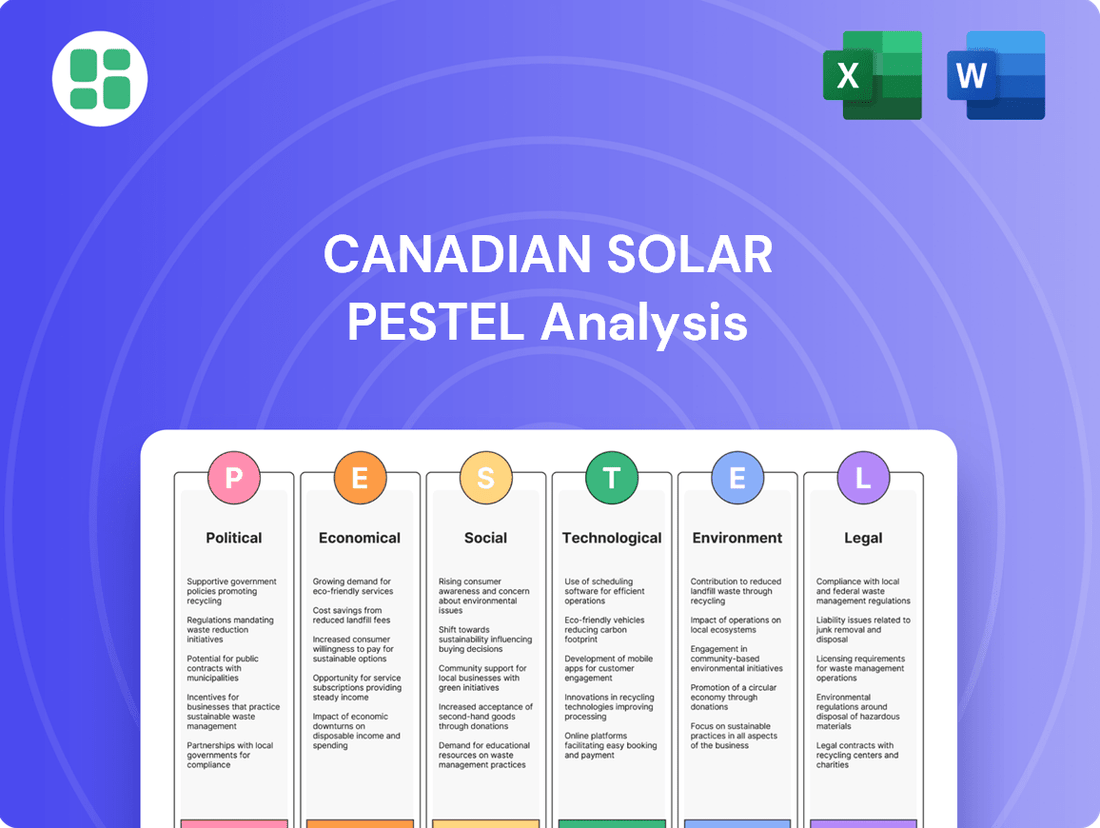

Canadian Solar PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canadian Solar Bundle

Canadian Solar operates within a dynamic global environment, influenced by evolving political landscapes, economic shifts, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying both opportunities and threats. Our comprehensive PESTEL analysis dives deep into these factors, offering actionable intelligence.

Gain a competitive edge by leveraging our expertly crafted PESTEL Analysis for Canadian Solar. Discover how governmental policies, economic trends, and societal changes directly impact the company's trajectory and uncover hidden growth avenues. Download the full version now to arm yourself with the insights needed to navigate this complex market.

Political factors

Government policies, like tax credits and grants, are a big deal for solar companies. For Canadian Solar, these incentives directly affect how profitable their projects are and how many they can build. For instance, the U.S. Inflation Reduction Act (IRA), enacted in 2022 and continuing through 2025 and beyond, offers significant tax credits for solar manufacturing and project development, which is a major tailwind for Canadian Solar's North American operations.

Changes to these support systems, whether they get cut or extended, really shape Canadian Solar's future projects and where they decide to invest their money. For example, in late 2023, some countries reviewed their feed-in tariffs, creating uncertainty for planned projects. The steadiness and clarity of these government programs are super important for Canadian Solar to plan its long-term strategy effectively.

Trade policies and tariffs significantly influence Canadian Solar's operational costs and market reach. For instance, ongoing trade tensions between major solar component producers like China and key markets such as the United States can lead to increased import duties on solar modules. This directly impacts Canadian Solar's cost of goods sold and its ability to offer competitive pricing in affected regions.

Navigating these intricate global trade regulations is crucial for maintaining supply chain integrity and cost efficiency. Canadian Solar must adapt to evolving trade landscapes, including potential anti-dumping and countervailing duties, which can add substantial costs to imported solar panels. For example, in 2023, the US continued to implement tariffs and explore measures like the Uyghur Forced Labor Prevention Act, affecting module imports and creating uncertainty for companies like Canadian Solar operating within or supplying to that market.

Many nations are setting aggressive renewable energy goals and enacting regulations that favor clean energy adoption, significantly boosting demand for solar products. For instance, Canada itself aims for 100% clean electricity by 2035, a target that directly stimulates the market for solar installations. These political commitments, like the European Union's Renewable Energy Directive aiming for 42.5% renewables by 2030, create a predictable and expanding market, benefiting companies like Canadian Solar.

Geopolitical Stability and International Relations

Geopolitical tensions, like those impacting global trade routes and resource availability in 2024 and 2025, directly affect Canadian Solar's supply chain. Disruptions can lead to increased costs for polysilicon, wafers, and other essential components, impacting project economics. The company's reliance on international manufacturing and diverse market presence means it's particularly exposed to these global political shifts.

Political stability in Canada, the United States, and emerging markets where Canadian Solar develops projects is crucial. Instability can deter investment, delay permitting, and increase the perceived risk of large-scale solar infrastructure. For instance, policy uncertainty in a major market could significantly alter the financial viability of planned projects, impacting Canadian Solar's revenue streams and growth projections.

- Supply Chain Vulnerability: Geopolitical events in 2024 have already demonstrated how quickly supply chains can be impacted, with some component prices seeing double-digit percentage increases due to trade disputes and regional conflicts.

- Market Access and Risk: Political instability in developing nations can elevate the country risk premium, making it more expensive for Canadian Solar to secure project financing and potentially impacting the scale of its operations in those regions.

- Trade Policy Impact: Shifting trade policies and tariffs between major economies, a continuing concern in 2024-2025, can directly influence the cost competitiveness of Canadian Solar's modules and the overall profitability of its projects.

Regulatory Frameworks and Permitting Processes

The regulatory landscape for solar projects in Canada presents a mixed picture for Canadian Solar. While some provinces offer streamlined permitting, others have more complex and lengthy processes. This inconsistency can impact project timelines and costs for their energy solutions division.

For instance, in 2023, Ontario's streamlined process for smaller-scale solar installations helped accelerate deployment, but larger utility-scale projects still faced intricate municipal and provincial approvals. This variability underscores the need for Canadian Solar to navigate diverse provincial requirements carefully.

Policy consistency is a critical factor for attracting and maintaining investment in the renewable energy sector. Fluctuations in government support or changes in regulatory frameworks can create uncertainty, potentially deterring the long-term capital required for solar development.

- Jurisdictional Variability: Regulatory frameworks and permitting processes for solar projects differ significantly across Canadian provinces and territories.

- Impact on Development: Streamlined processes accelerate project development and reduce costs for Canadian Solar, while complex procedures cause delays and increase expenses.

- Policy Predictability: Consistent and predictable government policies are essential for fostering investor confidence and ensuring sustained growth in the solar sector.

Government support, like tax credits and renewable energy targets, directly impacts Canadian Solar's profitability and market expansion. The U.S. Inflation Reduction Act, for example, offers substantial incentives through 2025, boosting North American operations. Conversely, changes in feed-in tariffs, as reviewed by some nations in late 2023, create project uncertainty.

Trade policies and tariffs are critical for managing costs and market access, with ongoing tensions in 2024-2025 impacting module pricing. Geopolitical shifts also pose supply chain risks, potentially increasing component costs. Political stability in key development regions is essential for attracting investment and ensuring project viability.

Regulatory consistency across different jurisdictions, such as Canadian provinces, significantly affects project timelines and expenses for Canadian Solar. Streamlined permitting accelerates development, while complex processes introduce delays and cost overruns, highlighting the need for careful navigation of diverse provincial requirements.

| Factor | Impact on Canadian Solar | 2024-2025 Data/Trend |

|---|---|---|

| Government Incentives | Boosts project profitability and development | IRA tax credits continue through 2025; some feed-in tariffs under review |

| Trade Policies/Tariffs | Affects cost of goods sold and market competitiveness | Ongoing trade tensions leading to potential import duty increases |

| Renewable Energy Goals | Drives market demand and predictable growth | Canada's 2035 clean electricity target; EU's 2030 renewable directive |

| Geopolitical Stability | Impacts supply chain costs and project financing | Global trade route disruptions affecting component prices |

| Regulatory Environment | Influences project timelines and development costs | Variability in permitting processes across Canadian provinces |

What is included in the product

This PESTLE analysis delves into the external macro-environmental forces impacting Canadian Solar, examining Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by identifying key trends and potential opportunities and threats within its operating landscape.

A PESTLE analysis of Canadian Solar offers a clear, summarized view of external factors impacting the company, relieving the pain of sifting through complex market data for strategic decision-making.

Economic factors

Global economic growth is a significant driver for Canadian Solar. When economies are expanding, businesses and industries tend to increase their energy consumption, which in turn boosts the demand for new solar installations. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, suggesting a potentially supportive environment for renewable energy investments.

Strong economic periods often translate into greater capital availability for infrastructure projects, including solar farms and distributed generation systems. This increased investment capacity directly benefits companies like Canadian Solar. In 2023, global renewable energy capacity additions reached a record high, with solar PV accounting for the majority, underscoring the correlation between economic health and solar market expansion.

Conversely, economic slowdowns or recessions can dampen demand. Reduced industrial activity and lower consumer spending may lead to decreased energy needs and a pullback in investment, potentially impacting the pipeline for new solar projects. For example, if global growth forecasts are revised downwards due to geopolitical instability or inflation concerns, Canadian Solar might face slower order intake.

Canadian Solar's profitability is significantly tied to the fluctuating costs of essential raw materials. For instance, polysilicon prices, a primary component in solar panels, saw considerable volatility. While prices eased in early 2024 after a surge in 2023, they remain sensitive to global supply and demand dynamics. Aluminum, glass, and silver, also critical for panel manufacturing, experience their own market swings, directly impacting Canadian Solar's cost of goods sold and overall profit margins.

Interest rates significantly influence the cost of capital for Canadian Solar's large-scale projects. As of early 2024, global central banks have maintained relatively stable, albeit elevated, interest rate environments following periods of aggressive hikes to combat inflation. For instance, the Bank of Canada's overnight rate has hovered around 5% for an extended period, directly impacting borrowing costs for developers.

Higher interest rates directly increase the cost of debt financing for Canadian Solar's project development. This can make new projects less financially appealing, potentially lowering projected internal rates of return (IRR) and impacting the company's ability to secure competitive financing. For example, a 1% increase in the cost of debt can significantly alter the profitability of a multi-hundred-million-dollar solar farm.

Access to a diverse range of financing options, including green bonds and project finance loans, is critical for Canadian Solar to mitigate the impact of fluctuating interest rates. The company's reliance on these varied sources allows it to adapt to changing market conditions and secure capital at more favorable terms, ensuring continued project pipeline growth.

Competition and Market Pricing Pressure

The solar sector is intensely competitive, with many global players vying for market share. This crowded landscape consistently exerts downward pressure on the prices of solar modules and related energy solutions. Canadian Solar, therefore, needs to consistently innovate and refine its cost efficiencies to remain competitive and secure its market position, especially as the price per watt is a significant consideration for customers.

Canadian Solar's ability to manage pricing pressure is crucial. For instance, by the end of 2023, the average selling price for solar modules had seen significant declines, with some reports indicating drops of over 30% year-over-year for certain types of panels. This trend is expected to continue into 2024, albeit at a potentially slower pace, as supply chains stabilize and demand remains robust.

- Intense Global Competition: The solar industry features a large number of manufacturers and developers worldwide, driving down prices.

- Price Per Watt Focus: Buyers prioritize cost-effectiveness, making price per watt a key competitive differentiator.

- Cost Optimization Necessity: Canadian Solar must continually improve its cost structure to maintain profitability and market share.

- Regional Market Saturation: In some areas, market saturation further exacerbates competitive pressures, demanding greater efficiency.

Energy Prices and Grid Parity

Energy prices are a critical factor for Canadian Solar, directly impacting the competitiveness of solar power against traditional sources. When electricity prices rise, solar energy becomes more attractive, especially as its Levelized Cost of Energy (LCOE) continues to fall. For instance, by mid-2024, the global average LCOE for utility-scale solar PV was around $35 per megawatt-hour, making it increasingly competitive with fossil fuels in many regions.

The achievement of grid parity, where solar power can compete with conventional electricity sources without subsidies, is a significant market expansion driver for Canadian Solar. As solar technology advances and manufacturing scales up, the cost of solar continues its downward trend. This economic competitiveness allows Canadian Solar to tap into broader markets and secure more projects.

- Falling LCOE: The global average LCOE for utility-scale solar PV reached approximately $35/MWh by mid-2024, a substantial decrease from previous years.

- Grid Parity Expansion: As solar costs decline, more markets are reaching grid parity, increasing the addressable market for Canadian Solar's solutions.

- Fossil Fuel Price Volatility: Fluctuations in natural gas and coal prices can further enhance solar's cost advantage, making it a more stable energy investment.

- Subsidies Reduction: The decreasing reliance on subsidies in many developed markets highlights solar's growing economic viability, a trend benefiting companies like Canadian Solar.

Global economic growth directly influences demand for solar energy. As economies expand, increased industrial and commercial activity boosts overall energy consumption, creating a greater need for renewable solutions like those offered by Canadian Solar. The International Monetary Fund (IMF) projected global growth at 3.2% for 2024, indicating a generally supportive economic climate for infrastructure investments.

Economic health also impacts capital availability for large-scale projects. Stronger economies typically mean more investment capital flowing into sectors like renewable energy, benefiting companies that develop and build solar farms. Global renewable energy capacity additions hit a record high in 2023, with solar PV leading the way, underscoring the link between economic prosperity and solar market expansion.

Conversely, economic downturns can slow project pipelines. Reduced industrial output and consumer spending can lower energy demand and investment appetite, potentially affecting Canadian Solar's order book. For instance, a slowdown in major markets could lead to delayed or scaled-back project developments.

| Economic Factor | Impact on Canadian Solar | 2024/2025 Data/Projection |

|---|---|---|

| Global Economic Growth | Drives demand for energy and infrastructure investment. | IMF projected 3.2% global growth for 2024. |

| Raw Material Costs | Affects manufacturing costs and profit margins. | Polysilicon prices eased in early 2024 but remain volatile. |

| Interest Rates | Influences cost of capital for project financing. | Bank of Canada's overnight rate around 5% as of early 2024. |

| Energy Prices | Determines solar's competitiveness against traditional sources. | Utility-scale solar PV LCOE around $35/MWh by mid-2024. |

Same Document Delivered

Canadian Solar PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Canadian Solar delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Understand the market landscape and potential challenges and opportunities that shape Canadian Solar's future.

Sociological factors

Public awareness of climate change is a significant driver for Canadian Solar. In 2024, surveys indicated that over 70% of Canadians are concerned about climate change, directly translating into increased demand for renewable energy solutions like solar power. This growing environmental consciousness makes communities more receptive to solar projects, smoothing the path for Canadian Solar's expansion and development efforts.

Consumers increasingly seek energy independence and cost savings, driving demand for distributed solar solutions. In 2024, Canadian Solar noted continued strong interest from homeowners and businesses looking to reduce their electricity bills and embrace sustainable living, directly benefiting their module sales and project development pipelines.

The desire for self-sufficiency and lower energy costs is a key sociological driver for Canadian Solar. By mid-2025, over 20% of new residential construction in select Canadian provinces was projected to incorporate solar readiness, reflecting this growing consumer preference for renewable energy integration.

Furthermore, consumer interest in energy storage solutions, often paired with solar installations, is on the rise. This trend offers Canadian Solar an opportunity to expand its offerings beyond just solar modules, providing integrated systems that enhance reliability and grid independence for end-users.

The booming solar sector in Canada is creating a significant need for skilled workers across manufacturing, development, installation, and upkeep. Canadian Solar, like its competitors, must focus on attracting and keeping qualified employees, while also tackling any emerging skill shortages.

In 2024, reports indicated a growing demand for solar technicians, with projections suggesting a need for thousands more by 2030 to meet renewable energy targets. This necessitates proactive investment in training and development initiatives to ensure Canadian Solar can maintain its growth trajectory and operational effectiveness.

Stakeholder Engagement and Community Relations

Canadian Solar's success in developing large-scale solar projects hinges on its ability to effectively engage with local communities, indigenous groups, and other key stakeholders. Addressing concerns about land use, visual impact, and environmental effects is crucial for obtaining social license to operate and gaining project acceptance, which directly influences the company's capacity to advance its project pipeline.

Positive community relations can be cultivated through various benefit-sharing initiatives. For instance, in 2024, Canadian Solar reported ongoing community engagement programs across its global project portfolio, aiming to foster mutual understanding and support. These programs often involve local job creation and investment, contributing to the economic well-being of the areas where projects are situated.

- Community Benefits: Programs often include local employment opportunities and direct financial contributions to community development funds.

- Indigenous Partnerships: Collaborative agreements with indigenous communities are increasingly important for project approvals and long-term sustainability.

- Social License: Securing community acceptance is a critical non-financial factor that can significantly impact project timelines and overall costs.

- Stakeholder Feedback: Actively incorporating feedback from local residents and groups helps mitigate potential conflicts and builds trust.

Health and Safety Standards

Societal expectations for worker safety and ethical labor practices across the supply chain are intensifying. Canadian Solar faces increasing scrutiny regarding its adherence to stringent health and safety standards in manufacturing and project operations. For instance, in 2024, the International Labour Organization reported a global increase in workplace inspections, highlighting this growing societal pressure.

Maintaining a strong reputation and meeting stakeholder demands necessitates ethical sourcing of materials and robust safety protocols. Compliance with international labor norms, such as those promoted by the UN Guiding Principles on Business and Human Rights, is becoming paramount for companies like Canadian Solar to operate responsibly and sustainably.

- Worker Safety: Societal pressure demands rigorous safety measures in all Canadian Solar facilities and project sites.

- Ethical Sourcing: Ensuring ethical labor practices and responsible material sourcing is crucial for stakeholder trust.

- International Norms: Adherence to global labor standards is increasingly a non-negotiable aspect of corporate responsibility.

- Reputation Management: Proactive management of health, safety, and ethical conduct directly impacts Canadian Solar's brand image and market standing.

Growing public concern over climate change in Canada, with over 70% of the population expressing worry in 2024, directly fuels demand for renewable energy solutions like those offered by Canadian Solar. This heightened environmental consciousness translates into greater community acceptance of solar projects, facilitating easier development and expansion for the company.

Consumers are increasingly prioritizing energy independence and cost savings, a trend that benefits Canadian Solar's distributed solar solutions. By mid-2025, over 20% of new homes in some Canadian provinces are expected to be solar-ready, underscoring this shift towards sustainable energy choices.

The burgeoning solar industry in Canada faces a critical need for skilled labor, with thousands of new solar technicians projected to be required by 2030. Canadian Solar must invest in training and development to address potential skill shortages and maintain its operational capacity.

Effective community engagement, including benefit-sharing initiatives and partnerships with indigenous groups, is essential for Canadian Solar to secure social license and project approvals. In 2024, the company actively managed community relations, demonstrating a commitment to local economic well-being and mutual support.

Technological factors

Canadian Solar benefits from ongoing advancements in solar cell technologies like PERC, TOPCon, and HJT, which are consistently pushing module efficiencies higher. For instance, by late 2024, leading module manufacturers were achieving efficiencies upwards of 23-24% for commercial panels, a significant jump from earlier generations.

These efficiency gains allow Canadian Solar to generate more power from the same surface area. This not only reduces the physical space needed for solar farms but also lowers associated installation and balance-of-system costs, making solar energy a more attractive and cost-effective solution in the competitive energy market.

The drive for higher energy yields directly improves project economics for Canadian Solar and its customers. By maximizing energy output per panel, projects become more profitable and achieve faster returns on investment, further solidifying solar's position as a key player in global energy infrastructure.

The energy storage sector is rapidly advancing, with battery technologies becoming more efficient and cost-effective. This progress allows for seamless integration with solar photovoltaic (PV) systems, creating hybrid solutions that can deliver reliable, dispatchable renewable energy. These advancements are key to grid stability and meeting the increasing demand for consistent power supply from renewable sources.

Canadian Solar is actively participating in this transformation by developing and deploying energy storage solutions. Their hybrid solar-plus-storage projects are designed to enhance grid reliability and offer more consistent power output than standalone solar installations. This strategic focus diversifies their market offerings beyond traditional solar PV generation, positioning them to capture a larger share of the evolving energy market.

For instance, in 2023, Canadian Solar announced a significant expansion of its energy storage pipeline, reaching over 1.7 GW of projects globally. This growth reflects the increasing market appetite for integrated solar and storage solutions, a trend expected to continue as grid operators prioritize flexibility and resilience. The company's commitment to this area underscores the technological shift towards dispatchable renewables.

Canadian Solar is actively integrating advancements in manufacturing, such as enhanced automation and novel materials, to boost production efficiency. These improvements directly translate to a lower cost per watt for their solar modules. For instance, by optimizing production lines, the company aims to minimize waste and uphold stringent product quality, which is crucial for staying competitive globally. In 2023, Canadian Solar reported a significant increase in module shipments, reaching 12.1 GW, underscoring their ability to scale production through these technological upgrades.

Smart Grid Technologies and Digitalization

The ongoing evolution of smart grid technologies, coupled with advancements in artificial intelligence and the digitalization of energy management, is significantly improving the integration of renewable energy sources into national power grids. This trend directly benefits companies like Canadian Solar.

Canadian Solar can harness these technological shifts to refine its project development and operational strategies. By integrating AI and data analytics, the company can boost energy output, accurately forecast performance, and contribute to greater grid stability, thereby elevating the value proposition of its diverse service offerings.

Data analytics are crucial for unlocking the full potential of these smart grid advancements. For instance:

- Optimized Energy Output: Predictive analytics can forecast solar irradiance and demand, allowing for more efficient energy generation and dispatch.

- Enhanced Grid Stability: AI algorithms can manage the intermittent nature of solar power, balancing supply and demand in real-time.

- Predictive Maintenance: Analyzing operational data can identify potential equipment failures before they occur, reducing downtime and costs.

- Improved Forecasting: Accurate weather and demand forecasting, powered by data analytics, leads to better resource allocation and profitability.

New Solar Applications and Material Science

Canadian Solar is actively exploring new frontiers in solar technology, including building-integrated photovoltaics (BIPV) and agrivoltaics. These innovative applications offer significant growth potential by seamlessly integrating solar power generation into everyday structures and agricultural land. For instance, BIPV solutions can transform building facades and rooftops into energy-producing assets, a market expected to see considerable expansion in the coming years.

Advancements in material science are also a key focus, aiming to enhance the durability and sustainability of solar components. Innovations in materials like perovskites and advanced silicon technologies are driving down manufacturing costs and boosting energy conversion efficiency. By staying at the forefront of these material science developments, Canadian Solar can improve its product performance and reduce the overall cost of solar energy, making it more accessible globally.

These technological explorations allow Canadian Solar to diversify its product portfolio and tap into emerging market segments. The company's commitment to monitoring and integrating these cutting-edge technologies positions it to capitalize on future market trends and maintain a competitive edge in the rapidly evolving renewable energy sector.

- BIPV Market Growth: The global BIPV market is projected to reach approximately $35 billion by 2030, indicating substantial future demand for integrated solar solutions.

- Material Efficiency Gains: Ongoing research aims to improve solar cell efficiency by an average of 1-2% annually through material science breakthroughs.

- Agrivoltaics Potential: Studies suggest agrivoltaics can increase crop yields by up to 10% in certain regions while generating electricity, showcasing a dual benefit.

Technological advancements are a cornerstone for Canadian Solar's growth, with ongoing improvements in solar cell efficiency, such as PERC and TOPCon, pushing module outputs higher. By late 2024, leading modules achieved over 23-24% efficiency, directly lowering installation costs and enhancing project economics by maximizing energy generation per panel.

The integration of energy storage solutions, driven by more efficient and cost-effective battery technologies, is crucial for providing reliable, dispatchable renewable energy. Canadian Solar's expansion of its energy storage pipeline to over 1.7 GW in 2023 highlights the market's demand for these hybrid systems, which improve grid stability and offer consistent power.

Manufacturing automation and novel materials are key to reducing the cost per watt for Canadian Solar's modules. With module shipments reaching 12.1 GW in 2023, the company demonstrates its ability to scale production through technological upgrades, while also exploring new frontiers like BIPV and agrivoltaics, markets projected for significant expansion.

| Key Technological Factor | Impact on Canadian Solar | Relevant Data (2023-2024) |

| Solar Cell Efficiency Gains | Increased power output, reduced land use, lower balance-of-system costs | Module efficiencies exceeding 23-24% (late 2024) |

| Energy Storage Advancements | Enables hybrid solutions, enhances grid reliability, diversifies revenue | 1.7 GW global energy storage pipeline expansion (2023) |

| Manufacturing Automation & New Materials | Lower cost per watt, improved production efficiency, enhanced durability | 12.1 GW module shipments (2023), ongoing R&D in perovskites |

| Smart Grid & Digitalization | Optimized energy output, enhanced grid stability, predictive maintenance | AI integration for performance forecasting and grid balancing |

Legal factors

The legal framework for energy in Canada, particularly around grid interconnection and renewable energy, significantly shapes Canadian Solar's operational landscape. For instance, the Alberta Utilities Commission (AUC) sets rules for grid access and transmission, impacting how quickly and cost-effectively new solar projects can connect. In 2024, Alberta continued to refine its interconnection queue management, a critical process for developers like Canadian Solar seeking to bring new capacity online.

Power Purchase Agreements (PPAs) are another vital legal element, dictating the terms and pricing for electricity sold from solar farms. Ontario's Independent Electricity System Operator (IESO) plays a key role in facilitating these agreements, and recent procurement rounds in 2024 have seen competitive pricing for renewable energy, directly affecting project economics for Canadian Solar.

Renewable energy portfolio standards, or targets, mandated by provincial governments create demand for solar power. British Columbia's Clean Energy Act, for example, sets targets that encourage investment in renewables, providing a stable market for Canadian Solar's utility-scale developments. These regulations are essential for ensuring the long-term viability of solar projects.

Environmental permitting and land use laws are critical hurdles for Canadian Solar's operations in Canada. Compliance with regulations covering environmental impact assessments, land use zoning, and wildlife protection is essential for project development. For instance, in 2023, the average time to secure all necessary federal and provincial environmental permits for large-scale renewable energy projects in Canada could range from 18 to 36 months, depending on the complexity and location.

Legal challenges or delays in obtaining these permits can significantly impact Canadian Solar's project timelines and inflate development costs. These delays often stem from stringent review processes, public consultations, and potential opposition from local communities or environmental groups. Adherence to these local and national environmental regulations is therefore paramount for maintaining project viability and operational efficiency.

Protecting Canadian Solar's intellectual property, particularly patents covering its innovative solar cell designs, advanced manufacturing techniques, and energy storage solutions, is paramount for sustaining its market leadership. These patents are vital for safeguarding its significant investments in research and development, ensuring its technological edge remains intact.

Legal avenues for enforcing these patent rights and deterring any potential infringement are essential safeguards. This proactive legal stance is critical to preserving the value of its proprietary technologies and preventing unauthorized use of its innovations.

The financial implications of intellectual property litigation are substantial, with significant costs associated with defending patents and pursuing infringement cases. For instance, major patent disputes in the technology sector can easily run into millions of dollars, impacting profitability and resource allocation.

International Trade Laws and Anti-Dumping Duties

Canadian Solar navigates a complex international trade landscape, where anti-dumping and countervailing duties can significantly impact its global operations. These legal frameworks are designed to protect domestic industries from unfairly priced imports, and their application can lead to substantial tariffs on solar products entering key markets. For instance, the imposition of duties by countries like the United States or the European Union directly affects Canadian Solar's cost structures and its ability to compete on price, making robust legal compliance and strategic trade planning essential.

The enforcement of these trade laws can create considerable uncertainty and necessitate adjustments to supply chain strategies. In 2023, for example, the U.S. Department of Commerce continued to investigate and impose duties on solar cells and modules from several Southeast Asian countries, which are crucial manufacturing hubs for many global solar companies, including potentially impacting Canadian Solar's sourcing and production models. Such actions underscore the need for Canadian Solar to maintain flexibility and proactively manage its legal and trade exposure.

- Trade Policy Impact: Tariffs imposed due to anti-dumping investigations can increase the cost of imported solar components, affecting Canadian Solar's profitability and competitiveness in affected markets.

- Market Access Restrictions: Legal rulings and enforcement actions can limit Canadian Solar's access to certain markets, forcing a re-evaluation of sales strategies and geographic focus.

- Supply Chain Restructuring: Trade disputes and the threat of duties often compel companies like Canadian Solar to diversify their manufacturing bases and supplier networks to mitigate risks and ensure market access.

Labor Laws and Supply Chain Compliance

Canadian Solar must navigate a complex web of labor laws, both domestically and internationally, to ensure fair wages, safe working conditions, and the absolute prohibition of forced labor within its operations and its extensive global supply chains. Failure to comply can lead to significant reputational damage, costly legal penalties, and even trade restrictions, impacting market access.

The company's commitment to supply chain transparency and ethical labor practices is paramount. Recent reports highlight increased regulatory focus on due diligence, especially concerning human rights and labor standards in manufacturing hubs. For instance, Canada's proposed Forced Labour Prevention Act aims to prevent goods produced wholly or in part by forced labour from entering the Canadian market, directly impacting companies like Canadian Solar if their supply chains are not rigorously vetted.

- Adherence to International Labor Organization (ILO) conventions on minimum age, forced labor, and discrimination is critical for global operations.

- Compliance with Canada's Modern Slavery Act and similar legislation in other key markets requires robust supplier auditing and reporting mechanisms.

- Due diligence obligations are expanding, compelling companies to proactively identify and mitigate labor risks throughout their value chains, a trend expected to intensify through 2025.

Regulatory frameworks governing renewable energy project development and operation in Canada are crucial for Canadian Solar. Compliance with provincial energy regulations, grid interconnection standards, and permitting processes directly influences project timelines and costs.

Power Purchase Agreements (PPAs) and renewable energy targets set by provincial governments create market stability, impacting Canadian Solar's revenue streams. For example, Ontario's 2024 procurement rounds for renewable energy capacity have seen competitive pricing, influencing project economics.

Environmental laws and land-use regulations are essential for obtaining permits. In 2023, securing these permits for large-scale projects in Canada could take 18 to 36 months, highlighting potential delays and cost implications for Canadian Solar.

Intellectual property laws protect Canadian Solar's technological innovations, safeguarding its competitive advantage. Patent enforcement is vital to prevent infringement and maintain market leadership, though litigation costs can be substantial.

Environmental factors

The global push to combat climate change and cut carbon emissions is a major force driving the solar sector's expansion. Canadian Solar, as a key player, actively helps lower greenhouse gas emissions by replacing fossil fuel power with solar energy. This directly supports national and international climate goals, boosting demand for their solar solutions.

The increasing global demand for solar energy, while positive for the environment, puts pressure on the supply chains for critical raw materials like polysilicon, silver, and aluminum. Concerns about the depletion of these finite resources are driving a push towards more sustainable sourcing practices and greater material efficiency in solar panel manufacturing. For instance, by 2025, the International Energy Agency (IEA) projects a significant rise in demand for critical minerals essential for clean energy technologies, including those used in solar PV.

Canadian Solar is actively addressing these challenges by prioritizing the efficient use of materials in its production processes and exploring avenues for sustainable sourcing. This includes investigating recycled content and alternative materials to reduce reliance on virgin resources. The company's commitment to resource efficiency aligns with the growing adoption of circular economy principles within the renewable energy sector, aiming to minimize waste and maximize the lifespan of its products.

The environmental footprint of solar products spans their entire journey, from mining raw materials and factory production to on-site setup, ongoing energy generation, and eventual disposal or recycling. Canadian Solar is actively working to lessen this impact by refining its manufacturing to use less energy and water. They are also establishing recycling initiatives for their solar panels, aiming to significantly cut down on landfill waste.

Land Use and Biodiversity Conservation

Large-scale solar installations, like those Canadian Solar develops, demand substantial land footprints. This can lead to conflicts over land use, potentially impacting agricultural land or natural habitats. For instance, a 2024 report highlighted that utility-scale solar farms in North America can range from 5 to 10 acres per megawatt, raising questions about efficient land utilization and potential ecological disruption.

Canadian Solar, like other developers, must navigate these challenges by conducting thorough environmental impact assessments. These assessments are critical for identifying and mitigating risks to biodiversity and ecosystems. The company's commitment to sustainable land management practices, including habitat restoration and minimizing fragmentation, is key to responsible development. By 2025, regulatory bodies are increasingly mandating these assessments for projects exceeding certain thresholds.

Key considerations for Canadian Solar regarding land use and biodiversity include:

- Site Selection: Prioritizing brownfield sites or areas with lower ecological sensitivity to minimize impact.

- Habitat Mitigation: Implementing strategies like wildlife corridors or native planting to offset habitat loss.

- Community Engagement: Collaborating with local stakeholders and conservation groups to address land use concerns and ensure biodiversity protection.

- Regulatory Compliance: Adhering to evolving environmental regulations and best practices for land management in solar development.

Waste Management and End-of-Life Recycling

As solar installations grow across Canada, managing end-of-life panels and electronic waste is a significant environmental concern. By 2030, it's estimated that the global solar industry could generate over 78 million metric tons of waste. Canadian Solar is actively engaged in developing and implementing recycling technologies to reclaim valuable materials like silicon, silver, and copper, thereby reducing landfill burden and adhering to circular economy principles.

These initiatives are crucial for mitigating future environmental liabilities and meeting evolving regulatory demands. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive already mandates specific recycling targets for solar panels. Canadian Solar's commitment to these practices positions them favorably in a market increasingly focused on sustainability and responsible lifecycle management.

Canadian Solar's efforts include:

- Developing advanced recycling processes: Focusing on efficient extraction of critical raw materials from decommissioned solar modules.

- Establishing collection and recycling programs: Creating accessible pathways for panel disposal and repurposing.

- Collaborating with industry partners: Working with research institutions and other manufacturers to advance recycling solutions.

The global transition to renewable energy, driven by climate change concerns, significantly boosts demand for solar solutions. Canadian Solar's operations directly contribute to reducing greenhouse gas emissions, aligning with international climate targets and increasing market opportunities.

The increasing demand for solar energy also highlights the finite nature of critical raw materials like polysilicon and silver. By 2025, the International Energy Agency (IEA) forecasts a substantial rise in demand for minerals essential for clean energy technologies, including solar PV, emphasizing the need for sustainable sourcing and material efficiency.

Canadian Solar is actively enhancing material efficiency and exploring sustainable sourcing, including recycled content, to mitigate reliance on virgin resources. This approach aligns with the growing adoption of circular economy principles within the renewable energy sector, aiming to minimize waste and extend product lifecycles.

The environmental footprint of solar products, from raw material extraction to end-of-life disposal, is a key consideration. Canadian Solar is refining manufacturing processes to reduce energy and water consumption and is establishing panel recycling initiatives to minimize landfill waste.

PESTLE Analysis Data Sources

Our Canadian Solar PESTLE Analysis is built on a robust foundation of data from official government agencies, including Natural Resources Canada and provincial energy ministries, alongside reports from reputable industry associations like the Canadian Solar Industries Association (CanSIA) and international bodies such as the International Energy Agency (IEA).