CAF Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAF Bundle

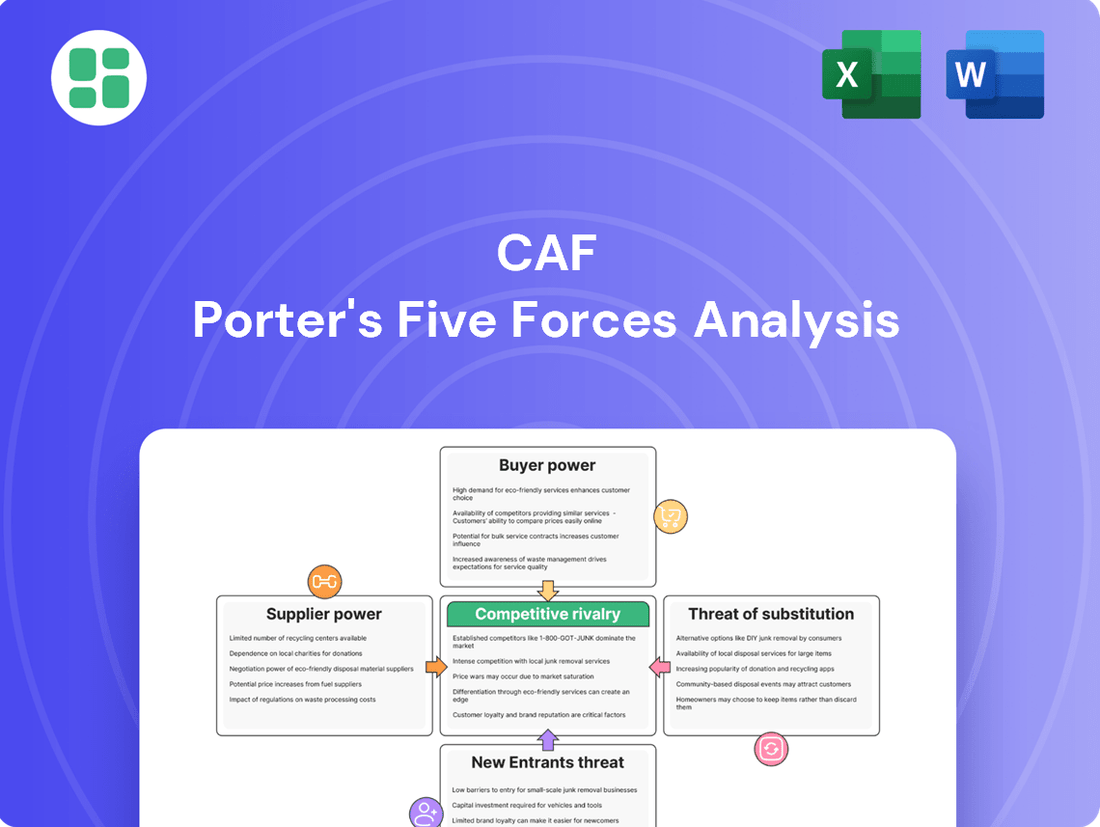

A Porter's Five Forces analysis for CAF reveals the intricate web of competitive pressures shaping its market. Understanding the intensity of rivalry, the power of buyers and suppliers, and the threats of substitutes and new entrants is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CAF’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

CAF's reliance on specialized suppliers for crucial components like propulsion systems and advanced materials significantly impacts supplier bargaining power. The unique nature of these parts often means a limited pool of qualified providers, giving them considerable leverage.

For instance, in the rail industry, the development and production of high-speed train propulsion systems can involve a handful of global specialists. In 2023, the global market for railway signaling systems was valued at approximately $10.5 billion, with a significant portion driven by a few key technology providers, highlighting the concentrated nature of this supply chain.

This dependency can translate into higher input costs for CAF and introduces potential vulnerabilities. If a critical supplier experiences production issues or faces geopolitical disruptions, it can directly affect CAF's manufacturing timelines and overall operational efficiency.

Switching suppliers in the complex railway manufacturing industry presents significant hurdles for CAF. These include the substantial costs associated with re-engineering components, obtaining new certifications, and conducting rigorous testing to guarantee compatibility and meet stringent safety regulations. These high switching costs effectively lock CAF into existing supplier relationships, thereby bolstering supplier bargaining power.

Furthermore, the prevalence of long-term contracts and deeply established supplier relationships in this sector creates further entrenchment. This makes it exceedingly difficult for CAF to readily alter its sourcing arrangements, reinforcing the leverage held by its current suppliers. For instance, in 2024, the average lead time for specialized railway components often exceeds 12 months, further complicating any potential supplier transition.

The global railway industry is experiencing a trend of consolidation among component suppliers. This means fewer companies are providing critical parts, which naturally gives them more leverage. For manufacturers like CAF, this reduction in alternatives can significantly impact their ability to negotiate favorable terms.

When a handful of major suppliers control the market for essential railway components, their combined bargaining power intensifies. This concentrated market share allows these dominant suppliers to exert greater influence over pricing, delivery timelines, and overall contract conditions, potentially leading to higher costs and less flexibility for buyers.

Impact of Raw Material Prices

The bargaining power of suppliers for CAF is significantly shaped by global raw material prices. For instance, the cost of steel and aluminum, crucial components in manufacturing, directly affects CAF's input expenses. In 2024, the price of steel, as tracked by indices like the S&P GSCI Steel, experienced volatility, with average prices for hot-rolled coil hovering around $750-$850 per ton for much of the year, a notable increase from pre-pandemic levels.

These price fluctuations in commodities like steel and aluminum can be passed on by suppliers, thereby amplifying their leverage over CAF. This dynamic is particularly challenging for CAF when undertaking long-term projects with pre-agreed fixed pricing. Such contracts can become less profitable if material costs surge unexpectedly, impacting CAF's overall financial performance.

The reliance on specific raw materials also plays a role. For CAF's advanced electronics segments, the availability and cost of rare earth metals are critical. Global supply chain disruptions or increased demand for these specialized materials, as seen in 2024 with heightened demand for electric vehicle components, can lead to price spikes and strengthen supplier positions.

- Steel Price Volatility: Average hot-rolled coil steel prices in 2024 ranged from $750-$850 per ton, impacting CAF's production costs.

- Aluminum Costs: Fluctuations in aluminum prices, a key CAF input, directly influence supplier bargaining power.

- Rare Earth Metal Demand: Increased global demand for rare earth metals in 2024, driven by sectors like EVs, can lead to higher prices and supplier leverage for CAF.

- Fixed-Price Contract Risks: Rising raw material costs can erode profitability on CAF's long-term projects with fixed pricing.

Forward Integration Potential of Suppliers

While it's not a frequent occurrence, major suppliers with advanced technological capabilities could potentially integrate forward into producing specialized sub-assemblies or even complete rolling stock for CAF. This hypothetical threat, even if unlikely, enhances their negotiating strength.

This forward integration potential means suppliers can exert greater influence, pushing CAF to consider strategic alliances and joint development efforts to lessen this bargaining power. For instance, a supplier investing heavily in new manufacturing technologies might see an opportunity to bypass intermediaries.

CAF's strategy should involve fostering strong relationships and collaborative innovation with key suppliers to mitigate the risk of suppliers leveraging their capabilities for greater control over the value chain.

- Forward Integration Threat: Large, technologically advanced suppliers possess the theoretical capability to move into sub-assembly or full rolling stock manufacturing, increasing their leverage.

- Strategic Mitigation: CAF can counter this by building robust partnerships and engaging in collaborative innovation with its suppliers.

- Supplier Investment: Suppliers making significant investments in advanced manufacturing or R&D may be more inclined to explore forward integration.

CAF faces significant supplier bargaining power due to the specialized nature of components and limited supplier options. This concentration, evident in the railway signaling market valued at $10.5 billion in 2023, means a few key players hold considerable leverage, impacting CAF's costs and operational timelines.

High switching costs, including re-engineering and regulatory approvals, further entrench CAF with existing suppliers, reinforcing their power. The average lead time for specialized railway components in 2024 exceeding 12 months underscores this dependency and makes supplier transitions challenging.

The consolidation trend in the railway component supply chain, coupled with volatile raw material prices like steel (averaging $750-$850 per ton for hot-rolled coil in 2024) and increased demand for rare earth metals, amplifies supplier leverage. This dynamic can squeeze profit margins on CAF's fixed-price contracts.

| Factor | Impact on CAF | Data Point (2024) |

| Supplier Concentration | Increased leverage, higher costs | Limited number of high-speed train propulsion system specialists |

| Switching Costs | Supplier lock-in, reduced negotiation flexibility | Average lead time for specialized components: >12 months |

| Raw Material Volatility | Erodes fixed-price contract profitability | Steel (hot-rolled coil): $750-$850/ton |

| Rare Earth Metal Demand | Higher prices, supplier leverage | Increased demand from EV sector |

What is included in the product

This analysis dissects the five competitive forces impacting CAF's industry: the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats by visually mapping the intensity of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

CAF's customers, primarily national railway operators and public transport authorities, engage in massive, infrequent purchases of rolling stock. These large-scale orders, often for entire fleets, grant them significant bargaining leverage because of the sheer volume and strategic nature of the deals.

For instance, a single fleet order can represent hundreds of millions of euros for CAF. In 2023, CAF secured a significant contract with the UK's South Western Railway for 72 new trains, a deal valued in the hundreds of millions, highlighting the substantial power these large, infrequent purchases confer upon buyers.

CAF’s significant customer base within the public sector faces highly structured procurement processes. These government-backed tenders are designed for transparency and competition, which inherently shifts bargaining power towards the customer. For instance, in 2023, public sector procurement in many developed economies represented a substantial portion of GDP, often exceeding 15%, creating a large market where competitive bidding is the norm.

These rigorous tender processes allow customers to negotiate aggressively on price, demand bespoke solutions, and set stringent delivery timelines. The lengthy and complex nature of these public procurement cycles, from initial bid submission to final contract award, can span many months, even years, giving customers ample opportunity to exert influence and secure favorable terms. This prolonged engagement period amplifies the customer’s leverage throughout the project lifecycle.

The railway vehicle and systems sector thrives on high customization, where each client's unique operational, environmental, and regulatory needs dictate specific product features. This bespoke approach inherently empowers customers, as they can precisely define requirements that directly influence the final product's design and cost structure.

For instance, a major European railway operator might specify advanced signaling integration and specific axle load capacities for a new fleet, directly impacting the manufacturer's engineering and production processes. This level of detail in customer specifications grants them significant leverage in negotiations, as deviations from these precise demands can lead to costly rework for the manufacturer.

Customer's Ability to Delay or Cancel Projects

Customers in the rail industry, particularly government entities, possess considerable leverage when they can delay or cancel large infrastructure projects. Given the often lengthy project timelines and substantial reliance on public funding, shifts in political winds, economic downturns, or budget reallocations can lead to project postponements or outright cancellations. This ability directly impacts CAF's revenue predictability and the stability of its order book.

For instance, a significant delay in a major rolling stock order, which can span several years from contract signing to final delivery, directly reduces CAF's near-term revenue. This uncertainty amplifies the customer's bargaining power, as they can use the threat of cancellation or delay to negotiate more favorable terms. In 2023, CAF reported a substantial order backlog, valued at €20.5 billion as of December 31, 2023, which offers a degree of insulation against the impact of individual project fluctuations. However, the potential for these large-scale delays remains a key factor in customer bargaining power.

- Project Delays: Government budget cycles and political priorities can lead to extended timelines for rail infrastructure projects.

- Cancellation Risk: Economic instability or changes in public policy can result in the cancellation of awarded contracts.

- Revenue Impact: Such customer actions directly affect CAF's revenue visibility and the predictability of its financial performance.

- Backlog Resilience: CAF's significant order backlog, exceeding €20 billion in late 2023, provides a buffer against the immediate impact of individual project disruptions.

Access to Multiple Global Competitors

CAF's customers face a moderate bargaining power, largely due to the presence of a concentrated yet strong set of global competitors. Major players like Alstom, Siemens Mobility, CRRC, and Hitachi Rail offer viable alternatives, enabling buyers to solicit bids and compare offerings effectively. This competitive landscape allows customers to negotiate terms and pricing, as demonstrated by CAF's own financial reports which often reflect the impact of competitive bidding processes on project margins.

The ability of customers to play manufacturers against each other is a significant factor. For instance, in 2024, several major rail infrastructure projects saw intense bidding wars, with CAF competing directly against these giants. This competition can lead to price concessions and more favorable contract terms for the buyers. The sheer scale and technological capabilities of these competitors mean that CAF cannot afford to be complacent, as customers can readily switch if pricing or product specifications are not met.

- Limited but Strong Competitor Pool: Alstom, Siemens Mobility, CRRC, and Hitachi Rail are key global players.

- Leveraging Competition: Customers can use the presence of these competitors to negotiate better deals.

- Impact on Pricing: Competitive bidding in 2024 has influenced project margins for manufacturers like CAF.

- Buyer Leverage: The availability of alternatives empowers customers to demand favorable terms.

CAF's customers, particularly large railway operators and public transport authorities, wield significant bargaining power due to the immense scale and infrequent nature of their rolling stock purchases. These substantial orders, often for entire fleets, represent hundreds of millions of euros, giving buyers considerable leverage. For example, CAF's 2023 contract with South Western Railway for 72 trains, valued in the hundreds of millions, exemplifies this buyer strength.

The highly structured, competitive, and transparent public procurement processes common in the sector further empower customers. These processes, often involving lengthy tender cycles, allow for aggressive price negotiation and the demand for bespoke solutions. In 2023, public sector procurement represented a significant portion of GDP in many developed economies, often exceeding 15%, underscoring the competitive environment buyers operate within.

Customers can also exert influence through potential project delays or cancellations, especially given the reliance on public funding and shifting political priorities. While CAF's substantial order backlog, exceeding €20.5 billion as of December 31, 2023, offers some resilience, the risk of project disruptions remains a key factor in customer leverage.

The presence of strong global competitors like Alstom, Siemens Mobility, CRRC, and Hitachi Rail allows customers to effectively solicit bids and negotiate favorable terms. Intense bidding wars observed in 2024 on major rail projects highlight how this competitive landscape enables buyers to secure better pricing and contract conditions.

| Factor | Impact on CAF | Customer Leverage |

| Large Order Volumes | High revenue potential per deal | Significant |

| Public Procurement Processes | Requires competitive bidding, price sensitivity | High |

| Project Delays/Cancellations | Revenue uncertainty, cash flow impact | Moderate to High |

| Competitor Landscape | Pressure on margins, need for competitive offers | Moderate to High |

Preview the Actual Deliverable

CAF Porter's Five Forces Analysis

This preview showcases the complete CAF Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises. You'll gain instant access to this actionable strategic tool, ready for immediate application to your business needs.

Rivalry Among Competitors

The rolling stock and railway equipment sector is characterized by the significant presence of global industry giants. Companies like Alstom, Siemens Mobility, CRRC, and Hitachi Rail, alongside CAF, command substantial market share. These established players leverage vast resources, advanced technological expertise, and extensive international networks, intensifying competition for lucrative global contracts.

CAF operates in a sector with substantial fixed costs, encompassing research and development, advanced manufacturing plants, and highly skilled personnel. These significant upfront investments necessitate a focus on high-volume production to achieve economies of scale and cover overheads efficiently.

This cost structure inherently fuels intense competition, as companies like CAF are driven to secure large orders to ensure their production capacity is fully utilized. The pressure to maintain high capacity utilization is critical; even a slight underutilization can severely impact profitability due to the fixed nature of these costs.

For instance, the global railway rolling stock market, which CAF is a major player in, is projected to reach approximately $230 billion by 2024, indicating the scale of investment and the competitive landscape for securing significant market share and production volume.

Competitive rivalry in the rail and transport sector is intensifying, largely fueled by rapid technological advancements. Companies are locked in a race to innovate, particularly in high-speed rail, electrification, advanced signaling systems, and the development of sustainable mobility options. This drive for innovation is central to gaining a competitive edge.

Differentiation is now heavily reliant on incorporating cutting-edge features, improving energy efficiency, and integrating smart technologies into their products. For instance, CAF's commitment to developing zero-emission solutions for buses is a significant differentiator, and this focus on sustainability is increasingly becoming a crucial factor for success in the broader rail market as well.

In 2023, global investment in rail infrastructure and rolling stock saw continued growth, with a particular emphasis on modernization and green technologies. CAF, in its 2023 financial reports, highlighted its ongoing investments in research and development, which are critical for maintaining its position in this innovation-driven landscape. The company's order book reflects this, with a substantial portion of new contracts specifying advanced, sustainable technologies.

Global Market Growth and Regional Dynamics

The global rolling stock market is expected to see consistent growth, propelled by increasing urbanization and significant infrastructure spending, particularly in sustainable transport solutions. This expansion, however, intensifies competition among established manufacturers as they target high-growth areas.

Key regions like Asia-Pacific and the Middle East are focal points for this competition, with substantial investments in railway networks. For instance, China's Belt and Road Initiative continues to spur demand for new rolling stock across numerous countries.

- Projected Market Growth: The global rolling stock market was valued at approximately $55 billion in 2023 and is anticipated to reach over $75 billion by 2028, demonstrating a compound annual growth rate (CAGR) of around 6.5% to 7%.

- Key Growth Drivers: Urbanization, government investments in high-speed rail and metro systems, and a global push for eco-friendly transportation are major catalysts.

- Intensifying Rivalry: Major players like Alstom, Siemens Mobility, CRRC Corporation, and Bombardier Transportation are actively competing for contracts, especially in emerging markets.

- Regional Focus: Asia-Pacific remains the largest market, driven by extensive development projects in countries such as India and China, followed by Europe and North America.

Long Sales Cycles and Relationship-Based Business

The competitive rivalry in the railway sector is intensified by exceptionally long sales cycles, often stretching over several years from the initial bid to project completion. This protracted timeline demands significant, ongoing investment in sales, marketing, and client relationship management, fostering a high-stakes environment.

The competitive rivalry within the rolling stock sector is fierce, driven by a concentrated market with a few dominant global players. These companies, including CAF, Siemens Mobility, Alstom, and CRRC, compete intensely for large-scale contracts, often requiring significant upfront investment and technological innovation.

The market's high fixed costs and the drive for economies of scale mean that securing substantial orders is crucial for profitability, further intensifying competition. This dynamic is evident in the global rolling stock market, projected to exceed $75 billion by 2028, with a CAGR of around 6.5% to 7%.

Innovation in areas like electrification and sustainable mobility is a key battleground, with companies differentiating themselves through advanced features and eco-friendly solutions. For instance, CAF's investment in zero-emission bus technology highlights this trend, which is also critical in the rail market.

The long sales cycles, often spanning several years, add another layer of complexity and competition, demanding sustained investment in client relationships and sales efforts.

| Key Competitors | Market Share (Approximate 2023/2024) | Key Strengths |

|---|---|---|

| Siemens Mobility | 15-20% | Technology leadership, broad product portfolio, strong European presence. |

| Alstom | 12-17% | Global reach, expertise in high-speed rail and signaling, sustainability focus. |

| CRRC Corporation | 25-30% | Dominant in China, massive production capacity, cost competitiveness. |

| Hitachi Rail | 5-8% | Strong in UK and Japan, focus on digital solutions and fleet modernization. |

| CAF | 4-6% | Agile manufacturing, strong presence in Spain and Latin America, growing focus on urban mobility. |

SSubstitutes Threaten

For freight, road transport's inherent flexibility and door-to-door capabilities make it a strong substitute, particularly for shorter hauls or specialized cargo where rail's fixed routes are less advantageous. In 2024, the global freight market saw continued reliance on road transport, with trucking accounting for approximately 70% of all freight moved within many developed economies.

In the passenger sector, the convenience and personalized routing offered by private vehicles and buses present a significant substitute to other modes like rail or air travel. The widespread adoption of ride-sharing services in 2024 further enhanced the accessibility and appeal of road-based passenger transport, offering on-demand solutions that directly compete with scheduled services.

While rail excels in bulk and mass transit efficiency, ongoing enhancements in road infrastructure and vehicle technology, including the rise of electric and autonomous trucks, can diminish rail's competitive edge. This is especially true in regions where rail networks are less extensive or modernized, making road transport a more viable and often faster alternative for a broader range of goods and passengers.

For long-distance passenger travel, air transportation stands as a potent substitute. Its primary advantage is speed, making it the go-to option for intercontinental journeys. In 2024, the International Air Transport Association (IATA) reported a significant recovery in air travel, with passenger numbers approaching pre-pandemic levels, underscoring its continued dominance for speed-sensitive travelers.

While high-speed rail is emerging as a competitor on certain routes, its effectiveness diminishes over very long distances where aviation's speed advantage is more pronounced. For example, a flight across the Atlantic or Pacific is still vastly quicker than any rail alternative. However, rail's appeal lies in its environmental benefits and the convenience of city-center to city-center connectivity, aspects where air travel often falls short due to airport locations and transit times.

For very heavy and bulk cargo, sea transportation remains a highly cost-effective alternative for international trade, often presenting a direct substitute for land-based freight. While rail is vital for the initial and final legs of many journeys, the sheer volume and weight of certain goods can make direct port-to-port shipping via ocean a more economical choice, bypassing extensive rail networks for transcontinental movements.

The cost-effectiveness of sea freight is a significant factor; for instance, in 2023, the average cost per ton-mile for bulk ocean shipping was considerably lower than for rail, especially for long-haul international routes. This economic advantage means that businesses moving vast quantities of commodities like coal, grain, or iron ore internationally will often opt for sea transport, limiting the substitutability of rail for these specific, large-scale movements.

Technological Advancements in Other Modes

Technological advancements in alternative transportation modes pose a significant threat. For instance, the ongoing development of autonomous driving technology for trucks, coupled with the increasing efficiency and adoption of electric vehicles, could make road transport a more compelling substitute for rail. This is particularly relevant as the trucking industry aims to reduce operational costs and improve delivery times.

Similarly, innovations in aviation, such as more fuel-efficient aircraft and advancements in cargo drone technology, present a threat by potentially offering faster transit times for certain types of freight. A 2024 report indicated a notable increase in air cargo volumes for high-value goods, suggesting a growing willingness to pay a premium for speed.

These innovations can divert demand from rail if they offer superior cost-effectiveness, speed, or environmental benefits. For example, a 10% reduction in per-mile operating costs for long-haul electric trucks could significantly alter modal choice decisions. Consequently, the rail sector must continuously innovate to maintain its competitive advantage.

Key areas of technological threat include:

- Autonomous Trucking: Potential for reduced labor costs and 24/7 operation, directly competing on long-haul routes.

- Electric Vehicles: Lower operating costs and environmental benefits make them increasingly attractive for freight.

- Advanced Air Cargo: Faster transit times for time-sensitive and high-value goods.

- Logistics Optimization Software: Improved route planning and load consolidation for road and air can enhance their overall efficiency.

Shift Towards Digital Communication and Remote Work

The increasing adoption of virtual meeting technologies and the widespread shift to remote work, significantly amplified by recent global events, are diminishing the necessity for intercity passenger transport. This trend directly impacts the demand for services like rail travel, as fewer business trips are undertaken. For instance, a 2023 Global Workplace Analytics report indicated that 12.7% of full-time employees work from home, and 54% of the workforce has a job that could be done remotely. This reduction in travel frequency can negatively affect the demand for new regional and high-speed passenger trains.

The threat of substitutes for traditional rail transport is growing due to these digital alternatives. While virtual meetings do not replace the need for physical movement entirely, they demonstrably reduce the frequency of such movements. This can translate to fewer passengers, impacting revenue streams for rail operators and potentially influencing investment decisions in new rolling stock. For example, in 2024, many companies continue to maintain hybrid work policies, further cementing the reduction in business travel compared to pre-pandemic levels.

- Digital Communication as a Substitute: Virtual meeting platforms offer a cost-effective and time-saving alternative to physical business travel.

- Remote Work Impact: The normalization of remote work reduces the overall need for employees to commute or travel between cities for meetings.

- Reduced Travel Frequency: While not a direct replacement for all travel, these digital shifts decrease the overall volume of intercity passenger movements.

- Investment Implications: This substitution threat may lead to reduced demand for new passenger trains as operators reassess future capacity needs.

The threat of substitutes for rail transport is multifaceted, encompassing road, air, and even digital alternatives. Road transport, particularly trucking, remains a dominant substitute for freight, accounting for around 70% of freight movement in many developed economies in 2024 due to its flexibility. For passengers, private vehicles and ride-sharing services offer personalized convenience, directly competing with scheduled rail services.

Air travel is a significant substitute for long-distance passenger journeys, with passenger numbers recovering to near pre-pandemic levels in 2024. While high-speed rail offers an alternative on certain routes, aviation's speed advantage for intercontinental travel remains unmatched. Sea freight is also a potent substitute for bulk international cargo, often proving more cost-effective per ton-mile than rail for large volumes, as seen in 2023 cost comparisons.

Technological advancements further bolster substitute threats. Autonomous and electric trucking could reduce operating costs for road freight, while advanced air cargo offers faster transit for high-value goods, with air cargo volumes for such items increasing in 2024. Additionally, the rise of virtual meetings and remote work, with 12.7% of full-time employees working from home in 2023, reduces the need for intercity passenger travel, impacting rail demand.

| Substitute Mode | Key Advantages for Rail Substitution | 2024/2023 Data Point |

|---|---|---|

| Road Freight (Trucking) | Flexibility, door-to-door delivery, cost-effectiveness for certain routes | Accounted for ~70% of freight movement in developed economies |

| Air Passenger Travel | Speed for long-distance and intercontinental travel | Passenger numbers recovered to near pre-pandemic levels |

| Sea Freight | Cost-effectiveness for bulk international cargo | Lower average cost per ton-mile than rail for bulk, long-haul |

| Digital Communication/Remote Work | Reduced need for business travel | 12.7% of full-time employees worked from home in 2023 |

Entrants Threaten

Entering the rolling stock manufacturing and railway equipment industry demands substantial capital. Think about the costs for research and development, setting up specialized factories, and securing financing for massive projects. For instance, a new high-speed train project could easily run into billions of dollars, making it incredibly tough for newcomers to compete.

The design, manufacturing, and maintenance of modern railway vehicles and systems require incredibly specialized engineering skills, cutting-edge technology, and ongoing research and development. Building this deep expertise and a competitive product line takes many years, creating a significant hurdle for newcomers aiming to enter the market quickly.

For instance, companies like Siemens Mobility invested heavily in R&D for their Velaro high-speed trains, which are crucial for long-distance travel. This continuous innovation, coupled with decades of accumulated knowledge in areas like advanced signaling and electrification, presents a formidable barrier to entry for any potential new competitor in the global rail sector.

The railway industry faces a significant threat from new entrants due to its exceptionally rigorous regulatory and safety standards. These aren't minor hurdles; they are fundamental requirements that new companies must meticulously address.

For instance, in the European Union, the European Union Agency for Railways (ERA) oversees interoperability and safety directives, demanding extensive documentation and testing. A new entrant might need to prove compliance with TSI (Technical Specifications for Interoperability) standards for various subsystems, a process that can take years and cost millions before a single train even operates commercially. This complexity inherently limits the number of entities capable of entering the market.

Established Customer Relationships and Project History

CAF and its established competitors benefit from long-standing relationships with public and private railway operators, often built over decades through successful project deliveries. For instance, in 2023, CAF secured a significant €400 million contract for new metro trains in Helsinki, a testament to its existing client trust.

Customers typically prefer proven suppliers with a track record of reliability and performance, making it challenging for new entrants to gain trust and secure initial contracts. This established history creates a substantial barrier, as new companies must demonstrate not only technical capability but also a history of successful, on-time, and within-budget project execution.

- Long-standing relationships: Decades of successful project deliveries foster deep trust with operators.

- Proven reliability: Customers prioritize suppliers with a demonstrable track record.

- High switching costs: The complexity and risk associated with changing suppliers deter new entrants.

- Brand reputation: Established players like CAF benefit from strong brand recognition and perceived quality.

Long Project Cycles and High Risk

The sheer scale and duration of railway projects present a formidable barrier. These undertakings, from initial planning to operational readiness, frequently stretch over many years, sometimes a decade or more. This protracted timeline means new players must commit substantial capital for extended periods without any immediate return, a significant deterrent for many.

This extended cash outflow coupled with the inherent complexities and uncertainties of large-scale infrastructure development translates into high financial risk. For instance, in 2024, major railway infrastructure projects globally continued to face budget overruns and delays, underscoring the financial exposure. A new entrant lacking the deep pockets and risk tolerance of established players would find it exceptionally difficult to navigate these challenges.

The threat of new entrants is therefore significantly dampened by these long project cycles and the associated high risk. Established companies with proven track records and access to substantial, patient capital are better positioned to absorb the upfront investment and manage the prolonged development phases.

- Long Project Cycles: Railway projects can span 5-15 years from conception to completion.

- High Capital Outlay: Initial investments often run into billions of dollars.

- Extended Cash Burn: New entrants face prolonged periods of negative cash flow before revenue generation.

- Financial Risk: Project delays and cost overruns are common, increasing the financial exposure for all participants.

The threat of new entrants in the rolling stock and railway equipment sector is considerably low. High capital requirements for R&D, manufacturing facilities, and securing project financing, often in the billions of dollars for projects like high-speed rail, present a significant initial barrier. For example, developing a new generation of high-speed train technology demands substantial upfront investment in research and advanced manufacturing capabilities.

The industry's reliance on specialized engineering expertise and proprietary technology, honed over many years, further restricts entry. Companies like Siemens Mobility, with decades of experience in areas such as advanced signaling and electrification, have built formidable knowledge bases. This deep technical know-how and continuous innovation cycle are difficult for newcomers to replicate quickly.

Stringent regulatory and safety standards, such as the TSI directives managed by the ERA in the EU, require extensive testing and documentation, a process that can take years and millions in compliance costs. This complexity naturally limits the pool of potential entrants capable of meeting these rigorous demands.

Established players benefit from long-standing relationships with operators, built on proven reliability and performance. New entrants struggle to gain this trust, as customers often prioritize suppliers with a demonstrable history of successful, on-time project delivery. For instance, CAF's 2023 €400 million contract for Helsinki metro trains highlights the value placed on existing client relationships.

| Barrier Category | Description | Example/Data Point |

| Capital Requirements | High initial investment for R&D, manufacturing, and project financing. | New high-speed train projects can cost billions. |

| Technical Expertise | Need for specialized engineering skills and advanced technology. | Siemens Mobility's extensive R&D in Velaro high-speed trains. |

| Regulatory Hurdles | Strict safety and interoperability standards require lengthy compliance processes. | ERA's TSI directives in the EU can take years and millions for compliance. |

| Customer Relationships | Established trust and preference for proven suppliers with track records. | CAF's €400 million contract in Helsinki (2023) reflects existing client trust. |

| Project Scale & Duration | Long project cycles (5-15 years) and high financial risk associated with extended cash burn. | Global railway projects in 2024 faced budget overruns and delays, increasing financial exposure. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including detailed company financial statements, expert industry analysis reports, and comprehensive market research databases. This blend ensures a thorough understanding of competitive intensity, supplier and buyer leverage, and the threat of new entrants and substitutes.