CACI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CACI Bundle

Understanding the competitive landscape is crucial for any business, and a Porter's Five Forces analysis provides a powerful framework to dissect CACI's market. This analysis reveals the underlying pressures that shape profitability, from the bargaining power of customers to the threat of new companies entering CACI's space.

The complete report goes beyond this overview, offering a detailed, force-by-force examination of CACI's competitive environment. Unlock actionable insights and strategic advantages by exploring the full spectrum of market dynamics.

Suppliers Bargaining Power

CACI International Inc's reliance on highly specialized talent, particularly in cybersecurity, data analytics, and agile development, significantly influences supplier power. The scarcity of individuals with these niche skills, especially those holding essential government security clearances, concentrates bargaining strength with these employees. This dynamic can directly impact CACI's operational costs, as evidenced by the competitive landscape for tech talent, where average salaries for cybersecurity analysts in 2024 often exceeded $110,000 annually, potentially driving up recruitment and retention expenses for CACI.

CACI's reliance on third-party proprietary technologies and specialized software, particularly for government clients, can significantly impact supplier bargaining power. When these technologies are critical to CACI's service delivery and are sourced from a limited number of specialized vendors, those suppliers gain considerable leverage. For instance, if CACI integrates advanced cybersecurity software or unique data analytics platforms that are not easily replicable, the suppliers of these solutions are in a strong negotiating position.

The high switching costs associated with adopting alternative systems further bolster the suppliers' leverage. If CACI has invested heavily in training its personnel on specific software, or if integrating new systems would require substantial re-engineering of existing solutions, the cost and disruption of changing suppliers become prohibitive. This lock-in effect means suppliers can potentially command higher prices or dictate terms, as CACI faces significant hurdles in seeking alternative providers.

For specialized defense, intelligence, and space projects, CACI might rely on unique hardware or components sourced from a limited number of manufacturers. This scarcity of specialized inputs significantly boosts the bargaining power of these niche suppliers, potentially impacting CACI's operational costs and project schedules.

Limited Subcontractor Pool for Classified Work

In the realm of classified government contracts, CACI faces a significant challenge with a limited subcontractor pool. This scarcity of qualified partners, those holding essential security clearances and specialized infrastructure, grants these subcontractors considerable bargaining power. They can dictate more favorable terms and command higher margins due to their indispensable role in fulfilling specific, high-security project requirements.

This situation directly impacts CACI's cost structure and project profitability. For instance, in 2024, the U.S. government continued to emphasize stringent security protocols for defense and intelligence contracting, further narrowing the field of eligible subcontractors. Those with Top Secret clearances and SCI access are particularly in demand, allowing them to negotiate from a position of strength.

- Limited Clearance Holders: The number of individuals and companies with the necessary security clearances for classified work remains a bottleneck.

- Specialized Infrastructure Needs: Secure facilities and IT infrastructure required for classified projects are costly and not widely available.

- High Demand, Low Supply: Prime contractors like CACI compete for a finite number of specialized subcontractors, driving up costs.

- Impact on Margins: Increased subcontractor costs directly compress the profit margins for prime contractors on these sensitive projects.

Regulatory Compliance and Certifications

Suppliers whose products or services necessitate specific government certifications, like the Cybersecurity Maturity Model Certification (CMMC) for U.S. Department of Defense contracts, wield significant bargaining power. CACI’s inability to secure these certifications from its suppliers would directly impede its ability to bid on and fulfill critical government contracts, effectively making these compliant suppliers indispensable.

This regulatory hurdle transforms compliant suppliers into essential gatekeepers within CACI's supply chain. For instance, as of early 2024, the U.S. Department of Defense continues to phase in CMMC requirements across its supply base, increasing the strategic importance and leverage of certified vendors.

- Regulatory Necessity: CMMC compliance is a mandatory prerequisite for many defense contracts, giving certified suppliers considerable leverage.

- Limited Supplier Pool: The specialized nature of these certifications often restricts the number of qualified suppliers available to CACI.

- Contractual Dependence: CACI's reliance on certified suppliers for defense work strengthens their negotiating position on price and terms.

The bargaining power of suppliers for CACI International Inc. is significantly influenced by the concentration of key technologies and specialized expertise within a limited vendor base. When CACI relies on proprietary software or unique hardware components that are not easily substitutable, these suppliers gain considerable leverage. This is particularly true in the defense and intelligence sectors where specialized solutions are often required.

| Supplier Characteristic | Impact on CACI | Example Data (2024) |

|---|---|---|

| Proprietary Technology Dependence | Increased costs, reduced flexibility | Average annual software licensing fees for specialized analytics platforms can range from $50,000 to over $250,000 depending on features and user count. |

| Limited Number of Specialized Vendors | Higher prices, potential supply chain disruptions | In niche areas like secure cloud infrastructure for classified data, the number of compliant providers might be less than a dozen for specific government requirements. |

| High Switching Costs | Supplier lock-in, difficulty in renegotiation | Implementing a new enterprise resource planning (ERP) system can cost millions and take years, making immediate supplier changes prohibitive. |

What is included in the product

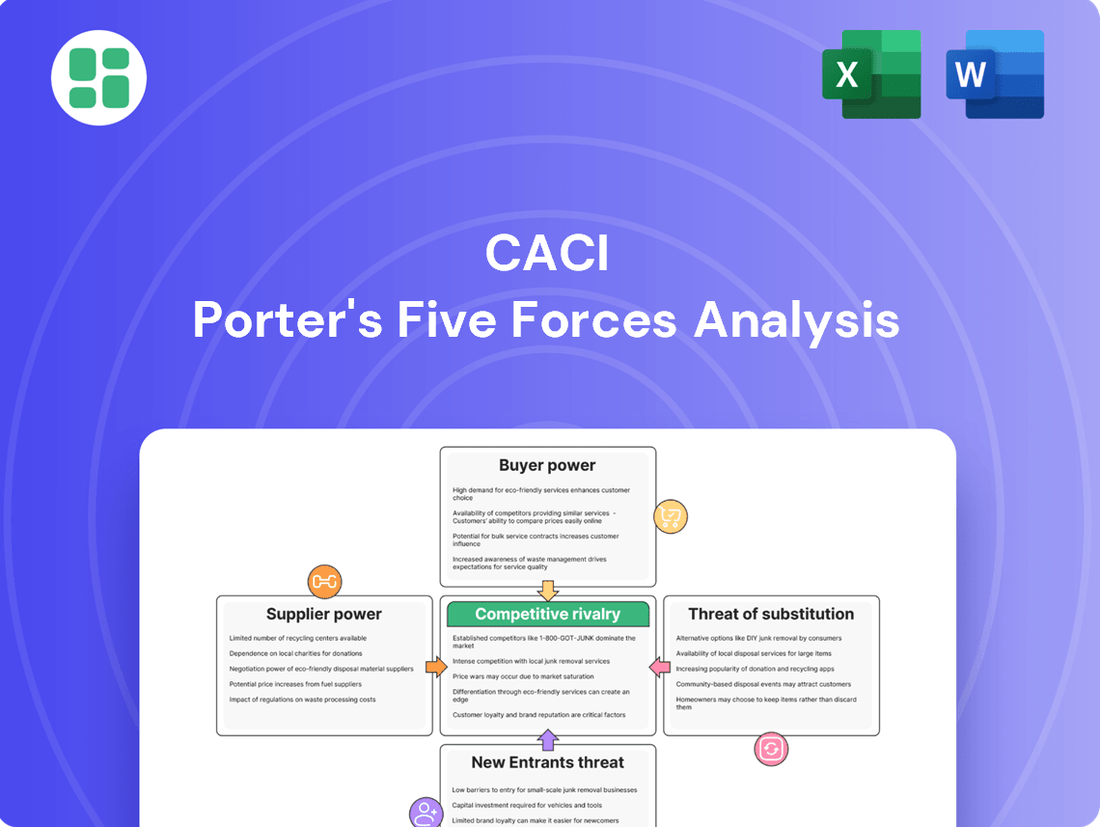

CACI's Porter's Five Forces Analysis dissects the competitive intensity within its operating environment, examining threats from new entrants, substitutes, buyer and supplier power, and the rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

CACI's customer base is highly concentrated, with the U.S. federal government being its primary client. This includes defense, intelligence, and civilian agencies, which collectively represent a massive demand. This singular, dominant customer possesses significant bargaining power, enabling it to heavily influence contract terms, pricing, and performance standards. CACI's substantial dependence on this customer means its financial health is directly linked to government spending priorities and budget allocations.

The U.S. government's procurement processes are intricate and time-consuming, often involving multiple stages of bidding and rigorous evaluations. This complexity gives government agencies, as CACI's customers, significant leverage to negotiate favorable pricing and demand cutting-edge solutions. CACI's ability to secure new contracts hinges on its continuous investment in these specialized bidding and proposal capabilities.

The federal government's stringent budgetary appropriations and rigorous public and congressional oversight create immense pressure for cost optimization. This directly translates into significant price sensitivity for contractors like CACI, who must deliver cost-effective solutions.

Government IT spending, a key market for CACI, is heavily influenced by these budget priorities. For instance, federal IT spending was projected to reach $143.9 billion in 2024, with a substantial portion allocated to modernization and cybersecurity, areas where CACI operates but also where budget constraints are keenly felt.

Ability to Insource or Diversify Contractors

The U.S. government, as CACI's primary customer, possesses the ability to insource certain capabilities or to diversify its contractor base. This means they can bring functions in-house or award contracts to multiple companies, limiting their dependence on any single provider like CACI. This inherent flexibility, even for specialized services, grants the government leverage.

For instance, while CACI offers highly specialized IT and engineering services, the government can still opt to develop internal expertise or spread work across various vendors. This is particularly relevant in areas where a deep bench of talent exists across the public and private sectors. In 2023, the U.S. federal government's IT spending was projected to reach over $140 billion, indicating the sheer scale of opportunities and the government's capacity to shift spending patterns.

- Government Insourcing Potential: The option to bring services in-house limits CACI's pricing power.

- Vendor Diversification: Awarding contracts to multiple companies reduces reliance on any one vendor.

- Specialized Services vs. Flexibility: While CACI's expertise is valuable, the government's need for flexibility remains a factor.

- Market Size Influence: The vast U.S. federal IT market ($140B+ in 2023) provides ample room for diversification and insourcing decisions.

Emphasis on Past Performance and Relationships

While CACI's extensive history of successful project execution and deep-rooted relationships with government agencies are significant assets, they don't entirely insulate it from customer bargaining power. The U.S. government, a primary customer, actively seeks to diversify its vendor base and rigorously assesses past performance for every new procurement. This means CACI must consistently prove its worth through innovation and dependable service delivery to maintain its existing contracts and secure future opportunities.

For instance, in fiscal year 2023, CACI reported that approximately 88% of its revenue came from contracts with the U.S. federal government, highlighting the concentrated nature of its customer base. This reliance means that government procurement policies and budget allocations directly influence CACI's revenue streams. The emphasis on "best value" procurements, which consider factors beyond just price, allows agencies to leverage CACI's past performance as a key negotiation point, potentially driving down margins if not managed strategically.

- Past Performance Evaluation: Government agencies frequently review contractor performance on previous projects, using this data to inform decisions on awarding new contracts.

- Vendor Diversification: A key government objective is to avoid over-reliance on single vendors, encouraging competition and giving customers leverage to seek alternative solutions.

- Relationship Leverage: Long-standing relationships, while valuable, can also be used by customers to negotiate more favorable terms, expecting continued high levels of service and innovation.

- Contract Renewal Dependence: CACI's significant reliance on existing contracts, representing a substantial portion of its revenue, makes it susceptible to customer demands for concessions to ensure continuity.

CACI's customer bargaining power is substantial due to its primary reliance on the U.S. federal government, which accounts for a significant majority of its revenue. This concentration means government agencies can exert considerable influence over pricing, contract terms, and service expectations. The government's ability to insource services or diversify its vendor pool further amplifies this leverage, compelling CACI to remain competitive and responsive to evolving demands.

The sheer scale of government IT spending, projected to exceed $140 billion in 2024, provides ample room for agencies to negotiate favorable terms and explore alternative providers. This market dynamic underscores the importance of CACI's continuous efforts to demonstrate value and innovation to maintain its client relationships and secure future business.

| Customer Factor | Impact on CACI | Supporting Data (approx.) |

|---|---|---|

| Customer Concentration | High Bargaining Power | ~88% of revenue from U.S. Federal Government (FY2023) |

| Procurement Complexity | Leverage for Price Negotiation | Intricate bidding processes, rigorous evaluations |

| Budgetary Constraints | Price Sensitivity | Federal IT spending ~$143.9 billion (2024 projection) |

| Insourcing/Diversification | Limits CACI's Pricing Power | Government can shift work to other vendors or internal teams |

Full Version Awaits

CACI Porter's Five Forces Analysis

The document you see here is the exact, fully formatted CACI Porter's Five Forces Analysis you will receive immediately after purchase. This comprehensive analysis, detailing the competitive landscape for CACI, is ready for your immediate use without any alterations or placeholders. You are previewing the final, professional document that will be instantly accessible upon completing your transaction.

Rivalry Among Competitors

The U.S. federal government contracting arena is a crowded space with many seasoned companies. Giants like Leidos, SAIC, and Booz Allen Hamilton are constantly competing for the same lucrative government deals, making the market incredibly mature and fierce.

This intense rivalry means that companies must aggressively bid on contracts, often driving down profit margins. To stand out, CACI and its peers must continuously innovate and demonstrate unique value propositions to secure their share of the market.

CACI operates in a market where many government contractors offer very similar IT solutions and services. This includes areas like cybersecurity, cloud computing, and data analytics. This overlap means companies often compete on price, making it tough to differentiate solely based on the services provided.

The government sector, a key market for CACI, saw significant IT spending in 2024, with agencies prioritizing digital modernization. For instance, the U.S. Department of Defense alone allocated billions to IT infrastructure and cybersecurity upgrades. This large market, however, is also densely populated with competitors offering comparable capabilities, intensifying the rivalry.

This intense competition among providers of similar IT services can lead to tighter profit margins. Companies like CACI must constantly innovate and demonstrate unique value propositions beyond standard offerings to capture market share and maintain profitability in 2024 and beyond.

CACI's competitive rivalry is intensified by high exit barriers within the government contracting sector. Companies like CACI have made substantial investments in specialized infrastructure and obtained crucial security clearances. These sunk costs, coupled with the unique nature of their assets and deep-rooted relationships with government agencies, make it exceptionally difficult and costly for firms to leave the market.

Importance of Contract Awards and Backlog

The competitive rivalry within the government contracting sector, particularly for companies like CACI, is intense. Success hinges on securing significant, multi-year government contracts that build a robust revenue backlog. This backlog is crucial for predictable revenue streams and sustained market presence.

CACI's strategic focus on winning these large awards underscores the high stakes involved. The company's performance in fiscal years 2024 and 2025 demonstrates this, with substantial contract wins directly impacting its future financial health and competitive standing.

- CACI's Fiscal Year 2024 Contract Wins: CACI reported significant contract awards throughout fiscal year 2024, bolstering its backlog and demonstrating its ability to secure key government business.

- Forward-Looking Backlog: The company's backlog, a direct result of these contract awards, provides a strong indicator of future revenue and operational stability in a highly competitive environment.

- Market Share Defense: Aggressively pursuing and winning these contracts is essential for CACI to defend and expand its market share against other major players in the government IT and consulting space.

- Impact of Contract Size: The sheer size and duration of these government contracts mean that each award has a material impact on a company's financial trajectory and its ability to invest in future growth.

Focus on Niche Expertise and Innovation

Competitive rivalry in the IT solutions sector, including companies like CACI, intensifies through the development of specialized expertise and novel offerings. This is particularly evident in rapidly evolving fields such as artificial intelligence, quantum computing, and sophisticated cybersecurity solutions.

Firms actively seek to differentiate themselves by making proactive investments in unique technologies. For instance, CACI's commitment to innovation is showcased by its DarkBlue Intelligence Suite, designed to provide advanced capabilities in intelligence analysis and data fusion.

- Niche Expertise: Companies compete by cultivating deep knowledge in specialized areas, such as AI-driven analytics or secure cloud migration.

- Innovation Investment: Significant R&D spending is crucial for developing proprietary technologies that offer a competitive advantage.

- Emerging Technologies: Early adoption and development in areas like quantum computing and advanced cybersecurity are key differentiators.

The competitive rivalry within the government contracting sector, where CACI operates, is extremely high. Many established players offer similar IT solutions and services, leading to intense bidding wars that can compress profit margins.

Companies must differentiate themselves through innovation and unique value propositions to secure lucrative, multi-year government contracts, which are essential for building a strong revenue backlog and ensuring future financial health.

For CACI, this means continuously investing in specialized expertise and emerging technologies, such as AI and advanced cybersecurity, to gain an edge. The substantial investments required for security clearances and specialized infrastructure also create high exit barriers, locking companies into this competitive landscape.

| Competitor | 2024 Revenue (Approx. Billions USD) | Key Service Overlap with CACI |

|---|---|---|

| Leidos | $15.0 | IT Modernization, Cybersecurity, Data Analytics |

| SAIC | $7.2 | Digital Transformation, Cloud Services, Mission Support |

| Booz Allen Hamilton | $10.0 | Cybersecurity, Data Science, Digital Solutions |

SSubstitutes Threaten

The U.S. federal government's capacity for insourcing IT functions presents a significant threat to companies like CACI. This means the government can choose to perform certain IT services internally, bypassing the need for external contractors. For example, in 2024, the federal government continued to explore insourcing opportunities for various IT support roles, aiming to leverage existing civilian workforce skills.

While highly specialized or mission-critical IT functions may still require external expertise, routine operations are prime candidates for insourcing. This trend could lead to a reduction in the total addressable market for IT outsourcing services, directly impacting revenue streams for companies heavily reliant on government contracts.

Government agencies increasingly consider Commercial Off-the-Shelf (COTS) software and hardware as viable alternatives to custom solutions. The growing maturity and enhanced security features of COTS products, especially in cloud computing, present a significant substitute threat for CACI. For instance, the U.S. government's adoption of cloud services, which reached an estimated $30 billion in 2023, highlights the market's shift towards readily available solutions.

The increasing maturity and adoption of open-source software present a significant threat of substitution for CACI's proprietary IT solutions. Government agencies, under pressure to reduce IT spending, are increasingly exploring open-source alternatives for various functions, potentially bypassing the need for custom development contracts. For instance, the global open-source market was valued at approximately $22.2 billion in 2023 and is projected to grow significantly, indicating a substantial pool of readily available and cost-effective substitutes.

Shifting Technology Paradigms

Shifting technology paradigms present a significant threat of substitution for CACI. Rapid advancements in areas like artificial intelligence (AI), automation, and advanced data analytics are fundamentally changing how government needs are met. These emerging solutions offer entirely new approaches to service delivery, potentially bypassing CACI's established models.

For instance, AI-powered analytics platforms are increasingly capable of performing tasks traditionally handled by human consultants, offering faster and potentially more cost-effective alternatives. In 2024, government spending on AI solutions within the defense and intelligence sectors alone was projected to exceed $20 billion, signaling a strong market shift towards these new technologies. This trend means that services CACI traditionally provides could be replaced by software or automated systems, diminishing the need for their specific expertise.

- AI-driven automation can substitute for manual data processing and analysis services.

- Cloud-native solutions offer scalable and flexible alternatives to on-premise IT infrastructure management.

- Low-code/no-code platforms empower agencies to develop custom applications, reducing reliance on traditional software development services.

- Emerging cybersecurity technologies may offer more proactive and automated threat detection, substituting for traditional security consulting.

Budgetary Shifts Towards Different Solutions

Budgetary shifts represent a significant threat of substitutes for CACI. For instance, a major reallocation of federal funds away from defense IT modernization and towards other national priorities, such as infrastructure renewal or healthcare technology, could directly impact CACI's primary revenue streams. Such a move would mean less available funding for the types of advanced software, cybersecurity, and data analytics services CACI specializes in.

Consider the 2024 US federal budget. While defense spending remains robust, there's increasing emphasis on areas like climate resilience and broadband expansion. If these non-IT-centric initiatives gain further traction and receive substantial budget increases, they could draw resources that might otherwise have been allocated to IT modernization projects, thus presenting a substitute to CACI's traditional offerings.

The government's adoption of entirely new operational models also poses a threat. If agencies increasingly opt for off-the-shelf cloud solutions or fully managed services from non-traditional IT providers, this could reduce the need for CACI's bespoke integration and custom development services. This trend is already visible as agencies seek to streamline operations and reduce overhead.

- Government Spending Reallocation: Shifts in federal priorities can divert funds from IT to other sectors.

- Emergence of New Technologies: Investments in non-IT solutions like advanced materials or biotech could reduce IT budgets.

- Adoption of Alternative Operational Models: Increased reliance on commercial off-the-shelf (COTS) software or fully managed services from cloud providers can substitute CACI's custom solutions.

- Focus on Different Infrastructure: A national push for physical infrastructure upgrades over digital modernization directly competes for government capital.

The threat of substitutes for CACI stems from readily available alternatives that can fulfill similar government IT needs, often at a lower cost or with greater flexibility. These substitutes can range from commercial off-the-shelf (COTS) software and open-source solutions to entirely new technological paradigms like AI-driven automation.

The U.S. government's increasing embrace of cloud services, a market valued at approximately $30 billion in 2023, exemplifies this trend. Furthermore, the global open-source market, estimated at $22.2 billion in 2023, offers a significant pool of cost-effective alternatives to proprietary solutions. These readily available options directly challenge CACI's custom development and integration services.

Emerging technologies like AI and automation are also presenting potent substitutes. For instance, AI-powered analytics platforms are increasingly capable of performing tasks traditionally requiring human expertise. Government spending on AI solutions within defense and intelligence sectors alone was projected to exceed $20 billion in 2024, highlighting the market's rapid shift towards these more automated and potentially cheaper alternatives.

Budgetary shifts and the adoption of alternative operational models further amplify this threat. A reallocation of federal funds away from IT modernization and towards other sectors, or an increased reliance on fully managed services from cloud providers, directly competes for government capital and diminishes the need for CACI's specialized services.

| Substitute Category | Examples | Market Context (2023/2024 Data) | Impact on CACI |

|---|---|---|---|

| Commercial Off-the-Shelf (COTS) Software | Pre-built software suites, SaaS platforms | U.S. government cloud services market ~ $30 billion (2023) | Reduces demand for custom software development. |

| Open-Source Software | Linux, Apache, Python libraries | Global open-source market ~ $22.2 billion (2023) | Offers cost-effective alternatives to proprietary solutions. |

| AI-driven Automation | AI analytics platforms, robotic process automation | U.S. defense/intelligence AI spending projected > $20 billion (2024) | Automates tasks previously performed by human consultants. |

| Cloud-Native Solutions | AWS, Azure, GCP managed services | Continued growth in public cloud adoption by government | Can replace on-premise infrastructure management services. |

Entrants Threaten

The U.S. federal government contracting market presents substantial barriers to entry for new firms. These include the necessity for extensive prior experience, a proven track record, and the ability to navigate a highly complex and often protracted procurement process. For instance, in 2023, the U.S. federal government awarded over $700 billion in contracts, with a significant portion going to established players with demonstrated capabilities and security clearances.

New entrants in sectors requiring government contracts face significant barriers due to the extensive need for security clearances and specialized certifications. Obtaining these clearances is a lengthy and costly endeavor, often taking months or even years and involving rigorous background checks for personnel and facilities. For example, the U.S. Department of Defense alone processes millions of security clearance applications annually, with some top-secret clearances requiring over a year to complete.

Established relationships and past performance are significant barriers for new entrants looking to compete with incumbent contractors like CACI. These companies have cultivated deep, long-standing connections with crucial government agencies, built on a solid track record of successful project execution. This history of reliability and proven capability fosters a high degree of trust, making it challenging for newcomers to gain a foothold quickly.

Capital Requirements for Bidding and Infrastructure

Bidding on significant government contracts, a key area for CACI, necessitates substantial upfront capital. This includes funding for detailed proposal development, acquiring specialized technology, and establishing robust IT infrastructure, often requiring secure facilities. For instance, in 2024, the U.S. federal government awarded over $700 billion in contracts, with many requiring extensive pre-qualification and investment from bidders.

These high capital requirements act as a significant barrier to entry for smaller or emerging companies. They may lack the financial resources to compete effectively against established players who can absorb these initial costs more readily. This can limit the pool of potential competitors, thereby reducing the threat of new entrants.

- Proposal Development Costs: Significant investment in skilled personnel, research, and documentation.

- Technology and Infrastructure: Outlays for specialized software, hardware, and secure operational environments.

- Financial Capacity: The need for substantial working capital to cover expenses during the bidding and potential contract execution phases.

- Market Access: Established relationships and past performance often required, which new entrants struggle to build without initial investment.

Risk of Bid Protests and Legal Challenges

The government contracting landscape, where CACI operates, is intensely competitive. This means that when a contract is awarded, new entrants often find themselves facing bid protests and legal challenges from incumbent or other established companies. This reality introduces significant uncertainty and can lead to considerable delays and escalating legal expenses, acting as a potent deterrent for potential new players entering the market.

For instance, in 2023, the U.S. Government Accountability Office (GAO) reported a sustained high volume of bid protests. While specific numbers for CACI's direct experience are proprietary, the overall trend indicates a pervasive risk. These challenges can tie up resources and create a challenging environment for new companies trying to gain a foothold.

- High Competition: Government contracting is a fiercely contested arena.

- Bid Protest Risk: New entrants face legal challenges from established firms.

- Cost and Delay: Protests lead to significant legal costs and project delays.

- Deterrent Effect: These factors discourage new companies from entering the market.

The threat of new entrants in the government contracting sector, where CACI operates, is significantly mitigated by substantial barriers. These include the immense capital required for proposal development, technology acquisition, and secure infrastructure, alongside the lengthy and complex process of obtaining necessary security clearances and certifications. Established relationships and a proven track record are also critical, making it difficult for newcomers to quickly gain trust and compete effectively against incumbent firms.

| Barrier Category | Specific Examples | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Proposal development, specialized technology, secure facilities | High upfront costs deter smaller firms; limits pool of competitors. |

| Regulatory & Security | Security clearances, certifications, compliance | Lengthy, costly processes; significant time investment needed. |

| Incumbent Advantage | Established relationships, past performance, trust | Difficult to replicate; new entrants struggle to build credibility. |

| Competitive Landscape | Bid protests, legal challenges | Increases risk, cost, and project delays for newcomers. |

Porter's Five Forces Analysis Data Sources

Our CACI Porter's Five Forces analysis is built upon a robust foundation of data, drawing from CACI's extensive internal market intelligence, proprietary industry databases, and publicly available company filings. This comprehensive approach ensures a deep understanding of competitive dynamics.