CAPITEC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAPITEC Bundle

CAPITEC's competitive landscape is shaped by intense rivalry, a moderate threat of new entrants, and significant buyer power due to readily available banking alternatives. Supplier power is relatively low, given the commoditized nature of many banking inputs. The threat of substitutes, however, remains a critical factor for CAPITEC's strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CAPITEC’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Capitec's reliance on technology makes its software and cloud providers powerful. Companies like Amazon Web Services (AWS) for data infrastructure and ACI Worldwide for payment processing are critical. Capitec's substantial IT investment, which grew by 27% to R1.9 billion in FY2024 (excluding staff costs), highlights the essential nature of these technology partners.

The banking sector, particularly for innovative digital banks like Capitec, relies heavily on specialized IT and data professionals. These roles are crucial for developing and maintaining cutting-edge platforms.

Capitec actively works to attract and retain this scarce talent, focusing on its employer brand and utilizing diverse recruitment strategies. This competition for skilled individuals can increase their influence.

In financial year 2024, Capitec saw a 15% rise in external hires for data and technology experts. This statistic underscores the high demand for these professionals and suggests they possess significant bargaining power.

Payment network operators like Visa and Mastercard hold a degree of bargaining power over Capitec Bank. As transactional banking is a core offering for Capitec, reliance on these established networks for payment processing is significant, impacting costs through transaction fees and service agreements. For instance, in 2023, global transaction volumes processed by major networks continued to grow, underscoring their pervasive role.

This dependence means Capitec must navigate the terms set by these networks. While not explicitly a dominant force in Capitec's specific analysis, the essential nature of their services allows for some leverage in fee structures and operational requirements. Capitec's strategic initiatives to diversify payment methods, exploring non-card transactions, aim to mitigate this ongoing reliance and potentially shift the balance of power.

Branch Network and ATM Infrastructure Providers

Suppliers of branch network and ATM infrastructure, including those for maintenance, security, and hardware, possess moderate bargaining power. Capitec's strategic decision to maintain and even expand its physical footprint, especially in South Africa, means these suppliers are crucial for operational continuity. For instance, Capitec Bank reported a significant increase in its branch network, reaching 700 branches by the end of fiscal year 2024, which underscores the reliance on these infrastructure providers.

The bargaining power of these suppliers is influenced by the specialized nature of their services and the capital investment required for their equipment. However, Capitec's scale and its ongoing investment in digital solutions may mitigate some of this power by seeking competitive tenders. The bank's approach contrasts with some competitors who have reduced their physical presence, highlighting Capitec's unique strategy of integrating digital and physical accessibility.

Key aspects influencing supplier power include:

- Specialized Equipment and Services: Providers of ATM hardware, maintenance, and physical security often have unique offerings that are not easily substituted.

- Geographic Reach: Suppliers capable of servicing Capitec's extensive nationwide network are more valuable, potentially increasing their leverage.

- Contractual Agreements: The terms and duration of contracts with these suppliers play a significant role in defining their bargaining power.

- Alternative Sourcing: While specialized, Capitec can explore multiple vendors to foster competition and manage supplier influence.

Regulatory and Compliance Service Providers

The South African banking sector, including Capitec, operates within a stringent regulatory environment. Ongoing reforms, such as the Basel III finalization and the implications of the Financial Action Task Force (FATF) grey listing, necessitate significant investment in compliance. This creates a strong position for suppliers of regulatory and compliance services.

Suppliers of specialized regulatory technology (RegTech) and compliance consulting are vital for banks to navigate these complexities. The increasing focus on efficiency, cybersecurity, and fraud prevention, particularly in light of evolving threats, further elevates the importance of these providers.

- Regulatory Burden: South Africa's banking sector faces continuous regulatory evolution, impacting operational requirements and technology investments.

- RegTech Demand: The adoption of RegTech solutions is driven by the need for efficiency and robust fraud prevention mechanisms.

- Supplier Importance: Specialized service providers offering compliance expertise and technology are critical enablers for banks like Capitec.

Capitec's reliance on technology providers, such as AWS for cloud infrastructure and ACI Worldwide for payment processing, grants these suppliers significant bargaining power. The bank's substantial IT investment, R1.9 billion in FY2024, underscores this dependence.

Similarly, the demand for specialized IT and data professionals, with external hires increasing by 15% in FY2024, indicates that skilled individuals hold considerable leverage due to their scarcity and critical role in innovation.

Payment networks like Visa and Mastercard also exert influence through transaction fees, as Capitec processes a significant volume of payments via these established channels. The bank's efforts to diversify payment methods aim to mitigate this reliance.

Suppliers of physical infrastructure, including ATMs and branch maintenance, possess moderate power, especially given Capitec's expanding branch network of 700 locations by FY2024. However, Capitec's scale and digital focus allow for competitive tendering.

| Supplier Category | Key Providers | Bargaining Power Influence | Capitec FY2024 Data Impact |

|---|---|---|---|

| Technology Infrastructure | AWS, ACI Worldwide | High (critical for operations, specialized services) | IT investment grew 27% to R1.9 billion |

| Specialized Talent | IT & Data Professionals | High (scarce skills, essential for innovation) | 15% increase in external tech hires |

| Payment Networks | Visa, Mastercard | Moderate to High (essential for transactions, fees) | Growing global transaction volumes |

| Physical Infrastructure | ATM/Branch Maintenance, Security | Moderate (specialized services, nationwide network) | Branch network reached 700 locations |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to CAPITEC's unique banking model.

CAPITEC's Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making and strategic adjustments to competitive pressures.

Customers Bargaining Power

Capitec's vast customer base, exceeding 24 million active clients, with 12.9 million actively using its mobile app, significantly shapes its bargaining power with customers. This scale, the largest for any bank in South Africa, means individual customers possess limited leverage to negotiate fees, as the bank operates on a high-volume, low-margin strategy.

While individual customers have little sway, the collective digital adoption and expectations of this large customer pool are powerful forces. These aggregated demands push Capitec towards continuous innovation and competitive pricing structures to maintain its market position and client satisfaction.

Capitec's strategic focus on individuals seeking affordable banking means its customer base is inherently price-sensitive. This sensitivity directly impacts the bank's ability to raise fees, as a significant increase could lead to customers seeking alternatives. In 2024, Capitec continued to emphasize its transparent, low-cost model, a key differentiator in attracting and retaining this segment.

The ease of switching banks in South Africa has significantly increased, directly impacting the bargaining power of customers. Digital-only banks and improved digital services from traditional banks mean consumers can move their accounts with greater convenience than ever before. This shift means customers have more choices readily available.

While Capitec has cultivated strong client loyalty through its compelling value proposition, the competitive landscape is intensifying. Banks are heavily investing in customer experience, offering more attractive products and services. This heightened competition empowers customers, as they can readily compare and switch to providers offering better terms or services, thereby increasing their collective bargaining power.

Access to Diverse Financial Products

Capitec's move into value-added services, insurance, and business banking broadens its appeal, yet customers retain the power to select specialized products from various competitors. This access to a diverse financial marketplace means Capitec must continually innovate its offerings to remain competitive.

The increasing customer demand for highly personalized and integrated financial experiences empowers them to cherry-pick specific services from different providers. This directly impacts Capitec's strategies for developing new products and setting prices, as they must ensure their integrated solutions offer superior value compared to à la carte options from rivals.

- Customer Choice: The availability of specialized financial products from numerous providers means customers aren't locked into a single institution for all their needs.

- Demand for Personalization: Customers expect tailored financial solutions, driving providers to offer flexible and customizable services.

- Competitive Pressure: Capitec faces pressure to match or exceed the specialized offerings and pricing of competitors across various financial segments.

- Impact on Strategy: Customer bargaining power influences Capitec's product development roadmap and pricing models, pushing for greater value and integration.

Financial Inclusion Initiatives

The South African government and its banking sector are actively pursuing financial inclusion, with a target of achieving 90% banked status by 2030. This national drive significantly boosts the bargaining power of customers, particularly those in previously underserved and low-income segments. As more individuals gain access to banking services, they gain greater choice and leverage over institutions like Capitec, which has historically focused on this market.

This increased access translates into a more discerning customer base. For instance, Capitec reported a 14% increase in its active client base in 2023, reaching 21.6 million clients. This growth, while positive, also means that a larger pool of customers can now compare offerings and switch providers if they find better value or service elsewhere, thereby enhancing their collective bargaining power.

The commitment to financial inclusion means that customers are less dependent on a single provider. This diversification of banking options empowers them to demand better pricing, improved digital services, and more personalized financial solutions. Banks must therefore continuously innovate and offer competitive products to retain these increasingly empowered clients.

- Increased Customer Choice: As financial inclusion expands, customers have more options, reducing their reliance on any single bank.

- Leverage Through Comparison: With greater access to information and services, customers can more easily compare offerings and switch providers.

- Demand for Better Value: Empowered customers are more likely to seek out and demand competitive pricing and superior service.

Capitec's extensive customer base, exceeding 24 million active clients in early 2024, grants significant collective bargaining power. While individual customers have limited leverage, their aggregated demand for competitive pricing and digital services pushes Capitec to maintain its low-cost strategy. The bank's 2023 financial results, showing a 14% increase in active clients to 21.6 million, underscore this large, price-sensitive segment's influence.

| Metric | Value (Early 2024) | Implication for Customer Bargaining Power |

|---|---|---|

| Active Clients | > 24 million | High collective power due to sheer numbers and potential for mass switching. |

| Mobile App Active Users | 12.9 million | Facilitates easy comparison and switching, amplifying customer leverage. |

| Client Growth (2023) | 14% | Indicates a growing, potentially more discerning customer base seeking better value. |

Preview the Actual Deliverable

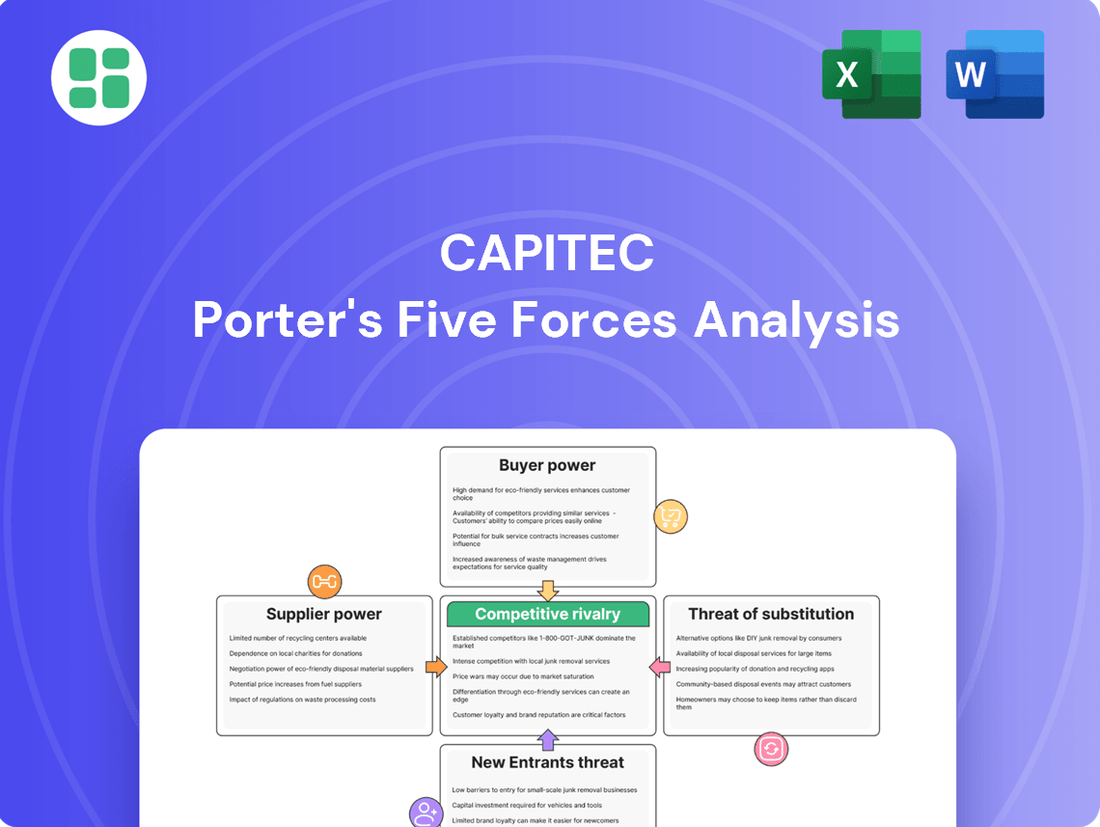

CAPITEC Porter's Five Forces Analysis

This preview showcases the comprehensive CAPITEC Porter's Five Forces Analysis you will receive immediately after purchase. You are viewing the exact, fully formatted document, ensuring no discrepancies or missing information. This professionally crafted analysis is ready for your immediate use, providing deep insights into CAPITEC's competitive landscape without any surprises.

Rivalry Among Competitors

Capitec faces formidable competition from South Africa's established 'Big Five' banks: Standard Bank, FNB, Nedbank, Absa, and Investec. These giants commanded approximately 90% of the total banking sector assets in early 2024, showcasing their immense market power and reach.

While Capitec has carved out a niche by attracting a large client base through its cost-effective banking model, the traditional banks are not standing still. They are actively investing in digital transformation and refining their strategies to retain and grow their market share.

The competitive rivalry within the banking sector is significantly amplified by the rise of digital-only banks and agile fintech firms. Players like TymeBank, which saw its customer base grow to over 9 million by early 2024, and Bank Zero are disrupting traditional banking models with their innovative, digitally-focused approaches. This surge of new entrants compels established institutions, including Capitec, to constantly refine and expand their digital services to remain competitive.

Banks are increasingly shifting focus from core lending to generating revenue through value-added services (VAS) and integrated product offerings within their digital platforms. This includes facilitating sales of items like insurance, mobile airtime, and electricity, effectively monetizing customer engagement on their apps. For instance, Capitec has demonstrated significant success in this domain, securing over 40% of South Africa's airtime and data transactions.

However, this strategic pivot means that other financial institutions are also actively developing and expanding their non-lending ecosystems. As more banks build out these integrated service offerings, the competition intensifies for capturing customer attention and securing a larger share of transactional income, thereby raising the stakes for competitive rivalry.

Expansion into New Segments

Capitec's strategic expansion into the business banking sector, particularly focusing on SMEs and the informal economy, intensifies competitive rivalry. This move directly challenges incumbent banks with established business offerings and agile fintech players like Yoco, which already cater to this market. The increasing number of players vying for this segment means more aggressive pricing and service innovation to attract and retain customers.

The competitive landscape is further shaped by Capitec's digital-first approach, which puts pressure on traditional banks to enhance their own digital capabilities for business clients. This expansion also brings Capitec into closer competition with other fintechs specializing in SME solutions, creating a more crowded and dynamic marketplace where differentiation through service and cost becomes paramount.

- Capitec's SME focus: Targeting underserved micro, small, and medium enterprises.

- Increased competition: Directly challenging established business banks and fintechs like Yoco.

- Digital innovation pressure: Forcing traditional banks to improve their digital business offerings.

- Market dynamics: Leading to a more contested environment with potential for price wars and service enhancements.

Regulatory Environment and Capital Requirements

South Africa's banking sector is navigating a complex regulatory landscape, significantly shaped by ongoing Basel reforms and the nation's FATF grey listing. These initiatives, while crucial for financial stability, impose substantial compliance burdens and necessitate robust capital management. For instance, in 2024, banks are actively working to meet heightened capital adequacy ratios, a direct consequence of these evolving international and domestic standards.

Capitec, like its peers, must continuously adapt its operational strategies to align with these stringent frameworks. Maintaining adequate capital buffers is not merely a compliance exercise but a strategic imperative that influences lending capacity, product development, and overall competitive positioning. The cost of compliance can impact profitability, creating a dynamic where regulatory adherence directly affects market competitiveness.

- Increased Compliance Costs: Banks face higher operational expenses due to new reporting requirements and risk management systems mandated by regulations.

- Capital Adequacy: Maintaining strong capital buffers is essential to absorb potential losses and meet regulatory expectations, impacting lending and investment decisions.

- Adaptation to Evolving Frameworks: The need to constantly update systems and processes to comply with changing rules requires significant investment and strategic foresight.

- Impact on Competitive Landscape: Stricter regulations can create barriers to entry and favor well-capitalized institutions, potentially reshaping market competition.

The competitive rivalry in South Africa's banking sector is intense, with Capitec facing pressure from both established giants and agile digital disruptors. The traditional 'Big Five' banks, holding around 90% of sector assets in early 2024, are enhancing their digital offerings to counter Capitec's cost-effective model. Meanwhile, digital-only banks like TymeBank, which surpassed 9 million customers by early 2024, are further intensifying competition through innovative, low-cost services.

Capitec's expansion into SME banking directly confronts established players and fintechs like Yoco, creating a more crowded market where service and cost differentiation are key. This strategic move necessitates continuous digital innovation, compelling all participants to refine their offerings and potentially leading to aggressive pricing strategies.

The shift towards value-added services, such as airtime and electricity sales, is a significant battleground. Capitec's success in capturing over 40% of airtime transactions highlights the revenue potential, but also means other banks are actively building similar integrated ecosystems, intensifying the fight for customer engagement and transactional income.

SSubstitutes Threaten

The proliferation of mobile money and digital wallets presents a notable threat, mirroring trends seen across Africa. These platforms enable users to manage savings, transfers, loans, and spending without needing a traditional bank.

While South Africa boasts higher banking penetration, these digital solutions offer a convenient and often more affordable avenue for essential financial activities, particularly appealing to those with limited access to traditional banking services. For instance, by mid-2024, mobile money platforms in various African markets were facilitating billions of dollars in transactions monthly, showcasing their significant reach and impact.

Fintech platforms offering digital credit and savings are a significant threat of substitutes for Capitec. These specialized platforms, often utilizing AI for credit assessments, directly compete for customers seeking accessible, small-scale financial solutions. For instance, in 2024, the global fintech lending market was projected to reach hundreds of billions of dollars, indicating substantial customer adoption of these alternatives.

Informal financial services, such as stokvels and community savings groups, are a significant threat to Capitec in South Africa, especially among lower-income customers. These informal networks provide savings, credit, and even insurance-like benefits, operating on trust and community ties, offering a viable alternative to formal banking. For instance, stokvels alone are estimated to manage billions of rands annually, demonstrating their substantial reach and impact within the South African financial landscape.

Retailer-Embedded Finance and Loyalty Programs

Non-banking entities, particularly large retailers and telecommunication firms, are increasingly stepping into the financial services arena. They are embedding payment solutions, credit facilities, and basic transaction capabilities directly into their loyalty programs. For instance, major retailers in South Africa, like Shoprite and Pick n Pay, have expanded their offerings beyond traditional loyalty points to include financial services, aiming to capture a larger share of consumer spending.

These integrated offerings can serve as viable substitutes for Capitec's core banking services, especially for transactional needs and basic credit. By seamlessly weaving financial functions into the customer's purchasing journey, these retailers reduce the perceived need for a separate banking relationship for everyday transactions. This trend is particularly pronounced in emerging markets where consumers may prioritize convenience and integrated solutions.

- Retailer Loyalty Programs Evolving: Retailers are enhancing loyalty programs to include financial services, making them attractive alternatives for basic banking needs.

- Embedded Finance Growth: The global embedded finance market is projected to reach significant figures, with payment solutions being a key component, indicating a strong substitute threat. For example, by 2026, the market is expected to grow substantially.

- Convenience as a Driver: Consumers increasingly value the convenience of managing finances within their retail interactions, potentially diverting transactional volume from traditional banks.

- Telecommunication Companies' Role: Telecoms are also leveraging their vast customer bases and digital infrastructure to offer mobile money and other financial services, acting as direct competitors for basic banking.

Cryptocurrencies and Blockchain-based Solutions

Cryptocurrencies and blockchain technology pose a potential long-term threat of substitution for traditional banking services, though their widespread adoption in South Africa is still developing. These innovations could provide alternative avenues for payments, cross-border remittances, and investment opportunities, potentially circumventing established financial intermediaries.

The South African Reserve Bank (SARB) is actively investigating the implications of central bank digital currencies (CBDCs) and the underlying blockchain technology. As of early 2024, the SARB has been involved in several pilot programs exploring the use of distributed ledger technology for wholesale payments and interbank settlements, indicating a serious consideration of these disruptive forces.

While not yet a significant threat to Capitec's current operations, the evolving landscape of digital assets and decentralized finance could offer substitutes for:

- Payment Systems: Cryptocurrencies offer peer-to-peer transaction capabilities that could bypass traditional banking networks for certain types of payments.

- Remittances: Blockchain-based solutions can facilitate faster and potentially cheaper international money transfers compared to traditional channels.

- Investment Vehicles: Digital assets provide alternative investment opportunities that may attract capital away from traditional savings and investment products offered by banks.

The threat of substitutes for Capitec is multifaceted, encompassing digital financial services, informal savings groups, and integrated offerings from non-banking entities. Mobile money platforms and fintech lenders are rapidly gaining traction, offering convenient and often lower-cost alternatives, particularly for transaction and credit needs. By mid-2024, mobile money platforms in various African markets were facilitating billions of dollars in transactions monthly, highlighting their significant reach.

Informal financial services like stokvels remain a powerful substitute, especially for lower-income segments, tapping into community trust and providing savings and credit. Stokvels alone are estimated to manage billions of rands annually in South Africa. Furthermore, large retailers and telecommunication companies are embedding financial services into their existing ecosystems, creating seamless alternatives for everyday banking needs.

The global embedded finance market is experiencing substantial growth, with payment solutions being a key driver, projected to reach significant figures by 2026. This trend indicates a growing consumer preference for integrated financial services within their purchasing journeys, potentially diverting transactional volume from traditional banks.

Entrants Threaten

The rise of digital-only banks and neo-banks presents a considerable threat to established players like Capitec. These agile competitors, such as TymeBank and Bank Zero in South Africa, operate with significantly lower overheads by eschewing physical branches. This allows them to offer highly competitive, often free or very low-cost, banking services, directly appealing to a broad customer base.

Leveraging technology for rapid scaling and customer acquisition, these new entrants are reshaping customer expectations. For instance, TymeBank reported over 8 million customers by early 2024, demonstrating the speed at which digital banks can gain traction. Their streamlined, user-friendly digital platforms and innovative product offerings, like TymeBank's savings accounts with attractive interest rates, directly challenge traditional banking models and draw customers away from incumbents.

The fintech landscape in South Africa is booming, with new companies constantly emerging to target specific areas like payments or lending. For instance, Yoco has become a significant player in the small business payment processing space. These agile startups can swiftly address unmet market needs or deliver more advanced, technology-focused services, posing a direct challenge to Capitec's broader service model.

While South Africa's banking sector is robustly regulated, recent moves like the introduction of regulatory sandboxes by the Prudential Authority are designed to integrate fintech innovations, potentially easing entry for agile new players. These sandboxes, operational since 2021, allow businesses to test new financial products in a controlled environment, fostering competition.

However, substantial barriers remain, including stringent capital adequacy requirements, the significant cost of compliance with regulations like the Financial Advisory and Intermediary Services Act, and the ever-increasing demands for sophisticated cybersecurity infrastructure, which can deter many potential entrants.

Large Non-Financial Corporations

Major non-financial corporations, particularly those in telecommunications or retail, pose a significant threat by potentially leveraging their extensive customer bases and established digital infrastructure to enter the financial services market. These giants can bypass traditional banking hurdles by offering integrated financial products, such as payments or lending, directly to their existing users. For instance, companies like MTN or Vodacom in South Africa, with millions of mobile subscribers, could easily transition into offering banking-like services, leveraging their brand trust and digital channels.

Capitec CEO Gerrie Fourie has publicly voiced greater concern about tech giants like Apple entering the banking space than traditional new banks. This sentiment underscores the disruptive potential of these large, non-financial entities. Apple, with its massive global user base and secure ecosystem, could introduce financial services that seamlessly integrate with its devices and services, offering a compelling alternative to traditional banking. By mid-2024, Apple Pay's adoption continued to grow, demonstrating its potential as a gateway for broader financial offerings.

- Telecommunication Companies: Leveraging vast subscriber bases and existing payment infrastructure (e.g., mobile money).

- Retail Giants: Utilizing customer loyalty programs and point-of-sale systems to offer credit or payment solutions.

- Tech Platforms: Integrating financial services into existing digital ecosystems, like app stores or social media.

- Disruption Potential: Offering lower fees and more convenient, digitally-native financial products.

Technological Advancements and Lower Costs

Technological advancements are significantly lowering the barrier to entry in the banking sector. Innovations like cloud computing and AI reduce the need for massive upfront investments in physical infrastructure and legacy systems. For instance, the rise of open banking APIs allows new players to integrate with existing payment networks and offer specialized services without building everything from scratch.

These technological shifts, coupled with a digital-first approach, empower new entrants to operate with substantially lower overheads compared to traditional banks. This cost advantage allows them to offer competitive pricing on services, directly challenging established players like Capitec. The threat is amplified as these nimble, tech-savvy competitors can quickly adapt to market changes and customer demands.

- Reduced Capital Expenditure: Cloud infrastructure and software-as-a-service (SaaS) models drastically cut the initial investment needed to launch banking operations.

- Digital-Only Operations: Eliminating physical branches significantly lowers operating costs, enabling more competitive pricing.

- Open Banking APIs: Facilitate faster integration and service delivery, reducing development time and costs for new entrants.

- AI and Automation: Streamline customer service, risk management, and back-office functions, further reducing operational expenses.

The threat of new entrants remains a significant concern for Capitec, primarily driven by the rapid growth of digital-only banks and fintech startups. These agile competitors, often operating with lower overheads due to their digital-first models, are attracting customers with competitive pricing and innovative services. For instance, TymeBank's customer base exceeded 8 million by early 2024, showcasing the speed at which these new players can scale.

Furthermore, large non-financial corporations, particularly telecommunication companies like MTN and Vodacom, possess the potential to leverage their extensive customer bases and digital infrastructure to offer integrated financial services. This poses a substantial threat, as highlighted by Capitec's CEO, who expressed greater concern about tech giants entering the banking space than traditional new banks. The ongoing growth of platforms like Apple Pay by mid-2024 underscores this potential for disruption.

Technological advancements, including cloud computing and open banking APIs, continue to lower the barriers to entry, enabling new players to launch and scale more efficiently. These factors collectively intensify the competitive landscape, forcing established institutions like Capitec to remain agile and responsive to evolving market dynamics and customer expectations.

| Competitor Type | Key Advantages | Example (South Africa) | Customer Acquisition Speed | Impact on Capitec |

|---|---|---|---|---|

| Digital-Only Banks | Lower overheads, competitive pricing, agile technology adoption | TymeBank | High (e.g., 8M+ customers by early 2024) | Direct competition for customer base, pressure on fees |

| Fintech Startups | Niche focus, specialized services, rapid innovation | Yoco (Payments) | Variable, often fast in specific segments | Disruption of specific service areas, potential for partnerships or acquisitions |

| Large Non-Financial Corporations (Telcos, Retail) | Extensive customer bases, brand trust, existing digital infrastructure | MTN, Vodacom | Potentially very high due to existing user base | Significant threat of ecosystem integration, cross-selling financial products |

Porter's Five Forces Analysis Data Sources

Our CAPITEC Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Capitec's annual reports, investor presentations, and official regulatory filings. We supplement this with industry-specific research from reputable financial institutions and market intelligence providers to capture the competitive landscape accurately.