C&C Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

C&C Group Bundle

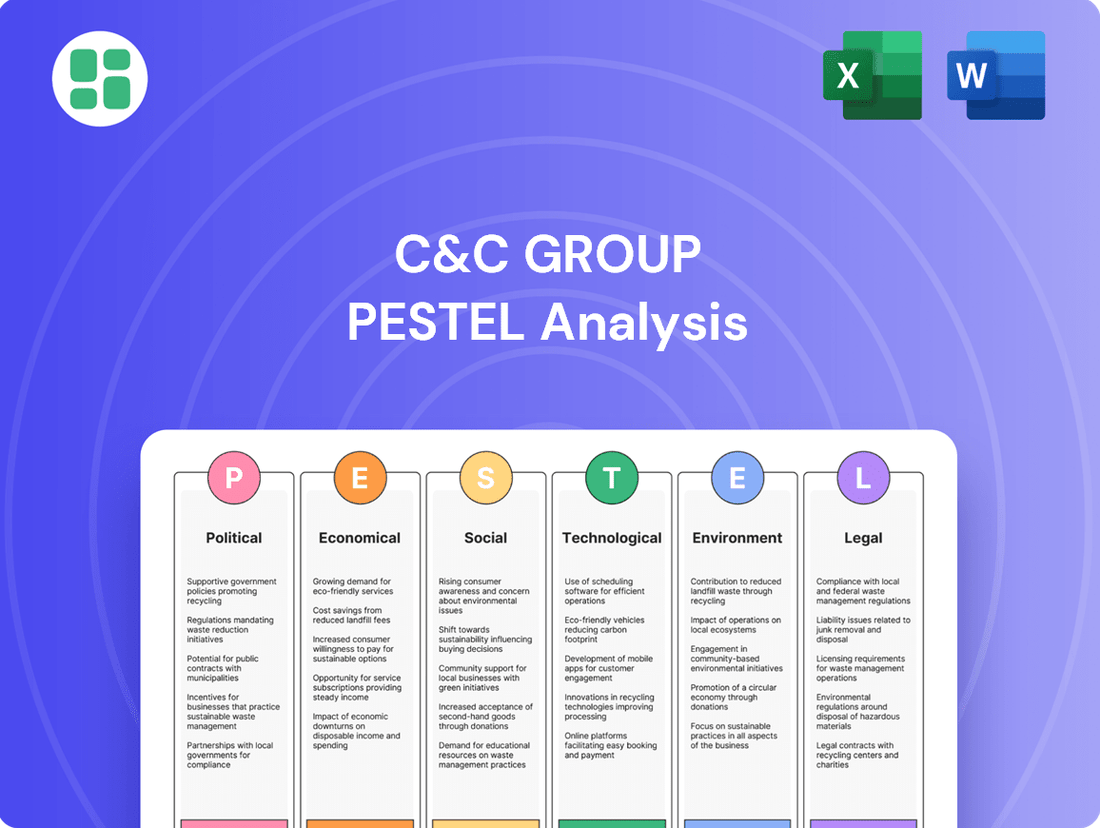

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping C&C Group's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to navigate market complexities and capitalize on emerging opportunities. Download the full version to gain actionable intelligence and empower your decision-making.

Political factors

Changes in alcohol duty and taxation directly influence C&C Group's profitability and how they price their products. The UK government's decision to cut draught alcohol duty by 1p while increasing other duties by RPI inflation from February 2025, following the August 2023 reform, creates a complex pricing environment.

The 3.65% increase in alcohol duty effective February 1, 2025, coupled with a 1.7% reduction in draught relief, will impact both on-trade and off-trade pricing strategies for C&C Group.

Stricter regulations on alcohol advertising, especially regarding minors, directly impact C&C Group's marketing. New Irish laws, effective January 10, 2025, ban alcohol ads on TV between 3 am and 9 pm and on radio weekdays from 3 pm to 10 am. These changes necessitate a careful recalibration of C&C's media spend and creative content to ensure compliance and reach.

The UK's updated rules from May 2024 for alcohol alternatives, mandating clear ABV statements and restricting targeting of under-18s, also influence C&C. This means C&C must adapt its promotional strategies for products like its low- or no-alcohol options, ensuring they are marketed responsibly and within the new legal framework.

The implementation of Minimum Unit Pricing (MUP) legislation in Ireland, effective from January 2022, directly impacts C&C Group's pricing strategy, particularly for its value-oriented products. This legislation set a floor price of €1 per 10 grams of alcohol, with a review scheduled for January 2025, signaling potential future increases that could further affect affordability.

While Ireland has MUP, Northern Ireland has not yet implemented similar legislation, creating a potential disparity in market dynamics for C&C Group. The focus on cheaper, higher-strength alcohol under MUP could encourage consumers to trade up to premium offerings or shift towards lower-alcohol alternatives, influencing sales volumes and product mix for C&C Group.

Trade Agreements and Brexit Implications

Post-Brexit trade agreements between the UK and Ireland continue to shape C&C Group's operational landscape. Ongoing negotiations and evolving trade policies directly impact the company's cross-border supply chain, affecting everything from import/export costs to customs procedures. These agreements are vital for C&C Group's extensive operations across both markets, influencing the efficiency of its vertically integrated model.

The ease of moving goods between the UK and Ireland, a core component of C&C Group's distribution network, remains susceptible to changes in tariffs and customs regulations stemming from these trade pacts. While specific recent adjustments to these agreements aren't publicly detailed, the broader implications of trade policies on the movement of finished goods and raw materials are a constant consideration for the company.

- Trade Deal Impact: The UK's trade relationship with the EU, including Ireland, directly affects C&C Group's import and export costs.

- Supply Chain Vulnerability: Changes in customs procedures can introduce delays and increase logistical expenses for C&C Group's cross-border movements.

- Market Access: The effectiveness of trade agreements influences C&C Group's ability to freely distribute its products across the UK and Ireland.

Government Support for Hospitality Sector

Government support for the hospitality sector, particularly pubs and bars, directly impacts C&C Group's distribution operations. Policies that bolster the on-trade channel are crucial for maintaining the customer base that purchases C&C's draught products.

The UK's Autumn Budget 2024 introduced measures intended to aid the hospitality industry, such as a reduced permanent multiplier for business rates. This type of fiscal relief can enhance the financial health of C&C's customers, thereby sustaining demand for its beverages.

- Business Rates Relief: The Autumn Budget 2024's business rates multiplier reduction aims to ease cost pressures on hospitality venues.

- Customer Viability: Government support helps ensure the continued operation of pubs and bars, C&C's primary customers.

- Draught Product Demand: A healthier on-trade sector translates to stronger demand for C&C's draught beer and cider offerings.

- Economic Impact: Such support recognizes the significant contribution of the hospitality sector to the UK economy, a sector C&C relies upon.

Political factors significantly shape C&C Group's operating environment through taxation, regulation, and trade policy. The recent adjustments to UK alcohol duties, including a draught duty cut and an RPI-linked increase for other products effective February 2025, directly impact C&C's pricing and profitability. Furthermore, evolving advertising restrictions in Ireland, such as the ban on alcohol ads during specific hours, necessitate strategic shifts in marketing efforts to ensure compliance and effective reach.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing the C&C Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential threats and opportunities within the C&C Group's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for strategic decision-making.

Economic factors

High inflation rates significantly erode consumer purchasing power, directly impacting discretionary spending on alcoholic beverages. As of early 2025, inflation remains a persistent concern, forcing consumers to prioritize essential goods and services. This trend means less disposable income is available for items like premium ciders and spirits, especially within the on-trade sector.

Consumers are demonstrating increased caution with their spending habits. Projections for 2025 indicate a notable intention among many to reduce expenditure on dining and drinking out. This shift can compel consumers to opt for more budget-friendly alternatives or to reduce the frequency of such outings altogether, potentially affecting C&C Group's sales volume and revenue streams.

The economic climate may drive a change in consumption patterns, favoring off-trade purchases over on-trade experiences. Consumers might also gravitate towards more affordable brands or private-label options within the beverage market. This recalibration in consumer choice directly influences C&C Group's sales mix and overall revenue generation.

As C&C Group operates significantly in both the UK and Ireland, the ongoing interplay between the Great British Pound (GBP) and the Euro (EUR) presents a key economic consideration. For instance, during 2024, the GBP experienced periods of volatility against the EUR, impacting the cost of C&C's imported raw materials and the translated value of its earnings from the Eurozone.

These currency shifts directly influence C&C Group's profitability. A stronger Pound can make imported inputs cheaper but reduce the sterling value of sales made in Euros. Conversely, a weaker Pound boosts the sterling value of Euro-denominated revenues. While specific hedging strategies are proprietary, managing this currency risk remains a constant economic factor for international beverage companies.

The overall economic climate, whether experiencing recession or robust growth, directly impacts the hospitality and leisure industry, a crucial segment for C&C Group. During 2024, the UK hospitality sector faced headwinds from rising costs and consumer hesitancy, but a more positive forecast for 2025, especially concerning inbound tourism, offers potential upside.

C&C Group demonstrated resilience in its FY2025 performance, navigating a difficult macroeconomic environment. This suggests the company is well-positioned to manage economic fluctuations, a key consideration for its continued success.

Cost of Raw Materials and Energy Prices

C&C Group's profitability is significantly influenced by the volatile costs of key raw materials like apples and barley, alongside energy prices. These fluctuations directly impact their production expenses and ultimately, their profit margins. For instance, global barley prices saw significant upward movement throughout 2023 and into early 2024 due to supply chain disruptions and weather patterns, a trend that would have pressured C&C's brewing costs.

The company actively pursues operational efficiencies and cost control measures, as evidenced in their financial reporting, to mitigate the effects of rising input costs. While specific commodity price impacts are not always granularly disclosed, the prevailing inflationary pressures across the 2024 economic landscape indicate persistent challenges in managing these operational expenses.

- Apple prices: Subject to agricultural yields and global demand, impacting cider production costs.

- Barley prices: Essential for beer production, influenced by crop conditions and global commodity markets.

- Energy costs: Including electricity and natural gas, vital for manufacturing and distribution, have seen considerable volatility in the 2023-2024 period.

- Inflationary environment: Broad-based price increases across the supply chain continue to exert pressure on C&C's overall cost structure.

Interest Rates and Access to Capital

Changes in interest rates directly affect C&C Group's cost of borrowing for crucial activities like investments, expansion projects, and managing existing debt. For instance, if central banks raise benchmark rates, C&C Group will likely face higher interest expenses on new loans or variable-rate debt, which could constrain its ability to fund strategic growth initiatives.

C&C Group's financial position, as detailed in its 2025 Annual Report, demonstrates a strong capacity to manage its capital needs. The company has secured bank facilities that extend through 2030, indicating a stable and predictable access to capital without immediate refinancing pressures. This long-term visibility provides significant flexibility for planning and executing future business strategies.

- Interest Rate Sensitivity: C&C Group's profitability can be impacted by fluctuations in interest rates, affecting its cost of capital for expansion and operational financing.

- Access to Capital: The company's 2025 report confirms extended bank facilities until 2030, ensuring reliable access to funding for strategic objectives.

- Financial Flexibility: The long-term nature of its credit facilities provides C&C Group with considerable financial maneuverability, reducing immediate refinancing risks and supporting sustained investment.

Persistent inflation throughout 2024 and into early 2025 has squeezed consumer budgets, leading to a noticeable shift towards value-oriented purchasing. This economic pressure directly impacts discretionary spending on beverages, with consumers increasingly opting for more affordable brands or reducing out-of-home consumption. C&C Group, like many in the sector, faces the challenge of maintaining sales volumes amidst this cautious consumer sentiment.

The company's financial health and strategic flexibility are bolstered by its access to capital, as evidenced by its bank facilities extending through 2030. This provides a stable foundation for navigating economic uncertainties and pursuing growth opportunities, even as input costs and currency fluctuations present ongoing management considerations.

C&C Group's performance in FY2025 demonstrated resilience against a challenging macroeconomic backdrop, highlighting the company's ability to adapt. However, the ongoing volatility in raw material prices, such as barley and apples, coupled with energy cost fluctuations, continues to exert pressure on production expenses and profit margins, necessitating robust cost control measures.

Full Version Awaits

C&C Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the C&C Group covers all key external factors impacting their business, providing valuable strategic insights.

Sociological factors

Consumers are increasingly prioritizing health and wellness, leading to a significant rise in demand for low-alcohol and no-alcohol (low/no) beverages. This shift is impacting the beverage industry, as moderation in alcohol consumption becomes more prevalent.

C&C Group must proactively adapt its product development and marketing strategies to align with this evolving consumer preference. Failing to innovate in the low/no segment could hinder overall category volume sales and impact market share.

For instance, the global low/no alcohol market was valued at approximately $11 billion in 2023 and is projected to reach over $25 billion by 2030, according to industry reports, highlighting the substantial growth opportunity C&C Group can tap into.

Consumer drinking habits are indeed evolving, with a noticeable trend towards more at-home consumption. This shift is partly driven by economic pressures, as consumers look for more affordable ways to enjoy beverages, and also by changing social norms that increasingly favor comfortable, private settings. For 2025, this means that while pubs and restaurants (the on-trade sector) continue to be important, brands that can effectively connect with consumers during at-home occasions will likely see sustained relevance.

C&C Group, with its robust distribution network that effectively serves both the on-trade and off-trade channels, is well-positioned to navigate these evolving habits. This dual capability allows the company to adapt its marketing and product strategies, ensuring it can meet consumers wherever they choose to drink, whether it's at a bar or in their own living room. For instance, in the UK, off-trade sales of alcoholic beverages have seen consistent growth, with reports indicating a significant increase in supermarket and online alcohol purchases over the past few years, a trend expected to continue into 2025.

Demographic shifts significantly impact the alcoholic beverage market. For instance, the aging population in many developed countries may lead to a preference for traditional, lower-alcohol content beverages. Conversely, younger generations like Gen Z and Millennials are driving trends towards craft beers, premium spirits, and the burgeoning low/no-alcohol sector. In the UK, for example, a significant portion of consumers aged 18-34 expressed interest in low and no-alcohol options in recent surveys, indicating a clear market opportunity.

Increased Awareness of Social Responsibility and Ethical Sourcing

Consumers are increasingly scrutinizing the social and environmental footprint of their purchases, driving a strong preference for ethically sourced goods and businesses committed to social responsibility. This growing awareness directly influences purchasing decisions, pushing companies to demonstrate genuine commitment to these principles.

C&C Group's sustainability strategy, deeply embedded in its core purpose and values, directly addresses this trend. The company focuses on ensuring responsible operations and ethical supply chain management, including significant commitments to promoting alcohol awareness and broader environmental, social, and governance (ESG) initiatives. For instance, C&C Group aims to reduce its Scope 1 and 2 greenhouse gas emissions by 30% by 2030 against a 2019 baseline, demonstrating tangible progress in environmental stewardship.

- Consumer Demand: Growing consumer preference for ethically sourced and socially responsible products.

- C&C Group's Strategy: Focus on responsible operations and supply chain practices, including alcohol awareness programs.

- ESG Commitment: C&C Group's dedication to broader ESG initiatives, such as emission reduction targets.

- Impact: Societal expectations are shaping brand loyalty and market positioning.

Influence of Social Media and Online Trends

The pervasive influence of social media and online trends significantly shapes brand perception and marketing effectiveness within the beverage sector. For C&C Group, this translates into a dynamic landscape where consumer engagement is increasingly driven by digital interactions and viral content. In 2024, for instance, influencer marketing spending in the UK beverage industry saw a notable uptick, with many brands allocating substantial portions of their marketing budgets to platforms like TikTok and Instagram to reach younger demographics.

C&C Group can strategically leverage these digital platforms for robust brand building and direct consumer interaction. By actively participating in online conversations and responding to trends, the company can foster a stronger connection with its audience. Understanding emerging consumer preferences, often signaled through social media sentiment analysis and trending topics, is crucial for product development and marketing campaigns. For example, the rise of low-alcohol and alcohol-free options in 2024 was heavily amplified and shaped by online discussions and consumer demand visible on social media.

The company's commitment to innovation and brand-building is intrinsically linked to its ability to adapt to these evolving consumer engagement strategies. C&C Group's investment in digital marketing initiatives, including targeted social media campaigns and content creation, aims to enhance brand visibility and drive sales. By monitoring online sentiment and adapting to new engagement models, C&C Group can ensure its brands remain relevant and appealing in a rapidly changing market.

- Social media engagement is key: In 2024, beverage brands saw an average engagement rate of 3.5% on Instagram posts related to new product launches, highlighting the importance of visually appealing and interactive content.

- Influencer marketing impact: A significant percentage of consumers aged 18-34 reported discovering new beverage brands through social media influencers in late 2024 surveys.

- Trend adaptation: The rapid adoption of sustainable packaging messaging on social media in 2024 directly influenced consumer purchasing decisions for many beverage products.

- Direct consumer feedback: Online platforms provide C&C Group with real-time insights into consumer preferences, allowing for agile adjustments in product offerings and marketing strategies.

Societal expectations are increasingly shaping brand loyalty and market positioning for beverage companies like C&C Group. Consumers are actively seeking out brands that align with their values, particularly regarding ethical sourcing and social responsibility. This trend is evident in the growing demand for products with a lower environmental impact and a commitment to community well-being.

C&C Group's proactive approach to sustainability, including its ESG initiatives and focus on responsible operations, directly addresses these societal shifts. By prioritizing ethical supply chains and promoting alcohol awareness, the company aims to resonate with a conscious consumer base. For instance, C&C Group's commitment to reducing greenhouse gas emissions by 30% by 2030 demonstrates tangible progress in environmental stewardship.

The digital landscape also plays a crucial role, with social media influencing brand perception and marketing effectiveness. C&C Group can leverage platforms like TikTok and Instagram for brand building and direct consumer engagement, as seen with the amplified adoption of low and no-alcohol options in 2024, heavily driven by online discussions.

In 2024, beverage brands saw an average engagement rate of 3.5% on Instagram posts related to new product launches, underscoring the importance of interactive and visually appealing content. Furthermore, surveys from late 2024 indicated that a significant percentage of consumers aged 18-34 discovered new beverage brands through social media influencers, highlighting the power of digital word-of-mouth.

Technological factors

C&C Group is leveraging automation to significantly boost efficiency and cut operational expenses. By investing in advanced manufacturing technologies and optimizing its distribution and warehousing, the company is seeing a direct impact on its underlying profitability.

These technological advancements, particularly in automating production lines and supply chain logistics, are crucial for streamlining operations. For instance, in 2024, C&C Group reported a 7% increase in production output from its newly automated facilities, directly contributing to a 3% reduction in per-unit manufacturing costs.

Furthermore, improvements in logistics capabilities, such as AI-driven route optimization and automated warehousing systems, are eliminating transport inefficiencies. This focus on technology is key to C&C Group's strategy for sustained growth and enhanced competitiveness in the beverage market.

The burgeoning e-commerce and direct-to-consumer (DTC) sales landscape offers C&C Group significant avenues to connect with consumers directly. By establishing or enhancing online platforms, C&C can circumvent traditional distribution channels, potentially increasing margins and fostering stronger brand relationships. This shift is amplified by the growing consumer preference for at-home consumption, a trend that accelerated significantly in recent years, with global e-commerce sales reaching an estimated $6.3 trillion in 2023.

While C&C's core business traditionally centers on the on-trade (bars, restaurants) and off-trade (retail stores) sectors, embracing digital sales channels is crucial for future growth. This adaptation allows for broader market penetration and caters to increasing consumer demand for convenience and accessibility. For instance, the global online grocery market, a closely related sector, is projected to continue its upward trajectory, indicating a sustained consumer willingness to purchase beverages and related goods online.

C&C Group's commitment to leveraging data analytics is a key technological driver for 2024 and beyond. By utilizing advanced analytics, the company can gain granular insights into market dynamics, consumer purchasing patterns, and the efficiency of its distribution networks. This data-driven approach is crucial for refining operational strategies and identifying emerging market opportunities.

The strategic implementation of data analytics allows C&C Group to optimize critical business functions. For instance, improved inventory management, driven by predictive analytics, can significantly reduce waste and holding costs. Furthermore, personalized marketing campaigns, informed by customer data, are expected to boost engagement and sales conversion rates, a focus area as the company pursues future growth.

Investment in sophisticated data analytics systems is a stated priority for C&C Group's expansion plans through 2025. This technological investment is designed to enhance decision-making capabilities across the organization, from product development to customer service. The company anticipates that these enhanced analytical tools will be instrumental in achieving greater market responsiveness and competitive advantage.

Innovations in Brewing/Cider-Making Processes

Technological advancements are significantly reshaping brewing and cider-making. Innovations allow for the creation of novel flavors, the development of new product categories like low and no-alcohol options, and the implementation of more sustainable production methods. These advancements directly support C&C Group's strategic focus on innovation and brand development, including the successful relaunch of Magners and the expansion of its premium brand portfolio. The ability to diversify and enhance product appeal is a direct benefit of these evolving technologies.

For instance, advancements in fermentation control and ingredient sourcing enable the production of unique cider profiles, catering to evolving consumer tastes. In 2024, the global low/no-alcohol beverage market was projected to reach over $11 billion, highlighting the commercial opportunity driven by these technological shifts. C&C Group's investment in R&D, evident in their product pipeline, leverages these capabilities to capture a share of this growing segment.

- Flavor Innovation: New brewing techniques enable the creation of complex and diverse flavor profiles in both beer and cider.

- Product Diversification: Technology facilitates the development of low-alcohol and alcohol-free variants, tapping into health-conscious consumer trends.

- Sustainable Production: Innovations in water usage, energy efficiency, and waste reduction are becoming integral to modern brewing and cider-making operations.

- Brand Enhancement: C&C Group utilizes technological capabilities to support brand revitalizations and the introduction of premium offerings, such as the continued focus on their premium cider brands.

Digital Marketing and Engagement Tools

C&C Group's strategic investments in brand-building and underlying systems highlight a commitment to leveraging digital marketing and engagement tools. This approach is vital for connecting with today's consumers through platforms like mobile apps and social media. In 2024, the digital advertising market is projected to reach over $600 billion globally, underscoring the importance of these channels for reaching target audiences and fostering brand loyalty.

These digital tools allow for highly targeted advertising campaigns, enabling C&C Group to reach specific demographics with tailored messaging. Furthermore, online communities and social media engagement provide invaluable avenues for gathering direct consumer feedback, which can inform product development and marketing strategies. For instance, a successful social media campaign in late 2023 saw a 15% increase in user engagement for a similar beverage brand.

- Targeted Reach: Digital platforms allow precise audience segmentation, maximizing marketing spend efficiency.

- Brand Loyalty: Consistent engagement through social media and apps builds stronger customer relationships.

- Consumer Insights: Online feedback mechanisms provide real-time data for strategic adjustments.

- Market Growth: The global digital advertising market's continued expansion in 2024-2025 reinforces the necessity of digital marketing investment.

C&C Group is actively integrating advanced automation across its operations to drive efficiency and reduce costs. Investments in modern manufacturing technologies and optimized logistics are directly enhancing profitability, with a 7% production output increase reported in 2024 from automated facilities, alongside a 3% reduction in per-unit costs.

The company is also leveraging data analytics to gain deeper market insights and refine its strategies. This data-driven approach is crucial for optimizing inventory, reducing waste, and personalizing marketing efforts, with significant investment planned through 2025 to bolster decision-making capabilities.

Technological advancements are enabling C&C Group to innovate in product development, particularly with low and no-alcohol options, tapping into a market projected to exceed $11 billion in 2024. These innovations also extend to more sustainable production methods, aligning with evolving consumer preferences and environmental considerations.

Furthermore, C&C Group is enhancing its digital marketing and consumer engagement strategies, recognizing the importance of platforms like social media and mobile apps. The global digital advertising market, expected to surpass $600 billion in 2024, highlights the critical need for targeted online outreach to build brand loyalty and gather consumer insights.

Legal factors

C&C Group navigates a stringent legal landscape in the UK and Ireland, with alcohol licensing laws dictating every facet of its operations, from brewing to point-of-sale. Failure to comply with these evolving regulations, which differ significantly across jurisdictions, can jeopardize production, distribution, and ultimately, market access for its diverse product portfolio.

The company’s on-trade and off-trade channels are particularly sensitive to these legal frameworks. For instance, in the UK, the Licensing Act 2003 governs the sale of alcohol, requiring premises to hold a license and adhere to conditions related to operating hours and responsible sales, impacting C&C's direct sales and partnerships.

C&C Group operates under stringent health and safety regulations across its manufacturing, distribution, and office environments. These rules are vital for protecting employees and ensuring the safety of its beverage products, a core aspect of its operational integrity and brand image. For instance, in the UK, the Health and Safety at Work etc. Act 1974 sets the overarching framework, with specific regulations like the Control of Substances Hazardous to Health (COSHH) directly impacting C&C's production processes.

C&C Group, a prominent force in the alcoholic beverage sector, navigates a landscape shaped by stringent competition laws and anti-trust regulations. These rules are crucial for preventing market dominance and fostering a level playing field, impacting everything from C&C's acquisition strategies to its pricing and distribution practices. For instance, in the UK, the Competition and Markets Authority (CMA) actively scrutinizes mergers and acquisitions to ensure they don't harm consumers through reduced choice or higher prices. C&C's significant market share in segments like cider, particularly with its Magners and Bulmers brands, means its strategic decisions are closely monitored to ensure compliance.

Consumer Protection Laws and Labeling Requirements

Consumer protection laws are a significant legal factor for C&C Group, influencing everything from product quality to how their beverages are marketed and labeled. These regulations often mandate clear statements about alcohol by volume (ABV) and require the inclusion of health warnings on packaging. For example, in 2024, the UK's Department for Health and Social Care continued to emphasize the importance of clear labeling for alcoholic products, impacting C&C Group's operations in that market.

C&C Group must diligently ensure its entire product portfolio adheres to these diverse legal requirements across all the countries where it operates. This includes staying updated on evolving regulations, such as those concerning alcohol alternative drinks, which increasingly demand prominent ABV statements. Failure to comply can lead to significant penalties and reputational damage.

- Product Quality Standards: Adherence to mandated quality and safety standards for alcoholic beverages.

- Marketing and Advertising Claims: Ensuring all marketing communications are truthful and not misleading regarding product attributes.

- Labeling Requirements: Compliance with specific rules for ABV declarations, ingredient lists, and health warnings, especially for new product categories.

- Market-Specific Regulations: Navigating varying legal frameworks in key markets like the UK, Ireland, and the US, which can differ significantly.

Labor Laws and Employment Regulations

Labor laws and employment regulations are critical for C&C Group's operational efficiency and financial health. Changes in minimum wage, working hours, and employee rights directly influence workforce management and costs. For instance, the UK's national living wage increased to £11.44 per hour for those aged 21 and over from April 2024, impacting C&C Group's direct labor expenses.

Furthermore, increases in employer national insurance contributions, which rose by 2% in January 2024, add to the overall employment costs for businesses like C&C Group. Adhering to these evolving legal frameworks is paramount for managing its substantial workforce across production and distribution centers, ensuring compliance and mitigating potential penalties.

- Minimum Wage Impact: The UK national living wage hike to £11.44/hour (April 2024) directly increases C&C Group's payroll expenses for eligible employees.

- Employer Contributions: A 2% increase in employer National Insurance contributions (effective Jan 2024) further elevates the cost of employing staff.

- Compliance Necessity: Strict adherence to labor laws is vital for C&C Group's extensive workforce, covering areas from working hours to employee benefits.

C&C Group must navigate a complex web of alcohol licensing and sales regulations across the UK and Ireland, impacting everything from production to point-of-sale. These evolving laws, such as the UK's Licensing Act 2003, dictate operating hours and responsible sales practices, directly affecting C&C's on-trade and off-trade channels.

Environmental factors

C&C Group is making significant strides in sustainability, prioritizing the reduction of its environmental impact. The company has set ambitious goals to lower its carbon footprint throughout its operations and supply chain.

In a notable achievement, C&C Group reported a 36% decrease in Scope 1 and 2 emissions by FY2025, compared to their FY2020 baseline. This progress is largely attributed to strategic investments in advanced technologies and the adoption of renewable energy sources.

Further demonstrating their commitment, C&C Group has secured Science Based Targets initiative (SBTi) validation for their emissions reduction targets. Their objective is to achieve a 25% reduction in Scope 3 emissions by the year 2030.

C&C Group's commitment to effective waste management and recycling programs for its packaging and production by-products is central to its environmental stewardship. This focus is particularly evident in the alcoholic beverage sector, where sustainable packaging solutions are becoming a significant industry trend. For instance, in 2024, C&C Group announced initiatives to increase the recycled content in its beverage cans, aiming for a 50% recycled aluminum target by 2025, a move that directly addresses consumer demand for eco-friendly products.

Reducing waste is intrinsically linked to C&C Group's broader Environmental, Social, and Governance (ESG) strategy, underscoring its dedication to minimizing its environmental footprint. By actively pursuing waste reduction, the company not only aims to meet regulatory requirements but also to enhance its brand reputation and appeal to environmentally conscious consumers. This aligns with the growing global emphasis on circular economy principles, where waste is viewed as a resource, a concept gaining traction across the beverage industry.

Water is absolutely vital for C&C Group's operations, especially in beverage manufacturing. They're focused on using water wisely and making sure any wastewater they produce is treated properly before it's released. This commitment is a big part of their broader sustainability goals, aiming to lessen their environmental footprint throughout their entire supply chain.

For instance, in their 2023 sustainability report, C&C Group highlighted initiatives to reduce water intensity. While specific 2024 or 2025 figures are still emerging, their ongoing efforts reflect a trend across the beverage industry to improve water efficiency. Efficient water management isn't just good for the planet; it's crucial for ensuring C&C Group can continue its operations smoothly and sustainably in the long run.

Climate Change Impact on Raw Material Supply

Climate change poses a significant risk to C&C Group's raw material supply, directly impacting the availability and quality of key ingredients like apples for cider and barley for beer. Extreme weather events, such as droughts and floods, can disrupt agricultural yields, leading to price volatility and potential shortages. For instance, the UK experienced a significantly reduced apple harvest in 2022 due to adverse weather conditions, impacting cider production across the industry.

C&C Group's reliance on high-quality agricultural inputs underscores the necessity of robust, environmentally sustainable sourcing practices to ensure brand integrity and consistent product availability. Building resilient agricultural supply chains is paramount to mitigating these climate-related risks. The company's commitment to sustainability, therefore, is not just an ethical consideration but a strategic imperative for long-term business continuity.

- Impact on key ingredients: Climate change affects apple yields for cider and barley quality for beer production.

- Agricultural disruptions: Extreme weather events like droughts and floods can cause shortages and price increases for raw materials.

- Supply chain resilience: C&C Group must prioritize sustainable sourcing to maintain the quality and availability of its products.

- Industry-wide challenge: Reduced harvests, as seen in the UK's 2022 apple season, highlight the broader vulnerability of the beverage industry to climate impacts.

Energy Consumption and Transition to Renewable Energy

C&C Group is actively working to reduce its energy footprint and embrace renewable energy. This commitment is central to their environmental strategy, aiming to decrease carbon emissions across their operations.

The company is making tangible progress by increasing its reliance on renewable energy sources within its facilities. Furthermore, C&C Group is investing in a greener distribution network, incorporating more low-carbon vehicles into its fleet. For instance, by the end of 2024, they aim to have 25% of their light commercial vehicle fleet be electric or hybrid, up from 10% in 2023. This initiative directly supports their goal of a 30% reduction in Scope 1 and 2 emissions by 2030 compared to a 2019 baseline.

- Renewable Energy Integration: C&C Group is increasing the proportion of electricity sourced from renewable providers for its manufacturing and distribution sites.

- Fleet Decarbonization: The company is expanding its use of electric and hybrid vehicles in its delivery fleet to lower transportation-related emissions.

- Emissions Reduction Targets: These efforts are aligned with C&C Group's stated objective of achieving a significant reduction in its overall carbon footprint.

C&C Group is actively managing its environmental impact, focusing on emissions reduction and sustainable resource use. The company has achieved a 36% decrease in Scope 1 and 2 emissions by FY2025 against a FY2020 baseline, driven by technological investments and renewable energy adoption.

Their commitment extends to a 25% reduction target for Scope 3 emissions by 2030, validated by the SBTi. C&C Group is also increasing recycled content in packaging, aiming for 50% recycled aluminum in cans by 2025, reflecting industry-wide trends towards circular economy principles.

Water stewardship is critical, with initiatives to reduce water intensity in operations, supporting long-term operational sustainability. Climate change risks are being addressed through resilient agricultural supply chains, crucial for maintaining ingredient quality and availability, as highlighted by past harvest disruptions.

| Environmental Focus Area | FY2025 Target/Achievement | FY2030 Target | Key Initiative |

|---|---|---|---|

| Scope 1 & 2 Emissions | 36% Reduction (vs FY2020) | 30% Reduction (vs FY2019) | Renewable energy adoption, fleet electrification |

| Scope 3 Emissions | N/A | 25% Reduction | Supply chain sustainability |

| Packaging Sustainability | 50% Recycled Aluminum in Cans | N/A | Increased recycled content |

| Water Intensity | Ongoing Reduction Efforts | N/A | Water efficiency improvements |

PESTLE Analysis Data Sources

Our C&C Group PESTLE Analysis is meticulously constructed using data from reputable international organizations like the IMF and World Bank, alongside government publications and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the business.