Calbee Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calbee Bundle

Calbee's competitive landscape is shaped by intense rivalry, the bargaining power of buyers, and the constant threat of new entrants and substitutes. Understanding these forces is crucial for navigating the snack food industry.

The complete report reveals the real forces shaping Calbee’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration for Calbee, a major snack producer, is generally low on a global scale. While Calbee utilizes significant volumes of key ingredients like potatoes and wheat, the vastness of global agricultural output means no single supplier can dictate terms. For instance, in 2024, global potato production exceeded 370 million metric tons, making it difficult for any one farm to hold substantial power over a large buyer like Calbee.

Calbee's switching costs for basic potato varieties are likely minimal, as numerous suppliers can offer comparable quality and pricing. This suggests low bargaining power for suppliers of these generic inputs.

However, for specialized ingredients or proprietary formulations, Calbee faces higher switching costs. These costs stem from ensuring quality consistency, reconfiguring logistics, and potentially investing in new research and development for alternative supplier inputs.

Calbee's commitment to natural ingredients and unique production methods may foster deeper ties with specific, high-quality suppliers, thereby increasing the cost and complexity of switching away from them.

The availability of substitute inputs significantly curtails supplier bargaining power. For Calbee, this means that if the price of a specific type of potato escalates, they can pivot to using different potato varieties or even shift production towards snacks that utilize grains like rice or corn. This flexibility in sourcing raw materials, such as the diverse range of potatoes and grains available globally, prevents any single supplier from dictating terms.

Supplier's Importance to Calbee

Suppliers are undeniably critical to Calbee's operations, providing the raw materials essential for its snack and food products. However, Calbee's substantial purchasing volume often positions it as a key client for many agricultural suppliers, which can create a degree of reciprocal dependence and help to moderate supplier power.

Calbee's strategic focus on supply chain optimization, as outlined in its 'Change 2025' plan, demonstrates a commitment to enhancing efficiency from procurement through to delivery. This proactive management of supplier relationships is designed to ensure consistent quality and availability of raw materials.

- Calbee's 'Change 2025' Strategy: Focuses on optimizing the entire supply chain, from raw material sourcing to final product delivery.

- Supplier Dependency: Calbee relies on a consistent supply of agricultural products like potatoes, corn, and wheat.

- Bargaining Power Dynamics: While suppliers are vital, Calbee's large-scale procurement can give it leverage in negotiations.

- Supply Chain Resilience: Efforts are underway to build a more robust and efficient supply network to mitigate risks.

Threat of Forward Integration by Suppliers

The threat of suppliers forward integrating into snack food manufacturing, thereby becoming competitors, is very low for Calbee.

Agricultural suppliers, the primary source of raw materials like potatoes and corn for Calbee, typically lack the substantial capital, sophisticated manufacturing capabilities, established distribution channels, and extensive marketing expertise needed to enter the highly competitive snack food market. For instance, establishing a snack food production facility comparable to Calbee's would require investments in the tens or hundreds of millions of dollars, a significant barrier for most raw material producers.

This inability of suppliers to effectively move into Calbee's business space significantly diminishes their bargaining power. Calbee, in 2024, continues to benefit from this dynamic, as its scale and operational complexity create a high barrier to entry for its raw material providers.

- Low Likelihood of Supplier Forward Integration: Agricultural suppliers typically lack the capital, brand recognition, and distribution networks essential for snack food production.

- High Barriers to Entry in Snack Food Manufacturing: The complexity of production, marketing, and distribution in the snack industry presents a formidable challenge for raw material providers.

- Reduced Supplier Bargaining Power: The low threat of forward integration means suppliers have less leverage to dictate terms to large players like Calbee.

The bargaining power of Calbee's suppliers is generally low, particularly for common agricultural inputs like potatoes and wheat, due to the vast global supply and Calbee's significant purchasing volume. While switching costs for basic ingredients are minimal, specialized or proprietary inputs can increase these costs, giving those specific suppliers more leverage. The threat of suppliers moving into Calbee's snack manufacturing business is negligible given the high capital and expertise required.

| Factor | Assessment for Calbee | Impact on Bargaining Power |

|---|---|---|

| Supplier Concentration | Low globally for agricultural inputs. | Low |

| Switching Costs (Basic Ingredients) | Minimal for standard potato varieties. | Low |

| Switching Costs (Specialized Ingredients) | Higher due to quality, logistics, R&D. | Moderate |

| Availability of Substitutes | High for various potato types and grains. | Low |

| Threat of Forward Integration | Very low for agricultural suppliers. | Low |

What is included in the product

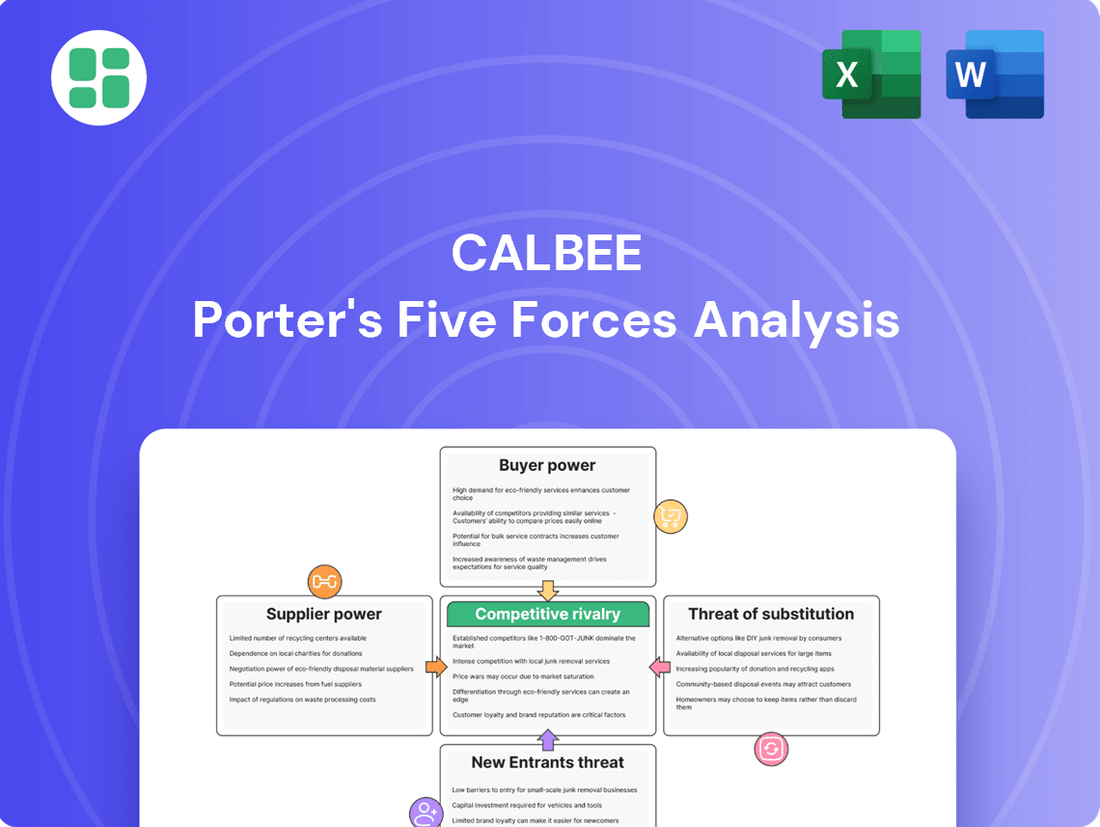

Calbee's Porter's Five Forces analysis details the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes within the snack food industry.

Quickly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Customer price sensitivity is a significant factor for Calbee. In the snack food industry, especially for everyday items, consumers tend to be quite aware of prices and will often choose the most affordable option. This is particularly true when there are many similar products available, making price a key battleground for market share.

Calbee faces this reality as they compete in a crowded snack market. For instance, in 2024, the global snack market was valued at over $170 billion, with a substantial portion driven by price-conscious consumers. This means that even small price increases can lead customers to switch to competitors.

However, the situation isn't uniform across all Calbee products. For their more premium or unique offerings, like specialty potato chips or innovative flavor combinations, customers may show less concern about the price. In these cases, factors like superior taste, perceived quality, and established brand loyalty can outweigh a slightly higher cost, allowing Calbee to command a premium.

The snack market is incredibly crowded, offering consumers a dizzying array of choices. Think about it: beyond Calbee's potato chips, there are countless other brands, plus crackers, sweets, and even healthier options like fruit and nuts readily available. This sheer volume of alternatives means customers hold a lot of sway.

If Calbee's offerings aren't hitting the mark on price, flavor, or even perceived health benefits, consumers can effortlessly pivot to a competitor. For instance, in 2024, the global snack market was valued at over $170 billion, with a significant portion driven by impulse purchases where price and immediate satisfaction are key factors. This competitive landscape directly amplifies customer bargaining power.

Customers today wield significant power due to readily available information about product ingredients, nutritional content, and pricing. This transparency extends across both physical stores and online platforms, allowing for easy comparison between Calbee and its competitors. For instance, in 2024, consumer spending on healthy snacks, a key segment for Calbee, continued to rise, with reports indicating a 7% year-over-year increase in this category.

Online reviews and social media are powerful tools that amplify customer voices, enabling them to share experiences and critique products. This collective feedback increases market transparency, directly impacting their ability to negotiate better terms or switch to alternatives. Calbee's strategic emphasis on natural ingredients and healthier options resonates well with this trend, as consumers actively seek out brands that align with their informed preferences.

Customer Concentration and Loyalty Programs

While individual consumers of Calbee products are highly fragmented, the company faces significant bargaining power from large retail chains. These major distributors, such as supermarkets and convenience stores, wield influence over shelf space allocation, pricing negotiations, and the terms of promotional activities, impacting Calbee's market access and profitability. For example, in 2024, major grocery retailers in Japan, where Calbee holds a substantial market share, continued to exert pressure on suppliers for favorable terms, a trend that is expected to persist.

Calbee is actively working to mitigate this retailer-driven bargaining power by fostering direct customer relationships. Initiatives like 'fan marketing' and collaborative business ventures aim to build brand loyalty and create a more direct connection with end consumers. This strategy is designed to reduce Calbee's sole reliance on the distribution channels controlled by large retailers, thereby strengthening its overall market position.

Calbee’s efforts to enhance customer loyalty are crucial for several reasons:

- Reduced Dependence on Retailer Terms: By cultivating a loyal customer base, Calbee can lessen its vulnerability to the pricing and promotional demands of large retail partners.

- Direct Feedback Loop: Direct engagement allows Calbee to gather valuable consumer insights, informing product development and marketing strategies more effectively.

- Brand Equity Enhancement: Strong fan engagement contributes to a more robust brand image, which can translate into greater pricing power and resilience against competitive pressures.

Threat of Backward Integration by Customers

The threat of customers, whether individual consumers or large retailers, engaging in backward integration to produce snacks themselves is largely insignificant for Calbee. The substantial capital outlay, intricate manufacturing processes, and complex supply chain management inherent in snack production present formidable barriers to entry for most customers.

While large retail chains might introduce private label snack brands, this strategy typically represents a competitive challenge rather than genuine backward integration. For instance, in 2024, the global snack market was valued at over $160 billion, with significant investment required in specialized equipment and quality control to compete effectively.

- High Capital Investment: Establishing snack production facilities requires millions in machinery, R&D, and facility upkeep.

- Manufacturing Complexity: Snack production involves precise ingredient sourcing, mixing, baking/frying, and packaging, demanding specialized expertise.

- Supply Chain Management: Securing consistent, high-quality raw materials and managing distribution networks are critical, complex undertakings.

- Private Labels vs. Backward Integration: Retailer private labels aim to capture margin and shelf space, not replicate the core competencies of established snack manufacturers like Calbee.

Calbee faces considerable customer bargaining power, primarily from large retail chains that control shelf space and pricing negotiations. Individual consumers also exert influence through price sensitivity and readily available information, though this is somewhat mitigated by brand loyalty for premium products. The threat of backward integration by customers is minimal due to high production costs and complexity.

| Factor | Impact on Calbee | Mitigation Strategies |

|---|---|---|

| Price Sensitivity of Individual Consumers | High for mass-market snacks; lower for premium/unique offerings. | Focus on perceived value, quality, and flavor differentiation. |

| Bargaining Power of Retailers | Significant due to control over distribution channels and negotiations. | Develop direct customer relationships, build brand loyalty. |

| Availability of Substitutes | High in the crowded snack market. | Product innovation, distinct branding, and marketing. |

| Customer Information Access | Increased transparency on pricing and ingredients. | Emphasize natural ingredients and health benefits. |

| Threat of Backward Integration | Very Low due to high capital and expertise requirements. | N/A (inherent barrier). |

What You See Is What You Get

Calbee Porter's Five Forces Analysis

This preview showcases the complete Calbee Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the snack food industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

The snack food industry, both in Japan and worldwide, is incredibly fragmented. This means Calbee doesn't just contend with a few big names; it faces a vast array of competitors. These range from global powerhouses like PepsiCo, whose Frito-Lay division is a major player, and Kellogg's, to a multitude of smaller local and regional companies that cater to specific tastes and demographics.

This crowded landscape creates significant pressure on Calbee. The constant influx of new products and marketing efforts from rivals means Calbee must continually innovate and adjust its pricing strategies to maintain its market share. For instance, in 2023, the global snack market was valued at over $164 billion, highlighting the sheer scale and competitive intensity Calbee operates within.

The Japanese snack market is anticipated to see a compound annual growth rate (CAGR) of approximately 3% to 4.1% between 2025 and 2030. This contrasts with the global snack food market, which is projected to expand at a more robust rate of around 6.4% annually. This disparity in growth rates means that companies like Calbee, operating within Japan, face a more competitive environment where market share gains are harder to achieve through simple market expansion.

Calbee enjoys strong brand recognition in Japan, particularly for its potato chips and Kappa Ebisen snacks, holding a significant market share. However, the snack industry's nature means product differentiation can be short-lived, as flavors and textures are relatively easy to imitate by competitors.

To counter this, Calbee is investing in innovation and emphasizing natural ingredients. The company's commitment is evident in its establishment of new research and development centers, aiming to continuously differentiate its offerings and cultivate lasting brand loyalty among consumers.

Switching Costs for Customers

Switching costs for consumers in the snack industry are remarkably low, meaning customers can easily opt for a different brand or type of snack with their next purchase. This ease of switching directly fuels intense competitive rivalry, compelling companies like Calbee to consistently invest in innovation, marketing, and value-added offerings to keep consumers engaged. For instance, in 2024, the global snack market, valued at over $160 billion, saw numerous new product launches, highlighting the pressure to differentiate in a low-switching-cost environment.

This dynamic forces snack manufacturers to focus on building brand loyalty through various strategies, as customers are not locked into specific products. Calbee's efforts in product development and promotional campaigns are crucial for maintaining market share. The average consumer in major markets like the US and Japan might try 3-4 different snack brands within a year, demonstrating the fluid nature of consumer preference when switching costs are minimal.

- Low Consumer Switching Costs: Consumers can readily switch between snack brands due to minimal financial or psychological barriers.

- Impact on Rivalry: This low switching cost intensifies competition, forcing companies to constantly innovate and offer compelling value propositions.

- Calbee's Strategic Imperative: Continuous product development, effective marketing, and value creation are essential for Calbee to retain its customer base in this environment.

Exit Barriers

Exit barriers in the snack manufacturing sector, including specialized production equipment and deeply entrenched supply networks, are moderately high. This can lead companies to persist in the market even when profits are slim, intensifying competition.

Calbee, for instance, has invested heavily in its manufacturing capabilities and distribution channels over its long operational history. These significant sunk costs make it difficult and costly for the company to withdraw from the market, even if current performance is suboptimal.

- Specialized Assets: Snack production often requires dedicated machinery that has limited alternative uses, creating a barrier to exiting the industry.

- Supply Chain Integration: Established relationships with suppliers and distributors represent significant investments that are hard to replicate or abandon.

- Brand Equity: Years of marketing and brand building result in substantial intangible assets that are difficult to recover upon exit.

- Calbee's Investments: Calbee's extensive factory network and long-standing brand recognition in Japan, a market where they hold a significant share, exemplify these high exit barriers.

The snack food industry is characterized by intense competition, with numerous players vying for consumer attention. Calbee faces pressure from global giants like PepsiCo and Kellogg's, as well as a multitude of smaller, agile competitors. This fragmented landscape, coupled with low consumer switching costs, necessitates continuous innovation and aggressive marketing from Calbee to maintain its market position.

In 2024, the global snack market was valued at over $160 billion, a testament to the industry's scale and the fierce rivalry within it. Calbee's strong brand presence in Japan, particularly for its potato chips, provides a solid foundation, but the ease with which consumers can try new products means differentiation is a constant challenge. The company's investment in R&D and natural ingredients is a strategic response to this dynamic.

The Japanese snack market, projected to grow at 3%-4.1% CAGR from 2025-2030, offers less room for expansion compared to the global market's 6.4% projected annual growth. This slower domestic growth further amplifies the competitive rivalry for Calbee, making market share gains harder to achieve through market expansion alone.

Calbee's significant investments in manufacturing and distribution, along with its established brand equity, create moderately high exit barriers. This means that even struggling competitors may remain in the market, contributing to sustained competitive pressure.

| Competitor Type | Market Share Impact | Calbee's Response |

| Global Snack Giants (e.g., PepsiCo, Kellogg's) | Significant, due to scale and resources | Focus on product differentiation, innovation, and brand loyalty |

| Local & Regional Competitors | Can capture niche markets and specific consumer preferences | Agile product development, localized marketing, and leveraging strong domestic brand recognition |

| New Entrants | Can disrupt the market with novel products or business models | Continuous R&D investment, strong supply chain management, and proactive marketing campaigns |

SSubstitutes Threaten

The threat of substitute products for Calbee is significant. Consumers have a vast array of alternative snacking options, ranging from confectionery and bakery items to healthier choices like fresh fruits and yogurt. In 2024, the global snack market continued to see a surge in demand for healthier options, with plant-based snacks alone projected to reach over $30 billion by 2026, indicating a strong availability of alternatives that compete on both price and perceived health benefits.

The threat of substitutes for Calbee's savory snacks is significant due to their widespread availability. Consumers can easily find alternatives in convenience stores, supermarkets, and online marketplaces, facilitating quick switches. In 2024, the global snack market saw continued growth, with healthy and plant-based options gaining substantial traction, offering consumers a diverse range of accessible substitutes.

Consumer willingness to switch to alternatives is significant, driven by shifting tastes and a growing appetite for healthier snacks, plant-based options, and international flavors. For instance, the global healthy snacks market was valued at approximately $111.4 billion in 2023 and is projected to reach $195.7 billion by 2030, showcasing a clear consumer shift. This means consumers are actively looking for products that offer benefits like increased protein, reduced sugar, or simpler ingredient lists, often referred to as 'clean labels'.

Calbee's strategic introduction of brands like Harvest Snaps, which emphasize healthier attributes, directly addresses this high propensity to substitute. This move reflects an understanding that consumers will readily abandon existing snack choices for those perceived as more beneficial or aligned with current wellness trends. The snack industry in 2024 is highly competitive, with brands constantly innovating to capture market share by appealing to these evolving consumer demands.

Quality and Performance of Substitutes

The quality and performance of substitute products are steadily improving, posing a significant threat. Innovations in plant-based ingredients, novel textures, and added functional benefits are constantly emerging from both new market entrants and established companies. For example, dehydrated fruit chips and protein bars now offer convenience and often better nutritional value than conventional potato chips.

This continuous enhancement of substitutes means consumers have increasingly viable alternatives. In 2024, the global market for healthy snacks, which includes many of these substitutes, saw substantial growth. Reports indicate the healthy snacks market reached an estimated USD 115 billion in 2023 and is projected to grow at a CAGR of over 6% through 2030, demonstrating the competitive pressure from these evolving alternatives.

- Rising Nutritional Standards: Substitute products are increasingly emphasizing health benefits, such as lower sodium, less fat, and added vitamins, directly challenging traditional snack offerings.

- Product Diversification: The snack category itself is diversifying beyond traditional chips, with options like vegetable crisps, lentil snacks, and fruit leathers gaining popularity due to their perceived healthfulness and unique flavors.

- Consumer Preference Shifts: A growing segment of consumers, particularly millennials and Gen Z, actively seek out snacks that align with their health and wellness goals, making substitutes more attractive.

Marketing and Promotion of Substitutes

Competitors in the snack industry are aggressively marketing and promoting substitute products. This often involves emphasizing perceived health benefits, novel ingredients, or unique taste experiences to capture consumer attention. For instance, in 2024, the plant-based snack market saw significant growth, with brands heavily investing in campaigns highlighting natural ingredients and sustainability. This sustained promotional activity directly influences consumer choices, encouraging them to try alternatives to traditional offerings.

Calbee needs to respond with robust marketing and continuous innovation to effectively counter the pervasive promotion of substitutes. This includes not only highlighting the quality and appeal of its existing product lines but also developing new products that align with evolving consumer preferences. For example, Calbee’s investment in R&D for healthier snack options, potentially leveraging its established expertise in potato-based snacks, could be a strategic move. The company’s marketing efforts must clearly articulate its value proposition, whether it’s taste, convenience, or nutritional benefits, to maintain and grow market share against a backdrop of intense competition from substitute products.

- Aggressive Marketing of Substitutes: Competitors frequently promote alternative snacks by emphasizing health aspects, unique ingredients, and indulgent qualities.

- Consumer Perception Influence: Consistent marketing efforts by rivals shape consumer views and encourage the trial of substitute products.

- Calbee's Counter-Strategy: Calbee must actively invest in its own marketing and innovation to counteract the strong promotional push from substitute offerings.

The threat of substitutes for Calbee is considerable, as consumers have a wide array of snacking choices. In 2024, the global snack market continued to see a rise in demand for healthier and plant-based options, with the latter alone projected to exceed $30 billion by 2026. This indicates a strong availability of alternatives that compete on both price and perceived health benefits, directly impacting Calbee's market position.

Calbee's strategic response includes introducing brands like Harvest Snaps, which highlight healthier attributes to align with evolving consumer preferences. The global healthy snacks market, valued at approximately $111.4 billion in 2023 and projected to reach $195.7 billion by 2030, demonstrates a clear consumer shift towards options with benefits like reduced sugar or cleaner ingredient lists.

The continuous improvement in quality and performance of substitute products, such as dehydrated fruit chips and protein bars, presents a significant challenge. The healthy snacks market's growth, estimated at USD 115 billion in 2023 and projected to grow at a CAGR of over 6% through 2030, underscores the competitive pressure from these evolving alternatives.

Competitors are aggressively marketing substitutes, emphasizing health, unique ingredients, and indulgence. For example, the plant-based snack market saw significant growth in 2024 with heavy investment in campaigns highlighting natural ingredients and sustainability. Calbee must counter this with robust marketing and innovation, clearly articulating its value proposition to maintain market share.

| Substitute Category | Key Attributes | Market Trend (2024 Focus) | Calbee's Response Strategy |

|---|---|---|---|

| Healthy Snacks | Low sugar, low fat, high fiber, natural ingredients | Growing demand, projected to reach $195.7B by 2030 | Product innovation (e.g., Harvest Snaps), clearer nutritional labeling |

| Plant-Based Snacks | Vegan, sustainable sourcing, protein-rich | Significant growth, exceeding $30B by 2026 | Expanding plant-based product lines, marketing sustainability |

| Convenience Snacks | On-the-go, single-serving, ready-to-eat | Continued strong demand in convenience channels | Optimizing packaging, ensuring widespread distribution |

| Premium/Artisan Snacks | Unique flavors, gourmet ingredients, artisanal production | Niche but growing segment, appealing to specific consumer tastes | Exploring premium product development, targeted marketing |

Entrants Threaten

Entering the mainstream snack food manufacturing sector, particularly to compete with established giants like Calbee, necessitates massive upfront capital. We're talking about significant investments in state-of-the-art production plants, sophisticated manufacturing equipment, robust research and development for new products, and building out widespread distribution channels.

For instance, a new entrant aiming to match Calbee's production capacity might need hundreds of millions of dollars just for initial plant setup and machinery. While smaller, specialized snack companies can certainly enter with less capital, focusing on niche markets, directly challenging Calbee's broad market presence requires substantial financial backing.

Securing shelf space in major supermarkets, convenience stores, and vending machines presents a formidable hurdle for newcomers looking to enter the snack market. Calbee, with its established presence, benefits from strong, long-term relationships with these key retailers.

New companies often find it challenging to gain prominent placement for their products, particularly in a saturated market like Japan. In 2023, convenience stores accounted for approximately 15% of total retail sales in Japan, underscoring their critical role as both distribution hubs and crucial testing grounds for new products.

Calbee enjoys robust brand loyalty, especially in Japan where its snacks are household names. This strong recognition, built over decades, makes it challenging for newcomers to capture market share. For instance, Calbee's market share in Japan's snack industry remains dominant, with its potato chip segment alone representing a significant portion of the overall market value.

Economies of Scale

Established players like Calbee leverage significant economies of scale in their operations. This translates to lower per-unit production costs, making it challenging for newcomers to compete on price. For instance, in 2023, Calbee's substantial production volume allowed them to secure more favorable raw material pricing compared to a smaller, emerging competitor.

These scale advantages extend to marketing and research and development. Calbee's larger budgets enable more extensive advertising campaigns and investment in new product innovation. A new entrant would struggle to match the market reach and product development pace that Calbee can afford due to its established scale.

- Lower Per-Unit Costs: Calbee's large-scale production in 2023 resulted in cost efficiencies that new entrants cannot easily replicate.

- Marketing Reach: Established brand recognition and marketing spend, supported by scale, create a barrier for new companies.

- R&D Investment Capacity: The financial muscle derived from economies of scale allows Calbee to invest more in innovation, widening the gap with potential entrants.

Government Policy and Regulations

Government policies and regulations significantly influence the threat of new entrants in the food industry, including for companies like Calbee. These regulations cover crucial areas such as food safety, accurate labeling, and quality standards. For instance, in 2024, many nations continued to strengthen food safety protocols, requiring rigorous testing and traceability throughout the supply chain.

New companies entering the market often face a steeper learning curve and higher initial costs to ensure full compliance with these established regulatory frameworks. Calbee, with its years of experience and existing infrastructure, is better positioned to manage these requirements efficiently compared to a newcomer. The complexity of navigating these rules can act as a substantial barrier, deterring potential new competitors.

- Food Safety Regulations: Compliance with standards set by bodies like the FDA (USA) or EFSA (Europe) requires significant investment in quality control and testing.

- Labeling Requirements: Accurate nutritional information, allergen declarations, and origin labeling are mandatory and can be complex to implement correctly.

- Quality Standards: Adherence to specific quality benchmarks, often varying by product category and region, adds another layer of operational challenge for new entrants.

The threat of new entrants for Calbee is moderate, primarily due to the substantial capital required for manufacturing and distribution. Building production facilities and securing shelf space in a competitive market like Japan, where convenience stores are vital distribution channels, demands significant investment. For example, in 2023, the snack food industry in Japan was valued at billions of dollars, indicating the scale of investment needed to gain meaningful market share.

Brand loyalty and economies of scale also present considerable barriers. Calbee's established brand recognition and its ability to leverage lower per-unit costs through large-scale production in 2023 make it difficult for newcomers to compete on price or market reach. Furthermore, navigating complex food safety and labeling regulations, which continued to strengthen in 2024, adds to the operational challenges and initial costs for any new player entering the snack food arena.

| Barrier Type | Description | Impact on New Entrants | Calbee's Advantage |

|---|---|---|---|

| Capital Requirements | High investment needed for production, R&D, and distribution. | Significant hurdle for smaller companies. | Established financial resources and infrastructure. |

| Brand Loyalty & Recognition | Strong customer preference for established brands. | Difficult to attract consumers away from trusted names. | Decades of market presence and consumer trust. |

| Economies of Scale | Lower per-unit costs due to high production volume. | Price competition is challenging for newcomers. | Cost efficiencies in sourcing, production, and marketing. |

| Distribution Channels | Securing shelf space in major retail outlets. | Limited access to consumers without strong retail relationships. | Existing, strong relationships with key retailers. |

| Regulatory Compliance | Adherence to food safety, labeling, and quality standards. | Increased initial costs and complexity for new entrants. | Existing infrastructure and expertise in compliance. |

Porter's Five Forces Analysis Data Sources

Our Calbee Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Calbee's annual reports, investor presentations, and publicly available financial statements. This is supplemented by industry-specific market research reports and publications from reputable sources like Statista and Euromonitor International to capture comprehensive competitive dynamics.