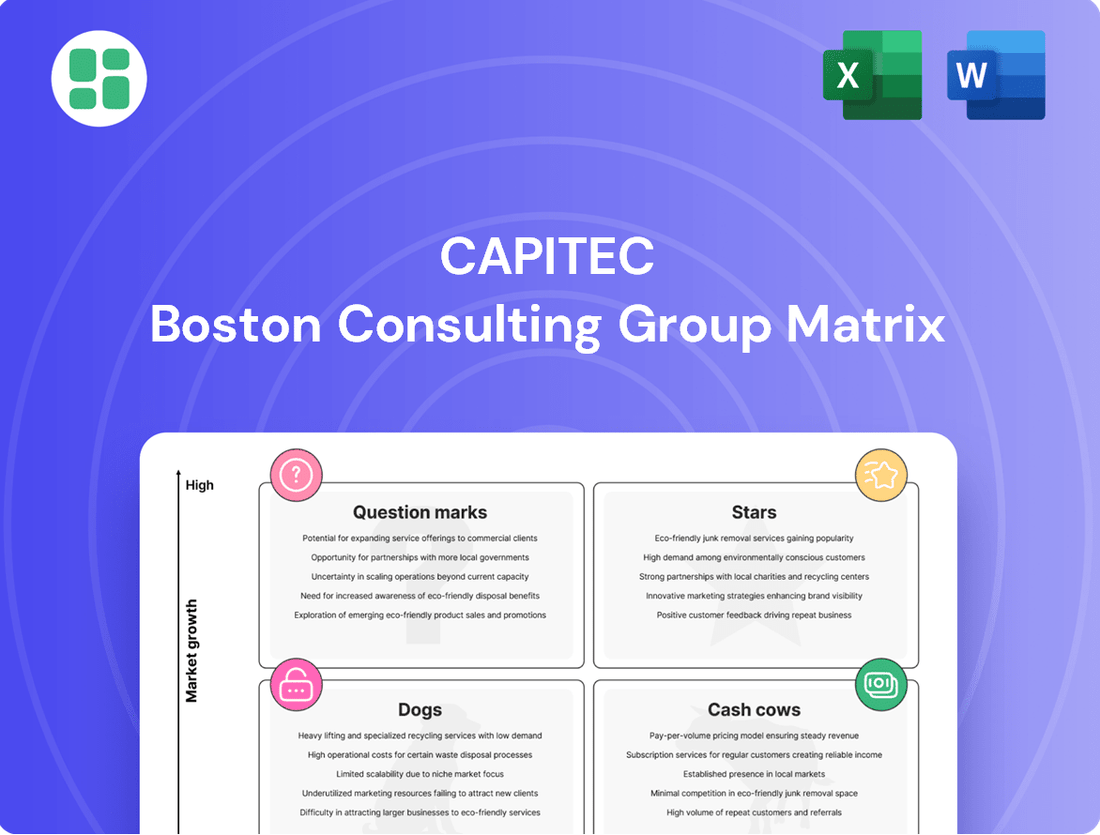

CAPITEC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAPITEC Bundle

Unlock the strategic potential of Capitec's product portfolio with our in-depth BCG Matrix analysis. Understand which offerings are driving growth and which may need a strategic rethink. This preview only scratches the surface of what you need to know to make informed decisions.

Dive deeper into Capitec's market position and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Capitec's digital banking app is a shining example of a Star in the BCG matrix. By February 2025, active app clients surged to 12.9 million, a testament to its rapid growth and widespread adoption.

This platform is the engine of Capitec's digital operations, processing a remarkable 88% of all digital transactions. This dominance underscores its strong market position within the burgeoning digital banking sector.

The app's success as a central hub for diverse financial services further solidifies its Star status, reflecting its ability to capture significant market share in a high-growth digital environment.

Capitec's Value-Added Services (VAS) ecosystem, encompassing prepaid vouchers and bill payments, is a significant growth driver. This segment saw its net income jump by an impressive 61% to R4.4 billion in FY2025, showcasing strong performance.

With over 11 million clients actively utilizing the app for these VAS, Capitec demonstrates deep market penetration. This high engagement underlines the growing demand for integrated digital financial utilities.

These services are crucial for boosting client engagement and significantly contributing to Capitec's non-interest income, solidifying their strategic importance.

Capitec Connect, the bank's mobile virtual network operator, is a prime example of a Star in the BCG Matrix. Its active SIM card connections surged by an impressive 74% in FY2025, reaching 1.6 million. This rapid expansion highlights its strong position in a growing market.

This mobile service is a cornerstone of Capitec's strategy to build an integrated ecosystem, effectively leveraging its substantial client base. The goal is to capture significant market share within the competitive telecommunications sector.

Capitec Connect's success is fueled by its straightforward and budget-friendly data plans. This approach resonates well with consumers, driving high adoption rates in an increasingly dynamic and expanding mobile market.

Emerging Business Banking Segment

Capitec's foray into business banking, especially for small and medium-sized enterprises (SMEs), represents a significant strategic move with substantial growth prospects. The bank's commitment to this segment is evidenced by a 15% increase in active business clients, reaching 218,207 by the fiscal year 2025.

This expansion is designed to capture market share in an area where traditional banking services can often be complex and costly for SMEs. Capitec's strategy of providing simplified processes and competitive pricing is resonating well, indicating a strong potential for disruption.

- Targeting SMEs: Capitec is strategically focusing on the underserved SME market.

- Client Growth: Active business clients grew by 15% to 218,207 by FY2025.

- Competitive Edge: The bank offers competitive fees and simplified services.

- Market Disruption: Aims to challenge established players and secure long-term growth.

Proprietary Insurance Offerings

Capitec's proprietary insurance offerings, launched under its own license in May 2023, are a significant growth driver, classifying them as a Star in the BCG matrix. This segment is experiencing rapid expansion, evidenced by its management of over 3.3 million active funeral and life cover policies by FY2025.

The insurance business contributed a substantial R1.9 billion in net insurance income during FY2025, underscoring its financial performance. This rapid adoption rate suggests Capitec is on track to become the fastest-growing life insurer in South Africa.

- Rapid Growth: Over 3.3 million active policies managed by FY2025.

- Strong Financial Contribution: R1.9 billion in net insurance income in FY2025.

- Market Positioning: Potentially the fastest-growing life insurer in South Africa.

- Strategic Advantage: Leverages extensive client base for market share capture in a growing sector.

Capitec's digital banking app is a shining example of a Star in the BCG matrix. By February 2025, active app clients surged to 12.9 million, a testament to its rapid growth and widespread adoption. This platform is the engine of Capitec's digital operations, processing a remarkable 88% of all digital transactions, underscoring its strong market position within the burgeoning digital banking sector. The app's success as a central hub for diverse financial services further solidifies its Star status, reflecting its ability to capture significant market share in a high-growth digital environment.

Capitec Connect, the bank's mobile virtual network operator, is a prime example of a Star in the BCG Matrix. Its active SIM card connections surged by an impressive 74% in FY2025, reaching 1.6 million. This rapid expansion highlights its strong position in a growing market, driven by straightforward and budget-friendly data plans that resonate well with consumers.

Capitec's proprietary insurance offerings are experiencing rapid expansion, evidenced by its management of over 3.3 million active funeral and life cover policies by FY2025. The insurance business contributed a substantial R1.9 billion in net insurance income during FY2025, underscoring its financial performance and positioning Capitec as a potentially fast-growing life insurer in South Africa.

Capitec's foray into business banking for SMEs represents a significant strategic move. The bank's commitment to this segment is evidenced by a 15% increase in active business clients, reaching 218,207 by FY2025, indicating strong potential for disruption in an area where traditional banking services can be complex.

| Business Unit | BCG Category | Key Metric (FY2025) | Performance Highlight |

|---|---|---|---|

| Digital Banking App | Star | 12.9 million active clients | Processes 88% of digital transactions |

| Capitec Connect (MVNO) | Star | 1.6 million active SIM connections | 74% growth in active SIMs |

| Insurance Offerings | Star | 3.3 million active policies | R1.9 billion net insurance income |

| SME Banking | Star | 218,207 active business clients | 15% growth in active business clients |

What is included in the product

This BCG Matrix analysis offers a tailored look at Capitec's portfolio, identifying units for investment, holding, or divestment.

The CAPITEC BCG Matrix provides a clear, one-page overview of each business unit's market position, relieving the pain of strategic uncertainty.

Cash Cows

Capitec's Global One transactional account is a definitive Cash Cow. By February 2025, it served over 24 million active clients, solidifying its position as South Africa's largest digital and most active bank.

This account consistently generates substantial transaction and commission income, which saw a robust 25% increase in FY2025. The success stems from a low-cost, high-volume strategy that yields strong profit margins and predictable cash flow, necessitating minimal ongoing investment.

Capitec's established savings and deposit products are the bedrock of its funding, representing a significant R173 billion in group deposit balances as of early 2024. These mature offerings are dependable sources of low-cost capital, instrumental in fueling the bank's lending operations.

While these products are well-established, Capitec continues to innovate, introducing features like notice deposits to enhance their appeal. The bank's reputation for simplicity and affordability ensures these accounts remain popular, generating consistent net interest income.

Capitec's mature personal credit solutions, especially unsecured lending, form a substantial and consistent part of its business, significantly boosting net interest income. This segment has a strong market share, delivering dependable revenue.

Extensive Branch Network Support

Capitec's extensive branch network, growing to 880 branches by fiscal year 2025, acts as a vital support system, particularly for cash-dependent transactions and new customer onboarding. This physical presence is a cornerstone for their mass-market strategy.

While the branch network itself might not be in a high-growth segment, it efficiently manages significant cash volumes and provides a critical touchpoint that builds customer trust and facilitates acquisition. It's a stable operational foundation.

- Branch Network Growth: Expanded to 880 branches by FY2025.

- Key Functions: Supports cash services and client onboarding.

- Strategic Role: Enhances accessibility and customer trust for the mass market.

- Operational Backbone: Provides a stable infrastructure for banking operations.

Card Payment Services

Capitec's card payment services represent a significant Cash Cow within its business portfolio. In FY2025, digital and card payments constituted a remarkable 90% of the bank's total transaction volumes, underscoring its dominant position in everyday consumer spending.

This high adoption rate translates directly into robust fee income, primarily derived from swipe and transaction charges. The maturity of this service means it demands minimal incremental investment for ongoing operations, ensuring a stable and predictable revenue stream from Capitec's extensive and active client base.

- High Transaction Volume: Digital and card payments accounted for 90% of transaction volumes in FY2025.

- Consistent Fee Income: Generates substantial revenue through swipe and transaction charges.

- Low Investment Requirement: Requires minimal new capital for continued operation.

- Stable Revenue Stream: Benefits from a large, active client base for predictable earnings.

Capitec's Global One account is a prime example of a Cash Cow, serving over 24 million active clients by February 2025. This high-volume, low-cost model generates substantial and consistent transaction and commission income, with a 25% increase in FY2025, requiring minimal new investment.

The bank's mature savings and deposit products, holding R173 billion in group deposits by early 2024, provide low-cost funding for lending operations. These dependable offerings, enhanced by features like notice deposits, ensure consistent net interest income.

Card payment services are another significant Cash Cow, representing 90% of transaction volumes in FY2025. This generates robust fee income from swipe and transaction charges with minimal ongoing investment needs.

| Product/Service | BCG Category | Key Metric | FY2025 Data Point | Significance |

|---|---|---|---|---|

| Global One Account | Cash Cow | Active Clients | > 24 Million | Dominant market share, consistent revenue |

| Savings & Deposits | Cash Cow | Group Deposits | R173 Billion (Early 2024) | Stable, low-cost funding source |

| Card Payments | Cash Cow | Transaction Volume Share | 90% | High fee income, minimal investment |

Full Transparency, Always

CAPITEC BCG Matrix

The preview you are seeing is the exact Capitec BCG Matrix report you will receive upon purchase, offering a complete and unwatermarked strategic analysis. This comprehensive document is professionally formatted and ready for immediate use in your business planning or presentations. You'll gain access to the full, detailed matrix, enabling informed decision-making regarding Capitec's product portfolio. Rest assured, what you preview is precisely what you will download, providing no surprises and full strategic value.

Dogs

Underutilized legacy systems, such as those potentially remaining from the Mercantile Bank acquisition before full integration, represent a significant challenge. These systems often incur high maintenance expenses while offering little in terms of efficiency or market growth. For instance, in 2024, many financial institutions reported that legacy IT infrastructure accounted for a substantial portion of their technology budget, often exceeding 50% for maintenance alone, with minimal return on investment.

Niche, unpopular specialized lending products would likely fall into the Dogs category for Capitec. These might include highly specific credit facilities for niche industries or unusual asset-backed loans that haven't gained significant market adoption. Their low market share and potential for high default rates, without offsetting high margins, would make them a drain on resources.

Inefficient manual back-office operations at Capitec, if any, would likely represent a "Dog" in the BCG Matrix. These are areas characterized by low growth and low market share, often due to reliance on outdated, paper-based processes. For instance, if a small portion of client onboarding or specific dispute resolution still involves extensive manual data entry and physical document handling, it would fall into this category.

Such operations typically suffer from high error rates, slow turnaround times, and increased costs per transaction. While they might serve a niche client segment or a diminishing transaction type, their inability to scale efficiently hinders their contribution to Capitec's overall profitability and competitive advantage. For example, if a particular legacy system for processing a specific type of loan application requires significant manual intervention, it would be a prime candidate for this classification.

Physical-Only Service Points in Low-Traffic Areas

While Capitec's broader branch network generally performs well as a Cash Cow, specific physical service points in low-traffic areas can be problematic. These smaller branches, especially those lacking robust digital integration, often struggle with low transaction volumes. In 2024, Capitec continued its strategy of optimizing its physical footprint, which includes evaluating underperforming locations.

These underperforming service points can be characterized as having a low market share within their immediate geographic area and facing limited growth prospects. They might represent a financial drain on resources without contributing significantly to the bank's overall profitability or customer acquisition. For instance, a branch with fewer than 500 active clients and a daily transaction count below 100 would likely fall into this category.

- Low Market Share: These points capture a minimal percentage of potential customers in their local catchment area.

- Low Growth Potential: The demographic or economic environment of these locations offers little opportunity for increased business.

- Resource Drain: Operational costs can outweigh the revenue generated, negatively impacting profitability.

- Digital Integration Gap: A lack of advanced digital services means these branches cannot compensate for low foot traffic through online or app-based transactions.

Outdated Investment or Wealth Advisory Services

If Capitec were to offer basic, non-digital, or high-cost investment advisory services, these would likely be considered Dogs in a BCG Matrix. Such services would clash with Capitec's established low-fee, high-volume strategy and struggle to gain traction. For instance, traditional wealth management fees can range from 1% to 2% of assets under management, a stark contrast to the digital-first, cost-conscious approach favored by many Capitec clients.

These outdated services would face significant challenges in a market rapidly shifting towards digital and automated investment platforms. By mid-2024, robo-advisors were managing billions in assets globally, demonstrating a clear client preference for accessible, low-cost digital solutions. Offerings that don't align with this trend would likely possess a low market share and limited growth potential.

- Low Market Share: Traditional advisory services often cater to a niche, high-net-worth segment, which may not align with Capitec's broader customer base.

- Limited Growth Potential: The trend towards digital wealth management, with platforms like Wealthfront and Betterment gaining significant traction, leaves little room for high-cost, non-digital alternatives.

- Brand Misalignment: Offering expensive, old-fashioned advisory services would contradict Capitec's brand image of affordability and accessibility.

- Competitive Disadvantage: Competitors offering digital, low-fee investment solutions would easily outmaneuver these legacy services.

Dogs within Capitec's portfolio represent offerings with low market share and low growth potential, often requiring significant resources without commensurate returns. These could include legacy IT systems, niche lending products with limited uptake, or inefficient manual processes that hinder scalability. For instance, by mid-2024, many financial institutions were still grappling with the cost of maintaining outdated IT infrastructure, which could consume over half of their tech budgets on upkeep alone.

These "Dog" segments, whether they are underperforming physical branches in low-traffic areas or outdated service offerings that clash with Capitec's digital-first strategy, drain capital and operational focus. A branch with fewer than 500 active clients, for example, would likely fall into this category, contributing little to overall profitability. The strategic imperative is to either divest these assets or invest in transforming them into more viable offerings.

| Category | Description | Capitec Example | Market Share | Growth Potential | Strategic Implication |

|---|---|---|---|---|---|

| Dogs | Low market share, low growth potential | Underutilized legacy systems, niche lending products | Low | Low | Divest or revitalize |

| Dogs | Low market share, low growth potential | Inefficient manual back-office operations | Low | Low | Automate or streamline |

| Dogs | Low market share, low growth potential | Underperforming physical branches | Low | Low | Optimize footprint or close |

Question Marks

Capitec is testing a new unsecured lending program for small businesses, focusing on cash flow instead of collateral. This initiative targets both formal and informal sectors, recognizing the significant potential within the R750 billion underserved market.

This new product is categorized as a Question Mark in the BCG Matrix. While the market it aims to penetrate is large and growing, Capitec's current market share is minimal because the product is still in its early development phase. Substantial investment and successful expansion are crucial for it to evolve into a Star performer.

Capitec's post-AvaFin international expansion is focused on early-stage market entries and partnerships. These ventures are characterized by high growth potential in new territories but currently hold a low market share. This positions them as potential Stars in the BCG matrix, requiring significant strategic investment and localization efforts to capture market share and achieve profitability.

Capitec's current use of data for 'next best actions' and fraud prevention is a strong foundation, but the leap to fully AI-driven personalized financial advisory tools, akin to robo-advisors, presents a significant opportunity. This segment holds substantial growth potential as consumers increasingly demand bespoke financial guidance.

While Capitec has a dominant market share in its core banking services, its presence in advanced AI advisory is currently minimal, placing it firmly in the Question Mark category of the BCG matrix. This low market share, coupled with high growth potential, necessitates a strategic decision on investment and development.

The development of these advanced tools requires considerable research and development expenditure. Furthermore, achieving client adoption and demonstrating the tangible benefits of AI-driven advice will be crucial for this initiative to transition from a Question Mark to a Star or Cash Cow.

Specialized High-Value Client Offerings

Specialized high-value client offerings, while not Capitec’s core focus, could be positioned as question marks in the BCG matrix. These would be new or developing products catering to individuals with more complex financial needs or higher net worth, moving beyond their typical mass-market appeal.

These offerings would likely have low market share currently, as Capitec builds out the infrastructure and marketing to attract and serve this segment. The goal would be to capture growth in a less saturated, higher-margin market, requiring significant investment in tailored services and relationship management.

- Targeting High-Net-Worth Individuals: Developing bespoke wealth management solutions or premium banking services for affluent clients.

- Complex Financial Needs: Offering sophisticated investment products, estate planning assistance, or specialized lending facilities.

- Low Market Share, High Growth Potential: These segments are typically characterized by lower penetration for Capitec but offer substantial revenue opportunities if successful.

- Investment Required: Significant investment in specialized staff, technology, and marketing campaigns would be necessary to gain traction.

Emerging Fintech Partnerships

Capitec's strategic focus on technology and innovation naturally leads to exploring partnerships with emerging fintech firms. These collaborations are positioned as potential Stars in the BCG matrix, signifying high growth prospects. For instance, integrating a new AI-driven credit scoring model from a fintech startup could rapidly expand Capitec's lending capabilities into previously underserved markets.

Such ventures, while promising high returns, typically begin with a low market share for the fintech partner. Capitec's existing customer base and brand recognition provide a fertile ground for these new services to gain traction. A successful integration, like the one seen with Capitec’s early adoption of mobile banking solutions which saw a significant increase in digital transactions, underscores the potential of these fintech alliances.

- High Growth Potential: Fintech partnerships can unlock new revenue streams and customer segments, mirroring the rapid expansion seen in digital payment solutions.

- Low Initial Market Share: Emerging fintechs often have limited reach, requiring Capitec's established infrastructure to scale.

- Integration Risk: The success hinges on seamless technological integration and market acceptance of the new offerings.

- Strategic Alignment: These partnerships align with Capitec's goal of offering a comprehensive digital banking ecosystem.

Capitec's foray into new, high-growth markets with nascent offerings exemplifies the Question Mark category. These initiatives, such as the unsecured lending program for small businesses, target substantial market potential but currently hold minimal market share due to their developmental stage.

The success of these Question Marks hinges on significant strategic investment and effective execution to capture market share and evolve into market leaders. Without this, they risk remaining underdeveloped or becoming Dogs.

For instance, Capitec's exploration of advanced AI-driven personalized financial advisory tools represents a significant opportunity in a rapidly expanding sector. However, its current minimal presence in this niche positions it squarely as a Question Mark, demanding substantial R&D and client adoption efforts.

Similarly, specialized offerings for high-net-worth individuals, while potentially lucrative, start with low market penetration for Capitec, requiring considerable investment in tailored services and marketing to succeed.

BCG Matrix Data Sources

Our Capitec BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.