Canadian Solar SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canadian Solar Bundle

Canadian Solar, a leader in solar technology, boasts strong global manufacturing capabilities and a robust project pipeline, but faces intense competition and fluctuating market demand. Understanding these dynamics is crucial for navigating the renewable energy sector.

Want the full story behind Canadian Solar's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Canadian Solar stands as a prominent global leader in solar energy, demonstrating a robust, diversified business model. Its operations span the entire solar value chain, from manufacturing solar photovoltaic modules to offering integrated energy solutions.

The company's extensive reach includes the design, development, and production of solar ingots, wafers, cells, and modules. Furthermore, Canadian Solar is actively involved in the development, construction, and operation of utility-scale solar power projects and energy storage solutions across the globe.

As of the first quarter of 2024, Canadian Solar reported a significant backlog of solar projects, underscoring its strong market position and ongoing growth trajectory in the renewable energy sector.

Canadian Solar boasts a robustly vertically integrated model, controlling production from raw materials like ingots and wafers all the way through to finished solar cells and modules. This end-to-end control is a significant advantage, allowing for greater oversight on quality and cost efficiency.

By the close of 2024, the company had established substantial manufacturing capabilities. Looking ahead, Canadian Solar has ambitious plans to expand its module production capacity to an impressive 61 GW by 2025. This scaling is critical for meeting growing global demand and solidifying its market position.

Canadian Solar's e-STORAGE subsidiary is a major strength, showing impressive growth. In late 2024, they reported a record quarter for deliveries and a hefty contracted backlog of $3.2 billion.

This energy storage business is emerging as a crucial profit engine for Canadian Solar. The company's storage pipeline has grown significantly, reaching 79 GWh, indicating substantial future project potential.

Extensive Global Project Development Pipeline

Canadian Solar boasts a substantial global project development pipeline, a significant strength. As of December 31, 2024, its Recurrent Energy subsidiary managed a solar development pipeline totaling 25 GWp and a battery energy storage development pipeline of 75 GWh. This robust pipeline offers excellent visibility into future revenue streams from both project sales and ongoing electricity generation.

Commitment to Innovation and R&D

Canadian Solar's dedication to innovation is a significant strength, evident in its consistent investment in research and development. This focus aims to enhance both the efficiency and reliability of its solar photovoltaic (PV) modules and battery energy storage systems. By pushing technological boundaries, the company positions itself at the forefront of the renewable energy sector.

The company's robust patent portfolio underscores its commitment to innovation. As of September 2024, Canadian Solar had secured 2,242 authorized patents worldwide. This extensive collection of intellectual property reflects a deep-seated drive for technological advancement, including key developments in areas such as N-type TOPCon modules, which offer improved performance characteristics.

- Commitment to Innovation: Continuous investment in R&D for solar PV modules and battery storage.

- Extensive Patent Portfolio: 2,242 authorized patents globally as of September 2024.

- Technological Advancements: Focus on improving module efficiency and reliability, including N-type TOPCon technology.

Canadian Solar's vertically integrated manufacturing strategy, from ingots to modules, provides significant cost control and quality assurance. The company is aggressively expanding its module production capacity, targeting 61 GW by 2025, which is crucial for capturing growing market demand.

The e-STORAGE subsidiary is a key growth driver, reporting a record quarter for deliveries and a substantial $3.2 billion contracted backlog in late 2024, with a 79 GWh storage pipeline indicating strong future revenue.

A vast global project development pipeline, including 25 GWp of solar and 75 GWh of battery storage as of December 2024, ensures future project sales and generation income visibility.

Canadian Solar's commitment to innovation is backed by 2,242 authorized patents globally as of September 2024, with a focus on enhancing module efficiency and reliability through technologies like N-type TOPCon.

| Metric | Value | As of Date |

|---|---|---|

| Module Production Capacity Target | 61 GW | 2025 |

| e-STORAGE Contracted Backlog | $3.2 billion | Late 2024 |

| e-STORAGE Pipeline | 79 GWh | Late 2024 |

| Recurrent Energy Solar Pipeline | 25 GWp | December 31, 2024 |

| Recurrent Energy Storage Pipeline | 75 GWh | December 31, 2024 |

| Authorized Patents | 2,242 | September 2024 |

What is included in the product

This analysis maps out Canadian Solar’s market strengths, operational gaps, and risks, offering a comprehensive view of its strategic position.

Offers a clear, actionable SWOT analysis of Canadian Solar, pinpointing key strengths and weaknesses to address operational inefficiencies and market challenges.

Weaknesses

Canadian Solar faces significant challenges due to the ongoing decline in solar module average selling prices (ASPs). This trend has put considerable pressure on the company's revenues and overall profitability.

The solar market experienced sharp price reductions throughout 2024, a situation that directly impacted Canadian Solar's financial performance. For instance, the company's gross margin saw a noticeable decrease compared to the previous year, largely attributed to these falling module prices.

While Canadian Solar has implemented various strategies to mitigate these effects, the persistent downward pressure on ASPs remains a key vulnerability. This makes it difficult to maintain robust financial results in the current market environment.

Canadian Solar's financial health is notably impacted by its substantial debt. By the end of 2024, the company's total debt stood at a considerable $5.2 billion. This high level of leverage could present challenges, particularly in navigating the fluctuating conditions often seen in the renewable energy sector.

Further pressure on its financial standing comes from projected capital expenditures. For 2025, Canadian Solar anticipates significant investments, which will likely require substantial funding and could strain its existing financial resources.

Canadian Solar faces considerable challenges due to trade protectionism and tariffs, especially impacting its significant U.S. market presence. Tariffs, which have reached as high as 286% on solar panel imports, directly inflate the company's operational costs and diminish its competitive edge.

These trade barriers also affect specific segments of Canadian Solar's business; for instance, a 145% tariff specifically targets the company's storage solutions, further complicating its ability to offer integrated solar and storage products profitably in key markets.

Project Execution Risks and Operating Losses in Project Development

Canadian Solar's Recurrent Energy segment faced significant headwinds in 2024, reporting an operating loss of $90.08 million. This was largely attributed to project delays and asset impairments, highlighting the inherent risks in developing large-scale renewable energy projects.

The company's substantial project pipeline, a key driver for future growth, is heavily reliant on several critical milestones. Securing necessary permits, finalizing power purchase agreements (PPAs), and obtaining adequate financing are all complex processes that carry substantial uncertainty, posing a significant weakness.

- Project Delays and Impairments: Operating loss of $90.08 million in Recurrent Energy in 2024 due to these issues.

- Permitting and Regulatory Hurdles: Delays in obtaining permits can significantly impact project timelines and costs.

- PPA Uncertainty: The success of projects is contingent on securing favorable power purchase agreements, which can be challenging in evolving energy markets.

- Financing Risks: Access to and cost of capital for large projects are subject to market conditions and investor sentiment.

Intense Competition and Global Oversupply

The solar module market is currently experiencing significant oversupply on a global scale, creating a highly competitive environment. This intense competition is particularly pronounced due to the dominant presence of Chinese manufacturers, who hold a substantial share of the market, often occupying the top positions in module production rankings.

This overcapacity has inevitably led to aggressive price wars among manufacturers. As a result, companies like Canadian Solar are compelled to compete on price, which directly impacts profit margins across the entire industry. For instance, in early 2024, module prices saw continued downward pressure, with some reports indicating average prices for Tier 1 modules hovering around $0.20 to $0.25 per watt, a significant drop from previous years.

- Global Oversupply: The solar module market is saturated with production capacity exceeding demand.

- Dominant Chinese Competition: Chinese manufacturers control a significant portion of global market share, intensifying competition.

- Price Wars: Overcapacity forces manufacturers into aggressive pricing strategies, squeezing profitability.

- Margin Pressure: Intense price competition directly impacts the financial performance and margins of companies in the sector.

Canadian Solar's significant debt burden, totaling $5.2 billion by the end of 2024, presents a considerable weakness. This high leverage could impede its ability to secure favorable financing for future projects, especially given the volatile nature of the renewable energy market.

The company's projected capital expenditures for 2025 also pose a challenge, potentially straining its financial resources as it invests in growth initiatives.

Furthermore, the Recurrent Energy segment reported an operating loss of $90.08 million in 2024, primarily due to project delays and asset impairments. This highlights the inherent risks and execution challenges in developing large-scale renewable energy projects.

Same Document Delivered

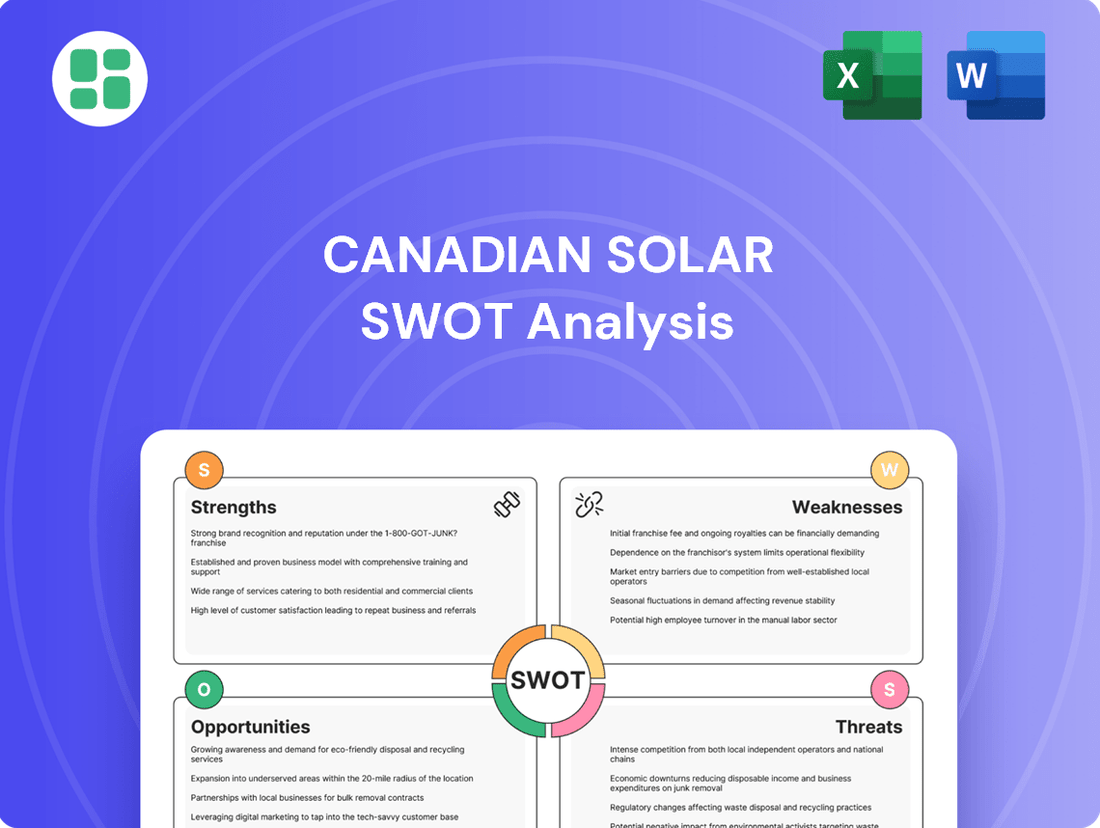

Canadian Solar SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Canadian Solar's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Canadian Solar's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to integrate the Canadian Solar SWOT analysis into your own strategic planning.

Opportunities

The worldwide appetite for renewable energy is surging. In 2024, global solar installations are projected to hit close to 600 gigawatts, a significant jump of 33% from the previous year. This rapid expansion presents a substantial opportunity for companies like Canadian Solar to capitalize on increasing demand.

Furthermore, the need for energy storage solutions is escalating. This is fueled by rising energy consumption from critical sectors such as data centers and the burgeoning electric vehicle market. Canadian Solar's ability to integrate storage with its solar offerings positions it well to meet this growing, dual demand.

Government initiatives and policies are a significant tailwind for Canadian Solar. The Inflation Reduction Act (IRA) in the U.S., for instance, offers substantial tax credits and incentives that directly benefit solar project developers and manufacturers. These policies are not limited to the U.S.; many countries are implementing similar programs to accelerate renewable energy adoption.

These favorable policies, including the ability to transfer tax credits, are crucial for Canadian Solar's project pipeline and domestic manufacturing expansion. For example, the IRA's manufacturing tax credits are designed to onshore solar production, a key area of focus for companies like Canadian Solar. This creates a more predictable and supportive environment for long-term investment in solar technology and infrastructure.

Ongoing advancements in solar panel technologies, like N-type TOPCon modules, are boosting efficiency and bifaciality, offering significant performance gains. For instance, in 2024, the efficiency of leading solar panels is consistently exceeding 23%, a notable jump from previous years. Innovations in energy storage, such as the development of more stable solid-state batteries, promise enhanced safety and energy density, which are crucial for grid-scale applications and electric vehicles, further driving demand for integrated solar solutions.

The integration of Artificial Intelligence (AI) and smart solar solutions is also a key opportunity, optimizing energy management and grid integration. AI algorithms can predict solar generation and demand more accurately, leading to better resource allocation and reduced curtailment. This technological synergy allows for more efficient utilization of solar power, contributing to lower overall energy costs and improved grid stability, a critical factor as renewable energy penetration increases.

Expansion into Emerging Markets and Distributed Generation

Canadian Solar is well-positioned to leverage the burgeoning demand in distributed generation, a sector experiencing significant growth globally. The increasing affordability of solar energy makes it an attractive option in many emerging markets, presenting a substantial opportunity for the company.

With operations spanning over 70 countries, Canadian Solar's established global footprint allows it to effectively penetrate these diverse and expanding markets. This extensive reach is a key advantage in capturing new growth opportunities.

- Distributed Generation Growth: The global distributed solar market is projected to see continued expansion, driven by policy support and declining costs.

- Emerging Market Potential: Regions like Southeast Asia and Latin America are showing strong solar adoption rates, offering significant untapped potential for Canadian Solar.

- Global Footprint Advantage: Canadian Solar's presence in over 70 countries facilitates rapid deployment and market penetration in new and developing solar markets.

Strategic Partnerships and Business Model Evolution

Canadian Solar is strategically evolving its Recurrent Energy subsidiary to embrace a partial Independent Power Producer (IPP) model, a move bolstered by substantial credit facilities. This transition is designed to generate more stable, recurring revenue streams, complementing its existing project development and sales business.

These strategic shifts are significantly enhanced by external financial backing. For instance, a notable $500 million investment commitment from BlackRock in Recurrent Energy underscores the attractiveness of Canadian Solar's renewable energy assets and its evolving business model. This partnership not only provides crucial capital for expansion but also validates the company's strategy in the eyes of the broader financial community.

This evolution opens up several key opportunities:

- Diversified Revenue Streams: The shift towards an IPP model allows Canadian Solar to capture long-term revenue from energy sales, reducing reliance on project development cycles.

- Enhanced Financial Flexibility: Significant credit facilities and strategic investments, like BlackRock's commitment, provide ample capital to fund growth initiatives and de-risk future projects.

- Attracting Strategic Investors: A clear path to recurring revenue and a demonstrated ability to secure large-scale financing can attract further investment from financial institutions and strategic partners.

- Strengthened Market Position: By becoming a partial IPP, Canadian Solar can build a portfolio of operating assets, increasing its overall valuation and market influence in the renewable energy sector.

Canadian Solar is poised to benefit from the accelerating global demand for solar energy, with projections indicating a significant increase in solar installations worldwide. The company's ability to integrate energy storage solutions addresses the growing need for reliable power, particularly from sectors like data centers and electric vehicles. Furthermore, supportive government policies, such as tax credits and incentives, create a favorable environment for project development and manufacturing expansion.

The company's strategic shift towards a partial Independent Power Producer (IPP) model, backed by substantial financial commitments like BlackRock's investment, is set to diversify revenue streams and enhance financial flexibility. This evolution allows Canadian Solar to capture long-term revenue from energy sales, thereby strengthening its market position and attracting further investment.

| Opportunity | Description | Supporting Data (2024/2025 Estimates) |

| Surging Global Solar Demand | Increasing worldwide adoption of solar power. | Global solar installations projected to reach ~600 GW in 2024, a 33% increase year-over-year. |

| Energy Storage Integration | Meeting demand for integrated solar and storage solutions. | Growth driven by data centers and EV market expansion. |

| Favorable Government Policies | Benefits from tax credits and incentives like the IRA. | IRA manufacturing tax credits encourage domestic solar production. |

| Distributed Generation Growth | Capitalizing on the expanding distributed solar market. | Emerging markets in Southeast Asia and Latin America show strong solar adoption. |

| IPP Model Evolution | Generating stable, recurring revenue streams. | $500 million investment commitment from BlackRock into Recurrent Energy. |

Threats

Chinese manufacturers, with their vast production capacities and often lower operating costs, continue to exert significant downward pressure on solar module prices globally. This intense competition means that even as demand grows, the profit margins for companies like Canadian Solar can be squeezed. For instance, in early 2024, the average selling price for Tier 1 solar modules saw a notable decline compared to the previous year, driven by this oversupply.

This price war directly impacts Canadian Solar's ability to maintain its market share and profitability. As major Chinese players prioritize higher shipment volumes, they can afford to accept thinner margins, forcing other market participants to either match these prices and absorb lower profits or risk losing sales. This dynamic creates a challenging environment for Canadian Solar to achieve its growth objectives without compromising its financial health.

Canadian Solar, like much of the solar industry, navigates a landscape fraught with shifting trade policies and the ever-present specter of tariffs. These uncertainties can significantly impact operational costs and market access.

For instance, the U.S. market, a crucial destination for solar products, has seen recent legislative actions imposing substantial tariffs on solar imports originating from Southeast Asian nations. Given that Canadian Solar also has manufacturing operations in these regions, such policies directly threaten to inflate the cost of goods and potentially destabilize established supply chains.

Canadian Solar, like many in the solar industry, faces significant risks from volatile raw material prices, particularly polysilicon. While polysilicon prices saw a notable decrease in late 2023 and early 2024, averaging around $10-12 per kilogram, this volatility can quickly impact manufacturing costs and, consequently, profit margins. For instance, a sudden surge in polysilicon demand or production issues could rapidly escalate costs.

Supply chain disruptions also pose a considerable threat. Geopolitical tensions can lead to trade restrictions or increased shipping costs, affecting the timely and cost-effective delivery of components. Furthermore, shortages in critical materials like lithium, essential for battery storage solutions that often accompany solar installations, could hinder growth in this segment. These disruptions can delay projects and increase overall project expenses.

Changes in Government Policies and Subsidy Reductions

Changes in government policies and subsidy reductions represent a significant threat to Canadian Solar. New administrations or shifts in political priorities can lead to policy uncertainty, directly impacting the financial viability of solar projects by reducing or eliminating crucial incentives like capital expenditure rebates and feed-in tariffs. For instance, in 2023, several countries reviewed or adjusted their renewable energy support mechanisms, creating a more challenging investment landscape.

These shifts can significantly affect project economics, making it harder to secure financing and achieve expected returns. For example, a reduction in a country's feed-in tariff rate, a common incentive for solar power generation, could decrease revenue streams for Canadian Solar's projects in that region. The company's 2023 financial reports highlighted the impact of evolving regulatory environments in key markets on its project pipeline and profitability.

Key concerns include:

- Policy Uncertainty: Unpredictable changes in government support can disrupt long-term project planning and investment.

- Subsidy Reductions: Declining financial incentives like capital expenditure rebates and feed-in tariffs directly impact project profitability and competitiveness.

- Market Access: New trade policies or tariffs implemented by governments could restrict market access for Canadian Solar's products and services.

- Regulatory Hurdles: Increased or altered permitting processes and environmental regulations can add costs and delays to project development.

Macroeconomic Headwinds and Project Financing Challenges

Macroeconomic headwinds pose a significant threat to Canadian Solar's project pipeline. Economic downturns can reduce demand for energy, while elevated interest rates, which have remained stubbornly high in many regions through early 2025, directly increase the cost of capital for new solar and storage projects. For instance, a 1% increase in interest rates can add millions to the financing cost of a large-scale solar farm.

The high cost of financing is particularly acute in developing and emerging markets, where Canadian Solar often seeks growth opportunities. These markets may also face currency volatility, further complicating project economics and increasing the risk of impairments. This financial pressure can lead to delays in project development and execution, directly impacting Canadian Solar's revenue recognition and overall financial performance.

These challenges can manifest in several ways:

- Increased Cost of Capital: Higher interest rates in 2024 and projected into 2025 make debt financing for new projects more expensive, potentially reducing project profitability.

- Reduced Project Viability: Economic slowdowns can decrease energy demand and make it harder to secure Power Purchase Agreements (PPAs) at favorable terms, impacting project feasibility.

- Financing Hurdles in Emerging Markets: Developing economies often experience higher borrowing costs and greater currency risks, creating significant obstacles for project financing and execution.

Intensified global competition, particularly from Chinese manufacturers with lower production costs, continues to drive down solar module prices. This aggressive pricing strategy, evident in early 2024 with average selling prices for Tier 1 modules declining year-over-year, puts pressure on Canadian Solar's profit margins and market share.

Shifting trade policies and tariffs, such as those impacting imports from Southeast Asia into the U.S. market in 2024, directly threaten to increase Canadian Solar's cost of goods and disrupt its supply chains. Additionally, volatile raw material prices, like polysilicon which averaged around $10-12 per kilogram in late 2023/early 2024 but remains susceptible to rapid fluctuations, can significantly impact manufacturing expenses.

Government policy changes, including potential reductions in subsidies and incentives like feed-in tariffs, create uncertainty for project development and profitability. For instance, several countries reviewed their renewable energy support mechanisms in 2023, impacting the investment landscape. Macroeconomic factors, such as elevated interest rates persisting through early 2025, increase the cost of capital for new projects, particularly in emerging markets where currency volatility adds further risk.

SWOT Analysis Data Sources

This Canadian Solar SWOT analysis is built upon a foundation of credible data, including official financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate assessment.