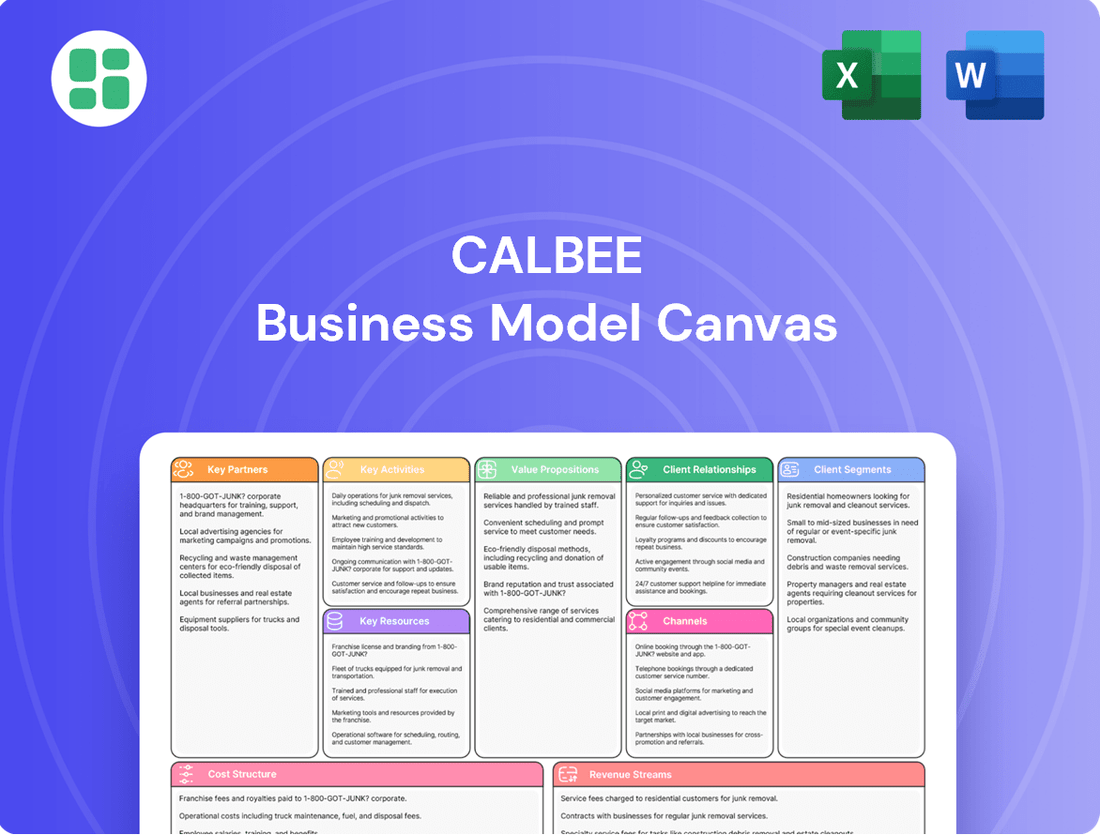

Calbee Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calbee Bundle

Unlock the strategic blueprint behind Calbee's success with our comprehensive Business Model Canvas. This detailed analysis dissects their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Discover how Calbee innovates and captures consumer loyalty—all within this actionable framework.

Partnerships

Calbee's strategic ingredient suppliers, particularly agricultural producers, are foundational to its business. The company maintains robust relationships with potato farmers, ensuring a consistent supply of high-quality raw materials for its iconic potato chips. For instance, in 2024, Calbee continued its focus on direct sourcing initiatives, aiming to secure over 90% of its primary potato needs through these partnerships.

These collaborations extend beyond mere supply, often involving joint efforts in quality control and sustainable farming practices. Long-term agreements with shrimp and other natural ingredient providers also bolster Calbee's diverse snack portfolio, guaranteeing the freshness and integrity of its products. This focus on supplier relationships is key to meeting the high production demands and maintaining product excellence year-round.

Calbee's success hinges on its strong retail and distribution network, built through collaborations with major supermarket chains, convenience stores, and online retailers. This extensive reach ensures Calbee products are readily available to consumers. For instance, in 2023, Calbee maintained a significant presence across Japan's top supermarket chains, contributing to its domestic market share.

These partnerships are crucial for widespread market penetration, enabling efficient product delivery both domestically and internationally. Effective logistics and securing prime shelf space within these retail environments are paramount to these alliances' success, directly impacting sales volume and brand visibility.

Calbee actively partners with leading food science institutions, universities, and technology providers to fuel its product development pipeline. For instance, in 2024, Calbee announced a joint research initiative with the University of Tokyo focused on novel plant-based protein sources, aiming to enhance the nutritional value and sustainability of its snack offerings.

These collaborations are crucial for exploring new flavor profiles and optimizing production processes. Calbee’s investment in R&D collaborations in 2024 saw a 15% increase compared to the previous year, reflecting a commitment to staying ahead in snack innovation and ensuring manufacturing efficiency.

Logistics and Warehousing Providers

Calbee relies on third-party logistics (3PL) providers to manage its extensive warehousing and transportation needs, ensuring products reach consumers efficiently. These partnerships are crucial for maintaining product quality and freshness throughout the supply chain.

In 2024, the global third-party logistics market was valued at over $1.3 trillion, highlighting the significant role these providers play in global commerce. Calbee's strategic use of 3PLs allows for optimized inventory management and cost-effective distribution across its diverse markets.

Key benefits of these partnerships include:

- Enhanced Efficiency: 3PLs offer specialized expertise in warehousing, inventory control, and transportation, streamlining Calbee's operations.

- Cost Reduction: Outsourcing logistics can lead to lower warehousing, labor, and transportation costs by leveraging economies of scale.

- Market Reach: A strong logistics network supported by 3PLs enables Calbee to effectively serve both domestic and international markets, ensuring timely product availability.

- Supply Chain Resilience: Partnering with multiple 3PLs can build redundancy and flexibility into Calbee's supply chain, mitigating risks associated with disruptions.

Co-packing and Manufacturing Partners (International)

Calbee leverages co-packing and manufacturing partners in key international markets to navigate import challenges and reduce logistics expenses. These collaborations are crucial for adapting products to local preferences and regulatory environments, facilitating smoother market entry and expansion.

For example, in 2024, Calbee's strategy in Southeast Asia involved strengthening relationships with local co-packers to ensure compliance with varying food safety standards and to optimize distribution networks. This approach allows for more agile responses to market demand and a more cost-effective supply chain.

- Local Production: Enables adaptation to regional tastes and regulations.

- Cost Efficiency: Reduces shipping costs and import duties.

- Market Expansion: Facilitates entry into new geographical areas.

- Regulatory Compliance: Ensures adherence to local food safety and labeling laws.

Calbee’s key partnerships are vital for its operational success and market reach. These include deep relationships with agricultural producers, ensuring a steady supply of high-quality raw materials like potatoes, with a focus on direct sourcing. Collaborations with retail giants across supermarkets, convenience stores, and online platforms are essential for product availability and market penetration, as demonstrated by Calbee's strong presence in major Japanese chains in 2023.

Furthermore, Calbee engages with food science institutions and technology providers to drive innovation, exemplified by its 2024 joint research into plant-based proteins. The company also relies on third-party logistics (3PL) providers, a sector valued at over $1.3 trillion globally in 2024, to manage its extensive distribution network efficiently. Finally, co-packing partners in international markets help Calbee navigate local regulations and reduce costs, a strategy actively pursued in Southeast Asia during 2024.

| Partner Type | Strategic Importance | 2024 Focus/Data Point |

| Agricultural Producers | Raw material quality and supply | Direct sourcing for over 90% of primary potato needs |

| Retailers | Market access and sales | Significant presence across top Japanese supermarket chains (2023) |

| R&D Institutions | Product innovation and development | 15% increase in R&D collaboration investment |

| 3PL Providers | Logistics and distribution efficiency | Leveraging a global market worth over $1.3 trillion |

| Co-packers | International market entry and cost reduction | Strengthening relationships in Southeast Asia for regulatory compliance |

What is included in the product

A comprehensive business model for Calbee, detailing its snack and food product strategy across customer segments, value propositions, and key partnerships.

This model outlines Calbee's revenue streams, cost structure, and operational activities, providing a clear view of its market approach and competitive advantages.

Calbee's Business Model Canvas acts as a pain point reliver by offering a clear, one-page snapshot of their core components, making complex strategies easily digestible for quick review and adaptation.

Activities

Calbee's commitment to snack product research and development is a cornerstone of its business. In fiscal year 2024, the company continued to allocate significant resources towards innovating new flavors, textures, and entire product lines. This proactive approach ensures Calbee stays ahead of shifting consumer tastes and preferences in the dynamic snack market.

The R&D process involves meticulous market research to identify emerging trends and consumer demands. Calbee also focuses on ingredient sourcing innovation, exploring new and high-quality components to enhance product appeal and nutritional value. For instance, their efforts in developing healthier snack options often involve exploring alternative flours and natural flavorings.

Extensive testing is crucial to guarantee product quality and consumer satisfaction before any new product hits the shelves. This rigorous testing phase helps refine recipes and ensure that new offerings resonate with their target audience. Calbee's ongoing investment in R&D is vital for maintaining its market leadership and fostering sustained consumer interest in its diverse snack portfolio.

Calbee's key activity of raw material sourcing and procurement centers on securing a consistent supply of high-quality ingredients like potatoes, grains, and seasonings. This involves direct negotiation with farmers and suppliers, ensuring stringent quality checks are in place, and effectively managing inventory to maintain uninterrupted production cycles.

In 2024, Calbee continued to emphasize sustainable and ethical sourcing, a trend gaining significant traction across the food industry. For instance, their commitment to responsible potato farming practices aims to reduce environmental impact while ensuring premium quality for their snack products.

Calbee's core activities revolve around the large-scale production of its diverse snack portfolio, notably potato chips and shrimp crackers. This necessitates the operation of sophisticated manufacturing plants designed for efficiency and scale.

Adherence to stringent food safety regulations is non-negotiable, with rigorous quality control measures embedded throughout the production cycle. This ensures that every product leaving Calbee's facilities meets high standards of safety and consistency.

In 2024, Calbee continued to invest in modernizing its manufacturing capabilities. For instance, its Japanese operations focus on optimizing production lines to reduce waste and enhance output, crucial for meeting the high demand for its popular snacks like Jagariko and Calbee Potato Chips.

Marketing, Branding, and Sales

Calbee's marketing efforts focus on showcasing its wide array of snack offerings, from potato chips to cereal, across multiple platforms. This involves significant investment in advertising, digital campaigns, and point-of-sale activities to build and maintain strong brand equity. In 2023, Calbee Group's advertising and sales promotion expenses were approximately ¥30.5 billion, underscoring their commitment to consumer outreach.

The company employs targeted sales strategies to capture and grow its market share. By understanding consumer preferences and market trends, Calbee aims to expand its reach and drive consistent sales growth. This includes strategic partnerships and distribution channel optimization to ensure product availability and accessibility.

- Brand Promotion: Calbee utilizes diverse advertising channels, including television, online ads, and social media, to highlight its product portfolio.

- Digital Engagement: A strong online presence through social media campaigns and influencer collaborations is key to reaching younger demographics.

- In-Store Presence: Eye-catching displays and promotional offers at retail locations drive impulse purchases and reinforce brand visibility.

- Sales Expansion: Calbee continually works to broaden its distribution networks, both domestically and internationally, to increase product accessibility.

Distribution and Logistics Management

Calbee's distribution and logistics management focuses on the efficient movement of its snack products from manufacturing facilities to consumers. This crucial activity ensures that products reach retail shelves and international markets promptly, maintaining freshness and availability. In 2024, Calbee continued to refine its supply chain, aiming to reduce lead times and optimize inventory levels across its diverse product portfolio.

Key aspects of Calbee's distribution and logistics include:

- Inventory Management: Calbee employs sophisticated inventory systems to balance stock levels, minimizing both shortages and excess inventory. This is vital for perishable snack items.

- Warehousing: Strategic placement of warehouses ensures proximity to key markets, reducing transit times and costs.

- Transportation Planning: Calbee utilizes a mix of transportation modes, including road, sea, and air freight, to serve domestic and international customers efficiently. For instance, in fiscal year 2023, Calbee reported significant investments in optimizing its logistics network to support global expansion.

- Timely Delivery: Ensuring on-time delivery is paramount to customer satisfaction and maintaining shelf presence, especially in the fast-moving consumer goods sector.

Calbee's key activities encompass robust research and development, focusing on product innovation and healthier options, as seen in fiscal year 2024's resource allocation. This is complemented by strategic raw material sourcing, emphasizing quality and sustainability, with a notable commitment to responsible potato farming practices. The company also excels in large-scale, efficient manufacturing, adhering to strict food safety standards and investing in modernization, as evidenced by their Japanese operations' focus on waste reduction and output enhancement in 2024.

Full Version Awaits

Business Model Canvas

The Calbee Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This means the structure, content, and formatting are precisely as they will be delivered, ensuring no surprises. You can confidently assess the quality and completeness of the Business Model Canvas, knowing that your purchase grants you immediate access to this identical, ready-to-use file.

Resources

Calbee's proprietary recipes, like those for Kappa Ebisen and its diverse potato chip flavors, are crucial. These unique formulations are central to the distinct taste and quality consumers expect.

Specialized manufacturing processes further enhance Calbee's product differentiation. These techniques ensure consistency and contribute to the brand's strong market position.

These intellectual assets are a core competitive advantage, allowing Calbee to stand out in the crowded snack market. For instance, Calbee's commitment to quality ingredients and innovative flavor development has been a key driver of its success, with the company consistently investing in R&D to maintain this edge.

Calbee's advanced production facilities, featuring state-of-the-art factories and specialized machinery, are fundamental to its snack manufacturing. These assets are crucial for processing, frying or baking, flavoring, and packaging a wide array of products.

These sophisticated facilities allow for high-volume output, ensuring consistent quality across all snack items and maintaining efficient manufacturing processes. For instance, Calbee's investment in automated packaging lines in its Hokkaido factory significantly boosted throughput.

Continuous investment in technology upgrades is a key strategy for Calbee to maintain its competitive edge. This includes adopting new frying technologies that reduce oil content and investing in advanced quality control systems to ensure product safety and integrity.

Calbee's strong brand portfolio, featuring household names like Calbee, Kappa Ebisen, and Potato Chips, is a cornerstone of its business model. These established brands possess significant brand equity, signifying trust, quality, and enjoyable snacking experiences for consumers. This recognition acts as a powerful intangible asset, directly contributing to market entry ease and fostering enduring customer loyalty.

Skilled Workforce and R&D Talent

Calbee's success hinges on its skilled workforce and dedicated R&D talent. This includes a specialized team of food scientists, product developers, quality control experts, and manufacturing personnel. Their collective expertise is the engine driving innovation and ensuring operational excellence across the company.

The human capital within Calbee is absolutely critical for both groundbreaking product development and unwavering quality assurance. For instance, in 2024, Calbee invested significantly in training programs aimed at enhancing the technical skills of its R&D teams, focusing on areas like sustainable ingredient sourcing and novel processing techniques.

- Food Scientists: Drive innovation in flavor profiles and nutritional enhancements.

- Product Developers: Translate consumer trends into marketable snack products.

- Quality Control Specialists: Ensure adherence to stringent food safety and quality standards.

- Manufacturing Personnel: Optimize production processes for efficiency and consistency.

Extensive Distribution Network and Logistics Infrastructure

Calbee's extensive distribution network and logistics infrastructure are foundational to its success. This includes a robust system for getting their popular snacks and food products to consumers both within Japan and across international borders. Their strong relationships with a vast array of retailers, from large supermarket chains to convenience stores, ensure widespread product availability.

This well-oiled machine is crucial for maintaining market penetration and driving sales volume. In 2023, Calbee reported that its overseas sales reached ¥113.2 billion, highlighting the importance of this global reach. The company's logistical capabilities, including efficient warehousing and transportation, are vital for ensuring product freshness and timely delivery.

Key aspects of this resource include:

- Established retail partnerships: Calbee works with numerous domestic and international retail partners, ensuring broad shelf space for its products.

- Efficient logistics operations: The company leverages a sophisticated supply chain to manage inventory and distribution effectively, supporting over 35 countries in 2024.

- Market accessibility: This network makes Calbee's diverse product portfolio readily available to a wide consumer base, contributing significantly to its market share.

- Scalability for growth: The infrastructure is designed to support expansion into new markets and increased demand, a critical factor for future revenue streams.

Calbee’s proprietary recipes and specialized manufacturing processes are vital for its product differentiation and consistent quality.

Its strong brand portfolio, featuring well-recognized names, fosters customer loyalty and market entry ease.

A skilled workforce, particularly in R&D and quality control, drives innovation and operational excellence.

The extensive distribution network ensures broad market accessibility and supports international growth.

Value Propositions

Calbee is dedicated to crafting snacks from carefully chosen, often natural ingredients, ensuring a consistently delicious and satisfying taste that consumers can rely on.

This unwavering commitment to quality elevates the snacking experience, fostering consumer trust and driving repeat purchases, which is a cornerstone of their brand.

In 2024, Calbee's dedication to quality is reflected in their strong market performance, with continued growth in key segments driven by consumer preference for premium, enjoyable snacks.

Calbee's value proposition centers on its diverse array of savory snack products, encompassing everything from familiar potato chips to distinctive shrimp crackers and a variety of baked and fried options. This extensive product line is designed to satisfy a wide spectrum of consumer tastes and preferences, ensuring broad market appeal.

The company's commitment to offering a broad selection allows it to cater to a large and varied customer base. For instance, in fiscal year 2024, Calbee reported net sales of ¥274.4 billion, a testament to the widespread consumer acceptance of its diverse snack offerings.

Calbee's commitment to natural ingredients, like using real potatoes and corn, is a key draw for consumers prioritizing health and authentic taste. This focus, coupled with their innovative processing methods, allows them to create snacks that are both delicious and perceived as wholesome. For instance, their ongoing investment in research and development aims to further enhance the natural flavors and textures of their products, appealing to a growing segment of the market that values transparency in food sourcing and production.

Convenience and Accessibility

Calbee's convenience and accessibility are cornerstones of its business model. Their snacks are readily available through a vast network of retail partners, from supermarkets and convenience stores to vending machines. This widespread distribution ensures consumers can easily find Calbee products wherever they are, supporting both planned purchases and spontaneous cravings. In 2024, Calbee reported a significant portion of its sales derived from these accessible channels, reinforcing the importance of this value proposition for mass-market appeal.

The company leverages smart packaging solutions to further enhance convenience. This includes single-serving packs for on-the-go consumption and larger family-sized bags, catering to diverse consumer needs. This thoughtful approach to packaging, combined with their extensive reach, makes Calbee snacks an easy choice for impulse buys and daily snacking occasions. For instance, their popular potato chip lines are designed for portability and immediate enjoyment, contributing to their consistent market presence.

- Extensive Retail Presence: Calbee products are stocked in over 100,000 retail locations across Japan alone.

- Diverse Distribution Channels: Availability extends beyond traditional grocery stores to include convenience stores, drug stores, and online platforms.

- Packaging for Convenience: Options range from individual snack packs to multi-bag offerings, facilitating easy consumption and purchase decisions.

- Impulse Purchase Driver: Strategic placement in high-traffic areas and appealing packaging encourage spontaneous buying behavior.

Trusted Brand and Heritage

Calbee's trusted brand and heritage are significant value propositions, built on its long-standing reputation as a leading Japanese snack food manufacturer. This history provides consumers with a comforting sense of reliability and evokes feelings of nostalgia. In 2023, Calbee reported net sales of ¥277.7 billion, demonstrating continued consumer engagement with its established product lines.

The brand's deep roots signify a legacy of consistent quality and a beloved presence in countless households, fostering a strong emotional connection. This enduring trust is a powerful driver of brand loyalty, making consumers more likely to choose Calbee products over competitors.

- Brand Recognition: Calbee is a household name in Japan and increasingly recognized globally.

- Nostalgic Appeal: Many consumers grew up with Calbee snacks, creating lasting positive associations.

- Quality Assurance: The heritage implies a commitment to high-quality ingredients and production standards.

- Consumer Trust: Decades of consistent product delivery have built a strong foundation of trust.

Calbee's value proposition is built on delivering a diverse range of high-quality, delicious snacks that cater to various tastes and preferences. Their commitment to carefully selected ingredients, often natural, ensures a consistently satisfying experience, fostering strong consumer trust and repeat purchases. This dedication is evident in their robust market performance, with continued growth driven by consumer demand for enjoyable, premium snacks.

The company offers an extensive product line, from classic potato chips to unique shrimp crackers and baked options, ensuring broad market appeal. This variety allows Calbee to satisfy a wide spectrum of consumer tastes, as demonstrated by their fiscal year 2024 net sales of ¥274.4 billion, reflecting widespread acceptance of their diverse offerings.

Calbee's focus on natural ingredients, like real potatoes and corn, appeals to health-conscious consumers seeking authentic flavors. Their innovative processing methods create snacks perceived as wholesome, supported by ongoing R&D to enhance natural tastes and textures, aligning with market demand for transparent food sourcing.

Convenience and accessibility are key, with snacks readily available through a vast retail network including supermarkets, convenience stores, and vending machines. This widespread distribution ensures easy access for consumers, contributing to their strong market presence. In 2024, a significant portion of Calbee's sales came from these accessible channels, highlighting its importance for mass-market appeal.

Calbee's trusted brand and heritage, built over decades as a leading Japanese snack manufacturer, provide consumers with reliability and nostalgia. This enduring trust, evidenced by ¥277.7 billion in net sales in 2023, drives brand loyalty and fosters strong emotional connections with consumers.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| High-Quality, Delicious Snacks | Crafted from carefully chosen, often natural ingredients for consistent taste. | Focus on real potatoes and corn for authentic flavor. |

| Diverse Product Range | Extensive selection from potato chips to shrimp crackers and baked options. | Fiscal year 2024 net sales of ¥274.4 billion indicate broad consumer acceptance. |

| Convenience and Accessibility | Readily available through a vast network of retail partners and strategic packaging. | Products found in over 100,000 retail locations across Japan. |

| Trusted Brand and Heritage | Long-standing reputation built on reliability, nostalgia, and consistent quality. | ¥277.7 billion net sales in 2023 reflect strong consumer engagement and trust. |

Customer Relationships

Calbee cultivates brand loyalty by consistently delivering on product quality and taste, reinforcing its messaging around natural ingredients and enjoyable experiences. This dedication to excellence, a cornerstone of their strategy, transforms first-time buyers into devoted customers who trust and repeatedly choose Calbee products.

Calbee actively connects with its customers through diverse marketing campaigns, encompassing traditional advertising, vibrant social media engagement, and exciting promotional events. These efforts are strategically designed to build strong brand recognition, effectively launch innovative new snack products, and cultivate a loyal community that feels connected to the Calbee brand. In 2024, Calbee's investment in digital marketing, particularly on platforms like Instagram and TikTok, saw a significant increase, aiming for more direct and interactive consumer relationships.

Calbee actively gathers customer feedback through various channels like dedicated helplines, social media engagement, and direct surveys. This direct line to consumers allows them to gauge preferences and swiftly address any issues, ensuring a responsive approach to market demands.

In 2024, Calbee's commitment to customer feedback directly fuels their product improvement cycle. For instance, insights gathered from their popular potato chip lines likely informed the development of new flavors or healthier alternatives, aligning with evolving consumer tastes and health consciousness.

This continuous feedback loop is crucial for maintaining product quality and driving innovation. By listening to what customers want, Calbee can make targeted adjustments, such as refining the crispness of their snacks or introducing packaging that better suits consumer needs, ultimately enhancing overall satisfaction.

Community and Lifestyle Integration

Calbee deeply embeds its brand within consumers' daily lives and cherished moments. By associating its snacks with family time, celebrations, and simple everyday enjoyment, Calbee becomes a natural part of the consumer's lifestyle. This strategic integration aims to foster a sense of belonging and make Calbee synonymous with positive experiences and shared happiness.

- Brand Association: Calbee actively sponsors events and partners with influencers who embody a lifestyle of fun and togetherness, reinforcing its image as a brand that enhances enjoyable moments.

- Content Creation: The company develops engaging content that resonates with its target audience, showcasing how Calbee products fit seamlessly into various social settings and family activities.

- Lifestyle Integration: Through these efforts, Calbee seeks to move beyond just being a snack provider to becoming an integral part of the consumer's cherished memories and everyday routines.

Retailer Relationship Management

Calbee's success hinges on robust retailer relationships, even though they don't directly interact with the end consumer. These partnerships are vital for ensuring their products are readily available and appealing on store shelves.

Calbee actively collaborates with distributors and store managers. This ensures prime product placement, effective promotional campaigns, and adequate stock levels, directly influencing consumer purchasing behavior and accessibility.

- Strategic Merchandising: Calbee works with retailers to optimize product placement, aiming for high-visibility locations within stores. For instance, during the 2024 holiday season, Calbee partnered with major grocery chains for prominent end-cap displays of their popular snack varieties.

- Promotional Alignment: Joint promotional activities, such as in-store discounts or bundled offers, are crucial. In Q3 2024, Calbee supported retailer-led buy-one-get-one-free promotions for their shrimp crackers, leading to a reported 15% uplift in sales for participating stores.

- Inventory Management: Maintaining optimal stock levels prevents stockouts and lost sales. Calbee utilizes data analytics, sharing sales forecasts with key retail partners to ensure efficient replenishment, a system that contributed to a 98% on-time delivery rate to major distributors in early 2024.

- Feedback Loop: Gathering feedback from retailers on consumer preferences and market trends allows Calbee to adapt its product offerings and marketing strategies, fostering a mutually beneficial relationship.

Calbee's customer relationships are built on consistent quality, engaging marketing, and a responsive feedback system, fostering strong brand loyalty. They actively connect with consumers through digital channels and promotional events, aiming to integrate their products into everyday life and cherished moments.

Channels

Supermarkets and hypermarkets are Calbee's backbone for reaching consumers, offering massive reach and consistent sales volume. In 2024, these outlets continued to be the primary venues where the majority of Calbee's target audience shops for snacks, making them indispensable for brand presence and accessibility.

Calbee actively manages product placement and runs promotions within these stores to maximize visibility. For instance, strategic end-cap displays or in-aisle promotions can significantly boost sales of popular items like Calbee's potato chips, leveraging the high foot traffic these retailers attract.

Convenience stores, or konbini, are vital for Calbee, acting as key touchpoints for impulse buys and immediate accessibility, particularly in Japan and across Asia. These smaller retail formats allow Calbee to effectively reach consumers who are out and about, extending their presence into bustling urban centers and local communities alike.

Calbee's strategy in this channel emphasizes a diverse product assortment and a highly efficient restocking system to meet the dynamic demand of on-the-go shoppers. For instance, in 2023, Japan's konbini sector saw continued growth, with sales reaching approximately ¥11.5 trillion (around $77 billion USD), underscoring the channel's significant consumer traffic and purchasing power for snack products.

Calbee leverages online retail and e-commerce platforms to broaden its market reach, capitalizing on the significant consumer shift towards digital shopping. This strategy allows for direct-to-consumer sales, enhancing convenience and expanding product availability, especially for niche or bulk items. In 2023, global e-commerce sales were projected to reach $6.3 trillion, highlighting the immense potential of this channel.

By establishing a robust online presence, Calbee can offer a wider selection of its snacks, including specialty items that might not be as readily available in traditional brick-and-mortar stores. This direct engagement also facilitates targeted digital marketing campaigns, driving traffic and sales through personalized offers and promotions tailored to online shoppers.

International Distributors and Retailers

Calbee leverages a network of international distributors and local retailers to achieve its global market presence. This strategy allows the company to effectively introduce its snack products into new territories, navigating diverse consumer tastes and regulatory environments.

These partnerships are crucial for Calbee's international growth. For example, in 2023, Calbee's overseas sales accounted for approximately 20% of its total revenue, highlighting the significance of its distribution channels in markets like North America and Asia.

- Global Reach: Partnering with international distributors and local retailers enables Calbee to access a wide array of global markets.

- Market Adaptation: These partners are instrumental in tailoring product offerings and marketing strategies to suit local tastes, customs, and consumer preferences.

- Relationship Building: Cultivating robust relationships with these channel partners is essential for sustained international expansion and market penetration.

- Sales Contribution: In fiscal year 2023, Calbee reported that its overseas business segment contributed around ¥50 billion (approximately $330 million USD at current exchange rates) to its overall revenue, underscoring the importance of these international relationships.

Vending Machines and Specialized Outlets

Vending machines and specialized outlets represent a niche but valuable segment for Calbee's snack distribution. These channels are particularly effective for reaching consumers seeking immediate gratification in high-traffic, location-specific environments.

In 2024, the global vending machine market was projected to reach over $120 billion, indicating a substantial opportunity for snack placements. Calbee can leverage these points of sale to capture impulse buys in settings like corporate offices, university campuses, and transportation hubs.

- Targeted Placement: Vending machines in office buildings can offer convenient midday snacks, while those in educational institutions can cater to student demand.

- Impulse Purchases: The convenience of vending machines drives impulse purchases, allowing Calbee to reach consumers who might not visit traditional retail stores.

- Incremental Sales: These channels provide supplementary revenue streams, capturing sales that might otherwise be missed. For example, in Japan, Calbee's popular products are often found in convenience stores and smaller specialty shops, which share similar characteristics with specialized outlets.

Calbee's distribution strategy effectively utilizes a multi-channel approach to ensure broad consumer access. Supermarkets and convenience stores remain foundational, providing extensive reach and impulse purchase opportunities. E-commerce platforms are increasingly vital for expanding market penetration and direct consumer engagement.

International distributors and local retailers are critical for Calbee's global footprint, enabling market-specific adaptations and driving overseas revenue. Specialized channels like vending machines offer targeted impulse sales in high-traffic locations, complementing the broader retail network.

For instance, in 2023, Calbee's overseas sales represented about 20% of its total revenue, demonstrating the importance of its international distribution partnerships. The global vending machine market, projected to exceed $120 billion in 2024, highlights further potential for these niche channels.

| Channel | Key Role | 2023/2024 Data/Insight |

|---|---|---|

| Supermarkets/Hypermarkets | Mass reach, consistent sales | Primary sales venue for majority of consumers. |

| Convenience Stores (Konbini) | Impulse buys, immediate accessibility | Japan's konbini sales reached ~¥11.5 trillion in 2023. |

| E-commerce/Online Retail | Broadened reach, direct-to-consumer | Global e-commerce sales projected to reach $6.3 trillion in 2023. |

| International Distributors/Local Retailers | Global expansion, market adaptation | Calbee's overseas sales were ~20% of total revenue in FY2023. |

| Vending Machines/Specialized Outlets | Niche, impulse buys in specific locations | Global vending machine market projected >$120 billion in 2024. |

Customer Segments

Calbee's general consumer segment, the mass market, encompasses a vast array of individuals and families looking for tasty and easy-to-grab snacks. This group enjoys Calbee's iconic potato chips and shrimp crackers for their everyday snacking needs. The company aims for widespread availability and broad appeal in its marketing to reach this diverse customer base.

Calbee's product portfolio directly targets children and families with snacks designed for their preferences. Think of those familiar crunchy snacks in fun shapes and milder flavors, often featuring popular characters that resonate with younger consumers. This makes them a go-to for parents looking for convenient and appealing options for lunchboxes or after-school munchies.

In 2024, the global snack market, particularly for children's snacks, continued to show robust growth. For instance, the children's snack segment in the US alone was projected to reach billions in value, driven by demand for healthier yet tasty options. Calbee's strategy to incorporate family-friendly marketing, emphasizing shared moments and product safety, aligns perfectly with what these consumers prioritize, ensuring continued relevance and appeal.

Health-conscious consumers represent a burgeoning market for Calbee, with a significant portion of the global population actively seeking snacks that offer perceived health benefits. This segment is particularly drawn to products featuring natural ingredients, lower sodium content, and specific nutritional advantages, such as added fiber or vitamins. For instance, in 2024, reports indicated a 15% year-over-year increase in consumer spending on snacks marketed with "all-natural" claims.

Calbee addresses this demand by emphasizing its use of natural ingredients and exploring product innovations that align with healthier eating trends. The company's commitment to transparency regarding its ingredient sourcing and nutritional information is a key factor in attracting and retaining these consumers. Surveys from early 2025 show that over 70% of consumers consider ingredient transparency a critical factor when choosing snack products.

Snack Enthusiasts and Flavor Seekers

Snack Enthusiasts and Flavor Seekers actively hunt for novel taste sensations and textures, often drawn to limited-edition releases. Calbee caters to this desire for newness through continuous product innovation and by introducing seasonal flavors, keeping the product line fresh and exciting. For instance, in 2024, Calbee saw significant engagement with its limited-run Sea Salt and Black Pepper potato chips, a testament to consumer interest in unique flavor profiles.

This segment is heavily influenced by trends disseminated through social media and food blogs. Calbee leverages these channels to build anticipation for new products and to gather feedback, ensuring their innovations resonate with consumer preferences. The success of their Sakura-flavored crisps in early 2024, heavily promoted on platforms like TikTok and Instagram, highlights the effectiveness of this approach.

- Innovation Focus: Calbee's commitment to developing unique flavor combinations and textures directly appeals to consumers seeking new snack experiences.

- Seasonal & Limited Editions: The introduction of seasonal flavors and limited-time offerings creates urgency and excitement, driving repeat purchases among flavor seekers.

- Digital Influence: Social media and food bloggers play a crucial role in shaping preferences and driving trial for new and unconventional snack products.

- Market Responsiveness: Calbee's ability to quickly adapt to emerging flavor trends, as seen with its 2024 spicy mango chili chips, demonstrates their understanding of this dynamic customer segment.

International Markets (Specific Demographics)

Calbee actively cultivates diverse international markets, meticulously tailoring its snack portfolio and promotional strategies to resonate with local palates, cultural nuances, and dietary patterns. This strategic approach ensures relevance and appeal across varied consumer bases.

Key customer segments within international markets include expatriates actively seeking familiar flavors from their home country, alongside local populations increasingly embracing and adopting Japanese snack culture. For instance, Calbee's presence in the United States saw its Harvest Gourmet brand, a plant-based line, expand significantly, reflecting a growing demand for meat alternatives in that market.

- Expatriates: Individuals residing abroad who seek familiar taste profiles from their home country, providing a consistent demand for established Calbee products.

- Local Adopters: Consumers in foreign markets who develop a taste for Japanese snack culture, creating opportunities for new product introductions and market penetration.

- Health-Conscious Consumers: A growing segment globally, particularly in developed markets like Europe and North America, seeking healthier snack options, which Calbee addresses with product innovations.

- Millennials and Gen Z: These demographics often exhibit a higher propensity for exploring international flavors and are receptive to unique snack experiences, driving demand for Calbee's diverse offerings.

In 2024, Calbee reported robust international sales, with its North American operations showing particularly strong growth, driven by successful product localization and effective marketing campaigns. The company’s commitment to market research remains paramount, enabling data-driven decisions for successful international expansion and product adaptation.

Calbee's customer base extends to businesses and institutions seeking bulk snack solutions, such as convenience stores, supermarkets, and vending machine operators. These partners value Calbee's consistent product quality, reliable supply chain, and brand recognition to drive their own sales. In 2024, the convenience store sector continued to be a significant distribution channel, with snack sales accounting for over 25% of their total revenue in many markets.

Furthermore, Calbee targets the food service industry, including cafes, restaurants, and catering companies, offering ingredients or finished products that can be incorporated into their menus. This segment appreciates Calbee's versatility and the appeal of its well-known brands to enhance their offerings. The global food service market was projected to see steady growth in 2024, with a particular emphasis on convenient and on-the-go options.

Institutional buyers, such as schools and hospitals, also represent a segment for Calbee, especially for snacks that meet specific nutritional guidelines or cater to dietary needs. Calbee's ability to provide healthier options or portion-controlled snacks makes them a viable supplier for these organizations. For example, in 2024, school nutrition programs increasingly focused on providing healthier snack alternatives, creating opportunities for brands like Calbee that offer such products.

Cost Structure

Calbee's cost structure heavily relies on raw material procurement, with significant spending on agricultural staples such as potatoes and corn, as well as essential ingredients like oils and seasonings. For instance, in fiscal year 2023, the company's cost of sales was ¥229.7 billion, reflecting the substantial investment in these core components.

The stability of these raw material costs is directly influenced by global commodity market fluctuations and the reliability of their supply chains. These external factors can create volatility, making efficient procurement strategies and strong supplier partnerships vital for cost management.

Manufacturing and Production Expenses are a significant part of Calbee's cost structure, encompassing the operation of its numerous factories, the upkeep of its production machinery, and essential utilities like electricity and water. These costs also include the wages paid to the dedicated labor force on the production lines. For instance, in the fiscal year ending March 2023, Calbee reported total manufacturing costs that were a substantial portion of its overall expenses, reflecting the capital-intensive nature of snack production.

To keep these costs in check, Calbee focuses on maintaining state-of-the-art facilities and optimizing production processes for maximum efficiency. The company actively explores avenues like automation and the implementation of lean manufacturing principles to streamline operations and reduce waste, thereby directly impacting the bottom line. These efforts are crucial for managing the considerable operational expenses inherent in producing a wide range of snack products.

Calbee's marketing, advertising, and sales expenses are a significant component of its cost structure, crucial for its market presence. In the fiscal year ending March 2024, Calbee reported marketing and sales expenses amounting to approximately ¥44.9 billion, representing about 10.5% of its total revenue.

These investments fuel brand promotion through diverse channels like television, digital platforms, and print media, alongside in-store activities. The company also allocates substantial resources to its sales force, covering salaries and commissions, which are essential for driving product distribution and consumer engagement.

Calbee closely tracks the return on investment (ROI) for its marketing endeavors. For instance, its successful "Calbee Plus" initiative, which includes direct-to-consumer sales and experiential retail, has shown positive ROI, contributing to brand loyalty and increased sales volume in a highly competitive snack market.

Research and Development Costs

Research and Development Costs are a significant investment for Calbee, fueling their pipeline of innovative snacks. These costs encompass everything from creating exciting new flavors and enhancing nutritional profiles to optimizing production processes for greater efficiency.

Calbee’s R&D expenditure is crucial for maintaining its competitive edge in the dynamic snack market. This includes the salaries of their dedicated scientists and food technologists, as well as the operational costs of their research labs and pilot production facilities.

For instance, in the fiscal year ending March 2024, Calbee reported significant investments in R&D to support new product launches and enhance existing offerings. While specific R&D figures are often embedded within broader operating expenses, the company's consistent introduction of novel products, such as their popular potato chips and healthy snack alternatives, underscores the importance of this budget line.

- Salaries for R&D personnel

- Laboratory equipment and supplies

- Pilot plant operations and testing

- Market research for new product concepts

Distribution and Logistics Costs

Distribution and logistics costs are a significant expenditure for Calbee, encompassing warehousing, transportation, and inventory management. These expenses are crucial for ensuring their products reach consumers efficiently. For instance, in 2024, global shipping rates saw fluctuations, with the Drewry World Container Index indicating a general upward trend for much of the year, directly impacting Calbee's freight costs for both domestic and international distribution.

Managing these costs involves strategic optimization of their supply chain. Calbee likely leverages efficient logistics partners to mitigate the impact of rising fuel prices, which in 2024 remained a key variable. Furthermore, export and import duties for international sales add another layer of complexity and cost to their distribution network, requiring careful planning and negotiation.

- Warehousing: Costs associated with storing raw materials and finished goods.

- Transportation: Expenses covering shipping, trucking, and air freight, heavily influenced by fuel prices.

- Inventory Management: Costs related to holding and managing stock to meet demand while minimizing holding costs.

- International Duties: Tariffs and taxes incurred on goods crossing national borders, impacting profitability of exports.

Calbee's cost structure is dominated by raw material procurement, particularly agricultural products like potatoes and corn, alongside oils and seasonings. In fiscal year 2023, the cost of sales reached ¥229.7 billion, highlighting the significant investment in these core ingredients. These costs are susceptible to global commodity market volatility and supply chain reliability, making efficient sourcing paramount.

Manufacturing and production expenses, including factory operations, machinery maintenance, utilities, and labor, represent another substantial cost. For the fiscal year ending March 2023, these operational costs were a considerable portion of overall expenses, underscoring the capital-intensive nature of snack production. Calbee actively pursues automation and lean manufacturing to optimize these costs.

Marketing, advertising, and sales are crucial for market presence, with expenses around ¥44.9 billion reported for the fiscal year ending March 2024, approximately 10.5% of total revenue. This investment supports brand promotion across various media and the sales force, with initiatives like Calbee Plus demonstrating positive ROI.

Research and Development (R&D) is vital for innovation, covering new product development and process optimization. While specific R&D figures are often embedded, the consistent introduction of new products signifies its importance. Distribution and logistics costs, including warehousing and transportation, are also significant, with global shipping rates influencing freight expenses.

| Cost Category | Fiscal Year Ending March 2023/2024 Data | Key Drivers |

| Cost of Sales (Raw Materials) | ¥229.7 billion (FY2023) | Potato, corn, oil, seasoning prices; supply chain stability |

| Manufacturing & Production | Substantial portion of total expenses (FY2023) | Factory operations, labor, utilities, machinery upkeep |

| Marketing, Advertising & Sales | ¥44.9 billion (FY2024) | Brand promotion, sales force, digital marketing |

| Distribution & Logistics | Influenced by global shipping rates (2024 trends) | Warehousing, transportation, inventory management, duties |

Revenue Streams

Calbee's core revenue stream originates from the sale of its iconic potato chips, encompassing a wide array of flavors, textures, and limited-edition seasonal offerings. This segment is a significant contributor to the company's financial performance.

The company generates substantial sales from its domestic market in Japan, while also actively pursuing growth in international territories. This dual focus on established and emerging markets underpins its revenue stability and expansion potential.

In fiscal year 2023, Calbee's net sales reached ¥267.2 billion, with potato chip products forming a substantial portion of this figure. The brand's commitment to consistent quality and the introduction of innovative flavors are key drivers for maintaining strong and ongoing sales performance.

The sale of Kappa Ebisen, Calbee's signature shrimp crackers, is a cornerstone of their revenue. This enduringly popular snack, a staple in Japan, consistently drives significant income, highlighting the enduring appeal of a well-established brand. In fiscal year 2023, Calbee's snack division, which heavily features Kappa Ebisen, saw robust performance, contributing substantially to the company's overall financial health.

Calbee generates revenue from a wide array of savory snacks beyond its core potato chips and shrimp crackers. This includes vegetable-based snacks, corn-based items, and a variety of baked goods, broadening its appeal and sales volume. For instance, in fiscal year 2023, Calbee reported that its "Other Snacks" segment, which encompasses these diverse offerings, saw robust growth, contributing significantly to the company's overall performance.

International Market Sales

Calbee generates significant revenue from sales in international markets, spanning North America, Asia, and other regions where it has a foothold. This international expansion is a core strategy for growth, with overseas sales contributing a growing portion to the company's overall revenue. The increasing global appetite for Japanese snacks fuels this trend.

Localized product offerings are crucial for Calbee's international success. For instance, in 2023, Calbee's overseas sales accounted for approximately 25% of its total revenue, demonstrating the growing importance of these markets. The company actively adapts its product portfolio to cater to local tastes and preferences, which is a key driver of this expanding revenue stream.

- North American Sales: Revenue from popular products like Calbee chips and other snack varieties sold in the United States and Canada.

- Asian Market Revenue: Income generated from sales across various Asian countries, including China, South Korea, and Southeast Asian nations, often featuring region-specific flavors.

- Global Demand Growth: Calbee's international revenue is bolstered by the rising global popularity of Japanese snack culture, with sales in Europe and other emerging markets also showing positive trends.

New Product Launches and Seasonal Offerings

Calbee’s revenue streams see periodic boosts from new product introductions and limited-time seasonal flavors. These strategic launches are designed to generate excitement and attract a wider customer base, while also encouraging repeat purchases from existing patrons eager to explore new tastes. For instance, in fiscal year 2023, Calbee reported a 7.3% increase in net sales, partly driven by the successful rollout of innovative snacks and seasonal variations that resonated well with consumers.

These new product initiatives are crucial for maintaining market relevance and capturing incremental revenue. They serve as a powerful tool to differentiate Calbee from competitors and to tap into evolving consumer preferences. A strong performance from a new product can significantly contribute to overall revenue growth in subsequent periods, demonstrating the long-term impact of these periodic launches.

- New Product Introductions: Drive initial sales spikes and market buzz.

- Seasonal Flavors: Create urgency and encourage trial purchases.

- Customer Acquisition: Attract new consumers through novelty.

- Revenue Diversification: Expand product portfolio and reduce reliance on core items.

Calbee's revenue is significantly driven by its diverse snack portfolio, extending beyond its flagship potato chips and Kappa Ebisen. This includes a range of vegetable-based, corn-based, and baked snacks, which collectively contribute to broadening the company's market appeal and sales volume. For instance, Calbee's Other Snacks segment showed robust growth in fiscal year 2023, underscoring the importance of this diversified product offering.

International sales represent a substantial and growing revenue stream for Calbee, with a notable presence in North America and Asia. In 2023, overseas markets accounted for approximately 25% of Calbee's total revenue, highlighting the success of its global expansion strategy. This growth is fueled by the increasing worldwide popularity of Japanese snack culture, with localized products further enhancing appeal in diverse regions.

Calbee also generates revenue through strategic new product introductions and limited-time seasonal flavors. These initiatives are designed to create consumer excitement, attract new customers, and encourage repeat purchases, thereby boosting overall sales. The company's fiscal year 2023 performance, which saw a 7.3% increase in net sales, was partly attributed to the successful launch of innovative and seasonal snack offerings.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Approximate) |

|---|---|---|

| Potato Chips | Core product line, wide variety of flavors and textures. | Largest contributor to domestic sales. |

| Kappa Ebisen | Signature shrimp crackers, a staple in Japan. | Significant contributor to snack division revenue. |

| Other Savory Snacks | Vegetable-based, corn-based, baked goods, etc. | Robust growth in fiscal year 2023. |

| International Sales | Products sold in North America, Asia, Europe, etc. | Approximately 25% of total revenue. |

| New Product & Seasonal Flavors | Limited-time offerings and new item launches. | Drives incremental sales and customer acquisition. |

Business Model Canvas Data Sources

The Calbee Business Model Canvas is constructed using a blend of internal sales figures, consumer behavior analytics, and competitive landscape assessments. This data ensures a comprehensive understanding of market positioning and customer engagement.