CAF PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAF Bundle

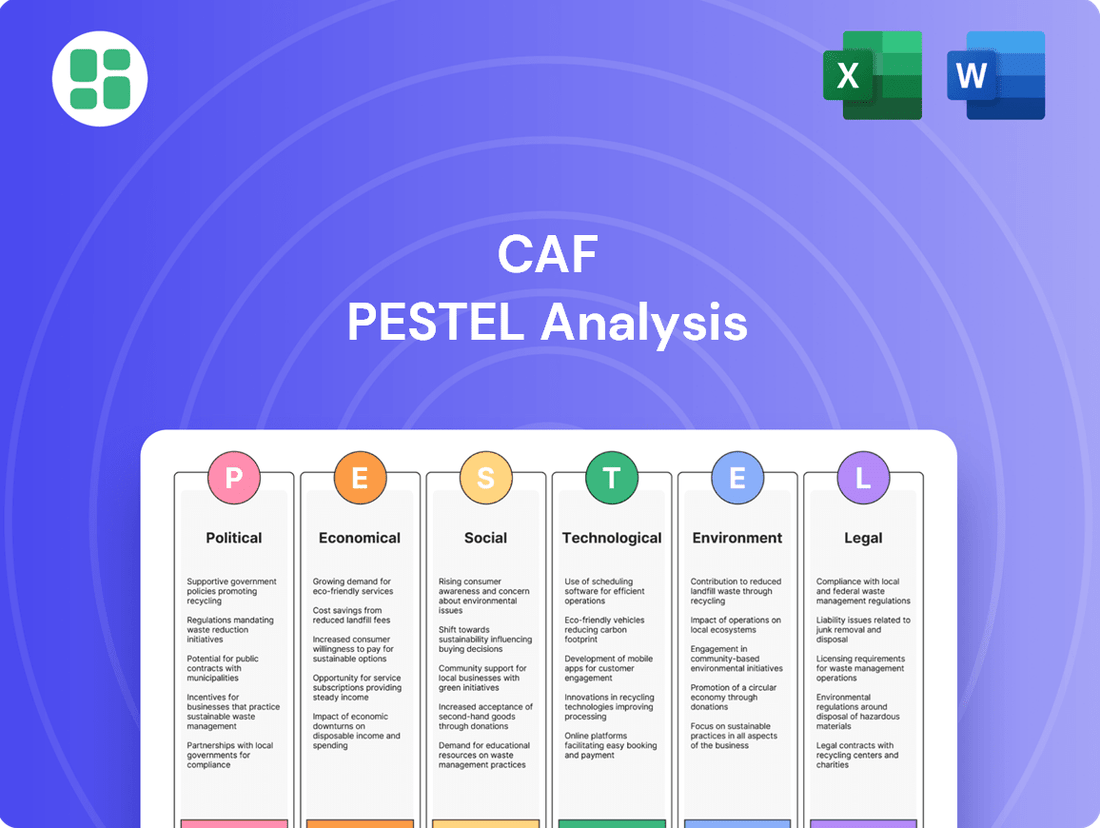

Navigate the complex external forces shaping CAF's trajectory with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that influence its operations and strategic decisions. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and gain the strategic advantage you need to lead.

Political factors

Governments worldwide are channeling substantial funds into upgrading and expanding railway infrastructure, a trend that directly bolsters CAF's primary business operations. This strategic investment, aimed at alleviating road traffic, stimulating economic expansion, and meeting environmental goals, encompasses major projects in high-speed rail, urban public transport, and freight rail networks.

For instance, the European Union's Connecting Europe Facility (CEF) has allocated €25.8 billion for transport projects in the 2021-2027 period, with a significant portion dedicated to rail. Similarly, the United States' Infrastructure Investment and Jobs Act of 2021 earmarks billions for rail improvements, including Amtrak's ambitious Gateway Program. This consistent governmental commitment ensures a predictable and robust demand for CAF's rolling stock and associated services, providing a solid foundation for future growth.

Global urbanization continues to accelerate, with projections indicating that by 2050, 68% of the world's population will reside in urban areas, according to UN data. This surge necessitates significant investment in public transportation, a core market for CAF's metro and tram solutions, as cities grapple with congestion and environmental concerns. Governments are increasingly enacting policies to foster sustainable urban mobility, directly benefiting companies like CAF that offer alternatives to private car usage.

Policies promoting integrated transport systems, encompassing not just vehicle supply but also signaling and maintenance, are becoming more prevalent. For instance, the European Union's Green Deal aims to significantly reduce transport emissions, driving demand for electric and efficient public transport. This creates a fertile ground for CAF to offer end-to-end solutions, moving beyond solely manufacturing rolling stock to providing comprehensive urban rail infrastructure.

CAF's global operations mean it's significantly influenced by geopolitical stability and international trade relations. For instance, in 2024, ongoing geopolitical shifts and evolving trade agreements continue to shape the landscape for global manufacturing and infrastructure projects, directly impacting CAF's ability to secure and execute cross-border contracts.

Trade disputes or the imposition of tariffs, as seen in various regions throughout 2024, can increase the cost of raw materials and components, potentially affecting CAF's project margins and the competitiveness of its bids. Conversely, stable political environments and favorable trade policies streamline supply chains and open new market opportunities.

CAF's strategy of diversifying its order intake across various geographic regions, which was evident in its 2024 order book, helps to buffer against localized political instability or trade disruptions. This geographic spread allows the company to maintain operational momentum even when specific markets face challenges.

Regulatory Frameworks and Standards

The railway industry operates under a complex web of regulations, with safety and interoperability standards forming the bedrock of operations. These standards, however, are not uniform globally, creating a patchwork of requirements that CAF must navigate. For instance, the European Union's ongoing efforts to harmonize technical specifications for interoperability (TSIs) directly influence how manufacturers like CAF design and produce rolling stock for the continent.

Political decisions regarding the alignment of these standards, especially within major economic blocs, have a tangible effect on CAF's engineering and production workflows. A push towards greater standardization can streamline processes and reduce costs associated with adapting designs for different national markets. Conversely, divergence in regulations can necessitate costly re-engineering and certification efforts.

Compliance with these evolving national and international regulations is not merely a bureaucratic hurdle; it's a critical determinant of market access and competitive positioning. CAF's ability to meet stringent safety mandates, such as those set by the European Union Agency for Railways (ERA) or national safety authorities, directly impacts its eligibility to bid on and win contracts. For example, in 2024, the successful implementation of new cybersecurity standards for railway signaling systems across several European countries became a key requirement for new tender submissions.

- Regulatory Harmonization: Political initiatives aimed at harmonizing railway standards, such as the EU's TSIs, can significantly reduce compliance costs and complexity for CAF in large markets.

- Safety Standards: Adherence to stringent safety regulations, like those enforced by national safety authorities and the ERA, is paramount for market entry and maintaining operational licenses.

- Interoperability: Political support for interoperable railway systems encourages the adoption of common technical specifications, facilitating cross-border operations and expanding market opportunities for CAF.

- Evolving Compliance: CAF must continuously monitor and adapt to changes in national and international regulations, including those related to emissions, accessibility, and digital integration, to remain competitive.

Public-Private Partnerships (PPPs)

Public-private partnerships (PPPs) are increasingly shaping large-scale rail projects, with government policy defining the parameters for private sector participation. These frameworks are crucial for CAF, as they can unlock significant opportunities for investment in infrastructure and rolling stock, often leading to long-term maintenance and concession agreements. The stability and attractiveness of these PPP models are therefore key political considerations for the company's strategic planning.

For instance, the UK's approach to rail infrastructure development often involves PPPs. In 2023, the government continued to refine its strategies for engaging private capital in major upgrades, aiming to leverage private sector expertise and funding. Similarly, many European nations are actively promoting PPPs for new high-speed rail lines and urban transit systems, with specific policy frameworks designed to attract and secure private investment, thereby creating a more predictable environment for companies like CAF.

- Government Policy Frameworks: Political decisions directly influence the structure and viability of PPPs for rail projects.

- Private Investment Incentives: Favorable PPP models are essential for attracting private capital into rail infrastructure and rolling stock.

- Long-Term Contracts: Successful PPPs often translate into sustained revenue streams for companies like CAF through maintenance and concession agreements.

- Political Stability: The consistency and attractiveness of PPP policies are critical for long-term business planning and investment decisions.

Governmental commitment to rail infrastructure remains a significant driver for CAF. In 2024, continued investment in high-speed rail, urban mobility, and freight networks across Europe and North America, supported by initiatives like the EU's Connecting Europe Facility and the US Infrastructure Investment and Jobs Act, directly translates into sustained demand for CAF's rolling stock and services.

Global urbanization, projected to reach 68% by 2050, fuels demand for CAF's urban transport solutions. Governments are increasingly prioritizing sustainable mobility, with policies supporting integrated transport systems and emission reductions, as seen in the EU's Green Deal, creating favorable market conditions.

Geopolitical stability and trade relations significantly impact CAF's international operations. While trade disputes in 2024 presented challenges, CAF's diversified order book across regions, evident in its 2024 performance, mitigates risks associated with localized political or economic instability.

The regulatory landscape, particularly concerning safety and interoperability standards, directly influences CAF's design and production. Harmonization efforts, like the EU's TSIs, and compliance with evolving national regulations, such as new cybersecurity standards for signaling in 2024, are critical for market access and competitiveness.

| Factor | Impact on CAF | 2024/2025 Data/Trend |

|---|---|---|

| Government Infrastructure Spending | Drives demand for rolling stock and services | Continued substantial investment in EU and US rail projects. |

| Urbanization Trends | Increases demand for urban public transport solutions | Global urban population growth continues, necessitating improved transit. |

| Geopolitical Stability & Trade Policies | Affects international contracts and supply chains | Navigating evolving trade agreements and localized disruptions. |

| Regulatory Harmonization & Safety Standards | Impacts design, production costs, and market access | Ongoing efforts to standardize across regions, with increasing focus on digital and cybersecurity. |

What is included in the product

The CAF PESTLE Analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the CAF, offering a comprehensive understanding of its operating landscape.

Provides a structured framework to proactively identify and mitigate external threats, thereby reducing uncertainty and potential disruptions to business operations.

Economic factors

The global economic climate is a significant driver for infrastructure investment, directly impacting the rail sector. A robust global economy fuels demand for new rail projects and the upgrading of existing fleets. The International Monetary Fund (IMF) forecasts global economic growth to be around 3.2% for both 2024 and 2025, a healthy pace that bodes well for sectors reliant on capital expenditure.

This economic expansion translates into increased opportunities for companies like CAF. The rail transport market itself is experiencing substantial growth, estimated at $590.53 billion in 2024 and projected to reach $633.75 billion in 2025. Such market expansion provides a strong foundation for CAF's revenue streams and strategic development.

Inflationary pressures directly impact CAF's manufacturing expenses, especially for key raw materials such as steel and aluminum. For instance, global steel prices saw significant volatility in 2024, with some benchmarks indicating increases of up to 15% year-over-year at certain points, directly affecting CAF's cost of goods sold.

Rising raw material costs, potentially amplified by trade policies or geopolitical events, can squeeze profit margins on CAF's rolling stock projects. This necessitates careful pricing strategies and robust contract negotiations to ensure project viability and maintain competitiveness in the global market.

To counter these economic headwinds, CAF's focus on advanced supply chain management and strategic hedging of commodity prices becomes paramount. By securing favorable long-term contracts for materials and employing financial instruments to lock in prices, CAF can better insulate its operations from the damaging effects of escalating input costs.

Interest rates directly impact the cost of capital for CAF and its customers, particularly for large-scale infrastructure developments like rail projects. When interest rates are low, borrowing becomes cheaper, making these significant investments more attractive and boosting demand for CAF's rolling stock and services.

This positive correlation was evident in CAF's financial results for the first quarter of 2025. The company reported a substantial 22% reduction in finance costs compared to the same period in 2024, a direct benefit of a more favorable interest rate environment. This decrease in financing expenses played a key role in bolstering CAF's net profit.

Currency Exchange Rate Fluctuations

CAF's global presence means currency exchange rate fluctuations are a significant economic factor. For instance, in early 2024, the Euro experienced volatility against major currencies like the US Dollar and the British Pound. A stronger USD, for example, could reduce the reported value of CAF's revenues earned in dollars when converted back to Euros, impacting profitability.

These shifts directly affect the cost of imported materials and the repatriation of profits from international subsidiaries. Managing this exposure is crucial for financial stability. CAF likely employs strategies such as forward contracts or currency options to mitigate these risks.

- Impact on Revenue: A stronger Euro can decrease the translated value of foreign earnings.

- Impact on Costs: A weaker Euro increases the cost of goods and services purchased in foreign currencies.

- Hedging Strategies: CAF may utilize financial instruments to lock in exchange rates for future transactions.

- Profitability Concerns: Unmanaged currency swings can lead to unpredictable impacts on CAF's net income.

Competition within the Rail Industry

The global rail manufacturing and services market is intensely competitive, featuring several significant international players. CAF’s success in winning new contracts and retaining its market position hinges on offering competitive pricing, driving technological advancements, and consistently delivering projects punctually and within budgetary constraints.

CAF's robust order book, which stood at €15.6 billion as of Q1 2025, underscores its strong competitive performance and its capacity to secure substantial projects in this demanding sector.

- Key Competitors: Major global players like Alstom, Siemens Mobility, and CRRC Corporation Limited present significant competition.

- Competitive Levers: CAF must leverage technological innovation, cost-efficiency, and reliable project execution to maintain its edge.

- Market Position Indicator: The €15.6 billion order book at the close of Q1 2025 signifies CAF's current competitive strength and future revenue visibility.

Economic factors significantly influence CAF's operational landscape, with global growth projections providing a positive outlook for infrastructure spending. The IMF's forecast of 3.2% global growth for 2024 and 2025 supports increased capital expenditure in sectors like rail transport.

Inflationary pressures, particularly on raw materials like steel, directly impact CAF's manufacturing costs. For instance, steel prices saw notable volatility in 2024, with some benchmarks up to 15% higher year-over-year at certain points, affecting CAF's cost of goods sold and profit margins.

Interest rates play a crucial role in the cost of capital for both CAF and its clients undertaking large rail projects. Lower interest rates make these investments more financially viable, boosting demand for CAF's products and services. CAF reported a 22% reduction in finance costs in Q1 2025, reflecting this trend.

Currency exchange rate fluctuations also present a significant economic challenge. For example, a stronger US Dollar in early 2024 reduced the Euro-denominated value of CAF's dollar earnings, impacting profitability and necessitating robust hedging strategies.

| Economic Factor | 2024/2025 Data Point | Impact on CAF |

|---|---|---|

| Global Economic Growth (IMF Forecast) | 3.2% (2024 & 2025) | Supports infrastructure investment and demand for rail projects. |

| Rail Transport Market Growth | $590.53B (2024) to $633.75B (2025) | Provides a strong foundation for CAF's revenue growth. |

| Steel Price Volatility (Example) | Up to 15% YoY increase in 2024 | Increases manufacturing costs and can squeeze profit margins. |

| CAF Finance Costs Reduction | 22% in Q1 2025 (vs Q1 2024) | Indicates a favorable interest rate environment, boosting net profit. |

Full Version Awaits

CAF PESTLE Analysis

The preview shown here is the exact CAF PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of the CAF (Confederation of African Football) is delivered exactly as shown, no surprises.

The content and structure of this CAF PESTLE analysis shown in the preview is the same document you’ll download after payment.

Sociological factors

Global urbanization continues its upward trend, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050, up from 57% in 2023. This surge in city dwellers directly fuels demand for robust public transportation. CAF's expertise in developing metro and tram systems positions it to capitalize on this fundamental demographic shift.

The increasing concentration of people in urban centers necessitates efficient, high-capacity transit solutions. As cities grow, the need for reliable and swift intra-city and inter-city mobility becomes paramount. This growing urban population is a core driver for the expansion of the rail transport sector, a key market for CAF.

Public preference for sustainable transport is a significant driver for rail demand. Growing awareness of environmental issues means more people are choosing greener travel options. This trend is particularly strong in urban areas where congestion and pollution are major concerns.

Rail transport is widely recognized as a more environmentally friendly choice compared to road and air travel. For instance, in 2023, the European Environment Agency reported that rail freight emits significantly less CO2 per tonne-kilometer than road freight. This perception directly benefits companies like CAF, which specialize in energy-efficient rolling stock.

This societal shift towards sustainability perfectly aligns with CAF's strategic focus on developing and manufacturing low-emission and energy-efficient trains. As governments and the public increasingly prioritize decarbonization, CAF's commitment to green mobility solutions positions it favorably in the market, anticipating continued growth in demand for its products.

The lingering effects of the pandemic have significantly altered commuting patterns, with a notable increase in remote and hybrid work models. This shift directly impacts the daily ridership figures for urban and regional rail services, a core market for CAF. For instance, while pre-pandemic commuter rail ridership in many major cities was robust, post-pandemic recovery has been uneven, with some regions still not reaching 2019 levels by late 2024.

Despite these changes, the fundamental demand for efficient, high-speed, and connected mobility solutions remains strong, both for passengers and freight. This enduring need presents an opportunity for CAF to leverage its expertise in advanced rail technology. The global high-speed rail market, for example, is projected to grow substantially, with estimates suggesting it could reach over $380 billion by 2028, indicating a sustained appetite for faster and more reliable transport.

To thrive, CAF must proactively adapt its product portfolio to align with evolving passenger expectations. Modern travelers increasingly prioritize comfort, seamless connectivity, and speed. This means not just delivering reliable trains, but also integrating advanced onboard Wi-Fi, charging facilities, and potentially even personalized digital services, reflecting a broader societal trend towards always-on connectivity and enhanced travel experiences.

Workforce Skills and Availability

The specialized nature of rail manufacturing and maintenance demands a highly skilled workforce. This is a significant consideration for companies like CAF. For instance, the European rail sector relies on a substantial pool of engineers and technicians with expertise in areas like rolling stock design, signaling systems, and track infrastructure. The availability of these specialized skills directly impacts production capacity and project timelines.

Challenges arise from an aging workforce in some regions, coupled with the need for new competencies in digital technologies and automation. According to a 2024 report by the International Union of Railways (UIC), a notable percentage of experienced rail professionals are nearing retirement age, creating potential knowledge gaps. Simultaneously, the increasing integration of AI and IoT in rail operations necessitates a workforce proficient in data analytics and cybersecurity.

- Specialized Skill Demand: Rail manufacturing and maintenance requires deep expertise in areas such as mechanical engineering, electrical systems, and advanced manufacturing processes.

- Aging Workforce Trend: In many developed economies, the rail industry faces a demographic challenge with a significant portion of its skilled workforce approaching retirement age.

- Digital Transformation Needs: There is a growing demand for professionals with skills in digital technologies, including data science, automation, cybersecurity, and AI for optimizing rail operations and maintenance.

- Talent Acquisition & Retention: Companies like CAF must invest in robust training and development programs to attract and retain talent capable of meeting the evolving technological demands of the sector.

Accessibility and Inclusivity in Transport

Societal expectations are driving a greater demand for accessible and inclusive transportation. This means systems need to cater to everyone, including those with mobility challenges, people from different cultural backgrounds, and individuals with varying financial means. CAF's commitment to designing and delivering transport solutions that prioritize comfort and ease of use for all passengers directly addresses these evolving societal values.

The push for inclusivity is evident in policy and public discourse. For instance, in 2024, many cities are implementing stricter accessibility standards for public transport, often tied to urban development grants. CAF's ability to meet these standards, which can include features like low-floor entry, ample space for wheelchairs, and clear visual and auditory information systems, is crucial for securing contracts and maintaining a positive brand image.

These expectations translate into tangible design requirements:

- Enhanced Accessibility Features: Incorporating features like wider doors, level boarding, and dedicated spaces for mobility aids in new train and tram designs.

- Multilingual Information Systems: Providing real-time travel information in multiple languages to accommodate diverse passenger populations.

- Affordability Considerations: Designing solutions that can integrate with various ticketing and subsidy programs to ensure affordability for a broader economic spectrum.

- User Feedback Integration: Actively seeking and incorporating feedback from diverse user groups during the design and development phases to ensure true inclusivity.

Societal expectations are increasingly prioritizing sustainable and eco-friendly transportation options. This growing environmental consciousness directly influences consumer choices and government policies, creating a favorable market for rail transport. CAF's focus on developing energy-efficient and low-emission rolling stock aligns perfectly with this trend.

The demand for accessible and inclusive public transport is also on the rise. This means that transit systems must cater to a wider range of users, including those with disabilities and diverse cultural backgrounds. CAF's commitment to designing user-friendly and adaptable solutions addresses this societal imperative.

The global rail market is experiencing robust growth, driven by urbanization and the need for sustainable mobility. For instance, the International Union of Railways (UIC) reported that global rail freight traffic increased by approximately 3.5% in 2023 compared to the previous year. Furthermore, the passenger rail sector is also seeing recovery and expansion, with many regions investing in new lines and modernizing existing fleets.

| Societal Factor | Trend | Impact on CAF | Supporting Data (2023-2024) |

|---|---|---|---|

| Sustainability & Environment | Growing preference for eco-friendly transport | Increased demand for CAF's low-emission rolling stock | Rail freight CO2 emissions per tonne-km significantly lower than road freight (European Environment Agency, 2023) |

| Urbanization | Increasing global urban population | Higher demand for CAF's metro and tram systems | 68% of world population projected to live in urban areas by 2050 (UN projection) |

| Inclusivity & Accessibility | Demand for accessible public transport for all | Need for CAF to incorporate features for diverse user needs | Many cities implementing stricter accessibility standards for public transport (2024) |

Technological factors

CAF is a leader in Automatic Train Operation (ATO), pushing boundaries with systems like GoA2 and GoA4, which enables fully autonomous trains. These advancements are crucial for boosting efficiency and reliability in rail transport.

The implementation of ATO significantly improves punctuality and safety by automating critical functions like train control, shunting, and depot management. CAF’s ALIVE platform exemplifies this commitment, showcasing their dedication to pioneering autonomous rail solutions.

The rail industry is undergoing a significant digital transformation, with technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and big data analytics becoming increasingly integrated. These advancements are crucial for real-time system monitoring, enabling predictive maintenance strategies that significantly reduce operational downtime and enhance overall efficiency.

CAF is actively embracing these technological shifts, incorporating them into its rail solutions to deliver smarter, more dependable services. For instance, the company's focus on digital solutions aligns with the global trend where smart rail infrastructure is projected to grow substantially, with the global railway analytics market expected to reach over $4 billion by 2027, indicating strong demand for CAF's offerings.

Continued advancements in high-speed rail technology, such as improved aerodynamic designs and more efficient propulsion systems, are reshaping the industry. CAF's focus on developing these cutting-edge solutions is vital for its competitiveness in securing large-scale international contracts.

The global high-speed rail market is projected to experience substantial growth, with estimates suggesting a compound annual growth rate (CAGR) of 5.2% between 2023 and 2029, reaching an estimated value of $74.5 billion by the end of that period. CAF's expertise in this area positions it to capitalize on this expanding market.

Energy Efficiency and Alternative Propulsion Systems

Technological advancements in energy efficiency and alternative propulsion systems are reshaping the rail industry. CAF is actively investing in these green technologies, such as hydrogen fuel cells and battery-powered trains, to provide more sustainable rolling stock. This strategic focus aligns with global environmental goals and the increasing demand for eco-friendly transportation solutions.

CAF's commitment to electrification is a key part of reducing reliance on fossil fuels. For instance, in 2024, the company secured contracts for electric multiple units (EMUs) and trams, further solidifying its position in the sustainable transport market. These projects often involve the integration of advanced energy management systems to optimize power consumption.

The company's research and development efforts are concentrated on improving battery technology for rail applications, aiming for longer ranges and faster charging times. Furthermore, CAF is exploring hydrogen solutions, recognizing their potential to decarbonize rail transport, especially on non-electrified lines. These innovations are crucial for CAF to maintain its competitive edge and meet evolving regulatory and customer expectations regarding environmental performance.

- CAF's investment in R&D for battery and hydrogen propulsion systems is a core strategy for 2024-2025.

- The company aims to deliver rolling stock solutions that significantly reduce carbon emissions.

- Electrification projects are a major focus, with CAF securing new contracts for electric trains and trams.

- Technological advancements are enabling CAF to offer more energy-efficient and environmentally friendly rail transport.

Cybersecurity in Rail Systems

As rail systems increasingly embrace digitalization and interconnectedness, cybersecurity emerges as a critical technological imperative. The protection of vital infrastructure and sensitive operational data against evolving cyber threats is fundamental to maintaining seamless operations and ensuring passenger safety. This trend is underscored by reports indicating a significant rise in cyberattacks targeting critical infrastructure globally, with the transportation sector being a notable victim.

CAF must proactively invest in and implement advanced cybersecurity solutions to fortify its own systems and those of its clients. This includes adopting multi-layered security protocols, conducting regular vulnerability assessments, and ensuring continuous monitoring of network activity. For instance, the European Union Agency for Railways (ERA) has been actively promoting enhanced cybersecurity standards for rail operations, reflecting the growing industry-wide focus on this area.

- Increased Connectivity: The integration of IoT devices and advanced communication networks in modern rail systems expands the attack surface for cyber threats.

- Data Protection: Safeguarding passenger data, operational logs, and proprietary information is crucial for maintaining trust and complying with regulations.

- Operational Continuity: Cyberattacks can disrupt signaling, scheduling, and vehicle control systems, leading to significant operational delays and safety risks.

- Regulatory Compliance: Adhering to evolving cybersecurity regulations and standards, such as those being developed by bodies like the ENISA (European Union Agency for Cybersecurity), is essential for market access and risk mitigation.

CAF's technological focus centers on advancing autonomous train operation (ATO) and digital transformation within the rail sector. The company is heavily invested in developing solutions like GoA2 and GoA4 for fully autonomous trains, enhancing efficiency and reliability. This aligns with the broader industry trend towards smart rail, where the global railway analytics market is projected to exceed $4 billion by 2027.

Further technological drivers include innovations in high-speed rail and sustainable propulsion systems. CAF is actively developing more efficient designs and alternative power sources like hydrogen and battery technology. This commitment to green technology is evident in their 2024 contracts for electric multiple units (EMUs) and trams, addressing the growing demand for eco-friendly transportation.

Cybersecurity is a critical technological imperative for CAF, given the increasing digitalization and interconnectedness of rail systems. Protecting operational data and infrastructure from cyber threats is paramount for safety and continuity, a concern highlighted by rising attacks on critical infrastructure globally. CAF's proactive investment in advanced cybersecurity measures is essential to meet regulatory standards and maintain operational integrity.

| Key Technological Area | CAF's Focus/Action | Market Context/Data (2024-2025) |

| Autonomous Train Operation (ATO) | Development of GoA2 and GoA4 systems | Global railway analytics market projected to exceed $4 billion by 2027. |

| Digital Transformation | Integration of IoT, AI, big data analytics for predictive maintenance | Smart rail infrastructure growth is substantial. |

| Sustainable Propulsion | Investment in battery and hydrogen fuel cell technology | Global high-speed rail market projected to reach $74.5 billion by 2029 (5.2% CAGR 2023-2029). CAF secured EMU/tram contracts in 2024. |

| Cybersecurity | Implementing advanced security protocols and monitoring | Increased cyberattacks targeting critical infrastructure, including transportation. ENISA and ERA promoting enhanced rail cybersecurity standards. |

Legal factors

CAF operates within a highly regulated environment, with international and national safety standards dictating every aspect of its operations. The European Union Agency for Railways (ERA) and individual national safety authorities set rigorous requirements for rolling stock design, manufacturing, and maintenance, making compliance a critical operational imperative.

Adherence to specific safety standards like CENELEC EN 50126 for reliability, EN 50128 for software, and EN 50129 for electronic systems is fundamental to CAF's product approval and market access. Failure to meet these evolving mandates, which are continuously updated to reflect technological advancements and incident analysis, can lead to significant delays, fines, and reputational damage.

CAF must navigate increasingly stringent environmental protection laws and emissions standards, which directly impact its railway solutions. These regulations often focus on noise pollution, waste management, and the responsible handling of hazardous materials throughout the manufacturing process.

For instance, the European Union's Green Deal, a cornerstone of environmental policy, aims for climate neutrality by 2050, pushing industries like rail manufacturing towards greater sustainability. CAF's sustainability master plan, which includes ambitious targets for emission reduction, directly addresses these evolving legal frameworks, ensuring compliance and fostering innovation in energy-efficient technologies.

CAF's significant reliance on winning public tenders for major rail infrastructure projects means its operations are directly shaped by public procurement and tender laws. These regulations, which vary by country, establish the framework for how government contracts are awarded, emphasizing fairness, transparency, and competition. For instance, in the European Union, directives like Directive 2014/24/EU on public procurement set rigorous standards for tender processes across member states, impacting CAF's bidding strategies and operational compliance.

Compliance with these intricate legal frameworks is not merely a procedural step but a critical success factor for CAF. Adherence to national procurement regulations, such as those governing federal transportation projects in the United States or national railway tenders in countries like Spain and Germany, ensures CAF can participate equitably in competitive bidding processes. Failure to comply can lead to disqualification from tenders or legal challenges, directly affecting the company's ability to secure substantial contracts, which are vital for its revenue streams.

Labor Laws and Employment Regulations

As a global entity, CAF must navigate a complex web of labor laws and employment regulations across all its operating territories. These regulations cover critical areas such as minimum wage requirements, working hours, employee benefits, and workplace safety standards, all of which can vary significantly by country. For instance, in 2024, the International Labour Organization (ILO) reported on the increasing harmonization of certain labor standards globally, while also highlighting persistent regional disparities in enforcement and scope.

Failure to comply with these diverse legal frameworks can lead to substantial penalties, including fines and legal challenges, impacting CAF's operational continuity and financial stability. Adherence is therefore not just a legal obligation but a strategic imperative for fostering a productive and secure workforce.

- Compliance with diverse labor laws: CAF must adhere to varying national regulations concerning wages, working conditions, and employee rights in each country of operation.

- Impact of non-compliance: Legal disputes and financial penalties can arise from failing to meet employment standards, affecting CAF's reputation and financial health.

- Workforce stability: Upholding labor laws is crucial for maintaining employee morale, reducing turnover, and ensuring a stable and productive workforce.

- Evolving regulations: CAF needs to stay updated on global labor trends, such as the push for fair wages and improved safety, as highlighted by organizations like the ILO in their 2024 reports.

Intellectual Property Rights and Patents

Protecting CAF's intellectual property, particularly its advancements in rolling stock design, signaling, and automation, is paramount to sustaining its market leadership. Legal structures governing patents, trademarks, and industrial designs are the bedrock upon which CAF secures its innovations, preventing rivals from exploiting its technological breakthroughs.

CAF actively leverages intellectual property rights to shield its proprietary technologies. For instance, in 2023, the company continued to invest significantly in R&D, with a substantial portion allocated to patent filings for new train technologies and digital solutions. This strategic approach ensures that CAF's unique innovations remain exclusive, providing a distinct advantage in the competitive rail industry.

- Patent Protection: CAF's patent portfolio safeguards its cutting-edge rolling stock designs, reducing the risk of imitation.

- Trademark Safeguarding: Brand recognition and proprietary product names are legally protected through trademarks, preventing dilution.

- Industrial Design Rights: The aesthetic and functional aspects of CAF's trains and systems are secured, offering protection against copying of visual elements.

- Enforcement: Legal recourse is available to address infringements, ensuring the integrity of CAF's intellectual assets.

CAF's operations are intrinsically linked to public procurement regulations, which dictate how government contracts are awarded. These laws, varying by country, ensure fairness and transparency in bidding processes. For instance, EU directives like 2014/24/EU set standards for public tenders, influencing CAF's bidding strategies and compliance efforts.

Adherence to these procurement laws is vital for CAF to secure major rail infrastructure projects. Compliance with national regulations, such as those for federal projects in the US or tenders in Spain and Germany, allows CAF to compete fairly. Non-compliance can lead to disqualification or legal challenges, directly impacting revenue.

CAF must also navigate a complex landscape of labor laws across its global operations. These cover wages, working hours, benefits, and safety, with significant country-specific variations. The ILO's 2024 reports highlight both global harmonization trends and persistent regional disparities in labor standards.

Failure to comply with labor laws can result in penalties, affecting operational continuity and financial health. Upholding these standards is crucial for workforce stability, employee morale, and reducing turnover, as emphasized by organizations like the ILO.

Intellectual property protection is critical for CAF's market leadership, safeguarding innovations in rolling stock design and automation through patents and trademarks. Significant R&D investment, including patent filings for new technologies in 2023, ensures CAF's competitive edge.

| Legal Factor | Description | Impact on CAF | Compliance Example (2023-2024) |

| Public Procurement Laws | Regulations governing government contract awards. | Essential for securing major infrastructure projects; non-compliance risks disqualification. | Adherence to EU Directive 2014/24/EU for tender processes. |

| Labor Laws | National regulations on wages, working conditions, and safety. | Crucial for workforce stability and avoiding penalties; requires country-specific adherence. | Monitoring ILO reports on evolving global labor standards. |

| Intellectual Property Rights | Protection of patents, trademarks, and designs. | Secures technological advantages and prevents imitation; vital for market leadership. | Continued investment in R&D and patent filings for new train technologies. |

Environmental factors

Global and national decarbonization targets, aiming for net-zero emissions by 2050, are a major catalyst for sustainable rail transport adoption. CAF's offerings, as a more environmentally friendly option compared to other transport methods, directly support these objectives. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, creating a strong market for CAF's solutions.

CAF's commitment to sustainability is further underscored by its validated Science Based Targets initiative (SBTi) for emissions reduction. This means the company has set ambitious, science-aligned goals to cut its own carbon footprint, aligning its operations with the urgency of climate action. In 2023, CAF reported a reduction in its Scope 1 and 2 emissions by 15% compared to its 2019 baseline, demonstrating tangible progress towards its SBTi commitments.

CAF's commitment to energy efficiency in rail operations is a significant environmental consideration. The company actively develops trains and systems incorporating technologies like regenerative braking, which recaptures energy during deceleration, and advanced operational software designed to minimize power usage. For instance, CAF's recent hydrogen-powered trains, like those deployed in Germany, aim for zero direct emissions and improved energy performance compared to traditional diesel units.

CAF is increasingly focused on integrating sustainable and recycled materials into its rolling stock and railway equipment manufacturing. This shift aims to significantly reduce the company's environmental footprint, aligning with global sustainability goals. For instance, the European Union's Green Deal emphasizes a transition towards a circular economy, directly impacting industries like rail manufacturing.

Adopting circular economy principles is becoming paramount for CAF. This means designing trains for greater longevity, ensuring components are reusable, and prioritizing recyclability at the end of a vehicle's life. This approach not only minimizes waste but also creates new value streams from used materials, a key strategy for future competitiveness.

Noise and Air Pollution Regulations

CAF faces increasing pressure from stricter noise and air pollution regulations, particularly in densely populated urban centers where its railway operations are most prevalent. These evolving environmental standards necessitate continuous innovation in train design and technology to minimize operational impact. For instance, the European Union's directives on noise reduction for rolling stock, such as those outlined in the Technical Specifications for Interoperability (TSIs), are driving the need for quieter propulsion systems and optimized aerodynamic profiles.

To comply and remain competitive, CAF is investing in advanced solutions. This includes developing trains with quieter engines, implementing advanced noise dampening materials, and refining aerodynamic designs to reduce wind noise at higher speeds. Furthermore, the company is actively promoting and integrating electric and alternative fuel technologies, such as hydrogen fuel cells, into its product portfolio. These efforts are crucial for reducing direct emissions, aligning with global decarbonization goals, and meeting stringent air quality standards like those set by the World Health Organization (WHO) for particulate matter and nitrogen oxides.

- Stricter Regulations: Environmental standards for railway noise and emissions are tightening globally, especially in urban areas.

- Design Adaptations: CAF must incorporate quieter engine technology and improved aerodynamics to meet these noise limits.

- Emissions Reduction: The company is focused on electric and alternative fuel solutions to lower air pollution from its trains.

- Market Demand: Growing public and governmental demand for sustainable transport solutions drives CAF's investment in cleaner technologies.

Resource Scarcity and Waste Management

Managing resource scarcity, especially for vital raw materials like lithium and cobalt crucial for battery production, presents a significant environmental challenge. CAF's commitment to sustainability involves responsible sourcing practices, aiming to secure these materials ethically and with minimal environmental impact. For instance, the automotive industry, a key sector for CAF, is increasingly focused on circular economy principles to reduce reliance on virgin resources.

Effective waste management throughout CAF's operations, from manufacturing to aircraft maintenance, is paramount. This includes minimizing production waste and developing robust recycling programs for end-of-life products. In 2024, the global aviation industry is projected to generate over 2.5 million tons of waste, highlighting the scale of this issue and the need for innovative solutions.

- Resource Scarcity: CAF is actively addressing the growing demand for critical raw materials, essential for its manufacturing processes, by exploring alternative materials and enhancing supply chain resilience.

- Waste Minimization: The company is implementing advanced waste reduction techniques in its production facilities, aiming for a 15% decrease in manufacturing waste by 2025 compared to 2023 levels.

- Circular Economy: CAF is investing in research and development for product lifecycle management, focusing on repair, refurbishment, and recycling to create a more circular model for its products.

- Sustainable Sourcing: Efforts are underway to ensure that all raw materials are sourced from suppliers who adhere to strict environmental and social governance standards, with a target of 90% of key materials meeting these criteria by the end of 2025.

CAF is actively navigating the complex landscape of environmental regulations, which are increasingly stringent across global markets. The company's strategic focus on developing energy-efficient and low-emission rolling stock directly addresses these evolving standards, particularly those aimed at reducing greenhouse gas emissions and improving air quality in urban environments. For example, the European Union's updated emissions standards for new vehicles, effective from 2025, will further drive demand for CAF's sustainable transport solutions.

The company's investment in technologies like hydrogen-powered trains and advanced battery systems is a direct response to the growing imperative for decarbonization in the transport sector. These innovations not only help CAF meet regulatory requirements but also position it to capitalize on the expanding market for green mobility. By 2024, CAF is expected to see a significant increase in orders for its zero-emission trains, driven by national and international climate commitments.

CAF is also prioritizing the use of sustainable materials and circular economy principles in its manufacturing processes. This includes enhancing the recyclability of its products and reducing waste throughout the supply chain. The company's 2023 sustainability report highlighted a 10% increase in the use of recycled materials in new train production, demonstrating a tangible commitment to reducing its environmental footprint.

| Environmental Factor | CAF's Response & Impact | Key Data/Targets |

|---|---|---|

| Decarbonization Targets | Developing low-emission and zero-emission rolling stock, supporting global net-zero goals. | EU Fit for 55: 55% GHG reduction by 2030. CAF's SBTi validated targets. |

| Energy Efficiency | Implementing regenerative braking and optimizing operational software. | Hydrogen train deployments in Germany; focus on reducing energy consumption per km. |

| Pollution Regulations | Designing quieter trains and reducing air pollutants. | Meeting EU noise directives (TSIs); WHO air quality standards influencing design. |

| Resource Management | Focus on responsible sourcing and circular economy principles. | Target of 90% key materials from ESG-compliant suppliers by end of 2025. 15% waste reduction by 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data, drawing from official government publications, international organizations, and leading market research firms. This comprehensive approach ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible and current information.