Canadian Solar Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canadian Solar Bundle

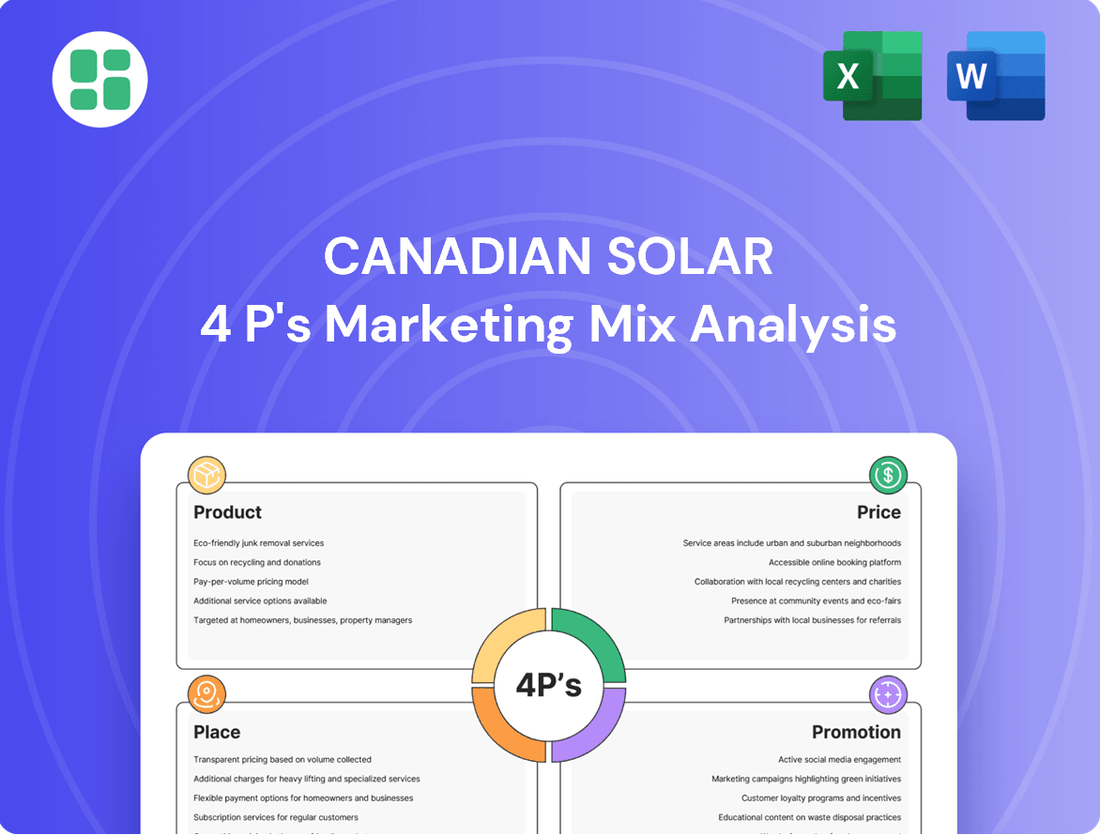

Canadian Solar's marketing prowess is evident in its robust product innovation, competitive pricing, strategic global distribution, and impactful promotional campaigns. Understanding these elements is key to grasping their market dominance.

Unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Canadian Solar, offering deep insights into their product development, pricing strategies, distribution networks, and promotional activities. This editable report is perfect for business professionals, students, and consultants seeking strategic advantage.

Product

Canadian Solar's product strategy for its solar photovoltaic (PV) modules centers on a comprehensive offering, covering the full manufacturing process from raw materials to finished panels. This vertical integration ensures quality control and allows for innovation across their product lines. Their modules are engineered for a broad spectrum of energy needs, from powering individual homes to supplying vast utility-scale solar farms.

The company actively promotes its commitment to premium quality and high efficiency, a key differentiator in the competitive solar market. They are investing in advanced technologies like N-type TOPCon and bifacial panels, which significantly boost energy generation. For instance, bifacial modules can increase energy yield by up to 25% compared to traditional monofacial panels, a crucial advantage for maximizing returns on investment for their customers.

Canadian Solar, through its subsidiary e-STORAGE, offers integrated utility-scale Battery Energy Storage Solutions (BESS). Their product line, including SolBank 3.0 and SolBank 3.0 Plus, utilizes advanced lithium-iron-phosphate technology for enhanced safety and performance, featuring active balancing battery management systems and liquid cooling.

These BESS offerings are comprehensive, encompassing turnkey systems, extended service agreements, and provisions for future capacity upgrades. This approach aims to provide customers with a complete, long-term energy storage solution tailored to their needs.

In 2024, the global BESS market is projected to reach over $25 billion, with significant growth driven by renewable energy integration. Canadian Solar's focus on advanced technology and integrated services positions them to capture a share of this expanding market.

Canadian Solar, through its subsidiary Recurrent Energy, is a major player in utility-scale solar power projects globally. They manage the entire project lifecycle, from initial design and development through to construction and ongoing operation, showcasing a comprehensive approach to renewable energy infrastructure.

As of the first quarter of 2025, Recurrent Energy boasted an impressive global solar project development pipeline. This pipeline is robust, encompassing projects currently under construction and those in various earlier stages of development, underscoring the company's significant commitment to expanding its solar footprint.

Energy Storage Projects Development and Operation

Canadian Solar's commitment extends beyond manufacturing Battery Energy Storage Systems (BESS). They are actively involved in the global development, construction, and operation of large-scale energy storage projects. These projects are crucial for grid stability and integrating renewable energy sources.

These integrated projects, often paired with their solar farms or as standalone facilities, deliver essential grid services. By Q1 2024, Canadian Solar reported a robust energy storage project pipeline of 27.5 GWh, demonstrating significant growth and a strong market presence. This pipeline is expected to continue expanding as demand for grid-scale storage solutions rises.

- Global Development: Canadian Solar develops, builds, and operates large-scale battery energy storage projects worldwide.

- Grid Integration: Projects are frequently co-located with solar parks or stand-alone, providing grid services and enhancing stability.

- Expanding Pipeline: As of Q1 2024, the company's energy storage project pipeline reached 27.5 GWh, indicating substantial ongoing development.

Integrated Energy Solutions and Services

Canadian Solar's product offering extends beyond just solar panels, encompassing a comprehensive suite of integrated energy solutions and services. This includes not only solar generation hardware but also energy storage and sophisticated energy management systems. They serve a broad customer base, from individual homeowners to large commercial enterprises, providing a one-stop shop for their renewable energy needs.

The company actively engages in engineering, procurement, and construction (EPC) services, offering complete solar system kits. Furthermore, Canadian Solar leverages its owned assets to provide power services and electricity operations, demonstrating a commitment to managing the entire energy lifecycle. This integrated approach aims to maximize value and address the varied requirements of different market segments.

- Holistic Energy Platform: Integration of solar generation, energy storage, and energy management for residential and commercial clients.

- Comprehensive Service Offering: Includes EPC services for solar system kits and power services from owned assets.

- Value Enhancement: Focus on delivering complete solutions that boost value and meet diverse market demands.

Canadian Solar's product strategy is a multi-faceted approach, offering not just high-efficiency solar modules like their N-type TOPCon and bifacial panels, but also integrated Battery Energy Storage Solutions (BESS). Their SolBank 3.0 and 3.0 Plus systems, utilizing safe lithium-iron-phosphate technology, provide comprehensive, long-term energy storage. This product depth extends to their subsidiary Recurrent Energy, which manages the entire lifecycle of utility-scale solar projects.

| Product Category | Key Features/Technologies | 2024/2025 Data Point |

|---|---|---|

| Solar Modules | N-type TOPCon, Bifacial | Bifacial modules can increase energy yield by up to 25% |

| Battery Energy Storage Systems (BESS) | SolBank 3.0, SolBank 3.0 Plus, LiFePO4 technology, active balancing, liquid cooling | Q1 2024 energy storage project pipeline: 27.5 GWh |

| Project Development | Utility-scale solar and storage projects, EPC services | Recurrent Energy: Robust global project development pipeline (as of Q1 2025) |

What is included in the product

This analysis offers a comprehensive examination of Canadian Solar's marketing mix, detailing their product innovation, pricing strategies, global distribution channels, and promotional efforts.

It provides a foundational understanding of Canadian Solar's market positioning and competitive advantages for strategic planning and benchmarking.

This analysis distills Canadian Solar's 4Ps into actionable strategies that directly address market challenges, easing the burden of complex decision-making.

It simplifies the understanding of how Canadian Solar's Product, Price, Place, and Promotion actively solve customer pain points, making marketing strategy more accessible.

Place

Canadian Solar's global direct sales strategy for large projects, especially utility-scale solar and energy storage, is a cornerstone of its market approach. This direct engagement model, often executed through its subsidiary Recurrent Energy, facilitates deep relationships with key clients like utilities and major industrial players.

This focused sales effort allows Canadian Solar to offer highly customized solutions, which is critical for the complex technical and financial requirements of large infrastructure projects. In 2023, Recurrent Energy, a key part of this strategy, continued to build a significant pipeline of solar and storage projects across North America, demonstrating the effectiveness of direct sales in securing substantial future revenue streams.

Canadian Solar leverages a robust wholesale distribution network to ensure its solar modules are accessible for residential and smaller commercial projects. This strategy, coupled with a strong network of partner retailers, facilitates broad market penetration for its photovoltaic products across diverse geographical areas.

The company's commitment to widespread availability is evident in its global reach, with module shipments extending to over 160 countries. This extensive network is crucial for meeting the growing demand for solar energy solutions worldwide, reinforcing Canadian Solar's position as a major player in the global solar market.

Canadian Solar strategically leverages partnerships to broaden its reach and secure significant sales volumes. These alliances, often in the form of supply agreements with fellow renewable energy developers, are crucial for driving revenue and accessing untapped markets. For instance, in 2023, the company announced a significant module supply agreement with a major European developer, expected to deliver substantial revenue in 2024 and beyond.

The company's e-STORAGE division also taps into partnerships to accelerate the adoption of its energy storage solutions. By collaborating with system integrators and project developers, Canadian Solar aims to enhance its market penetration and capitalize on the growing demand for grid-scale battery storage. These collaborations are key to meeting their 2024 sales targets for storage projects.

Geographically Diversified Project Development

Canadian Solar, through its subsidiary Recurrent Energy, actively pursues a geographically diversified project development strategy. This approach spans solar and battery energy storage projects across six continents, allowing the company to tap into a wide array of global renewable energy opportunities.

This extensive global presence is crucial for Canadian Solar. It enables the company to effectively mitigate risks associated with any single market and to take advantage of differing regulatory frameworks and market demands worldwide. For instance, as of early 2024, Canadian Solar reported a robust project pipeline exceeding 20 GW, with a significant portion located in North America, Europe, and Asia, demonstrating this commitment to diversification.

- Global Footprint: Projects developed across North America, South America, Europe, Asia, Africa, and Australia.

- Risk Mitigation: Diversification reduces reliance on any single market's economic or political conditions.

- Opportunity Capture: Ability to leverage varying renewable energy incentives and demand across different regions.

- 20 GW Pipeline: A substantial portion of this pipeline is strategically located across key international markets as of early 2024.

Manufacturing Facilities in Key Regions

Canadian Solar strategically positions its manufacturing operations in key global regions, including Asia and the Americas, to efficiently serve its worldwide customer base and facilitate project development. This geographical spread is crucial for managing logistics and responding to market demands effectively.

The company's commitment to expanding its manufacturing footprint is evident in its significant investments in North America. For example, Canadian Solar is actively increasing production capacity at its U.S. module assembly facility and building a new solar cell manufacturing plant in Indiana. This expansion aims to bolster localized supply chains and mitigate potential impacts from trade policies.

- Asia: Established manufacturing hubs for module and component production.

- Americas: Growing presence with new module and cell facilities in the U.S. to enhance regional supply chain resilience.

- Indiana Facility: Targeted to produce 5 GW of solar cells annually, commencing production in 2024, with plans for further expansion.

- U.S. Module Facility: Capacity expansion efforts are underway to meet increasing domestic demand.

Canadian Solar's strategic placement of its manufacturing facilities, primarily in Asia and increasingly in the Americas, is key to its global supply chain efficiency. This dual-region approach allows for localized production, reducing shipping costs and lead times for its diverse customer base.

The company's significant investments in North America, including expanding its U.S. module assembly and building a new solar cell plant in Indiana, underscore a commitment to regional supply chain resilience and meeting growing domestic demand. The Indiana facility, slated for 5 GW of annual solar cell production starting in 2024, is a prime example of this strategic geographical positioning.

| Manufacturing Location | Key Products | Strategic Importance | Capacity/Investment (2024/2025 Focus) |

|---|---|---|---|

| Asia | Solar Modules, Components | Cost-effective production, large-scale output | Continued high-volume production, ongoing efficiency improvements |

| North America (U.S.) | Solar Modules, Solar Cells | Supply chain resilience, reduced tariffs, local market access | Indiana cell plant: 5 GW annual capacity (commencing 2024); U.S. module facility: capacity expansion |

Full Version Awaits

Canadian Solar 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Canadian Solar's 4Ps (Product, Price, Place, Promotion) is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Canadian Solar is committed to investor relations, offering detailed quarterly and annual financial reports. These reports, along with earnings calls and presentations, provide crucial insights into the company's performance and strategic path. For instance, in Q1 2024, Canadian Solar reported a revenue of $1.1 billion, demonstrating its operational scale and financial transparency.

This consistent and open communication fosters trust among investors and financially-literate decision-makers. By sharing performance metrics and future outlooks, Canadian Solar empowers stakeholders to make informed choices. The company's proactive approach ensures that information regarding its market position and financial health is readily accessible.

Canadian Solar consistently engages with key industry events like Intersolar Europe and RE+ in North America. In 2024, the company highlighted its latest TOPBiHiMAX modules, achieving up to 680W, at these significant gatherings. This active presence allows them to directly connect with over 100,000 attendees annually, fostering crucial business relationships and demonstrating technological advancements.

Canadian Solar strategically leverages its digital marketing and online presence to connect with a global audience. This includes a robust corporate website, active social media engagement, and the dissemination of news releases through online channels. These efforts are crucial for informing customers and investors about project achievements, new product introductions, and financial performance.

In 2023, Canadian Solar reported a revenue of $5.7 billion, underscoring the importance of its digital outreach in communicating its business progress. An effective online presence is paramount for building brand recognition and fostering B2B relationships within the competitive renewable energy sector.

Sustainability and Corporate Social Responsibility (CSR) Reporting

Canadian Solar places significant emphasis on Sustainability and Corporate Social Responsibility (CSR), publishing comprehensive annual Corporate Sustainability Reports. These reports detail the company's performance and commitments across environmental, social, and governance (ESG) factors.

Aligned with global reporting standards, these disclosures underscore Canadian Solar's commitment to sustainable development. For instance, in their 2023 report, the company highlighted a reduction in greenhouse gas emissions intensity by 15% compared to their 2019 baseline, demonstrating tangible progress in their environmental stewardship.

This transparent approach to ESG reporting not only bolsters Canadian Solar's reputation but also enhances its appeal to a growing segment of investors and partners prioritizing responsible business practices. This focus is increasingly critical as sustainable investing continues to gain momentum, with ESG funds attracting substantial capital inflows globally.

- Environmental Impact: Reduced GHG emissions intensity by 15% (2023 vs. 2019 baseline).

- Social Responsibility: Commitment to fair labor practices and community engagement initiatives.

- Governance: Adherence to high ethical standards and transparent reporting structures.

- Investor Appeal: Attracting environmentally conscious investors and partners through robust ESG disclosures.

Public Relations and Media Engagement

Canadian Solar actively manages its public image through strategic public relations and media engagement. This includes disseminating press releases highlighting key milestones such as the completion of major solar projects, breakthroughs in technology, and recognition through corporate awards. For instance, news of new energy storage installations or accolades for product design directly contributes to favorable media attention, solidifying Canadian Solar's reputation as an industry innovator and leader.

The company's proactive communication efforts aim to foster positive sentiment and build trust with stakeholders. In 2024, Canadian Solar announced several significant project developments, including the commencement of construction on a 100 MW solar farm in Brazil and the successful commissioning of a large-scale battery storage project in California, which generated considerable positive press.

These public relations activities are crucial for reinforcing Canadian Solar's brand identity and market position. The company's consistent communication about its technological advancements, such as its proprietary solar cell efficiency improvements, further enhances its image as a forward-thinking and reliable partner in the renewable energy sector.

- Project Milestones: Announcements of project completions and commencements, like the 100 MW Brazilian solar farm in 2024, garner positive media attention.

- Technological Advancements: Highlighting innovations, such as improved solar cell efficiency, reinforces the company's leadership.

- Corporate Recognition: Awards for product design and corporate responsibility contribute to a strong, positive brand image.

- Media Coverage: Strategic press releases aim to secure favorable media coverage, enhancing brand visibility and trust.

Canadian Solar's promotional efforts focus on building strong investor relations through transparent financial reporting and engaging directly with industry stakeholders. The company actively participates in major solar energy events, showcasing its latest technologies like the 680W TOPBiHiMAX modules in 2024, to foster business relationships and highlight innovation.

Digital marketing and a robust online presence are key, with the company utilizing its website and social media to share project achievements and financial performance, as evidenced by its $5.7 billion revenue in 2023. This digital outreach is vital for brand recognition and B2B connections in the competitive renewable energy market.

Sustainability and CSR are central to their promotion, with detailed annual reports highlighting ESG commitments, such as a 15% reduction in GHG emissions intensity by 2023. This focus on responsible practices appeals to a growing segment of investors prioritizing sustainability.

Strategic public relations, including press releases on project milestones like the 100 MW Brazilian solar farm commencement in 2024, and technological advancements, actively shape a positive brand image and reinforce their market leadership.

| Promotion Tactic | Key Activities | 2024/2025 Data/Examples |

|---|---|---|

| Investor Relations | Quarterly/Annual Reports, Earnings Calls | Q1 2024 Revenue: $1.1 billion; Consistent disclosure |

| Industry Events | Exhibiting new technologies, networking | Intersolar Europe, RE+; Highlighted 680W TOPBiHiMAX modules |

| Digital Marketing | Website, Social Media, News Releases | 2023 Revenue: $5.7 billion; Building brand recognition |

| Sustainability Reporting | ESG Reports, CSR Initiatives | 15% GHG emissions intensity reduction (2023 vs. 2019); Attracting ESG investors |

| Public Relations | Press Releases, Media Engagement | 100 MW Brazilian solar farm commencement (2024); Positive media coverage |

Price

Canadian Solar navigates the fiercely competitive solar module sector with a strategic focus on disciplined order-taking to uphold profitable pricing. Despite persistent overcapacity and tariff headwinds, the company leverages cost efficiencies from its integrated supply chain to present compelling module prices.

The company's module average selling prices (ASPs) are meticulously managed, reflecting a deliberate approach to market volatility. For instance, in Q1 2024, Canadian Solar reported an average selling price of $0.27 per watt for its solar modules, a slight decrease from the previous quarter but indicative of their strategy to remain competitive while managing profitability.

For its large-scale solar and battery storage projects, Canadian Solar employs value-based pricing. This approach reflects the full scope of their offerings, encompassing development, construction, and ongoing operations.

The perceived value of reliable performance and essential grid services allows for project-specific pricing. For instance, in 2023, Canadian Solar secured over 1.5 GW of solar and storage projects in the United States, with pricing reflecting these comprehensive solution benefits.

Long-term power purchase agreements (PPAs) and service contracts are frequently utilized to lock in this value, providing predictable revenue streams and demonstrating the long-term economic advantages for clients.

Canadian Solar actively utilizes a range of strategic financing options to fuel its substantial project development pipeline. These include robust project financing structures, crucial tax equity investments, and flexible corporate credit facilities. This multi-faceted financing strategy is key to supporting the significant capital outlays required for their global expansion, particularly in growing their Independent Power Producer (IPP) segment.

For instance, in 2023, Canadian Solar secured approximately $2.4 billion in financing for its solar and battery storage projects, demonstrating its ability to attract diverse capital sources. The company's proactive approach to securing these varied financing solutions enhances the accessibility and appeal of its projects to a broad spectrum of investors and strategic partners, thereby accelerating growth.

Contracted Backlog and Long-Term Agreements

Canadian Solar's contracted backlog, especially for its e-STORAGE battery solutions, provides a strong foundation for future revenue. This secured pipeline offers significant revenue visibility, a key element in managing market fluctuations.

Long-term service agreements and contracted orders are crucial for Canadian Solar. They enable the company to maintain predictable revenue streams and manage pricing strategies effectively, even when the market faces short-term volatility.

- Secured Revenue: As of Q1 2024, Canadian Solar reported a total backlog of $7.1 billion, with $2.4 billion in the energy storage segment.

- Revenue Visibility: This backlog provides clear visibility into future earnings, reducing reliance on immediate market conditions.

- Pricing Stability: Long-term agreements allow for more stable pricing, mitigating the impact of fluctuating commodity costs.

Adaptation to Market Demand and Geopolitical Factors

Canadian Solar's pricing is dynamic, reacting to shifts in market demand and competitor actions. For instance, in Q1 2024, the company noted a 17% year-over-year increase in total revenue to $1.7 billion, driven by strong module shipments, demonstrating their ability to manage pricing amidst fluctuating market conditions.

Geopolitical factors, including trade policies and tariffs, significantly influence Canadian Solar's pricing strategies. The company's 2024 full-year revenue guidance, projected between $7.2 billion and $7.8 billion, reflects ongoing adjustments to navigate policy uncertainties and maintain profitable growth.

- Adaptive Pricing: Canadian Solar adjusts pricing based on market demand, competitor pricing, and geopolitical events.

- Guidance Adjustments: The company revises its full-year guidance to align with evolving policy uncertainties and market conditions.

- Profitability Focus: Despite industry pressures, Canadian Solar prioritizes profitable growth through strategic sales adjustments.

- Revenue Performance: In Q1 2024, Canadian Solar achieved $1.7 billion in revenue, up 17% year-over-year, highlighting effective market adaptation.

Canadian Solar's pricing strategy balances competitive module pricing with value-based project pricing for larger solar and storage solutions. The company aims to maintain profitability through disciplined order-taking and leveraging its integrated supply chain for cost efficiencies.

Module average selling prices (ASPs) are actively managed; for instance, in Q1 2024, module ASPs were around $0.27 per watt. For projects, pricing reflects the comprehensive value of development, construction, and operations, often secured through long-term PPAs.

The company's significant backlog, totaling $7.1 billion as of Q1 2024, provides revenue visibility and supports more stable pricing, particularly for its energy storage solutions.

Canadian Solar's 2024 revenue guidance of $7.2 billion to $7.8 billion reflects its adaptive pricing in response to market demand, geopolitical factors, and policy uncertainties, aiming for profitable growth.

| Metric | Q1 2024 | Full Year 2024 Guidance |

| Module ASP (per watt) | $0.27 | N/A |

| Total Backlog | $7.1 billion | N/A |

| Energy Storage Backlog | $2.4 billion | N/A |

| Total Revenue | $1.7 billion (Q1 2024) | $7.2 - $7.8 billion |

4P's Marketing Mix Analysis Data Sources

Our analysis of Canadian Solar's 4Ps is grounded in comprehensive data, including official company reports, investor relations materials, and detailed product specifications. We also leverage industry-specific market research and competitor analyses to ensure accuracy.