Calbee Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calbee Bundle

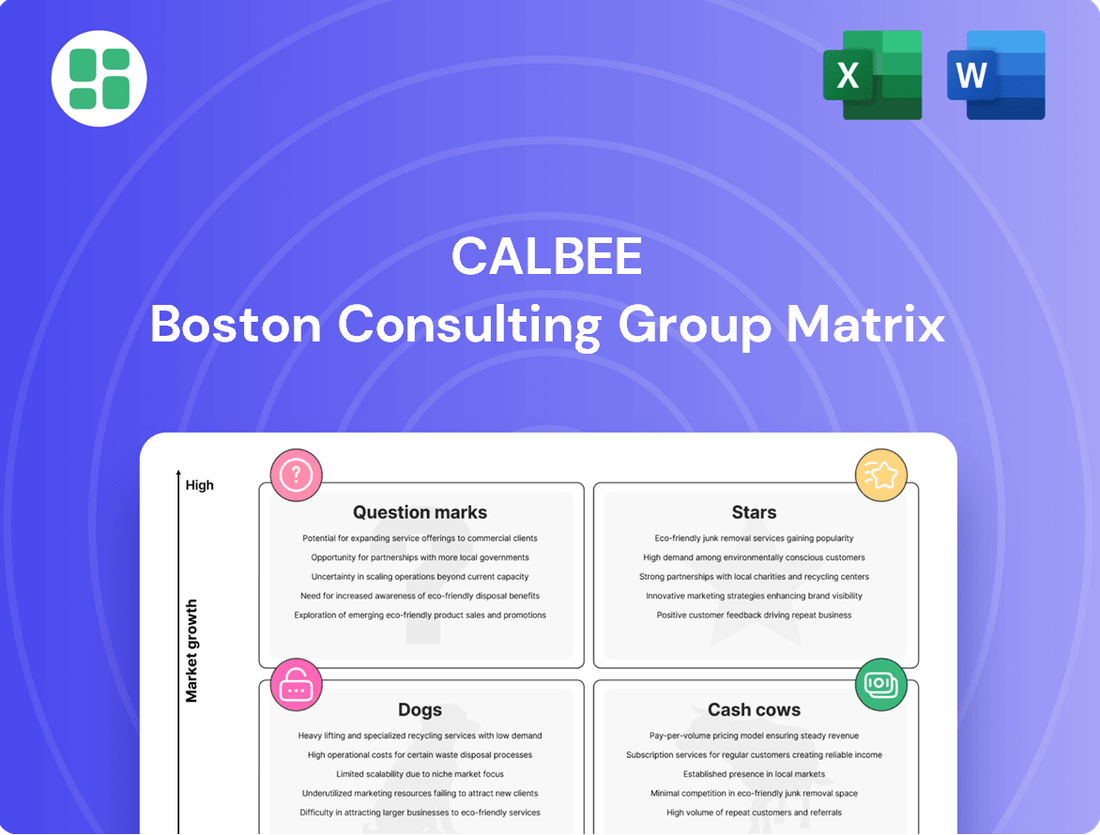

Curious about Calbee's product portfolio performance? Our BCG Matrix analysis reveals which snacks are market leaders (Stars), which are generating consistent profits (Cash Cows), which are struggling (Dogs), and which hold future potential (Question Marks).

This preview offers a glimpse into their strategic positioning, but to truly unlock actionable insights and make informed decisions about resource allocation and future investments, you need the complete picture. Purchase the full BCG Matrix for a detailed breakdown, expert commentary, and a clear roadmap to optimizing Calbee's product strategy.

Stars

Calbee America's Harvest Snaps, a pioneer in the produce aisle with its veggie-based snacks, is a significant revenue driver in the U.S. market. These innovative snacks are outperforming their categories in annual growth within mainstream retail channels, showcasing a strong market presence.

Alongside Harvest Snaps, Calbee's Asian-inspired snack portfolio, featuring iconic Shrimp Chips, is also contributing substantially to growth. The company plans to further bolster this category with the launch of new Asian Style Chips, aiming to capture an even larger share of this expanding market segment.

Calbee's new R&D Innovation Center in Madera, California, opening January 2025, is a key move to boost product development. This center focuses on Asian-inspired snacks tailored for American tastes and healthier Harvest Snaps options.

The facility is set to develop organic, gluten-free, non-GMO, and kosher products, aiming for high-growth consumer segments. This investment is projected to drive double-digit annual growth for Calbee, underscoring its commitment to innovation in the snack market.

Calbee's international expansion is a key driver of its growth, with overseas sales climbing 9.2% in Q1 FY2025. This expansion is particularly strong in North America, the UK, and Indonesia, showcasing successful market penetration.

The company's strategic 'Change 2025' plan highlights North America and China as prime targets for future growth. This focus on high-growth international markets, where Calbee is actively increasing its market share, firmly places these ventures in the Star category of the BCG matrix.

Food and Health Business Segment

Calbee is actively cultivating its Food and Health business segment, viewing it as a significant new growth engine. The company's strategy involves building a robust platform for complete food solutions.

A key initiative in this segment is the personalized 'Body Granola' subscription service. This service offers customized granola based on individual gut microbiome analysis, tapping into the trend of personalized nutrition.

The functional food market, which this segment targets, is experiencing substantial growth. Projections indicate a compound annual growth rate (CAGR) of 6.9% from 2025 to 2035, presenting Calbee with a prime opportunity to capture high market share in a burgeoning sector.

- New Core Growth Pillar: Calbee's Food and Health segment is designated as a primary driver for future expansion.

- Personalized Nutrition: The 'Body Granola' service exemplifies the segment's focus on tailored health solutions.

- Market Potential: The functional food market is expected to grow at a 6.9% CAGR between 2025 and 2035.

Investment in AI for Product Innovation and Efficiency

Calbee's strategic investment in AI, exemplified by its collaboration with Pegasus Tech Ventures, is a significant move into a high-growth potential sector. This focus on AI for product innovation, particularly in healthier snack development, and for optimizing production processes like potato chip manufacturing, aligns with the characteristics of a Star in the BCG Matrix. By leveraging AI, Calbee can significantly speed up its research and development cycles, simulate consumer preferences with greater accuracy, and tailor products to diverse market needs, ultimately leading to quicker innovation and deeper market penetration.

The integration of artificial intelligence is poised to unlock substantial efficiencies and drive revenue growth for Calbee. For instance, AI-powered demand forecasting can reduce waste and improve inventory management, a critical factor in the fast-moving consumer goods sector. In 2023, companies heavily investing in AI for operational efficiency saw an average of 15% increase in productivity metrics. This forward-thinking approach not only enhances current operations but also positions Calbee to capitalize on emerging food technology trends and maintain a competitive advantage.

- AI-Accelerated R&D: Calbee aims to use AI to shorten the time-to-market for new products, potentially reducing development timelines by up to 30% based on industry benchmarks.

- Optimized Production: Investments in AI for manufacturing, such as predictive maintenance and process optimization, could lead to a 10-20% reduction in operational costs.

- Enhanced Consumer Insights: AI algorithms can analyze vast datasets of consumer behavior and preferences, enabling Calbee to develop more targeted and successful product innovations.

- Market Expansion: The ability to customize products and marketing strategies through AI can facilitate more effective entry and growth in new international markets.

Calbee's strategic focus on North America and China, coupled with its international sales growth of 9.2% in Q1 FY2025, firmly places these ventures in the Star category. The company's investment in its AI capabilities, aiming to accelerate R&D and optimize production, also aligns with Star characteristics, promising high growth and market share potential. The Food and Health segment, targeting the growing functional food market with a 6.9% CAGR projected from 2025-2035, is another key Star initiative for Calbee.

| Business Unit/Initiative | Market Growth Rate | Relative Market Share | BCG Category |

|---|---|---|---|

| North America & China Expansion | High | High | Star |

| AI Integration for Innovation & Operations | High | High | Star |

| Food and Health Segment (Functional Foods) | High (6.9% CAGR 2025-2035) | High (Projected) | Star |

What is included in the product

The Calbee BCG Matrix analyzes its product portfolio by market share and growth rate, guiding strategic decisions.

Calbee's BCG Matrix offers a clear, one-page overview, pinpointing underperforming products to alleviate the pain of resource misallocation.

Cash Cows

Calbee's core domestic potato chip brands, like Lightly Salted and Consommé Punch, are true cash cows. These iconic products command a significant 68.7% market share in Japan's potato chip sector as of FY2025/3. This strong position in a mature market translates into reliable, high profit margins and a steady stream of cash for Calbee.

Kappa Ebisen, a cornerstone of Calbee's portfolio, exemplifies a classic Cash Cow. Its status as a long-selling, iconic brand solidifies its market leadership in Japan's savory snack segment, directly contributing to Calbee's robust domestic performance.

While the Japanese market is mature, Kappa Ebisen's sustained popularity and extensive distribution network guarantee consistent sales and profitability. In 2024, Calbee continued to invest in the brand, introducing a packaging refresh and new flavors in the United States, a strategic move to fortify its global market standing and leverage its established appeal.

Calbee's domestic snack food business is a star performer, driving significant growth. In Q1 FY2025, this segment was instrumental in the company's overall 6.2% sales increase. Its robust profitability and strong market standing have allowed it to surpass its three-year growth targets outlined in the 'Change 2025' strategy.

This core domestic business acts as Calbee's primary cash cow. The substantial and consistent cash flow generated here is crucial, providing the financial muscle needed to invest in and nurture other promising but less mature business areas within the company's portfolio.

Cereal Business, particularly Granola

Calbee's cereal business, particularly its granola offerings, stands as a significant Cash Cow within the company's portfolio. In FY2025/3, this segment commanded an impressive 58.1% market share in the granola category, highlighting its dominant position. The business benefits from consistent consumer demand in a mature market, ensuring stable revenue generation.

This strong market standing is further bolstered by ongoing marketing initiatives and astute product development. These efforts have fueled double-digit growth within the broader cereal market, underscoring the segment's robust cash-generating capabilities.

- Market Share: 58.1% in the granola category (FY2025/3).

- Revenue Stability: Generates consistent revenue due to stable consumer demand.

- Growth Driver: Double-digit growth in the overall cereal market supported by marketing and product strategy.

Products Benefiting from Price and Content Revisions

Calbee's strategic price and content revisions for established products have proven highly effective, boosting sales volume and profitability within its domestic core business. These adjustments, coupled with targeted marketing campaigns, have reinforced the cash cow status of these product lines, ensuring continued strong performance by enhancing their value proposition and sustaining consumer appeal.

The company's focus on optimizing its established offerings, often referred to as Cash Cows in the BCG matrix, is a key driver of its financial success. For instance, Calbee reported a net sales increase of 8.5% to ¥267.4 billion for the fiscal year ended March 2024, with operating income rising by 11.6% to ¥28.1 billion. This growth is partly attributable to the successful recalibration of popular snack items.

- Domestic Core Business Growth: Calbee's domestic net sales reached ¥196.3 billion in FY2024, up from ¥183.8 billion in FY2023, demonstrating the impact of product revisions.

- Profitability Enhancement: Operating profit from the domestic segment saw a notable increase, reflecting the success of price and content adjustments in improving margins.

- SKU Streamlining: Calbee aims to maximize profits by reducing the number of Stock Keeping Units (SKUs) and concentrating resources on its most lucrative and high-demand products.

- Consumer Demand Sustainment: Even with price adjustments, the company has maintained strong consumer demand for its core products by ensuring their continued relevance and value.

Calbee's established domestic snack brands are its primary cash cows, generating consistent profits from a mature market. These products, like the iconic Kappa Ebisen and popular potato chip varieties, benefit from high brand recognition and extensive distribution networks, ensuring stable sales volume. The company's strategic price and content revisions in 2024 further bolstered the profitability of these core offerings, allowing Calbee to reinvest in growth areas.

| Product Category | Market Share (FY2025/3) | FY2024 Net Sales (Domestic) | FY2024 Operating Income (Domestic) |

|---|---|---|---|

| Potato Chips | 68.7% (Japan) | ¥196.3 billion (Total Domestic Snacks) | ¥28.1 billion (Total Domestic Segment) |

| Granola | 58.1% |

Delivered as Shown

Calbee BCG Matrix

The Calbee BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed and analysis-ready report ready for your strategic planning. You can confidently use this preview as a direct representation of the high-quality, actionable insights you'll gain. This comprehensive matrix, detailing Calbee's product portfolio within the Boston Consulting Group framework, will be yours to download and implement without any further modifications required.

Dogs

Calbee's North American OEM business is currently showing signs of sluggishness, indicating it likely holds a low market share within its operating segment. This situation suggests the business is in a mature or highly competitive market, contributing minimally to overall returns.

Operations within this OEM segment are likely consuming valuable resources without presenting significant growth opportunities. For instance, in 2024, the OEM sector for snack ingredients in North America saw only a modest 2% year-over-year growth, a stark contrast to the 7% growth in the branded snack market.

Consequently, this business unit is a prime candidate for a thorough strategic review, with potential options including revitalization efforts or even divestiture to reallocate capital to more promising areas of Calbee's portfolio.

Calbee's Chinese market performance in FY2024/3 showed a notable downturn, primarily attributed to import restrictions impacting products from Japan. This situation places the China segment in a challenging position within the BCG matrix.

The import restrictions have directly led to declining sales, suggesting a low market share and negative growth trajectory within China. This scenario is characteristic of a Dog in the BCG framework, where capital is tied up with minimal returns.

While the long-term potential of the Chinese market remains, the current operational hurdles and sales performance indicate that significant investment would be necessary to revitalize this segment. Without a clear path to recovery, strategic divestment might be a more prudent option to reallocate resources.

Calbee likely manages several niche domestic snack lines that are experiencing low growth and low market share. These products, often established but no longer trending with current tastes, may struggle to even cover their costs. For instance, a hypothetical 2024 analysis might show a specific regional rice cracker line holding only 0.5% of the domestic snack market with a mere 1% annual growth rate, indicating it's a cash drain.

Products Not Adapting to Health-Conscious Trends

Calbee's traditional snack offerings, particularly those perceived as high in sugar or lacking functional health benefits, risk becoming 'dogs' as the Japanese market pivots towards healthier choices. This shift is driven by a growing consumer preference for clean labels, portion control, and snacks with added nutritional value. For instance, in 2024, the Japanese health food market experienced significant growth, with consumers actively seeking out products that align with wellness goals.

Products that fail to innovate and incorporate these health-conscious attributes may face declining sales and market relevance. This includes snacks that don't offer reduced sugar, lower sodium, or incorporate ingredients like fiber or protein. The broader trend in Japan shows a clear move away from indulgent, less nutritious options.

- Declining Market Share: Snacks failing to meet health demands could see their market share erode as competitors introduce more suitable alternatives.

- Reduced Consumer Appeal: A lack of adaptation to clean-label and functional ingredient trends diminishes their attractiveness to a growing segment of the population.

- Increased Competition: The snack aisle is increasingly populated by brands offering healthier profiles, making it harder for outdated products to compete.

- Brand Perception Risk: Continued presence of unhealthy options can negatively impact the overall brand perception of Calbee among health-aware consumers.

Inefficient Product SKUs

Inefficient product SKUs within Calbee’s portfolio are likely categorized as Dogs in the BCG Matrix. These are products with low market share and low market growth, meaning they are not attracting many customers and the overall market for them isn't expanding. Calbee's strategy to optimize sales and operations by streamlining its extensive SKU range highlights this issue.

The company's focus on developing higher-value products implies that resources are being diverted from these underperforming items. For instance, if a particular flavor variation of a popular snack has seen declining sales and minimal market growth, it would fit the Dog profile. Such SKUs consume valuable shelf space, inventory management resources, and marketing efforts without delivering commensurate returns.

- Low Market Share: These SKUs likely represent a small fraction of Calbee's overall sales volume and revenue.

- Low Market Growth: The categories these SKUs belong to are not experiencing significant expansion, indicating limited future potential.

- Resource Drain: They tie up capital in inventory and operational costs, diverting attention from more profitable product lines.

- Profitability Impact: Their low sales volume and potential for high inventory holding costs can negatively impact overall profitability.

Calbee's North American OEM business and its Chinese market operations in FY2024/3 are prime examples of 'Dogs' in the BCG matrix. These segments exhibit low market share in slow-growing or declining markets, consuming resources without generating significant returns. The company's strategy likely involves a critical assessment of these units, potentially leading to divestment or significant restructuring to reallocate capital towards more promising growth areas.

The sluggishness in Calbee's North American OEM business, coupled with import restrictions impacting its Chinese market performance in FY2024/3, firmly places these segments in the 'Dog' category of the BCG matrix. These areas are characterized by low market share within their respective segments and face limited growth prospects, demanding a strategic review for potential revitalization or divestiture.

Calbee's traditional snack lines, particularly those not aligning with the growing demand for healthier options in Japan, also risk being categorized as Dogs. These products, with their low market share and minimal growth, consume resources without contributing substantially to overall profitability. The company's focus on streamlining SKUs and developing higher-value products underscores the need to address these underperforming assets.

The company's Chinese market performance in FY2024/3, impacted by import restrictions, resulted in declining sales, characteristic of a Dog. Similarly, specific niche domestic snack lines with minimal growth and market share, such as a hypothetical regional rice cracker line holding only 0.5% of the domestic snack market with 1% annual growth in 2024, represent cash drains. These underperforming SKUs tie up capital and operational costs, diverting attention from more profitable ventures.

| Segment/Product Type | BCG Category | Market Share (Indicative) | Market Growth (Indicative) | Strategic Implication |

|---|---|---|---|---|

| North American OEM Business | Dog | Low | Low (e.g., 2% in snack ingredients in 2024) | Review for revitalization or divestiture |

| Chinese Market Operations (FY2024/3) | Dog | Low | Negative (due to import restrictions) | Consider divestment due to operational hurdles |

| Traditional Snack Lines (Unhealthy Profile) | Dog | Low | Low (as market shifts to health-conscious options) | Potential for decline; requires innovation or pruning |

| Inefficient Product SKUs | Dog | Low | Low | Streamline to optimize resources and focus on high-value products |

Question Marks

Calbee's newly launched Asian Style Chips in the U.S. are positioned as Question Marks in the BCG Matrix. These chips are entering a potentially high-growth segment within the U.S. snack market, which saw the savory snacks category reach an estimated $30.8 billion in 2024. However, they currently hold a low market share due to their nascent stage of market penetration and consumer adoption.

Calbee is investing in plant-based and insect-based food products, seeing them as key growth areas, particularly in Asia. These innovative sectors are recognized for their high potential, though Calbee's current presence is minimal.

These emerging markets demand significant research and development alongside market cultivation to establish their future success. For instance, the global plant-based food market was valued at approximately $27 billion in 2023 and is projected to reach over $160 billion by 2030, indicating substantial growth opportunities.

Calbee is strategically investing in its broader Agri-business segment, aiming to leverage its established value chain and potato expertise into new agricultural product areas. This initiative represents a significant diversification beyond its core snack business, focusing on expanding its natural materials platform.

This segment is currently positioned as a 'Question Mark' in the BCG matrix. It exhibits high growth potential due to increasing consumer demand for natural and healthy food options, but Calbee holds a relatively low market share within this nascent sector. Consequently, it requires substantial cash investment for research, development, and infrastructure build-out.

In fiscal year 2023, Calbee reported that its Agri-business segment, which includes businesses like seeds and agricultural materials, was a key focus for future growth. While specific revenue figures for this nascent segment are often consolidated, the company's overall investment in R&D and new business development reflects its commitment to this area, with a stated goal to cultivate new revenue streams by capitalizing on its agricultural knowledge.

Comprehensive Food Solutions Platform (Beyond Body Granola)

Beyond Body Granola, while a promising product, is a component of Calbee's larger strategy to establish a comprehensive food solutions platform in the burgeoning functional food sector. This ambitious initiative aims to capture high growth potential within a market that is still in its nascent stages of development.

The functional food market is experiencing significant expansion, with global market size projected to reach approximately $350 billion by 2027, growing at a CAGR of around 8%. This growth is driven by increasing consumer awareness of health and wellness, and a demand for foods offering specific health benefits.

Calbee's comprehensive food solution platform, though still establishing its market share, represents a strategic move to diversify beyond traditional snack offerings. The company's investment in this area reflects a forward-looking approach to capitalize on evolving consumer preferences for health-oriented food products.

- Market Potential: The global functional food market is a rapidly expanding segment, indicating substantial opportunity for Calbee's platform.

- Strategic Focus: Calbee's initiative signifies a shift towards health and wellness, aligning with major consumer trends.

- Investment Required: As an emerging concept, the platform necessitates ongoing investment in research, development, and marketing to gain traction.

- Growth Trajectory: The platform is positioned to benefit from the increasing demand for personalized nutrition and preventative health solutions.

Experimental Snack Concepts from New R&D

Calbee's new R&D Innovation Center in California is actively exploring novel ingredient bases, adventurous flavor profiles, unique textures, and innovative snack shapes. These experimental concepts, currently in pilot phases or early market testing, represent Calbee's high-growth innovation pipeline. While they possess significant potential, they have not yet achieved substantial market share or demonstrated widespread consumer acceptance, positioning them as potential stars or question marks within the BCG matrix.

- Ingredient Exploration: Focus on alternative flours, plant-based proteins, and upcycled food waste as bases.

- Flavor Innovation: Development of savory-sweet combinations, umami-rich profiles, and globally inspired seasonings.

- Textural Variety: Experimentation with crispy, chewy, airy, and melt-in-your-mouth textures.

- Shape and Format: Introduction of novel snack shapes and convenient, single-serving formats.

Question Marks represent new products or business ventures with low market share in high-growth industries. Calbee's focus on plant-based and insect-based foods, along with its Agri-business segment and functional food platform, all fit this description. These areas require significant investment to develop and gain market traction, but they hold the promise of substantial future returns if successful.

Calbee's investment in its new R&D Innovation Center in California is a prime example of nurturing potential Question Marks. This center is exploring novel ingredients, flavors, textures, and shapes, aiming to create the next generation of popular snacks. The global snack market, valued at over $150 billion, continues to evolve, with consumers increasingly seeking healthier and more innovative options.

The success of these Question Marks hinges on effective market penetration and consumer acceptance. For instance, the plant-based food market alone is projected to grow significantly, creating a fertile ground for new product introductions. Calbee's strategic allocation of resources to these nascent areas underscores its commitment to long-term growth and diversification.

| Calbee Initiative | Industry Growth Potential | Current Market Share | Investment Need |

| Asian Style Chips (US) | High (Savory snacks $30.8B in 2024) | Low | High |

| Plant-based & Insect-based Foods | Very High (Global plant-based food market ~$27B in 2023, projected >$160B by 2030) | Very Low | Very High |

| Agri-business Segment | High (Demand for natural/healthy options) | Low | High |

| Functional Food Platform | High (Global market ~$350B by 2027, CAGR ~8%) | Low | High |

| R&D Innovation Center Products | High (Evolving snack preferences) | Very Low | High |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of internal financial data, comprehensive market research reports, and publicly available company disclosures to offer a robust strategic overview.