Canadian Solar Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canadian Solar Bundle

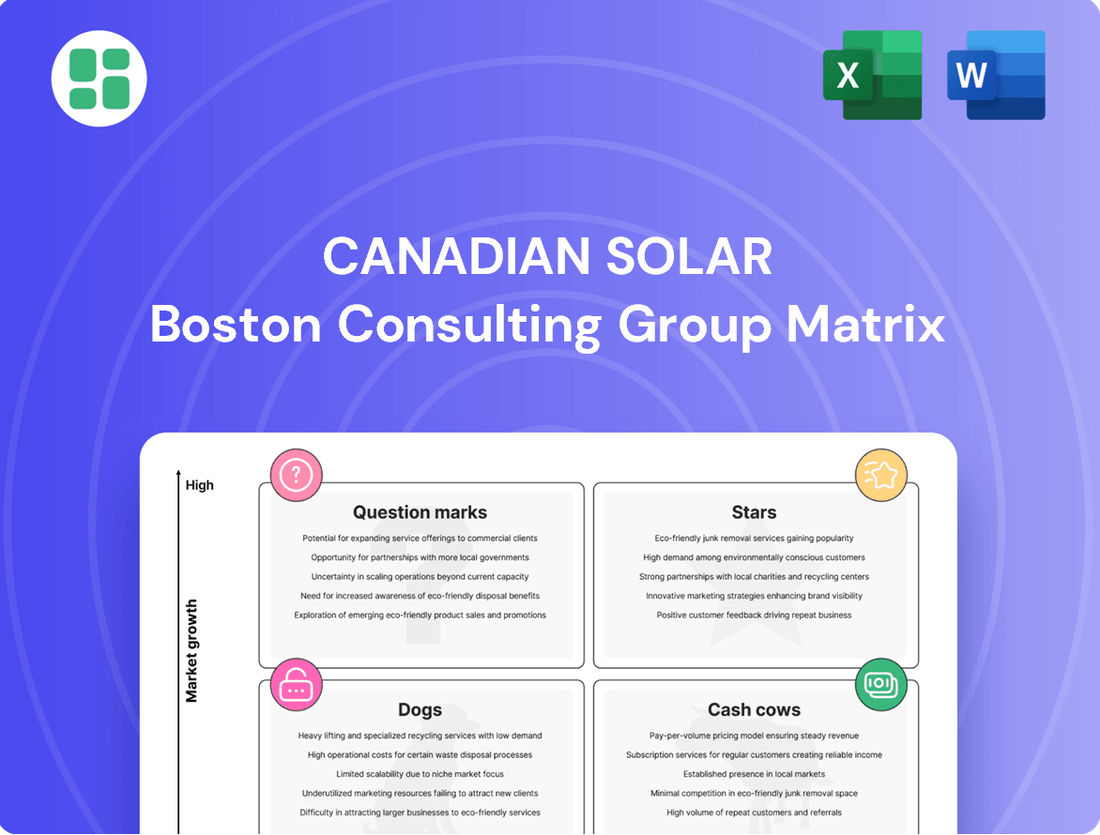

Curious about Canadian Solar's product portfolio performance? This preview offers a glimpse into their strategic positioning, hinting at their Stars, Cash Cows, Dogs, and Question Marks.

Unlock the complete picture and gain a competitive edge by purchasing the full BCG Matrix. It's your essential guide to understanding where Canadian Solar excels and where future growth opportunities lie, empowering you to make informed decisions.

Don't miss out on the detailed quadrant analysis and actionable strategies. Invest in the full report today to transform your understanding of Canadian Solar's market dynamics and chart a course for success.

Stars

Canadian Solar's Battery Energy Storage Solutions (BESS), notably its SolBank 3.0 and SolBank 3.0 Plus, represent a significant growth driver. As of March 31, 2025, the company achieved a record 91 GWh pipeline and secured $3.2 billion in contracted backlog for its e-STORAGE segment, underscoring robust market traction. This strong performance firmly places BESS as a Star within Canadian Solar's BCG Matrix, fueled by escalating demand for grid stability and renewable energy integration.

Recurrent Energy, Canadian Solar's dedicated project development division, boasts an impressive global pipeline of approximately 27 GWp as of March 31, 2025. This robust development portfolio underscores its significant presence in the utility-scale solar market.

The company is actively engaged in developing, constructing, and operating large-scale solar farms across the globe. This strategic focus positions Recurrent Energy to capture substantial market share in a rapidly expanding sector.

Canadian Solar's transition towards an Independent Power Producer (IPP) model within Recurrent Energy is designed to secure predictable, long-term revenue streams. This shift leverages their extensive project pipeline and operational expertise.

Canadian Solar is a dominant force in the high-efficiency N-type TOPCon solar module market. Their new 5GW facility in Texas is now operational, boosting supply for these advanced panels. These modules boast impressive efficiency, reaching up to 24.4%, and bifacial capabilities, meeting strong market demand for cutting-edge solar technology.

Strategic Expansion in U.S. Manufacturing

Canadian Solar is making significant investments in U.S. manufacturing, focusing on solar modules, cells, and energy storage. This expansion is a direct response to the burgeoning U.S. solar market, bolstered by legislative support such as the Inflation Reduction Act.

The company's strategy involves establishing and expanding domestic production capabilities to better serve the North American market and mitigate the impact of tariffs. This localized approach is key to securing a competitive edge in a vital growth sector.

- U.S. Manufacturing Investment: Canadian Solar announced plans to invest over $260 million in its U.S. manufacturing facilities by 2024, creating approximately 250 jobs.

- IRA Impact: The Inflation Reduction Act is expected to drive substantial growth in U.S. solar manufacturing, and Canadian Solar aims to leverage these incentives.

- Market Share: By localizing production, Canadian Solar strengthens its market presence in the U.S., a region projected to see continued high demand for solar and storage solutions.

Integrated Smart Energy Solutions (e.g., EP Cube)

While not a primary revenue generator currently, Canadian Solar's investment in integrated smart energy solutions, exemplified by products like the EP Cube, positions them for future growth. The EP Cube, recognized with design awards in 2025, highlights the company's commitment to energy management and optimization.

This strategic direction aligns with the expanding smart energy market, where demand for intelligent energy solutions is rapidly increasing. For instance, the global smart energy market was valued at approximately $35 billion in 2023 and is projected to grow significantly in the coming years, driven by advancements in grid modernization and renewable energy integration.

- Market Focus: Integrated smart energy solutions, including energy storage and management systems.

- Product Innovation: Recognition of EP Cube with design awards in 2025 signals a focus on advanced technology.

- Growth Potential: Catering to the high-growth smart energy market, which is experiencing substantial expansion.

- Strategic Importance: Emphasizes energy optimization and management, crucial for future energy landscapes.

Canadian Solar's high-efficiency N-type TOPCon solar modules, with efficiencies reaching up to 24.4%, represent a significant growth area. The operational 5GW facility in Texas is a key contributor, meeting robust demand for advanced solar technology. This segment is a Star due to its technological edge and strong market reception.

| Product Segment | Growth Potential | Market Share | Key Strengths |

|---|---|---|---|

| N-type TOPCon Modules | High | Growing | High efficiency (up to 24.4%), bifacial capabilities |

| Battery Energy Storage Solutions (BESS) | Very High | Significant | Record pipeline (91 GWh as of March 31, 2025), contracted backlog ($3.2 billion) |

| Utility-Scale Project Development (Recurrent Energy) | High | Substantial | Large global pipeline (approx. 27 GWp as of March 31, 2025), IPP transition |

What is included in the product

This BCG Matrix analysis for Canadian Solar details strategic recommendations for each product/business unit, guiding investment and divestment decisions.

The Canadian Solar BCG Matrix provides a clear, one-page overview of each business unit's strategic position, alleviating the pain of unclear portfolio management.

Cash Cows

Canadian Solar's established PV module manufacturing, a significant player in the mainstream solar market, continues to be a robust revenue generator. With a legacy spanning over 24 years and nearly 150 GW of modules shipped globally, the company holds a strong position.

Despite pressures from declining average selling prices, this segment demonstrates resilience. In the first quarter of 2025, Canadian Solar reported shipments of 6.9 GW of modules, underscoring its substantial market share in this mature yet vital sector.

Canadian Solar's operational solar power plants, primarily managed by Recurrent Energy, represent a significant cash cow. These assets offer a reliable stream of recurring revenue from electricity sales, a testament to the company's strong development and execution capabilities.

As of March 31, 2025, Canadian Solar has successfully developed, constructed, and connected an impressive 11.6 gigawatt-peak (GWp) of solar power projects worldwide. This substantial operational base is crucial for generating consistent cash flows.

The mature nature of these solar assets means they require relatively minimal ongoing capital investment for maintenance and operation. This low reinvestment requirement allows the cash generated to be readily available for other strategic initiatives or shareholder returns, a hallmark of a cash cow business.

Canadian Solar's extensive global sales and distribution network, reaching active buying customers in over 160 countries and supported by subsidiaries in 23 nations, positions it strongly within its industry. This vast infrastructure ensures efficient product delivery, underpinning consistent sales volumes across both developed and developing markets.

Solar Ingot and Wafer Production

Canadian Solar's ingot and wafer production represents a crucial element of its vertical integration strategy. This segment, while operating in a more mature industry stage with established technologies, underpins the company's ability to control costs and ensure supply chain stability for its higher-profile module manufacturing and project development businesses.

The company's commitment to this foundational stage allows for significant cost advantages. For instance, in 2023, Canadian Solar reported that its wafer production capacity was approximately 10 GW, contributing to its overall cost competitiveness in a market where raw material costs are a major determinant of profitability.

- Cost Control: Vertical integration in ingot and wafer production directly impacts the cost of goods sold for solar modules.

- Supply Chain Security: Owning these upstream capabilities reduces reliance on external suppliers, mitigating risks of shortages or price volatility.

- Mature Market Dynamics: While less dynamic than downstream segments, this area offers stable, albeit lower, margins and predictable operational requirements.

- Technological Foundation: Expertise in ingot and wafer manufacturing supports innovation and quality control across the entire PV value chain.

Long-Term Operations & Maintenance (O&M) Services

Canadian Solar's Long-Term Operations & Maintenance (O&M) services are a significant cash cow within its business portfolio. These services, offered to both its own solar power projects and battery energy storage systems, as well as third-party clients, generate consistent and predictable revenue. This stability is a direct result of long-term contracts, which minimize the need for substantial new capital investments and capitalize on the company's established technical expertise.

The O&M segment benefits from a low capital expenditure requirement, allowing it to efficiently convert revenue into cash flow. This makes it a reliable source of funds for Canadian Solar, supporting its other business units. For example, in 2023, the company reported a substantial portion of its revenue coming from its energy services segment, which includes O&M, highlighting its importance as a steady income generator.

- Predictable Revenue: Long-term O&M contracts provide a stable, recurring income stream, unlike project development which can be more cyclical.

- Low Capital Intensity: These services require minimal new capital expenditure, as they leverage existing infrastructure and expertise, leading to strong cash conversion.

- Leverages Existing Expertise: Canadian Solar's deep experience in developing and operating solar and storage projects translates directly into valuable O&M services.

- Diversification of Revenue: Offering O&M to third parties diversifies Canadian Solar's customer base and revenue sources beyond its own project pipeline.

Canadian Solar's established PV module manufacturing is a significant cash cow, consistently generating revenue despite market price pressures. With over 24 years of experience and nearly 150 GW of modules shipped globally, this segment demonstrates resilience and a strong market position.

The company's operational solar power plants, managed by Recurrent Energy, are also prime cash cows, providing a steady income from electricity sales. As of March 31, 2025, Canadian Solar had developed 11.6 GWp of solar projects, ensuring a substantial base for consistent cash flow generation.

Long-term Operations & Maintenance (O&M) services for both its own and third-party solar and storage systems represent another key cash cow. These services offer predictable, recurring revenue with low capital expenditure, making them a reliable source of funds for the company.

Canadian Solar's ingot and wafer production, while in a mature stage, acts as a foundational cash cow by enabling cost control and supply chain security. In 2023, its wafer production capacity was around 10 GW, contributing to overall cost competitiveness.

| Segment | Description | Key Cash Cow Attributes | Relevant Data (as of latest available) |

|---|---|---|---|

| PV Module Manufacturing | Established, high-volume production. | Resilient revenue, strong market share. | Nearly 150 GW shipped globally; 6.9 GW shipments in Q1 2025. |

| Operational Solar Power Plants | Recurrent Energy managed assets. | Steady recurring revenue from electricity sales. | 11.6 GWp developed globally as of March 31, 2025. |

| Operations & Maintenance (O&M) Services | Services for own and third-party projects. | Predictable, recurring revenue, low capital intensity. | Significant portion of revenue from energy services in 2023. |

| Ingot & Wafer Production | Vertical integration for cost control. | Cost advantages, supply chain stability. | ~10 GW wafer production capacity in 2023. |

Delivered as Shown

Canadian Solar BCG Matrix

The Canadian Solar BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no sample data, and no hidden surprises – just the complete, analysis-ready report ready for your strategic planning.

Dogs

Legacy low-efficiency PV module lines, particularly those based on PERC technology, are increasingly becoming a challenge in the solar industry as the market rapidly adopts more advanced N-type TOPCon modules. Canadian Solar, like many manufacturers, is prioritizing the transition to these newer, more efficient technologies. Any remaining production or inventory of these older modules would likely see declining demand and pressure on profitability, especially with intense competition and a clear market preference for higher-performing solar products.

Underperforming or divested small-scale projects in Canadian Solar's portfolio would be classified as Dogs. These are ventures that have a low market share and low growth prospects. For instance, if a small community solar farm in a region with declining electricity demand is experiencing frequent technical malfunctions, it would fit this description.

Such projects drain capital and management attention without yielding significant returns. In 2024, Canadian Solar has been actively managing its project pipeline, and any small-scale initiatives that consistently miss performance targets or are flagged for sale due to poor economic viability would be categorized here, representing a strategic need for divestment or restructuring.

Niche markets with limited penetration, such as specialized solar solutions for remote Arctic communities or specific industrial applications in underdeveloped regions of Canada, represent areas where Canadian Solar currently holds a minimal market share. These segments often feature entrenched local competitors with strong relationships and understanding of unique regional demands, leading to low growth prospects for Canadian Solar. For instance, in 2024, while the overall Canadian solar market saw significant expansion, these highly specific, low-penetration niches remained largely stagnant, with Canadian Solar's contribution being negligible.

Obsolete Manufacturing Assets

Obsolete manufacturing assets represent Canadian Solar's older production lines or equipment that are no longer economically viable. These might be facilities dedicated to technologies that have been surpassed by newer, more efficient methods. For instance, older solar panel manufacturing equipment that cannot achieve the cost-per-watt of current N-type cell production would fall into this category.

Canadian Solar's strategic shift towards N-type technology, as highlighted by their significant capacity expansions, directly impacts the classification of their legacy assets. Any manufacturing facilities or equipment tied to previous P-type technologies that are proving difficult to repurpose or are incurring high operational costs without maintaining a competitive market position would be classified as obsolete.

The company's 2024 investments in advanced manufacturing, particularly for N-type cells, underscore the diminishing relevance of older systems. For example, if a facility built for older ingot or wafer production methods cannot be efficiently upgraded to handle the demands of N-type materials, it risks becoming an obsolete asset.

- Legacy P-type production lines: Assets dedicated to older solar cell technologies.

- High operating costs: Facilities with expenses that outweigh their market competitiveness.

- Difficulty in conversion: Equipment that cannot be easily adapted to new, advanced technologies like N-type.

- Diminishing market demand: Production capacity for technologies no longer favored by the market.

Certain Regional Markets with Intense Competition and Low Returns

Certain geographic markets present significant hurdles for Canadian Solar, marked by intense competition and consequently, diminished returns. These regions often grapple with oversupply issues, forcing aggressive pricing strategies that erode profit margins. Unfavorable regulatory landscapes can further exacerbate these challenges, hindering market share growth.

Canadian Solar's Q1 2025 performance underscored these difficulties, with management reporting ongoing challenges in the solar market and softer storage shipments. This sentiment reflects the pressure of operating in saturated or less supportive markets.

- Intense Competition: Markets with numerous players often lead to price wars, squeezing profitability.

- Regulatory Headwinds: Unfavorable policies or changes can significantly impact project economics and market access.

- Oversupply: A glut of solar products can drive down prices, making it harder for companies to achieve healthy margins.

- Low Profit Margins: The combination of these factors results in reduced profitability for Canadian Solar in these specific regions.

Canadian Solar's "Dogs" represent underperforming or obsolete segments of its business, characterized by low market share and limited growth potential. This includes legacy low-efficiency solar module lines, such as older PERC technology, which are increasingly being sidelined by the market's rapid adoption of more advanced N-type TOPCon modules. For example, in 2024, the company continued its strategic pivot, making older production assets less competitive.

These "Dogs" also encompass small-scale projects that consistently miss performance targets or face divestment due to poor economic viability, draining resources without significant returns. Additionally, niche markets with minimal penetration and entrenched local competition, where Canadian Solar holds a negligible share, fall into this category. The company's 2024 efforts to manage its project pipeline and focus on high-growth areas mean these lagging ventures are prime candidates for restructuring or sale.

Obsolete manufacturing assets, like older equipment that cannot efficiently produce newer, high-efficiency solar cells, are also classified as Dogs. Canadian Solar's significant 2024 investments in N-type cell manufacturing highlight the diminishing relevance of older systems. Furthermore, geographic markets with intense competition and unfavorable regulatory landscapes, leading to low profit margins, represent areas where the company faces significant headwinds.

Canadian Solar's Q1 2025 performance indicated ongoing market challenges, with softer storage shipments reflecting pressure in saturated or less supportive regions, reinforcing the "Dog" classification for such markets.

Question Marks

Canadian Solar's potential ventures into green hydrogen production and related technologies would likely be classified as Question Marks within the BCG matrix. This sector is characterized by rapid growth potential, but it's still in its early stages, demanding substantial capital investment and facing uncertainties in market share acquisition.

The green hydrogen market, projected to reach hundreds of billions of dollars globally by 2030, presents a high-growth opportunity. However, these initiatives are capital-intensive, with significant upfront costs for electrolyzers, infrastructure, and renewable energy sourcing, leading to uncertain short-term returns despite promising long-term prospects.

When Canadian Solar enters entirely new geographical markets where it has little to no existing market share, these ventures initially operate as Stars. These markets offer high growth potential for solar and storage, but Canadian Solar needs to invest heavily to gain traction and establish a competitive position. For instance, in 2023, Canadian Solar reported significant revenue growth in emerging markets, indicating successful initial phases in new territories.

Canadian Solar's exploration into novel energy storage technologies, such as solid-state batteries or advanced flow batteries, would fall into the Question Marks category of the BCG Matrix. These ventures represent significant R&D investments with the potential for substantial future market disruption, mirroring the high-risk, high-reward profile of this quadrant.

While specific investment figures for these nascent technologies are often proprietary, the broader energy storage market is projected for robust growth. For instance, the global energy storage market was valued at approximately $25 billion in 2023 and is expected to reach over $100 billion by 2030, indicating the immense potential Canadian Solar is targeting with these unproven applications.

Residential and Commercial & Industrial (C&I) Solutions in Highly Competitive Regions

Canadian Solar's direct residential and smaller-scale Commercial & Industrial (C&I) solutions in highly competitive and fragmented regions, such as mature rooftop solar markets, could be classified as question marks in the BCG matrix. These segments, while representing growth opportunities, often demand substantial investment to gain traction and scale against established players.

For instance, in 2023, the global rooftop solar market saw significant growth, but in regions with high competition, new entrants or those with limited market share struggle to achieve profitability without aggressive market penetration strategies. Canadian Solar's strategy in these areas would focus on building brand recognition and distribution networks.

- Low Market Share: Direct residential and smaller C&I solutions may have a limited presence in highly saturated markets.

- High Growth Potential: These segments are expanding, offering future revenue streams if market share can be captured.

- Significant Investment Needed: Scaling operations and marketing in competitive environments requires substantial capital outlay.

- Strategic Focus: Success hinges on differentiating offerings and building strong customer relationships.

Innovative Financing Models for Project Development

Canadian Solar's move into new markets or novel project types, such as advanced battery storage or green hydrogen integration, could position these ventures as 'Question Marks' within its BCG matrix. This is especially true if they rely on innovative financing models.

These complex structures, including green bonds with specific impact metrics or blended finance approaches combining public and private capital, aim to attract significant investment for high-growth potential. For instance, in 2024, the global green bond market continued its expansion, with issuance expected to reach over $1 trillion, indicating investor appetite for sustainable projects, though specific adoption for novel Canadian Solar projects remains to be seen.

- Unproven Profitability: While aiming for rapid growth, the long-term profitability and scalability of these new financing models for nascent project types are not yet established.

- Market Adoption Risk: The success of these innovative financing models depends on their acceptance by a broad range of investors and regulatory bodies in new jurisdictions.

- Capital Intensity: Developing novel projects often requires substantial upfront capital, making the ability to secure diverse and flexible financing crucial for Canadian Solar's expansion.

- Emerging Project Types: Financing for projects like large-scale offshore wind farms or integrated renewable energy systems with significant storage components often requires tailored, complex financial instruments.

Canadian Solar's ventures into emerging technologies like advanced battery storage or green hydrogen production are strong candidates for the Question Mark category in the BCG matrix. These areas offer substantial growth potential, but Canadian Solar currently holds a low market share and faces significant investment needs to establish a strong competitive position.

The company's strategic focus on these high-potential, yet unproven, markets necessitates considerable capital expenditure for research, development, and market penetration. For instance, the global green hydrogen market is anticipated to grow significantly, with projections suggesting it could reach hundreds of billions of dollars by 2030, highlighting the opportunity but also the scale of investment required.

These initiatives are characterized by high uncertainty regarding future profitability and market adoption. Canadian Solar must invest heavily to build brand recognition and distribution networks in these nascent sectors, aiming to convert these Question Marks into Stars or Cash Cows over time.

| Initiative | BCG Category | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| Green Hydrogen | Question Mark | High | Low | High |

| Advanced Battery Storage | Question Mark | High | Low | High |

| New Geographic Markets (Initial Entry) | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our Canadian Solar BCG Matrix is informed by a blend of financial disclosures, market research, and industry performance data to provide strategic insights.