Calbee Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calbee Bundle

Calbee's success hinges on a masterful blend of its 4Ps. Their innovative product portfolio, from classic potato chips to unique snacks, consistently delights consumers, while their strategic pricing ensures accessibility and value. Discover how their widespread distribution and engaging promotional campaigns create a powerful market presence.

Want to understand the full picture? Dive deeper into Calbee's product innovation, pricing strategies, distribution networks, and promotional tactics. Get instant access to a comprehensive, editable 4Ps Marketing Mix Analysis, perfect for business professionals and students seeking actionable insights.

Product

Calbee's diverse snack portfolio is a cornerstone of its marketing strategy, featuring a wide array of savory options like its renowned potato chips and shrimp crackers, known as Kappa Ebisen. This extensive range, encompassing both baked and fried snacks, is designed to satisfy a broad spectrum of consumer tastes, from classic Japanese flavors to those adapted for international palates, thereby securing broad market penetration.

The company's commitment to product variety is evident in its continuous assessment and refinement of Stock Keeping Units (SKUs). This meticulous approach aims to bolster brand equity and ensure alignment with evolving customer demands, a strategy that has seen Calbee maintain strong market positions. For instance, in the fiscal year ending March 2024, Calbee reported net sales of ¥280.5 billion, underscoring the success of its broad product offerings.

Calbee's product strategy deeply emphasizes natural ingredients and a commitment to delivering high-quality snack experiences. This focus is a cornerstone of their appeal to health-conscious consumers.

The company showcases a distinct value chain, starting with the careful development and sustainable sourcing of key ingredients like potatoes. This meticulous approach ensures quality is maintained from the ground up.

This dedication to naturalness and quality directly addresses the increasing consumer preference for healthier food choices. For instance, Calbee's potato chip sales in Japan reached approximately ¥180 billion in fiscal year 2023, reflecting strong market acceptance of their product quality.

Calbee's commitment to innovation is a cornerstone of its marketing strategy, driving new product development and operational efficiencies. The introduction of the Jagarico snack-in-a-cup revolutionized convenience snacking, while their expansion into the Food and Health sector with personalized Body Granola demonstrates a forward-thinking approach to consumer wellness. This focus on novel offerings ensures Calbee remains relevant in a dynamic market.

The company is also leveraging cutting-edge technology, including artificial intelligence, to enhance its production and research capabilities. By optimizing potato chip manufacturing and accelerating R&D cycles, Calbee aims to bring innovative products to market faster. Furthermore, AI-driven insights into consumer behavior will enable greater product customization, as seen in their personalized granola offerings, directly addressing evolving consumer demands.

Strategic Line Expansion

Calbee's strategic line expansion moves beyond its core snack business, notably into agri-business with a focus on sweet potatoes and the burgeoning 'Food and Health' sector. This diversification is designed to unlock new value streams and build future growth engines, capitalizing on existing operational synergies. For instance, Calbee's investment in agri-business aims to secure stable raw material supply and explore new product development opportunities, potentially mirroring the success of their potato-based snacks.

The company actively refreshes its product portfolio through innovative flavors and packaging. A prime example is the recent redesign of Calbee America's Shrimp Chips, enhancing market appeal and consumer engagement. This continuous product evolution is crucial for maintaining market relevance and capturing evolving consumer preferences in the competitive snack industry.

Calbee's expansion strategy is supported by its financial performance. In the fiscal year ending March 2024, Calbee reported net sales of ¥274.9 billion, with operating income reaching ¥20.1 billion. This financial strength provides a solid foundation for investing in new business areas and product development initiatives.

- Agri-business Focus: Calbee is investing in sweet potato cultivation and related products, aiming for vertical integration and new market segments.

- Food and Health Sector: Entry into this area targets health-conscious consumers and expands Calbee's product offerings beyond traditional snacks.

- Product Innovation: Continuous introduction of new flavors and packaging updates, such as the recent refresh for Calbee America's Shrimp Chips, drives consumer interest.

- Financial Backing: Fiscal year 2024 net sales of ¥274.9 billion and operating income of ¥20.1 billion support these strategic expansion efforts.

Brand Experience and Packaging

Calbee's brand experience centers on delivering enjoyable snacking moments, often infused with authentic Japanese culinary influences. This commitment is evident in their product development, aiming to provide consumers with unique and satisfying tastes that resonate with cultural heritage.

Packaging is a vital component of Calbee's marketing strategy, designed to elevate brand recognition and capture consumer attention on crowded retail shelves. A prime example is the recent packaging refresh for Calbee Shrimp Chips in the U.S. market. This initiative involved introducing bolder color palettes and more prominent graphics, ensuring consistency with global branding and a stronger appeal to a wider consumer base.

- Brand Experience: Focus on enjoyable snacking, reflecting Japanese culinary traditions.

- Packaging Strategy: Enhances brand recognition and shelf presence.

- U.S. Shrimp Chips Refresh: Implemented bolder colors and prominent graphics for global alignment and consumer attraction.

Calbee's product strategy emphasizes a broad and innovative portfolio, ranging from classic potato chips and shrimp crackers to health-focused options like Body Granola. The company continuously refines its Stock Keeping Units (SKUs) to align with evolving consumer preferences and bolster brand equity. This dedication to quality and natural ingredients underpins their appeal, as seen in their strong performance in the Japanese potato chip market.

Innovation is a key driver, exemplified by the Jagarico snack-in-a-cup and the expansion into agri-business and the Food and Health sector. Calbee leverages technology, including AI, to enhance production and R&D, aiming for faster market introductions and greater product customization. Recent packaging updates, like those for Calbee America's Shrimp Chips, further aim to boost market appeal.

Calbee's financial strength supports these product initiatives. In the fiscal year ending March 2024, the company reported net sales of ¥274.9 billion and operating income of ¥20.1 billion, providing a solid base for continued investment in product development and diversification.

| Product Category | Key Characteristics | Fiscal Year 2023/2024 Data |

|---|---|---|

| Potato Chips | Natural ingredients, diverse flavors | Japanese market sales approx. ¥180 billion (FY2023) |

| Shrimp Crackers (Kappa Ebisen) | Savory, international appeal | Packaging refresh in U.S. market |

| Jagarico | Convenience snacking | Revolutionized snack-in-a-cup format |

| Body Granola | Health-focused, personalized | Expansion into Food and Health sector |

| Agri-business | Sweet potato cultivation, vertical integration | Strategic investment for raw material security |

What is included in the product

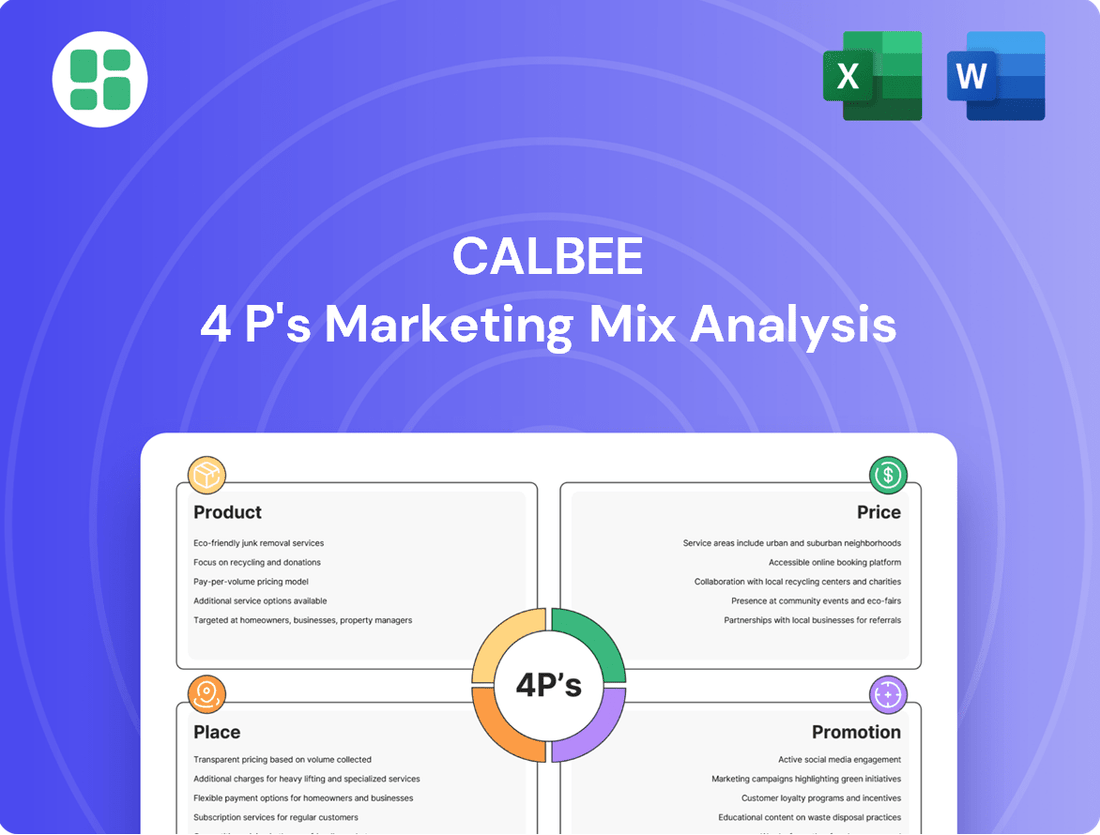

This Calbee 4P's Marketing Mix Analysis offers a comprehensive examination of the company's product innovation, pricing strategies, distribution channels, and promotional activities.

It provides actionable insights into Calbee's market positioning and competitive advantages, ideal for strategic planning and performance benchmarking.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of deciphering intricate plans for Calbee's 4Ps.

Provides a clear, concise overview of Calbee's marketing mix, reducing the burden of understanding their strategic approach.

Place

Calbee's extensive retail distribution is a cornerstone of its market success. Their products, from potato chips to granola, are readily found in almost every Japanese supermarket and convenience store, reaching consumers wherever they shop. This broad accessibility is crucial for a fast-moving consumer goods company like Calbee.

Beyond Japan, Calbee has strategically expanded its retail footprint. In the United States, for instance, Calbee America's snacks are available in major grocery chains and specialty stores, mirroring their domestic strategy. This international presence, coupled with their strong domestic market share, which stood at approximately 30% of the Japanese snack market as of early 2024, highlights the effectiveness of their widespread availability.

Calbee is strategically targeting North America and China for significant international expansion, viewing them as crucial growth engines. The company plans to boost its overseas revenue ratio substantially by 2025 through targeted investments.

To support this global push, Calbee is allocating considerable funds towards mergers and acquisitions (M&A) and enhancing its production capabilities. This includes building new facilities in key regions like the United Kingdom and Indonesia, alongside strengthening its North American operations.

Calbee's commitment to an optimized supply chain and logistics is central to its operational strategy, focusing on a sustainable and efficient value chain from sourcing raw materials to final product delivery. This involves significant investment in modernizing production capabilities.

The company is actively investing in automation and new factory constructions, exemplified by its state-of-the-art Hiroshima plant. This facility is designed to boost production efficiency, meet escalating demand, and refine logistics operations.

Calbee is implementing advanced systems like Sales & Operations Planning (S&OP) and a supply chain optimization system named C-BOSS. These initiatives aim to create a transparent flow of information across the entire value chain, speeding up decisions and minimizing waste.

Online and Direct Sales Channels

While Calbee has historically leaned on traditional retail, the company is actively expanding its online and direct sales channels. This strategic shift is particularly evident in newer, more niche product areas such as personalized granola services, which are well-suited for direct-to-consumer models. This expansion aims to capture a broader consumer base and offer greater convenience.

The increasing importance of e-commerce for snack and breakfast food distribution cannot be overstated. For instance, the global instant oatmeal market, a segment where Calbee operates, saw significant growth through online platforms. Data from 2023 indicated that e-commerce accounted for over 30% of total sales in this category in key markets, highlighting the necessity for Calbee to strengthen its digital presence.

- E-commerce Growth: The global market for breakfast cereals, including instant oatmeal, experienced a notable surge in online sales, with projections indicating continued double-digit growth through 2025.

- Direct-to-Consumer (DTC) Potential: Calbee's exploration of personalized granola via direct sales channels taps into the growing consumer demand for customized food products, a trend that gained momentum in 2024.

- Expanded Reach: Online platforms offer Calbee the ability to reach consumers beyond traditional supermarket footprints, providing access to a wider product selection and facilitating easier purchasing decisions.

- Data-Driven Insights: Leveraging online sales data allows Calbee to gain deeper insights into consumer preferences and purchasing behaviors, informing future product development and marketing strategies.

Partnerships and Localized Production

Calbee strategically leverages partnerships and localized production to cater to diverse regional tastes and market demands. A prime example is its joint venture with Universal Robina in the Philippines, a move designed to enhance its foothold in the Southeast Asian market.

This approach extends to its operations in China, where Calbee is increasing contract manufacturing volumes. Such collaborations, alongside global R&D efforts, are crucial for developing products that resonate with local consumer preferences, ensuring relevance and market penetration.

- Strategic Joint Ventures: Calbee's partnership with Universal Robina in the Philippines exemplifies a commitment to regional market penetration and understanding local consumer nuances.

- Localized Manufacturing: Expansion of contract manufacturing in China demonstrates a focus on adapting production to meet specific market needs and potentially reduce logistical costs.

- Global R&D Collaboration: Working with international partners on research and development helps Calbee innovate and tailor new products for diverse global palates.

- Market Responsiveness: These initiatives allow Calbee to respond effectively to localized demand, a key element in its global marketing strategy for snacks and food products.

Calbee's distribution strategy emphasizes widespread availability, ensuring its products are accessible in virtually all Japanese supermarkets and convenience stores. This broad reach is vital for its fast-moving consumer goods. Internationally, Calbee mirrors this approach, with its snacks available in major U.S. grocery chains and specialty stores, reinforcing its commitment to making products easily obtainable for consumers worldwide.

Full Version Awaits

Calbee 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Calbee's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Calbee is actively reinforcing its corporate and product brands through targeted communication, highlighting its strengths in raw materials, quality, and taste. This strategy aims to solidify its competitive edge in the market.

With flagship products like Potato Chips marking significant anniversaries, Calbee is implementing initiatives to deepen consumer brand loyalty. The focus is on communicating the comprehensive value of the Calbee brand, extending beyond just its appealing taste profile.

Calbee effectively utilizes digital marketing and social media to foster a strong connection with its consumers. This strategy is evident in campaigns that not only celebrate the brand's history but also actively encourage user participation. For instance, giveaways offering trips to Japan or product bundles are designed to boost engagement and brand recall, especially for iconic products like Calbee Shrimp Chips in the U.S. market.

These digital initiatives are crucial for building a dedicated online community and enhancing brand recognition. By consistently interacting with customers through social media, Calbee cultivates a sense of loyalty and keeps its products top-of-mind. This online presence is a key driver for increasing brand visibility and, consequently, sales.

Calbee’s promotional strategy heavily relies on product-specific campaigns, a key element of its marketing mix. For instance, their popular Pro Baseball Chips often feature collectible player cards, a tactic that resonates deeply with sports enthusiasts and creates a strong incentive for purchase beyond the snack itself. This approach effectively targets niche demographics and enhances the perceived value of the product.

These limited-time offers and unique product inclusions are designed to generate buzz and foster customer loyalty, encouraging consumers to return for more. By creating a sense of urgency and exclusivity through these special editions, Calbee drives immediate sales and builds anticipation for future releases, as seen in their consistent engagement with collectible-driven promotions throughout 2024 and into early 2025.

Public Relations and Corporate Messaging

Calbee's public relations strategy focuses on transparent communication through integrated reports and financial result disclosures. This approach effectively conveys their growth ambitions, sustainability commitments, and core corporate values to a broad stakeholder base.

The company emphasizes its dedication to product quality, the use of natural ingredients, and proactive environmental initiatives. These efforts are designed to cultivate a positive corporate image and foster deep trust with consumers, reinforcing long-term brand equity.

For instance, Calbee's commitment to sustainability is often highlighted in their annual reports. In their fiscal year ending March 2024, the company reported progress on reducing plastic packaging by 15% across key product lines, a tangible demonstration of their environmental focus that resonates with increasingly eco-conscious consumers.

- Integrated Reporting: Calbee publishes comprehensive integrated reports detailing financial performance alongside environmental, social, and governance (ESG) initiatives.

- Financial Transparency: Regular disclosure of financial results ensures stakeholders have up-to-date information on the company's performance and strategic direction.

- Sustainability Messaging: Highlighting commitments to natural ingredients and environmental protection builds trust and appeals to a values-driven consumer base.

- Brand Equity: Consistent and transparent communication directly contributes to strengthening Calbee's brand reputation and long-term market position.

Global Brand Recognition and Local Adaptation

Calbee is strategically enhancing its global brand recognition while meticulously tailoring its marketing efforts to resonate with diverse local tastes and preferences. This dual approach aims to solidify its Japanese heritage on the international stage and simultaneously foster deep connections with consumers in each market. By establishing a Marketing Direction Center (MDC), Calbee is centralizing its strategic planning, ensuring that marketing initiatives are optimized for overall business growth and that its global marketing talent is continuously developed.

To amplify its international presence, Calbee has designated five core brands—JagaRico, Jagabee, Frugra, Kappa-Ebisen, and Harvest Snaps—as its global flagship products. This focus is designed to cultivate stronger cross-regional collaboration and enable more responsive, agile marketing strategies. For instance, Harvest Snaps, a key product in the US market, has seen significant growth, contributing to Calbee's international revenue streams. In 2023, Calbee's overseas sales reached approximately ¥105.9 billion, a testament to its expanding global footprint and successful localization efforts.

- Global Brand Focus: JagaRico, Jagabee, Frugra, Kappa-Ebisen, and Harvest Snaps are prioritized for global expansion.

- MDC Establishment: A Marketing Direction Center is being formed to guide global strategy and talent development.

- Localization Strategy: Marketing approaches are adapted to local consumer preferences to maximize impact.

- Overseas Sales Growth: Calbee's international sales reached approximately ¥105.9 billion in 2023, indicating successful global market penetration.

Calbee's promotional efforts are multifaceted, blending digital engagement with tangible product incentives. Campaigns leveraging social media and giveaways, like trips to Japan, aim to boost consumer interaction and brand recall. Product-specific promotions, such as collectible player cards in Pro Baseball Chips, effectively target niche audiences and enhance perceived value.

These tactics create excitement and encourage repeat purchases, with limited-time offers and exclusive inclusions driving immediate sales and building anticipation for new releases. This strategy was evident throughout 2024 and into early 2025, as Calbee continued its focus on collectible-driven promotions.

Calbee also emphasizes public relations through transparent reporting, detailing financial performance and ESG initiatives. This communication strategy highlights their commitment to quality, natural ingredients, and environmental responsibility, fostering consumer trust and strengthening brand equity. For example, in fiscal year ending March 2024, Calbee reported a 15% reduction in plastic packaging across key product lines.

The company is strategically focusing on five global flagship brands: JagaRico, Jagabee, Frugra, Kappa-Ebisen, and Harvest Snaps. This international expansion is supported by a centralized Marketing Direction Center to optimize global strategies and talent. Calbee's overseas sales reached approximately ¥105.9 billion in 2023, demonstrating successful global market penetration and localization efforts.

| Key Promotional Tactic | Objective | Example Product/Initiative | Impact/Metric | Timeframe Focus |

|---|---|---|---|---|

| Digital Engagement & Giveaways | Boost consumer interaction, brand recall | Trips to Japan, product bundles | Increased social media engagement | Ongoing (e.g., 2024-2025) |

| Product-Specific Incentives | Target niche demographics, enhance value | Collectible player cards (Pro Baseball Chips) | Increased purchase intent | Ongoing (e.g., 2024-2025) |

| Public Relations & Transparency | Build trust, enhance brand equity | Integrated reports, sustainability messaging | 15% plastic packaging reduction (FY Mar 2024) | Ongoing |

| Global Brand Prioritization | Expand international presence | JagaRico, Jagabee, Frugra, Kappa-Ebisen, Harvest Snaps | ¥105.9 billion overseas sales (2023) | Ongoing |

Price

Calbee's pricing strategy is deeply intertwined with how consumers perceive the value of its snacks, focusing on enjoyable experiences and natural ingredients. This approach allows them to position their products as premium within the snack market.

In response to escalating costs, Calbee has strategically adjusted both prices and package volumes. For instance, in late 2023, they announced price hikes on several popular items, with some seeing an increase of around 5-10%, a move designed to offset rising raw material and energy expenses while carefully managing customer perception of value.

Despite these necessary price adjustments, a significant portion of Calbee's customer base continues to acknowledge the inherent value in their offerings. This loyalty suggests that the brand's commitment to quality ingredients and satisfying taste experiences resonates strongly, even when faced with higher price points.

Calbee actively manages its pricing strategy to counter economic headwinds and rising input expenses, notably for key ingredients like potatoes and palm oil. This adaptability is crucial for sustained profitability.

For instance, Calbee previously implemented price increases ranging from 5% to 20% on snacks and cereals in Japan. This strategic adjustment was a direct response to escalating operational costs, ensuring the company could maintain healthy profit margins in a challenging market environment.

Calbee navigates a fiercely competitive snack market where pricing is a critical lever. Competitor pricing and fluctuating market demand heavily influence their strategies, requiring a delicate balance between maintaining brand value and offering attractive price points. For instance, the global potato chip market, projected to reach $35.4 billion by 2027, showcases intense competition, pushing brands to optimize pricing.

Discounts and Promotional Pricing

Calbee employs a dynamic pricing strategy, balancing value with promotional tactics to boost sales. The company has demonstrated success in increasing sales volume following price and content adjustments, showcasing an adaptive approach to the market. This flexibility is key to maximizing revenue potential.

Calbee's promotional pricing aims to capture market share and encourage trial. For instance, in fiscal year 2024, Calbee reported a 3.6% increase in net sales, reaching ¥277.4 billion, partly attributed to effective sales promotions alongside product innovation. This suggests that strategic discounts can effectively drive consumer purchasing behavior.

- Sales Promotions: Calbee frequently uses sales promotions to drive immediate purchase intent.

- Volume Growth: The company has achieved higher sales volumes even after revising prices and product offerings.

- Price Flexibility: Calbee adapts its pricing to market conditions and promotional goals.

- Demand Stimulation: Discounts and promotions are key tools to stimulate demand for their snack products.

International Pricing Considerations

Calbee's international pricing strategy must account for varying economic conditions and consumer demands across different markets. As Calbee aims to boost its overseas sales, which represented 23.7% of its total net sales in fiscal year 2023, it strategically adjusts prices to align with local purchasing power, competitive pressures, and the costs associated with distribution channels in key regions like North America and China.

The company's commitment to international growth, evidenced by its investment in overseas manufacturing facilities and market development, directly influences its global pricing approach. For instance, in markets where Calbee faces intense competition from established local brands, pricing may be more aggressive to gain market share. Conversely, in regions with higher disposable incomes, premium pricing might be employed for specialized or innovative product offerings.

Key considerations for Calbee's international pricing include:

- Local Purchasing Power: Adjusting price points to match the economic capacity of consumers in target countries, ensuring affordability and market penetration.

- Competitive Landscape: Analyzing competitor pricing strategies to position Calbee products effectively and maintain a competitive edge.

- Distribution Costs: Factoring in logistics, tariffs, and retailer margins to determine a final price that is both profitable and appealing to consumers.

- Currency Fluctuations: Managing the impact of exchange rate volatility on import/export costs and overall pricing competitiveness.

Calbee's pricing strategy balances perceived value with cost realities, often employing price adjustments to offset rising input expenses. For example, in late 2023, they implemented price increases of 5-10% on select products to manage increased raw material and energy costs.

Despite these adjustments, Calbee maintains strong customer loyalty, indicating that their focus on quality ingredients and taste continues to justify the price points for many consumers. This customer trust is a key asset in their pricing decisions.

The company also utilizes promotional pricing to stimulate demand and capture market share, contributing to sales growth. In fiscal year 2024, Calbee reported net sales of ¥277.4 billion, a 3.6% increase, partly due to effective promotions alongside product innovation.

Internationally, Calbee tailors its pricing to local purchasing power, competitive landscapes, and distribution costs. With overseas sales accounting for 23.7% of total net sales in fiscal year 2023, strategic price adjustments are crucial for market penetration and profitability in diverse global markets.

| Pricing Tactic | Description | Impact/Example |

|---|---|---|

| Value-Based Pricing | Aligning prices with the perceived value of enjoyable experiences and natural ingredients. | Positions products as premium in the snack market. |

| Cost-Plus Adjustments | Increasing prices to offset rising raw material and energy costs. | Late 2023 price hikes of 5-10% on popular items. |

| Promotional Pricing | Using discounts and special offers to drive sales volume and market share. | Contributed to a 3.6% net sales increase in FY2024. |

| International Price Adaptation | Adjusting prices based on local economic conditions, competition, and distribution costs. | Overseas sales were 23.7% of total net sales in FY2023. |

4P's Marketing Mix Analysis Data Sources

Our Calbee 4P's Marketing Mix Analysis is built on a foundation of verifiable data, including Calbee's official financial reports, investor relations materials, and detailed product information from their corporate website. We also incorporate insights from reputable industry publications and e-commerce platforms to ensure a comprehensive view of their market presence.