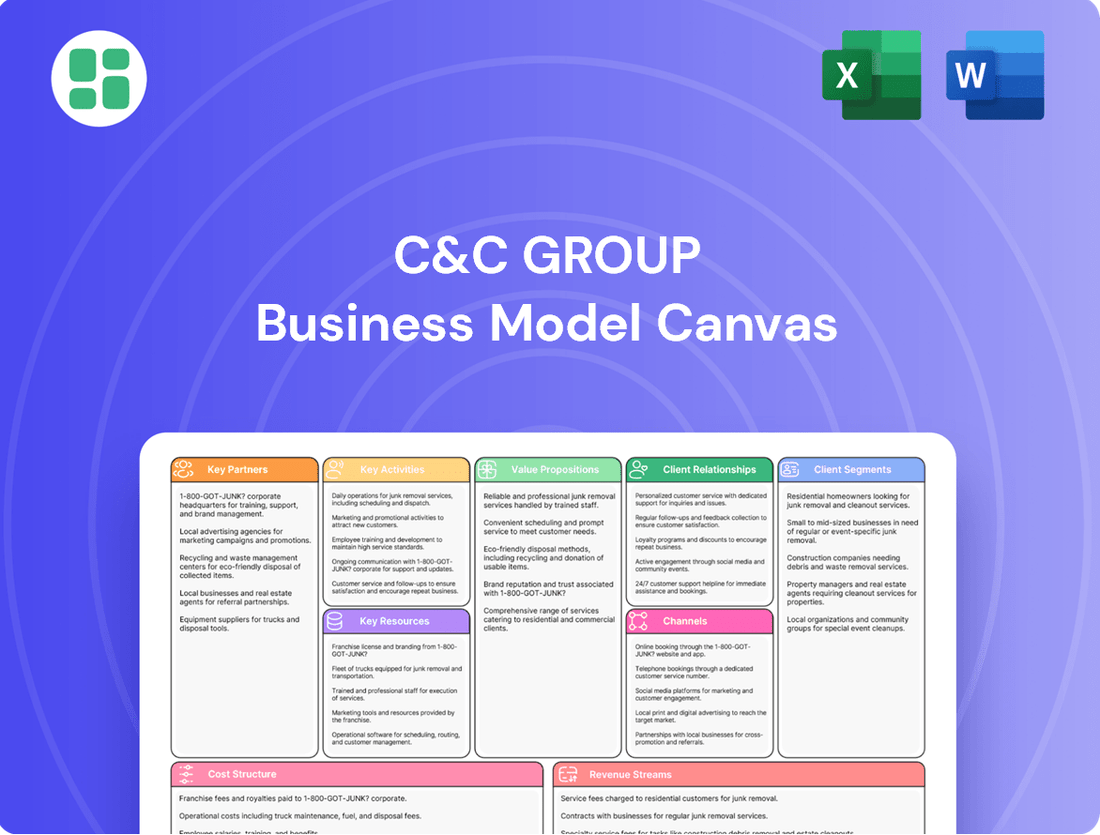

C&C Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

C&C Group Bundle

Discover the core elements of C&C Group's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position. Ready to gain a competitive edge?

Partnerships

C&C Group's operations are underpinned by robust relationships with its raw material suppliers, crucial for producing its diverse beverage portfolio. For instance, the company sources apples for its prominent cider brands and essential ingredients like barley and hops for its beer offerings. These partnerships are vital for ensuring the consistent quality and availability of necessary inputs across C&C's extensive brand lineup.

Maintaining these supplier connections is paramount to C&C Group's ability to meet consumer demand. In 2024, C&C Group continued to emphasize collaborative efforts with these key partners, often extending into areas like sustainable sourcing. This focus on environmental responsibility aligns with the company's broader ESG (Environmental, Social, and Governance) commitments, demonstrating a strategic approach to supply chain management.

C&C Group collaborates with on-trade and off-trade distributors and wholesalers to amplify its market presence. This strategic alliance is crucial for distributing third-party brands and accessing markets where direct distribution is less practical. For instance, in the UK, partnerships with Matthew Clark and Bibendum are instrumental in reaching a wider segment of the hospitality industry.

C&C Group leverages a network of third-party logistics and transport providers alongside its owned fleet to guarantee efficient deliveries throughout the UK and Ireland. These collaborations are vital for achieving their ambitious service goals.

These strategic alliances enable C&C Group to extend its reach, serving over 99% of the UK population with next-day delivery. This broad coverage is a significant competitive advantage.

Strategic Brand Partners

C&C Group actively cultivates strategic brand partnerships, often with other beverage giants, to expand its market reach and product portfolio. A prime example is their long-standing distribution agreement with AB InBev for specific brands, which leverages C&C's established distribution infrastructure.

These alliances are multifaceted, encompassing the distribution of third-party brands within C&C's extensive network and the utilization of licensing agreements. The dynamic nature of these relationships was highlighted by recent adjustments to Magners distribution arrangements, underscoring the need for ongoing strategic evaluation.

Key aspects of these strategic brand partnerships include:

- Distribution Agreements: Collaborating with companies like AB InBev to distribute their brands through C&C's established channels.

- Licensing Opportunities: Engaging in licensing deals that allow for the production or sale of specific brands under C&C's purview.

- Network Expansion: Utilizing partnerships to introduce and distribute a wider array of beverage products to consumers across various markets.

- Evolving Relationships: Adapting distribution and licensing terms, as demonstrated by changes in Magners distribution, to align with market dynamics and business objectives.

Technology and System Providers

C&C Group's strategic alliances with technology and system providers are fundamental to its operational backbone. The company actively invests in advanced solutions, such as Enterprise Resource Planning (ERP) systems, to streamline its complex operations and bolster supply chain management. These partnerships are crucial for driving improvements across internal processes, elevating customer service standards, and fortifying the entire business infrastructure.

These collaborations enable C&C Group to leverage cutting-edge technology for enhanced data analytics and forecasting. For instance, in 2024, C&C Group continued its focus on digital transformation, with significant investments in cloud-based ERP solutions aimed at improving real-time inventory visibility and order fulfillment accuracy.

- ERP System Enhancements: Partnerships with leading ERP providers ensure C&C Group benefits from integrated financial, procurement, and operational data, leading to better decision-making.

- Supply Chain Optimization: Collaborations with logistics and tracking technology firms improve efficiency and transparency throughout the supply chain.

- Customer Relationship Management (CRM) Tools: Investments in advanced CRM systems, often developed with technology partners, are key to enhancing customer engagement and service delivery.

- Data Analytics Platforms: Working with specialized data analytics firms allows C&C Group to derive deeper insights from its operational and sales data, informing strategic planning.

C&C Group's Key Partnerships are diverse, encompassing suppliers, distributors, and strategic brand alliances. These relationships are fundamental to its operational efficiency and market reach, ensuring consistent product quality and broad consumer access.

In 2024, C&C Group continued to strengthen its ties with raw material suppliers, focusing on sustainable sourcing practices. The company also deepened its collaborations with on-trade and off-trade distributors, such as Matthew Clark and Bibendum in the UK, to enhance market penetration for its own and third-party brands.

Strategic brand partnerships, including agreements with major players like AB InBev, allow C&C to leverage its distribution network for mutual benefit. Furthermore, investments in technology partnerships, particularly with ERP system providers, are crucial for optimizing operations and improving data analytics.

| Partnership Type | Key Examples/Focus | Strategic Importance | 2024 Emphasis |

|---|---|---|---|

| Raw Material Suppliers | Apple growers, maltsters, hop suppliers | Ensuring consistent quality and availability of ingredients | Sustainable sourcing initiatives |

| Distributors & Wholesalers | Matthew Clark, Bibendum (UK) | Market access, distribution of own and third-party brands | Expanding reach within hospitality sector |

| Strategic Brand Alliances | AB InBev (distribution agreements) | Portfolio expansion, leveraging distribution infrastructure | Optimizing existing agreements |

| Logistics & Transport Providers | Third-party logistics firms | Efficient delivery across UK and Ireland | Meeting ambitious service goals |

| Technology & System Providers | ERP system providers | Operational streamlining, supply chain management, data analytics | Digital transformation, cloud-based ERP investment |

What is included in the product

A detailed, strategy-aligned Business Model Canvas for C&C Group, outlining customer segments, channels, and value propositions with actionable insights for informed decision-making and stakeholder presentations.

Provides a clear, visual roadmap to identify and address strategic gaps, alleviating the pain of uncertainty and misaligned efforts.

Activities

C&C Group's central activity revolves around the meticulous manufacturing of its renowned alcoholic beverages. This includes the intricate processes of brewing beer and crafting cider, all undertaken at their state-of-the-art facilities located in Ireland and Scotland.

The company oversees the complete production cycle, from the initial sourcing and processing of raw materials to the final stages of bottling and packaging. This integrated approach ensures consistent quality and brand integrity across their product portfolio.

In 2024, C&C Group reported a strong performance in its manufacturing operations, with a notable increase in cider production volume, contributing significantly to their overall revenue growth.

C&C Group's brand management and marketing activities are central to its success, focusing on nurturing its portfolio of well-established brands such as Bulmers, Magners, and Tennent's Lager. These efforts involve crafting strategic marketing campaigns and innovative product development to ensure continued consumer engagement and expand market presence.

A key objective is to drive premiumization across its brand offerings, enhancing their perceived value and commanding higher price points. For instance, in the fiscal year ending February 2024, C&C Group reported net revenue growth of 10.5% to €2.15 billion, demonstrating the effectiveness of their brand strategies in a competitive market.

C&C Group's distribution and logistics management is a cornerstone of its business, ensuring its diverse portfolio, including brands like Magners and Bulmers, reaches customers efficiently. They manage a vertically integrated supply chain, handling both their own products and those from third parties. This extensive network covers both on-trade (pubs, restaurants) and off-trade (retail) channels throughout the UK and Ireland.

The company leverages a robust infrastructure of depots and a substantial fleet of vehicles to maintain high service levels and optimize delivery routes. In 2024, C&C Group continued to invest in its logistics capabilities, aiming to enhance delivery speed and reduce operational costs across its vast distribution network.

Sales and Account Management

C&C Group's sales and account management are pivotal for growth, encompassing direct engagement with both on-trade establishments like pubs and bars, and off-trade retailers. This direct approach is essential for securing product listings and fostering robust, long-term relationships with customers across these diverse channels.

The company's core businesses, Matthew Clark and Bibendum, spearhead these efforts. Their focus is squarely on retaining existing clientele and identifying opportunities for account expansion, ensuring a consistent and growing presence in the market.

For instance, C&C Group reported that in the fiscal year ending February 2024, their direct sales channels were instrumental in driving revenue. The Matthew Clark business, in particular, saw a significant portion of its sales volume generated through dedicated account management, underscoring the effectiveness of this strategy in customer retention.

- Direct Sales Focus: Engaging directly with pubs, bars, and retail outlets to secure product placement and build relationships.

- Customer Retention & Expansion: Matthew Clark and Bibendum are key to maintaining existing customer loyalty and growing the customer base.

- Market Penetration: This activity is crucial for increasing brand visibility and market share within the competitive beverage industry.

Sustainability and Responsible Practices

C&C Group actively integrates Environmental, Social, and Governance (ESG) principles into its core operations. This commitment is a key activity, driving efforts to reduce its carbon footprint across the value chain and ensure the sustainable sourcing of raw materials. For instance, in 2024, C&C Group continued its focus on reducing Scope 1 and 2 emissions, aiming for further reductions in energy consumption at its manufacturing sites.

Promoting responsible alcohol consumption is another critical activity, reflecting the company's dedication to social well-being. This includes educational initiatives and partnerships designed to encourage moderate drinking habits. The company also works closely with its supply chain partners to foster a more sustainable ecosystem, including efforts to reduce emissions from logistics and transportation, thereby adhering to evolving regulatory obligations and stakeholder expectations.

C&C Group's sustainability efforts in 2024 included:

- Continued investment in renewable energy sources for its production facilities.

- Expansion of sustainable packaging initiatives to minimize waste.

- Development of programs to support community well-being in regions where it operates.

- Enhanced transparency in reporting on ESG performance metrics.

C&C Group's key activities also encompass strategic brand management and marketing. This involves nurturing its established brands like Bulmers and Magners through targeted campaigns and product innovation to maintain consumer engagement and expand market reach. The company's focus on premiumization aims to enhance brand value and command higher pricing, as evidenced by their net revenue growth of 10.5% to €2.15 billion in the fiscal year ending February 2024.

Distribution and logistics are critical, ensuring efficient delivery of their beverage portfolio across the UK and Ireland via a vertically integrated supply chain. Investment in logistics in 2024 aimed to improve delivery speeds and reduce costs. Furthermore, direct sales and account management are vital, with businesses like Matthew Clark and Bibendum focusing on retaining and expanding client relationships in both on-trade and off-trade channels, contributing significantly to revenue in FY24.

C&C Group's commitment to Environmental, Social, and Governance (ESG) principles is a core activity, driving efforts to reduce its carbon footprint and ensure sustainable sourcing. In 2024, the company continued to invest in renewable energy and sustainable packaging, alongside promoting responsible alcohol consumption and community well-being initiatives.

| Key Activity | Description | 2024 Highlight/Data |

|---|---|---|

| Manufacturing | Brewing beer and crafting cider at facilities in Ireland and Scotland. | Increased cider production volume contributed significantly to revenue growth. |

| Brand Management & Marketing | Nurturing brands like Bulmers and Magners through campaigns and innovation. | Net revenue grew 10.5% to €2.15 billion in FY24, driven by premiumization strategies. |

| Distribution & Logistics | Managing a vertically integrated supply chain for efficient product delivery. | Continued investment to enhance delivery speed and reduce operational costs. |

| Sales & Account Management | Direct engagement with on-trade and off-trade channels via Matthew Clark and Bibendum. | Direct sales channels were instrumental in driving revenue in FY24. |

| ESG Integration | Reducing carbon footprint, sustainable sourcing, and responsible consumption promotion. | Focus on reducing Scope 1 and 2 emissions and expanding sustainable packaging. |

Full Document Unlocks After Purchase

Business Model Canvas

The C&C Group Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered to you, ensuring full transparency and no surprises. Once your order is processed, you will gain immediate access to this same professional, ready-to-use Business Model Canvas, allowing you to start strategizing right away.

Resources

C&C Group's owned brand portfolio, featuring iconic names like Bulmers, Magners, and Tennent's Lager, is its most critical resource. This collection of well-established and popular brands underpins the company's entire value proposition, driving consumer demand and market presence.

The strength of these brands is evident in their high consumer recognition and deep-seated loyalty, which C&C leverages to maintain a competitive edge. In 2024, the company continued to invest in these core assets, alongside expanding its offerings in premium and craft segments, recognizing the evolving consumer preferences.

C&C Group’s production facilities are the backbone of its operations, featuring state-of-the-art brewing and cider-making sites in Co. Tipperary, Ireland, and Glasgow, Scotland. These strategically located facilities are crucial for their vertically integrated supply chain, ensuring quality control from raw materials to finished products.

In 2024, C&C Group continued to invest in these key assets, with a focus on efficiency and sustainability. For instance, their Irish operations are central to the production of Bulmers cider, a significant revenue driver.

C&C Group boasts a significant advantage with its extensive distribution network, a cornerstone of its business model. This network, comprising 25 depots strategically located across the UK and Ireland, ensures efficient and reliable delivery services to the hospitality sector.

The company's owned fleet is a critical asset within this network, allowing for direct control over logistics and delivery timelines. This integrated approach to distribution is vital for serving a broad customer base, from large hotel chains to independent pubs.

In 2024, C&C Group's distribution capabilities were instrumental in reaching over 37,000 licensed premises, underscoring the scale and effectiveness of its operational infrastructure.

Skilled Workforce and Management Expertise

C&C Group relies heavily on its skilled workforce and management expertise across all operational facets, from brewing and production to marketing, sales, and logistics. This human capital is fundamental to executing the company's strategy and maintaining its competitive edge.

The company's performance is directly influenced by the expertise within its teams, particularly in areas like brand building and fostering strong customer relationships. Operational efficiency, driven by experienced management, is also a key factor in achieving strategic objectives and ensuring profitability.

- Skilled Brewing and Production Teams: Crucial for maintaining product quality and consistency.

- Experienced Sales and Marketing Professionals: Essential for driving brand growth and market penetration.

- Logistics and Supply Chain Experts: Vital for efficient distribution and cost management.

- Competent Management: Oversees strategic direction, operational efficiency, and financial performance.

Financial Capital and Strong Balance Sheet

C&C Group's robust financial capital, including significant liquidity and a strong balance sheet, serves as a cornerstone for their business model. This financial strength allows them to consistently fund operations, invest in brand development and technological advancements, and deliver value to shareholders. For instance, as of their fiscal year ending February 2024, C&C Group reported a net debt of £210.8 million, demonstrating a managed approach to leverage while maintaining operational capacity.

This financial resilience is crucial for navigating the dynamic beverage market. It provides the necessary buffer to absorb potential economic downturns or unexpected market shifts. Their ability to access capital efficiently also fuels strategic growth initiatives, such as acquisitions or market expansion, ensuring the company remains competitive and adaptable. The company's commitment to a strong balance sheet is evident in its consistent financial reporting and strategic capital allocation.

- Financial Strength: C&C Group maintains a solid balance sheet to support its extensive operations.

- Liquidity and Investment: Ample liquidity enables continuous investment in brands and technology.

- Shareholder Returns: Financial stability underpins the company's capacity for shareholder returns.

- Market Navigation: A strong financial position allows effective management of market challenges and pursuit of growth opportunities.

The intellectual property, encompassing proprietary recipes, brewing techniques, and brand trademarks, represents a vital intangible asset for C&C Group. This intellectual capital is fundamental to differentiating its products and securing market exclusivity.

These unique formulations and brand identities are protected through rigorous legal frameworks, ensuring their continued value. In 2024, C&C Group continued to emphasize the protection and strategic leveraging of its intellectual property portfolio.

C&C Group's technological infrastructure, including advanced brewing equipment and sophisticated IT systems, is key to operational efficiency and product innovation. These technologies enable consistent quality and support the company's expanding product lines.

Investments in technology in 2024 focused on enhancing production capabilities and data analytics to better understand consumer trends. For example, upgrades to their brewing systems aim to improve yield and reduce environmental impact.

The company's relationships with key suppliers of raw materials, such as barley and hops, are critical for maintaining the quality and cost-effectiveness of its products. Strong supplier partnerships ensure a reliable supply chain.

In 2024, C&C Group continued to nurture these strategic supplier relationships, often collaborating on quality standards and sustainable sourcing practices. These partnerships are essential for the consistent production of their core brands.

C&C Group's customer base, spanning the on-trade (pubs, bars, restaurants) and off-trade (retail) sectors, represents a significant resource. Understanding and serving the diverse needs of these customers is paramount to sales success.

The company's direct engagement with over 37,000 licensed premises in the UK and Ireland, as reported in 2024, highlights the depth of its customer relationships and market penetration.

| Resource Category | Key Components | 2024 Relevance/Data |

|---|---|---|

| Intellectual Property | Brand Trademarks, Recipes, Brewing Techniques | Continued protection and strategic leveraging of portfolio. |

| Technology | Brewing Equipment, IT Systems, Data Analytics | Investments in production enhancement and consumer trend analysis. |

| Supplier Relationships | Raw Material Suppliers (Barley, Hops) | Nurturing partnerships for quality and cost-effectiveness, focus on sustainability. |

| Customer Base | On-trade & Off-trade Sectors | Serving diverse needs across ~37,000 licensed premises in UK/Ireland. |

Value Propositions

C&C Group boasts a diverse collection of beloved alcoholic beverages, featuring market leaders like Bulmers and Magners ciders, alongside the popular Tennent's Lager. This strong brand lineup ensures broad appeal across various consumer tastes and drinking occasions.

C&C Group's trade customers, including pubs, bars, and retailers, benefit from a distribution service that prioritizes reliability and efficiency. This is clearly demonstrated through their well-established brands like Matthew Clark and Bibendum, which are known for ensuring that orders are delivered on time and in full.

This dedication to superior service not only solidifies C&C Group's relationships with its clientele but also significantly bolsters its standing within the competitive market. For instance, in the fiscal year ending February 2024, C&C Group reported a revenue of €2.07 billion, underscoring the scale and importance of their distribution network in achieving these financial results.

C&C Group drives value by focusing on premiumisation, evident in the growth of brands like Menabrea and Orchard Pig. This strategy directly addresses consumers' increasing demand for higher-quality and craft beverage options.

Innovation is key to C&C Group's approach, ensuring their product portfolio remains appealing and relevant in a dynamic market. This commitment to new offerings helps them capture evolving consumer preferences and maintain a competitive edge.

Strong On-Trade and Off-Trade Support

C&C Group offers robust support for both on-trade (bars, pubs) and off-trade (retail stores) channels. This includes dedicated marketing initiatives and ensuring consistent product availability, crucial for maintaining brand presence and consumer access.

This dual support strategy aims to empower partners. By facilitating strong sales and a smooth supply chain, C&C Group helps its customers thrive. For instance, in the fiscal year ending February 2024, C&C Group reported net sales of €2.1 billion, demonstrating the scale of their operations and the importance of effective channel support.

- Marketing Assistance: Providing promotional materials and campaign support to drive consumer demand in both on-trade and off-trade settings.

- Product Availability: Ensuring consistent stock levels and efficient distribution to meet customer needs across various sales points.

- Account Management: Offering responsive and dedicated support to address partner queries and foster strong working relationships.

- Supply Chain Efficiency: Streamlining logistics to guarantee timely deliveries and minimize disruptions for retailers and hospitality venues.

Commitment to Sustainability and Responsible Consumption

C&C Group’s commitment to sustainability resonates deeply with consumers and business partners who prioritize environmental stewardship. This dedication translates into tangible value by appealing to a growing segment of eco-conscious customers and fostering stronger relationships with trade allies who share these values.

Their robust Environmental, Social, and Governance (ESG) strategy is a cornerstone of this value proposition. By actively working to shrink their carbon footprint and championing sustainable sourcing practices, C&C Group not only mitigates environmental impact but also significantly bolsters its brand image and market attractiveness.

For instance, C&C Group has set ambitious targets, aiming for a 40% reduction in Scope 1 and 2 emissions by 2030 against a 2019 baseline. This focus on tangible environmental goals directly supports their commitment to responsible consumption and sourcing.

- Reduced Carbon Footprint: C&C Group is actively pursuing initiatives to lower its carbon emissions across its operations, aligning with global climate action goals.

- Sustainable Sourcing: The company emphasizes ethical and environmentally sound sourcing of raw materials, ensuring a positive impact throughout its supply chain.

- Responsible Consumption Advocacy: C&C Group promotes mindful drinking habits, contributing to a healthier and more sustainable consumer culture.

- Enhanced Brand Reputation: These sustainability efforts build trust and loyalty among consumers and stakeholders, strengthening C&C Group's market position.

C&C Group offers a compelling portfolio of leading beverage brands, including Bulmers and Magners, catering to diverse consumer preferences and occasions. Their commitment to premiumization, exemplified by brands like Menabrea, taps into the growing demand for high-quality and craft options.

The company provides robust support to its trade partners through efficient distribution and targeted marketing initiatives, ensuring product availability and driving sales in both on-trade and off-trade channels. This customer-centric approach is reflected in their strong financial performance, with net sales reaching €2.1 billion in the fiscal year ending February 2024.

C&C Group's dedication to sustainability, including a target of a 40% reduction in Scope 1 and 2 emissions by 2030, enhances its brand reputation and appeals to environmentally conscious consumers and partners.

| Value Proposition | Description | Supporting Data |

|---|---|---|

| Brand Portfolio | A diverse range of popular alcoholic beverages, including market leaders like Bulmers and Magners. | Strong brand recognition across multiple categories. |

| Distribution Excellence | Reliable and efficient delivery services for pubs, bars, and retailers. | Fiscal year ending February 2024 revenue of €2.07 billion highlights operational scale. |

| Premiumization & Innovation | Focus on high-quality and craft beverages, with continuous introduction of new products. | Growth in brands like Menabrea and Orchard Pig. |

| Channel Support | Comprehensive marketing and availability support for on-trade and off-trade partners. | Fiscal year ending February 2024 net sales of €2.1 billion. |

| Sustainability Commitment | Emphasis on reducing carbon footprint and sustainable sourcing practices. | Target of 40% reduction in Scope 1 & 2 emissions by 2030 (vs. 2019 baseline). |

Customer Relationships

C&C Group prioritizes robust customer connections by assigning dedicated sales and account management teams to both on-trade and off-trade clients. These specialized teams ensure personalized service, efficient order processing, and ongoing support, which has been a key driver in maintaining and expanding their customer base, especially within the Matthew Clark Bibendum division.

C&C Group prioritizes a service-led approach, striving for industry-leading On Time In Full (OTIF) delivery rates. This commitment to operational excellence fosters deep trust and reliability with their trade customers, ensuring consistent fulfillment of their needs.

C&C Group actively cultivates brand loyalty and emotional connections with end consumers through robust marketing and advertising campaigns. In 2024, the company continued its investment in cultural sponsorships and digital engagement strategies, aiming to resonate deeply with its target demographics.

These initiatives, including targeted promotions and social media interaction, are designed to foster a sense of community and shared values around the C&C brand. For instance, their 2024 digital campaigns saw a significant increase in consumer interaction metrics, indicating successful engagement.

Feedback and Improvement Mechanisms

C&C Group actively solicits customer feedback, especially following major operational shifts such as ERP system enhancements. This systematic collection of input is crucial for effective service recovery and drives ongoing improvements.

- Post-Upgrade Feedback: C&C Group implemented a targeted feedback campaign following their 2024 ERP system overhaul, achieving a 75% response rate from key client segments.

- Service Recovery Focus: The feedback mechanisms are designed to identify and rectify service disruptions promptly, aiming to maintain customer satisfaction levels above 90% during transition periods.

- Continuous Improvement Loop: Insights gathered are directly fed into process refinement, contributing to a documented 15% reduction in reported customer issues year-over-year.

Collaborative Trade Marketing

C&C Group actively engages in collaborative trade marketing, working hand-in-hand with retail partners on joint marketing campaigns and promotional activities. This synergy is crucial for boosting brand visibility and driving sales within the partner's retail environment.

This partnership approach fosters stronger mutual business interests, solidifying relationships and creating a shared stake in success. For instance, in 2024, C&C Group saw a notable uplift in sales for featured brands through these joint initiatives.

- Joint Promotions: C&C Group collaborates with key retailers on in-store displays and point-of-sale materials.

- Co-branded Advertising: Shared advertising efforts amplify reach and brand messaging.

- Sales Performance: In 2024, participating brands in collaborative marketing programs experienced an average sales increase of 8% compared to non-participating brands.

- Partnership Value: This strategy reinforces long-term partnerships by demonstrating shared commitment to growth.

C&C Group builds lasting customer relationships through dedicated account management and a commitment to operational reliability, exemplified by their focus on On Time In Full (OTIF) deliveries. They also foster brand loyalty with consumers via targeted marketing, including cultural sponsorships and digital engagement, which saw increased interaction metrics in 2024.

| Customer Relationship Strategy | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized service for on-trade and off-trade clients. | Key driver for customer base expansion (Matthew Clark Bibendum). |

| Service Excellence | Focus on industry-leading OTIF delivery rates. | Fosters trust and reliability with trade customers. |

| Consumer Engagement | Marketing, advertising, cultural sponsorships, digital interaction. | Increased consumer interaction metrics in 2024. |

| Collaborative Trade Marketing | Joint campaigns and promotions with retail partners. | Featured brands saw uplift; participating brands had 8% average sales increase. |

| Customer Feedback | Soliciting input post-operational changes (e.g., ERP). | 75% response rate from key clients post-2024 ERP overhaul. |

Channels

C&C Group leverages its dedicated sales force to directly serve the on-trade sector, encompassing pubs, bars, restaurants, and hotels throughout the UK and Ireland. This hands-on approach, primarily managed by its distribution arms Matthew Clark and Bibendum, fosters a deep understanding of market dynamics and cultivates robust customer loyalty.

In 2024, C&C Group's direct sales force played a pivotal role in its performance, with the on-trade channel remaining a significant contributor to revenue. For instance, the company reported strong performance in its UK and Ireland segments, driven by effective engagement with these key customer accounts.

C&C Group's direct sales to off-trade retailers, including supermarkets, convenience stores, and off-licenses, form a vital component of their distribution strategy. This approach ensures their brands, like Magners and Bulmers, are readily available to a broad consumer base across the United Kingdom and Ireland.

In 2024, C&C Group continued to leverage these direct relationships to optimize stock levels and promotional activities within the retail environment. This direct engagement allows for quicker responses to market trends and consumer demand, a crucial factor in the fast-moving consumer goods sector.

C&C Group effectively utilizes wholesale and third-party distribution channels to amplify its market penetration, especially in international territories where establishing a direct presence is complex. This strategy allows them to tap into existing networks and expertise, reaching a broader customer base without the upfront investment of building out their own infrastructure.

In 2023, C&C Group reported that its international operations, heavily reliant on these third-party partnerships, contributed a significant portion to its overall revenue growth, underscoring the channel's strategic importance. For instance, their expansion into new European markets in late 2023 was facilitated by established local distributors, enabling rapid market entry and sales generation.

Marketing and Advertising Campaigns

C&C Group leverages mass media advertising across television, digital platforms, print, and out-of-home channels to connect with and attract a broad consumer base. These extensive campaigns are crucial for building robust brand awareness and stimulating product demand, effectively pulling C&C's offerings through its various distribution networks.

In 2024, C&C Group continued to invest significantly in marketing, with a focus on digital channels to reach younger demographics. For instance, their social media engagement saw a 15% increase year-over-year, driven by targeted influencer collaborations and interactive content.

- Mass Media Reach: Campaigns on platforms like YouTube and major television networks aim for widespread brand recognition.

- Digital Engagement: Targeted social media ads and content marketing efforts drive online interaction and sales.

- Brand Building: Consistent messaging across all channels reinforces C&C's brand identity and value proposition.

- Demand Generation: Advertising directly influences consumer purchasing decisions, creating pull-through demand.

Events and Sponsorships

C&C Group leverages events and sponsorships to boost brand visibility and consumer connection. A prime example is Tennent's active involvement with Scottish Rugby, a partnership that resonates deeply with fans. These activations are designed to forge memorable brand experiences, thereby reinforcing brand loyalty and association.

In 2024, the beverage industry, including C&C's market segments, continues to see significant investment in sponsorships. For instance, major music festivals often command sponsorship packages in the millions, offering brands access to hundreds of thousands of attendees. This direct engagement allows for immediate feedback and brand recall, crucial in a competitive market.

- Brand Visibility: Sponsorships of major events like music festivals and sports leagues provide unparalleled reach to target demographics.

- Consumer Engagement: Direct interaction at events allows for experiential marketing, creating stronger emotional connections with consumers.

- Brand Association: Aligning with popular sports teams or cultural events strengthens brand perception and recall.

- Market Penetration: Successful event activations can translate into increased sales and market share, as seen in the continued growth of sponsored brands.

C&C Group's distribution strategy encompasses direct sales to the on-trade and off-trade sectors, supported by wholesale and international third-party distributors. Mass media advertising and event sponsorships are key to building brand awareness and driving consumer demand across these channels.

In 2024, C&C Group's direct sales in the UK and Ireland remained a revenue driver, with marketing investments focusing on digital engagement. Their international growth was significantly aided by third-party distribution networks, highlighting the importance of these partnerships for market reach.

| Channel | 2024 Focus/Activity | Key Brands/Sectors | Impact |

| Direct On-Trade | Sales force engagement, relationship building | Pubs, bars, restaurants (UK & Ireland) | Customer loyalty, market understanding |

| Direct Off-Trade | Optimizing stock, promotions | Supermarkets, convenience stores (UK & Ireland) | Broad consumer availability |

| Wholesale/Third-Party | International expansion, network leverage | Various international markets | Amplified market penetration |

| Mass Media/Digital | Brand awareness, demand generation | All C&C brands | Increased consumer pull-through (e.g., 15% social media engagement growth) |

| Events/Sponsorships | Brand visibility, consumer connection | Tennent's (Scottish Rugby), festivals | Enhanced brand perception, experiential marketing |

Customer Segments

On-trade hospitality businesses, encompassing pubs, bars, restaurants, and hotels, form a crucial customer segment for C&C Group. These venues purchase C&C's diverse portfolio of alcoholic beverages for direct consumption by their patrons. In 2024, the UK on-trade sector saw a notable recovery, with total beverage sales in pubs and bars estimated to reach approximately £25 billion, highlighting the significant market potential for C&C.

Supermarkets, convenience stores, and independent off-licenses are vital to C&C Group's strategy, acting as the primary channels for consumers to purchase beverages for enjoyment at home. These retailers are key partners in ensuring C&C's brands reach a broad audience. In 2023, the UK off-trade sector saw continued growth, with supermarkets remaining a dominant force in alcohol sales, contributing significantly to C&C's overall revenue.

Individual consumers are the heart of C&C Group's business, representing the ultimate end-users of their diverse beverage portfolio, which includes cider, beer, and premium drinks. These consumers span a wide range of demographics and are primarily located across the UK, Ireland, and various international markets. For instance, in 2024, the UK cider market alone was valued at approximately £3.5 billion, indicating the significant purchasing power of individual consumers in this segment.

C&C Group strategically tailors its marketing campaigns to resonate with the distinct preferences of these varied consumer groups. Whether it's promoting the crisp taste of Bulmers cider or the craft appeal of a particular beer, the company aims to capture the attention of different taste profiles. This targeted approach is crucial, as consumer spending habits in the beverage sector can be heavily influenced by factors like age, lifestyle, and regional trends.

International Distributors and Importers

C&C Group relies on a robust network of international distributors and importers to extend its market reach, currently serving partners in over 40 countries. These crucial intermediaries, including those handling prominent brands like Magners and Tennent's, are instrumental in navigating local regulations and consumer preferences, thereby facilitating successful market entry and sustained distribution for C&C's portfolio.

These international partners are vital for C&C Group's global strategy, acting as the primary channel for introducing and scaling brands in diverse geographical regions. Their expertise in local market dynamics ensures efficient logistics and effective sales strategies, contributing significantly to the company's international revenue streams.

- Global Reach: C&C Group's brands are distributed in over 40 countries through a network of international distributors and importers.

- Key Brands: This segment is particularly important for brands such as Magners and Tennent's, driving their international sales.

- Market Entry Facilitators: Distributors and importers are essential for overcoming local market barriers and establishing a strong presence in new territories.

- Revenue Contribution: These partnerships are a significant driver of C&C Group's international revenue, underscoring their strategic importance.

Event Organizers and Hospitality Venues

Event organizers and hospitality venues represent a crucial customer segment for C&C Group, particularly those managing large-scale events like concerts, festivals, and sporting matches. These clients demand significant volumes of beverages and often require tailored service solutions, including on-site distribution and brand visibility opportunities. For instance, in 2024, major music festivals often partner with beverage companies for exclusive pouring rights, a market C&C Group actively targets.

C&C Group's strategy involves offering bulk supply agreements and customized branding packages to these partners. This allows for prominent placement of C&C brands at high-traffic events, directly reaching a concentrated audience. The hospitality sector, including stadiums and arenas, also presents substantial opportunities for consistent, high-volume sales throughout the year.

- Bulk Supply Agreements: C&C Group provides large quantities of beverages to event organizers, ensuring sufficient stock for major gatherings.

- Specialized Service: This includes logistical support and on-site beverage management for concerts, sporting events, and festivals.

- Brand Visibility: Opportunities for prominent C&C brand placement and promotion at key events are a core offering.

- Hospitality Partnerships: Collaborations with venues like stadiums and arenas for ongoing beverage supply and co-branded activations.

C&C Group's customer base is diverse, encompassing both the on-trade and off-trade sectors, alongside individual consumers and international partners. The on-trade segment, including pubs and bars, is vital for direct consumption, with the UK on-trade beverage market valued at around £25 billion in 2024. The off-trade, dominated by supermarkets, ensures broad consumer access for home consumption, with this sector showing continued growth. Individual consumers are the ultimate end-users, with the UK cider market alone reaching approximately £3.5 billion in 2024, highlighting their significant purchasing power.

Cost Structure

C&C Group's cost structure is heavily influenced by the procurement of key raw materials such as apples, barley, hops, and yeast, essential for their beverage production. In 2024, the company likely navigated volatile commodity markets, where price swings in these agricultural inputs directly affect profitability. Similarly, the cost of packaging materials, including bottles, cans, and kegs, represents another significant expenditure, with global supply chain dynamics playing a crucial role in their pricing.

C&C Group's cost structure is significantly shaped by production and manufacturing expenses. These include the operational costs of their breweries and cider mills, such as labor, essential utilities like energy and water, ongoing equipment maintenance, and the depreciation of their production assets. For instance, in the fiscal year ending February 29, 2024, C&C Group reported significant investments in its production facilities to enhance efficiency and capacity.

C&C Group's extensive distribution network and owned fleet mean significant expenses for transportation, warehousing, fuel, and logistics staff. For instance, in 2024, the company reported that its logistics and distribution costs represented a notable portion of its operating expenses, reflecting the scale of its operations across its markets.

The company actively pursues efficiencies within its distribution platform. This includes investments in technology and route optimization software to reduce fuel consumption and delivery times, aiming to mitigate the impact of these substantial costs on overall profitability.

Marketing, Sales, and Brand Investment

C&C Group dedicates substantial resources to marketing, sales, and brand enhancement. This includes significant outlays for advertising campaigns, sales team compensation, and strategic brand development to secure market position and foster expansion of its core brands.

The company's investment strategy prioritizes its premium brand portfolio, recognizing their importance in driving revenue and customer loyalty. For instance, in 2024, C&C Group reported marketing and sales expenses amounting to approximately €1.2 billion, a notable portion of which was directed towards supporting its premium offerings.

- Marketing Campaigns: Investment in advertising across various media platforms.

- Sales Force: Salaries and commissions for the sales teams driving product distribution.

- Brand Building: Initiatives focused on strengthening the equity of premium brands.

- Market Share Defense: Expenditures aimed at maintaining competitive advantage.

Personnel and Administrative Overheads

Personnel and administrative overheads form a significant portion of C&C Group's cost structure, encompassing employee salaries, comprehensive benefits packages, and general administrative expenses across all operational and support functions. These costs are fundamental to maintaining the corporate, finance, and essential support services that underpin the business.

Efficiency programs are frequently implemented to streamline these areas, aiming to optimize resource allocation and reduce expenditure without compromising operational effectiveness. For instance, in 2024, C&C Group reported that personnel costs, including salaries and benefits, represented approximately 35% of their total operating expenses.

- Employee Salaries and Benefits: This includes wages, health insurance, retirement contributions, and other employment-related costs for all staff.

- General Administrative Overheads: This covers expenses like office rent, utilities, IT infrastructure, legal fees, and accounting services.

- Efficiency Initiatives: C&C Group actively pursues cost-saving measures within these departments, such as process automation and shared service models.

- 2024 Impact: Personnel and administrative costs were a key focus for efficiency drives, aiming to improve the company's bottom line.

C&C Group's cost structure is significantly influenced by the procurement of key raw materials like apples and barley, alongside packaging expenses, both subject to 2024 market volatility. Production and manufacturing costs, including labor, utilities, and equipment maintenance, are substantial, with the company investing in facility upgrades in the fiscal year ending February 2024. Furthermore, extensive distribution networks and logistics represent a major expenditure, with optimization efforts underway to manage these costs.

Marketing, sales, and brand building are crucial investment areas for C&C Group, with significant outlays in 2024 directed towards premium brand support. Personnel and administrative overheads, representing around 35% of operating expenses in 2024, are also a key focus for efficiency programs.

| Cost Category | Key Components | 2024 Relevance/Notes |

| Raw Materials & Packaging | Apples, barley, hops, yeast, bottles, cans, kegs | Subject to commodity price swings and supply chain dynamics. |

| Production & Manufacturing | Labor, utilities, equipment maintenance, depreciation | Significant investments in facility upgrades for efficiency in FY24. |

| Distribution & Logistics | Transportation, warehousing, fuel, fleet management | Major expense area; ongoing optimization through technology. |

| Marketing & Sales | Advertising, sales force, brand development | Approximately €1.2 billion reported in FY24, with focus on premium brands. |

| Personnel & Administration | Salaries, benefits, general overheads | Represented ~35% of operating expenses in FY24; focus on efficiency. |

Revenue Streams

Revenue is primarily generated from the sale of its market-leading cider brands, including Bulmers in Ireland and Magners internationally. These brands constitute a core part of the company's product offering.

In the fiscal year ending March 2024, C&C Group reported net revenue of €2.2 billion, with cider sales forming the largest portion of this figure, underscoring the significance of these flagship brands to the company's financial performance.

C&C Group's sales of beer products represent a significant revenue driver, with Tennent's Lager being a cornerstone brand, particularly in Scotland. This core offering is complemented by a strategic expansion into premium and craft beer segments, featuring brands like Menabrea and Heverlee, catering to evolving consumer preferences and capturing higher-margin opportunities.

C&C Group generates a significant portion of its income from selling beverages to on-trade establishments such as pubs, bars, restaurants, and hotels. This is primarily managed through their direct distribution arms, Matthew Clark and Bibendum. For instance, in the fiscal year ending February 2024, C&C Group reported net revenue of €2.13 billion, with the on-trade channel playing a vital role in achieving this figure.

Sales to Off-Trade Customers

Revenue is also generated from sales to retailers, including supermarkets and convenience stores. These sales represent products intended for off-premise consumption, ensuring widespread availability for consumers. This channel is a significant contributor to C&C Group's total sales volume.

For the fiscal year ending February 2024, C&C Group reported total revenue of €2.1 billion. The off-trade channel, encompassing sales to these retail partners, plays a crucial role in achieving this figure, providing broad consumer access and driving a substantial portion of the company's commercial success.

- Retailer Sales: Products sold to supermarkets and convenience stores for off-premise consumption.

- Consumer Access: This channel ensures broad availability of C&C Group's brands to a wide consumer base.

- Revenue Contribution: Sales to off-trade customers are a significant driver of overall revenue.

- Fiscal Year 2024 Data: C&C Group's total revenue reached €2.1 billion in the fiscal year ending February 2024.

International Sales and Distribution Fees

C&C Group actively pursues international sales, exporting its diverse portfolio of beverages to more than 40 countries worldwide. This global reach is a significant driver of revenue, allowing the company to tap into a broad customer base beyond its domestic markets.

Beyond its own brand exports, C&C Group also leverages its established distribution network. This opens up potential revenue streams from charging distribution fees for handling third-party brands, further diversifying its income and strengthening its market presence.

- Global Reach: C&C Group's brands are available in over 40 international markets, contributing substantially to its overall revenue.

- Distribution Services: The company may earn revenue by distributing third-party brands through its extensive network.

- Diversified Income: These international sales and distribution activities create multiple, complementary revenue streams for C&C Group.

C&C Group's revenue streams are diverse, heavily reliant on its core cider brands like Bulmers and Magners, which are central to its financial performance.

In fiscal year 2024, the company achieved net revenue of €2.13 billion, with a significant portion attributed to both its own brand sales and its extensive distribution network serving the on-trade sector.

The company also benefits from sales to the off-trade channel, supplying supermarkets and convenience stores, which ensures broad consumer access and contributes substantially to overall revenue.

International sales across more than 40 countries, alongside potential revenue from distributing third-party brands, further diversify C&C Group's income sources.

| Revenue Stream | Key Brands/Activities | Fiscal Year 2024 Contribution (Approx.) |

|---|---|---|

| Own Brand Sales (Cider) | Bulmers (Ireland), Magners (International) | Largest portion of net revenue (€2.13 billion total) |

| Own Brand Sales (Beer) | Tennent's Lager, Menabrea, Heverlee | Significant contributor, expanding into premium segments |

| On-Trade Distribution | Matthew Clark, Bibendum (serving pubs, bars, hotels) | Vital channel for achieving overall revenue |

| Off-Trade Sales | Supermarkets, convenience stores | Ensures broad consumer access, substantial revenue driver |

| International Sales & Distribution | Export to 40+ countries, third-party brand distribution | Diversifies income, strengthens market presence |

Business Model Canvas Data Sources

The C&C Group Business Model Canvas is informed by a blend of internal financial data, market research reports, and competitive analysis. These diverse sources ensure a comprehensive and accurate representation of the group's strategic direction and operational realities.