CAF SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAF Bundle

Uncover the CAF's strategic advantages and potential hurdles with our comprehensive SWOT analysis. This report delves deep into their market position, operational efficiencies, and competitive landscape, offering a clear roadmap for understanding their trajectory.

Want to truly grasp the CAF's competitive edge and potential challenges? Purchase the complete SWOT analysis to access a professionally crafted, fully editable document that provides actionable insights for strategic planning and informed decision-making.

Strengths

CAF boasts a remarkably diverse product portfolio, spanning high-speed trains, regional trains, metros, trams, and locomotives. This extensive range allows them to meet a wide spectrum of global transportation demands. For instance, in 2024, CAF secured a significant contract for metro vehicles in a major European city, highlighting their strength in urban mobility solutions.

Complementing their manufacturing prowess, CAF delivers comprehensive rail-related services. These include vital areas like signaling systems, infrastructure development, and ongoing maintenance, enabling them to offer truly integrated project capabilities. This holistic approach positions CAF as a full-service provider, capable of managing complex rail projects from conception to completion.

This broad and integrated offering allows CAF to effectively tap into various market segments and cater to a wide array of client requirements worldwide. Their ability to provide both rolling stock and associated services provides a competitive edge, as demonstrated by their consistent performance in international tenders.

CAF's financial performance in early 2025 showcases impressive strength, with Q1 revenue climbing 11% and net profit surging by 53%. This robust growth underscores the company's ability to convert market opportunities into tangible financial gains.

The company's order backlog hit an all-time high of €15.6 billion in Q1 2025. This substantial backlog provides exceptional revenue visibility for the coming periods, signaling strong and sustained market demand for CAF's offerings and ensuring operational stability.

CAF boasts a robust global presence, actively serving clients across the world. This international reach is underscored by significant contract wins, including substantial rail maintenance agreements secured in Brazil and New Zealand during 2024. Furthermore, the company has received notable rolling stock orders from various European nations and the United States, highlighting its broad market penetration.

This extensive international footprint is a key strength, significantly reducing CAF's reliance on any single geographic market. It also serves as a clear testament to the company's proven ability to compete effectively and successfully deliver complex projects on a global scale, a critical factor in the competitive rail industry.

Technological Leadership and Innovation Commitment

CAF's dedication to technological advancement is a significant strength, evident in its active pursuit of cutting-edge railway solutions. The company is deeply involved in developing hydrogen-powered vehicles, a key area for sustainable transport. Furthermore, CAF's participation in EU RAIL underscores its commitment to collaborative research and development, pushing the boundaries of what's possible in the sector.

This innovation drive is strategically aligned with the broader industry's move towards digitalization, artificial intelligence, and smart technologies. By embracing these advancements, CAF aims to enhance operational efficiency and bolster safety across its projects. This forward-thinking approach ensures CAF remains a competitive player, capable of adapting to and shaping the future demands of the railway industry.

- Hydrogen Mobility: CAF is actively developing hydrogen-powered trains, aligning with global decarbonization efforts.

- EU RAIL Collaboration: Involvement in EU RAIL initiatives signifies a commitment to collaborative R&D and innovation.

- Digitalization Focus: Strategic planning incorporates digitalization, AI, and smart technologies for improved railway systems.

Integrated Business Model and Project Structuring Expertise

CAF's integrated business model covers the full railway solution lifecycle, from initial design and manufacturing to ongoing operation and maintenance. This holistic approach, coupled with deep expertise in project structuring and financing, simplifies complex projects for clients. For instance, CAF secured a significant €1.4 billion contract in 2023 for the supply and maintenance of 140 trains for the Madrid Metro, a testament to their ability to manage large-scale, integrated projects.

This end-to-end capability provides a distinct advantage, potentially reducing project complexity and mitigating risks by consolidating services with a single, experienced provider. Their ability to handle financing, as demonstrated by their involvement in various public-private partnerships, further solidifies this strength. CAF's order backlog as of the first half of 2024 remained robust, exceeding €20 billion, indicating continued demand for their comprehensive solutions.

- End-to-End Lifecycle Management: CAF manages railway projects from concept to long-term operation.

- Project Structuring and Financing Expertise: Proven ability to structure and finance complex rail initiatives.

- Risk Reduction for Clients: Streamlined approach with a single, experienced provider minimizes client project complexity.

- Strong Order Book: A substantial backlog, over €20 billion in H1 2024, underscores client confidence in their integrated model.

CAF's diverse product range, from high-speed trains to trams, addresses varied global transport needs, as evidenced by their 2024 contract for metro vehicles in a major European city. Their integrated service offerings, including signaling and maintenance, position them as a full-service provider capable of managing complex rail projects from start to finish.

The company's financial health is robust, with Q1 2025 revenue up 11% and net profit surging 53%. This strong performance is supported by an all-time high order backlog of €15.6 billion in Q1 2025, ensuring significant revenue visibility and operational stability.

CAF's global reach, demonstrated by 2024 rail maintenance contracts in Brazil and New Zealand and rolling stock orders from Europe and the US, reduces market dependency and highlights their international project delivery capability. Their commitment to innovation, particularly in hydrogen mobility and digitalization through initiatives like EU RAIL, positions them for future growth.

| Metric | Q1 2025 | 2024 | Q1 2025 vs Q1 2024 |

| Revenue Growth | - | - | 11% |

| Net Profit Growth | - | - | 53% |

| Order Backlog | €15.6 billion | - | All-time high |

What is included in the product

Analyzes CAF’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential roadblocks into opportunities.

Weaknesses

CAF's substantial reliance on public sector spending, particularly for large infrastructure projects, presents a notable weakness. For instance, in 2023, government contracts represented a significant majority of CAF's order backlog, highlighting this dependency. This makes the company vulnerable to shifts in government budgets and policy priorities, potentially impacting the flow of new business.

Economic downturns or changes in political cycles can directly affect the volume and scheduling of CAF's projects. This exposure introduces a degree of uncertainty into the company's long-term project pipeline and revenue predictability. For example, a delay in a major national rail infrastructure tender in 2024, due to budgetary reallocations, impacted CAF's immediate order intake projections.

CAF's railway projects often endure protracted sales cycles, stretching from initial bidding to final contract signing, and the subsequent implementation phases can be equally lengthy. This extended timeline ties up substantial capital and resources, impacting immediate cash flow and investment returns.

The inherent complexity of railway infrastructure projects exposes CAF to significant risks, including potential cost overruns and unforeseen technical hurdles. For instance, major rail projects globally have seen average cost increases of 20% above initial estimates, a risk factor CAF must diligently manage.

Project delays are a common occurrence in the rail sector, often stemming from regulatory approvals, land acquisition issues, or supply chain disruptions. These delays can further exacerbate cost overruns and strain client relationships, directly impacting CAF's profitability and operational efficiency.

CAF's operations are inherently capital-intensive. Developing and producing cutting-edge trains and rail infrastructure demands significant upfront investment in research, specialized factories, and sophisticated equipment. For instance, in 2023, CAF reported capital expenditures of €372 million, reflecting ongoing investments in its manufacturing capabilities and product development to stay ahead in a competitive market.

This high capital requirement can strain financial resources, potentially limiting CAF's ability to pursue all growth opportunities simultaneously or respond quickly to market shifts without further financing. Maintaining competitiveness necessitates a constant cycle of reinvestment in technology and facilities, which can impact profitability margins if not managed efficiently.

Vulnerability to Raw Material Price Volatility

CAF's reliance on key materials like steel and aluminum makes it susceptible to price swings. For instance, global steel prices saw significant volatility in 2024, with some benchmarks experiencing double-digit percentage changes within months, directly impacting CAF's input costs.

This sensitivity can directly affect CAF's profitability. If the company cannot effectively pass on increased raw material expenses to its customers, its profit margins could be squeezed. For example, a sustained 10% increase in steel prices, a primary component in train manufacturing, could translate to a noticeable reduction in net profit if not offset by other efficiencies or price adjustments.

- Steel Price Fluctuations: Global steel prices experienced considerable volatility throughout 2024, impacting manufacturing costs.

- Aluminum Market Sensitivity: Aluminum, another critical component, also faced price pressures due to supply chain disruptions and demand shifts.

- Margin Squeeze Potential: Unhedged increases in raw material costs can directly reduce CAF's profit margins.

- Hedging and Pricing Strategies: The effectiveness of CAF's hedging strategies and its ability to adjust pricing are crucial for mitigating this weakness.

Intense Global Competition and Market Concentration

CAF faces significant challenges due to the intensely competitive global rolling stock market, which is largely controlled by a handful of major international manufacturers. This concentration means that securing new contracts requires not only competitive pricing but also a constant drive for innovation in technology and service offerings.

The pressure on profit margins is substantial, as aggressive pricing strategies are common among key players. For instance, in 2023, the global railway rolling stock market was valued at approximately $50 billion, with growth projected to reach over $70 billion by 2028, indicating a highly contested but expanding sector.

- Market Dominance: A few multinational corporations hold a significant share of the global rolling stock market, limiting opportunities for smaller or less established companies.

- Pricing Pressure: Intense competition often forces manufacturers to lower prices, impacting profitability and the ability to invest in research and development.

- Differentiation Imperative: Continuous investment in advanced technologies, such as high-speed rail components and sustainable mobility solutions, is crucial for CAF to stand out and win bids.

CAF's extensive reliance on public sector funding, particularly for large infrastructure projects, poses a significant vulnerability. In 2023, government contracts constituted the majority of CAF's order backlog, underscoring this dependency. This makes the company susceptible to changes in government budgets and policy shifts, which can affect the influx of new business.

Economic downturns or shifts in political cycles can directly impact the volume and timing of CAF's projects. This exposure introduces uncertainty into the company's long-term project pipeline and revenue predictability. For instance, a delay in a major national rail infrastructure tender in 2024, due to budgetary reallocations, impacted CAF's immediate order intake projections.

The railway sector is characterized by protracted sales cycles, from bidding to contract signing and implementation, tying up substantial capital and resources. This can strain immediate cash flow and investment returns, as seen in the extended timelines for major European rail network upgrades.

CAF's operations are inherently capital-intensive, requiring significant upfront investment in research, specialized factories, and sophisticated equipment. In 2023, CAF reported capital expenditures of €372 million, reflecting ongoing investments in manufacturing capabilities and product development to maintain market competitiveness.

The company's dependence on key materials like steel and aluminum exposes it to price volatility. For example, global steel prices saw significant fluctuations in 2024, with some benchmarks experiencing double-digit percentage changes within months, directly affecting CAF's input costs.

| Weakness Category | Specific Challenge | Impact on CAF | Example/Data Point |

| Public Sector Dependency | Reliance on government contracts | Vulnerability to budget cuts and policy changes | Majority of 2023 order backlog from government projects |

| Project Complexity & Delays | Long sales cycles and implementation phases | Tied-up capital, potential cash flow strain | Extended timelines for major rail infrastructure projects |

| Capital Intensity | High investment in R&D and facilities | Potential strain on financial resources, limits growth pursuit | €372 million capital expenditure in 2023 |

| Raw Material Price Volatility | Sensitivity to steel and aluminum prices | Potential margin squeeze if costs cannot be passed on | Double-digit percentage changes in steel prices during 2024 |

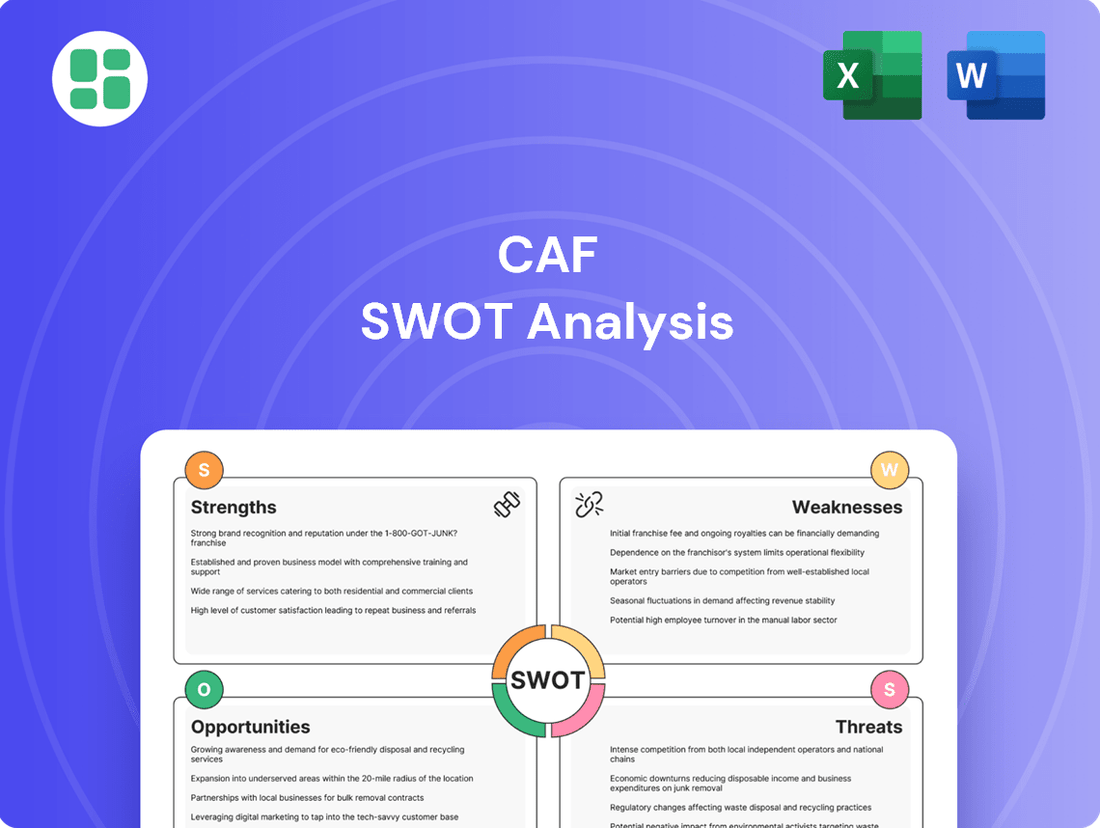

Preview the Actual Deliverable

CAF SWOT Analysis

This is the actual CAF SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full CAF SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real CAF SWOT analysis document you'll receive—professional, structured, and ready to use.

Opportunities

The global push for decarbonization is significantly boosting demand for sustainable transportation. This includes a strong focus on electric, hybrid, and hydrogen-powered vehicles, with railways playing a crucial role in this transition. For instance, the global railway market is projected to reach approximately $270 billion by 2027, with a substantial portion dedicated to electrification and new energy technologies.

CAF's established expertise in manufacturing electric and hybrid trains, along with its ongoing development in hydrogen-powered solutions, positions it favorably to capitalize on this expanding market. The company's commitment to innovation in these areas directly addresses the growing need for environmentally friendly public transport, a key driver for infrastructure investment worldwide.

CAF is well-positioned to capitalize on the accelerating trend of global urbanization. As cities expand, the need for efficient mass transit systems, such as metros and trams, intensifies. This demographic shift directly translates into a sustained demand for new rolling stock and comprehensive transport solutions, presenting a significant growth opportunity for CAF.

By 2050, it's projected that 68% of the world's population will live in urban areas, a substantial increase from today's 56%. This surge in urban dwellers necessitates robust public transportation infrastructure. CAF's expertise in manufacturing trains and providing integrated mobility solutions aligns perfectly with the requirements of these growing urban centers, offering a clear path for increased revenue and market share.

Globally, a significant portion of rail infrastructure is aging, necessitating substantial investment in upgrades, refurbishment, and the replacement of outdated rolling stock and signaling systems. This presents a consistent, long-term demand for experienced companies like CAF. For instance, in 2024, the European Union alone is projected to invest billions in rail modernization projects, with a strong focus on high-speed rail and digital signaling, areas where CAF has proven expertise.

This continuous need for modernization translates into a steady pipeline of projects and maintenance contracts, offering CAF a stable revenue stream. Many national railway operators are actively seeking to enhance efficiency, safety, and capacity, driving demand for new trains and advanced control systems. CAF's established presence and track record in delivering these complex upgrades position it favorably to capture a significant share of this market throughout 2024 and into 2025.

Advancements in Rail Technology and Digitalization

The rail sector is rapidly embracing new technologies like AI, IoT, and predictive maintenance, aiming to boost efficiency and safety. CAF is well-positioned to capitalize on this by creating more intelligent products and services, potentially integrating autonomous train operations and advanced signaling to meet evolving industry demands.

These advancements offer significant opportunities for CAF to enhance its product portfolio and operational capabilities. For instance, the global railway signaling market was valued at approximately USD 8.5 billion in 2023 and is projected to reach USD 12.8 billion by 2030, growing at a CAGR of 6.1%. This growth underscores the increasing investment in modernizing rail infrastructure and control systems, areas where CAF can innovate.

CAF can leverage these trends by focusing on:

- Developing AI-powered predictive maintenance solutions to reduce downtime and operational costs for rail operators.

- Integrating IoT sensors into rolling stock and infrastructure for real-time monitoring and data analytics.

- Exploring partnerships or internal development for autonomous train technologies and advanced digital signaling systems to offer next-generation solutions.

Expansion into Emerging Markets and Developing Economies

Emerging markets and developing economies are increasingly prioritizing transportation infrastructure development to fuel economic expansion and manage rapid urbanization. This presents a substantial opportunity for CAF to tap into significant, largely unexploited market potential. For instance, the African Development Bank projected that Africa's infrastructure financing needs could reach $130-$170 billion annually, with a significant portion dedicated to transport.

CAF's expertise in providing comprehensive mobility solutions, from rolling stock to signaling systems, aligns perfectly with the needs of these growing regions. The company can leverage its established reputation and technological capabilities to secure large-scale projects, thereby expanding its global footprint. Many of these nations are actively seeking partners to modernize their rail networks and urban transport systems, creating a fertile ground for CAF's offerings.

- Untapped Market Potential: Developing nations are investing heavily in infrastructure to support economic growth and urbanization.

- Demand for Modernization: CAF can capitalize on the need for advanced rail and urban transport solutions in these regions.

- Large-Scale Projects: Opportunities exist for securing significant contracts as countries upgrade their transportation networks.

- Global Reach Expansion: Entering these markets will diversify CAF's revenue streams and enhance its international presence.

CAF is strategically positioned to benefit from the global shift towards sustainable transportation, particularly in the burgeoning electric and hydrogen train markets. The company's expertise in these areas directly addresses the increasing demand for eco-friendly public transit, a key driver for infrastructure investment. For example, the global railway market is expected to reach around $270 billion by 2027, with a significant portion allocated to sustainable technologies.

The company is also well-placed to meet the needs of rapidly urbanizing populations worldwide, as cities expand and require more efficient mass transit solutions like metros and trams. With 68% of the global population projected to live in urban areas by 2050, the demand for new rolling stock and integrated mobility systems presents a substantial growth avenue for CAF.

Furthermore, the ongoing modernization of aging rail infrastructure across the globe offers CAF a consistent stream of opportunities. Billions are being invested in rail upgrades, including high-speed rail and digital signaling, areas where CAF possesses proven capabilities. This continuous need for refurbishment and replacement of outdated systems ensures a steady project pipeline for the company.

CAF can also leverage the rapid technological advancements in the rail sector, such as AI and IoT, to enhance its product offerings with intelligent solutions and predictive maintenance. The global railway signaling market alone, valued at approximately $8.5 billion in 2023, is projected to grow significantly, indicating strong demand for modern control systems.

Emerging markets represent another significant opportunity, as developing economies prioritize transportation infrastructure to foster economic growth and manage urbanization. CAF's comprehensive mobility solutions are well-suited to these regions, which are actively seeking partners for rail network modernization, offering CAF a chance to expand its global presence and secure large-scale projects.

| Opportunity | Description | Market Data/Projection |

| Sustainable Transportation Demand | Growing need for electric, hybrid, and hydrogen trains driven by decarbonization efforts. | Global railway market projected to reach ~$270 billion by 2027. |

| Urbanization Trends | Increased demand for efficient mass transit (metros, trams) in expanding cities. | 68% of global population to live in urban areas by 2050. |

| Rail Infrastructure Modernization | Investment in upgrading aging rail networks, rolling stock, and signaling systems. | EU investing billions in rail modernization projects in 2024. |

| Technological Advancements | Integration of AI, IoT, and predictive maintenance in rail operations. | Global railway signaling market valued at ~$8.5 billion in 2023, growing to ~$12.8 billion by 2030. |

| Emerging Markets Growth | Infrastructure development in developing economies to support economic expansion. | Africa's infrastructure financing needs estimated at $130-$170 billion annually. |

Threats

Global economic instability, particularly a potential slowdown in major markets like Europe and China, poses a significant threat to CAF. A projected global GDP growth of around 2.7% for 2024, down from earlier forecasts, could translate into reduced public investment in infrastructure, directly impacting CAF's order pipeline. This economic uncertainty makes it harder to secure new, large-scale projects.

Geopolitical tensions, such as the ongoing conflicts in Eastern Europe and the Middle East, present significant threats. These situations can disrupt global supply chains, as seen with the impact on energy and commodity prices throughout 2024. Increased trade protectionism, with countries imposing tariffs and non-tariff barriers, could raise import/export costs for CAF and create obstacles for market expansion, potentially affecting its international project viability.

The railway sector faces a significant threat from evolving regulatory landscapes, demanding constant adaptation. For instance, new European Union directives on interoperability and safety, effective from 2024, require substantial investment in upgrading signaling systems and rolling stock, potentially impacting CAF's project timelines and increasing compliance expenditures.

These stringent changes, particularly concerning environmental performance and accessibility standards, necessitate considerable research and development. CAF's commitment to innovation, while a strength, also exposes it to the financial burden of meeting these ever-increasing demands, which could divert resources from other growth initiatives.

Intensifying Competition and Price Wars

CAF operates in a fiercely competitive global market for rolling stock and railway systems. Established international manufacturers constantly vie for significant infrastructure contracts, creating a challenging environment for securing new business.

This intense rivalry often translates into aggressive bidding and price wars. Companies may lower their profit margins to win bids, which can negatively impact profitability and make it harder to achieve desired financial returns on projects awarded in 2024 and projected for 2025.

- Intensified bidding: Competitors frequently engage in aggressive pricing strategies to secure major contracts.

- Margin erosion: Price wars can significantly reduce profit margins for CAF and its rivals.

- Market share pressure: The need to win contracts can force companies to accept lower profitability to maintain or grow market share.

- Project viability: Extremely low bids may question the long-term viability and profitability of awarded projects.

Supply Chain Disruptions and Component Shortages

The intricate manufacturing process for railway equipment, like that produced by CAF, is heavily dependent on a global network of suppliers for specialized components. Any hiccup in this chain, whether from geopolitical instability, natural disasters, or simply a scarcity of essential raw materials, can create significant problems. These disruptions directly translate into production slowdowns, escalating manufacturing expenses, and a struggle to meet crucial delivery deadlines for new rolling stock and maintenance parts.

For instance, the semiconductor shortage that began in 2020 and continued through 2023 significantly impacted numerous manufacturing sectors, including automotive and industrial equipment, which often share component suppliers with the rail industry. While the situation has eased, the vulnerability remains. In 2024, continued geopolitical tensions and potential trade disputes could reintroduce supply chain volatility, impacting the availability and cost of critical electronic and metal components essential for CAF's product lines.

- Global Supply Chain Reliance: CAF's production of advanced rail systems necessitates a vast array of specialized parts sourced internationally.

- Vulnerability to Global Events: Unforeseen events such as natural disasters, trade wars, or pandemics can halt or delay the flow of essential components.

- Impact on Production and Costs: Disruptions lead to manufacturing delays, increased component prices, and the potential inability to fulfill existing orders on time.

- Component Shortage Example: The recent semiconductor crisis highlighted how shortages in even one critical area can ripple through complex manufacturing operations.

Intensified competition in the global rail market poses a significant threat, with rivals frequently employing aggressive pricing strategies. This can lead to margin erosion, as companies may lower profit margins to secure contracts, impacting overall profitability for CAF in 2024 and beyond. The pressure to maintain market share necessitates careful balancing of competitive pricing with sustainable financial returns.

CAF's reliance on a global supply chain makes it vulnerable to disruptions. Events like geopolitical tensions or trade disputes can impact the availability and cost of critical components, leading to production delays and increased manufacturing expenses. The semiconductor shortage experienced through 2023 serves as a stark reminder of this vulnerability, with potential for similar issues to arise in 2024 impacting electronic and metal components.

Evolving regulatory landscapes, particularly in the European Union, demand continuous adaptation and investment. New directives on interoperability and safety, effective from 2024, require upgrades that could affect project timelines and increase compliance costs for CAF. Meeting stringent environmental and accessibility standards also necessitates substantial R&D investment, potentially diverting resources from other growth areas.

| Threat Category | Specific Threat | Potential Impact | Relevant Data/Context |

|---|---|---|---|

| Economic Instability | Global economic slowdown | Reduced public infrastructure investment, impacting order pipeline | Projected global GDP growth ~2.7% for 2024 |

| Geopolitical Tensions | Trade protectionism | Increased import/export costs, market expansion obstacles | Ongoing conflicts impacting energy/commodity prices in 2024 |

| Regulatory Landscape | New EU interoperability directives | Increased compliance costs, potential project timeline impacts | Directives effective from 2024 |

| Competition | Aggressive bidding and price wars | Margin erosion, pressure on profitability | Intensified rivalry for major infrastructure contracts |

| Supply Chain Vulnerability | Disruption of specialized component supply | Production slowdowns, increased manufacturing expenses | Recurrence of semiconductor shortage risks in 2024 |

SWOT Analysis Data Sources

This CAF SWOT analysis is built upon a foundation of robust data, encompassing internal financial reports, comprehensive market intelligence, and expert industry evaluations to provide a thorough and actionable strategic overview.