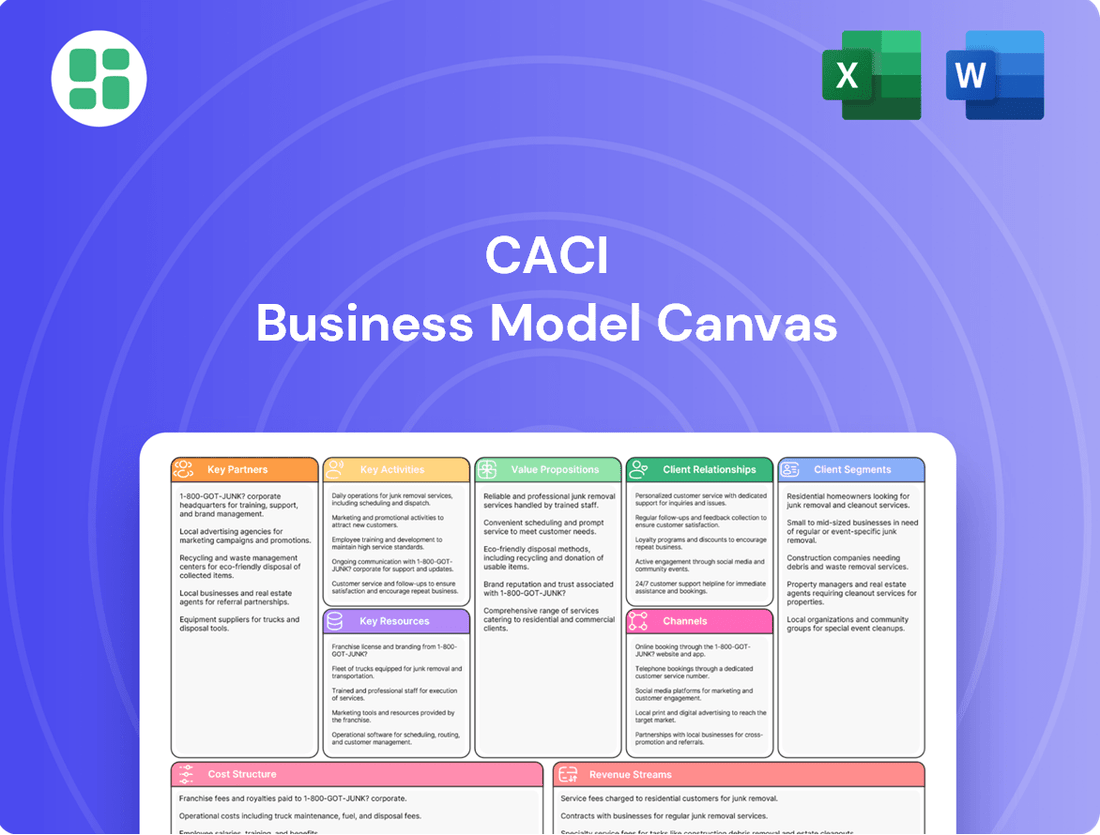

CACI Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CACI Bundle

Curious about CACI's strategic framework? Our Business Model Canvas offers a clear, concise overview of how they deliver value and achieve market success. It's a powerful tool for understanding their core operations and competitive advantages.

Want to dissect CACI's winning formula? This comprehensive Business Model Canvas breaks down their customer segments, revenue streams, and key resources. Download it to gain actionable insights for your own business strategy.

Partnerships

CACI's key partnerships are with U.S. federal government entities like the Department of Defense and the Intelligence Community. These collaborations are vital, with over 95% of CACI's revenue stemming from government contracts, highlighting their critical importance to the company's operations.

Deep understanding of government agency policies and evolving challenges is paramount for CACI to successfully bid on and execute contracts. This intimate knowledge allows them to align their services with the specific needs and strategic objectives of these crucial partners.

CACI actively collaborates with technology vendors and software providers to embed advanced solutions into its service portfolio. A prime example is their partnership with GitLab, focusing on DevSecOps software development, which streamlines and secures the entire software lifecycle.

These strategic alliances are crucial for CACI, enabling them to offer clients, particularly government agencies, highly sophisticated and agile software and hardware capabilities. For instance, in 2024, CACI continued to emphasize its commitment to leveraging best-in-class technologies to address evolving national security and digital transformation needs.

By integrating innovations from partners like GitLab, CACI ensures its offerings remain at the forefront of technological advancement, allowing them to effectively meet the complex and often rapidly changing requirements of their government clientele and maintain a competitive edge in the market.

CACI actively partners with academic and research institutions, such as the United States Military Academy at West Point, to foster cutting-edge research and development. These collaborations are particularly focused on advancing electronic warfare technologies, a critical area for national defense. For instance, CACI's involvement with USMA aims to cultivate a robust pipeline of future military operators and enhance its relationships with prospective clients and collaborators.

Strategic Acquisition Targets

CACI actively pursues strategic acquisitions to accelerate growth and enhance its competitive edge. In fiscal year 2024, the company completed significant acquisitions, including Azure Summit Technology and Applied Insight. These moves are designed to rapidly integrate new technologies and customer bases, bolstering CACI's expertise in critical sectors.

These acquisitions specifically target areas like intelligence, surveillance, reconnaissance, electronic warfare, and signals intelligence. They also aim to strengthen CACI's capabilities in cloud migration and advanced analytics. This inorganic growth strategy is a cornerstone of CACI's approach to expanding market share and broadening its service portfolio.

- Acquisition Strategy: CACI frequently acquires companies to expand expertise and market share.

- FY2024 Acquisitions: Notable acquisitions in fiscal year 2024 include Azure Summit Technology and Applied Insight.

- Capability Enhancement: These acquisitions bolster CACI's offerings in intelligence, electronic warfare, and cloud migration.

- Inorganic Growth: The strategy allows for rapid integration of new technologies and customer relationships.

Other Prime Contractors and Subcontractors

CACI actively cultivates strategic alliances with other information technology firms, frequently serving as either a prime contractor or a subcontractor on substantial government initiatives. These collaborations are crucial for CACI to pursue and successfully execute multi-million dollar, multi-year contracts, expanding its market reach and capabilities.

These partnerships are instrumental in accessing larger, more complex opportunities that might be beyond the scope of a single entity. By teaming with other prime contractors and subcontractors, CACI can leverage specialized expertise and resources, enhancing its competitive edge and ability to deliver comprehensive solutions.

For instance, in fiscal year 2023, CACI reported approximately $6.2 billion in revenue, a significant portion of which is likely driven by its participation in large-scale government contracts secured through these key partnerships. These relationships allow CACI to bid on and win contracts that require a broad range of technical skills and project management experience.

- Prime Contractor Roles: CACI often leads large government projects, managing subcontractors to deliver integrated solutions.

- Subcontractor Engagements: CACI also supports other prime contractors by providing specialized services and expertise.

- Access to Larger Contracts: Partnerships enable CACI to compete for contracts valued in the hundreds of millions or even billions of dollars.

- Synergistic Expertise: Collaborations allow for the pooling of diverse technical skills, enhancing project success rates.

CACI's key partnerships are primarily with U.S. federal government agencies, forming the bedrock of its business model. These relationships are critical, with over 95% of CACI's revenue derived from government contracts, underscoring the vital nature of these alliances for operational success.

Beyond government entities, CACI strategically partners with technology vendors and academic institutions to integrate cutting-edge solutions and foster innovation. For example, collaborations with firms like GitLab enhance DevSecOps capabilities, while partnerships with institutions like the United States Military Academy at West Point advance electronic warfare technologies.

Furthermore, CACI actively pursues strategic acquisitions, such as Azure Summit Technology and Applied Insight in fiscal year 2024, to rapidly expand its expertise and market reach in areas like intelligence and cloud migration. These inorganic growth strategies are essential for maintaining a competitive edge and delivering advanced capabilities.

| Partnership Type | Key Focus Areas | Examples/Impact |

|---|---|---|

| Government Agencies | National Security, Defense, Intelligence | Over 95% of revenue from government contracts; deep understanding of agency needs is paramount. |

| Technology Vendors | DevSecOps, Cloud Solutions, Advanced Analytics | Partnership with GitLab for streamlined software development; integration of best-in-class technologies. |

| Academic/Research Institutions | Electronic Warfare, Future Workforce Development | Collaboration with US Military Academy at West Point to advance R&D and cultivate talent pipeline. |

| Strategic Acquisitions | Intelligence, EW, Cloud Migration, Signals Intelligence | Acquisition of Azure Summit Technology and Applied Insight (FY2024) to enhance capabilities and market share. |

What is included in the product

A structured framework detailing CACI's strategic approach, outlining key customer segments, value propositions, and revenue streams.

This model provides a clear, visual representation of CACI's operational and strategic elements, facilitating understanding of its market position and growth drivers.

Simplifies complex business strategies into a clear, visual framework, alleviating the pain of strategic ambiguity.

Provides a structured approach to identifying and addressing market gaps, relieving the pain of unaddressed customer needs.

Activities

CACI's core activities revolve around delivering sophisticated information solutions and services. This includes expertise in agile development, robust cybersecurity measures, advanced data analytics, and comprehensive enterprise IT support.

The company manages the entire lifecycle of these solutions, from initial design and development through to seamless integration. This end-to-end approach ensures clients receive fully functional and optimized technology.

CACI's primary focus is on providing technology-driven services and products tailored to meet the complex and evolving needs of government clients. For instance, in fiscal year 2023, CACI reported substantial growth in its technology solutions, highlighting the demand for these specialized capabilities.

CACI's core activities revolve around designing, developing, and integrating sophisticated software solutions. They heavily lean on agile methodologies and DevSecOps, ensuring rapid and secure delivery.

This commitment is evident in their operation of numerous agile teams, which collectively push out thousands of software releases each year. This high velocity underscores their focus on efficiency and speed in delivering critical capabilities.

This "software superpower" is vital for CACI's mission to modernize government IT infrastructure and enhance national security systems, providing them a distinct competitive edge.

CACI's key activities heavily involve providing advanced cybersecurity solutions, safeguarding vital government and commercial networks against evolving threats. They also excel in data analytics, transforming complex datasets into actionable intelligence for national security and business strategy.

These capabilities are central to CACI's mission, enabling clients to protect sensitive information and make data-driven decisions. For instance, in 2024, CACI continued to secure critical infrastructure, with their cybersecurity segment contributing significantly to their overall revenue growth.

The company offers a comprehensive suite of cyber services, encompassing both offensive measures to identify vulnerabilities and defensive strategies for threat mitigation and rapid incident response. This dual approach ensures robust protection and resilience.

Government Contract Management and Business Development

A core activity for CACI is the comprehensive management and strategic pursuit of government contracts. This involves a diligent process of identifying opportunities, crafting winning proposals, and overseeing the execution of these critical agreements.

Proactive business development is paramount, focusing on building relationships and understanding agency needs to secure lucrative, long-term engagements. This includes mastering complex contracting mechanisms such as Indefinite Delivery/Indefinite Quantity (ID/IQ) vehicles, which are vital for sustained growth.

CACI's success in this arena is underscored by its significant contract wins. For instance, the company secured over $14 billion in contract awards during fiscal year 2024, a testament to its robust business development and contract management capabilities.

- Strategic Bidding: Developing competitive and compliant proposals for government solicitations.

- Contract Execution: Ensuring successful delivery and management of awarded contracts.

- Business Development: Proactively identifying and pursuing new government opportunities.

- Contract Vehicle Navigation: Expertise in utilizing various government contracting vehicles like ID/IQ.

Research, Development, and Innovation

CACI International dedicates significant resources to research, development, and innovation, a cornerstone of its business model. This focus ensures the company stays ahead in critical areas like artificial intelligence, autonomous systems, and advanced human-machine interfaces. For fiscal year 2023, CACI reported $6.1 billion in revenue, underscoring the scale of its operations and its capacity for sustained R&D investment.

The company's strategy of investing ahead of anticipated needs allows it to proactively develop solutions for evolving national security requirements. This forward-thinking approach is crucial for maintaining a competitive edge and delivering state-of-the-art capabilities to its clients.

- AI and Autonomy: CACI is actively developing AI-driven solutions for intelligence analysis and autonomous platform control.

- Human-Machine Teaming: Innovation efforts are concentrated on enhancing collaboration between human operators and advanced technological systems.

- Cybersecurity Enhancements: R&D is also focused on creating more robust and adaptive cybersecurity measures to protect critical infrastructure.

- Cloud and Data Analytics: CACI invests in developing advanced cloud-based platforms and data analytics tools to support complex mission needs.

CACI's key activities center on providing advanced technology solutions, particularly in areas like agile software development and robust cybersecurity. They focus on modernizing IT infrastructure and enhancing national security systems, a strategy that saw significant investment in fiscal year 2023.

A crucial activity involves the strategic management and pursuit of government contracts, with business development and navigating contracting vehicles like ID/IQ being paramount. This focus resulted in over $14 billion in contract awards during fiscal year 2024.

CACI also invests heavily in research and development, particularly in artificial intelligence, autonomous systems, and human-machine interfaces. This innovation drive, supported by a fiscal year 2023 revenue of $6.1 billion, ensures they deliver cutting-edge capabilities.

| Key Activity | Description | Fiscal Year 2024 Impact |

| Technology Solutions Delivery | Agile development, cybersecurity, data analytics, IT modernization | Significant revenue growth in technology solutions |

| Government Contract Management | Strategic bidding, contract execution, business development | Over $14 billion in contract awards |

| Research & Development | AI, autonomous systems, cybersecurity enhancements | Investment supporting innovation for evolving national security needs |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas preview you're viewing is an exact representation of the final document you will receive upon purchase. This ensures you know precisely what you're getting, with no hidden surprises or altered formatting. Once your order is complete, you'll gain full access to this identical, professionally structured Business Model Canvas, ready for immediate use and customization.

Resources

CACI's most critical resource is its approximately 25,000-strong workforce, a deep wellspring of specialized skills and knowledge essential for national security and government modernization initiatives. This human capital represents the company's intellectual property, a vital asset in a competitive landscape.

The expertise of CACI's employees spans critical domains such as engineering, data science, cybersecurity, and program management, equipping them to tackle complex challenges for government clients. This specialized talent is the engine driving CACI's service delivery and innovation.

Crucially, this workforce possesses invaluable mission knowledge, particularly for classified customers, enabling CACI to operate effectively in sensitive environments. This deep understanding of client missions is a significant differentiator, solidifying CACI's position as a trusted partner.

CACI's proprietary technology, including its DarkBlue Intelligence Suite and CrossBeam optical systems, forms a cornerstone of its value proposition. These advanced solutions offer unique capabilities in critical defense and intelligence sectors, such as signals intelligence and electronic warfare.

The company's commitment to ongoing research and development in these specialized areas is evident. For instance, CACI's focus on data visualization and advanced analytics within these suites allows for enhanced mission effectiveness for its clients.

CACI's extensive government contract vehicles, including Indefinite Delivery/Indefinite Quantity (ID/IQ) contracts and General Services Administration (GSA) schedules, are a cornerstone of its business model. These pre-negotiated agreements significantly simplify the government's procurement process, making it easier and faster for agencies to acquire CACI's services. This efficiency is a major draw for government clients.

These contract vehicles act as vital gateways, enabling CACI to secure new task orders and ensuring a consistent flow of revenue. For instance, CACI's participation in various GSA schedules provides broad access to federal agencies seeking IT solutions and professional services. This robust contract portfolio underpins CACI's ability to maintain a predictable and substantial revenue stream, a critical factor in its financial stability and growth strategy.

Secure Facilities and IT Infrastructure

CACI’s commitment to national security is underscored by its secure facilities and IT infrastructure, crucial for handling classified government information. These assets are compliant with rigorous federal security standards, enabling the execution of mission-critical programs.

The company operates advanced data centers, secure networks, and specialized labs for development and testing. These physical and digital safeguards are fundamental to CACI's ability to manage sensitive data effectively.

- Secure Facilities: CACI maintains highly secure physical locations to protect sensitive government data and operations.

- Robust IT Infrastructure: This includes advanced data centers and secure networks designed to meet stringent federal compliance.

- Compliance: Adherence to federal security standards is paramount for handling classified information and executing mission-critical programs.

- Specialized Labs: Dedicated facilities support the development and testing of advanced solutions for government clients.

Strong Financial Capital and Backlog

CACI's robust financial capital, evidenced by its strong balance sheet, is a cornerstone of its business model, enabling significant investments in operations and strategic growth initiatives. This financial strength underpins the company's capacity for both organic expansion and targeted acquisitions.

The company's substantial contract backlog, exceeding $31 billion as of fiscal year 2025, provides a clear line of sight into future revenue streams, offering considerable predictability and stability. This backlog is a critical asset, directly supporting CACI's long-term financial planning and operational execution.

- Financial Strength: CACI's strong balance sheet acts as a key resource, funding daily operations, strategic acquisitions, and internal development projects.

- Predictable Revenue: A backlog of over $31 billion in fiscal year 2025 ensures a reliable future revenue stream, crucial for sustained growth.

- Investment Capacity: This financial stability empowers CACI to pursue long-term growth strategies and allocate capital effectively across its business segments.

CACI's key resources are its skilled workforce, proprietary technologies, extensive government contract vehicles, secure facilities, and strong financial capital. These elements collectively enable CACI to deliver specialized solutions and maintain a competitive edge in the government contracting sector.

The company's approximately 25,000 employees bring deep expertise in areas like cybersecurity and data science, crucial for national security missions. CACI's proprietary technologies, such as the DarkBlue Intelligence Suite, offer unique capabilities in signals intelligence. Furthermore, a backlog exceeding $31 billion as of fiscal year 2025 underscores its financial stability and predictable revenue streams.

| Resource Category | Key Components | Significance for CACI | Data Point (FY25 unless noted) |

|---|---|---|---|

| Human Capital | ~25,000 Employees; Specialized Skills (Cybersecurity, Data Science, Engineering) | Intellectual property, mission knowledge, service delivery | Workforce size |

| Proprietary Technology | DarkBlue Intelligence Suite, CrossBeam Optical Systems | Unique defense/intelligence capabilities, R&D focus | N/A (Specific product details) |

| Contract Vehicles | ID/IQ Contracts, GSA Schedules | Simplified procurement, revenue stream access | N/A (Contract types) |

| Infrastructure | Secure Facilities, Advanced Data Centers, Secure Networks | Handling classified data, compliance with federal standards | N/A (Security compliance) |

| Financial Capital | Strong Balance Sheet, Substantial Contract Backlog | Investment capacity, predictable revenue, growth enablement | >$31 Billion (Contract Backlog) |

Value Propositions

CACI's value proposition for enhanced national security and mission success is built on providing specialized expertise and cutting-edge technology that directly bolsters critical government operations. This focus allows agencies to effectively address dynamic threats and achieve vital strategic goals.

The company's solutions are designed to speed up the delivery of impactful results, driving tangible positive outcomes for intelligence and defense sectors. For instance, in fiscal year 2023, CACI reported a backlog of $7.1 billion, demonstrating the ongoing demand for its mission-critical services.

Ultimately, this commitment to enabling mission success directly contributes to the robust safeguarding of the United States and its international allies.

CACI provides critical solutions for government modernization, focusing on enterprise IT, digital transformation, and process automation to boost federal agency efficiency. They facilitate the shift from outdated systems to more agile and contemporary platforms, improving overall productivity.

A prime example of this is CACI's ongoing collaboration with NASA, which seeks to standardize and centralize IT services across a vast array of systems. This initiative directly supports NASA's modernization goals by streamlining operations and enhancing data accessibility.

CACI offers advanced, differentiated technology solutions in critical fields such as cybersecurity, data analytics, signals intelligence, and electronic warfare. These offerings frequently integrate artificial intelligence and machine learning to give clients a distinct advantage in challenging operational settings.

The company's approach emphasizes rapid prototyping and the adoption of commercial best practices for software-defined development, ensuring clients receive cutting-edge solutions quickly. For instance, CACI's fiscal year 2023 saw significant growth in its technology solutions, contributing to its overall revenue of $6.7 billion, with a notable portion driven by these advanced capabilities.

Reliable and Trusted Partnership

CACI cultivates a reliable and trusted partnership by consistently delivering exceptional performance and adhering to ethical standards, fostering enduring relationships with its government clientele. This commitment is underscored by a proven history of providing mission-critical solutions around the clock, solidifying client confidence. For instance, CACI's sustained success in securing multi-year contracts, such as the significant indefinite-delivery/indefinite-quantity (IDIQ) agreements, highlights the deep trust clients place in their capabilities and reliability.

This deep-seated trust translates directly into sustained business and long-term engagements, as evidenced by CACI's robust backlog and consistent contract renewals. Their ability to meet evolving national security and government operational needs, often within demanding timelines, reinforces their standing as a go-to partner. In 2023, CACI reported a backlog of approximately $25.7 billion, a testament to the ongoing trust and demand for their services.

- Proven Track Record: CACI's consistent delivery of quality solutions builds a foundation of trust.

- Mission Critical Support: Providing 24/7/365 support for essential government operations reinforces reliability.

- Long-Term Relationships: Trust fosters repeat business and the securing of extended contracts.

- Financial Stability: A substantial backlog, like CACI's $25.7 billion in 2023, reflects client confidence and partnership longevity.

Cost-Effectiveness and Optimized Performance

CACI's value proposition centers on delivering cost-effectiveness and optimized performance for government agencies. By streamlining operations and enhancing efficiency, CACI enables these agencies to achieve their missions while adhering to strict budgetary limitations. This focus on value is crucial in a sector often facing fiscal pressures.

In 2024, CACI continued to emphasize its role in delivering efficient solutions. For instance, its work in modernizing IT infrastructure for defense agencies aims to reduce long-term operational costs. Their approach often involves leveraging advanced technologies to automate processes, thereby cutting down on manual labor and associated expenses.

- Cost Savings: CACI's solutions are designed to directly reduce expenditure for government clients through improved operational efficiency.

- Performance Enhancement: The company focuses on optimizing the performance of critical systems, leading to better mission outcomes.

- Budgetary Alignment: CACI's offerings are particularly valuable for agencies operating under tight budget constraints, providing high value for the investment.

- Reduced Complexity: By simplifying operational processes, CACI helps agencies manage their resources more effectively and reduce overhead.

CACI's value proposition for its government clients is multifaceted, focusing on delivering specialized expertise and advanced technology to enhance national security and ensure mission success. They provide critical solutions for government modernization, emphasizing enterprise IT and digital transformation to boost federal agency efficiency and streamline operations.

The company also offers differentiated technology solutions in key areas like cybersecurity and data analytics, often incorporating AI and machine learning to provide clients with a competitive edge. Furthermore, CACI cultivates trust through consistent performance and ethical practices, fostering long-term partnerships and securing substantial, multi-year contracts.

Finally, CACI delivers cost-effectiveness and optimized performance, enabling agencies to achieve their missions within budgetary constraints by reducing operational costs and enhancing system efficiency.

| Value Proposition Area | Key Focus | Supporting Data/Examples |

|---|---|---|

| Mission Success & National Security | Specialized expertise and cutting-edge technology for critical government operations. | Bolsters dynamic threat response and strategic goal achievement. Fiscal Year 2023 backlog of $7.1 billion indicates strong demand. |

| Government Modernization & Efficiency | Enterprise IT, digital transformation, and process automation for federal agencies. | Facilitates shift from legacy to modern systems. Collaboration with NASA to standardize IT services. |

| Advanced Technology Solutions | Cybersecurity, data analytics, signals intelligence, electronic warfare with AI/ML integration. | Rapid prototyping and commercial best practices for software development. Fiscal Year 2023 revenue of $6.7 billion, with significant technology solution contributions. |

| Trusted Partnership & Reliability | Consistent performance, ethical standards, and 24/7 mission-critical support. | Fosters enduring client relationships and secures extended contracts. Fiscal Year 2023 backlog of approximately $25.7 billion reflects deep client trust. |

| Cost-Effectiveness & Performance Optimization | Streamlining operations and enhancing efficiency for budgetary adherence. | Emphasis on reducing long-term operational costs through IT modernization and process automation. |

Customer Relationships

CACI prioritizes building enduring, strategic partnerships with its government clientele. This involves deeply understanding their long-term objectives and the evolving landscape of their challenges, ensuring CACI’s solutions remain relevant and impactful.

These foundational relationships are cemented through consistent delivery of high-quality services and a forward-thinking strategy to anticipate and address client needs proactively. This commitment fosters trust and mutual reliance.

CACI’s impressive client retention rate, consistently above 90% in recent years, is a testament to the strength and success of these long-term strategic partnerships. This high retention signifies deep client satisfaction and the value CACI provides.

CACI's commitment to dedicated program management and robust support teams is central to their customer relationships. They actively foster close collaboration and maintain regular communication, ensuring clients feel heard and valued throughout the project lifecycle. This proactive approach, emphasizing operational excellence, is designed to guarantee successful project execution and sustained client satisfaction.

CACI's customer relationships are significantly shaped by its expert-driven advisory and consultation services. This approach allows them to deeply understand client needs, helping government agencies define requirements and conceptualize future technological solutions.

By acting as a thought leader and a trusted resource, CACI fosters strong partnerships. This consultative model, where CACI is partially guided by client-identified present and future challenges, ensures their offerings remain highly relevant and impactful.

Tailored Solution Development and Integration

CACI cultivates strong customer relationships by meticulously tailoring solutions to the precise needs of each government agency. This bespoke development process ensures that the technology and services offered are not just relevant, but highly effective in addressing unique challenges.

The integration of these tailored solutions into existing agency infrastructures is a critical component of CACI's customer relationship strategy. This seamless incorporation minimizes disruption and maximizes the immediate utility of the provided capabilities.

- Bespoke Solutions: CACI focuses on custom-built technology and services designed for specific agency requirements, enhancing relevance and effectiveness.

- Seamless Integration: The company prioritizes integrating its solutions into existing client infrastructures to ensure smooth adoption and immediate value.

- Addressing Complex Needs: This tailored approach is particularly vital for national security customers, who often have highly specialized and intricate operational demands.

Proactive Engagement and Innovation Sharing

CACI actively engages customers, sharing insights on emerging technologies and innovative solutions to anticipate future needs. This proactive stance ensures clients remain competitive in the fast-evolving tech sector.

This forward-thinking strategy not only benefits clients but also solidifies CACI's reputation as a leader in advanced capabilities. For instance, CACI's commitment to innovation was highlighted in 2024 with the launch of several new AI-driven solutions for defense clients, aiming to enhance battlefield awareness.

- Proactive Technology Sharing: CACI consistently briefs clients on advancements in areas like cloud computing and cybersecurity, enabling them to plan for future technological integration.

- Anticipating Client Needs: By understanding market trends and client challenges, CACI develops tailored solutions before they are explicitly requested, fostering strong partnerships.

- Innovation Showcase: CACI regularly hosts workshops and webinars to demonstrate new capabilities, such as their 2024 advancements in secure data analytics platforms for government agencies.

- Strengthening Partnerships: This collaborative approach, sharing both challenges and opportunities, deepens client relationships and positions CACI as a trusted advisor.

CACI's customer relationships are built on a foundation of deep understanding and proactive engagement, ensuring tailored solutions for government agencies. Their consistent client retention, often exceeding 90%, underscores the success of this approach, which emphasizes collaboration and expert consultation to address complex, evolving needs, particularly within national security sectors.

Channels

CACI's primary channel is direct government contracting, where it acts as a prime contractor. This means CACI secures large, multi-year deals directly with federal agencies, including the Department of Defense, the Intelligence Community, and various civilian departments.

This direct prime contracting model is CACI's dominant revenue stream. The company has a strong track record of winning substantial new contract awards, underscoring its position as a key government partner.

The reliance on this channel is significant, with over 95% of CACI's total revenue stemming from U.S. government contracts. This highlights the company's deep integration within the federal procurement ecosystem.

CACI's business model heavily relies on government-wide acquisition contracts (GWACs) and Indefinite Delivery/Indefinite Quantity (ID/IQ) vehicles. These pre-negotiated agreements streamline federal procurement, allowing CACI to rapidly deliver its technology and services. For instance, CACI's participation in contracts like CIO-SP3 and JETS 2.0 facilitates efficient service delivery to a broad range of federal agencies.

CACI leverages subcontracting partnerships to access larger government contracts, acting as a key supplier for prime contractors. This strategy allows CACI to extend its core competencies, such as IT modernization and cybersecurity, into diverse programs. For instance, in fiscal year 2023, CACI reported significant revenue growth, partly fueled by its participation in major federal IT modernization efforts where it often serves as a subcontractor.

Strategic Acquisitions

Strategic acquisitions are a key channel for CACI to broaden its market reach and customer base. By integrating companies that already have strong relationships and specialized contract vehicles, CACI can quickly gain access to new segments. This inorganic growth complements organic efforts, directly fueling market penetration and expanding its service offerings to a wider array of clients.

For instance, CACI's acquisition strategy in 2023 and early 2024 has demonstrably strengthened its position. The acquisition of Azure Summit Technology in November 2023, valued at $300 million, brought significant expertise in cloud, cyber, and intelligence, along with established relationships within key government agencies. Similarly, the acquisition of Applied Insight in January 2024, for approximately $200 million, further bolstered CACI's capabilities in areas critical to national security, enhancing its ability to serve existing and new government clients.

- Market Expansion: Acquisitions provide immediate access to new customer segments and geographic markets.

- Capability Enhancement: Integrates specialized technologies and expertise, improving CACI's service portfolio.

- Customer Base Growth: Absorbs companies with established client relationships and contract vehicles.

- Inorganic Growth Driver: A core strategy for accelerating market share and revenue growth.

Industry Events and Conferences

CACI actively participates in key government and defense industry events, such as the annual Association of the United States Army (AUSA) exposition and the Sea, Air & Space Symposium. These engagements are crucial for showcasing CACI's advanced technology solutions and expertise in areas like cybersecurity and digital transformation.

These conferences serve as vital networking hubs, allowing CACI to connect directly with potential clients and government decision-makers. For instance, at the 2023 AFCEA West conference, CACI highlighted its contributions to naval modernization efforts, reinforcing its strategic positioning.

By demonstrating leadership in critical technology sectors at these forums, CACI strengthens its brand visibility and influence within the defense ecosystem. Such participation directly supports business development by fostering relationships and identifying new opportunities, underscoring the strategic importance of these industry gatherings.

- Showcasing Capabilities: CACI uses industry events to display its cutting-edge solutions in cybersecurity, cloud computing, and data analytics.

- Networking Opportunities: Conferences facilitate direct engagement with government officials, prime contractors, and potential clients, fostering valuable relationships.

- Market Intelligence: Participation offers insights into emerging trends, competitor activities, and evolving customer needs within the defense and government sectors.

- Brand Reinforcement: Consistent presence at major events helps solidify CACI's reputation as a leader and innovator in its core markets.

CACI's primary channels are direct government contracting, leveraging prime contracts and participating in government-wide acquisition contracts (GWACs) and Indefinite Delivery/Indefinite Quantity (ID/IQ) vehicles. These channels are supplemented by strategic acquisitions and active engagement in industry events.

In fiscal year 2023, CACI reported total revenue of $6.2 billion, with the vast majority derived from U.S. government contracts, underscoring the dominance of its direct contracting channel.

The company's acquisition strategy, including the November 2023 purchase of Azure Summit Technology for $300 million and the January 2024 acquisition of Applied Insight for approximately $200 million, has significantly expanded its market reach and capabilities.

Participation in key industry events like AUSA and Sea, Air & Space Symposium in 2023 and early 2024 allowed CACI to showcase its solutions and build relationships with government clients, directly contributing to business development.

Customer Segments

The U.S. Department of Defense (DoD) represents CACI's most significant customer segment, driving a substantial portion of its revenue. CACI provides crucial information solutions and services across various DoD branches and commands, supporting national security objectives.

CACI's engagement with the DoD spans critical defense missions, encompassing areas like intelligence analysis, electronic warfare, and the modernization of IT infrastructure for key entities such as the U.S. Army, Navy, and Space Force. This deep integration highlights CACI's role in enabling advanced military capabilities.

In fiscal year 2024, contracts with the DoD accounted for an impressive 74.4% of CACI's total revenue. This substantial reliance underscores the strategic importance of the DoD as a foundational client for CACI's business operations and growth.

CACI's customer segment within the U.S. Intelligence Community (IC) is a cornerstone of its business, encompassing a broad range of agencies focused on national security. These clients rely on CACI for critical services including advanced data analytics, sophisticated geospatial intelligence, and robust cyber operations, all essential for safeguarding national interests.

In 2024, CACI continued to solidify its position by securing substantial contracts, demonstrating the ongoing demand for its specialized expertise within classified national security environments. These agreements underscore CACI's vital role in supporting the intelligence operations and missions of multiple IC agencies, leveraging cutting-edge technology and deep domain knowledge.

CACI serves a broad spectrum of federal civilian agencies, offering critical IT and professional services that drive government modernization and enterprise IT upgrades. This includes significant work with agencies like NASA, where CACI delivers digital solutions and essential IT support.

This diversification into civilian sectors is a strategic move for CACI, helping to balance its customer base and reduce reliance solely on defense contracts. For instance, in fiscal year 2023, CACI reported that its civilian sector represented a substantial portion of its business, demonstrating its growing presence and capabilities beyond defense.

Homeland Security

CACI offers critical solutions and services to agencies within the Department of Homeland Security (DHS), focusing on vital national security requirements like border protection and internal security. This segment, while representing a smaller portion of CACI's overall revenue, is crucial for supporting essential government functions. In fiscal year 2023, CACI's federal government segment, which includes DHS, generated significant revenue, underscoring the importance of these partnerships.

CACI's commitment extends to safeguarding the U.K. border through its U.K. operations, demonstrating a broader scope of national security support. These services are designed to enhance security posture and operational effectiveness for government clients. The company's expertise in areas like cybersecurity and intelligence analysis is particularly relevant to homeland security missions.

- DHS Support: CACI provides technology and services to enhance border security and internal safety for the Department of Homeland Security.

- U.K. Border Security: CACI's U.K. operations actively contribute to safeguarding the United Kingdom's borders.

- Strategic Importance: While a smaller revenue contributor, this segment is vital for national security operations and government support.

- Fiscal Year 2023 Data: CACI's federal government segment, encompassing DHS, demonstrated robust performance in the most recent fiscal year, highlighting the demand for its services.

International Operations (Limited)

While CACI's core business is heavily concentrated on the U.S. federal government, it maintains a limited but strategic international presence. These operations are primarily conducted through subsidiaries situated in Europe, catering to both foreign governmental entities and commercial businesses.

These international ventures, though representing a minor portion of CACI's overall revenue, are crucial for establishing a diversified geographic footprint. For example, CACI's operations in the United Kingdom achieved record revenue in fiscal year 2024, largely due to their support for secure government organizations.

- Geographic Diversification: Limited international operations in Europe provide a broader market reach beyond the U.S.

- Subsidiary Structure: Operations are managed through European subsidiaries, allowing for localized service delivery.

- Revenue Contribution: International segments contribute a small but growing percentage to total company revenues.

- Key Market Focus: Serves foreign governments and commercial enterprises, with a notable success in the UK's secure government sector in FY24.

CACI's customer base is predominantly government-focused, with the U.S. Department of Defense (DoD) being its largest client, accounting for 74.4% of revenue in fiscal year 2024. The company also serves the U.S. Intelligence Community (IC) with advanced data analytics and cyber operations, and various federal civilian agencies like NASA, focusing on IT modernization. CACI also has a growing international presence, particularly in the U.K., supporting secure government organizations.

| Customer Segment | Description | FY2024 Revenue Contribution |

|---|---|---|

| U.S. Department of Defense (DoD) | Provides information solutions and services for national security missions across Army, Navy, and Space Force. | 74.4% |

| U.S. Intelligence Community (IC) | Offers advanced data analytics, geospatial intelligence, and cyber operations for national security agencies. | Significant, but not specified as a percentage. |

| Federal Civilian Agencies | Delivers IT and professional services for modernization and upgrades, including work with NASA. | Substantial portion of business (FY2023 data). |

| Department of Homeland Security (DHS) & U.K. Operations | Supports border protection, internal security, and U.K. border safeguarding. | Smaller portion of overall revenue, but vital. U.K. operations achieved record revenue in FY24. |

Cost Structure

Personnel and labor costs represent a substantial component of CACI's expense structure. This category encompasses salaries, comprehensive benefits packages, and ongoing training programs designed to maintain a highly skilled workforce. For the fiscal year ending June 30, 2023, CACI reported total salaries, wages, and benefits of $3.5 billion, underscoring the critical role of human capital in their operations.

CACI's cost structure heavily features subcontractor expenses, a direct reflection of their strategy to leverage external expertise for specific project needs and to scale operations efficiently. These costs are variable, directly correlating with the volume and complexity of contracts secured. For instance, in fiscal year 2023, CACI reported approximately $1.3 billion in subcontractor costs, highlighting their significant reliance on external partners to deliver comprehensive solutions across their diverse service offerings.

CACI's commitment to cutting-edge solutions means significant investment in technology. This includes the costs of acquiring, developing, and maintaining sophisticated software and hardware. For instance, in fiscal year 2023, CACI reported that its total operating expenses were approximately $5.7 billion, a substantial portion of which is allocated to technology advancements and infrastructure.

These expenditures are crucial for CACI to offer its clients advanced capabilities. The company continuously invests in research and development, as well as integrating new platforms and systems to stay ahead. This ongoing capital outlay is essential for maintaining its technology-first offering and competitive edge in the market.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses are the backbone of CACI's operational overhead. These encompass a range of essential costs, from the salaries of its executive leadership and administrative teams to the upkeep of office facilities, legal counsel, and vital corporate functions. In 2023, CACI reported G&A expenses of $571.3 million, reflecting the significant investment required to manage a global technology and services enterprise.

The efficient management of these G&A costs is paramount to CACI's sustained profitability. These expenses, while not directly tied to service delivery, are indispensable for the overall strategic direction, compliance, and smooth functioning of the organization. For instance, CACI's commitment to innovation and market presence necessitates investment in marketing and corporate development, contributing to the overall G&A figure.

- Executive and Administrative Salaries: Compensation for leadership and support staff crucial for company management.

- Office Facilities and Operations: Costs associated with maintaining physical workspaces and essential utilities.

- Legal and Compliance: Expenses incurred for legal services, regulatory adherence, and corporate governance.

- Marketing and Corporate Functions: Investment in brand building, business development, and strategic initiatives.

Mergers and Acquisitions (M&A) Related Costs

CACI's aggressive mergers and acquisitions strategy, a key driver of its growth, necessitates significant expenditure. These costs encompass thorough due diligence to assess potential targets, the complex process of integrating acquired businesses into CACI's existing operations, and the financing arrangements required for these transactions. While these are strategic investments, they manifest as substantial, often one-time or short-term, financial outlays.

For instance, CACI's 2023 fiscal year saw notable acquisitions, including Azure Summit Technology and Applied Insight. These strategic moves, while bolstering CACI's capabilities in areas like artificial intelligence and cybersecurity, involved considerable financial commitments. These M&A related costs are crucial to understand when evaluating CACI's overall cost structure and its investment in future expansion.

- Due Diligence Expenses: Costs associated with investigating the financial, legal, and operational health of target companies.

- Integration Costs: Expenditures for merging systems, processes, and personnel post-acquisition.

- Financing Fees: Expenses related to securing capital for acquisitions, such as investment banking fees and loan origination costs.

- Acquisition Premiums: The amount paid above the target company's market value, reflecting the strategic importance of the deal.

CACI's cost structure is heavily influenced by its commitment to research and development (R&D) and the continuous pursuit of technological innovation. These investments are vital for developing new solutions and enhancing existing offerings to maintain a competitive edge in the technology and services sector. In fiscal year 2023, CACI's operating expenses totaled approximately $5.7 billion, with a significant portion directed towards R&D and technological advancements.

| Cost Category | Fiscal Year 2023 (Approximate) | Significance |

|---|---|---|

| Personnel and Labor | $3.5 billion | Core operational expense, reflecting investment in skilled workforce. |

| Subcontractor Costs | $1.3 billion | Key for scaling operations and leveraging specialized external expertise. |

| Technology and R&D | Significant portion of $5.7 billion total operating expenses | Essential for innovation and maintaining a competitive technological edge. |

| General and Administrative (G&A) | $571.3 million | Covers essential overhead for strategic management and corporate functions. |

Revenue Streams

CACI generates revenue through firm-fixed-price contracts, locking in a set price from the start. This structure offers predictable income but demands stringent cost management for profitability. For instance, a significant $100 million firm-fixed-price contract was awarded to CACI for the Terrestrial Layer System Brigade Combat Team Manpack.

CACI also generates revenue through cost-plus contracts. In these arrangements, CACI is reimbursed for its direct and indirect costs associated with a project, plus an agreed-upon fee. This fee can be fixed or a percentage of the costs.

These types of contracts are frequently utilized for research and development initiatives or for complex projects where the scope might not be fully defined at the outset. For instance, CACI received a $19.5 million modification for engineering services under a cost-plus-fixed-fee structure in 2024.

While cost-plus contracts generally present a lower financial risk for CACI compared to fixed-price contracts, they necessitate sophisticated and accurate cost accounting systems to ensure proper tracking and reporting of all expenses. This allows for transparent and justifiable billing to the client.

CACI generates revenue through Time and Materials (T&M) contracts, a common approach for staff augmentation and ongoing support services. This model allows billing based on actual labor hours at pre-set rates and the cost of materials utilized. It provides significant flexibility for both CACI and its government clients, especially when project scopes are likely to change.

Indefinite Delivery/Indefinite Quantity (ID/IQ) Task Orders

A significant portion of CACI's revenue is generated through Indefinite Delivery/Indefinite Quantity (ID/IQ) task orders. These are essentially flexible contracts that allow government agencies to order specific services as they need them, based on terms already agreed upon. This structure provides CACI with a predictable and substantial revenue stream.

For example, CACI secured an $805 million task order from the U.S. Navy's NavalX Office. This single order highlights the immense value and consistency that ID/IQ task orders bring to CACI's business model. It demonstrates their ability to secure large, long-term projects that fuel ongoing revenue.

- ID/IQ Task Orders: A primary revenue driver for CACI, enabling flexible service procurement.

- Example: $805 million task order for the U.S. Navy's NavalX Office showcases the scale of these contracts.

- Revenue Consistency: These task orders provide a stable and substantial income source, supporting sustained growth.

Product Sales and Technology Licensing

CACI International diversifies its revenue beyond core services by selling proprietary products and licensing its technology. This segment is expanding as the company strategically integrates more product-based solutions, often acquired through mergers and acquisitions, into its offerings.

The emphasis on a technology-first approach fuels growth in this area, with CACI increasingly offering advanced hardware and software. For instance, in fiscal year 2023, CACI reported significant growth in its technology solutions segment, reflecting this strategic shift.

- Product Sales: Revenue generated from the direct sale of CACI-developed or acquired hardware and software.

- Technology Licensing: Income derived from allowing other entities to use CACI's proprietary technologies.

- Growth Driver: This stream is a key area for expansion as CACI prioritizes technology integration.

- FY23 Performance: CACI's fiscal year 2023 results highlighted increased contributions from technology-centric offerings.

CACI's revenue streams are diverse, primarily driven by various contract types with government clients. These include firm-fixed-price contracts, offering predictable income, and cost-plus contracts, which reimburse costs plus a fee, often used for R&D. Time and Materials contracts are utilized for staff augmentation and support, billing based on labor hours and materials.

A significant portion of revenue comes from Indefinite Delivery/Indefinite Quantity (ID/IQ) task orders, providing flexible service procurement and consistent income, exemplified by an $805 million U.S. Navy task order. CACI also generates revenue through the sale of proprietary products and technology licensing, a growing segment fueled by a technology-first strategy, as seen in its fiscal year 2023 performance.

| Contract Type | Description | Example/Impact |

|---|---|---|

| Firm-Fixed-Price | Set price from the start, requires cost management. | $100 million contract for Terrestrial Layer System. |

| Cost-Plus | Reimburses costs plus a fee (fixed or percentage). | $19.5 million modification for engineering services in 2024. |

| Time and Materials (T&M) | Bills based on labor hours and material costs. | Common for staff augmentation and ongoing support. |

| ID/IQ Task Orders | Flexible orders based on pre-agreed terms. | $805 million U.S. Navy task order; provides substantial revenue. |

| Product Sales & Licensing | Revenue from proprietary hardware, software, and technology use. | Growing segment, significant growth noted in FY23. |

Business Model Canvas Data Sources

The CACI Business Model Canvas is informed by a blend of internal financial performance data, extensive market research reports, and competitive intelligence gathered from industry analysis. This multi-faceted approach ensures a robust and accurate representation of CACI's strategic and operational landscape.