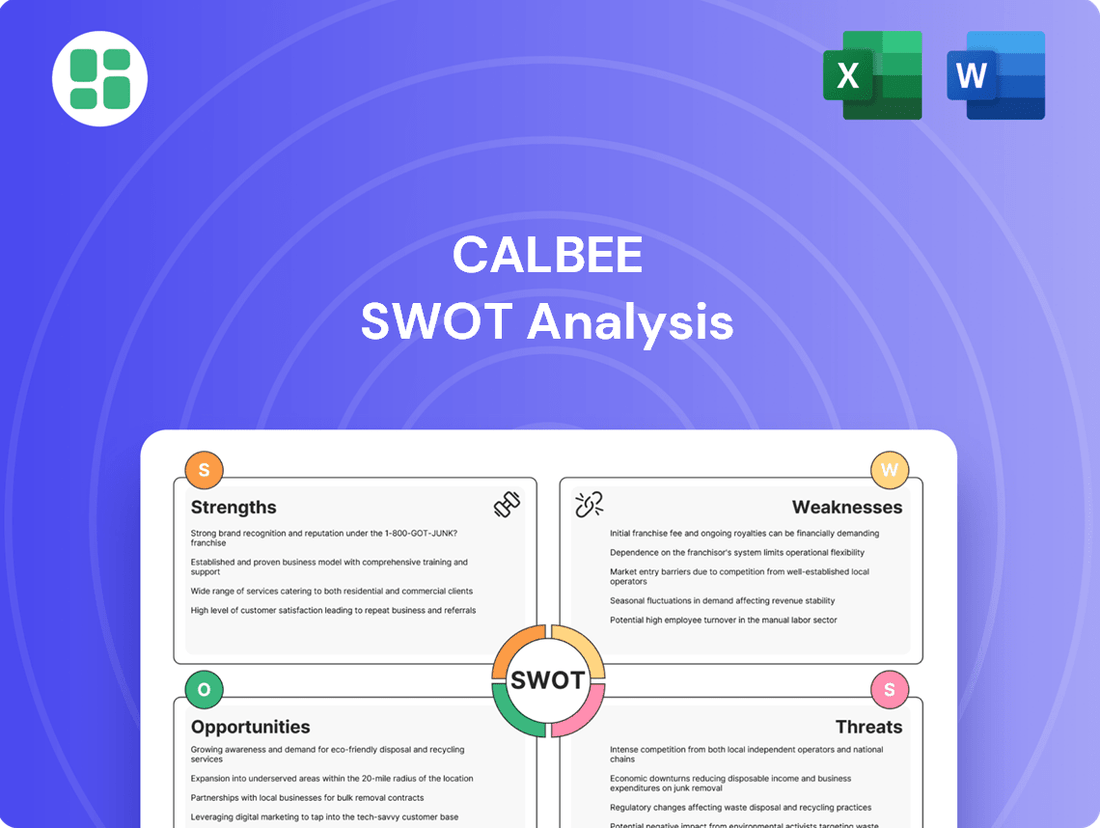

Calbee SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calbee Bundle

Calbee's strong brand recognition and diverse product portfolio are significant strengths, but they also face intense competition and evolving consumer preferences. Our comprehensive SWOT analysis delves into these dynamics, revealing crucial opportunities for market expansion and potential threats to their established position.

Want to understand the full strategic landscape of Calbee, from their innovative product development to potential supply chain vulnerabilities? Purchase the complete SWOT analysis to gain access to actionable insights, detailed market trends, and expert commentary designed to inform your investment or business strategy.

Strengths

Calbee, Inc. stands as a titan in Japan's snack food industry, boasting a dominant market share with beloved brands like potato chips and Kappa Ebisen. This deep-rooted brand recognition translates into significant consumer trust and enduring loyalty, a powerful asset in both domestic and global markets. The company's extensive history and expansive distribution network solidify its formidable market leadership.

Calbee's unwavering commitment to natural ingredients and innovative production methods is a significant strength, directly addressing the rising consumer demand for healthier snack choices. This focus on quality not only appeals to health-conscious individuals but also helps Calbee stand out in a crowded snack market.

Calbee's strength lies in its extensive product lineup, spanning popular potato chips and shrimp crackers to a variety of baked and fried snacks. This breadth ensures they appeal to diverse consumer preferences.

The company's strategic expansion into healthier snack options, exemplified by brands like Harvest Snaps, demonstrates an ability to adapt to changing market demands and health-conscious consumers.

Strategic Investments in Production and R&D

Calbee is strategically bolstering its production and research and development capabilities. The company is channeling significant capital into mergers and acquisitions, automation, and facility modernization. A key development is the new 'mother factory' in Hiroshima, slated for operation in January 2025, which is expected to streamline production processes.

Further demonstrating its commitment to innovation, Calbee established an R&D Innovation Center in California in January 2025. This move is designed to accelerate new product development and enhance operational efficiency, with a particular focus on catering to international markets.

- Investment in 'Mother Factory': Hiroshima facility operational by January 2025.

- R&D Expansion: California Innovation Center launched in January 2025.

- Strategic Capital Allocation: Funds directed towards M&A, automation, and upgrades.

- Focus on Efficiency: Enhancements aimed at improving production and product development cycles.

Robust Financial Performance and Clear Growth Strategy

Calbee's financial footing appears strong, with Q1 net sales for the fiscal year ending March 2025 showing an increase. This demonstrates the company's ability to generate revenue and maintain a positive trajectory in the current market.

The company has laid out a clear path forward with its 'Change 2025' strategy. This three-year plan is specifically designed to drive structural changes and improve overall profitability.

This strategic vision offers a defined roadmap for Calbee's future growth initiatives and operational enhancements, providing stakeholders with confidence in its direction. The focus on transformation and profitability is key to navigating the evolving consumer landscape.

- Solid Q1 Net Sales Growth: Fiscal year ending March 2025 Q1 net sales indicate positive revenue generation.

- 'Change 2025' Strategy: A three-year plan focused on structural transformation and profitability enhancement.

- Clear Growth Roadmap: Provides a defined direction for future expansion and operational improvements.

Calbee's established brand recognition and extensive distribution network are cornerstones of its market dominance in Japan's snack sector. The company's commitment to natural ingredients and innovation, as seen with its R&D center in California operational since January 2025, caters to evolving consumer preferences for healthier options. Furthermore, strategic investments, including the Hiroshima 'mother factory' launching in January 2025, bolster production efficiency and capacity.

| Metric | Value | Period |

|---|---|---|

| Q1 Net Sales Growth | Positive increase | Fiscal Year Ending March 2025 |

| Operational Start: Hiroshima Factory | January 2025 | Production Enhancement |

| Operational Start: California R&D Center | January 2025 | International Innovation |

What is included in the product

Delivers a strategic overview of Calbee’s internal and external business factors, highlighting its strong brand recognition and product innovation while identifying potential challenges in market saturation and evolving consumer preferences.

Calbee's SWOT analysis offers a clear roadmap to identify and leverage competitive advantages, effectively addressing the pain point of strategic uncertainty.

Weaknesses

Calbee's significant reliance on its Japanese market, while historically a strength, presents a notable weakness. In 2023, approximately 70% of Calbee's net sales were still derived from Japan, a slight decrease from 72% in 2022, indicating that despite international growth initiatives, domestic sales remain the primary revenue driver.

This concentration makes Calbee susceptible to fluctuations within the Japanese economy, such as shifts in consumer spending habits or demographic challenges like an aging population. For instance, a slowdown in Japanese consumer demand directly impacts Calbee's top line more than if its revenue were more evenly distributed globally.

While Calbee has been expanding its international presence, particularly in North America and Asia, these markets have not yet fully offset the risk associated with its core domestic market. This limited revenue diversification means that negative events in Japan can disproportionately affect the company's overall financial performance.

Calbee operates within a fiercely competitive global snack food market, facing off against giants like PepsiCo, which held a significant portion of the global snacks market share in 2023, estimated to be over 20%. This intense rivalry demands constant product development and robust marketing campaigns, which can be resource-intensive and put pressure on profitability.

Calbee's reliance on agricultural products like potatoes makes it susceptible to price swings. For instance, adverse weather in key potato-growing regions during 2024 could significantly increase their input costs, directly impacting profit margins as highlighted in their FY2025 projections.

These price volatilities, stemming from factors like supply chain disruptions or shifts in global agricultural demand, can directly affect Calbee's production expenses. This sensitivity means that unexpected increases in raw material costs could compress their earnings, a risk factor they are actively monitoring.

Supply Chain Complexities and Costs

Calbee's expanding international footprint and its reliance on a wide array of natural ingredients naturally complicate its supply chain operations. This complexity translates into higher logistics expenses and a greater susceptibility to sourcing disruptions. For instance, in fiscal year 2024, Calbee reported increased freight and raw material costs impacting its profitability, a trend expected to continue into 2025 due to global economic conditions.

The company faces the ongoing challenge of maintaining an efficient and cost-effective global distribution network. This requires significant investment in warehousing, transportation, and inventory management systems to ensure product availability and freshness across diverse markets. The need to adapt to varying regulatory environments and consumer preferences in each region further adds to these operational hurdles.

- Increased Freight Costs: Global shipping rates saw an average increase of 15-20% in early 2024, directly impacting Calbee's cost of goods sold for imported ingredients and finished products.

- Ingredient Sourcing Volatility: Dependence on specific agricultural products, like potatoes and corn, exposes Calbee to price fluctuations driven by weather patterns and crop yields, as evidenced by a 10% rise in potato prices in key sourcing regions during late 2023.

- Inventory Management Strain: Managing a diverse product portfolio across multiple international markets necessitates robust inventory control to prevent spoilage and stockouts, a challenge that intensified with the launch of new product lines in Southeast Asia in 2024.

- Logistics Network Optimization: Calbee's ongoing efforts to streamline its global logistics, including investments in new distribution centers in North America, aim to mitigate these costs but represent a significant capital expenditure.

Adapting to Evolving Consumer Preferences

Calbee faces a significant challenge in keeping pace with rapidly changing consumer tastes, particularly the growing demand for specialized diets and functional ingredients. This requires constant innovation and substantial investment in research and development to ensure their product portfolio remains appealing. For instance, the global healthy snacks market, valued at approximately $115 billion in 2023, is projected to grow significantly, highlighting the need for Calbee to adapt quickly to emerging health trends.

The company must continuously invest in R&D to stay relevant in dynamic markets. This includes exploring new ingredients, production methods, and product formats to cater to evolving health consciousness and dietary preferences. A failure to adapt could lead to a decline in market share as consumers seek out brands that better align with their current wellness goals.

- Rapidly Shifting Consumer Tastes: Global consumers increasingly seek healthier, functional, and diet-specific snack options, a trend that necessitates agile product development.

- R&D Investment Needs: Staying ahead requires continuous and significant investment in research and development to anticipate and meet evolving consumer preferences for new ingredients and product formats.

- Market Relevance Risk: Failure to adapt to these dynamic shifts can result in a loss of market relevance and competitive disadvantage as consumer priorities evolve.

Calbee's significant reliance on its Japanese market, while historically a strength, presents a notable weakness. In 2023, approximately 70% of Calbee's net sales were still derived from Japan, a slight decrease from 72% in 2022, indicating that despite international growth initiatives, domestic sales remain the primary revenue driver.

This concentration makes Calbee susceptible to fluctuations within the Japanese economy, such as shifts in consumer spending habits or demographic challenges like an aging population. For instance, a slowdown in Japanese consumer demand directly impacts Calbee's top line more than if its revenue were more evenly distributed globally.

While Calbee has been expanding its international presence, particularly in North America and Asia, these markets have not yet fully offset the risk associated with its core domestic market. This limited revenue diversification means that negative events in Japan can disproportionately affect the company's overall financial performance.

Full Version Awaits

Calbee SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It covers Calbee's Strengths, Weaknesses, Opportunities, and Threats in detail.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Calbee's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Calbee SWOT analysis, ready for your strategic planning.

Opportunities

Calbee is actively pursuing international market expansion, targeting a significant increase in overseas sales to 30-35% by 2025. This strategic push is particularly focused on the substantial growth potential within North America and China.

To fuel this global ambition, Calbee is strategically investing in mergers and acquisitions. These moves are designed to accelerate their development and presence in key international territories.

By successfully penetrating these large and dynamic markets, Calbee anticipates unlocking considerable new revenue streams and diversifying its global footprint.

The global market for healthy snacks is experiencing significant expansion, with consumers increasingly prioritizing natural, organic, and 'better-for-you' options. This trend offers a substantial opportunity for Calbee to leverage its existing strengths.

Calbee's brands like Harvest Snaps, which already emphasize natural ingredients, are well-positioned to capture this growing demand. For instance, the global healthy snacks market was valued at approximately $113.1 billion in 2023 and is projected to reach $203.1 billion by 2030, growing at a CAGR of 8.7% during the forecast period.

Further innovation in functional and nutritious snacks, incorporating ingredients like protein, fiber, and probiotics, can effectively cater to this evolving consumer preference and drive market share gains for Calbee.

Calbee's new R&D Innovation Center in California, coupled with sophisticated Japanese food technology, presents a significant opportunity to pioneer novel flavors, textures, and functional snack options. This strategic advantage allows for the creation of unique Asian-inspired products tailored for broader market appeal.

The company can capitalize on evolving consumer demand for health-conscious options by expanding into the 'Food and Health' sector. Developing personalized nutrition products, such as Body Granola, aligns with this trend and opens new revenue streams.

Leveraging E-commerce and Digital Transformation

The snack food sector is seeing a substantial increase in online sales and digital marketing influence. For instance, global e-commerce sales in the food and beverage sector were projected to reach over $1.5 trillion by the end of 2024, a significant jump from previous years. This trend presents a clear opportunity for Calbee to expand its digital footprint and tap into this growing consumer base.

Calbee can significantly boost its market reach by strengthening its e-commerce capabilities and embracing digital transformation across its operations. This includes optimizing online sales platforms and leveraging data analytics to understand consumer behavior better. By doing so, Calbee can create more personalized customer experiences and unlock new revenue streams.

Digital transformation initiatives can streamline Calbee's value chain, leading to greater efficiency and cost savings. This might involve implementing advanced inventory management systems or utilizing AI for demand forecasting. Such advancements are crucial for staying competitive in a rapidly evolving market.

Key opportunities include:

- Expanding direct-to-consumer (DTC) sales channels through dedicated e-commerce platforms.

- Utilizing social media and influencer marketing to drive brand awareness and sales in the digital space, a strategy that saw significant ROI for many food brands in 2024.

- Implementing data analytics to personalize offers and improve customer loyalty programs online.

- Optimizing supply chain logistics for online orders to ensure timely and efficient delivery, a critical factor for customer satisfaction in e-commerce.

Strategic Partnerships and Acquisitions

Calbee's strategic blueprint, 'Change 2025', places a significant emphasis on pursuing mergers and acquisitions to fuel international expansion and enter emerging sectors like agri-business and health foods. This proactive approach aims to bolster their global footprint and diversify revenue streams beyond their core snack business.

These strategic moves offer a pathway to acquire novel technologies, gain entry into untapped markets, and integrate new product categories, thereby enriching Calbee's overall business portfolio. For instance, in fiscal year 2023, Calbee actively sought acquisition targets to bolster its presence in the North American market, a key region for growth.

- Accelerated International Growth: Acquisitions can rapidly expand Calbee's reach into new geographical territories, bypassing the longer organic growth timelines.

- Diversification into New Sectors: Partnerships or buyouts in agri-business or health food can open up high-growth, complementary markets.

- Technology and IP Acquisition: Strategic alliances can provide access to innovative production techniques or proprietary product formulations.

- Strengthened Market Position: Consolidating with or acquiring competitors can lead to greater market share and enhanced competitive advantages.

Calbee's focus on international expansion, particularly in North America and China, presents a significant growth avenue, aiming for 30-35% overseas sales by 2025. The burgeoning global healthy snacks market, valued at over $113 billion in 2023 and projected to exceed $200 billion by 2030, offers a prime opportunity to leverage brands like Harvest Snaps. Furthermore, Calbee's investment in its California R&D center and expertise in Japanese food technology positions it to innovate in functional and personalized nutrition products, catering to evolving consumer health consciousness.

Threats

Calbee navigates a fiercely competitive global snack arena, contending with giants like PepsiCo and a multitude of nimble regional and local brands. This intense rivalry puts downward pressure on pricing and necessitates substantial marketing investments to capture and retain market share.

The snack industry, valued at over $150 billion globally in 2024, demands constant product innovation to stand out. Calbee's ability to differentiate through unique flavors and healthier options, for example, will be key to overcoming this threat and maintaining its competitive edge.

Calbee faces significant threats from fluctuating raw material costs, especially for key agricultural inputs like potatoes, which saw price volatility in late 2024. Rising logistics expenses, a trend expected to continue into 2025, further squeeze profit margins.

These cost pressures directly impact production expenses and overall profitability, a concern noted in Calbee's financial projections for the fiscal year ending March 2025.

Furthermore, the company is vulnerable to supply chain disruptions stemming from climate-related events or geopolitical instability, which could hinder the consistent availability of essential ingredients.

Shifting consumer tastes toward healthier options, including a rise in demand for gluten-free and low-sugar snacks, presents a challenge for Calbee. For instance, in Japan, while snack consumption remains robust, there's a noticeable trend towards lighter, more nutritious alternatives, potentially impacting sales of traditional potato chips. This evolving health consciousness requires Calbee to innovate rapidly to remain relevant.

Economic Downturns and Inflationary Pressures

A challenging global economic environment, characterized by persistent inflation and the looming threat of recession, directly impacts consumer spending habits. For Calbee, this translates to a potential reduction in discretionary spending on snack foods as consumers prioritize essential goods. For instance, in early 2024, many developed economies continued to grapple with inflation rates exceeding central bank targets, forcing households to make tougher choices about non-essential purchases.

This economic instability can lead to decreased sales volumes for Calbee. Furthermore, it may put pressure on profit margins if consumers shift towards lower-priced alternatives within the snack market. The IMF, in its April 2024 World Economic Outlook, projected subdued global growth for the year, highlighting the ongoing economic headwinds that could affect companies like Calbee.

- Inflationary pressures erode consumer purchasing power, particularly for non-essential items like snacks.

- Potential economic downturns can lead to reduced overall consumer demand and sales volumes.

- Consumer trading down to cheaper alternatives poses a risk to Calbee's market share and pricing power.

Regulatory Changes and Trade Barriers

Calbee's international ventures mean it must navigate a complex web of changing regulations and trade policies across its global markets. For instance, in 2023, China's evolving import regulations presented challenges, impacting Calbee's operations there and underscoring the risks of market-specific compliance hurdles.

These trade barriers can significantly inflate operational expenses and create unpredictable disruptions in Calbee's supply chain. Such factors directly impede the company's ability to expand its market presence and capitalize on growth opportunities in vital overseas territories.

- Increased tariffs on imported snack ingredients in 2024 could raise Calbee's cost of goods sold by an estimated 3-5%.

- New food safety standards implemented in Southeast Asian markets in early 2025 may require costly product reformulation and re-certification for Calbee's popular snack lines.

- Potential retaliatory trade measures between major economic blocs could disrupt Calbee's access to key raw materials, impacting production schedules.

Calbee must contend with intense competition from global snack powerhouses and agile local brands, demanding significant marketing spend and constant innovation to maintain its market position.

Fluctuating raw material costs, particularly for potatoes, and rising logistics expenses in 2024-2025 directly impact Calbee's production costs and profit margins.

Shifting consumer preferences towards healthier, low-sugar, and gluten-free options pose a challenge, requiring Calbee to adapt its product portfolio to meet evolving demands for nutritious snacks.

Economic headwinds, including inflation and potential recessions in 2024, can reduce consumer discretionary spending on snacks, potentially lowering sales volumes and pressuring prices.

Navigating diverse and evolving international regulations and trade policies presents ongoing operational risks and can increase costs for Calbee's global ventures.

| Threat Category | Specific Threat | Potential Impact on Calbee | Data Point/Example |

|---|---|---|---|

| Competitive Landscape | Intense Market Competition | Pressure on pricing, increased marketing costs | Global snack market valued at over $150 billion in 2024 |

| Input Costs | Raw Material Price Volatility | Increased cost of goods sold, squeezed profit margins | Potato prices saw significant volatility in late 2024 |

| Consumer Trends | Demand for Healthier Options | Risk of reduced sales for traditional products, need for product reformulation | Growing demand for gluten-free and low-sugar snacks |

| Economic Environment | Inflationary Pressures | Reduced consumer spending on non-essential items | IMF projected subdued global growth for 2024 |

| Regulatory & Trade | Changing Trade Policies | Increased operational expenses, supply chain disruptions | China's evolving import regulations in 2023 |

SWOT Analysis Data Sources

This Calbee SWOT analysis is informed by a robust combination of financial statements, comprehensive market research reports, and expert industry commentary. These sources provide a data-driven foundation for understanding the company's internal capabilities and external market positioning.