Canadian Solar Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canadian Solar Bundle

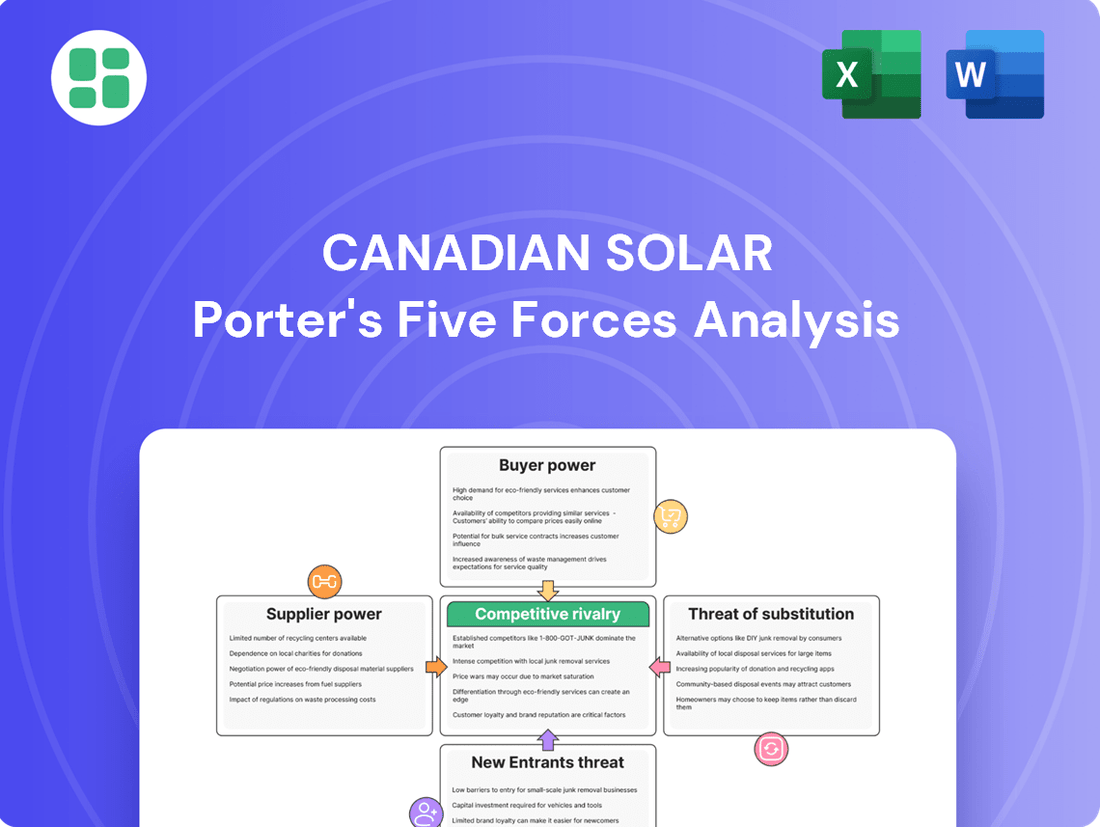

Canadian Solar operates in a dynamic renewable energy sector, facing significant competitive pressures. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of substitutes and new entrants is crucial for strategic planning.

The complete report reveals the real forces shaping Canadian Solar’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The polysilicon market, crucial for solar cells, is a complex area for Canadian Solar. While the market is expanding, with an estimated size of $11.84 billion by 2025, significant overcapacity, particularly from China, poses a challenge. Chinese production is projected to exceed 3.5 million metric tons by 2025, far surpassing the estimated demand of 1.9 million metric tons, which could weaken supplier pricing power.

However, this dynamic isn't entirely one-sided. Volatility in the costs of key materials like silicon and lithium could actually limit further declines in solar module prices through 2025. This suggests that while oversupply might pressure some suppliers, the overall cost environment still grants certain material providers a degree of leverage.

While Canadian Solar has a degree of vertical integration, controlling ingot, wafer, cell, and module manufacturing, the upstream supply chain for crucial inputs like polysilicon and specialized manufacturing equipment remains a potential area of supplier power. China's significant dominance in polysilicon production, with ongoing capacity expansions, directly impacts global supply availability and pricing trends, giving these suppliers considerable leverage.

Suppliers of cutting-edge manufacturing equipment and specialized solar cell technologies, like TOPCon and HJT, wield considerable bargaining power. This strength stems from their proprietary intellectual property and the substantial research and development investments needed to create these innovations. For instance, the development of advanced cell architectures often necessitates partnerships with a limited number of specialized equipment manufacturers.

Logistics and Trade Policy Impacts

Global supply chains for solar components are highly vulnerable to geopolitical events and trade policies. For instance, in 2023, ongoing trade disputes and tariffs, particularly those impacting imports into the United States, led to significant price fluctuations and supply chain realignments for manufacturers like Canadian Solar. These disruptions directly translate to higher sourcing costs and increased complexity in securing essential materials.

The impact of these trade policies is substantial. For example, U.S. tariffs imposed on solar imports from various nations have demonstrably increased module prices, forcing companies to rapidly reconfigure their supply chains to mitigate these added expenses. This dynamic directly affects the cost structure of solar manufacturers, influencing their profitability and competitive positioning.

- Trade Tariffs: Increased costs for imported solar components due to tariffs, impacting overall project economics.

- Geopolitical Tensions: Supply chain disruptions and uncertainty arising from international conflicts and political instability.

- Freight Rates: Volatility in shipping costs directly influences the landed cost of materials and finished goods.

- Supply Chain Realignment: Manufacturers are forced to adapt sourcing strategies, potentially leading to higher operational costs.

Labor and Skilled Workforce Availability

The availability of skilled labor is a significant factor influencing the bargaining power of suppliers in the solar industry. Specialized knowledge is crucial for manufacturing advanced solar components, developing complex projects, and ensuring efficient installation. A scarcity of these skilled professionals can empower suppliers of specialized services and expertise.

Indeed, a shortage of skilled labor has been identified as a major impediment to the continued growth of solar energy in various regions. For instance, in 2023, reports indicated ongoing challenges in finding qualified technicians for solar installations in North America and Europe, potentially increasing labor costs and giving more leverage to those with the necessary skills.

- Skilled Workforce Demand: The global expansion of solar projects requires a growing pool of trained engineers, technicians, and installers.

- Regional Shortages: Certain regions face acute shortages of specialized solar labor, driving up wages and supplier costs.

- Impact on Project Timelines: Labor availability directly affects the speed and cost of solar project development and execution.

Suppliers of polysilicon, a key material for solar cells, hold significant bargaining power due to market concentration and ongoing demand. Despite overcapacity concerns from China, which could depress prices, volatility in raw material costs like silicon can bolster supplier leverage through 2025.

Canadian Solar's vertical integration offers some buffer, but upstream suppliers of polysilicon and specialized manufacturing equipment, particularly those with proprietary technology like TOPCon and HJT, retain considerable power. China's dominance in polysilicon production, with capacity expected to exceed 3.5 million metric tons by 2025, grants these suppliers considerable influence over global pricing and availability.

Geopolitical events and trade policies, such as U.S. tariffs in 2023, directly increase sourcing costs and supply chain complexity, strengthening supplier positions. A global shortage of skilled labor for solar installations, noted in 2023 across North America and Europe, further empowers specialized service providers and equipment manufacturers.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Context (as of July 2025 knowledge) |

|---|---|---|

| Polysilicon Market Dynamics | Moderate to High | China's projected polysilicon production to exceed 3.5 million metric tons by 2025, against demand of 1.9 million metric tons, could pressure prices, but raw material cost volatility can support supplier leverage. |

| Specialized Technology & Equipment | High | Proprietary intellectual property and R&D investment in advanced cell architectures (TOPCon, HJT) limit the supplier pool, granting them significant pricing power. |

| Geopolitical & Trade Policies | High | Tariffs and trade disputes (e.g., U.S. tariffs in 2023) disrupt supply chains and increase sourcing costs, enhancing supplier leverage. |

| Skilled Labor Availability | Moderate to High | Shortages of qualified solar technicians in regions like North America and Europe (reported in 2023) increase labor costs, empowering skilled service providers. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Canadian Solar's position in the global solar industry.

Instantly identify competitive pressures impacting Canadian Solar's profitability with a clear, visual representation of each Porter's Five Forces factor.

Customers Bargaining Power

Customers hold significant bargaining power due to the consistent drop in solar module prices. Technological progress and increased production volumes have made solar photovoltaic panels more affordable, with utility-scale systems reaching as low as $1 per watt in 2025. This trend allows buyers to negotiate better terms, as module prices have found a stable, competitive footing across many markets.

For large-scale utility and commercial solar projects, customers, often independent power producers or utilities, are highly price-sensitive due to the significant capital investment involved and competitive bidding processes. This sensitivity means that pricing is a critical factor in securing these substantial contracts. In 2023, the global solar market saw continued pressure on module prices, with average selling prices (ASPs) experiencing declines, a trend directly influenced by this customer price sensitivity.

The global solar module manufacturing market is quite crowded, with many companies vying for business. This abundance of choice significantly strengthens the bargaining power of customers, as they can easily switch suppliers if they're not satisfied with pricing or terms. Manufacturers have less leverage when customers have so many alternatives.

In 2024, the top ten solar module manufacturers collectively shipped a remarkable 500 GW. While this highlights a degree of market concentration, it also underscores the intense competition among these major players and numerous smaller ones. Customers can leverage this competitive landscape to negotiate better deals.

Growing Awareness and Information Access

Customers are becoming much more aware of solar energy's advantages and the costs involved, thanks to widespread awareness initiatives and easily available online resources. This heightened understanding allows them to make smarter choices and easily compare different solar providers.

The ability to access detailed information empowers customers to negotiate better terms and pricing. For instance, by understanding the levelized cost of energy (LCOE) for various solar technologies, customers can push for more competitive quotes from suppliers like Canadian Solar.

- Informed Decision-Making: Customers can now easily research solar panel efficiency, warranty terms, and installer reputations.

- Price Comparison: Online platforms and consumer reviews facilitate direct comparison of pricing and service offerings from multiple solar companies.

- Demand for Transparency: Increased information access leads to a greater demand for clear, upfront pricing and performance guarantees.

- Negotiating Power: Well-informed customers are better equipped to negotiate installation costs and financing options.

Diversified Product Offerings (Solar + Storage)

Canadian Solar's expansion into diversified product offerings, particularly integrating battery energy storage with solar modules, can shift the bargaining power of customers. When customers seek complete energy solutions rather than just solar panels, their reliance on a single supplier for integrated systems can diminish their leverage. This is especially true as the demand for complementary products like solar batteries continues to grow, with the global energy storage market projected to reach hundreds of billions of dollars by the late 2020s.

The increasing demand for integrated solar and storage solutions, coupled with the expansion of energy storage services by solar companies, signifies a change in customer needs. This evolution presents an opportunity for companies like Canadian Solar to capture more value, potentially reducing the bargaining power of customers who are looking for these comprehensive packages. For instance, by 2023, Canadian Solar had a significant backlog of storage projects, indicating a strong market pull for these integrated offerings.

- Integrated Solutions: Customers seeking a single provider for both solar panels and battery storage may find their bargaining power reduced due to the complexity and specialized nature of these combined systems.

- Market Demand Shift: The rising demand for energy storage, a market expected to see substantial growth in the coming years, allows solar companies offering these complementary services to potentially command higher prices and reduce customer price sensitivity.

- Value Capture: By bundling solar and storage, Canadian Solar can enhance its value proposition, leading to stronger customer relationships and potentially less price-based negotiation.

Customers possess considerable bargaining power in the solar industry, largely driven by falling module prices and a competitive market. This power is amplified as buyers become more informed about costs and performance, enabling them to negotiate more effectively with suppliers like Canadian Solar.

The intense competition among numerous solar module manufacturers, including major players who shipped approximately 500 GW in 2024, gives customers ample choice. This abundance allows them to easily switch suppliers if pricing or terms are not favorable, limiting individual manufacturer leverage.

However, Canadian Solar's move into integrated solar and storage solutions is beginning to shift this dynamic. As customers increasingly seek comprehensive energy systems, their reliance on single providers for these complex packages can reduce their bargaining power, especially given the growing market for energy storage.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Trend |

|---|---|---|

| Price Sensitivity | High | Utility-scale solar costs approaching $1/watt by 2025; 2023 saw continued module ASP declines. |

| Availability of Substitutes | High | Crowded global module manufacturing market with many suppliers. |

| Customer Information | Increasing | Widespread access to LCOE, efficiency, and warranty data. |

| Demand for Integrated Solutions | Decreasing (for integrated offerings) | Growing demand for solar + storage; Canadian Solar's backlog of storage projects. |

Same Document Delivered

Canadian Solar Porter's Five Forces Analysis

This preview shows the exact Canadian Solar Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the solar industry. This comprehensive document is professionally formatted and ready for your immediate use and strategic planning.

Rivalry Among Competitors

The solar industry, especially module manufacturing, faces extremely tough global competition. Many companies, particularly those in China, have flooded the market, causing an oversupply that drives down prices. This intense rivalry means even leading manufacturers saw losses in 2024, despite shipping record amounts, due to falling revenues.

The solar industry is no stranger to intense competition, often leading to price wars. This is largely fueled by periods of overcapacity and rapid technological advancements, which put significant pressure on manufacturers like Canadian Solar to lower their prices. This dynamic directly impacts profitability, squeezing profit margins for all players in the market.

Canadian Solar itself experienced this firsthand. For instance, in the fourth quarter of 2024, the company saw its gross margin decline compared to the previous quarter. A primary driver for this reduction was the decrease in average selling prices (ASPs) for their solar modules, a clear indicator of the ongoing price pressure within the industry.

While basic solar panels are quite similar, the real competition lies in how efficient, dependable, and technologically advanced they are. Companies are pushing the envelope with innovations like N-type TOPCon and HJT cells.

Canadian Solar is actively staying ahead by introducing new products. For instance, they've launched their TOPCon 2.0 modules and the SolBank 3.0 Plus energy storage system, showcasing their commitment to innovation and maintaining a strong market position.

Vertical Integration and Geographic Expansion

Competitive rivalry in the solar industry is intensifying as leading players increasingly embrace vertical integration. This strategy allows them to gain better control over costs and secure their supply chains, a crucial advantage in a volatile market. For instance, by the end of 2023, many of the top solar manufacturers had invested heavily in polysilicon production, module assembly, and even downstream project development.

Geographic expansion is another key battleground. Companies are strategically establishing manufacturing footprints in multiple countries to circumvent trade barriers and tap into diverse markets. By mid-2024, approximately 70% of the top ten solar panel manufacturers operated production facilities in at least three different countries, demonstrating a clear trend to mitigate risks and enhance global competitiveness.

- Vertical Integration: Manufacturers are bringing more of the production process in-house, from raw materials to finished products.

- Geographic Diversification: A significant portion of leading solar manufacturers now have operations in three or more countries.

- Cost Control: Vertical integration aims to reduce reliance on external suppliers and manage production costs more effectively.

- Market Access: Expanding manufacturing globally helps companies navigate tariffs and gain easier access to key international markets.

Energy Storage and Project Development Competition

The competitive landscape for Canadian Solar extends significantly beyond just solar panel manufacturing. It now encompasses the entire energy solution, particularly in large-scale project development and the increasingly vital battery energy storage systems (BESS) sector. This means competition isn't just about who makes the best panels, but who can deliver complete, integrated energy projects.

Canadian Solar's strategic push into energy storage, evidenced by its growing e-STORAGE pipeline, places it directly against a multitude of competitors in this fast-expanding market. The energy storage sector is attracting significant investment and innovation, leading to a crowded field of established energy companies, specialized storage providers, and even new entrants.

- Intensifying Rivalry: Competition in energy storage is fierce, with numerous companies vying for market share in project development and BESS deployment.

- Broadened Competition Scope: Canadian Solar's competitive pressures now include companies offering comprehensive energy solutions, not just component manufacturing.

- Market Growth Dynamics: The rapid growth of the energy storage market in 2024 and projected through 2025 means more players are entering, intensifying the rivalry for project opportunities and technological advancements.

The competitive rivalry in the solar industry remains intense, driven by oversupply and price pressures. For instance, in Q1 2024, Canadian Solar reported a gross margin of 14.9%, a decrease from 17.2% in Q1 2023, largely due to falling average selling prices for modules.

Companies are differentiating through technological advancements like N-type TOPCon, with Canadian Solar launching its TOPCon 2.0 modules. Vertical integration, with many top manufacturers investing in polysilicon and assembly by end-2023, and geographic diversification, with around 70% of top players operating in over three countries by mid-2024, are key strategies to manage costs and market access.

Competition has expanded beyond module manufacturing to include integrated energy solutions and battery energy storage systems (BESS). Canadian Solar's e-storage pipeline competes with a growing number of energy companies and specialized providers in this rapidly expanding market.

| Metric | 2023 (Approx.) | 2024 (Q1) | Impact on Rivalry |

|---|---|---|---|

| Canadian Solar Gross Margin | 17.2% (Q1 2023) | 14.9% (Q1 2024) | Indicates price pressure and reduced profitability due to competition. |

| Vertical Integration Adoption | High (e.g., polysilicon) | Continued Investment | Aims to control costs and supply chains, intensifying competition for those not integrated. |

| Geographic Diversification | 70% of top 10 in 3+ countries (mid-2024) | Ongoing Trend | Helps navigate trade barriers and access diverse markets, increasing competitive reach. |

SSubstitutes Threaten

Other renewable energy sources like wind, hydro, and geothermal power pose a threat of substitution for Canadian Solar, especially when considering large-scale grid integration. While solar is incredibly cost-competitive, these alternatives offer different advantages. For instance, in 2024, onshore wind farms were on average 53% cheaper than the lowest-cost fossil fuels, with solar PV being 41% cheaper, demonstrating that while solar is strong, other renewables also present compelling economic arguments.

Traditional fossil fuels like natural gas and coal remain a substitute for solar energy, especially in areas with existing infrastructure or when energy security is paramount. However, the economic landscape is shifting dramatically; in 2024, 91% of new utility-scale renewable projects are now more cost-effective than their fossil fuel counterparts, significantly weakening this threat.

Investments in energy efficiency and demand-side management (DSM) present a significant threat of substitution for new solar capacity. By reducing overall electricity consumption, these initiatives can lessen the demand for additional power generation, including solar. For instance, in 2024, many Canadian utilities continued to offer substantial rebates for energy-efficient upgrades, directly impacting the market for new solar installations by lowering the overall need for electricity.

Nuclear Power and Emerging Technologies

Nuclear power presents a significant, albeit complex, substitute for solar energy in Canada. It provides a consistent, zero-emission baseload power source, crucial for grid stability. However, its substantial upfront capital investment and lengthy construction periods, often spanning a decade or more, present considerable barriers to entry and slower deployment compared to solar projects.

Emerging energy technologies, while not currently direct competitors, represent a future threat of substitution. These include advancements in geothermal energy, which can offer reliable baseload power, and the development of small modular reactors (SMRs). While SMRs are still in developmental stages and face regulatory hurdles, their potential for faster deployment and lower initial costs compared to traditional nuclear plants could make them more viable substitutes for solar in the long term.

- Nuclear Power: Offers stable, low-carbon baseload generation but requires high upfront costs and long development timelines.

- Emerging Technologies: Advanced geothermal and small modular reactors (SMRs) are potential long-term substitutes.

- Canadian Context: Canada has existing nuclear capacity and is exploring SMR development, indicating a potential shift in the energy landscape.

- Substitution Impact: The viability of these substitutes will depend on their cost-competitiveness, scalability, and regulatory approvals in the coming years.

Grid Modernization and Distributed Generation

The threat of substitutes for Canadian Solar's large-scale solar farms is growing as grid modernization and distributed generation gain traction. Advancements in smart grids and localized energy solutions like microgrids and combined heat and power systems offer compelling alternatives. For instance, by the end of 2023, the global microgrid market was valued at approximately $30 billion, with projections indicating significant growth, suggesting a shift towards more decentralized energy models.

Furthermore, the increasing adoption of solar batteries for home and business backup power underscores a move towards energy independence, reducing reliance on traditional utility-scale power sources. In 2024, the residential energy storage market alone saw substantial expansion, with installations in key markets like the US exceeding previous years' figures, demonstrating a clear consumer preference for self-sufficiency and resilience, which directly competes with the output of centralized solar projects.

- Grid Modernization: Investments in smart grid technologies enhance the efficiency and reliability of localized energy distribution, making distributed generation more viable.

- Distributed Generation: Microgrids and combined heat and power systems provide alternative energy sources that can reduce demand for large, centralized solar installations.

- Energy Storage: The rise of solar batteries for backup power empowers consumers with energy independence, posing a substitute for grid-dependent solar power.

- Market Trends: The growing microgrid market (valued around $30 billion by end-2023) and expansion in residential energy storage highlight increasing competition from decentralized solutions.

The threat of substitutes for Canadian Solar is multifaceted, encompassing other renewable sources, traditional fuels, energy efficiency, and emerging technologies. While solar PV is increasingly cost-competitive, alternatives like wind and hydro offer different advantages, with onshore wind farms being 53% cheaper than the lowest-cost fossil fuels in 2024, and solar PV 41% cheaper.

Energy efficiency measures and demand-side management directly reduce the need for new power generation, including solar, especially as Canadian utilities offer significant rebates for energy-efficient upgrades in 2024. Nuclear power, though a zero-emission source, faces high capital costs and long development times, making it a less immediate substitute. Emerging technologies like advanced geothermal and small modular reactors (SMRs) present longer-term substitution risks.

| Substitute Energy Source | Key Characteristics | 2024 Cost Competitiveness (Relative to Fossil Fuels) | Canadian Context/Trends |

|---|---|---|---|

| Wind Power | Low-carbon, intermittent | Onshore wind 53% cheaper | Significant existing capacity, ongoing development |

| Hydroelectric Power | Low-carbon, baseload potential | Varies by region, often cost-effective | Established infrastructure, high upfront investment for new large-scale projects |

| Geothermal Power | Low-carbon, baseload potential | Site-specific, can be cost-competitive | Exploration and development ongoing, potential for future growth |

| Energy Efficiency/DSM | Reduces demand | Rebates offered by utilities | Impacts need for new generation capacity |

| Nuclear Power | Zero-emission, baseload | High upfront capital, long development | Existing capacity, SMR development being explored |

Entrants Threaten

The solar manufacturing and large-scale project development sectors demand significant upfront capital for factories, specialized equipment, and project financing. This high capital intensity acts as a formidable barrier, making it difficult for newcomers to challenge established players like Canadian Solar.

The solar industry's reliance on cutting-edge technology and substantial research and development (R&D) investment presents a significant barrier for new entrants. Success hinges on deep expertise in areas such as photovoltaic cell efficiency, advanced module design, and manufacturing processes. For instance, companies like Canadian Solar invest heavily in R&D; in 2023, they reported R&D expenses of $82.5 million, focusing on next-generation technologies to maintain their competitive edge.

Established players like Canadian Solar benefit from deeply entrenched supply chain and distribution networks. These existing relationships with suppliers, distributors, and off-takers, coupled with strong brand recognition and a proven project execution history, present a significant hurdle for newcomers. Building these extensive networks from the ground up is a costly and time-consuming endeavor, effectively raising the barrier to entry.

Regulatory Hurdles and Policy Uncertainty

New companies entering the Canadian solar market face substantial regulatory challenges. Navigating complex permitting processes and understanding evolving trade policies, like potential tariffs and local content requirements, can be a significant barrier. For instance, the uncertainty surrounding potential new tariffs on solar components, a key concern for businesses in 2025, could significantly impact the cost-effectiveness of new ventures.

Political and legislative uncertainty further amplifies the threat of new entrants. Changes to solar incentives, which can vary by province and federal initiatives, create an unpredictable operating environment. This instability makes it difficult for new players to forecast project economics and secure financing, thereby deterring market entry.

- Regulatory Complexity: New entrants must contend with diverse provincial and federal regulations governing solar installations, grid connection, and environmental impact assessments.

- Policy Uncertainty: Evolving government incentives, tax credits, and potential trade barriers (e.g., tariffs on imported solar panels) create significant financial risk for new market participants.

- Permitting Delays: Lengthy and often unpredictable permitting processes at municipal and regional levels can stall project development and increase upfront costs for new companies.

- Local Content Requirements: Some jurisdictions may impose local content rules, requiring a certain percentage of materials or labor to be sourced domestically, which can be challenging for new entrants without established supply chains.

Economies of Scale and Cost Competitiveness

Existing players in the solar industry, including Canadian Solar, often benefit significantly from economies of scale. This means they can produce solar modules at a lower cost per unit due to their large-scale manufacturing operations and bulk purchasing power for raw materials. For example, in 2023, the average manufacturing cost for a solar module saw continued declines, driven by these efficiencies, making it harder for smaller, newer companies to compete on price.

New entrants face a substantial hurdle in matching the cost competitiveness of established firms. They typically lack the existing infrastructure and long-term supplier relationships that allow incumbents to secure materials at more favorable rates. This cost disadvantage is particularly acute in a market where price per watt has been a primary driver of demand, especially with global module prices experiencing volatility and downward pressure throughout 2024.

- Economies of Scale: Incumbent solar manufacturers leverage massive production volumes to reduce per-unit costs.

- Cost Competitiveness: Lower production costs allow established firms to offer more competitive pricing.

- Barriers for New Entrants: New companies struggle to achieve similar cost efficiencies due to smaller scale and less established supply chains.

- Price Sensitivity: The solar market's high price sensitivity amplifies the advantage of cost-efficient incumbents.

The threat of new entrants in the Canadian solar market is moderate, largely due to significant capital requirements, technological expertise, and established supply chains that favor incumbents like Canadian Solar. While the market is growing, the substantial investment needed for manufacturing, R&D, and navigating complex regulations acts as a deterrent for many potential new players. Economies of scale achieved by established firms also create a considerable cost advantage, making it difficult for newcomers to compete on price.

| Barrier to Entry | Impact on New Entrants | Example for Canadian Solar |

|---|---|---|

| High Capital Intensity | Requires substantial upfront investment for factories and equipment. | Canadian Solar's extensive manufacturing facilities represent a significant capital outlay. |

| Technological Expertise & R&D | Demands continuous investment in innovation for efficiency and design. | In 2023, Canadian Solar invested $82.5 million in R&D to maintain its technological lead. |

| Established Supply Chains & Distribution | New entrants must build networks, which is time-consuming and costly. | Canadian Solar's long-standing relationships with suppliers and distributors provide a competitive edge. |

| Economies of Scale | Lower per-unit costs for established players make price competition difficult. | Large-scale production allows Canadian Solar to achieve cost efficiencies in module manufacturing. |

Porter's Five Forces Analysis Data Sources

Our Canadian Solar Porter's Five Forces analysis leverages data from company annual reports, investor presentations, and industry-specific market research from firms like BloombergNEF and Wood Mackenzie. We also incorporate government reports on renewable energy policy and trade data from Statistics Canada to provide a comprehensive view of the competitive landscape.