CACI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CACI Bundle

Unlock the critical external factors shaping CACI's trajectory with our comprehensive PESTLE analysis. Understand the political landscape, economic shifts, and technological advancements that influence its operations and market position. Don't just react to change; anticipate it. Purchase the full analysis now to gain actionable intelligence and strategic foresight.

Political factors

CACI's financial performance is closely tied to U.S. government spending, especially in defense and national security sectors. Changes in federal budget allocations and defense appropriations directly influence the company's ability to secure new contracts and expand its business.

The proposed Fiscal Year 2025 defense budget, estimated at $850 billion, highlights key investment areas like technological modernization, cybersecurity enhancements, and advancements in space capabilities. These priorities align well with CACI's core offerings, creating substantial growth potential and contract opportunities for the company.

Heightened global tensions and ongoing conflicts, particularly in Eastern Europe and the Middle East, are a significant driver for CACI's business. These unstable geopolitical environments directly translate into increased demand for defense and intelligence services, which are CACI's core competencies.

This trend is reflected in global defense spending. For instance, the Stockholm International Peace Research Institute (SIPRI) reported that global military expenditure reached an all-time high of $2.44 trillion in 2023, a 6.8% increase in real terms from 2022. This surge in spending directly benefits companies like CACI that provide advanced technological solutions for national security.

Changes in U.S. presidential administrations and their policy priorities significantly influence the government contracting landscape, directly impacting companies like CACI. For instance, the Biden administration's emphasis on modernizing federal IT infrastructure and enhancing cybersecurity presents a fertile ground for CACI's expertise.

Current administration priorities, such as the push for digital transformation across federal agencies, directly translate into increased demand for CACI's technology and consulting services. This focus is underscored by initiatives like the Federal Civilian Cloud Strategy, aiming to accelerate cloud adoption and improve citizen services.

Cybersecurity remains a paramount concern, with the administration allocating substantial resources to bolster defenses against evolving threats. CACI's robust cybersecurity solutions are well-positioned to capitalize on this ongoing government investment, as evidenced by continued contract awards in this sector throughout 2024.

Procurement Policies and Regulations

CACI's ability to secure government contracts is significantly shaped by evolving procurement policies. For instance, efforts to streamline the Federal Acquisition Regulation (FAR) and boost competition are key. Executive Order 14275, enacted in April 2025, specifically targets FAR reform, promising quicker contract awards and easier compliance for companies like CACI.

These policy shifts directly impact CACI's bidding strategies and success rates. The government’s push for modernization aims to create a more agile procurement environment. This means CACI must remain adaptable to new regulations to maintain its competitive edge in the federal contracting space.

The implications for CACI are substantial:

- Increased Opportunities: Streamlined FAR could open more avenues for CACI to bid on and win contracts.

- Competitive Landscape: Greater emphasis on competition may require CACI to refine its value proposition.

- Compliance Agility: Adapting to revised regulations, such as those stemming from EO 14275, is crucial.

- Efficiency Gains: Simplified compliance could lead to reduced administrative burdens and faster project initiation.

International Alliances and Defense Cooperation

CACI's strategic engagement in international defense cooperation, exemplified by its provision of Counter Uncrewed Aircraft System (C-UAS) technology to Canada for NATO operations, highlights the expanding political landscape influencing its operations. This collaboration not only strengthens CACI's position within established alliances but also signals opportunities for broader market penetration and new contract streams for its specialized defense solutions.

These international partnerships are crucial for navigating the complex geopolitical environment, allowing CACI to leverage its technological expertise in high-demand areas. The company's role in supporting NATO's operational readiness underscores the political capital CACI accrues through its contributions to collective security efforts, potentially leading to preferential treatment in future defense procurement processes.

- CACI's C-UAS technology deployment for NATO operations in Canada

- Expansion into new international markets driven by defense alliances

- Leveraging political influence for future contract opportunities

- Strengthening global security partnerships through technological contributions

Political factors significantly shape CACI's operational environment, particularly through U.S. government spending priorities. The proposed Fiscal Year 2025 defense budget, estimated at $850 billion, prioritizes areas like technological modernization and cybersecurity, directly benefiting CACI's core business segments.

Global geopolitical instability, such as ongoing conflicts in Eastern Europe and the Middle East, fuels demand for defense and intelligence services, CACI's specialties. This trend is supported by the Stockholm International Peace Research Institute's report of global military expenditure reaching $2.44 trillion in 2023, a 6.8% real-terms increase.

Changes in U.S. administration policies, like the current focus on digital transformation and cybersecurity, create substantial opportunities for CACI. Initiatives such as the Federal Civilian Cloud Strategy underscore this, driving demand for CACI's technology and consulting expertise.

Evolving government procurement policies, including efforts to streamline the Federal Acquisition Regulation (FAR) as targeted by Executive Order 14275 in April 2025, impact CACI's contract acquisition strategies and competitive positioning.

What is included in the product

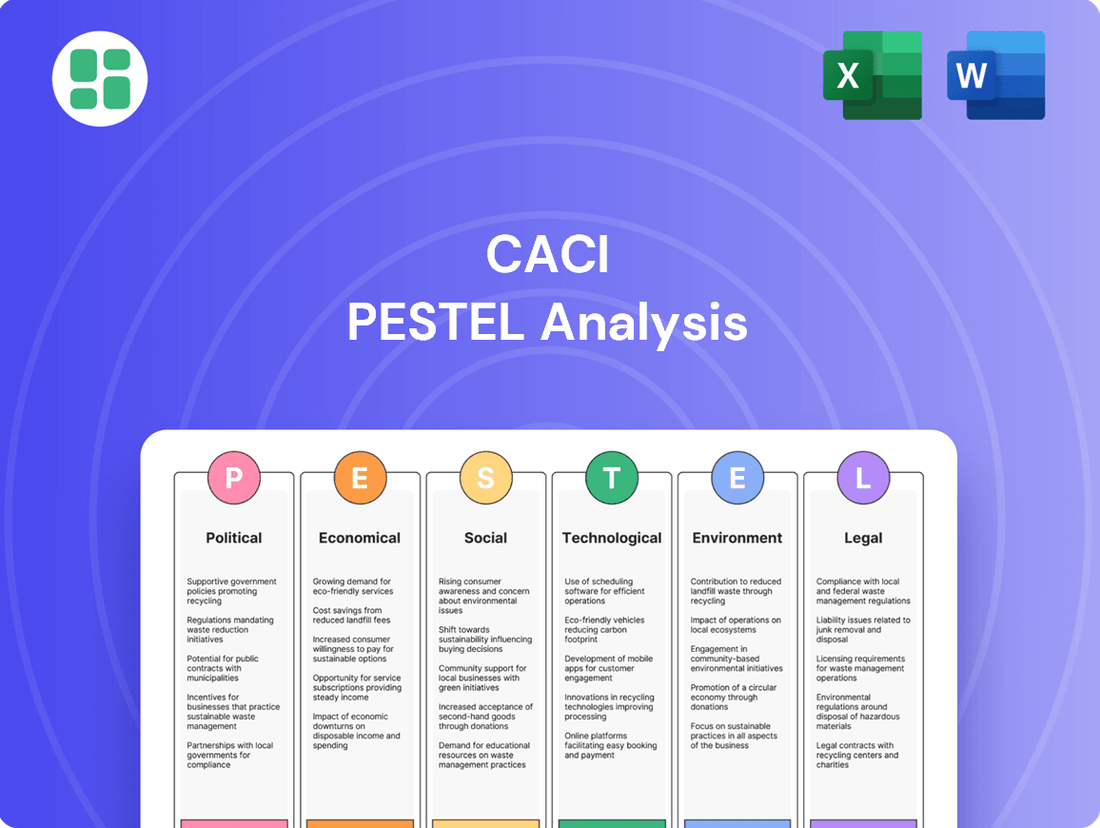

The CACI PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing CACI's operations and strategic positioning.

The CACI PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain of navigating complex market dynamics by offering a clear roadmap for strategic decision-making.

Economic factors

The U.S. federal budget and its deficit levels directly impact government contract availability for companies like CACI. As of early 2024, the national debt has surpassed $34 trillion, and ongoing discussions around the debt ceiling and budget allocations create an environment of fiscal uncertainty.

While defense spending, a core area for CACI, generally remains a priority, broader economic pressures and potential fiscal austerity measures could influence the size and number of new contracts awarded. For instance, continuing resolutions, which extend previous budget levels, can limit the scope for new, large-scale projects, affecting companies reliant on government funding.

Inflationary pressures in 2024 and early 2025 directly impact CACI's operational costs. Rising labor wages, increased prices for raw materials, and the ongoing demand for advanced technology solutions are key drivers. For instance, the US Bureau of Labor Statistics reported a 3.9% annual increase in the Consumer Price Index (CPI) as of April 2024, indicating sustained inflationary trends that will likely affect CACI's procurement and personnel expenses.

Managing these escalating costs is paramount for CACI, particularly with a significant portion of its business involving fixed-price contracts. The company's ability to maintain healthy profit margins hinges on its effectiveness in cost control and its capacity to negotiate favorable terms for materials and services. Failure to adequately manage these rising expenses could directly erode profitability on existing and future projects.

Interest rates significantly influence CACI's financial flexibility. As of mid-2024, the Federal Reserve maintained a benchmark interest rate range of 5.25% to 5.50%, impacting the cost of any new debt CACI might take on for expansion or acquisitions. Higher rates increase borrowing expenses, potentially slowing growth initiatives.

Conversely, a stable or declining interest rate environment, such as the projected slight easing in late 2024 or early 2025, would lower CACI's cost of capital. This could enable more aggressive strategic investments, including potential mergers and acquisitions, or support share repurchase programs, thereby enhancing shareholder returns.

Labor Market Conditions and Talent Costs

The availability and cost of specialized talent, particularly in cybersecurity, data analytics, and software development, are paramount for CACI's operational success and growth. A competitive labor market directly influences the company's ability to attract and retain these essential professionals, potentially increasing recruitment expenses and compensation packages. For instance, the U.S. Bureau of Labor Statistics projected a 32% growth for information security analysts from 2022 to 2032, indicating continued demand and upward pressure on salaries.

This dynamic labor environment can significantly impact CACI's profitability by driving up talent acquisition and retention costs. As demand for skilled workers intensifies, companies often face higher wage expectations and increased investment in benefits and training to remain competitive. In 2024, average salaries for cybersecurity analysts in the U.S. ranged from $100,000 to $130,000 annually, reflecting the premium placed on these critical skills.

- High Demand for Tech Talent: CACI relies on a robust pool of professionals skilled in cybersecurity, data analytics, and software engineering.

- Talent Cost Inflation: A tight labor market, characterized by high demand and limited supply of specialized skills, leads to increased salary and benefit costs for CACI.

- Impact on Profitability: Escalating talent costs can directly affect CACI's profit margins if not effectively managed through strategic talent acquisition and retention initiatives.

- 2024-2025 Outlook: Projections indicate continued strong demand for these roles, suggesting ongoing pressure on labor costs for companies like CACI.

M&A Activity in Defense and Government IT

Mergers and acquisitions (M&A) within the aerospace, defense, and government IT sectors are a significant economic factor influencing CACI. These deals are often fueled by a need for technological advancement and the pursuit of economies of scale, creating both strategic opportunities and competitive pressures. The first quarter of 2025 continued to show robust M&A activity in the aerospace and defense (AD&S) sector, with strategic buyers being particularly active in consolidating market share and capabilities.

The trend of consolidation is evident as companies seek to enhance their offerings and operational efficiency. For CACI, this means a dynamic competitive landscape where established players and emerging entities alike are looking to grow through acquisitions. This environment necessitates a keen understanding of market valuations and potential synergies to navigate effectively.

Key observations from the AD&S M&A market in Q1 2025 include:

- Increased deal volume: The sector experienced a notable uptick in the number of transactions compared to previous periods.

- Strategic buyer dominance: A substantial percentage of these deals were driven by established companies looking to acquire complementary technologies or expand their market reach.

- Focus on technology integration: Many acquisitions were centered around acquiring advanced capabilities in areas like artificial intelligence, cybersecurity, and cloud computing.

- Geopolitical influences: Global security concerns continue to underpin investment and M&A activity as governments prioritize modernization and defense readiness.

The U.S. federal budget and its deficit levels directly impact government contract availability for companies like CACI. As of early 2024, the national debt has surpassed $34 trillion, and ongoing discussions around the debt ceiling and budget allocations create an environment of fiscal uncertainty. While defense spending, a core area for CACI, generally remains a priority, broader economic pressures and potential fiscal austerity measures could influence the size and number of new contracts awarded.

Inflationary pressures in 2024 and early 2025 directly impact CACI's operational costs. Rising labor wages, increased prices for raw materials, and the ongoing demand for advanced technology solutions are key drivers. For instance, the US Bureau of Labor Statistics reported a 3.9% annual increase in the Consumer Price Index (CPI) as of April 2024, indicating sustained inflationary trends that will likely affect CACI's procurement and personnel expenses.

Interest rates significantly influence CACI's financial flexibility. As of mid-2024, the Federal Reserve maintained a benchmark interest rate range of 5.25% to 5.50%, impacting the cost of any new debt CACI might take on for expansion or acquisitions. Higher rates increase borrowing expenses, potentially slowing growth initiatives.

The availability and cost of specialized talent, particularly in cybersecurity, data analytics, and software development, are paramount for CACI's operational success and growth. A competitive labor market directly influences the company's ability to attract and retain these essential professionals, potentially increasing recruitment expenses and compensation packages. For instance, the U.S. Bureau of Labor Statistics projected a 32% growth for information security analysts from 2022 to 2032, indicating continued demand and upward pressure on salaries.

Mergers and acquisitions (M&A) within the aerospace, defense, and government IT sectors are a significant economic factor influencing CACI. These deals are often fueled by a need for technological advancement and the pursuit of economies of scale, creating both strategic opportunities and competitive pressures. The first quarter of 2025 continued to show robust M&A activity in the aerospace and defense (AD&S) sector, with strategic buyers being particularly active in consolidating market share and capabilities.

| Economic Factor | 2024/2025 Data Point | Impact on CACI |

|---|---|---|

| U.S. National Debt | Exceeded $34 trillion (early 2024) | Potential for fiscal uncertainty, influencing government contract availability and size. |

| Inflation Rate (CPI) | 3.9% annual increase (April 2024) | Increases operational costs for labor and materials, impacting profit margins, especially on fixed-price contracts. |

| Federal Reserve Benchmark Interest Rate | 5.25% - 5.50% (mid-2024) | Higher borrowing costs for expansion/acquisitions; potential easing late 2024/early 2025 could lower capital costs. |

| Demand for Tech Talent (e.g., InfoSec Analysts) | Projected 32% growth (2022-2032) | Intensifies competition for skilled professionals, driving up recruitment and compensation expenses. |

| Aerospace & Defense M&A Activity | Robust in Q1 2025, driven by strategic buyers | Creates a dynamic competitive landscape and opportunities for growth through acquisition or facing consolidation pressures. |

Preview the Actual Deliverable

CACI PESTLE Analysis

The preview shown here is the exact CACI PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive PESTLE analysis for CACI.

Sociological factors

CACI's success hinges on the demographic makeup of its workforce and the availability of STEM talent, especially in high-demand fields like cybersecurity and AI. The U.S. Bureau of Labor Statistics projects a 32% growth in information security analyst roles from 2022 to 2032, a faster-than-average increase, highlighting the critical need for skilled professionals.

The company actively addresses this by focusing on veteran hiring, recognizing their valuable skills and experience. CACI's commitment to cybersecurity training, exemplified by partnerships like the one with the Commonwealth Cyber Initiative, directly cultivates the talent pipeline necessary to meet the evolving demands of the defense and technology sectors.

Public sentiment regarding government efficiency, national security priorities, and defense spending can indirectly influence political decisions on budget allocations and contract oversight. For instance, a 2024 Pew Research Center survey indicated that while a majority of Americans believe national security is important, there's also significant concern about government spending efficiency, with many advocating for better oversight of defense contracts.

Maintaining a positive reputation for ethical conduct and effective service delivery is crucial for companies like CACI. Public trust, often shaped by perceptions of government performance, can impact the willingness of taxpayers and policymakers to support large-scale government contracts, including those in the defense sector.

Public awareness of data privacy is soaring, with a significant majority of consumers expressing concern. For instance, a 2024 Pew Research Center study found that 81% of Americans feel they have very little or no control over the data companies collect about them. This growing unease directly impacts government contractors like CACI, who handle vast amounts of sensitive information.

These shifting expectations mean that organizations must prioritize transparency and robust security measures. CACI's investment in AI-powered solutions for securing sensitive operations directly addresses this societal demand for ethical data handling and advanced protection, aligning its services with public sentiment and regulatory pressures.

Diversity, Equity, and Inclusion (DEI)

The increasing focus on Diversity, Equity, and Inclusion (DEI) significantly shapes CACI's operational landscape. This societal shift influences hiring, fosters a more inclusive corporate culture, and guides partnership decisions, particularly within government contracting where DEI metrics are increasingly scrutinized. Demonstrating a robust commitment to DEI can bolster CACI's reputation, making it a more attractive employer and strategic partner.

CACI actively promotes DEI through various initiatives. For instance, in fiscal year 2023, the company reported progress in its workforce diversity, with women comprising 30% of its management roles and 34% of its total workforce. These figures reflect a conscious effort to build a more representative team. Such efforts are crucial for aligning with government mandates and client expectations.

- Workforce Representation: CACI aims to increase representation across all levels, with particular attention to underrepresented groups in technical and leadership positions.

- Inclusive Culture: The company fosters an environment where all employees feel valued and have equal opportunities for growth and development.

- Supplier Diversity: CACI actively seeks to partner with diverse suppliers, contributing to a broader economic impact and meeting government contracting requirements.

- Community Engagement: Initiatives often extend beyond the workplace, supporting community programs that promote STEM education and opportunities for diverse populations.

Impact of Remote Work Trends

The shift towards remote and hybrid work models significantly impacts CACI's service delivery and workforce management. Adapting to these evolving work arrangements is crucial for maintaining operational efficiency and client satisfaction.

This trend necessitates robust cybersecurity measures and enhanced collaboration tools to ensure seamless operations and data protection in a distributed environment. For instance, CACI's investment in secure cloud solutions and advanced communication platforms directly addresses these needs.

- Increased demand for cybersecurity solutions: As more employees work remotely, the attack surface expands, driving demand for CACI's cybersecurity services.

- Adaptation of client engagement models: CACI must evolve its client interaction methods to accommodate remote and hybrid workforces, potentially leveraging virtual collaboration tools.

- Workforce flexibility and talent acquisition: Remote work allows CACI to tap into a broader talent pool, irrespective of geographical location, potentially improving recruitment and retention.

- Operational adjustments for distributed teams: CACI needs to implement strategies that foster collaboration, maintain productivity, and ensure employee well-being across dispersed teams.

Societal attitudes towards technology and its role in government operations are evolving, impacting demand for CACI's services. A 2024 Deloitte survey revealed that 70% of citizens expect government services to be as seamless and user-friendly as private sector digital offerings, pushing for greater technological integration.

This societal expectation drives a need for advanced digital transformation and citizen-centric solutions, areas where CACI is strategically positioned. The company's focus on modernizing government IT infrastructure and enhancing digital service delivery directly aligns with these public demands.

Public perception of data privacy and security is a significant sociological factor influencing CACI's operations. As data breaches become more prevalent, public trust in organizations handling sensitive information is paramount. A 2024 report by the Identity Theft Resource Center noted a 14% increase in data breaches in the first half of 2024 compared to the same period in 2023, underscoring heightened public awareness and concern.

CACI's commitment to robust cybersecurity and ethical data handling is therefore critical for maintaining its reputation and securing government contracts. The company's investments in AI-driven security platforms and compliance with stringent data protection regulations are key to addressing these societal concerns and building public confidence.

Technological factors

CACI is strategically leveraging advancements in artificial intelligence, machine learning, and automation to bolster its service portfolio and streamline operations. The company is actively engaged in providing AI and geospatial expertise to critical government agencies, such as the National Geospatial-Intelligence Agency (NGA).

These technologies are being integrated to automate tasks like report generation and enhance predictive modeling capabilities, thereby improving efficiency and delivering more sophisticated solutions to clients. This focus on AI and automation is crucial for CACI to maintain its competitive edge in the evolving technology landscape.

The escalating complexity and frequency of cyber threats directly fuel a persistent need for sophisticated cybersecurity solutions, a domain where CACI excels. This evolving landscape ensures ongoing demand for CACI's core competencies in protecting critical digital infrastructure.

CACI actively works to identify and neutralize emerging cyber threats. For instance, in 2023, the company secured a significant contract valued at $1.7 billion to bolster the cyber defenses of the U.S. Army, demonstrating its crucial role in national security and its ability to win substantial government business in this critical sector.

Federal agencies are heavily investing in cloud adoption and digital transformation, a trend directly benefiting CACI's core competencies in enterprise IT and modernization. This strategic shift by the government creates a robust demand for the very services CACI provides, driving significant market opportunities.

The General Services Administration's (GSA) IT modernization plan for 2025 specifically highlights the critical role of cloud technologies and the need for digital platform agility. This governmental focus directly translates into a favorable environment for CACI, as their expertise aligns perfectly with these stated federal priorities, positioning them to capture a larger share of the digital modernization spend.

Quantum Computing and Emerging Technologies

Quantum computing, though still in its early stages, holds the potential to revolutionize areas like cybersecurity and advanced data analytics. These advancements could significantly impact how CACI and its clients handle sensitive information and process complex datasets. CACI's strategic investments in future capabilities are designed to ensure it can leverage these emerging technologies. For instance, the company's ongoing research and development spending, which reached $698 million in fiscal year 2023, reflects a commitment to staying at the forefront of technological innovation.

The implications for CACI are substantial, particularly in areas like secure communications and data encryption, where quantum advancements could render current methods obsolete. By focusing on adaptable and differentiated capabilities, CACI aims to be well-positioned to integrate quantum solutions as they mature. This forward-looking approach is crucial for maintaining a competitive edge in a rapidly evolving technological landscape. The company's FY24 guidance anticipates continued investment in R&D, underscoring its dedication to future-proofing its offerings.

Emerging technologies also encompass advancements in artificial intelligence, machine learning, and advanced analytics. These fields are already transforming government and commercial sectors by enabling more efficient operations and deeper insights. CACI's strategic partnerships and acquisitions, such as its acquisition of Axiom in 2023 for $300 million, demonstrate its intent to bolster its expertise in these critical technological domains. These moves are vital for CACI to offer cutting-edge solutions to its clientele.

The company's ability to adapt to these technological shifts will be a key determinant of its long-term success. CACI's emphasis on developing agile and scalable solutions allows it to respond effectively to the dynamic nature of technological progress. This proactive stance ensures that CACI remains a valuable partner for organizations navigating the complexities of digital transformation. The company's sustained revenue growth, projected to continue in 2024, is partly attributed to its successful integration of advanced technologies into its service portfolio.

Data Analytics and Visualization

The increasing volume of data generated by government agencies necessitates sophisticated tools for analysis and interpretation. CACI is well-positioned to meet this demand, offering expertise in advanced data analytics and visualization solutions. This capability is crucial for informed decision-making across various sectors.

CACI's role in providing these technologies is significant. For instance, the company secured a sole-source contract to deliver advanced data visualization technology to the Department of Defense (DoD) and the Intelligence Community. This highlights the critical need for agencies to process and derive actionable insights from complex datasets.

- Data Growth: The global datasphere is projected to reach 295 zettabytes by 2026, underscoring the need for advanced analytics.

- Government Demand: Agencies are increasingly investing in data analytics to improve operational efficiency and national security.

- CACI's Role: CACI's expertise in data visualization directly addresses the challenge of making large datasets comprehensible and actionable for government clients.

- Contract Value: While specific contract values are often proprietary, the sole-source nature of such agreements indicates substantial investment and reliance on CACI's capabilities.

CACI's technological strategy centers on leveraging AI, machine learning, and automation to enhance its offerings and operational efficiency, particularly for government clients like the NGA. The company's focus on these areas is key to maintaining its competitive edge in a rapidly evolving tech landscape.

The increasing demand for advanced cybersecurity solutions, driven by escalating cyber threats, directly plays to CACI's strengths. The company's significant $1.7 billion contract in 2023 to bolster U.S. Army cyber defenses exemplifies its vital role in national security and its success in securing substantial government business.

Federal agencies' push towards cloud adoption and digital transformation creates a strong market for CACI's IT and modernization services. The GSA's 2025 IT modernization plan, emphasizing cloud technologies and platform agility, aligns perfectly with CACI's expertise, positioning it to capture significant digital modernization spending.

Emerging technologies like quantum computing present opportunities for CACI in advanced data analytics and cybersecurity, areas where its $698 million R&D investment in fiscal year 2023 is crucial. CACI's acquisition of Axiom for $300 million in 2023 also highlights its commitment to strengthening its AI and advanced analytics capabilities.

| Technology Area | CACI's Focus/Investment | Market Driver | Example/Data Point |

| Artificial Intelligence & Machine Learning | Service portfolio enhancement, operational streamlining, AI/geospatial expertise for government agencies | Increased demand for data-driven insights and automation | Acquisition of Axiom for $300 million (2023) |

| Cybersecurity | Protecting critical digital infrastructure, neutralizing emerging threats | Escalating complexity and frequency of cyber threats | $1.7 billion contract for U.S. Army cyber defenses (2023) |

| Cloud Computing & Digital Transformation | Enterprise IT, modernization services | Federal agency investment in cloud adoption | GSA's IT modernization plan for 2025 emphasizes cloud technologies |

| Advanced Data Analytics | Data visualization, interpretation of large datasets | Growing data volumes generated by government agencies | Sole-source contract for advanced data visualization with DoD and Intelligence Community |

| Quantum Computing | Research and development in future capabilities | Potential to revolutionize cybersecurity and data analytics | $698 million R&D spending in FY2023 |

Legal factors

CACI's operations are heavily shaped by government contracting regulations, notably the Federal Acquisition Regulation (FAR) and the Defense Federal Acquisition Regulation Supplement (DFARS). These rules dictate how CACI secures and executes contracts with the U.S. government, impacting everything from pricing to compliance.

In 2024 and looking into 2025, regulatory shifts are ongoing. Proposed changes aim to standardize suspension and debarment processes, offering more predictability for contractors like CACI. Additionally, updates to cost or pricing data requirements are being considered, which could influence how CACI prices its services and products for government clients.

CACI's operations are significantly shaped by data privacy and security compliance, particularly with the increasing stringency of regulations like the Cybersecurity Maturity Model Certification (CMMC). As a defense contractor, adherence to CMMC Level 3, for instance, is essential for handling controlled unclassified information, impacting CACI's ability to secure and maintain government contracts. Failure to meet these evolving cybersecurity mandates can result in lost business opportunities and reputational damage.

CACI's ability to manage and protect its intellectual property (IP) is paramount, especially concerning its proprietary technologies developed for government clients. This involves navigating the legal landscape of patents, copyrights, and trade secrets to safeguard its innovations from unauthorized use.

The company actively engages in licensing agreements, both to leverage its own IP and to utilize technologies from third parties. These agreements are crucial for facilitating collaborations and ensuring compliance with government regulations, impacting CACI's revenue streams and operational capabilities.

In 2024, CACI's commitment to innovation is reflected in its significant investments in research and development, which directly fuels its IP portfolio. While specific figures for IP licensing revenue are not publicly detailed, the company's strategic focus on advanced technology solutions, such as AI and cybersecurity, underscores the legal importance of robust IP management.

Ethics and Anti-Corruption Laws

As a government contractor, CACI operates under stringent ethics and anti-corruption laws, such as the Foreign Corrupt Practices Act (FCPA) and various federal procurement regulations. Adherence to these rules is critical for maintaining its eligibility for lucrative federal contracts, which formed a significant portion of its revenue. For instance, in fiscal year 2023, CACI reported approximately $6.2 billion in federal government contracts, underscoring the importance of compliance.

Failure to comply can result in severe penalties, including debarment from future government work, hefty fines, and reputational damage. CACI's commitment to ethical conduct is therefore not just a matter of legal obligation but a core business imperative. The company actively invests in compliance programs and training to ensure its employees and partners uphold the highest ethical standards, safeguarding its ability to secure and maintain government business.

- FCPA Compliance: CACI must ensure its operations, especially internationally, do not involve bribery or corruption to secure or retain business.

- Federal Acquisition Regulation (FAR): Adherence to FAR clauses related to ethics, business integrity, and anti-corruption is mandatory for all government contractors.

- Reputational Risk: Violations can lead to loss of trust from government agencies and the public, impacting future contract opportunities.

- Internal Controls: Robust internal policies and training programs are essential to prevent and detect potential ethical breaches.

Contract Protest and Litigation Risk

Government contracting, by its very nature, exposes companies like CACI to the risk of contract protests and subsequent litigation. These legal challenges can arise from unsuccessful bidders or disputes over contract terms, potentially delaying crucial contract awards or even disrupting ongoing projects. In fiscal year 2023, the U.S. Government Accountability Office (GAO) reported over 2,000 bid protest filings, highlighting the prevalence of these legal hurdles.

CACI must actively manage these legal risks to ensure operational continuity and protect its financial interests. Litigation can lead to significant legal expenses, potential contract modifications, or even adverse rulings that impact future business opportunities. For instance, a successful protest could result in a re-evaluation of bids, pushing back project timelines and associated revenue streams.

- Bid Protests: Unsuccessful bidders can formally challenge the award of a government contract, leading to reviews by agencies or the GAO.

- Litigation Risk: Disputes over contract performance, scope, or payment can escalate to formal legal proceedings, incurring substantial costs.

- Impact on Operations: Legal challenges can stall contract awards, impacting CACI's ability to commence new projects and generate revenue.

CACI's legal framework is deeply intertwined with government regulations, impacting its ability to secure and execute contracts. Compliance with evolving cybersecurity mandates like CMMC is critical for handling sensitive government information, directly affecting CACI's access to lucrative defense contracts. The company's robust intellectual property management is also legally essential for protecting its innovations and facilitating licensing agreements, which are vital for its revenue streams and operational capabilities.

Environmental factors

The U.S. federal government is actively pushing sustainability, with initiatives like the Federal Sustainability Plan aiming for 100% clean electricity by 2030 and net-zero emissions by 2050. This means companies like CACI, which contract with the government, will likely see increasing pressure to demonstrate environmentally responsible practices in their operations and supply chains.

For CACI, this translates to potential requirements for greener IT solutions, reduced carbon footprints in its service delivery, and adherence to sustainable procurement policies. For instance, the Biden-Harris administration's Federal Buy Clean initiative, which started in 2022, encourages the use of low-carbon building materials, a trend that could extend to other government technology procurements, impacting CACI's sourcing and delivery models.

CACI, as an IT solutions provider, faces increasing pressure to enhance energy efficiency in its operations and client data centers. This focus is driven by global sustainability goals and regulatory shifts aimed at reducing carbon footprints.

Optimizing IT infrastructure for lower energy consumption presents a significant competitive advantage. For instance, the global IT sector's energy consumption was projected to reach 2.5% of total global electricity by 2025, highlighting the scale of the challenge and opportunity.

Companies like CACI can leverage advanced cooling techniques, server virtualization, and workload optimization to reduce power usage. In 2024, many businesses are investing in green IT solutions, with a growing market for energy-efficient hardware and software.

CACI's technology supply chain faces increasing environmental scrutiny, particularly concerning the sourcing of raw materials and the management of electronic waste. Regulations like the EU's Restriction of Hazardous Substances (RoHS) directive, which CACI must adhere to for products sold in Europe, directly impact component selection and manufacturing processes.

Ensuring compliance with evolving environmental standards is crucial for CACI's operational resilience and market access. For instance, the growing global focus on circular economy principles means CACI needs to actively manage the lifecycle of its technology products, from responsible sourcing to end-of-life recycling, a challenge amplified by the complexity of its international supplier network.

Climate Change Adaptation and Resilience

Climate change, while not a direct operational concern for CACI's core IT and consulting services, presents indirect opportunities. The increasing focus on national resilience and infrastructure upgrades in response to extreme weather events could spur demand for CACI's data analytics and strategic planning capabilities. For instance, government investments in climate adaptation infrastructure, projected to be substantial in the coming years, may require sophisticated data modeling and project management, areas where CACI excels.

The push for greater national security resilience in the face of climate-related disruptions, such as supply chain vulnerabilities or critical infrastructure protection, also aligns with CACI's expertise. As governments and defense agencies grapple with these evolving threats, there's a growing need for advanced analytics to predict impacts and develop mitigation strategies. This translates into potential contracts for CACI in areas like cybersecurity for resilient systems and intelligence analysis of climate-driven risks.

- Growing Demand for Resilience: Global spending on climate adaptation is expected to reach hundreds of billions annually by 2030, creating a market for resilience-focused solutions.

- Infrastructure Modernization: Governments worldwide are earmarking significant funds for infrastructure upgrades, including those designed to withstand climate impacts, potentially benefiting CACI's project management and IT integration services.

- Data Analytics for Risk Assessment: The need to quantify and manage climate-related risks is driving demand for advanced data analytics, a key CACI offering.

Corporate Social Responsibility (CSR) and ESG Reporting

CACI's commitment to Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) reporting is increasingly scrutinized by investors and stakeholders. This focus means CACI is expected to actively showcase its dedication to environmental stewardship. For instance, in its 2023 Corporate Social Responsibility Report, CACI highlighted a 5% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2022 baseline, demonstrating tangible progress.

Investor demand for robust ESG data continues to climb. Funds focused on ESG principles saw significant inflows throughout 2024, with global ESG assets projected to reach $33.9 trillion by 2026, according to Bloomberg Intelligence. This trend pressures companies like CACI to provide transparent and measurable data on their environmental impact and social initiatives.

CACI's publicly available corporate responsibility reports are key platforms for addressing these ESG aspects. These reports detail initiatives such as:

- Sustainable IT practices: Efforts to reduce e-waste and promote energy-efficient data centers.

- Ethical supply chain management: Ensuring partners adhere to environmental and labor standards.

- Community engagement programs: Investments in STEM education and local development.

- Diversity and inclusion metrics: Reporting on workforce representation and equitable opportunities.

CACI's operations are increasingly influenced by environmental regulations and sustainability goals, pushing for greener IT solutions and reduced carbon footprints.

The company must navigate evolving standards for energy efficiency, waste management, and responsible sourcing within its technology supply chain, impacting component selection and product lifecycles.

Climate change presents indirect opportunities for CACI through demand for resilience-focused solutions, infrastructure modernization, and advanced data analytics for risk assessment, aligning with national security and adaptation efforts.

Investor and stakeholder scrutiny of CACI's Corporate Social Responsibility and ESG performance is intensifying, requiring transparent reporting on environmental impact and sustainable practices.

| Environmental Factor | Impact on CACI | Data/Trend (2024-2025) |

|---|---|---|

| Government Sustainability Initiatives | Increased demand for green IT, reduced emissions in operations and supply chain. | Federal Sustainability Plan targets 100% clean electricity by 2030. Biden-Harris administration's Federal Buy Clean initiative (from 2022) influences procurement. |

| Energy Efficiency in IT | Opportunity for competitive advantage through optimized infrastructure. | Global IT sector energy consumption projected at 2.5% of global electricity by 2025. Growing investment in energy-efficient hardware and software in 2024. |

| Supply Chain Scrutiny & E-waste | Need for compliance with regulations like RoHS, responsible sourcing, and end-of-life management. | EU's RoHS directive impacts component selection. Growing focus on circular economy principles. |

| Climate Change Adaptation & Resilience | Demand for data analytics, strategic planning, and cybersecurity for resilient systems. | Global spending on climate adaptation projected to reach hundreds of billions annually by 2030. Significant government funds for climate-resilient infrastructure upgrades. |

| ESG Reporting & Investor Demand | Pressure for transparent and measurable data on environmental impact. | CACI reported a 5% reduction in Scope 1 & 2 GHG emissions (vs. 2022 baseline) in its 2023 CSR Report. Global ESG assets projected to reach $33.9 trillion by 2026. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, leading economic research institutions, and reputable industry-specific reports. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive overview.