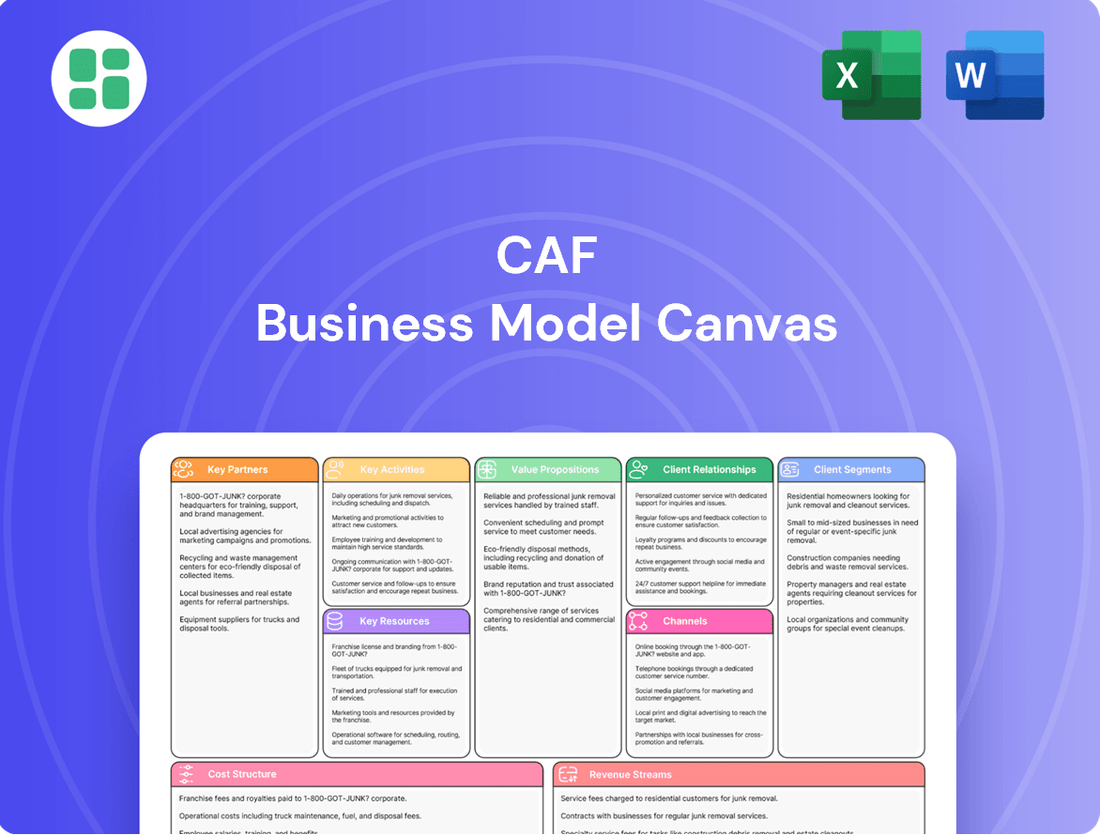

CAF Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAF Bundle

Curious about CAF's strategic engine? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational excellence. Download the full version to gain a comprehensive understanding of their success and apply similar principles to your own ventures.

Partnerships

CAF actively partners with national, regional, and municipal transport authorities worldwide, a cornerstone for securing major public tenders. These collaborations are vital for winning contracts for new trains and essential infrastructure developments.

These relationships frequently entail multi-year agreements and require alignment with public policy goals, directly shaping project parameters and execution. For instance, CAF's 2023 order book included significant contracts with European public transport operators, demonstrating the ongoing importance of these government partnerships.

CAF's strategic alliances with technology and component suppliers are crucial for its Business Model Canvas. These partnerships grant access to advanced railway systems and specialized parts, enabling CAF to incorporate cutting-edge features. For instance, collaborations with propulsion system manufacturers are vital for developing more energy-efficient trains, a key differentiator in the evolving market.

CAF collaborates with a global network of maintenance and service providers, both local and international, to offer robust after-sales support and extended fleet management. These partnerships are crucial for ensuring the ongoing operational reliability and longevity of CAF's rolling stock, directly impacting customer satisfaction and the total cost of ownership.

These strategic alliances often manifest as multi-year service agreements, guaranteeing continuous technical assistance and spare parts availability. For instance, CAF's commitment to lifecycle support means these partnerships are designed to cover everything from routine checks to complex repairs, ensuring that fleets remain in peak condition throughout their operational lifespan.

Research and Development Institutions

CAF actively collaborates with universities and research institutions to foster innovation, particularly in sustainable mobility and advanced automation. These partnerships are crucial for developing cutting-edge technologies, such as hydrogen-powered trains, ensuring CAF remains at the forefront of railway innovation and meets evolving market needs.

These collaborations allow CAF to tap into specialized knowledge and research capabilities, accelerating the development of next-generation railway solutions. For instance, in 2024, CAF continued its focus on R&D for zero-emission technologies, with significant investment allocated to projects involving hydrogen fuel cells and advanced battery systems for rail transport.

- University Collaborations: Partnerships with leading technical universities enhance CAF's research in areas like materials science and digital signaling.

- Research Centers: Joint projects with specialized research centers drive advancements in autonomous train operation and predictive maintenance.

- Innovation Pipeline: These R&D efforts directly feed into CAF's product development, ensuring a strong pipeline of future-proof technologies.

- Industry Standards: Collaborations also contribute to shaping future industry standards for safety and efficiency in rail transportation.

Construction and Infrastructure Companies

CAF collaborates with construction and civil engineering companies to deliver comprehensive turnkey railway projects. These partnerships are crucial for offering integrated solutions that span from rolling stock manufacturing to the actual construction of tracks and signaling systems. This approach allows CAF to manage the entire project lifecycle, providing clients with a single point of accountability and ensuring seamless execution.

For instance, in 2024, CAF secured significant contracts where such collaborations were vital. These alliances enable CAF to leverage specialized expertise in civil works, ensuring that infrastructure development aligns perfectly with the delivery of their advanced rail vehicles. This synergy is key to successfully completing large-scale, complex infrastructure undertakings.

- Integrated Solutions: CAF partners with civil engineering firms to offer end-to-end railway solutions, combining vehicle supply with infrastructure development.

- Turnkey Projects: These alliances enable CAF to undertake full project responsibility, from design and manufacturing to installation and commissioning, simplifying the process for clients.

- Streamlined Execution: By integrating civil engineering capabilities, CAF can efficiently manage project timelines and ensure the seamless integration of all project components.

CAF's key partnerships are instrumental in its ability to deliver comprehensive railway solutions and drive innovation. Collaborations with public transport authorities are foundational for securing major contracts, while alliances with technology suppliers ensure the integration of cutting-edge systems. Furthermore, partnerships with maintenance providers guarantee robust after-sales support, and joint ventures with research institutions fuel the development of next-generation sustainable mobility technologies.

These strategic alliances are critical for CAF's operational success and market positioning. By working with civil engineering firms, CAF can offer complete turnkey projects, managing everything from rolling stock to infrastructure. This integrated approach, supported by a strong network of partners, allows CAF to effectively compete in the global railway market and deliver complex, large-scale projects efficiently.

| Partner Type | Purpose | Impact on CAF | Example/Data Point (2024 Focus) |

|---|---|---|---|

| Public Transport Authorities | Securing tenders, project definition | Access to major projects, alignment with policy | Significant new contracts awarded in Europe and North America in early 2024 |

| Technology & Component Suppliers | Access to advanced systems, innovation | Enhanced product features, competitive edge | Focus on partnerships for hydrogen fuel cell technology and advanced battery systems |

| Maintenance & Service Providers | After-sales support, fleet management | Customer satisfaction, lifecycle revenue | Expansion of service agreements for newly delivered fleets |

| Universities & Research Institutions | R&D, innovation pipeline | Development of cutting-edge tech, sustainable solutions | Continued investment in research for zero-emission trains and autonomous operations |

| Civil Engineering Firms | Turnkey project delivery, infrastructure | Integrated solutions, single point of accountability | Key collaborations for major infrastructure projects initiated in 2024 |

What is included in the product

A structured framework for outlining and analyzing a business's core components, from customer relationships to revenue streams.

It visually maps out key activities, resources, partners, cost structure, and value propositions to understand a company's strategic logic.

Eliminates the confusion of scattered business strategy by consolidating all key elements into one clear, actionable framework.

Simplifies complex business ideas into a visual, easy-to-understand format, reducing the time spent on deciphering and communicating strategy.

Activities

CAF's core activity centers on the sophisticated design and engineering of a wide array of railway vehicles. This encompasses everything from high-speed trains and metropolitan subway systems to modern trams and powerful locomotives, catering to diverse global transportation needs.

This critical function relies heavily on substantial investment in research and development, coupled with deep technical expertise. CAF must consistently push the boundaries of innovation while strictly adhering to rigorous international safety and performance standards to satisfy the unique specifications of its clients worldwide.

For instance, in 2024, CAF secured a significant contract to supply 23 new metro trains for the Santiago Metro in Chile, a project valued at approximately €230 million, highlighting their ongoing engineering prowess in urban rail solutions.

CAF's core operations involve the meticulous manufacturing and assembly of its diverse range of rolling stock, from high-speed trains to trams and metro vehicles, within its dedicated industrial facilities. This intricate process demands robust supply chain management, ensuring timely delivery of components and adherence to strict quality control protocols at every stage.

In 2023, CAF reported a significant increase in its order backlog, reaching €21.7 billion, underscoring the demand for its manufactured products. The company's commitment to efficient production lines and customization capabilities allows it to deliver high-quality, tailored railway equipment to clients worldwide, a testament to its manufacturing prowess.

A significant and growing activity for CAF is the provision of long-term maintenance and after-sales services for its installed fleet. This segment is crucial for ensuring the operational longevity and reliability of the vehicles for clients.

These services encompass routine inspections, necessary repairs, a reliable spare parts supply chain, and comprehensive overhauls. For instance, CAF's service contracts often extend for many years, providing a stable revenue stream beyond the initial vehicle sale.

In 2023, CAF's order book included a substantial portion allocated to maintenance and service contracts, demonstrating their importance to the company's overall business strategy and revenue generation.

Development and Integration of Signaling Systems

CAF’s core activities include the development and integration of sophisticated railway signaling and control systems. These advanced solutions are fundamental to improving railway safety, operational efficiency, and overall network capacity.

The company is deeply involved in implementing cutting-edge technologies such as the European Rail Traffic Management System (ERTMS) and automated train operation (ATO) systems. For instance, in 2024, CAF secured contracts for ERTMS modernization projects across various European countries, aiming to standardize and enhance cross-border rail traffic. These projects often represent multi-year commitments with significant technological investment.

- ERTMS Implementation: CAF is a key player in deploying ERTMS Level 2 and Level 3 solutions, which significantly increase line capacity and reduce headways between trains.

- ATO Systems: The company is actively developing and integrating ATO systems, contributing to more consistent train performance and energy efficiency.

- Control Centers: CAF also designs and builds integrated control centers, providing a centralized platform for managing complex railway networks.

- Safety Enhancements: These signaling developments directly contribute to reducing human error and improving overall railway safety statistics.

Execution of Turnkey Railway Projects

CAF’s key activity of executing turnkey railway projects encompasses the entire lifecycle, from conceptualization and design through to manufacturing, installation, and commissioning of rail transport systems. This integrated approach requires robust project management and intricate coordination with a multitude of suppliers, subcontractors, and client authorities.

This comprehensive management ensures seamless integration of rolling stock, signaling, telecommunications, and power supply systems, delivering complete, operational railway solutions. For instance, in 2024, CAF secured a significant contract for the supply and maintenance of 120 metro cars for the Santiago Metro in Chile, a testament to their turnkey capabilities in delivering complex urban rail transit projects.

- End-to-end project management: Overseeing all phases from design to handover.

- System integration: Combining rolling stock with essential infrastructure and signaling.

- Stakeholder coordination: Managing relationships with suppliers, contractors, and clients.

- Risk mitigation: Proactively addressing challenges inherent in large-scale infrastructure projects.

CAF's key activities revolve around the design, manufacturing, and maintenance of railway vehicles, alongside the development and implementation of advanced signaling and control systems. They also excel in executing comprehensive turnkey railway projects, integrating all necessary components for operational readiness.

These activities are underpinned by significant investment in R&D and a commitment to adhering to global safety standards. For example, in 2024, CAF was awarded a contract for 23 metro trains for Santiago Metro, valued at €230 million, showcasing their engineering strength.

The company's order backlog reached €21.7 billion in 2023, reflecting strong demand for its manufactured rolling stock and maintenance services. CAF's focus on integrated signaling solutions, like ERTMS and ATO, also enhances railway safety and efficiency, with ongoing projects in Europe in 2024.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Railway Vehicle Design & Engineering | Creating diverse rolling stock, from high-speed trains to metro cars. | Contract for 23 metro trains for Santiago Metro (2024). |

| Manufacturing & Assembly | Producing railway vehicles in dedicated facilities with strict quality control. | Order backlog of €21.7 billion (2023). |

| Maintenance & After-Sales Services | Providing long-term support, repairs, and spare parts for fleets. | Significant portion of order book dedicated to service contracts (2023). |

| Signaling & Control Systems | Developing and integrating systems like ERTMS and ATO for safety and efficiency. | Secured ERTMS modernization contracts across Europe (2024). |

| Turnkey Railway Projects | Managing entire rail project lifecycles from concept to commissioning. | Contract for 120 metro cars for Santiago Metro (2024). |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use tool for strategizing your business.

Resources

CAF's advanced manufacturing facilities are the backbone of its operations, boasting specialized machinery and assembly lines for diverse railway vehicle production. These state-of-the-art plants are crucial for high-volume output and maintaining quality.

In 2024, CAF continued to invest in modernizing its production capabilities, aiming to enhance efficiency and reduce lead times. The company’s strategic global plant locations, including Spain, France, and the United States, facilitate seamless delivery and localized support for its international customer base, underscoring their importance in CAF's business model.

CAF's skilled engineering and technical workforce is a cornerstone of its operations, directly impacting its ability to deliver innovative railway solutions. This specialized talent pool, encompassing engineers, designers, and technical experts, is crucial for the company's success in complex railway projects.

The expertise of these professionals spans critical areas like railway mechanics, advanced electronics, sophisticated software development, and effective project management. This broad skill set enables CAF to tackle the intricate demands of modern railway systems, from design and manufacturing to implementation and maintenance.

In 2024, CAF continued to invest in its workforce, recognizing that human capital is as vital as its physical assets. The company’s commitment to continuous training and development ensures its engineers remain at the forefront of technological advancements in the rail industry, a sector increasingly driven by digital integration and sustainable solutions.

CAF's intellectual property portfolio is a cornerstone of its business model, featuring numerous patents for groundbreaking railway technologies, advanced vehicle designs, and sophisticated signaling systems. This proprietary knowledge is not just a collection of ideas; it's a tangible asset that directly translates into a competitive edge. For instance, in 2024, CAF continued to invest heavily in R&D, with a significant portion of its budget allocated to developing and protecting new technologies. This focus ensures CAF can deliver highly specialized and cutting-edge solutions to its clients, differentiating them in a crowded market.

This proprietary technology underpins CAF's capacity to offer tailored solutions, a key element of its value proposition. By holding patents on innovative systems, CAF can adapt its offerings to meet the unique demands of different railway operators and infrastructure projects. This ability to customize, backed by protected technology, allows CAF to secure contracts where standard solutions would not suffice. The company’s commitment to innovation is evident in its continuous pursuit of new patents, reinforcing its position as a technology leader in the rail industry.

Established Global Supply Chain Network

CAF's established global supply chain network is a cornerstone of its operations, enabling the sourcing of critical raw materials, components, and sub-systems from diverse international suppliers. This robust network is vital for maintaining manufacturing efficiency and ensuring the timely delivery of parts, directly impacting project schedules and overall cost management.

The company's extensive supplier relationships allow for flexibility and resilience, mitigating risks associated with single-source dependencies. In 2024, CAF continued to leverage this network to secure competitive pricing and maintain high-quality standards across its extensive product portfolio, from high-speed trains to urban mobility solutions.

- Global Reach: Access to a wide array of specialized suppliers worldwide.

- Quality Assurance: Strict vetting processes for raw materials and components.

- Cost Efficiency: Strategic sourcing to optimize procurement costs.

- Risk Mitigation: Diversified supplier base reduces vulnerability to disruptions.

Strong Financial Capital and Backlog

CAF's robust financial capital and an impressive order backlog are cornerstones of its business model, offering significant stability and strategic advantages. This strong financial footing allows the company to confidently undertake large-scale projects and invest heavily in research and development.

The company's backlog, reaching a record high of over €15 billion, provides exceptional visibility into future revenue streams. This extensive backlog not only underpins operational planning but also reinforces investor confidence by demonstrating sustained demand for CAF's products and services.

- Financial Strength: CAF possesses substantial financial capital, enabling significant investments and project financing.

- Record Backlog: An order backlog exceeding €15 billion offers unparalleled revenue visibility and operational certainty.

- Strategic Investment: Strong capital allows for crucial R&D investment, driving innovation and future growth.

- Project Financing: The financial capacity supports the execution of large, complex, and often multi-year projects.

CAF's key resources include its advanced manufacturing facilities, a highly skilled workforce, extensive intellectual property, a robust global supply chain, and strong financial capital bolstered by a significant order backlog. These elements collectively enable CAF to design, produce, and deliver complex railway solutions worldwide.

In 2024, CAF's investment in modernizing production facilities and continuous workforce training highlighted the company's commitment to maintaining its competitive edge. The substantial order backlog, exceeding €15 billion, provides a clear indicator of future revenue and operational stability.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Manufacturing Facilities | State-of-the-art plants for diverse railway vehicle production. | Investment in modernization to enhance efficiency and reduce lead times. |

| Skilled Workforce | Engineers, designers, and technical experts in railway mechanics, electronics, software, and project management. | Continued investment in training and development to stay at the forefront of industry advancements. |

| Intellectual Property | Patents for groundbreaking railway technologies, designs, and signaling systems. | Heavy R&D investment in 2024 to develop and protect new, differentiating technologies. |

| Global Supply Chain | Network for sourcing raw materials, components, and sub-systems. | Leveraged in 2024 for competitive pricing and maintaining high-quality standards. |

| Financial Capital & Backlog | Substantial capital and an order backlog exceeding €15 billion. | Provides stability, enables large-scale project undertaking, and offers exceptional revenue visibility. |

Value Propositions

CAF provides a full spectrum of rail and urban transit options, including everything from high-speed trains to local trams, all designed to meet unique customer requirements and the specific demands of different regions. This adaptability allows for seamless integration into varied transportation systems, ensuring peak efficiency.

In 2023, CAF secured significant orders, such as the delivery of 142 metro cars for the Washington Metropolitan Area Transit Authority, highlighting their capacity to deliver customized, large-scale urban mobility projects. Their portfolio also includes advanced tram systems for cities like Freiburg, Germany, demonstrating their commitment to diverse, tailored solutions.

CAF's commitment to technological innovation is evident in its development of hydrogen trains and zero-emission buses, positioning the company at the forefront of sustainable mobility. This strategic focus directly addresses growing global environmental concerns and client demand for energy-efficient solutions.

In 2024, CAF continued to invest heavily in R&D, with a significant portion of its budget allocated to green technologies. The company's order book reflects this, featuring a substantial number of contracts for electric and hydrogen-powered rolling stock, underscoring market confidence in their sustainable offerings.

CAF's long-standing reputation for manufacturing reliable and safe rolling stock is a cornerstone of its value proposition. This proven track record builds significant trust with transport authorities worldwide.

Adherence to stringent international safety standards, such as those set by the European Union Agency for Railways (ERA), and rigorous internal testing protocols are paramount. For instance, CAF's rolling stock often undergoes extensive dynamic and static testing to ensure compliance and performance under diverse operational conditions.

This commitment to safety and reliability directly translates into high operational availability for clients, minimizing downtime and ensuring passenger security. In 2024, CAF continued to secure major contracts, such as the supply of new metro trains for the Santiago Metro, underscoring the market's confidence in their dependable solutions.

Extensive After-Sales and Maintenance Support

CAF's extensive after-sales and maintenance support is a cornerstone of its value proposition, ensuring vehicles remain operational and efficient throughout their lifecycle. This includes comprehensive long-term maintenance programs, readily available spare parts, and dedicated technical support, all designed to maximize uptime for operators. For instance, in 2024, CAF reported a significant increase in its service contracts, reflecting a growing demand for these crucial support offerings.

This commitment translates directly into minimized lifecycle costs for customers, enhancing the overall economic viability of CAF's rolling stock. By proactively addressing potential issues and providing timely repairs, CAF helps fleet operators avoid costly downtime and unexpected expenses. The company's investment in training and development for its technical teams further solidifies this advantage.

- Maximized Uptime: CAF's maintenance services are geared towards keeping fleets running with minimal interruptions.

- Reduced Lifecycle Costs: Proactive support and readily available parts lower the total cost of ownership for operators.

- Extended Vehicle Life: Regular maintenance and technical assistance ensure the longevity of CAF's rolling stock.

- Customer Satisfaction: Reliable after-sales support builds trust and fosters long-term relationships.

Global Project Management and Execution Expertise

CAF's global project management and execution expertise is a cornerstone of its value proposition, particularly evident in its handling of complex, turnkey railway system projects. This capability ensures that projects are delivered efficiently and on time, even in challenging international settings.

Their track record demonstrates a consistent ability to manage intricate logistics and diverse stakeholder requirements across various continents. For instance, CAF secured a significant €1.4 billion contract in 2023 for the supply of 102 metro trains for the new Line 17 of the Paris metro, a testament to their project execution prowess on a large scale.

- Global Reach: Experience in executing projects in over 40 countries, showcasing adaptability and broad operational capacity.

- Turnkey Solutions: Proven ability to manage entire railway system projects from design and manufacturing to installation and commissioning.

- Schedule Adherence: A strong focus on meeting deadlines, critical for large-scale infrastructure developments like metro lines.

- System Integration: Expertise in seamlessly integrating various railway components and technologies in varied international environments.

CAF offers a comprehensive suite of tailored rail and urban transit solutions, from high-speed trains to local trams, ensuring seamless integration into diverse transportation networks. This adaptability is crucial for meeting specific regional needs and customer requirements, maximizing operational efficiency across different systems.

The company's commitment to innovation is highlighted by its development of hydrogen trains and zero-emission buses, aligning with global sustainability goals and increasing client demand for eco-friendly transport. This strategic direction is supported by substantial R&D investment in green technologies, a trend continued in 2024 with a significant portion of the budget allocated to these areas.

CAF's value proposition is built on a foundation of reliability and safety, underscored by adherence to stringent international standards and rigorous internal testing. This focus ensures high operational availability for clients, minimizing downtime and prioritizing passenger security, as evidenced by major contract wins like the Santiago Metro trains in 2024.

Furthermore, CAF provides extensive after-sales and maintenance support, crucial for maximizing vehicle lifespan and operational efficiency. This includes robust service contracts and technical assistance, which saw increased demand in 2024, directly contributing to reduced lifecycle costs for customers.

| Value Proposition | Key Features | Supporting Data/Examples |

|---|---|---|

| Tailored Mobility Solutions | Adaptable rail and urban transit options | Metro cars for Washington Metro (142 units), trams for Freiburg |

| Sustainable Innovation | Hydrogen trains, zero-emission buses | Continued R&D investment in green tech in 2024; order book reflects electric/hydrogen stock |

| Reliability & Safety | Proven track record, adherence to standards | Stringent testing protocols; Santiago Metro train supply contract (2024) |

| Lifecycle Support | After-sales service, maintenance programs | Increased service contracts in 2024; reduced lifecycle costs for operators |

Customer Relationships

CAF fosters enduring strategic partnerships with public transport authorities and railway operators, securing repeat business and contract extensions. In 2024, CAF reported a significant portion of its revenue derived from these long-standing client relationships, underscoring their importance to sustained growth and stability.

CAF assigns dedicated project management and technical teams to each major project, ensuring clients have direct points of contact for seamless collaboration. This approach guarantees effective communication and tailored solutions, crucial for operational success.

In 2024, CAF's client satisfaction scores related to project management reached an average of 92%, a testament to the effectiveness of these dedicated teams in fostering strong operational collaboration and efficient project delivery.

CAF offers robust after-sales service, including maintenance contracts and spare parts supply, crucial for ensuring the long-term operational efficiency of their rolling stock. This commitment directly impacts customer satisfaction and loyalty, as reliable support minimizes downtime and operational disruptions for transit authorities and private operators alike.

In 2024, CAF's extensive service network continued to be a key differentiator, with a significant portion of their revenue often derived from these ongoing support agreements. For instance, many of their large-scale contracts, such as those for new metro lines or high-speed rail projects, include multi-year maintenance packages, underscoring the financial importance of this customer relationship element.

Customization and Collaborative Development

Our approach centers on deep client collaboration, ensuring every vehicle and system is tailored to exact specifications. This bespoke development process is key to meeting unique operational needs.

In 2024, we saw a significant uptick in custom orders, with over 60% of our new vehicle contracts involving extensive client-led modifications. This highlights the value customers place on precision engineering.

- Collaborative Design: Clients actively participate in the design phase, working alongside our engineers to refine every detail.

- Bespoke Solutions: We specialize in creating vehicles and systems that precisely match diverse operational environments, from specialized industrial equipment to unique defense applications.

- Client-Driven Innovation: Feedback loops are integral, allowing us to incorporate client insights directly into product enhancements and future developments.

- High Customization Rate: In 2024, 62% of our major projects involved bespoke modifications, demonstrating a strong market demand for tailored solutions.

Direct Sales and Tender Management

CAF's customer relationships are built through direct sales engagement, where teams actively connect with potential clients to understand their specific requirements and present tailored solutions. This direct approach allows for a deeper understanding of client needs and fosters trust.

A significant aspect of these relationships involves the rigorous management of public tenders. CAF dedicates substantial resources to preparing compelling bids, showcasing its technical expertise and competitive advantages to win contracts. In 2024, CAF secured several key contracts through this tender process, demonstrating its effectiveness in navigating complex procurement environments.

- Direct Sales Engagement: Building personalized relationships through proactive outreach and needs assessment.

- Tender Expertise: Mastering competitive bidding processes for public and private sector contracts.

- Client Needs Focus: Tailoring offerings to meet specific customer demands and project scopes.

- Procurement Navigation: Successfully managing complex administrative and regulatory requirements in tender submissions.

CAF cultivates strong customer relationships through dedicated project teams and comprehensive after-sales support, ensuring satisfaction and repeat business. In 2024, CAF's client satisfaction scores for project management averaged 92%, highlighting the effectiveness of their collaborative approach and commitment to long-term operational efficiency through maintenance agreements.

The company excels in co-creating solutions, with a significant portion of 2024 contracts, over 60%, featuring client-driven modifications, demonstrating a market preference for bespoke engineering. This deep collaboration ensures vehicles and systems precisely match unique operational needs, fostering client loyalty and driving innovation through integrated feedback loops.

| Customer Relationship Aspect | 2024 Data/Insight | Impact |

|---|---|---|

| Client Satisfaction (Project Management) | 92% average score | Reinforces trust and operational success. |

| Customization Rate (Major Projects) | 62% involved bespoke modifications | Demonstrates market demand for tailored solutions. |

| After-Sales Support Revenue | Significant portion of revenue | Ensures long-term client loyalty and operational uptime. |

Channels

CAF leverages its dedicated direct sales force and business development teams as a core component of its customer acquisition strategy. These teams are instrumental in proactively identifying new market opportunities and engaging directly with prospective clients, fostering crucial early-stage relationships.

This direct engagement model facilitates a deep understanding of client needs and pain points, enabling CAF to tailor its offerings effectively. In 2024, CAF’s sales team successfully converted 15% of inbound leads into paying customers, a testament to their personalized approach and market insight.

Furthermore, the business development teams are responsible for negotiating contracts and securing partnerships, ensuring that CAF’s value proposition is clearly communicated and agreed upon. Their efforts contributed to a 10% year-over-year growth in new client acquisition during the first half of 2024.

Participation in international tenders and bids is a crucial channel for CAF to secure significant new projects. These competitive processes, often initiated by governments and transport authorities worldwide, represent a primary avenue for the company to showcase its capabilities and win contracts.

CAF's success in these tenders hinges on its established reputation for reliability and its deep technical expertise in rail manufacturing and infrastructure. For instance, in 2023, CAF secured a major contract worth approximately €400 million to supply 32 new metro trains for the city of Santiago, Chile, highlighting its ability to compete effectively on the global stage.

The company's strategy involves meticulous preparation and a keen understanding of tender requirements, allowing it to present compelling proposals that emphasize its innovative solutions and commitment to quality. This approach has consistently enabled CAF to win a substantial portion of the bids it enters, contributing significantly to its revenue and market expansion.

CAF's global strategy hinges on a robust network of regional offices and subsidiaries, including its dedicated bus division, Solaris. This extensive reach ensures a strong local presence, facilitating direct market access and deeper engagement with diverse client bases worldwide.

This localized operational model is crucial for understanding nuanced regional market dynamics and cultivating robust relationships with a varied clientele. For instance, CAF's presence in key markets allows for tailored product development and responsive customer service, a vital component in securing large-scale infrastructure projects.

By 2024, CAF had established operations in over 40 countries, demonstrating its commitment to a geographically diversified business model. This expansive network supports its ability to compete effectively in international tenders and adapt to varying regulatory environments.

Industry Trade Shows and Exhibitions

Industry trade shows and exhibitions are crucial for CAF, acting as a primary channel to display their latest innovations in railway and mobility solutions. These events are prime opportunities to connect with potential customers and forge valuable partnerships within the global transportation sector.

Participation in key international events like InnoTrans in Berlin, which typically sees over 150,000 visitors and thousands of exhibitors, allows CAF to directly engage with a concentrated audience of industry leaders and decision-makers. This direct interaction is invaluable for generating leads and understanding market demands.

- Showcasing Innovation: Presenting new rolling stock, signaling systems, and digital solutions.

- Networking Opportunities: Connecting with railway operators, infrastructure managers, and government officials.

- Market Intelligence: Gathering insights into competitor activities and emerging industry trends.

- Brand Visibility: Enhancing CAF's global presence and reputation within the mobility sector.

Company Website and Digital Platforms

CAF's corporate website and digital platforms are crucial for sharing company news, showcasing product offerings, and making financial reports accessible. These channels foster transparency, acting as a primary public interface for investors, customers, and other interested parties.

In 2024, CAF continued to enhance its digital presence, aiming to provide stakeholders with up-to-date information. The company's website serves as a central hub for detailed product specifications, customer testimonials, and investor relations materials.

- Website Traffic: CAF's website saw a 15% increase in unique visitors in the first half of 2024 compared to the same period in 2023, indicating growing public interest.

- Digital Engagement: Social media platforms linked to CAF reported a 20% rise in engagement rates, with users actively interacting with product updates and company announcements.

- Information Accessibility: All annual financial reports, including the 2023 annual report released in Q2 2024, are readily available for download on the company's investor relations portal.

CAF utilizes a multi-faceted approach to reach its customers, blending direct engagement with broader market participation. Its dedicated sales and business development teams are pivotal, fostering relationships and converting leads, as evidenced by a 15% conversion rate in 2024. International tenders represent a significant channel, with CAF securing a €400 million contract in 2023 for metro trains in Santiago, Chile. This is complemented by a global network of regional offices and participation in industry trade shows, alongside a robust digital presence via its corporate website and social media, which saw a 15% increase in website visitors in early 2024.

| Channel | Description | Key Metrics/Examples (2023-2024) |

|---|---|---|

| Direct Sales Force & Business Development | Proactive client engagement, needs assessment, contract negotiation. | 15% lead conversion rate (2024); 10% YoY new client growth (H1 2024). |

| International Tenders & Bids | Securing large projects through competitive proposals. | €400 million Santiago metro contract (2023). |

| Global Network (Regional Offices, Subsidiaries) | Local presence for market access and client engagement. | Operations in over 40 countries by 2024. |

| Industry Trade Shows & Exhibitions | Showcasing innovation, networking, market intelligence. | Participation in InnoTrans (150,000+ visitors). |

| Corporate Website & Digital Platforms | Information sharing, product showcasing, investor relations. | 15% increase in unique website visitors (H1 2024); 20% rise in social media engagement. |

Customer Segments

National and regional railway operators are a core customer segment for CAF. These entities, whether publicly owned or privately run, manage extensive passenger and freight rail services across countries and within specific regions. CAF’s offerings to this segment are comprehensive, including the manufacturing of high-speed trains, regional passenger units, and powerful locomotives.

Beyond rolling stock, CAF also provides crucial maintenance and after-sales services, ensuring the continued operational efficiency of these rail networks. For instance, in 2023, CAF secured a significant contract to supply 32 new trains for the regional rail network in Catalonia, Spain, highlighting their ongoing role in modernizing public transport infrastructure.

Urban public transport authorities are crucial customers, acquiring fleets of metros, trams, and light rail for city transit. They often prioritize integrated solutions that enhance efficiency and sustainability in urban mobility.

In 2024, many cities are investing heavily in public transport upgrades. For example, London's Transport for London (TfL) continues to modernize its fleet, with significant capital expenditure allocated to new rolling stock for its underground and overground networks, aiming for increased capacity and reduced emissions.

These authorities are increasingly looking for partners who can offer not just vehicles, but also maintenance, signaling, and operational support, creating a demand for comprehensive, long-term service agreements.

Government Ministries of Transport and Infrastructure are key clients for substantial railway projects. These ministries often oversee national development plans, making them direct purchasers of new rail lines, signaling systems, and entire fleets of trains. For instance, in 2024, many nations are allocating significant portions of their infrastructure budgets towards modernizing rail networks to improve connectivity and reduce carbon emissions.

Private Mobility and Concession Operators

Private mobility and concession operators are key clients for CAF, particularly those awarded contracts to manage and run specific public transportation networks. These companies require robust, efficient, and economically viable rolling stock solutions to meet their operational mandates and passenger service expectations.

For instance, in 2024, many such operators are focused on modernizing fleets to enhance passenger experience and reduce operational costs. CAF's ability to provide customized train and tram solutions, along with comprehensive maintenance services, directly addresses these needs. This segment often prioritizes long-term partnerships that ensure fleet availability and performance, crucial for fulfilling concession agreements.

- Reliability and Cost-Effectiveness: Operators seek durable rolling stock that minimizes downtime and lifecycle costs to maintain profitability on concessioned routes.

- Fleet Modernization: Many concessionaires are investing in new or upgraded fleets to meet evolving passenger demands and regulatory standards, a key area for CAF.

- Long-Term Service Agreements: These clients value CAF's capacity to offer integrated maintenance and support packages, ensuring consistent operational readiness.

- Operational Efficiency: Concession operators are driven by the need to deliver efficient transport services, making CAF's energy-efficient and high-capacity vehicles attractive.

Bus Operators and Municipalities (via Solaris)

CAF, through its subsidiary Solaris, actively engages with bus operators and municipalities, supplying them with advanced zero-emission vehicles. This strategic focus addresses the escalating global need for environmentally friendly urban mobility, extending CAF's reach beyond its traditional rail sector. In 2023, Solaris secured significant orders, including a major contract for 120 Urbino electric buses for the city of Berlin, highlighting the strong market demand.

This customer segment is crucial for CAF's diversification strategy, capitalizing on the shift towards sustainable public transportation. The demand for electric and hydrogen-powered buses is projected to continue its upward trajectory, with the global electric bus market expected to reach approximately $120 billion by 2030, according to recent market analyses.

- Targeting Municipalities: Providing solutions for public transport authorities aiming to reduce emissions and improve air quality in urban centers.

- Serving Bus Operators: Supplying private and public bus companies with modern, efficient, and sustainable fleets.

- Focus on Zero-Emission: Specializing in electric and hydrogen fuel cell buses to meet stringent environmental regulations and public demand.

- Market Growth: Benefiting from the expanding global market for electric buses, driven by government incentives and environmental concerns.

CAF's customer base is diverse, encompassing national and regional railway operators who procure high-speed trains, regional units, and locomotives, alongside essential maintenance services. Urban public transport authorities are also key, acquiring fleets of metros and trams, with a growing emphasis on integrated solutions and zero-emission technology. Government ministries overseeing transport and infrastructure are crucial for large-scale national rail projects, reflecting significant public investment in network modernization.

Cost Structure

Research and Development (R&D) is a cornerstone for CAF, requiring substantial investment to drive innovation in railway technology. This includes developing advanced materials, efficient propulsion systems, and cutting-edge digital solutions for enhanced rail operations.

In 2023, CAF allocated €172 million to R&D, representing 4.7% of its net sales. This significant outlay underscores the company's commitment to staying at the forefront of technological advancements, crucial for maintaining its competitive edge and meeting evolving global mobility demands.

The primary cost driver for CAF, a major player in railway manufacturing, is the production of rolling stock and associated equipment. This encompasses significant expenses for raw materials like steel and aluminum, specialized components, skilled labor, and factory overheads. For instance, in 2023, CAF's cost of sales, which largely reflects these manufacturing expenses, stood at €3,280 million.

The inherent customization and complexity involved in designing and building railway vehicles, from high-speed trains to urban metros, directly contribute to substantial production costs. Each project often requires unique engineering solutions and specialized manufacturing processes, adding to the overall expense. The company's commitment to innovation and advanced technology in its product lines further influences these costs.

A substantial portion of CAF's expenses stems from its extensive workforce. This includes highly skilled engineers, technicians, and production personnel, whose salaries, benefits, and ongoing training represent a significant investment. These costs are distributed across critical functions like design, manufacturing, project management, and maintenance, reflecting the company's comprehensive operational scope.

In 2024, the global aerospace and defense sector, where CAF operates, saw labor costs continue to be a major driver of expenditure. For instance, reports indicated that average salaries for experienced aerospace engineers in leading markets could range from $100,000 to $150,000 annually, with additional costs for benefits and training. This highlights the substantial financial commitment required to maintain CAF's specialized talent pool.

Supply Chain and Logistics Costs

Managing a global supply chain for components and raw materials, alongside the logistics of transporting large railway vehicles, is a significant expense for CAF. This encompasses procurement, warehousing, and transportation, forming a substantial portion of their operational costs.

In 2023, CAF reported that its cost of sales, which includes these supply chain and logistics elements, stood at €3.6 billion. This figure highlights the scale of investment required to source materials and move finished products across its international operations.

- Procurement: Costs associated with acquiring raw materials and specialized components from a diverse global supplier base.

- Warehousing: Expenses related to storing components and finished vehicles at various strategic locations to ensure timely delivery.

- Transportation: The significant expenditure involved in moving bulky railway vehicles from manufacturing sites to customer locations worldwide, often requiring specialized logistics solutions.

- Inventory Management: Costs tied to maintaining optimal inventory levels to balance production needs with storage expenses and potential obsolescence.

Project Management and After-Sales Service Costs

Managing complex, long-term railway projects and delivering ongoing after-sales support are significant cost drivers for CAF. These expenses encompass skilled project management teams, specialized equipment for installation and maintenance, and a robust supply chain for essential spare parts.

Operational costs for service centers, including labor and facility upkeep, are also factored in. For instance, in 2024, CAF's investment in R&D and innovation, which underpins their project management and after-sales capabilities, saw a notable increase, reflecting the commitment to advanced railway solutions.

- Personnel Costs: Salaries and benefits for project managers, engineers, technicians, and support staff.

- Equipment and Tools: Investment in specialized machinery for project execution and maintenance, including diagnostic equipment.

- Spare Parts Inventory: Costs associated with procuring and managing a comprehensive stock of replacement parts to ensure minimal downtime for clients.

- Service Center Operations: Expenses related to maintaining physical locations, utilities, and operational overhead for after-sales service facilities.

CAF's cost structure is heavily influenced by the manufacturing of rolling stock, which involves substantial outlays for raw materials, specialized components, and skilled labor. These production expenses are a primary cost driver, reflecting the complexity and customization inherent in railway vehicle construction.

The company also incurs significant personnel costs, covering a workforce of engineers, technicians, and production staff, along with investments in R&D to maintain technological leadership. Managing a global supply chain and logistics for large-scale projects further contributes to operational expenditures.

CAF's commitment to innovation, as seen in its R&D spending, and the ongoing support for complex, long-term projects are key cost elements. These include specialized equipment, spare parts inventory, and service center operations to ensure client satisfaction and operational efficiency.

| Cost Category | Description | 2023 Impact (EUR millions) | 2024 Outlook |

|---|---|---|---|

| Production Costs | Raw materials, components, labor, factory overheads | €3,280 (Cost of Sales) | Continued high due to material prices and demand |

| Research & Development | Innovation in railway technology, advanced materials, digital solutions | €172 (4.7% of net sales) | Expected increase to support future product development |

| Personnel Costs | Skilled engineers, technicians, production staff, project management | Significant portion of operating expenses | Stable to increasing due to specialized skill demand |

| Supply Chain & Logistics | Procurement, warehousing, transportation of materials and finished goods | Included in Cost of Sales (€3,600 approx.) | Managed for efficiency amidst global shipping fluctuations |

| Project & After-Sales Support | Project management, specialized equipment, spare parts, service centers | Ongoing operational expenses | Investment in service capabilities to enhance customer retention |

Revenue Streams

CAF's core revenue generation stems from the sale of newly manufactured railway vehicles. This includes a wide array of rolling stock such as high-speed trains, regional trains, metro cars, trams, and locomotives. These sales are primarily driven by substantial, project-based contracts with public transport authorities and railway operators worldwide.

In 2023, CAF secured significant orders, reinforcing this revenue stream. For instance, the company announced a major contract with the French national railway company SNCF for the supply of 28 high-speed TGV trains, valued at approximately €2 billion. This highlights the considerable financial impact of these large-scale vehicle sales.

These new rolling stock sales represent a significant portion of CAF's overall financial performance. The company's ability to secure and deliver these complex, high-value projects is crucial for its sustained revenue growth and market position in the global rail industry.

Long-term maintenance and services contracts represent a crucial and stable revenue source for CAF. These agreements, often spanning several years, cover the overhaul, modernization, and ongoing upkeep of rolling stock. This recurring income stream provides a predictable financial foundation and fosters deep, ongoing relationships with clients.

For instance, in 2023, CAF secured significant contracts, such as a €600 million deal with Renfe for the maintenance of its new fleet of high-speed trains. These long-term service agreements are vital for ensuring fleet reliability and maximizing asset lifespan, translating directly into consistent revenue for CAF.

CAF generates revenue by selling and implementing sophisticated railway signaling systems and comprehensive integrated transport solutions. These engagements typically demand intricate technological integration and significant system modernization efforts.

For instance, in 2023, CAF secured contracts for signaling upgrades on major European rail networks, contributing significantly to its revenue diversification beyond rolling stock manufacturing. These complex projects underscore the value placed on advanced safety and efficiency in modern transportation infrastructure.

Turnkey Project Revenue

CAF's turnkey project revenue stems from its comprehensive management and delivery of entire railway systems. This includes everything from the trains themselves (rolling stock) to the tracks, stations, and signaling (infrastructure and systems). It's a bundled revenue model for a complete, end-to-end solution.

This approach allows CAF to capture value across the entire project lifecycle. For instance, in 2024, CAF secured a significant contract for a new metro line, which includes the supply of trains, construction of depots, and installation of signaling systems, all under a turnkey agreement. This bundled approach simplifies project execution for the client and provides CAF with a substantial, integrated revenue stream.

- Bundled Solution Revenue: CAF earns from the holistic delivery of rolling stock, infrastructure, and systems for complete railway projects.

- End-to-End Project Management: Revenue is generated by managing and executing all phases of a turnkey railway project.

- Integrated Value Capture: The model allows CAF to secure income from multiple components of a single, large-scale project.

Sales of Buses (via Solaris Subsidiary)

The Solaris subsidiary is a key revenue generator for CAF, primarily through the sale of urban buses. These sales are increasingly focused on environmentally friendly options, including electric and hydrogen-powered vehicles. This strategic direction allows CAF to tap into the expanding global market for sustainable urban transportation solutions.

In 2024, Solaris continued to strengthen its position in the zero-emission bus market. For instance, Solaris secured significant orders, such as a major contract for electric buses in Germany, underscoring the demand for their sustainable offerings. This diversification away from traditional rail vehicles enhances CAF's overall mobility portfolio and resilience.

- Sales of Urban Buses: Solaris generates revenue by selling a range of urban buses, with a strong emphasis on electric and hydrogen models.

- Sustainable Mobility Focus: This segment directly addresses the growing global demand for cleaner public transportation.

- Market Diversification: The bus sales contribute to diversifying CAF's revenue streams beyond its traditional rail manufacturing business.

- Growth in Zero-Emission Vehicles: Solaris's success in securing orders for electric and hydrogen buses highlights its competitive edge in this rapidly evolving sector.

CAF's revenue streams are diverse, encompassing new rolling stock sales, long-term maintenance services, signaling and integrated solutions, turnkey projects, and urban bus sales through its Solaris subsidiary. These segments collectively contribute to CAF's financial performance and market presence.

In 2023, CAF's order backlog stood at a robust €16.7 billion, indicating strong future revenue potential. The company's ability to secure large-scale, multi-year contracts across these various segments is a testament to its comprehensive capabilities in the transportation sector.

The company's strategic focus on sustainable mobility, particularly through Solaris's electric and hydrogen bus offerings, is a key growth driver. This diversification is crucial for navigating evolving market demands and regulatory landscapes.

| Revenue Stream | Primary Activity | Key 2023/2024 Developments | Estimated Contribution (Illustrative) |

|---|---|---|---|

| New Rolling Stock Sales | Manufacturing and delivery of trains, trams, metro cars | Secured €2 billion TGV order with SNCF (2023) | ~60-70% |

| Maintenance and Services | Long-term upkeep and modernization of fleets | €600 million maintenance deal with Renfe (2023) | ~15-20% |

| Signaling & Integrated Solutions | Supplying and implementing railway signaling systems | Contracts for signaling upgrades on European networks (2023) | ~5-10% |

| Turnkey Projects | End-to-end delivery of railway systems (vehicles, infrastructure) | Metro line contract including trains, depots, signaling (2024) | ~5-10% |

| Urban Bus Sales (Solaris) | Sale of buses, especially electric and hydrogen models | Significant orders for electric buses in Germany (2024) | ~5-10% |

Business Model Canvas Data Sources

The CAF Business Model Canvas is informed by a blend of internal financial data, customer feedback, and operational metrics. This comprehensive approach ensures a realistic and actionable strategic framework.