CAF Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAF Bundle

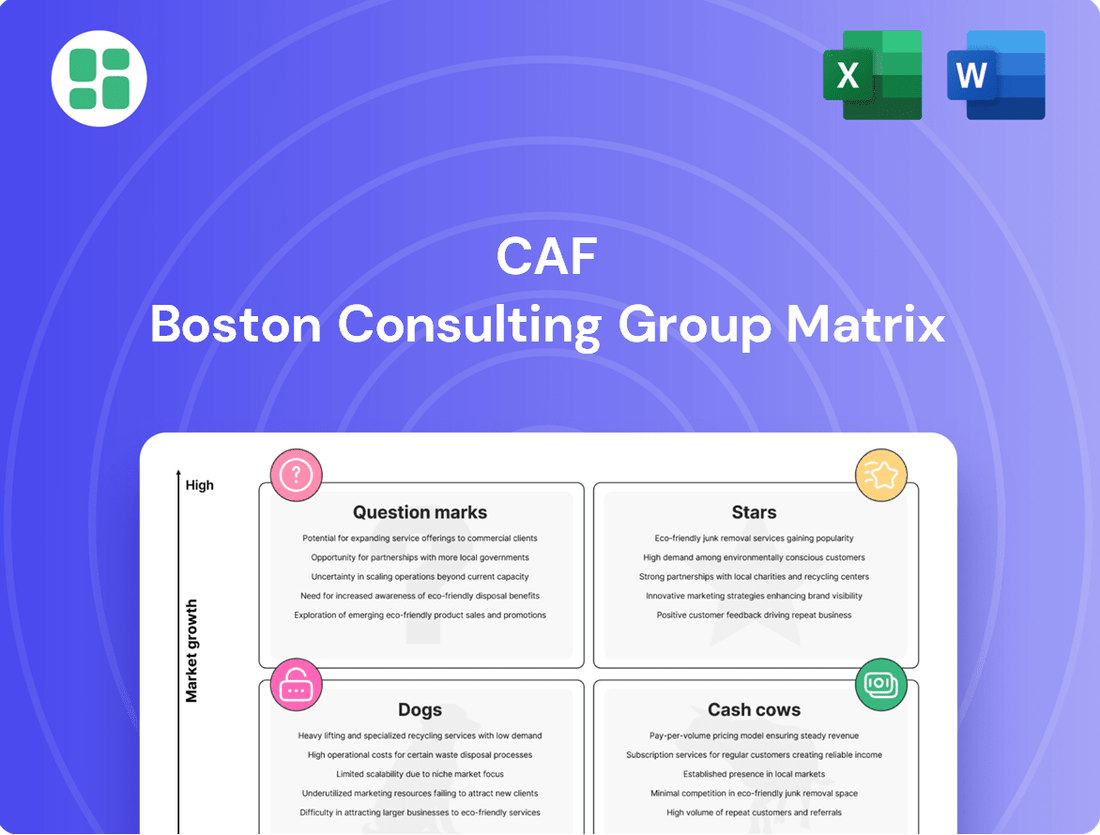

The BCG Matrix is a powerful tool for analyzing a company's product portfolio, categorizing each product into Stars, Cash Cows, Dogs, or Question Marks based on market growth and relative market share. This allows for informed decisions on resource allocation and strategic planning. Purchase the full BCG Matrix to gain a comprehensive understanding of your product mix and unlock actionable strategies for growth and profitability.

Stars

CAF's high-speed train offerings are a clear Star in the BCG matrix, particularly those securing significant contracts in rapidly developing regions. For instance, CAF's involvement in projects within the Asia-Pacific and Middle East regions highlights their strong position in these high-growth markets.

These emerging markets are prioritizing substantial infrastructure development, with a strong emphasis on modern and efficient rail networks. CAF's success in winning large-scale projects here signifies a high market share in a segment experiencing rapid expansion, requiring investment but promising substantial future returns.

By 2024, CAF had secured orders for high-speed units in countries like Saudi Arabia, further solidifying its presence in these dynamic markets. This strategic positioning allows CAF to capture significant market share while these regions continue their robust infrastructure investment cycles.

CAF's Urbos tramway platform, particularly its OESS-equipped variants, is a strong contender in the next-generation metro and tram market. These systems enable catenary-free operation, a significant advantage for urban environments seeking aesthetic and operational flexibility. The Bologna and Rome contracts, along with the Omaha order for OESS trams, underscore the market's appetite for these advanced solutions.

CAF's commitment to advanced digital signaling and automation, particularly with its 'Optio' system and automated train operation trials, positions it strongly within the railway automation sector. This focus is crucial as the global connected rail market expands, with integrated IoT sensors and communication-based train control systems becoming essential for enhanced efficiency and safety.

The company's investment in these areas reflects a strategic move into a high-growth segment. For instance, the European Train Control System (ETCS) market, a key component of modern rail signaling, is projected to grow significantly. Reports from 2024 indicate a compound annual growth rate (CAGR) of over 8% for the ETCS market, driven by the need for interoperability and increased line capacity.

Turnkey Rail Project Solutions

CAF's ability to provide complete turnkey rail projects, from initial design and manufacturing to infrastructure development and ongoing maintenance, firmly places their turnkey rail project solutions in the Star category. These extensive undertakings are characteristic of complex, large-scale ventures that demand significant capital but also promise substantial returns, particularly in areas actively expanding their rail networks.

The company's robust order book, exceeding €15 billion in late 2023, and its successful execution of major projects highlight its strong standing in this expanding market.

- Turnkey Project Scope: CAF manages the entire lifecycle of rail projects, including design, manufacturing, signaling, electrification, and civil works.

- Market Position: Recognized for its comprehensive approach, CAF is a key player in large-scale infrastructure development globally.

- Financial Strength: A substantial order backlog, reaching €15.2 billion by the end of 2023, demonstrates strong demand and execution capability.

- Growth Potential: Investment in major rail expansion projects worldwide fuels the high-growth potential for these integrated solutions.

Hydrogen-Powered Train Development and Pilot Programs

CAF's involvement in projects like FCH2Rail showcases their commitment to hydrogen train technology. This initiative, a collaboration including Renfe and Adif, successfully tested a hydrogen-powered train in Spain during 2023, achieving speeds of up to 140 km/h and covering over 1,000 km on a single refueling. This development highlights CAF's innovative edge in a sector prioritizing decarbonization.

These advancements position CAF favorably in the emerging hydrogen train market, a segment poised for significant growth as the rail industry seeks alternatives to diesel. While the upfront investment in research, development, and necessary infrastructure remains substantial, CAF's early leadership in this area is a strategic advantage.

The potential for hydrogen trains to replace diesel traction on non-electrified railway lines represents a considerable future market opportunity. By 2024, several European countries are actively exploring or piloting hydrogen train solutions, signaling a growing demand for such sustainable transport options.

- FCH2Rail Project: Successful testing of hydrogen-powered trains in Spain.

- Market Potential: Significant growth expected for hydrogen trains as diesel replacements.

- Decarbonization Leadership: CAF is at the forefront of sustainable rail transport innovation.

CAF's high-speed train offerings and turnkey project solutions are clear Stars, demonstrating strong market share in high-growth regions and complex, large-scale ventures. Their commitment to advanced signaling and automation, particularly with the Optio system, also positions them as Stars in the expanding connected rail market. These segments require significant investment but promise substantial future returns.

The company's robust order book, exceeding €15 billion in late 2023, and its successful execution of major projects highlight its strong standing in these expanding markets.

| Segment | Market Growth | CAF's Position | Key Initiatives | 2024 Data/Projections |

|---|---|---|---|---|

| High-Speed Trains | High (Asia-Pacific, Middle East) | Strong Market Share | Projects in Saudi Arabia | Continued infrastructure investment in target regions |

| Turnkey Rail Projects | High (Global Rail Expansion) | Key Player | Order backlog > €15 billion (late 2023) | Robust demand for integrated solutions |

| Railway Automation (ETCS) | High (8%+ CAGR projected) | Strong Contender | 'Optio' system, automated train operation trials | Growing need for interoperability and efficiency |

What is included in the product

Strategic framework for evaluating business units based on market share and growth.

Guides investment decisions by categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

Quickly identify underperforming units and reallocate resources effectively.

Cash Cows

CAF's extensive portfolio of long-term maintenance and service contracts for its installed base of rolling stock is a prime example of a cash cow. These contracts offer predictable, recurring revenue with strong profit margins, leveraging CAF's existing infrastructure and deep expertise in the rail sector.

In 2024, CAF's service segment continues to be a bedrock of financial stability. The company manages over 150 service contracts spanning 20 countries, servicing an impressive fleet of approximately 11,600 vehicles. This robust operational footprint ensures a consistent and reliable inflow of cash, underpinning the company's overall financial health.

Established regional and commuter train fleets are CAF's dependable cash cows. These proven models are already operating successfully in established markets like Europe and Latin America, meaning they need minimal marketing. This ongoing demand, coupled with sales of spare parts, provides a consistent revenue stream. For instance, CAF's continued deliveries to major French operators underscore the stability of this segment.

CAF's standard metro train deliveries and fleet upgrades represent a strong cash cow. Contracts like those for Metro Madrid or Medellín Metro are prime examples of these core, revenue-generating activities.

These projects often stem from existing relationships and frameworks, signifying CAF's substantial market share in established urban transit sectors. This repeat business ensures a stable income stream.

The predictability inherent in these infrastructure projects, coupled with relatively low market growth, translates into consistent and reliable cash flow for CAF. For instance, in 2024, CAF secured significant orders for new metro units and modernization programs across various European cities, reinforcing this segment's cash-generating power.

Supply of Core Rail Components and Spares

The supply of core rail components and spares for CAF's extensive global installed base is a quintessential cash cow. This segment thrives on the ongoing operational requirements of existing fleets and infrastructure, generating predictable revenue streams. Unlike new product development, this area demands minimal high-growth investment, allowing it to consistently contribute to CAF's overall profitability.

This steady demand ensures a reliable income source for CAF. For instance, in 2023, CAF reported a significant portion of its revenue derived from maintenance and spare parts, underscoring the cash cow status of this business line. The company's commitment to supporting its installed base globally solidifies this segment's role.

- Consistent Revenue Generation: The ongoing need for maintenance and replacement parts for CAF's vast installed base ensures a steady income.

- Low Investment Requirements: Unlike new product lines, this segment requires less capital for growth, leading to higher profit margins.

- Global Installed Base: CAF's presence across numerous countries with active rail networks creates a broad and sustained demand for its components and spares.

- Profitability Driver: This segment acts as a stable financial pillar, providing consistent profits that can fund other areas of the business.

Refurbishment and Modernization Services

Refurbishment and modernization services for rolling stock and rail systems represent a significant cash cow for CAF. These offerings tap into a mature market where clients prioritize extending the lifespan of existing assets over the substantial investment required for new fleets. CAF's established technical prowess and deep client relationships are key differentiators in this segment, enabling them to deliver cost-effective solutions.

This steady income stream is crucial for CAF's financial stability. For instance, in 2024, the company continued to secure contracts for upgrading older train sets across various European networks, contributing to a predictable revenue base. These projects often involve leveraging existing manufacturing capabilities and supply chains, thereby minimizing incremental investment and maximizing profitability.

- Steady Revenue Generation: Refurbishment projects provide a consistent income stream, bolstering CAF's financial performance.

- Leveraging Existing Strengths: CAF capitalizes on its established technical expertise and strong client relationships in a mature market.

- Cost-Effectiveness for Clients: These services offer clients a more economical alternative to purchasing entirely new rail fleets.

- Low-Risk Operations: The mature nature of the market and existing client base contribute to lower operational risks for CAF.

CAF's established regional and commuter train fleets are dependable cash cows, requiring minimal marketing due to their proven success in markets like Europe and Latin America. This consistent demand, alongside spare parts sales, provides a stable revenue stream, as seen in ongoing deliveries to major French operators.

The supply of core rail components and spares for CAF's extensive global installed base is a quintessential cash cow, generating predictable revenue with minimal high-growth investment. For instance, in 2023, maintenance and spare parts significantly contributed to CAF's revenue, highlighting this segment's role.

Refurbishment and modernization services for rolling stock represent a significant cash cow, tapping into a mature market where clients extend asset lifespans. CAF's technical prowess and client relationships enable cost-effective solutions, with contracts for upgrading older train sets in Europe contributing to a predictable revenue base in 2024.

| Segment | Description | Key Characteristic | 2024 Example |

| Service Contracts | Long-term maintenance and service for rolling stock | Predictable, recurring revenue, strong margins | Over 150 contracts in 20 countries servicing ~11,600 vehicles |

| Established Train Fleets | Sales of proven regional and commuter train models | Low marketing needs, ongoing demand, spare parts | Deliveries to major French operators |

| Core Components & Spares | Supply of parts for global installed base | Steady demand, low investment, high profitability | Significant revenue contribution in 2023 |

| Refurbishment & Modernization | Upgrading existing rolling stock | Mature market, cost-effectiveness for clients | Contracts for upgrading older train sets in Europe |

What You’re Viewing Is Included

CAF BCG Matrix

The CAF BCG Matrix document you are currently previewing is precisely the comprehensive resource you will receive immediately after purchase. This means you'll gain access to the full, unwatermarked, and professionally formatted analysis, ready for immediate strategic application without any additional steps or modifications. You can confidently plan your next steps, knowing that the analytical depth and clarity you see here are exactly what you'll be working with. This preview ensures transparency and guarantees that the purchased document is a complete and actionable tool for your business planning and decision-making processes.

Dogs

Legacy locomotive models, often characterized by lower energy efficiency and reliance on traditional diesel, are increasingly facing declining demand. This trend is driven by global efforts to reduce emissions, with many regions implementing stricter environmental regulations that favor electric or alternative-fuel locomotives. For instance, the European Union's push for decarbonization in rail transport, aiming for a significant reduction in CO2 emissions by 2030, directly impacts the market for older diesel models.

These older models typically hold a low market share within a shrinking market segment. Their future growth prospects are minimal, and continuing to invest in their production can tie up valuable manufacturing resources. In 2024, the global rail freight market, while growing, is seeing a substantial shift towards greener technologies, making these legacy products less competitive and likely to yield poor returns on further investment.

Niche rail equipment, designed for highly specialized, small-scale applications, often struggles to gain widespread market traction. These products, like certain legacy signaling systems or custom-built maintenance vehicles for unique track gauges, represent a challenge within the CAF BCG Matrix.

Their limited market appeal translates to a low market share, compounded by stagnant or declining growth prospects. For instance, a specialized track inspection device for a single, short-line railway might have only a handful of potential buyers globally, limiting its revenue potential significantly.

Consequently, these businesses often become cash traps. Resources are continuously invested in production, maintenance, and limited sales efforts, yet the returns are minimal, failing to justify the ongoing expenditure. In 2024, companies with such product lines might see their R&D budgets for these items frozen, or even reduced, as capital is reallocated to more promising ventures.

Older, non-digital or less integrated signaling systems and basic infrastructure solutions are increasingly becoming Dogs in the CAF BCG Matrix. These legacy offerings struggle to keep pace with the market's shift towards advanced, connected rail systems and smart rail trends.

The demand for modern connectivity and digital integration in rail infrastructure is growing rapidly. For instance, the global railway signaling market size was valued at USD 10.2 billion in 2023 and is projected to reach USD 15.5 billion by 2030, growing at a CAGR of 6.2%. This growth is driven by the adoption of digital technologies, highlighting the declining relevance of outdated systems.

Maintaining these legacy offerings can also lead to disproportionate costs due to limited scalability and higher operational expenses compared to newer, more efficient solutions. As a result, their market share and profitability are likely to decline further.

Unprofitable Small-Scale Regional Projects

Unprofitable small-scale regional projects often fall into the Dogs category of the CAF BCG Matrix. These are typically characterized by low market share in a slow-growing or declining regional market. For instance, a small rail infrastructure company might find itself bidding on numerous highly competitive, low-margin contracts for minor track upgrades in a specific geographic area. The potential for securing larger, more lucrative follow-on work from these small projects is often minimal, leading to a situation where resources are stretched thin for little reward.

These types of projects can become a drain on a company's resources. Consider a scenario where a firm dedicates significant engineering and project management time to secure a $5 million regional rail project with a projected net profit of only $150,000 (a 3% margin). If the company undertakes several such projects, the cumulative management attention and capital tied up might outweigh the modest returns. In 2024, the average profit margin for small construction firms in the US was around 1.5% to 3%, highlighting how easily regional projects can become unprofitable if not managed carefully.

- Low Market Share: Participation in niche, highly competitive regional markets where the company holds a small percentage of the total contract volume.

- Limited Growth Potential: Projects with minimal prospects for expansion or securing larger, more profitable follow-on contracts within the same region or sector.

- Resource Drain: Activities that consume disproportionate management time, capital, and operational resources relative to the low returns generated, impacting overall profitability.

- Strategic Re-evaluation: These projects are often candidates for divestiture, strategic partnerships, or outright avoidance to redirect resources towards more promising ventures.

Products Dependent on Obsolete Technologies

Products heavily dependent on outdated manufacturing or unsustainable materials fall into the Dogs category of the CAF BCG Matrix. Continued investment in these lines means rising costs and declining consumer interest, resulting in low profits and little to no future growth. For instance, companies still relying on legacy semiconductor fabrication methods for certain electronics may face significant cost increases as newer, more efficient processes become standard.

These product lines often struggle with diminishing market share and profitability. By 2024, the global market for products based on older technologies, such as CRT monitors, saw a significant contraction, with sales declining by over 90% compared to their peak. Companies maintaining such offerings often do so for niche markets or legacy support, but the overall trend points towards obsolescence.

- High Production Costs: Reliance on outdated machinery and specialized components drives up manufacturing expenses.

- Declining Market Demand: Consumer preference shifts towards newer, more advanced, or environmentally friendly alternatives.

- Limited Growth Potential: The inherent obsolescence of the underlying technology caps any significant expansion opportunities.

- Environmental Concerns: Older processes may also be less sustainable, leading to regulatory pressures and increased disposal costs.

Dogs represent products or business units with low market share in slow-growing or declining industries. These offerings often consume resources without generating substantial returns, making them a strategic challenge. In 2024, many legacy technology products or niche services that fail to adapt to market evolution are prime examples of Dogs.

These segments typically face declining demand and limited growth prospects, leading to poor profitability. Companies often find themselves investing in maintenance and support for these units, which ties up capital that could be better utilized elsewhere. The focus for Dogs is usually on minimizing losses or divesting to reallocate resources.

For instance, companies still heavily invested in older, less efficient manufacturing processes for certain components might see their products categorized as Dogs. The global trend towards automation and advanced materials in manufacturing, as seen in the automotive sector's shift to electric vehicles and sustainable materials, leaves older methods behind.

The challenge with Dogs lies in their inability to compete effectively in evolving markets. Their low market share and lack of growth potential mean they rarely contribute significantly to a company's overall success. In 2024, the strategic imperative for such units is often a thorough review for potential discontinuation or sale.

| CAF BCG Category | Characteristics | Strategic Implications | 2024 Market Context Example |

|---|---|---|---|

| Dogs | Low market share, low growth industry | Divest, harvest, or minimize investment | Legacy software systems with declining user bases and high maintenance costs. |

| Dogs | Low market share, declining industry | Consider liquidation or niche focus | Traditional print media advertising services in an increasingly digital advertising landscape. |

| Dogs | Low market share, stagnant industry | Reduce costs and manage for cash | Specialized industrial equipment designed for industries undergoing significant consolidation or decline. |

Question Marks

CAF's ventures into autonomous train control systems position it in a high-growth sector with significant future potential. However, the current market share for fully autonomous rail is still relatively low, reflecting the technology's nascent stage of widespread adoption. This places CAF's autonomous rail development in the "Question Marks" category of the BCG matrix, requiring careful strategic consideration.

The global connected rail market is projected to expand considerably, with autonomous rail being a key driver of this growth. Despite this upward trend, the path to widespread commercialization for autonomous trains involves substantial research and development investments. CAF's commitment to these advanced solutions means significant capital outlay is necessary, with the ultimate market share and profitability remaining uncertain.

Expansion into untapped, high-growth geographic markets represents CAF's "Question Marks" in the BCG Matrix. These initiatives involve significant upfront investment in market research, establishing local partnerships, and bidding on initial projects, with the potential for substantial market share gains but also considerable risk. For instance, CAF's recent foray into the Southeast Asian renewable energy sector, a region experiencing rapid economic development and a strong push towards green infrastructure, exemplifies this strategy. Early project wins, such as a solar farm development deal in Vietnam valued at an estimated $50 million in late 2023, are promising indicators of future success, though the long-term viability and profitability of these new ventures are still being assessed.

Investing in hyperloop or other ultra-high-speed transport component R&D places these ventures squarely in the Question Mark category of the BCG matrix. While the potential for market disruption and immense growth is undeniable, the current reality is a nascent market with virtually zero share, demanding substantial upfront investment for development.

The technological and regulatory landscapes present significant challenges, making commercial viability a distant prospect. For instance, early projections for hyperloop systems often cite costs in the billions, underscoring the capital intensity of this R&D. Despite these hurdles, the allure of revolutionizing travel keeps investment flowing into this high-risk, high-reward frontier.

Advanced Predictive Maintenance and Digital Services

CAF is investing in advanced digital services for predictive maintenance and smart rail asset management. This area represents a significant growth opportunity as rail operators increasingly focus on optimizing efficiency and reducing downtime. While CAF's capabilities in these specialized digital offerings are developing, their market share might currently be less established compared to pure technology companies.

The market for these sophisticated digital solutions is expanding rapidly. For instance, the global railway analytics market was valued at approximately USD 1.5 billion in 2023 and is projected to grow at a compound annual growth rate of over 15% through 2030, indicating strong demand. CAF's strategic push into this segment is crucial for capturing a larger share of this evolving market.

To effectively compete and scale these advanced digital services, CAF will need to continue making substantial investments. This includes research and development for new analytical tools, enhancing data integration capabilities, and building a robust digital service infrastructure. The goal is to move beyond traditional maintenance contracts into value-added, data-driven solutions.

- Market Growth: The railway analytics market is expected to reach over USD 3.5 billion by 2030, driven by the need for operational efficiency.

- CAF's Position: While CAF offers digital solutions, its market share in highly specialized predictive maintenance services may be lower than dedicated tech firms.

- Investment Needs: Significant R&D and infrastructure investment is required to scale CAF's advanced digital service offerings and enhance real-time operational analytics.

- Competitive Landscape: Dedicated technology providers are strong competitors, necessitating continuous innovation and service enhancement from CAF.

New Zero-Emission Bus Technologies (beyond current offerings)

While Solaris, a CAF subsidiary, is a recognized leader in zero-emission buses, venturing into entirely novel technologies like solid-state battery buses or next-generation fuel cell systems represents a potential 'Question Mark' in the CAF BCG Matrix. These advanced solutions aim to tap into the rapidly expanding sustainable mobility market, which is projected to see significant growth in the coming years. For instance, the global electric bus market was valued at approximately $50 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, according to industry reports.

These emerging technologies, however, necessitate substantial investment in research and development to overcome technical hurdles and achieve commercial viability. Market acceptance also remains a key factor, as operators may be hesitant to adopt unproven systems despite their potential benefits. For example, solid-state batteries, while offering higher energy density and faster charging, are still largely in the pilot or early commercialization phases, with widespread adoption expected to take several more years. Successfully navigating these challenges will be crucial for these new technologies to transition from question marks to stars.

- Emerging Technologies: Focus on solid-state batteries and advanced fuel cell systems beyond current deployments.

- Market Potential: Targeting the high-growth sustainable mobility segment, with the global electric bus market projected for significant expansion.

- Investment Needs: Requires substantial R&D investment to address technical challenges and ensure scalability.

- Market Acceptance Risk: Potential for slow adoption due to the unproven nature of these technologies in large-scale commercial operations.

CAF's investments in nascent, high-potential areas like fully autonomous train control systems and ultra-high-speed transport component R&D represent classic Question Marks. These ventures require significant capital for development and market entry, with uncertain outcomes regarding market share and profitability.

The company's expansion into new geographic markets, such as Southeast Asia for renewable energy projects, also falls into this category. While offering substantial growth potential, these initiatives carry inherent risks due to market unfamiliarity and the need for substantial upfront investment in research and local partnerships.

Similarly, CAF's push into advanced digital services for predictive maintenance and smart rail asset management, while tapping into a growing market, positions them as a Question Mark. They are investing heavily to build capabilities and market share against established tech players in this rapidly expanding analytics sector.

Ventures into next-generation sustainable mobility technologies, like solid-state battery buses through its Solaris subsidiary, are also Question Marks. These require considerable R&D to overcome technical hurdles and achieve market acceptance in a sector with strong growth projections.

| Venture Area | Market Growth Potential | Current Market Share | Investment Needs | Risk Level |

| Autonomous Train Control | Very High | Low (Nascent) | High (R&D, Infrastructure) | High |

| Ultra-High-Speed Transport R&D | Extremely High | Negligible (Conceptual) | Very High (R&D) | Very High |

| New Geographic Markets (e.g., SE Asia Renewables) | High | Low (New Entrant) | High (Market Entry, Partnerships) | High |

| Advanced Digital Services (Predictive Maintenance) | High | Moderate (Developing) | Moderate (R&D, Infrastructure) | Moderate |

| Next-Gen Sustainable Mobility (Solid-State Batteries) | Very High | Very Low (Emerging) | High (R&D) | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, growth projections, and competitive intelligence, to provide a robust strategic framework.