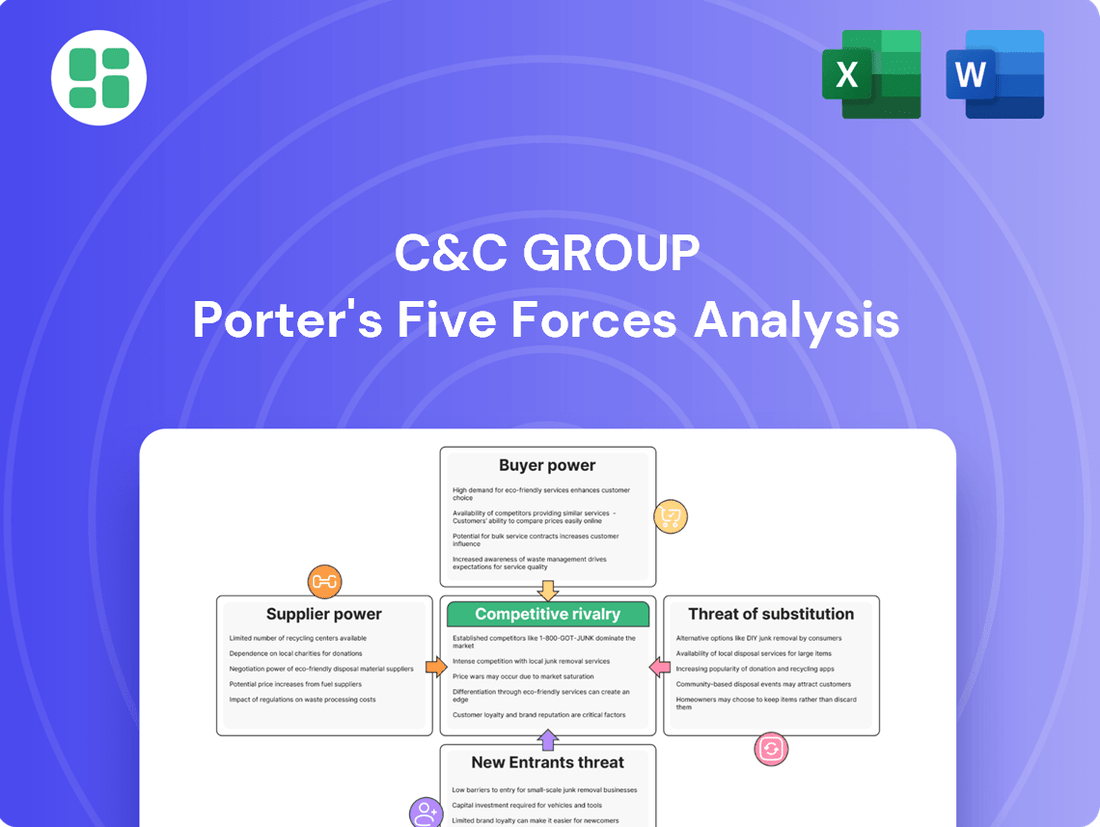

C&C Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

C&C Group Bundle

Understanding the forces shaping the beverage industry is crucial for any stakeholder in C&C Group. Our Porter's Five Forces analysis reveals the intense competition, supplier leverage, and buyer power that define this market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore C&C Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

C&C Group's vertically integrated supply chain, covering manufacturing, marketing, and distribution, significantly reduces the bargaining power of individual suppliers. This integration means C&C has greater control over its operations, from sourcing raw materials to delivering finished products, lessening its dependence on external suppliers for critical functions.

With manufacturing facilities in Co. Tipperary, Ireland, and Glasgow, Scotland, C&C Group solidifies its position by owning key production assets. This ownership structure allows for more streamlined operations and potentially better negotiation leverage with any remaining external suppliers, as the company internalizes a larger portion of its value chain.

C&C Group's strategic engagement with suppliers, particularly on sustainability, suggests a shift in bargaining power dynamics. By collaborating on initiatives like CDP environmental data requests and science-based carbon reduction targets, C&C Group aims to influence supplier practices, moving beyond a simple buyer-seller relationship.

This proactive approach, including commitments to sustainably sourced products, indicates a focus on long-term partnerships rather than short-term cost negotiations. Such collaborations can foster supplier loyalty and innovation, potentially mitigating the suppliers' ability to exert significant pricing pressure.

The success of C&C Group's brands, particularly its ciders and beers, is intrinsically linked to the quality of its primary ingredients like apples, barley, and hops. This reliance means that while C&C Group holds some negotiation power, the consistent availability and superior quality of these agricultural inputs are paramount, giving suppliers of specialized or high-grade materials significant leverage.

Supplier Information Management

C&C Group actively manages its supplier relationships through robust policies, such as its Sustainable and Ethical Procurement Policy and a comprehensive Code of Conduct. This proactive approach sets clear expectations for suppliers regarding ethical practices and environmental standards.

By establishing these guidelines and reserving the right to assess compliance, C&C Group effectively mitigates the bargaining power of its suppliers. This ensures that the supply base aligns with the Group's operational and ethical mandates, reinforcing C&C's control within its supply chain.

- Supplier Compliance: C&C Group's policies require suppliers to adhere to ethical and environmental criteria.

- Assessment Rights: The Group retains the right to evaluate supplier adherence to its standards.

- Reduced Supplier Leverage: These measures diminish supplier power by ensuring alignment with C&C's operational and ethical framework.

Economies of Scale in Procurement

C&C Group's substantial purchasing volumes, as a major player in the UK and Irish alcoholic beverage market, grant it significant economies of scale. This purchasing power enables them to secure more advantageous pricing and terms from suppliers for essential inputs like packaging and logistics. For instance, in fiscal year 2024, C&C Group reported net revenue of €2.1 billion, underscoring the sheer scale of their procurement operations.

These economies of scale directly diminish the bargaining power of suppliers. Suppliers are incentivized to offer better deals to C&C Group to secure these large, consistent orders. This dynamic reduces the suppliers' ability to dictate terms or raise prices unilaterally, as C&C Group can often leverage alternative suppliers or internalize certain processes if necessary.

- Significant Purchasing Volumes: C&C Group's market presence translates to substantial orders for raw materials, packaging, and services.

- Negotiating Leverage: Large order quantities allow C&C Group to negotiate favorable pricing and payment terms with suppliers.

- Supplier Dependence: Suppliers often rely on C&C Group's business, increasing C&C's power in negotiations.

- Cost Reduction: Economies of scale in procurement contribute to lower overall production costs for C&C Group.

C&C Group's considerable purchasing power, evidenced by €2.1 billion in net revenue for fiscal year 2024, allows it to negotiate favorable terms with suppliers. This scale means suppliers are more inclined to offer competitive pricing to secure C&C's large, consistent orders, thereby reducing supplier leverage.

The company's vertical integration and ownership of key production assets further consolidate its position, lessening reliance on external suppliers and enhancing negotiation strength. By controlling more of its value chain, C&C can mitigate supplier-driven cost increases.

C&C's proactive supplier engagement, focusing on sustainability and ethical practices through policies and assessments, also serves to align suppliers with the Group's objectives. This collaborative approach, rather than purely transactional, aims to foster loyalty and innovation, potentially dampening suppliers' ability to exert pricing pressure.

| Metric | Value (FY24) | Impact on Supplier Bargaining Power |

|---|---|---|

| Net Revenue | €2.1 billion | Significant purchasing volume amplifies C&C's negotiating leverage. |

| Vertical Integration | Owned manufacturing facilities (Ireland, Scotland) | Reduces dependence on external suppliers, increasing C&C's control. |

| Supplier Policies | Sustainable & Ethical Procurement Policy, Code of Conduct | Establishes standards, diminishing supplier power by ensuring alignment with C&C's framework. |

What is included in the product

This Porter's Five Forces analysis for C&C Group dissects the competitive intensity within the beverage industry, examining threats from new entrants, the bargaining power of buyers and suppliers, and the availability of substitutes.

Instantly identify and quantify competitive pressures, allowing for targeted strategies to alleviate market friction.

Customers Bargaining Power

C&C Group's dual market presence, serving both on-trade (pubs, bars) and off-trade (supermarkets) channels, creates a complex dynamic for customer bargaining power. While major off-trade retailers can leverage their significant purchase volumes to negotiate favorable terms, C&C's deep penetration and established relationships within the more fragmented on-trade sector offer a degree of counter-balance. This diversification allows C&C to mitigate the concentrated power of a few large off-trade customers by maintaining strong ties with a broader base of on-trade partners.

C&C Group's market-leading distribution network, operating under brands like Matthew Clark and Bibendum, significantly diminishes the bargaining power of its customers. As the number one drinks distributor in the UK and Ireland hospitality sectors, C&C offers unparalleled scale and reach, ensuring next-day delivery to 99% of the UK.

This extensive distribution capability, coupled with a deep understanding of customer needs, makes C&C an indispensable route-to-market for many beverage producers. Consequently, customers have fewer viable alternatives for comparable service levels, thereby limiting their ability to negotiate more favorable terms.

C&C Group's strong brand portfolio, featuring market leaders like Bulmers, Magners, and Tennent's Lager, significantly enhances its bargaining power against customers. These brands have consistently shown robust performance and market share growth, indicating deep consumer preference and loyalty. For instance, in the fiscal year ending February 2024, C&C Group reported net revenue growth, underscoring the continued strength of its core brands in competitive markets.

Improved Customer Service Levels

C&C Group's commitment to enhancing customer service following their ERP system upgrade has demonstrably strengthened their position against customer bargaining power. By achieving high on-time-in-full (OTIF) delivery rates, they are meeting and exceeding customer expectations, a critical factor in retaining business. This focus on operational excellence directly reduces the customers' inclination to switch suppliers.

The positive impact of these improved service levels is evident in customer retention and growth. For instance, Matthew Clark Bibendum, a key part of C&C Group, has successfully expanded its customer base. This growth signifies increased customer satisfaction and loyalty, effectively diminishing the bargaining leverage customers would otherwise have if C&C Group's service was subpar.

- Restored and improved customer service levels post-ERP upgrade.

- Achieved high on-time-in-full (OTIF) delivery rates, exceeding industry benchmarks.

- Enhanced customer satisfaction, leading to reduced incentive to seek alternative suppliers.

- Matthew Clark Bibendum's customer base growth indicates strong customer retention and loyalty.

Customer Base Growth and Retention

C&C Group's distribution arm, notably Matthew Clark Bibendum, has demonstrated robust growth in its customer base, a testament to its enhanced service levels. This expansion, coupled with strong customer loyalty, suggests that C&C is adept at satisfying client demands and fostering enduring partnerships.

The company's success in retaining customers, evidenced by consistently improved service metrics, directly translates to a reduced ability for individual customers to exert significant price pressure or demand more favorable terms. This customer base growth and retention are key factors in mitigating the bargaining power of customers for C&C Group.

- Matthew Clark Bibendum's customer base growth

- High customer retention rates

- Improved service levels

- Diminished customer bargaining power

C&C Group's bargaining power with customers is significantly influenced by its extensive distribution network and strong brand portfolio. As the leading drinks distributor in the UK and Ireland hospitality sectors, C&C offers unparalleled reach and reliability, making it a crucial partner for many beverage producers. This market dominance, combined with popular brands like Bulmers and Magners, limits customers' ability to negotiate better terms due to fewer viable alternatives.

The company's recent focus on operational excellence, particularly after its ERP system upgrade, has led to improved customer service, including high on-time-in-full (OTIF) delivery rates. This enhanced service directly strengthens C&C's position by increasing customer satisfaction and loyalty, thereby reducing the incentive for customers to seek out other suppliers or demand more favorable pricing.

C&C Group's performance in the fiscal year ending February 2024 highlights the effectiveness of these strategies, with reported net revenue growth. This financial success is underpinned by strong customer retention and the expansion of its customer base, particularly through its Matthew Clark Bibendum division, which indicates a reduced ability for individual customers to exert significant bargaining power.

| Metric | C&C Group Performance (FY ending Feb 2024) | Impact on Customer Bargaining Power |

|---|---|---|

| Net Revenue Growth | Reported growth | Indicates strong market position and brand demand, limiting customer negotiation leverage. |

| OTIF Delivery Rates | High, exceeding benchmarks | Reduces customer incentive to switch suppliers, thus diminishing their bargaining power. |

| Customer Base Expansion (Matthew Clark Bibendum) | Growth achieved | Signifies strong customer satisfaction and loyalty, weakening individual customer bargaining power. |

| Brand Strength (e.g., Bulmers, Magners) | Market leaders with consistent performance | Deep consumer preference makes brands less susceptible to customer price pressure. |

Same Document Delivered

C&C Group Porter's Five Forces Analysis

This preview showcases the complete C&C Group Porter's Five Forces Analysis, offering a thorough examination of competitive forces within their industry. You're looking at the actual document, meaning the detailed insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry are precisely what you'll receive. Once your purchase is complete, you’ll gain instant access to this exact, professionally formatted file, ready for immediate strategic application.

Rivalry Among Competitors

The alcoholic beverage market in the UK and Ireland is notably mature, presenting a demanding landscape for C&C Group. This maturity, coupled with challenging macroeconomic factors such as subdued consumer confidence and evolving legislative frameworks, intensifies competitive rivalry.

Companies like C&C Group face significant pressure to capture and retain market share, making operational efficiency and clear brand differentiation paramount. For instance, in 2024, the UK off-trade alcohol market saw continued price sensitivity among consumers, with discounters gaining traction, underscoring the need for strong value propositions.

C&C Group faces a highly competitive environment, contending with major global beverage conglomerates like Heineken and Carlsberg, as well as robust local players in each of its operating regions. This means C&C must consistently invest in its brands, drive innovation, and fortify its distribution networks to stay ahead. For instance, in the UK, a key market, the beer and cider sector sees intense rivalry, with global giants holding substantial market share. In 2024, the global alcoholic beverage market was valued at over $1.5 trillion, highlighting the sheer scale of competition C&C navigates.

Despite a challenging market environment, C&C Group's core brands, including Bulmers and Tennent's, have shown remarkable resilience. These brands have successfully gained market share within the on-trade sector, a testament to their enduring consumer appeal and the effectiveness of C&C's competitive strategies.

Strategic Focus on Premiumisation and Innovation

C&C Group is enhancing its competitive standing by focusing on premiumisation and innovation within its product lines. This strategy aims to differentiate the company by emphasizing value rather than just price, which is crucial in a market often characterized by intense price-based competition.

The company's efforts include significant investments in innovation and the strategic relaunch of brands like Magners. Furthermore, C&C is expanding its presence in the premium beer segment with brands such as Menabrea and Orchard Pig. This deliberate move towards higher-margin products allows C&C to carve out a distinct market position.

- Premiumisation Strategy: Relaunch of Magners, growth in premium beers like Menabrea and Orchard Pig.

- Innovation Investment: Focus on developing new, higher-margin products.

- Competitive Advantage: Differentiation through value, reducing reliance on price competition.

- Market Positioning: Shifting towards a premium segment to mitigate direct rivalry.

Vertically Integrated Business Model

C&C Group's vertically integrated business model, encompassing both manufacturing and distribution, creates a significant competitive moat. This integration allows C&C to manage its entire supply chain, from production to the end consumer, fostering operational efficiencies and cost advantages. For instance, in 2024, C&C reported strong performance in its owned brands, benefiting from this streamlined approach.

This control over manufacturing and distribution provides a powerful route-to-market for C&C's own brands, such as Magners and Bulmers, as well as its agency brands. The ability to efficiently deliver products to a wide range of retail and hospitality outlets makes it challenging for competitors to match C&C's scale and market penetration. This integrated structure also enhances C&C's ability to respond swiftly to market trends and consumer demand.

- Vertical Integration: C&C controls manufacturing and distribution, offering a distinct advantage.

- Supply Chain Efficiency: This model allows for greater oversight and cost optimization throughout the value chain.

- Market Access: A strong distribution network facilitates efficient delivery for both owned and agency brands.

- Competitive Barrier: The scale and reach of C&C's integrated operations are difficult for rivals to replicate.

The competitive rivalry for C&C Group is intense, fueled by a mature UK and Ireland alcoholic beverage market and significant pressure from both global giants and local players. In 2024, the market's price sensitivity, with discounters gaining ground, means C&C must focus on value and brand differentiation to maintain its position.

C&C's vertically integrated model, controlling manufacturing and distribution, provides a crucial competitive edge, enabling operational efficiencies and a strong route-to-market for its brands like Bulmers and Tennent's. This integration makes it challenging for competitors to match C&C's scale and market penetration.

The company is actively combating this rivalry by investing in premiumisation and innovation, exemplified by brand relaunches and expansion into premium beer segments, aiming to differentiate through value rather than price. This strategic shift is vital in a market valued at over $1.5 trillion globally in 2024.

SSubstitutes Threaten

The growing consumer demand for moderation presents a significant threat of substitutes for C&C Group. Sales of non-alcoholic and low-alcohol beverages have surged, with the global low-alcohol and no-alcohol market projected to reach $10.16 billion in 2024, according to Statista. This shift, fueled by health consciousness, directly challenges C&C's traditional alcoholic product portfolio.

C&C Group is actively addressing the threat of substitutes by innovating within its own product lines. Recognizing the growing consumer demand for healthier options, the company has launched low and no-alcohol versions of its popular brands. This strategic move aims to capture market share from consumers who are reducing their alcohol intake, offering them familiar brands in a modified format.

This adaptation is crucial in a market where substitutes, ranging from non-alcoholic beverages to other alcoholic categories, are increasingly appealing. By providing appealing low/no-alcohol alternatives, C&C Group effectively neutralizes some of the substitution pressure. For instance, the company's commitment to responsible drinking initiatives further bolsters its brand image among a wider consumer base, including those who may be actively seeking out healthier choices.

Consumers have a vast selection of beverages beyond cider and beer, including spirits, wine, and non-alcoholic options like soft drinks. These alternatives directly compete for consumer spending on refreshment and social occasions. For instance, the global spirits market was valued at approximately $1.1 trillion in 2023, demonstrating its significant scale as a substitute.

While C&C Group does distribute some of these competing categories, a notable shift in consumer preference towards spirits or premium wines, where C&C may lack a strong owned-brand portfolio, could directly affect its sales and revenue streams. This highlights the importance of C&C's brand strategy across diverse beverage segments.

Lifestyle and Leisure Activity Substitutes

Consumers have a vast array of choices for how they spend their leisure time and disposable income, extending far beyond direct beverage competitors. For instance, in 2024, the global market for experiences and entertainment, including travel, dining out, and digital subscriptions, continued to grow, presenting a significant alternative to purchasing alcoholic beverages. Economic shifts, such as inflation impacting consumer spending power, can further encourage a pivot towards less expensive leisure pursuits. This broadens the competitive landscape for C&C Group considerably.

The threat of substitutes is amplified when considering the diverse ways consumers allocate their discretionary funds. Instead of buying cider or other alcoholic drinks, individuals might opt for streaming service subscriptions, gym memberships, or even home improvement projects. Data from 2024 suggests a continued rise in spending on digital entertainment and wellness activities, indicating a growing preference for these non-beverage-related expenditures. This trend directly impacts the potential market share for C&C's offerings.

- Diversified Leisure Spending: Consumers allocate disposable income to a wide range of activities like travel, dining, and digital entertainment, diverting funds from beverage purchases.

- Economic Influences: Inflationary pressures and economic uncertainty in 2024 encouraged consumers to prioritize value and potentially shift spending away from discretionary items like alcoholic beverages.

- Growth in Alternative Sectors: The digital entertainment and wellness industries experienced robust growth in 2024, presenting strong alternative options for consumer leisure expenditure.

Innovation in Substitute Categories

The non-alcoholic beverage sector is a hotbed of innovation, with new flavors, functional benefits, and entirely new product categories emerging at a rapid pace. This constant evolution of substitutes, such as the growing popularity of functional drinks and nootropics, poses an ongoing challenge for C&C Group. The company must ensure its alcoholic beverages remain appealing and competitive against these increasingly sophisticated non-alcoholic alternatives.

For instance, the global functional beverage market was valued at approximately $125 billion in 2023 and is projected to reach over $200 billion by 2030, indicating a significant shift in consumer preferences towards health-oriented drinks. This growth directly impacts categories where C&C operates, as consumers may opt for a vitamin-infused water or a cognitive-enhancing beverage over a traditional alcoholic drink.

- Growing Functional Beverage Market: The increasing consumer demand for beverages offering health benefits beyond basic hydration creates direct competition for C&C's core products.

- Nootropics and Cognitive Enhancers: The rise of nootropics, marketed for improved focus and mental performance, offers a novel substitute for social occasions traditionally involving alcohol.

- Flavor and Format Innovation: Non-alcoholic options are continually diversifying in flavor profiles and formats, mimicking or even surpassing the variety traditionally found in alcoholic beverages.

The threat of substitutes for C&C Group is multifaceted, encompassing both direct beverage alternatives and broader lifestyle choices. The burgeoning non-alcoholic and low-alcohol beverage market, projected to hit $10.16 billion in 2024, directly challenges C&C's traditional offerings. Furthermore, the vast global spirits market, valued at around $1.1 trillion in 2023, represents a significant competitor for consumer spending on social occasions.

Consumers are increasingly diverting discretionary income towards experiences like travel and digital entertainment, with these sectors showing continued growth in 2024. This shift, coupled with economic factors like inflation, encourages a pivot towards less expensive leisure pursuits, impacting the potential market share for C&C's products. The innovation within the functional beverage sector, valued at approximately $125 billion in 2023, also presents a growing challenge as consumers seek health-oriented alternatives.

| Substitute Category | 2024 Market Projection/Value | Impact on C&C Group |

|---|---|---|

| Low/No-Alcohol Beverages | $10.16 billion | Direct competition for traditional alcoholic beverage sales. |

| Spirits | ~$1.1 trillion (2023) | Significant competitor for consumer spending on social occasions. |

| Experiences & Entertainment | Continued growth in 2024 | Diversion of discretionary income away from beverage purchases. |

| Functional Beverages | ~$125 billion (2023) | Growing consumer preference for health-oriented drinks over alcohol. |

Entrants Threaten

The alcoholic beverage industry, especially for companies like C&C Group with established manufacturing and distribution networks, demands significant upfront capital. This includes substantial investment in production facilities, specialized brewing or cider-making equipment, and the complex logistics required to get products to market.

These high capital requirements act as a considerable deterrent for potential new players looking to enter the market at a competitive scale. For instance, building a new, modern brewery or cider production facility can easily run into tens or even hundreds of millions of dollars, a sum that many smaller ventures cannot readily access.

This financial barrier means that only well-funded corporations or those with access to substantial private equity are likely to challenge established players like C&C Group. The sheer cost of matching existing infrastructure and achieving efficient economies of scale makes it very difficult for newcomers to gain meaningful traction.

The threat of new entrants for C&C Group is significantly mitigated by its deeply entrenched brand loyalty and substantial market share. Brands like Bulmers, Magners, and Tennent's are not just names; they represent decades of consumer trust and preference, particularly in their core markets. For instance, Bulmers is a dominant force in the Irish cider market, consistently holding a leading share. This strong consumer connection makes it incredibly difficult and expensive for newcomers to gain traction.

C&C Group's extensive distribution network, particularly through its market-leading entities Matthew Clark and Bibendum, acts as a formidable barrier to new entrants in the UK and Ireland beverage market. This network offers an unparalleled route-to-market for a wide array of products, both its own and those of third parties.

The sheer scale and efficiency required to replicate such a vast logistical operation, capable of ensuring next-day delivery across a substantial portion of the population, presents a significant financial and operational challenge for any aspiring competitor. For instance, in 2024, C&C's distribution arm handled millions of cases, underscoring the substantial infrastructure investment needed to compete.

Regulatory and Licensing Hurdles

The alcoholic beverage sector, including C&C Group's markets in the UK and Ireland, faces significant regulatory complexities. New entrants must contend with intricate licensing procedures, substantial excise duties, and stringent marketing limitations.

Navigating this dense regulatory environment demands considerable expertise and financial resources, acting as a substantial deterrent for aspiring competitors. For instance, in 2023, the UK government collected over £10 billion in alcohol duty, highlighting the financial commitment required from operators.

- Licensing: Securing the necessary licenses to produce, distribute, and sell alcohol is a time-consuming and costly process.

- Excise Duties: High excise taxes on alcoholic products directly impact profitability and require robust financial planning.

- Marketing Restrictions: Regulations on advertising and promotion limit how new brands can reach consumers, increasing customer acquisition costs.

Economies of Scale and Experience Curve

Existing players like C&C Group leverage significant economies of scale in their operations. This includes bulk purchasing of raw materials, efficient large-scale production facilities, and established, cost-effective distribution networks. For instance, in 2024, C&C Group reported a revenue of €2.1 billion, indicating a substantial operational footprint that allows for lower per-unit production costs compared to any nascent competitor.

New entrants face a considerable barrier due to the inability to immediately match these cost efficiencies. They would likely incur higher initial per-unit costs for production and distribution, making it challenging to compete on price with established brands. This cost disadvantage is further amplified by the experience curve effect; C&C Group has years of operational refinement, leading to optimized processes and reduced waste, which new entrants cannot replicate overnight.

- Economies of Scale: C&C Group's €2.1 billion revenue in 2024 signifies substantial purchasing power and operational leverage.

- Experience Curve: Years of refined production and distribution processes provide C&C Group with inherent cost advantages.

- Cost Disadvantage for New Entrants: Start-ups would struggle to achieve comparable unit costs, impacting pricing flexibility and profitability.

The threat of new entrants for C&C Group is generally low due to significant barriers. High capital investment for production and distribution, coupled with entrenched brand loyalty and extensive distribution networks, makes market entry difficult. Furthermore, stringent regulations and licensing requirements add complexity and cost for any aspiring competitor.

These factors combine to create a formidable challenge for newcomers. For instance, the substantial investment required to build a modern beverage production facility can easily reach tens of millions of dollars, a cost that deters many potential entrants. Additionally, C&C's 2024 revenue of €2.1 billion highlights its operational scale, which translates into cost efficiencies that are hard for new players to match immediately.

| Barrier Type | Impact on New Entrants | C&C Group Advantage |

|---|---|---|

| Capital Requirements | High (tens of millions of dollars for facilities) | Established infrastructure, economies of scale |

| Brand Loyalty & Market Share | Significant challenge to overcome | Dominant brands like Bulmers, Magners |

| Distribution Networks | Difficult and costly to replicate | Extensive network via Matthew Clark and Bibendum |

| Regulatory Environment | Complex and costly to navigate | Expertise and resources to manage compliance |

| Economies of Scale | Higher initial per-unit costs | Lower production and distribution costs due to €2.1 billion 2024 revenue |

Porter's Five Forces Analysis Data Sources

Our C&C Group Porter's Five Forces analysis is built upon a robust foundation of data, drawing from the company's annual reports, industry-specific market research from firms like Statista and IBISWorld, and publicly available regulatory filings. This comprehensive approach ensures a thorough understanding of the competitive landscape.