake of these convenient, everyday services. This demonstrates the financial viability of offering integrated solutions that cater to a wide range of customer needs within a single banking platform.

- Prepaid Services: Customers regularly purchase prepaid electricity and airtime, demonstrating a reliance on Capitec for essential daily transactions.

- Funeral Plans: A significant portion of clients opt for Capitec's funeral cover, highlighting trust in the bank for important life event services.

- Convenience Factor: The ease of accessing these diverse services through a single, user-friendly app or branch network is a primary draw for this client segment.

- Revenue Diversification: These value-added offerings contribute to Capitec's overall financial performance, reducing reliance solely on traditional lending and interest income.

Individuals Requiring Credit and Insurance

Capitec serves a significant customer segment that actively seeks accessible credit and insurance solutions. This includes individuals looking for personal loans and credit cards, as well as affordable life and funeral insurance. The bank has strategically grown its product suite to meet these specific financial needs.

In 2024, Capitec's focus on these segments is evident in its continued expansion of credit and insurance offerings. The bank reported a substantial increase in its credit portfolio, reflecting strong demand from clients requiring these financial tools. Furthermore, the uptake of their insurance products underscores their commitment to providing comprehensive financial security.

- Personal Loans: Capitec's personal loans are a key draw for individuals needing funds for various purposes, from consolidating debt to financing significant purchases.

- Credit Cards: The bank offers credit cards designed for accessibility and ease of use, catering to customers looking to build or manage their credit history.

- Life Insurance: Capitec provides life insurance options that are straightforward and affordable, offering peace of mind to policyholders.

- Funeral Insurance: Recognizing the importance of covering final expenses, the bank offers funeral insurance, a vital product for many South African families.

Capitec's customer segments are diverse, ranging from the mass market in South Africa to digitally savvy individuals and small to medium enterprises (SMEs). The bank also caters to clients who utilize its value-added services like prepaid utilities and insurance, as well as those seeking credit solutions.

In 2024, Capitec served over 22 million clients, with a significant portion actively using its digital channels. SMEs represent a growing focus, benefiting from practical and cost-effective banking solutions. The uptake of credit and insurance products also saw substantial growth.

| Customer Segment | Key Characteristics | 2024 Data/Insights |

|---|---|---|

| Mass Market | South African individuals seeking simple, affordable banking. | Over 22 million clients served. |

| Digitally Savvy | Clients preferring mobile and online banking. | Over 1.7 million active clients on digital channels (H1 2024). |

| SMEs | Small and Medium Enterprises needing transactional services and financing. | Focus on digital tools for cash management and payments. |

| Value-Added Service Users | Clients using prepaid, airtime, and funeral plans. | Contributed to substantial increase in transaction-based revenue. |

| Credit & Insurance Seekers | Individuals needing personal loans, credit cards, and insurance. | Reported substantial increase in credit portfolio and insurance uptake. |

Cost Structure

Capitec Bank invests heavily in its technology and infrastructure, recognizing it as a core driver of its business model. This includes significant expenditure on developing, maintaining, and upgrading its IT systems, cloud services, and digital platforms. For instance, in the fiscal year ending February 2024, Capitec reported IT and related expenses of R7.4 billion, a substantial portion of which fuels these technological advancements.

These investments are crucial for enhancing customer experience, ensuring operational efficiency, and maintaining robust cybersecurity. Key areas of spending include data migration projects, the continuous development of its mobile banking app, and strengthening its defenses against cyber threats. This commitment to technology allows Capitec to offer seamless digital banking services and adapt quickly to evolving market demands.

Salaries, benefits, and ongoing training for Capitec's extensive workforce, encompassing branch personnel, IT specialists, and customer service representatives, constitute a significant portion of their operational expenditures. In 2024, Capitec's employee-related costs were a key driver of their overall cost base, reflecting their commitment to a large, skilled team.

The bank places a strong emphasis on attracting and retaining specialized IT talent, a critical component for their digital-first banking model. This investment in scarce IT skills is essential for maintaining their competitive edge in a rapidly evolving technological landscape.

Capitec's extensive physical branch network and ATM infrastructure represent a substantial cost component. These expenses encompass rent for prime locations, utilities to power these facilities, robust security measures to protect assets and customers, and the intricate logistics of cash management, including replenishment and security.

For the financial year ending February 29, 2024, Capitec reported operating expenses of R17.7 billion. While the specific breakdown for branch and ATM maintenance isn't itemized separately in all public disclosures, it forms a critical part of the overall operational expenditure required to maintain its widespread physical presence and accessibility for millions of clients across South Africa.

Marketing and Brand Building

Capitec invests significantly in marketing and brand building to differentiate itself in the crowded financial services sector. This expenditure is vital for attracting new customers and fostering loyalty among its existing client base. The brand's core message of affordability and simplicity is consistently communicated through various channels.

In 2024, Capitec's marketing efforts were a key driver of its growth. The bank reported a notable increase in its customer base, underscoring the effectiveness of its outreach strategies. These initiatives aim to reinforce Capitec's position as a leading digital bank focused on accessible financial solutions.

- Advertising Campaigns: Significant investment in digital and traditional advertising to reach a broad audience.

- Promotional Activities: Offering competitive rates and incentives to attract and retain clients.

- Brand Messaging: Consistent communication of core values like affordability, simplicity, and accessibility.

- Digital Engagement: Focus on social media and online platforms to build community and brand awareness.

Regulatory and Compliance Costs

As a key part of its operational expenses, Capitec, like any regulated financial institution, dedicates significant resources to its regulatory and compliance framework. These costs are essential for maintaining its banking license and ensuring adherence to South Africa's stringent financial laws.

These expenditures cover a broad spectrum, including the implementation and maintenance of robust risk management systems, anti-money laundering (AML) protocols, and Know Your Customer (KYC) procedures. Consumer protection measures, such as fair lending practices and transparent fee structures, also contribute to these costs.

For instance, in its 2024 financial year, Capitec reported that its operating expenses, which encompass these regulatory and compliance activities, grew by 11% to R16.6 billion. This highlights the substantial investment required to navigate the complex regulatory landscape.

- Regulatory Adherence: Costs associated with meeting the requirements set by the South African Reserve Bank (SARB) and other financial regulators.

- Compliance Systems: Investment in technology and personnel for monitoring transactions, reporting, and ensuring data privacy.

- Risk Management: Expenses related to credit risk, market risk, operational risk, and liquidity risk management frameworks.

- Consumer Protection: Costs incurred to ensure fair treatment of customers and compliance with consumer financial protection laws.

Capitec's cost structure is heavily influenced by its technology investments, with R7.4 billion allocated to IT and related expenses in the fiscal year ending February 2024. This includes ongoing development of its digital platforms and cybersecurity measures. Employee costs, particularly for skilled IT professionals, also represent a significant outlay, reflecting the bank's digital-first strategy.

The extensive branch and ATM network incurs substantial costs for rent, utilities, security, and cash management, contributing to the overall operating expenses. Marketing and brand building are also key cost drivers, with the bank investing in campaigns to attract and retain its customer base, which grew notably in 2024.

Furthermore, Capitec dedicates significant resources to its regulatory and compliance framework, essential for maintaining its banking license and adhering to South African financial laws. These costs cover risk management systems, AML/KYC procedures, and consumer protection measures, with operating expenses growing by 11% to R16.6 billion in FY24.

| Cost Category | FY24 Expenditure (R billion) | Key Drivers |

|---|---|---|

| Technology & Infrastructure | 7.4 | IT system development, maintenance, cloud services, cybersecurity |

| Employee Costs | Significant portion of operating expenses | Salaries, benefits, training, specialized IT talent acquisition |

| Physical Network | Part of operating expenses | Branch/ATM rent, utilities, security, cash management logistics |

| Marketing & Brand Building | Key driver of growth | Advertising, promotions, digital engagement |

| Regulatory & Compliance | Included in operating expenses | Risk management, AML/KYC, consumer protection, regulatory adherence |

Revenue Streams

Capitec's primary revenue source, Net Interest Income (NII), is generated from the interest charged on loans and advances made to both individual and business clients. This includes a variety of credit products such as personal loans, credit cards, and business credit facilities.

This income is calculated after accounting for the interest paid out to clients on their savings and deposit accounts. For instance, in the financial year ending February 2024, Capitec reported a Net Interest Income of R25.7 billion, highlighting the significant contribution of lending activities to its overall profitability.

Capitec generates substantial revenue from transaction and commission income, a key component of its non-interest earnings. This includes fees from a wide array of banking activities such as card swipes, digital fund transfers, and managing debit orders. These are high-volume, low-margin revenue streams that contribute significantly to the bank's overall financial health.

In the financial year 2024, Capitec reported a notable increase in transaction and commission income, reflecting the growing adoption of its digital banking services. For instance, the bank processed billions in transactions, with a substantial portion attributed to its digital platforms. This data underscores the effectiveness of their strategy in capturing a large share of everyday banking activities.

Capitec's revenue from value-added services (VAS) is a significant and expanding component of its business. This includes income generated from facilitating prepaid airtime, data, and electricity purchases, as well as handling bill payments for customers. These everyday transactions contribute substantially to the bank's overall earnings.

The bank's mobile virtual network operator (MVNO), Capitec Connect, further diversifies this VAS income stream. In 2024, Capitec reported that its prepaid data offerings, including those through Capitec Connect, saw continued strong uptake, highlighting the growing reliance on these services for customer engagement and revenue generation.

Insurance Income

Capitec's insurance segment is a significant and growing revenue stream. The company leverages its extensive client base to offer a range of insurance products, primarily focusing on life and funeral cover. This strategy allows Capitec to deepen client relationships and generate recurring income.

In the financial year ending February 2024, Capitec reported substantial growth in its insurance business. Gross written premiums for its funeral and life insurance products saw a notable increase, contributing positively to the group's overall profitability. This expansion is driven by the convenience of purchasing these policies through Capitec's established banking channels.

- Funeral and Life Insurance Premiums: Growing income from policies sold directly under Capitec's own license.

- Client Penetration: Increased uptake of insurance products by Capitec's large and active customer base.

- Diversified Earnings: Insurance income provides a valuable diversification of revenue away from traditional lending.

- Profitability Contribution: The insurance segment is becoming an increasingly important contributor to the group's bottom line.

Interchange and Payment Processing Fees

Interchange and payment processing fees are a significant revenue stream for Capitec, stemming from every digital payment and card transaction facilitated. These fees, including interchange fees earned when customers use their Capitec cards, directly boost the bank's non-interest income, demonstrating the value derived from its extensive payment network.

- Interchange Fees: Earned from transactions where Capitec's cards are used, compensating the bank for bearing the risk and cost of processing.

- Processing Fees: Charged to merchants for the convenience and security of accepting digital and card payments through Capitec's infrastructure.

- Digital Transaction Growth: In 2024, Capitec continued to see robust growth in digital transaction volumes, directly translating into higher fee-based income.

Capitec's revenue streams are diverse, with Net Interest Income (NII) from lending forming the bedrock. This is complemented by substantial income from transaction and commission fees, particularly from digital banking activities, and value-added services like prepaid airtime and electricity purchases. The bank has also successfully expanded its insurance offerings, generating premiums from funeral and life cover, and earns interchange and payment processing fees from its extensive digital payment network.

| Revenue Stream | Description | FY2024 Contribution (Illustrative) |

|---|---|---|

| Net Interest Income (NII) | Interest earned on loans minus interest paid on deposits. | R25.7 billion (FY ending Feb 2024) |

| Transaction & Commission Income | Fees from card swipes, digital transfers, debit orders. | Significant growth in FY2024, billions processed digitally. |

| Value-Added Services (VAS) | Income from prepaid airtime, data, electricity, bill payments. | Strong uptake of prepaid data offerings, including Capitec Connect. |

| Insurance Premiums | Income from funeral and life insurance policies. | Notable increase in gross written premiums in FY2024. |

| Interchange & Processing Fees | Fees from card transactions and payment processing. | Robust growth in digital transaction volumes in 2024. |

Business Model Canvas Data Sources

The CAPITEC Business Model Canvas is built using a blend of internal financial data, extensive market research on banking trends, and insights from customer feedback. These foundational elements ensure each block of the canvas is informed by Capitec's operational realities and market positioning.