CACI Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CACI Bundle

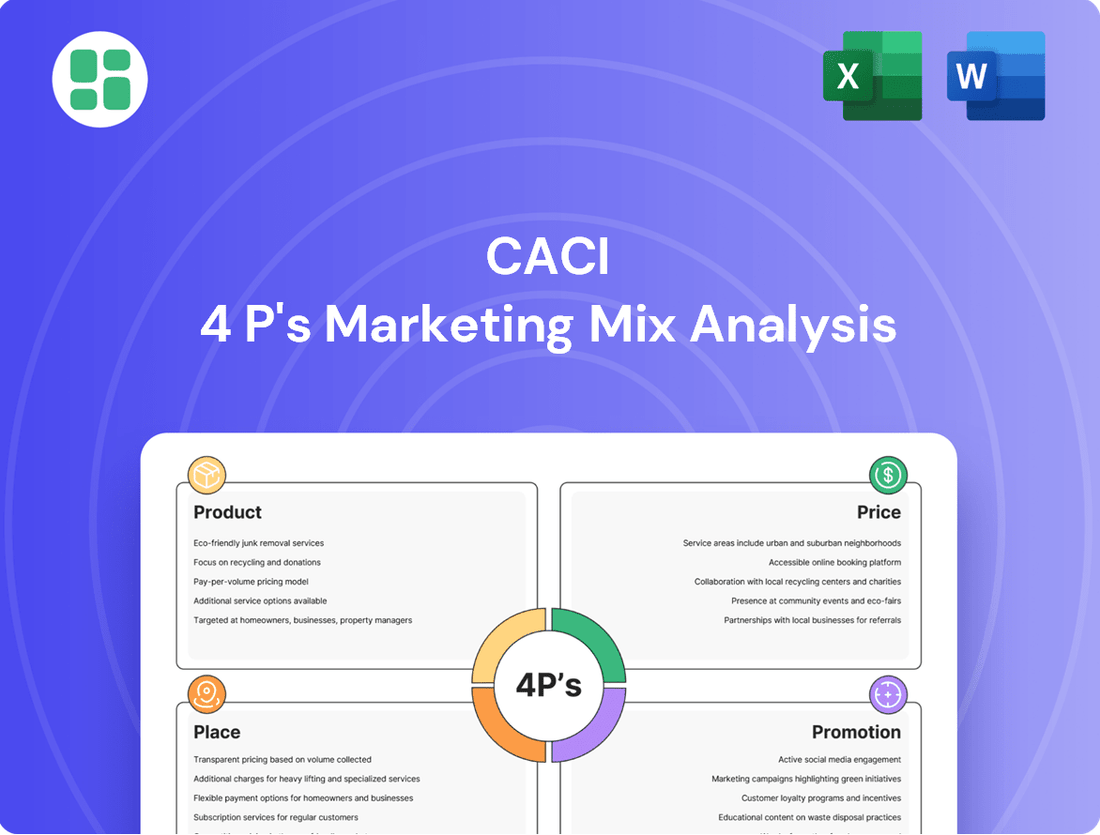

Uncover the strategic brilliance behind CACI's marketing efforts with our comprehensive 4P's analysis. We delve deep into their product innovation, pricing strategies, distribution channels, and promotional activities, revealing the core elements of their market dominance.

Ready to elevate your own marketing game? Get instant access to the full, editable CACI 4P's Marketing Mix Analysis, packed with actionable insights and real-world examples to guide your strategic planning.

Product

CACI's technology-driven solutions are central to its marketing mix, providing a robust suite of information services tailored for government and national security needs. These offerings leverage advanced technology and deep domain expertise to tackle complex challenges, from sophisticated cybersecurity threats to intricate data analytics. For instance, CACI's commitment to innovation is reflected in its investments, with the company consistently highlighting its R&D efforts in its financial reports, aiming to deliver unique capabilities that directly address federal agency requirements.

CACI's product strategy centers on core expertise in agile development, cybersecurity, data analytics, and enterprise IT. This focused portfolio allows them to deliver specialized, advanced software-defined technologies and integrated solutions.

The company's commitment to these areas is evident in its continuous investment, aiming to leverage talent and innovation. For instance, in fiscal year 2023, CACI reported significant revenue growth driven by these specialized capabilities, particularly in supporting the U.S. federal government's evolving technological needs.

CACI's Customized Government Modernization offering focuses on creating bespoke digital solutions for agencies like the Department of Defense and intelligence communities. This includes modernizing critical legacy systems and migrating them to secure cloud environments, aiming to boost operational efficiency. For instance, CACI's work in 2023 supported significant digital transformation initiatives, contributing to a more agile and responsive government.

Mission-Critical Support

CACI's mission-critical support directly addresses enduring national security needs, ensuring vital operations continue uninterrupted. Their products and services are designed to safeguard U.S. interests through advanced technological solutions.

This focus on essential capabilities means CACI's offerings are consistently in demand. For instance, in fiscal year 2023, CACI reported a backlog of $7.5 billion, demonstrating the sustained need for their mission-critical support. This backlog is a strong indicator of future revenue and the ongoing importance of their work.

- Electromagnetic Spectrum Operations: Essential for modern warfare and intelligence gathering.

- Counter-Uncrewed Systems (C-UxS): Vital for defending against evolving threats.

- Optical Communications for Space: Crucial for secure and high-bandwidth satellite communications.

Proprietary s and Offerings

CACI's strategic advantage extends beyond its service offerings through significant investment in proprietary products and data solutions. These specialized software and hardware innovations are designed to create a distinct market position and deliver unique value.

A prime example of this focus is the Terrestrial Layer System Brigade Combat Team Manpack (TLS BCT Manpack), a sophisticated solution developed for the U.S. Army. This initiative underscores CACI's commitment to advancing its technological capabilities and offering high-value intellectual property.

CACI's proprietary product strategy aims to capture higher margins and foster customer loyalty by providing solutions that are difficult for competitors to replicate. This move up the technology stack is crucial for long-term growth and differentiation in the competitive defense and intelligence sectors.

- Proprietary Products: CACI develops specialized software and hardware, such as the TLS BCT Manpack, to create unique market offerings.

- Intellectual Property: The company aims to move up the technology stack, focusing on high-value intellectual property to enhance its competitive edge.

- Market Differentiation: Proprietary solutions allow CACI to stand out from competitors and offer specialized capabilities to its clients.

- Investment Focus: CACI actively invests in developing and enhancing its product portfolio to maintain its technological leadership.

CACI's product strategy is deeply rooted in its advanced technology solutions and domain expertise, specifically targeting government and national security needs. The company focuses on areas like agile development, cybersecurity, data analytics, and enterprise IT, delivering specialized software and integrated systems. This product focus is supported by consistent investment in research and development, aiming to provide unique capabilities that meet evolving federal agency requirements.

CACI's product portfolio includes mission-critical support and proprietary solutions, such as the Terrestrial Layer System Brigade Combat Team Manpack. These offerings are designed to enhance operational efficiency and provide a competitive edge. In fiscal year 2023, CACI saw significant revenue growth driven by these specialized capabilities, demonstrating the strong demand for their technology-driven solutions.

| Product Area | Key Offerings | Fiscal Year 2023 Impact |

|---|---|---|

| Information Technology & Cybersecurity | Agile development, cloud migration, data analytics, cybersecurity solutions | Revenue growth driven by federal government modernization initiatives |

| National Security Solutions | Electromagnetic Spectrum Operations, Counter-Uncrewed Systems (C-UxS), secure satellite communications | Addressing evolving threats and intelligence gathering needs |

| Proprietary Products | Terrestrial Layer System Brigade Combat Team Manpack (TLS BCT Manpack) | Enhancing technological capabilities and intellectual property |

What is included in the product

This analysis provides a comprehensive examination of CACI's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

Transforms complex CACI 4P's analysis into actionable, easily understood insights, alleviating the pain of information overload.

Streamlines marketing strategy by providing a clear, concise framework for evaluating Product, Price, Place, and Promotion, reducing confusion and accelerating decision-making.

Place

CACI's marketing strategy heavily leans on direct engagement with U.S. federal government agencies, a core component of its 4P's analysis, particularly in the 'Place' aspect. This direct approach bypasses intermediaries, allowing CACI to build deep, trusted relationships with critical decision-makers and procurement offices within defense, intelligence, and civilian sectors.

This direct distribution model is fundamental to CACI's success, as evidenced by its significant contract wins. For instance, in fiscal year 2023, CACI secured over $6.5 billion in prime contract awards from the U.S. federal government, underscoring the effectiveness of its direct engagement strategy in securing substantial business.

CACI leverages strategic contract vehicles to ensure efficient distribution within the federal government sector. These frameworks, like multiple-award indefinite-delivery/indefinite-quantity (IDIQ) contracts, simplify the procurement journey for agencies seeking CACI's solutions. This strategic positioning is crucial for maintaining consistent market access and facilitating the flow of services.

The company's success in winning substantial, long-term contracts underscores its capability to secure significant new business. For instance, CACI secured a prime position on the U.S. Army's $11.5 billion IT Enterprise Solutions-2 (ITES-3) contract in 2018, a testament to its competitive strength. Such wins directly translate into sustained revenue streams and a deeper integration into government operations.

CACI's 'Place' strategy emphasizes flexible service delivery, offering both on-site presence and secure remote operations. This approach ensures that solutions are tailored to client needs, whether it requires direct engagement or secure digital access. For instance, in 2024, CACI's cybersecurity services saw a significant increase in remote delivery, reflecting the growing demand for secure cloud-based solutions, with over 60% of client interactions managed remotely to maintain operational continuity and data integrity.

Global Operational Footprint

CACI's operational footprint is strategically designed to support its core U.S. federal government client base, but it extends internationally to serve vital government missions and a growing international customer set. This global presence ensures they can deliver essential technology and expertise wherever it's required, reinforcing their commitment to clients operating in diverse environments.

Their international operations are particularly focused on regions critical to U.S. national security and diplomatic efforts. This allows CACI to provide localized support and adapt its solutions to the specific needs of overseas operations and international partners.

- Europe: CACI has a significant presence in Europe, supporting U.S. military and intelligence agencies with a range of services, including cybersecurity and IT modernization.

- Asia: In Asia, CACI's operations focus on providing advanced technology solutions and support to U.S. government entities and select allied nations.

- Global Reach: As of fiscal year 2023, CACI reported that approximately 10% of its revenue was generated from international operations, highlighting its expanding global engagement.

Integrated Supply Chain and Partnerships

CACI's approach to integrated supply chains and partnerships is crucial for navigating the complexity of government contracts. They leverage a network of specialized partners to deliver comprehensive solutions, ensuring all aspects of a project are covered. This collaborative model allows CACI to offer a wider range of capabilities than they could alone.

Strategic acquisitions play a key role in strengthening this integrated approach. For instance, CACI's acquisition of Azure Summit Technology in late 2023 bolstered their capabilities in areas like artificial intelligence and cloud solutions, directly enhancing their ability to provide specialized, end-to-end offerings to government clients. This expansion of their service portfolio through strategic additions is a testament to their commitment to a robust supply chain.

- Supply Chain Integration: CACI manages a complex network of suppliers and partners to deliver integrated solutions for government clients.

- Strategic Acquisitions: Acquisitions like Azure Summit Technology (announced late 2023) enhance specialized technology offerings and broaden service portfolios.

- End-to-End Delivery: Partnerships and integrated supply chains enable CACI to provide complete, comprehensive solutions from start to finish.

- Government Contract Complexity: CACI's model is designed to meet the intricate demands and diverse requirements of government projects.

CACI's 'Place' in its marketing mix centers on its direct distribution channels to the U.S. federal government, a strategy that emphasizes deep client relationships and efficient procurement. This direct engagement model, coupled with strategic contract vehicles like IDIQ contracts, ensures streamlined access to government agencies seeking CACI's technology and expertise. The company's ability to secure substantial prime contract awards, such as over $6.5 billion in fiscal year 2023, validates the effectiveness of this placement strategy.

CACI's service delivery model offers flexibility, supporting both on-site and secure remote operations to meet diverse client needs, particularly evident in its cybersecurity services where remote delivery increased in 2024. Its global footprint extends to Europe and Asia, supporting U.S. national security missions and allied nations, with international operations contributing approximately 10% of revenue in fiscal year 2023. Strategic acquisitions, like Azure Summit Technology in late 2023, further enhance CACI's integrated supply chain and ability to deliver end-to-end solutions.

| Distribution Channel | Key Strategy | Fiscal Year 2023 Data | Recent Developments |

|---|---|---|---|

| Direct to U.S. Federal Government | Building trusted relationships, bypassing intermediaries | Over $6.5 billion in prime contract awards | Continued focus on major defense and intelligence contracts |

| Strategic Contract Vehicles | Utilizing IDIQ contracts for efficient procurement | Facilitating multi-year, large-scale project delivery | Ongoing participation in key government IT and cybersecurity vehicles |

| Global Operations | Supporting U.S. missions and international partners | ~10% of revenue from international operations | Acquisition of Azure Summit Technology (late 2023) to bolster AI and cloud capabilities |

Preview the Actual Deliverable

CACI 4P's Marketing Mix Analysis

The preview you see here is not a demo—it's the full, finished CACI 4P's Marketing Mix Analysis document you’ll own. You'll receive this exact, comprehensive analysis immediately after purchase, ready for immediate application. This ensures you know precisely what you're getting, with no hidden surprises.

Promotion

CACI's promotional strategy deeply engages with government stakeholders, focusing on building robust relationships with policymakers and agency leaders. This proactive approach involves direct lobbying efforts and active participation in crucial policy discussions, underscoring CACI's commitment to national security and modernization initiatives.

The company prioritizes establishing trust and credibility within the federal landscape, a critical element for securing long-term contracts and influencing future government technology procurements. For instance, CACI's investment in government relations is a key differentiator in a competitive market where understanding and aligning with federal priorities is paramount.

CACI actively engages in and sponsors key industry conferences focused on defense, intelligence, and government IT. This strategic participation allows them to highlight their specialized expertise and technological advancements to a targeted audience.

By publishing white papers, case studies, and expert articles at these events, CACI effectively demonstrates its innovative capabilities. For instance, their presence at major events like the Association of the United States Army (AUSA) Annual Meeting and Intelligence & National Security Summit (INSS) in 2024 provides platforms for sharing insights. This consistent output of valuable content solidifies their reputation as a thought leader.

CACI International frequently highlights its significant contract awards as a core promotional strategy. For instance, in fiscal year 2023, the company secured multiple large contracts, including a substantial award with the Department of Defense valued at approximately $1.7 billion, demonstrating their ongoing success in securing key government business.

These public announcements, often detailing awards in the hundreds of millions or even billions, act as compelling proof of CACI's expertise and reliability. This reinforces their reputation as a dependable partner, fostering market confidence and attracting further business opportunities.

Corporate Responsibility and Reputation Building

CACI leverages its deep-rooted culture of character, ethics, and integrity as a key promotional element, consistently showcased in their Corporate Responsibility Reports. This commitment to corporate social responsibility, coupled with active employee engagement and community involvement, bolsters their standing as a trustworthy and principled partner for government clients.

Their reputation is further amplified by external validation. For instance, CACI's consistent recognition as a Fortune World's Most Admired Company serves as a powerful testament to their ethical operations and business practices, directly influencing stakeholder perception and trust.

This dedication to responsible business translates into tangible benefits. In 2023, CACI reported a 94% employee engagement score, underscoring the internal alignment with their stated values. Furthermore, their community impact programs in 2024 supported over 50 non-profit organizations, demonstrating a tangible commitment beyond core business operations.

- Culture of Integrity: CACI's emphasis on character and ethics is a core promotional pillar, reinforced through public reporting.

- Reputation as a Partner: Corporate social responsibility and community engagement build trust and position CACI as a reliable government partner.

- External Validation: Fortune World's Most Admired Company accolades provide strong, independent endorsement of CACI's values.

- Data-Backed Commitment: High employee engagement (94% in 2023) and significant community support (50+ organizations in 2024) validate their corporate responsibility claims.

Targeted Digital and Investor Communications

CACI leverages targeted digital channels, including its dedicated investor relations website and timely press releases, to disseminate crucial information regarding its financial performance, strategic direction, and technological innovations. These platforms are essential for keeping its diverse stakeholder base informed and engaged.

Investor presentations and quarterly earnings calls are pivotal in CACI's promotional efforts. These forums provide direct opportunities to articulate the company's value proposition and future growth potential to the financial community, fostering understanding and confidence.

- Digital Outreach: CACI's investor relations website and press releases serve as primary digital conduits for financial and strategic updates.

- Financial Community Engagement: Investor presentations and earnings calls are key platforms for communicating value and growth prospects.

- Information Dissemination: The company prioritizes clear and consistent communication of performance metrics and strategic initiatives.

CACI's promotional strategy centers on demonstrating its value and expertise to government clients and stakeholders. This involves highlighting significant contract wins, such as securing a $1.7 billion Department of Defense award in fiscal year 2023, which validates their capabilities.

The company actively participates in industry events, like the AUSA Annual Meeting and INSS in 2024, to showcase technological advancements and thought leadership through publications like white papers and case studies.

CACI also emphasizes its strong corporate culture, ethical practices, and community involvement, reinforced by external recognition like being named a Fortune World's Most Admired Company. This builds trust and positions them as a reliable partner.

Digital channels, including their investor relations website and earnings calls, are crucial for communicating financial performance and strategic direction to investors and the broader financial community.

| Promotional Tactic | Key Activities | Impact/Validation |

|---|---|---|

| Contract Wins | Highlighting large contract awards | Demonstrates expertise and reliability; FY23 DoD award approx. $1.7 billion |

| Industry Engagement | Sponsorship and participation in conferences (e.g., AUSA, INSS 2024) | Showcases technological advancements and thought leadership |

| Corporate Responsibility | Emphasis on ethics, integrity, and community support | Builds trust and reputation; 94% employee engagement (2023), 50+ non-profits supported (2024) |

| Digital & Financial Communication | Investor relations website, press releases, earnings calls | Informs stakeholders about financial performance and strategy |

Price

CACI's pricing strategy is deeply intertwined with the specific types of government contracts it secures. The company predominantly utilizes firm-fixed-price contracts, where the price is set and not subject to adjustment, for projects with well-defined scopes and minimal risk. For more complex or uncertain endeavors, CACI also leverages cost-plus-fee contracts, which cover allowable costs plus a fee, and time-and-materials contracts, billing for direct labor and indirect costs plus a fixed hourly rate. These models are crucial for aligning CACI's revenue with the inherent risks and the evolving nature of its services to federal agencies.

CACI thrives in the competitive government contracting arena, where winning bids hinges on a compelling value proposition. Their pricing strategies are calibrated to showcase the substantial impact of their national security and government efficiency solutions, aiming to secure contracts by balancing cost-effectiveness with unique, high-value capabilities.

CACI's pricing strategy heavily leverages its long-term contractual engagements, reflecting the sustained nature of its service delivery and the value derived from multi-year partnerships. This approach ensures a stable and predictable revenue stream, crucial for consistent financial performance.

The company's impressive backlog, which stood at over $31 billion as of the first quarter of fiscal year 2024, underscores the market's confidence in CACI's ability to deliver on these extended commitments. This substantial backlog directly translates into a predictable pricing environment, as contracts are typically locked in for extended periods.

Alignment with Federal Budgets and Funding

CACI's pricing is deeply intertwined with federal budget cycles and national security spending. The company’s strategy focuses on aligning its services with robustly funded government initiatives, ensuring its price points are competitive and justifiable within agency budgets. This necessitates a keen awareness of government fiscal planning and spending priorities.

For instance, CACI's 2024 fiscal year revenue saw significant contributions from defense and intelligence sectors, reflecting the alignment of its pricing with substantial government outlays in these areas. The company's ability to secure contracts often hinges on its capacity to demonstrate value within the established budgetary constraints of agencies like the Department of Defense, which allocated over $886 billion for fiscal year 2024.

- Fiscal Year Alignment: CACI's pricing is structured to align with the US federal government's fiscal year (October 1 - September 30), optimizing for budget allocation and expenditure cycles.

- Budgetary Justification: Price points are set to be justifiable within specific agency budgets, often tied to well-funded programs in defense, intelligence, and civilian modernization.

- Market Responsiveness: CACI monitors proposed and enacted federal budgets, adjusting its pricing and service offerings to capitalize on emerging funding opportunities and national priorities.

- Competitive Pricing: The company aims for competitive pricing that reflects the value delivered, considering government procurement regulations and the competitive landscape for similar services.

Financial Performance and Shareholder Value

CACI's pricing strategy is intrinsically linked to its pursuit of robust financial performance. The company aims for consistent revenue growth, healthy EBITDA margins, and significant free cash flow generation. This financial discipline underpins its ability to invest in growth and return capital to shareholders.

This focus on financial strength directly translates into shareholder value through strategic capital deployment. CACI actively engages in share repurchases and pursues value-enhancing acquisitions. These actions are designed to boost earnings per share and ultimately increase the overall value for its investors.

- Revenue Growth: CACI reported a 7.7% increase in total revenue for fiscal year 2024, reaching $6.7 billion.

- EBITDA Margins: The company maintained a strong adjusted EBITDA margin of 16.1% in FY24.

- Free Cash Flow: CACI generated $749 million in free cash flow in FY24, demonstrating its operational efficiency.

- Shareholder Returns: In FY24, CACI repurchased approximately $300 million of its common stock.

CACI's pricing strategy is fundamentally tied to its contract types and the value it delivers to government clients. The company's ability to secure and profit from firm-fixed-price, cost-plus-fee, and time-and-materials contracts directly influences its revenue and financial performance. This approach ensures pricing aligns with project scope, risk, and the evolving needs of federal agencies.

The company's pricing is also heavily influenced by its long-term contract engagements and its alignment with robust federal spending. With a backlog exceeding $31 billion in Q1 FY24, CACI benefits from predictable revenue streams. This stability allows for strategic pricing that reflects sustained service delivery and multi-year partnerships, particularly within well-funded sectors like defense and intelligence, which saw significant outlays in FY24.

| Metric | FY23 (Approximate) | FY24 |

|---|---|---|

| Total Revenue | $6.2 Billion | $6.7 Billion (7.7% Increase) |

| Adjusted EBITDA Margin | ~15.5% | 16.1% |

| Free Cash Flow | ~$650 Million | $749 Million |

| Share Repurchases (FY24) | N/A | ~$300 Million |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis leverages a comprehensive suite of data sources, including official company reports, investor communications, and publicly available financial filings. We also incorporate insights from industry-specific databases and competitive intelligence platforms to ensure a thorough understanding of each element.