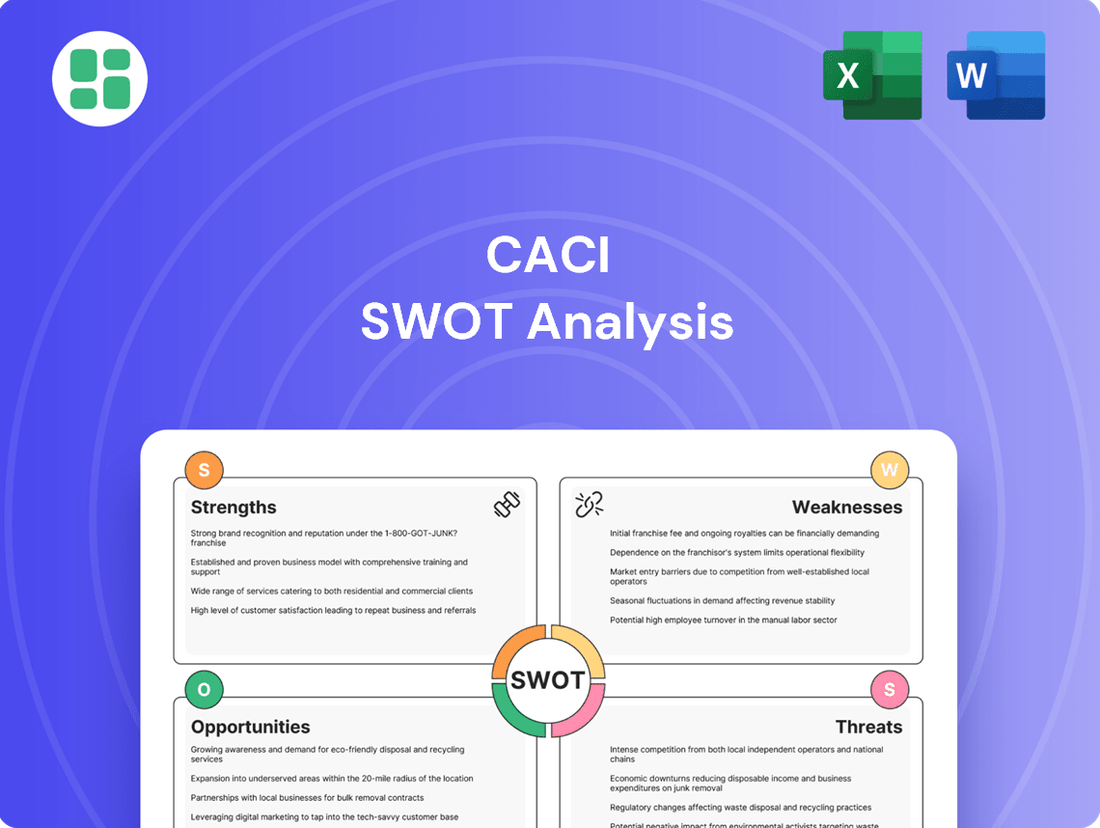

CACI SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CACI Bundle

CACI's strategic positioning is fortified by its strong government contracts and advanced technological capabilities, but it also faces intense competition and evolving regulatory landscapes. Our comprehensive SWOT analysis dives deep into these factors, revealing the nuances of CACI's market dominance and potential vulnerabilities.

Want the full story behind CACI's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CACI International Inc. has showcased impressive financial strength, with fiscal years 2024 and 2025 marking periods of substantial revenue and net income expansion. The company's top-line figures climbed from $7.7 billion in FY24 to $8.6 billion in FY25, a clear indicator of consistent growth and market demand for its services.

CACI's profound expertise in national security and government modernization is a significant strength. Their leadership in agile development, cybersecurity, data analytics, and enterprise IT allows them to tackle the most demanding government challenges.

This deep technical knowledge makes CACI an indispensable partner for U.S. federal agencies. For instance, in fiscal year 2023, CACI secured significant contracts in these very areas, demonstrating their ongoing relevance and capability in supporting critical government missions.

CACI boasts a robust contract backlog, a key strength ensuring predictable future revenue. In fiscal year 2024, the company secured $14.2 billion in contract awards, followed by an additional $9.6 billion in fiscal year 2025, demonstrating a consistent ability to win new business and maintain strong book-to-bill ratios.

These wins are not just in volume but also in quality, with CACI consistently securing significant contracts from major clients. Notable successes include awards from NASA, the U.S. Army, and various intelligence community agencies, highlighting the company's competitive edge and the trust placed in its capabilities.

Strategic Acquisitions Enhancing Capabilities

CACI's strategic acquisitions are a cornerstone of its growth, consistently bolstering its technological prowess and market reach. Recent moves have significantly amplified its expertise in critical areas such as advanced biometrics, sophisticated cloud engineering, and cutting-edge electromagnetic spectrum technologies.

These targeted acquisitions aren't just about adding new services; they are about integrating new capabilities that directly address evolving customer needs and market demands. For instance, the acquisition of Azure Summit Technology in 2023, valued at approximately $50 million, not only broadened CACI's customer portfolio but also solidified its competitive standing in key defense and intelligence sectors.

- Enhanced Technological Portfolio: Acquisitions have expanded CACI's offerings in biometrics, cloud engineering, and electromagnetic spectrum technologies.

- Market Expansion: Strategic purchases, like Azure Summit Technology, have broadened CACI's customer base and strengthened its market position.

- Competitive Advantage: Integrating acquired capabilities allows CACI to offer more comprehensive solutions, setting it apart from competitors.

Alignment with National Security Priorities and Software Focus

CACI International strategically positions itself by aligning its core competencies with critical and consistently funded national security objectives. This includes significant focus areas such as the electromagnetic spectrum, counter-unmanned aircraft systems (Counter-UAS), and the modernization of defense software systems. This deliberate alignment ensures CACI's offerings remain highly relevant and in demand within the evolving landscape of national security challenges.

The company highlights its leadership in leveraging commercially developed software-defined technologies and embracing agile development practices. This approach allows for rapid adaptation and innovation, crucial for addressing dynamic threat environments. For instance, in fiscal year 2023, CACI reported strong growth in its defense and intelligence segments, reflecting the demand for its specialized capabilities in these priority areas.

- Strategic Focus: CACI's emphasis on national security priorities like electromagnetic spectrum operations and Counter-UAS directly addresses high-demand government needs.

- Technology Leadership: The company's commitment to commercially developed software-defined technology and agile methodologies fosters innovation and rapid deployment of solutions.

- Market Demand: This strategic alignment translates into sustained demand for CACI's services, evidenced by consistent contract wins and revenue growth in key government sectors.

CACI's strengths lie in its deep expertise in national security and government modernization, particularly in agile development, cybersecurity, and data analytics. The company's robust contract backlog, evidenced by $14.2 billion in awards in FY24 and $9.6 billion in FY25, ensures predictable revenue streams and demonstrates its ability to secure significant government contracts.

| Strength Area | Description | Supporting Data (FY24/FY25) |

|---|---|---|

| Expertise | National Security & Government Modernization (Agile, Cyber, Data Analytics) | Secured significant contracts in these areas in FY23. |

| Financial Stability | Robust Contract Backlog | $14.2B in FY24 awards, $9.6B in FY25 awards. |

| Strategic Growth | Targeted Acquisitions | Acquired Azure Summit Technology (~$50M in 2023) to enhance capabilities. |

| Market Alignment | Focus on Critical National Security Objectives | Emphasis on electromagnetic spectrum, Counter-UAS, and defense software modernization. |

What is included in the product

Analyzes CACI’s competitive position through key internal and external factors, highlighting strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential threats into opportunities.

Weaknesses

CACI International's significant reliance on U.S. federal government contracts presents a notable weakness. In fiscal year 2023, approximately 85% of CACI's revenue was derived from federal government sources, highlighting a concentrated customer base.

This substantial dependence makes CACI particularly susceptible to fluctuations in government spending and procurement policies. Changes in federal budget allocations, shifts in national priorities, or alterations in contracting procedures could directly and materially affect the company's revenue streams and profitability.

CACI operates within a fiercely competitive government contracting landscape, where securing and retaining key contracts is an ongoing challenge. Rivals frequently bid aggressively, increasing the risk of CACI losing out on lucrative opportunities. For instance, in fiscal year 2023, the federal government awarded billions in IT and consulting contracts, a significant portion of which went to CACI's major competitors, highlighting the intense bidding.

The prevalence of bid protests further complicates matters, often causing delays in contract awards and the commencement of new projects. These delays can directly impact CACI's revenue streams and hinder its planned growth trajectories. The pressure to maintain competitive pricing while delivering high-quality services is a constant factor in this environment.

Government procurement, a cornerstone for CACI's revenue, faces potential headwinds from slower award decisions and invoice processing. This is partly attributed to a reduction in contracting officers within government agencies, a trend observed throughout 2024 and projected to continue impacting the early part of 2025. These delays can directly affect CACI's revenue recognition timeline and strain its operational cash flow, requiring careful management of working capital.

Navigating these bureaucratic complexities demands significant internal resources and can introduce a degree of financial unpredictability for CACI. For instance, extended approval cycles for new contracts or modifications can push anticipated revenue further into future fiscal periods, making precise financial forecasting more challenging. The company must maintain robust internal processes to mitigate the impact of these external delays.

Talent Acquisition and Retention Challenges

CACI consistently grapples with difficulties in attracting and keeping employees with the specialized skills and security clearances essential for its government contracts. The competitive landscape for talent in cybersecurity and advanced information technology is particularly intense, requiring ongoing investment in retention strategies. A constricted labor market in 2024 and projected into 2025 is likely to exacerbate these challenges, potentially inflating labor costs and posing risks to timely project completion.

Key challenges include:

- Intense competition for cleared personnel: Demand for individuals with specific security clearances often outstrips supply, driving up recruitment expenses.

- High demand for niche skills: Expertise in areas like artificial intelligence, cloud computing, and data analytics is critical, and CACI competes with numerous firms for this talent.

- Rising labor costs: To attract and retain top talent in a tight market, CACI may need to offer more competitive compensation and benefits, impacting its bottom line.

Operational Risks in International Markets

While international operations represent a smaller segment of CACI's overall revenue, they introduce a distinct set of vulnerabilities. For instance, in fiscal year 2023, CACI's international segment contributed approximately 10% of its total revenue, highlighting its relatively minor but still present global footprint.

These international ventures expose CACI to inherent risks such as adverse currency fluctuations, which can impact profitability when earnings are repatriated. Furthermore, longer payment cycles common in some international markets can strain working capital. Geopolitical uncertainties and differing regulatory landscapes also add layers of complexity and potential instability to these operations.

- Currency Volatility: Fluctuations in exchange rates can directly affect the value of international earnings when converted back to U.S. dollars.

- Extended Payment Terms: Some foreign clients may have longer payment cycles compared to domestic customers, potentially impacting cash flow.

- Geopolitical and Regulatory Risks: Political instability, trade disputes, and varying legal frameworks in different countries can create operational challenges and unforeseen costs.

CACI's heavy reliance on U.S. federal government contracts, accounting for around 85% of its revenue in fiscal year 2023, creates significant vulnerability to shifts in government spending and policy. This concentration makes the company susceptible to budget cuts, changes in procurement strategies, and the impact of bid protests, which can delay revenue recognition and hinder growth. Furthermore, the intense competition within the government contracting sector means CACI constantly faces pressure to maintain competitive pricing while delivering high-quality services, potentially impacting profit margins.

The company also faces challenges in securing and retaining talent with the necessary specialized skills and security clearances, particularly in high-demand areas like cybersecurity and AI. A constricted labor market in 2024 and into 2025 is likely to exacerbate these issues, potentially increasing labor costs and affecting project timelines. International operations, though smaller at about 10% of FY2023 revenue, introduce risks from currency fluctuations, extended payment cycles, and geopolitical instability, adding layers of complexity to CACI's financial outlook.

Preview Before You Purchase

CACI SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

The dynamic national security environment and the persistent requirement for updated IT systems create substantial demand for CACI's expertise. This is particularly true as the U.S. government actively pursues digital transformation initiatives across its agencies.

With the U.S. federal government allocating significant resources to modernize enterprise IT infrastructure and bolster cybersecurity defenses, CACI is strategically positioned to secure new contracts. For instance, in fiscal year 2023, federal IT spending reached an estimated $140 billion, with a substantial portion directed towards modernization efforts.

CACI's comprehensive suite of IT modernization, cloud computing, and cybersecurity solutions directly addresses these government priorities, enabling the company to effectively leverage these widespread market trends for growth.

CACI is strategically focusing on high-demand technology sectors like electromagnetic spectrum operations, counter-UAS, and space systems. These areas are critical to national security and are receiving significant government investment, positioning CACI for substantial future revenue streams.

The company's commitment to these growth avenues is evident in its ongoing R&D and acquisition strategies. For instance, CACI's fiscal year 2023 revenue reached $6.5 billion, with a notable portion attributed to its advanced technology solutions, reflecting the market's demand for its expertise in these strategic domains.

CACI can capitalize on the accelerating integration of artificial intelligence and sophisticated data analytics across industries. In 2024, the global AI market was projected to reach over $200 billion, with significant growth expected in government and defense sectors where CACI has a strong presence. By embedding AI into its existing solutions and developing new AI-powered platforms, CACI can offer more intelligent, predictive, and automated services to its clients, thereby boosting efficiency and creating a distinct competitive edge.

Increased Defense Spending Due to Geopolitical Instability

Heightened global geopolitical tensions and ongoing conflicts are a significant driver for increased defense spending, especially within the U.S. defense budget. This trend provides a substantial tailwind for companies like CACI, as government agencies are prioritizing investments in modernization, cyber resilience, and advanced space capabilities, all areas where CACI excels.

The U.S. Department of Defense budget for fiscal year 2024, for instance, was approximately $886 billion, reflecting a commitment to bolstering national security. This robust spending environment translates directly into more contract opportunities and the potential for larger contract awards for CACI, particularly in areas such as:

- Advanced cyber solutions

- Intelligence analysis and support

- Modernization of command and control systems

- Space domain awareness and operations

Strategic Acquisitions and Partnerships

CACI can continue its successful strategy of pursuing strategic acquisitions and forming partnerships to enhance its technological capabilities and market reach. This inorganic growth approach allows for rapid integration of new technologies and expertise, thereby broadening its customer base and solidifying its competitive position in burgeoning sectors. For instance, CACI's acquisition of SAIC's federal IT and electronic warfare business in late 2023 for $1.2 billion significantly expanded its offerings and client portfolio.

These moves are crucial for staying ahead in a rapidly evolving industry. By integrating advanced solutions and talent, CACI can better serve existing clients and attract new ones, particularly in high-demand areas like cybersecurity and artificial intelligence. The company's consistent history of successful integrations, such as the acquisition of Bluestone Analytics in 2022, demonstrates the efficacy of this growth model.

Opportunities for further expansion through inorganic means are abundant. CACI can target companies with specialized AI, data analytics, or cloud computing expertise to complement its existing strengths. The company’s strong financial performance, with reported revenue of $6.5 billion for the fiscal year ending June 30, 2023, provides a solid foundation for funding future strategic investments.

Key areas for potential acquisitions and partnerships include:

- Advanced AI and Machine Learning Capabilities: Acquiring firms specializing in AI-driven analytics and predictive modeling.

- Cybersecurity Solutions: Targeting companies with cutting-edge threat detection and prevention technologies.

- Cloud Migration and Management Services: Partnering with or acquiring firms expert in cloud infrastructure and hybrid cloud solutions.

- Data Analytics Platforms: Integrating businesses that offer robust data visualization and processing tools.

CACI is well-positioned to benefit from increased U.S. government spending on IT modernization and cybersecurity, with federal IT spending projected to exceed $140 billion in fiscal year 2023. The company's focus on high-demand areas like electromagnetic spectrum operations and space systems, which are critical to national security, is expected to drive significant future revenue. CACI's strategic acquisitions, such as the $1.2 billion purchase of SAIC's federal IT and electronic warfare business in late 2023, further bolster its capabilities and market reach.

The growing global AI market, projected to surpass $200 billion in 2024, presents a substantial opportunity for CACI to integrate AI and data analytics into its offerings, enhancing efficiency and competitiveness. Heightened geopolitical tensions are also driving increased defense spending, with the U.S. Department of Defense budget for fiscal year 2024 at approximately $886 billion, creating more contract opportunities in advanced cyber solutions, intelligence support, and space domain awareness.

| Opportunity Area | Market Driver | CACI's Relevance | Fiscal Year 2023 Revenue | Fiscal Year 2024 Budget (DoD) |

|---|---|---|---|---|

| IT Modernization & Cybersecurity | Digital transformation initiatives | Core service offerings | $6.5 billion | N/A (Broader IT spending) |

| Advanced Technologies (Space, EW, Counter-UAS) | National security requirements | Strategic focus areas | Significant portion of $6.5 billion | N/A (Specific program funding) |

| AI & Data Analytics Integration | Market growth ($200B+ in 2024) | Enhancing existing solutions | N/A (Emerging integration) | N/A |

| Inorganic Growth (Acquisitions) | Expanding capabilities and market share | Proven strategy (e.g., SAIC acquisition) | N/A (Acquisition impact) | N/A |

Threats

CACI's reliance on U.S. government contracts makes it vulnerable to changes in federal spending. For instance, the U.S. federal budget for fiscal year 2024 saw debates around spending levels, impacting agencies that are CACI's key clients.

Budgetary constraints or shifts in national priorities, such as increased defense spending versus civilian agency funding, can directly affect the demand for CACI's services. The ongoing political climate and the potential for sequestration or continuing resolutions introduce considerable uncertainty into future revenue projections.

In fiscal year 2023, CACI reported that approximately 90% of its revenue was derived from U.S. government contracts, highlighting the significant exposure to government funding fluctuations.

The government IT solutions market is exceptionally crowded, featuring many well-established companies vying for contracts. This fierce competition often translates into significant pricing pressures, potentially squeezing profit margins on crucial government projects.

For instance, in fiscal year 2023, CACI secured over $6 billion in new contract awards, highlighting the competitive landscape where winning these deals requires sharp pricing strategies. The need to constantly innovate and maintain cost-effectiveness is paramount for CACI to stand out and secure future business in this demanding environment.

CACI, as a key player in providing sensitive information solutions, constantly battles evolving cybersecurity threats. The company's reliance on secure data handling makes it a prime target for malicious actors. A significant data breach could result in substantial financial penalties and severely erode client confidence, impacting future contracts.

The potential for system failures or successful cyberattacks poses a considerable threat to CACI's operations and reputation. In 2023, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report 2023, highlighting the financial implications. Continuous, robust investment in advanced security measures and ongoing vigilance are therefore critical to mitigating these substantial risks.

Regulatory and Compliance Risks

CACI's reliance on government contracts exposes it to significant regulatory and compliance risks. Changes in federal procurement laws or cybersecurity mandates, for instance, could necessitate costly adjustments to CACI's operations and service delivery. Failure to adhere to these evolving regulations, such as those related to data privacy under the Federal Information Security Management Act (FISMA), could lead to substantial fines, contract terminations, and damage to its reputation within the federal sector.

The intricate web of government regulations demands constant vigilance and investment in compliance infrastructure. For example, CACI must ensure its systems and personnel meet stringent requirements for handling classified information and adhering to ethical conduct standards. In 2023, the U.S. government continued to emphasize cybersecurity and data integrity, with agencies like the Department of Defense awarding billions in contracts that require rigorous compliance with security protocols.

- Regulatory Scrutiny: CACI operates within a highly regulated environment, particularly concerning its work with U.S. federal agencies.

- Compliance Costs: Maintaining adherence to diverse and evolving regulations, including data security and procurement rules, incurs ongoing operational expenses.

- Contractual Impact: Non-compliance can directly jeopardize existing government contracts and hinder the acquisition of new ones, impacting revenue streams.

- Reputational Damage: Regulatory violations can severely damage CACI's standing with government clients and the broader defense and intelligence communities.

Supply Chain and Manufacturing Disruptions

CACI International, like many in the defense and technology sectors, is susceptible to supply chain and manufacturing disruptions. For instance, the production of specialized components, such as those for its space optical terminals, can be significantly impacted by global supply chain bottlenecks. These issues can lead to production slowdowns.

Such disruptions directly affect CACI's capacity to fulfill its contractual obligations on time. Delays in delivering critical systems or services can result in missed deadlines and, consequently, potential financial penalties or loss of future business opportunities. This was a concern noted in industry reports throughout 2024, as global logistics continued to experience volatility.

The operational efficiency and overall profitability of CACI can be undermined by these external factors. For example, a shortage of a key microchip could halt a production line for weeks, increasing per-unit costs and impacting revenue recognition. The company's reliance on a complex, global network of suppliers means that even localized issues can have a cascading effect.

- Vulnerability to Global Supply Chain Issues: CACI's specialized products, like space optical terminals, depend on intricate global supply chains.

- Impact on Contract Fulfillment: Disruptions can cause delays, potentially leading to penalties and affecting CACI's reputation for timely delivery.

- Operational and Financial Strain: Manufacturing slowdowns directly impact operational efficiency and can reduce profitability due to increased costs and delayed revenue.

CACI faces significant threats from intense competition within the government IT solutions sector. This crowded market often leads to aggressive pricing strategies, which can compress profit margins on awarded contracts. For instance, in fiscal year 2023, CACI secured over $6 billion in new contract awards, underscoring the competitive nature of securing such business.

The company's heavy reliance on U.S. government contracts, which constituted approximately 90% of its revenue in fiscal year 2023, makes it highly susceptible to shifts in federal spending and budgetary priorities. Debates around the U.S. federal budget for fiscal year 2024 highlight the inherent uncertainty in future revenue streams due to potential spending cuts or reallocations.

Evolving cybersecurity threats pose a constant danger, as CACI's handling of sensitive information makes it a target for malicious actors. A significant data breach could lead to substantial financial penalties and a severe erosion of client trust, impacting its ability to secure future contracts. The global average cost of a data breach reached $4.45 million in 2023, illustrating the financial stakes involved.

CACI is also vulnerable to disruptions in the global supply chain, particularly for specialized components used in its products. Such disruptions can cause production delays, impacting its ability to meet contractual obligations on time and potentially leading to financial penalties or the loss of future business. Industry reports throughout 2024 noted the continued volatility in global logistics.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including CACI's official financial filings, comprehensive market research reports, and expert industry analysis to ensure a well-informed strategic assessment.