C&C Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

C&C Group Bundle

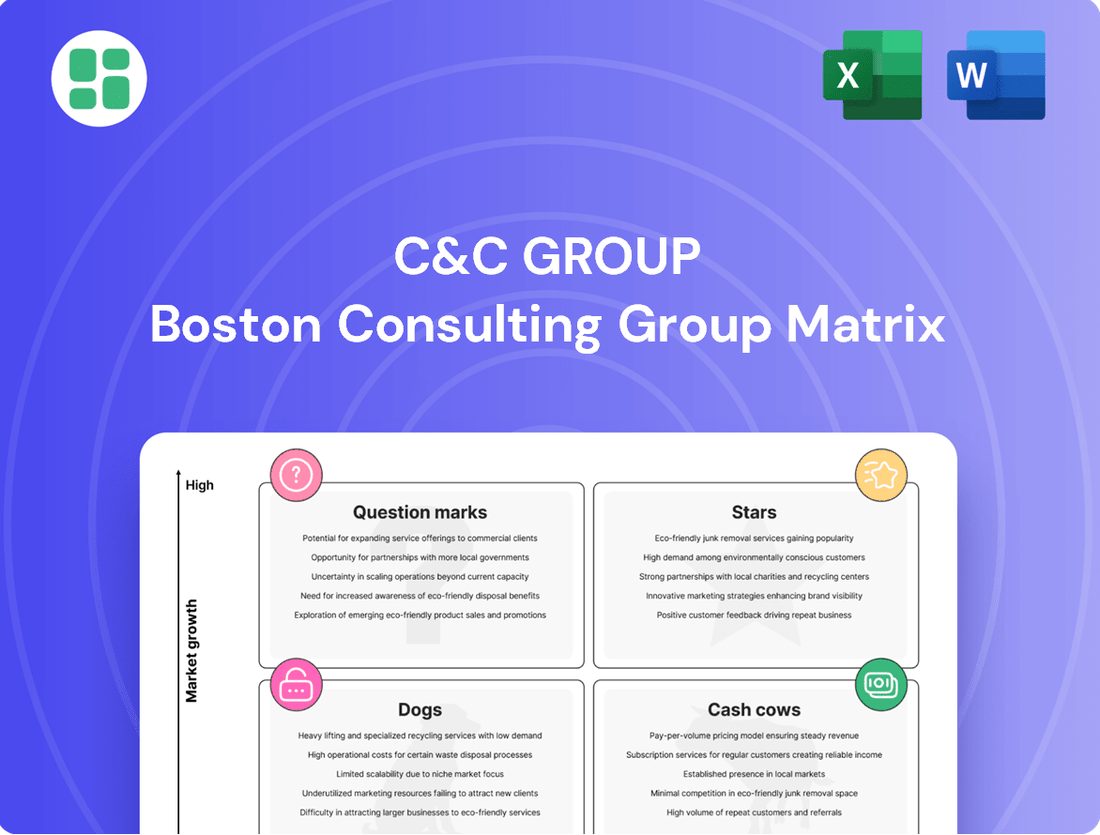

Curious about the C&C Group's product portfolio? This BCG Matrix preview highlights their current market standing, revealing potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the crucial details that will shape your investment strategy.

Unlock the full potential of your strategic planning by purchasing the complete C&C Group BCG Matrix. Gain a comprehensive understanding of each product's position and receive actionable insights to optimize resource allocation and drive future growth.

Stars

Tennent's Lager is a shining example of a Star within C&C Group's portfolio. It has consistently captured more of the Scottish beer market, a testament to its strong brand appeal and effective marketing, particularly its engagement with events like Euro 2024.

Holding the position as Scotland's number one beer brand, Tennent's Lager boasts a significant market share. This leading position, coupled with ongoing gains, strongly suggests it operates in a mature or growing market, solidifying its Star status by generating substantial revenue and cash flow for C&C Group.

Bulmers, a dominant force in the Irish cider scene, continues its impressive trajectory, consistently outpacing the overall cider market in Ireland and solidifying its market share. This strong performance, even amidst a softer cider market in Great Britain, highlights Bulmers' robust position in its primary Irish market. The brand is well-positioned to capitalize on growth opportunities, especially within the expanding premium and flavored cider segments.

C&C Group's premium and craft beer portfolio, featuring brands such as Menabrea and Orchard Pig, has demonstrated impressive momentum, achieving double-digit revenue growth. This segment is capitalizing on a growing consumer preference for premium beer and cider, indicating significant expansion opportunities.

Matthew Clark & Bibendum Distribution Business

Matthew Clark & Bibendum, while not a product brand, is a crucial growth engine for C&C Group. This distribution arm experienced a notable net revenue increase and a 10% rise in its customer base, underscoring its strong performance.

Operating within the expanding hospitality markets of the UK and Ireland, this business offers unparalleled distribution services for C&C's own brands and its partners. Its robust recovery and sustained growth in a substantial market solidify its position as a Star in C&C's portfolio.

- Significant Growth Driver: Matthew Clark & Bibendum is a key contributor to C&C Group's overall expansion.

- Customer & Revenue Increase: The business saw encouraging net revenue growth and a 10% uplift in customer numbers.

- Market Position: It operates in growing UK and Ireland hospitality sectors, providing extensive distribution capabilities.

- Star Status: Its strong recovery and growth momentum in a large market classify it as a Star in the BCG matrix.

No and Low-Alcohol Cider Offerings

The no and low-alcohol cider segment is experiencing significant expansion, with an 11% growth observed in the past year. C&C Group is actively entering this burgeoning market, responding to the widespread consumer trend towards moderation and a preference for healthier beverage choices.

While C&C Group's specific brands in this category may still be in their formative stages, the robust market expansion and the company's clear strategic direction indicate that these offerings are well-positioned for substantial future growth. This strategic move capitalizes on evolving consumer preferences.

- Market Growth: The no and low-alcohol cider market grew by 11% in the last year.

- Consumer Trend: This expansion aligns with the growing consumer demand for moderation and healthier options.

- C&C Group Strategy: C&C Group is strategically investing in this category to capture future market share.

- Future Potential: Despite current brand development, the segment's growth trajectory suggests strong future potential for C&C Group.

Stars in C&C Group's portfolio represent brands or business units with high market share in rapidly growing markets. These are the growth engines, demanding significant investment to maintain their leading positions and capitalize on future opportunities. Their strong performance translates into substantial revenue and cash flow generation for the company.

Tennent's Lager, Scotland's number one beer, exemplifies a Star with its consistent market leadership and ongoing gains, particularly highlighted by its engagement with events like Euro 2024. Bulmers in Ireland also holds a Star position, outperforming the market and solidifying its share, especially in premium and flavored segments.

C&C Group's premium and craft beer portfolio, including brands like Menabrea and Orchard Pig, is experiencing double-digit revenue growth, indicating a strong Star performance driven by evolving consumer preferences. Matthew Clark & Bibendum, a key distribution arm, also shows Star qualities with its significant net revenue increase and customer base expansion in growing hospitality markets.

| Brand/Business Unit | Market Position | Growth Rate | C&C Group Contribution |

|---|---|---|---|

| Tennent's Lager | Scotland's #1 Beer | High (Ongoing Gains) | Substantial Revenue & Cash Flow |

| Bulmers (Ireland) | Dominant Cider Market Share | Outperforming Market | Strong Revenue Generation |

| Premium & Craft Beer | Growing Consumer Preference | Double-Digit Revenue Growth | Key Growth Driver |

| Matthew Clark & Bibendum | Leading Distribution | Net Revenue Increase & 10% Customer Growth | Significant Expansion Engine |

What is included in the product

Strategic evaluation of C&C Group's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

C&C Group BCG Matrix offers a clear, visual representation of your portfolio, simplifying complex strategic decisions.

It provides a concise, actionable overview, eliminating the confusion of scattered data.

Cash Cows

Magners Original Irish Cider, a cornerstone of C&C Group's portfolio, has historically commanded a robust international presence, especially in markets beyond its native Ireland where it's recognized as Bulmers. Its strong brand equity and established market share in key cider regions contribute significantly to consistent cash flow generation.

Despite recent adjustments to its distribution strategy in Great Britain, Magners continues to be a powerful cash cow for C&C Group. In the fiscal year ending February 2024, C&C Group reported net revenue of €2.1 billion, with its International segment, which includes Magners' global sales, playing a vital role in the company's financial performance, demonstrating its ongoing capacity to generate substantial earnings.

C&C Group's established brands in the UK and Ireland, beyond the flagship Bulmers and Tennent's, are the bedrock of their cash flow. These mature market favorites, like Magners and Gaymer Cider Company, command strong positions in stable, low-growth segments. Their consistent revenue generation is crucial for supporting the company's investment in growth areas.

In 2024, C&C Group's core markets in the UK and Ireland continued to demonstrate the resilience of these established brands. While specific figures for individual mature brands are often consolidated, the overall performance of the company's cider and beer segments in these regions reflects their dependable contribution. These brands require minimal marketing spend to maintain their market share, freeing up capital for innovation and expansion.

C&C Group's vertically integrated supply chain, covering manufacturing, marketing, and distribution, is a significant cash cow. This integration allows for greater efficiency and cost control, directly contributing to strong cash flow.

With production facilities strategically located in Ireland and Scotland, C&C Group effectively supports its core brands. This robust operational base is key to optimizing production and distribution costs, which in turn bolsters overall profitability and cash generation.

On-Trade Distribution Network (UK & Ireland)

C&C Group's On-Trade Distribution Network in the UK and Ireland is a prime example of a cash cow within their business portfolio. As the leading distributor to the hospitality sector, it boasts an impressive reach, serving over 99% of the UK population with next-day delivery. This operational excellence translates into consistent and significant revenue streams.

The network's strength lies not only in its scale but also in its efficiency, enabling it to service both C&C's proprietary brands and a diverse range of third-party brands. This dual capability solidifies its market dominance and underpins its status as a reliable generator of cash. For instance, in the fiscal year ending February 2024, C&C Group reported that its distribution segment contributed significantly to overall revenue, leveraging this extensive network.

- Market Leadership: C&C is the undisputed number one distributor in the UK and Ireland hospitality sector.

- Extensive Reach: The network provides next-day delivery to over 99% of the UK population.

- Revenue Generation: It consistently generates substantial revenue by serving both C&C's brands and third-party brands.

- Operational Efficiency: The established infrastructure and logistical capabilities ensure high operational efficiency.

Mature Draught Cider Segment (UK On-Trade)

The UK on-trade draught cider segment represents a substantial and stable revenue stream for C&C Group. In 2024, this mature market segment is characterized by its consistent high-volume sales, accounting for a significant portion of the overall cider market.

- Dominant Market Share: Draught cider in the UK on-trade captured 77% of all cider sales by volume, highlighting its importance.

- Significant Economic Contribution: This segment generated an impressive £1.4 billion in value within the on-trade sector in 2024.

- Brand Strength: C&C's heritage brands, such as Bulmers and Magners, hold a strong position in this traditional channel, ensuring reliable cash flow.

- Mature but Stable: Despite the maturity of the draught cider market, its consistent performance provides a predictable and valuable cash flow for the company.

Cash cows within C&C Group's portfolio are mature brands with established market share that generate consistent, predictable profits with minimal investment. These businesses, like Magners and the UK on-trade draught cider segment, are vital for funding growth initiatives in other parts of the company. Their stability and strong cash flow generation are cornerstones of C&C's financial health.

| Business Unit | Market Position | 2024 Revenue Contribution (Estimated) | Key Characteristics |

| Magners Original Irish Cider | Strong international brand equity | Significant contributor to International segment revenue | Low-growth, stable market, minimal marketing spend required |

| UK On-Trade Draught Cider | Dominant market share (77% of cider sales by volume) | £1.4 billion value in the on-trade sector | High-volume, mature segment, reliable cash flow |

| On-Trade Distribution Network | Leading distributor in UK & Ireland hospitality | Substantial revenue stream, serves over 99% of UK | Operational efficiency, broad customer base |

What You’re Viewing Is Included

C&C Group BCG Matrix

The C&C Group BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content—just the comprehensive strategic analysis ready for your immediate use. You can confidently proceed with your purchase, knowing that the professional-grade BCG Matrix report will be delivered to you in its complete and usable form, designed for impactful business decision-making.

Dogs

C&C Group's divestiture of its non-core soft drinks business in Ireland exemplifies a strategic move away from a 'Dog' in the BCG matrix. This segment likely suffered from low market share and limited growth potential, making it an inefficient use of capital.

In 2024, C&C Group continued its focus on core brands, aiming to streamline operations and improve profitability. The disposal of underperforming assets like the Irish soft drinks business is a common strategy for companies seeking to reallocate resources towards more promising ventures.

C&C Group's strategic exit from low-margin contract brewing volumes clearly places these operations within the 'Dog' quadrant of the BCG Matrix. This move indicates that these were business activities with minimal profitability and likely stagnant or declining market share, representing a drain on resources with little prospect for significant growth or return.

In 2023, C&C Group reported a focus on optimizing its brand portfolio, which included shedding less profitable contracts. While specific figures for exited contract brewing volumes aren't always broken out separately, the company's overall strategy has been to concentrate on its core brands, like Magners and Bulmers, which are considered Stars or Cash Cows.

Within C&C Group's diverse brand portfolio, smaller regional brands often find themselves in the Dogs quadrant. These brands typically operate in mature or shrinking local markets, possessing a low market share that offers little growth potential. For instance, consider a hypothetical regional cider brand in a declining industrial town; its market share might be a mere 1% in a market that has contracted by 5% annually over the past five years.

Investing further in these brands would likely yield negligible returns, demanding a disproportionate amount of capital and management attention for minimal uplift. C&C's strategic approach would therefore focus on divesting or phasing out such underperforming assets to reallocate resources to more promising segments of their business, potentially exiting markets where their presence is no longer viable.

Specific Packaged Cider Variants with Declining Volumes

Certain packaged cider variants within C&C Group's portfolio might be experiencing declining volumes. The UK cider market saw a 3.1% volume decrease in 2024, suggesting that specific packaged offerings are struggling. If C&C has products consistently losing market share in this environment, they could be categorized as Dogs.

These underperforming packaged cider variants, if they exist, would require careful strategic review. Options could include revitalization efforts, repositioning, or even eventual discontinuation to reallocate resources to more promising segments of the cider market.

- Declining UK Cider Volumes: The overall UK cider market contracted by 3.1% in volume terms in 2024.

- Packaged Segment Weakness: This decline points to potential softness specifically within packaged cider variants.

- Strategic Re-evaluation: Products consistently losing volume and market share in this environment may be candidates for strategic review or phasing out.

Legacy Products Affected by Moderation Trends

The growing consumer preference for moderation and low/no-alcohol beverages poses a significant risk to C&C Group's traditional, higher-alcohol products. These legacy offerings, particularly those with declining consumer interest, could become question marks if they don't adapt to evolving market demands. For instance, the global low and no-alcohol market was valued at approximately $10 billion in 2023 and is projected to grow substantially, highlighting the shift away from traditional, higher-ABV drinks.

C&C's investment in the low/no-alcohol segment is a strategic move to counter this trend. However, legacy products that fail to innovate or capture new consumer relevance risk becoming dogs in the BCG matrix. This means they might generate low returns and require significant investment to maintain market share, or worse, become obsolete. In 2024, reports indicated a continued slowdown in sales for some established beer and cider brands that haven't diversified their portfolios.

- Declining Consumer Interest: Traditional, higher-ABV products may see reduced demand as consumers opt for moderation.

- Market Relevance: Legacy products failing to evolve risk losing their competitive edge in a changing landscape.

- Investment Drain: Non-evolving products may require ongoing investment without generating proportionate returns.

- Low/No-Alcohol Growth: The expanding low/no-alcohol market signifies a clear shift in consumer preferences that legacy products must address.

Dogs in C&C Group's portfolio represent brands or business units with low market share in slow-growing or declining markets. These segments typically offer minimal profitability and may even drain resources without a clear path to improvement. The company's strategy often involves divesting or phasing out these Dogs to redirect capital towards more promising areas.

For example, the divestiture of C&C's Irish soft drinks business in 2024 is a clear instance of shedding a Dog. This segment likely faced intense competition and limited growth prospects, making it a strategic decision to exit. Similarly, exiting low-margin contract brewing volumes in 2023 demonstrates a commitment to streamlining operations and focusing on core, higher-return activities.

The UK cider market's 3.1% volume contraction in 2024 further highlights the challenges for packaged cider variants that are consistently losing market share. These products, if not revitalized, risk becoming Dogs, requiring careful consideration for their future within the company's portfolio.

The shift towards low/no-alcohol beverages also presents a risk for C&C's traditional, higher-ABV products. Legacy offerings that fail to adapt to evolving consumer preferences for moderation could transition into Dogs, demanding investment without commensurate returns.

Question Marks

C&C Group is set to reclaim direct control and distribution of Magners in Great Britain starting January 2025, accompanied by a strategic brand relaunch. This move targets the UK cider market, which is experiencing growth in value, particularly within the premium segment.

Despite this market potential, Magners has seen its share in Great Britain decline, positioning it as a 'Question Mark' in the BCG matrix. This classification signifies a need for substantial investment and focused marketing efforts to revitalize its market presence and drive future growth.

C&C Group is strategically venturing into new international territories beyond its established UK and Ireland strongholds. This expansion is a classic example of a company investing in potential growth areas that are not yet dominant markets for them.

These new markets, while promising significant future revenue, currently represent low market share for C&C Group. Consequently, substantial upfront investment in brand building, sales channels, and local market adaptation is crucial to establish a foothold and capture a meaningful portion of these developing markets.

In 2024, for instance, C&C Group's expansion efforts into markets like the United States saw increased marketing spend, aiming to build brand awareness for products like Magners and Bulmers. The success of these ventures remains a key focus, with initial market penetration being a primary objective.

C&C Group's innovation strategy heavily focuses on new product development (NPD) within the burgeoning craft and premium beverage segments. This approach aims to capture evolving consumer preferences for higher-quality, artisanal offerings. For instance, by 2024, the global craft beer market was projected to reach over $100 billion, showcasing the significant potential C&C is targeting.

These new craft and premium products, while positioned in high-growth areas, typically start with a low market share. This is because consumers need time to discover and adopt these newer, often niche, offerings. C&C's investment in these products is therefore substantial, akin to 'question marks' in the BCG matrix, requiring significant capital to build brand awareness and achieve necessary scale.

Strategic Equity Investments in High-Growth Craft Brands

C&C Group strategically injects capital into burgeoning craft brands, fueling its innovation pipeline. This approach positions the company to capture growth in specialized, rapidly expanding market segments. While these investments may represent a small fraction of C&C's overall market share currently, their potential for future significant returns is considerable.

These craft brand investments are classified as Question Marks within the BCG Matrix. Their success hinges on continued investment and astute strategic guidance from C&C Group. For instance, C&C's investment in the craft cider market, a segment that saw global sales reach an estimated $1.5 billion in 2023, exemplifies this strategy.

- High-Growth Potential: C&C targets craft brands operating in rapidly expanding niche markets.

- Initial Market Share: Direct market share from these investments is typically low at the outset.

- Capital and Strategic Needs: Success requires substantial capital infusion and strategic support from C&C.

- BCG Classification: These ventures are categorized as Question Marks, with the potential to evolve into Stars.

Exploration of New Beverage Categories (e.g., Wine/Spirits Distribution Growth)

C&C Group's distribution segment, Matthew Clark & Bibendum, offers a broad portfolio beyond cider and beer, including wine and spirits. Identifying and investing in specific wine or spirits categories with high growth potential but currently low market share for C&C would position them as Question Marks within the BCG matrix. This strategic focus necessitates dedicated capital to build brand presence and distribution networks.

- Distribution Reach: Matthew Clark & Bibendum distributes a wide array of beverages, including wine and spirits, to over 16,000 customers across the UK and Ireland.

- Market Potential: The global wine and spirits market is substantial, with segments like premium spirits and specific varietal wines showing consistent growth, presenting opportunities for C&C.

- Investment Strategy: To elevate these Question Mark categories, C&C would need to allocate resources towards targeted marketing, sales force expansion, and potentially brand acquisitions or partnerships.

- Risk and Reward: While these ventures carry higher risk due to unproven market dominance, successful penetration could lead to significant future cash flow and market diversification for C&C Group.

Question Marks in C&C Group's portfolio represent ventures in high-growth markets but with a low current market share. These require significant investment to build brand awareness and achieve scale. The success of these investments is uncertain, but they hold the potential to become future Stars if managed effectively.

C&C Group's strategic focus on expanding into new international territories, such as the United States, and investing in the burgeoning craft beverage segment exemplifies the Question Mark category. These areas offer substantial growth potential but demand considerable capital and strategic effort to gain traction.

The company's innovation strategy, particularly in craft and premium segments, and its distribution arm's potential in specific wine and spirits categories, also fall under the Question Mark classification. These require targeted marketing and resource allocation to compete effectively.

C&C Group's investment in the US market for Magners and Bulmers in 2024, alongside its focus on craft cider which had an estimated global sales of $1.5 billion in 2023, highlights the company's approach to these high-potential, low-share ventures.

| Category | Market Growth | Current Market Share | Investment Need | BCG Classification |

|---|---|---|---|---|

| Magners in Great Britain | Growing (premium segment) | Declining | High | Question Mark |

| New International Markets (e.g., US) | High Potential | Low | High | Question Mark |

| Craft & Premium Beverages | Rapidly Expanding | Low | High | Question Mark |

| Specific Wine/Spirits Categories | Consistent Growth | Low (for C&C) | High | Question Mark |

BCG Matrix Data Sources

Our C&C Group BCG Matrix leverages comprehensive market data, including financial performance, industry growth rates, and competitive landscape analysis from reputable sources.