C&C Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

C&C Group Bundle

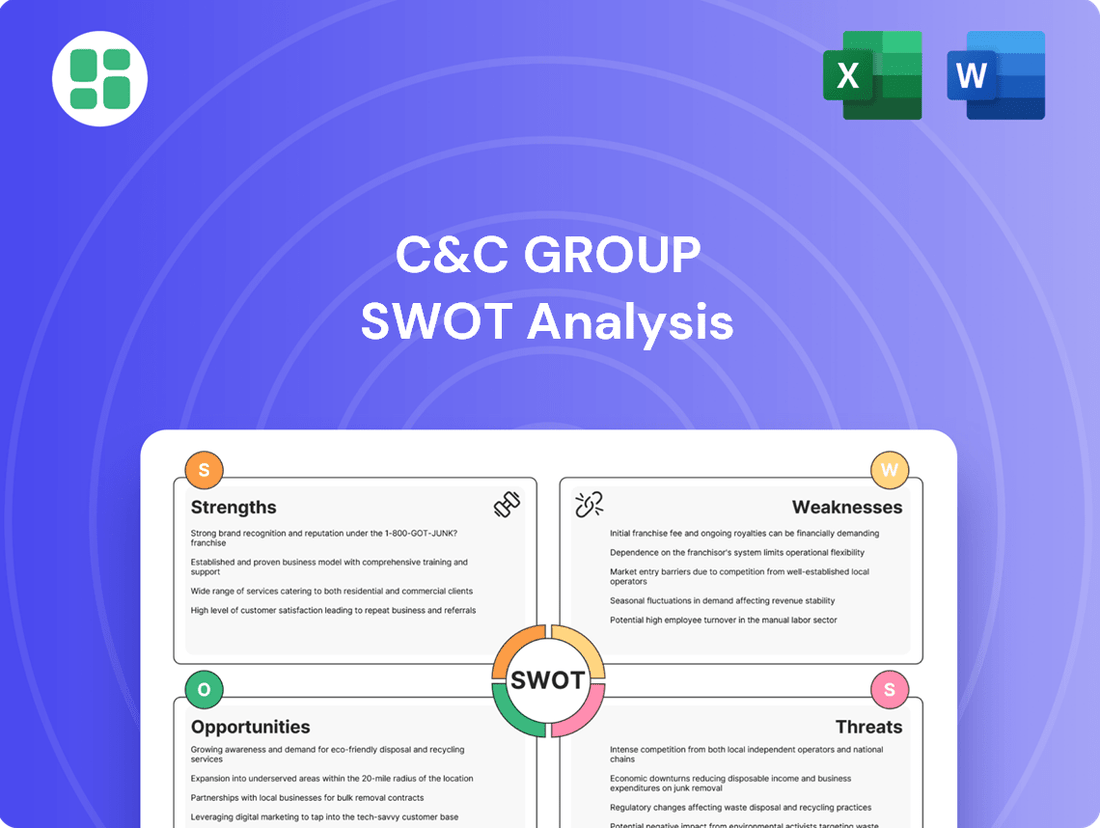

The C&C Group's SWOT analysis reveals a dynamic market position, highlighting key strengths like brand recognition and strategic partnerships, alongside potential weaknesses in operational efficiency. Understanding these internal factors is crucial for navigating the competitive landscape.

To truly grasp the opportunities and threats facing C&C Group, delve into our comprehensive SWOT analysis. This in-depth report offers actionable insights and strategic takeaways, perfect for investors and business strategists.

Want to unlock the full potential of C&C Group's market strategy? Purchase the complete SWOT analysis for a professionally written, fully editable report designed to support your planning and decision-making.

Strengths

C&C Group's strength lies in its robust and varied brand portfolio, featuring established market leaders such as Bulmers in Ireland and Tennent's in Scotland, both demonstrating continued market share gains. This broad appeal across different segments of the beverage market provides a significant competitive advantage.

The company is also experiencing impressive double-digit revenue growth from its premium and craft brands, including Menabrea and Orchard Pig. This success highlights C&C Group's ability to adapt to and capitalize on evolving consumer preferences for higher-value, differentiated products.

This strategic diversification within its brand offerings not only solidifies its market leadership but also builds resilience against potential shifts in consumer tastes or economic conditions, ensuring a more stable revenue stream.

C&C Group boasts a market-leading distribution network through its operation of Matthew Clark Bibendum, the premier drinks distributor in the UK and Ireland hospitality industry. This powerful distribution channel is a significant asset, offering unparalleled access to a vast customer base.

In the 2024 fiscal year, Matthew Clark Bibendum saw its customer numbers grow by a healthy 8%. Furthermore, the company maintained exceptional operational efficiency, achieving over 97% on-time delivery rates, underscoring the reliability and strength of its distribution capabilities.

This extensive reach and proven operational excellence provide C&C Group with a critical and highly effective route-to-market for its own brands and those of its partners, solidifying its competitive advantage in the sector.

C&C Group's ownership of manufacturing and packing facilities in Ireland and Scotland grants them robust control over their entire supply chain, from raw materials to final delivery. This vertical integration is a significant strength, allowing for enhanced operational efficiency and consistent quality across their beverage portfolio.

This direct management of production and distribution means C&C Group can better optimize costs and react swiftly to changing market conditions. For instance, in the fiscal year ending February 2024, C&C Group reported net revenue of €2.14 billion, a testament to the operational effectiveness that vertical integration supports.

Resilient Financial Performance and Strong Cash Generation

C&C Group demonstrated impressive financial resilience through challenging market conditions. In FY2025, the company reported a substantial increase in its underlying group operating profit, highlighting its ability to navigate economic headwinds effectively. This strong performance underpins the company's robust free cash flow generation.

The group's financial strength is further evidenced by its robust balance sheet. This solid financial footing enables C&C Group to commit to returning €150 million to shareholders via dividends and share buybacks between FY2025 and FY2027. Such financial stability offers considerable flexibility for future strategic investments and operational growth.

- FY2025 Underlying Operating Profit Growth: Significant increase reported, demonstrating resilience.

- Strong Free Cash Flow: Consistent generation provides financial flexibility.

- Robust Balance Sheet: Supports financial stability and strategic initiatives.

- Shareholder Returns: Commitment to return €150 million from FY2025-FY2027.

Commitment to Sustainability and ESG Initiatives

C&C Group has deeply integrated a robust Environmental, Social, and Governance (ESG) strategy into its operational framework. This commitment is underscored by ambitious targets, including achieving carbon neutrality by 2050 and a significant 35% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, measured against a FY2020 baseline. This proactive stance resonates strongly with the growing market preference for sustainable business practices.

The company actively engages its supply chain partners to minimize environmental footprints and enhance sustainability reporting. This collaborative approach demonstrates a clear vision for long-term responsible growth.

- Ambitious ESG Targets: Aiming for carbon neutrality by 2050 and a 35% reduction in Scope 1 & 2 emissions by 2030 (vs. FY2020).

- Consumer & Investor Alignment: Directly addresses increasing demand for sustainable and ethically managed businesses.

- Supply Chain Collaboration: Proactively works with suppliers to improve environmental performance and reporting standards.

- Future-Oriented Strategy: Positions C&C Group favorably in an evolving regulatory and market landscape.

C&C Group's diversified brand portfolio, featuring strong performers like Bulmers and Tennent's, provides a solid foundation. The company's success in premium and craft segments, demonstrated by double-digit revenue growth from brands such as Menabrea, shows an ability to adapt to consumer trends.

Its market-leading distribution network, operated by Matthew Clark Bibendum, which saw an 8% customer growth in FY2024 and maintained over 97% on-time delivery, offers unparalleled market access. Vertical integration through owned manufacturing facilities enhances operational control and efficiency, contributing to a net revenue of €2.14 billion in FY2024.

Financially, C&C Group exhibited resilience in FY2025 with increased underlying operating profit and strong free cash flow, supported by a robust balance sheet. This financial strength underpins a commitment to return €150 million to shareholders between FY2025 and FY2027.

The company's proactive ESG strategy, including targets for carbon neutrality by 2050 and a 35% reduction in Scope 1 and 2 emissions by 2030 (vs. FY2020), aligns with market demands for sustainability.

| Strength Area | Key Metric/Fact | Impact |

|---|---|---|

| Brand Portfolio | Market leadership of Bulmers (Ireland) & Tennent's (Scotland) | Strong market share and brand recognition |

| Premium & Craft Growth | Double-digit revenue growth (e.g., Menabrea, Orchard Pig) | Capitalizes on evolving consumer preferences |

| Distribution Network | Matthew Clark Bibendum: 8% customer growth (FY2024), >97% on-time delivery | Unparalleled market access and operational reliability |

| Vertical Integration | Owned manufacturing facilities, FY2024 Net Revenue: €2.14 billion | Enhanced control, efficiency, and consistent quality |

| Financial Resilience | FY2025 Underlying Operating Profit increase, €150m shareholder returns (FY2025-FY2027) | Financial stability and flexibility for growth |

| ESG Commitment | 35% Scope 1 & 2 emissions reduction target by 2030 (vs. FY2020) | Positive market perception and regulatory preparedness |

What is included in the product

Examines the opportunities and risks shaping the future of C&C Group by analyzing its strengths, weaknesses, opportunities, and threats.

Identifies critical weaknesses and threats, enabling proactive risk mitigation and focused improvement efforts.

Weaknesses

C&C Group experienced considerable operational hiccups, notably the challenging rollout of its Enterprise Resource Planning (ERP) system at Matthew Clark during the fiscal year 2024. This led to significant exceptional costs and a dip in service levels, directly impacting business operations and customer satisfaction.

The ERP implementation issues resulted in tangible financial consequences, with the company reporting material exceptional costs in FY2024 related to this project. While service levels have since improved, the disruption underscored the inherent risks in large-scale system transitions and their potential to affect profitability and business momentum.

C&C Group's reliance on the UK and Ireland for the majority of its revenue, despite international expansion efforts, presents a significant weakness. In the fiscal year ending February 2024, these core markets accounted for a substantial portion of its sales, exposing the company to localized economic downturns and regulatory shifts. This concentration limits the benefits of geographic diversification, making C&C Group particularly vulnerable to market-specific risks.

C&C Group has experienced a noticeable dip in softer cider volumes across Great Britain. Recent reports for the fiscal year ending February 2024 showed a volume decline in this key segment, impacting overall net revenue. This softness is partly linked to unfavorable weather patterns during the crucial summer months and a generally subdued consumer spending environment.

This trend is particularly concerning given C&C Group's historical strength in the cider market. The company's performance in Great Britain, a significant revenue generator, is directly affected by this volume contraction. Successfully navigating this challenge is vital for C&C to protect its market share and profitability within this core product category.

Underperformance of Magners Brand in UK

The Magners brand in the UK has been a notable weakness for C&C Group, showing declining volumes and net revenue. This underperformance led to a significant non-cash goodwill impairment charge of €255 million in FY2024, directly impacting the group's profitability.

While C&C is regaining full control of its Great Britain distribution, the brand's historical struggles necessitate a substantial turnaround strategy. This situation highlights the challenges in revitalizing established brands within a competitive market.

- Declining UK Performance: Magners has seen a consistent drop in sales volume and net revenue in the crucial UK market.

- FY2024 Impairment: A €255 million non-cash impairment of goodwill was recognized in FY2024 due to Magners' underperformance.

- Distribution Reacquisition: C&C is taking back full control of distribution in Great Britain, aiming to improve Magners' market position.

- Revitalization Needs: The brand requires significant investment and strategic changes to reverse its declining trajectory and contribute positively to group results.

Sensitivity to Macroeconomic Headwinds and Consumer Confidence

C&C Group's performance is significantly vulnerable to shifts in the broader economic landscape. For instance, elevated inflation rates in the UK and Ireland, as observed through the Consumer Price Index (CPI) which stood at 2.3% in April 2024, directly erode consumer purchasing power. This dampens discretionary spending on items like alcoholic beverages, creating a challenging market environment for the company.

Furthermore, a decline in consumer confidence acts as a potent headwind. When consumers feel less secure about their financial future, they tend to cut back on non-essential purchases. This can translate into reduced sales volumes for C&C Group's products, impacting revenue streams and potentially pressuring profit margins as the company navigates a less buoyant economic backdrop.

- Economic Sensitivity: The hospitality sector, including alcoholic beverage sales, is highly susceptible to macroeconomic factors.

- Inflationary Impact: Rising inflation in the UK and Ireland (CPI at 2.3% in April 2024) reduces disposable income, affecting consumer spending on C&C's products.

- Consumer Confidence: Low consumer confidence further curtails discretionary spending, posing a risk to revenue growth and profitability.

C&C Group faces significant headwinds from its overreliance on the UK and Ireland markets. These regions, while core to its business, expose the company to localized economic downturns and regulatory changes, limiting the benefits of geographic diversification. The substantial impairment of €255 million for the Magners brand in FY2024, stemming from declining UK performance, underscores the brand's struggles and the need for a robust turnaround strategy. Furthermore, the company experienced a volume decline in Great Britain's softer cider segment in FY2024, impacted by unfavorable weather and subdued consumer spending.

The operational challenges encountered with the ERP system rollout at Matthew Clark in FY2024 resulted in considerable exceptional costs and a temporary dip in service levels. This disruption highlighted the inherent risks associated with large-scale system transitions and their potential to impact profitability and business momentum. The company's performance is also highly sensitive to macroeconomic factors, with elevated inflation rates (CPI at 2.3% in April 2024) and declining consumer confidence in the UK and Ireland directly impacting disposable income and discretionary spending on beverages.

| Weakness | Description | Impact | FY2024 Data/Context |

|---|---|---|---|

| Geographic Concentration | High reliance on UK & Ireland markets. | Vulnerability to localized economic/regulatory shifts. | Core markets accounted for a substantial portion of sales. |

| Brand Performance (Magners UK) | Declining volumes and net revenue. | Significant goodwill impairment (€255 million). | €255 million non-cash impairment recognized. |

| Product Segment Performance (GB Softer Cider) | Volume decline in Great Britain. | Impact on overall net revenue. | Volume contraction noted in FY2024. |

| Operational Disruption (ERP Rollout) | Challenges during Matthew Clark's ERP implementation. | Exceptional costs and temporary service level dip. | Material exceptional costs reported in FY2024. |

| Macroeconomic Sensitivity | Susceptibility to inflation and consumer confidence. | Reduced disposable income and discretionary spending. | UK CPI at 2.3% in April 2024. |

Preview the Actual Deliverable

C&C Group SWOT Analysis

The preview you see is the actual C&C Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed breakdown of Strengths, Weaknesses, Opportunities, and Threats is ready for your strategic planning. Unlock the full report to gain comprehensive insights.

Opportunities

C&C Group's established presence, exporting Magners and Tennent's to over 40 nations, highlights a prime opportunity for deeper international market penetration and export growth. This existing global footprint provides a solid foundation for expanding into new territories.

By actively pursuing diversification beyond its primary UK and Ireland markets, C&C can significantly mitigate geographic concentration risks and access untapped growth potential. This strategic move is crucial for long-term resilience and expansion.

For instance, in 2023, C&C reported that its international segment, which includes exports, saw a notable increase in net revenue, demonstrating the inherent potential in these markets. Cultivating strategic alliances and implementing tailored marketing campaigns in promising new regions could unlock substantial future revenue streams and solidify C&C's global brand position.

C&C Group's premium beer and cider brands, like Menabrea and Orchard Pig, have demonstrated strong double-digit growth, presenting a significant opportunity. This trend highlights consumer demand for higher-quality, unique beverages, enabling C&C to achieve better profit margins and capture a growing market share.

C&C Group's strategic decision to relaunch the Magners brand and reclaim direct distribution control in Great Britain starting January 2025 is a prime opportunity. This move allows for concentrated investment in brand development and ensures sales, marketing, and distribution are fully aligned, a crucial step for a brand that saw its revenue decline by 10.3% in the first half of fiscal year 2024 compared to the previous year.

By taking the reins, C&C can directly influence Magners’ trajectory, aiming to reverse recent performance dips and solidify its position as a more robust contributor to the group's overall portfolio. This direct control is vital for executing a revitalized marketing strategy and ensuring optimal market presence, potentially recapturing market share lost in prior periods.

Leveraging Distribution Network for Customer Acquisition

C&C Group's Matthew Clark Bibendum distribution arm is showing impressive recovery, with customer numbers bouncing back and service levels reaching new highs. This strong performance is a significant opportunity to attract more customers and increase market share within the crucial hospitality industry.

The company's ability to maintain top-tier service and deliver excellent value positions it to become the go-to distributor for an even broader array of customers and brands.

- Distribution Network Strength: Matthew Clark Bibendum's recovery in customer numbers and service levels, as reported in recent financial updates, highlights its robust operational capacity.

- Market Penetration Potential: The existing strong distribution platform offers a clear avenue for C&C Group to expand its reach and acquire new customers in the hospitality sector.

- Competitive Advantage: By continuing to offer industry-leading service and value, C&C can solidify its competitive edge and attract a wider customer base.

Investing in Technology and Operational Efficiency

C&C Group's commitment to ongoing strategic investments in technology and operational efficiency is a key opportunity for sustained profitable growth. These investments directly impact the bottom line by streamlining processes and reducing overhead. For instance, improvements in supply chain efficiencies have already demonstrably boosted underlying profitability.

Further technological advancements and process optimizations offer significant potential to not only reduce costs but also elevate service levels. This dual benefit strengthens C&C Group's competitive standing in the market. By embracing innovation, the company can unlock new avenues for enhanced customer satisfaction and operational excellence.

- Enhanced Supply Chain: Investments in technology are improving C&C Group's production, distribution, and warehousing, leading to increased profitability.

- Cost Reduction: Further process optimizations can significantly lower operational expenses.

- Competitive Edge: Technological advancements will strengthen the company's market position by improving service and efficiency.

- Profitability Growth: These investments are directly linked to the company's long-term profitable growth trajectory.

C&C Group's robust distribution network, particularly Matthew Clark Bibendum, presents a significant opportunity. This segment has seen customer numbers rebound and service levels improve, positioning it to attract more clients within the hospitality sector and expand its market share.

The company's premium brands, such as Menabrea and Orchard Pig, are experiencing strong double-digit growth, indicating a consumer preference for higher-quality beverages. This trend allows C&C to achieve better profit margins and capture a larger share of a growing market segment.

Furthermore, C&C's strategic decision to regain direct distribution control of Magners in Great Britain from January 2025 offers a chance to revitalize the brand. This move enables focused investment in marketing and ensures sales and distribution efforts are aligned, potentially reversing the 10.3% revenue decline seen in the first half of fiscal year 2024 for the brand.

C&C's ongoing investment in technology and operational efficiency is another key opportunity for profitable growth. Streamlined processes and supply chain improvements have already boosted profitability, with further advancements promising to reduce costs and enhance customer service, thereby strengthening its competitive position.

| Opportunity Area | Key Metric/Indicator | Data/Observation |

|---|---|---|

| International Market Penetration | Export Nations | Established presence in over 40 nations |

| Premium Brand Growth | Brand Growth Rate | Double-digit growth for Menabrea and Orchard Pig |

| Magners Relaunch | Previous H1 FY24 Revenue Decline | 10.3% decline |

| Distribution Network Recovery | Matthew Clark Bibendum Performance | Customer numbers and service levels improving |

| Operational Efficiency | Impact of Investments | Boosted underlying profitability via supply chain improvements |

Threats

A significant threat for C&C Group stems from evolving consumer preferences, especially the increasing focus on health and wellness. This trend could potentially reduce overall alcohol consumption or drive a greater demand for lower-alcohol and non-alcoholic beverages, directly impacting sales volumes for C&C's traditional alcoholic product lines.

For instance, the global non-alcoholic beverage market is projected to reach approximately USD 1.1 trillion by 2026, indicating a substantial shift in consumer spending. C&C needs to proactively adapt its product portfolio and marketing approaches to resonate with these broader societal changes and capitalize on emerging consumer demands.

The alcoholic beverage sector is fiercely contested, with C&C Group navigating a landscape populated by global behemoths, agile regional operators, and a rapidly expanding array of craft breweries and distilleries. This crowded market forces constant price adjustments and escalates marketing expenditures, making it a significant hurdle to retain and grow market share.

For instance, in 2024, major competitors like Diageo and Pernod Ricard continue to invest heavily in brand building and new product development, while the craft segment saw over 9,000 breweries operating in the US alone by early 2025, according to industry reports. This intense rivalry necessitates C&C Group's ongoing commitment to innovation and distinct brand positioning to stand out.

C&C Group is navigating a landscape marked by persistent macroeconomic inflation, which is driving up the costs of essential inputs like raw materials, energy, and transportation. For instance, global energy prices saw significant volatility throughout 2024, impacting production and distribution expenses across many industries.

These escalating operational expenses directly threaten to compress C&C Group's profit margins. The company's success hinges on its capacity to absorb or pass on these increased costs. Failing to do so effectively could erode profitability, especially if consumer price sensitivity limits the ability to implement price hikes.

Managing these rising costs while maintaining consumer demand presents a significant hurdle. C&C Group's strategic approach to cost management, including operational efficiencies and potentially selective price adjustments, will be paramount in ensuring sustained financial performance through 2025.

Regulatory Changes and Increased Taxation on Alcohol

Changes in government regulations, particularly concerning alcohol taxation and public health policies, represent a significant threat to C&C Group. For instance, the UK government's ongoing reviews of alcohol duty, which could see further increases, directly impact pricing strategies and consumer affordability. In 2024, the alcohol duty system in the UK underwent a significant overhaul, aiming to simplify it but also potentially leading to varied impacts across different product categories.

Stricter advertising rules and new public health initiatives, such as proposed restrictions on alcohol marketing or labeling requirements, could also curtail demand and increase compliance costs. C&C Group must remain vigilant in monitoring these evolving legislative landscapes across its key markets, including Ireland and the United States, to navigate potential adverse effects on sales volumes and profitability.

The company's exposure to different regulatory regimes means that a synchronized increase in taxes or a tightening of advertising standards across multiple jurisdictions could amplify the negative impact.

- Potential for increased excise duties on cider and beer products in key markets like the UK and Ireland.

- Stricter regulations on alcohol advertising and promotion could limit market reach and brand visibility.

- New public health policies, such as sugar taxes or calorie labeling mandates, may necessitate product reformulation or impact consumer perception.

- Navigating diverse and potentially conflicting regulatory frameworks across international markets adds complexity and cost.

Economic Downturn and Subdued Consumer Spending

Continued challenging macroeconomic conditions and subdued consumer confidence in C&C Group's core markets, particularly the UK and Ireland, present a risk to sales and profitability. Economic uncertainty can lead to reduced discretionary spending in the hospitality sector and lower demand for premium beverages. A prolonged downturn could significantly impact the company's financial performance.

For instance, in the fiscal year ending February 2024, C&C Group reported that while net revenue grew by 8.3% to €2.1 billion, the economic backdrop remained a key consideration. Persistent inflation and cost-of-living pressures in the UK and Ireland directly influence consumer purchasing power for non-essential items like premium beverages.

- Economic Uncertainty: Lingering inflation and potential interest rate hikes in key markets like the UK and Ireland could further dampen consumer confidence.

- Discretionary Spending Impact: A slowdown in consumer spending directly affects the hospitality sector, a crucial channel for C&C Group's products, potentially leading to reduced on-trade sales.

- Volume Sensitivity: C&C Group's reliance on volume sales means that a sustained economic downturn could lead to a significant contraction in revenue and profit margins.

- Premium Product Vulnerability: During periods of economic strain, consumers may trade down from premium beverage offerings, impacting C&C Group's higher-margin products.

The competitive landscape poses a significant threat, with C&C Group facing intense rivalry from global players and a growing craft segment. This necessitates continuous innovation and brand differentiation to maintain market share amidst escalating marketing costs.

Economic headwinds, including persistent inflation and cost-of-living pressures in the UK and Ireland, directly impact consumer spending on discretionary items like premium beverages. This economic uncertainty can lead to reduced demand, particularly in the hospitality sector, a key sales channel for C&C.

| Threat Category | Description | Impact on C&C Group |

| Intense Competition | Presence of global giants and numerous craft producers | Pressure on pricing, increased marketing spend, need for differentiation |

| Economic Downturn | Inflation, cost-of-living crisis in core markets | Reduced consumer spending, lower demand in hospitality, potential for trading down |

| Regulatory Changes | Potential for increased alcohol duties, stricter advertising rules | Higher operating costs, reduced profitability, limitations on market reach |

| Shifting Consumer Preferences | Growing demand for health-conscious and low/no-alcohol options | Potential decline in sales of traditional alcoholic products, need for portfolio adaptation |

SWOT Analysis Data Sources

This C&C Group SWOT analysis is built upon a robust foundation of data, drawing from verified financial reports, comprehensive market intelligence, and expert industry commentary to ensure a thorough and accurate strategic assessment.