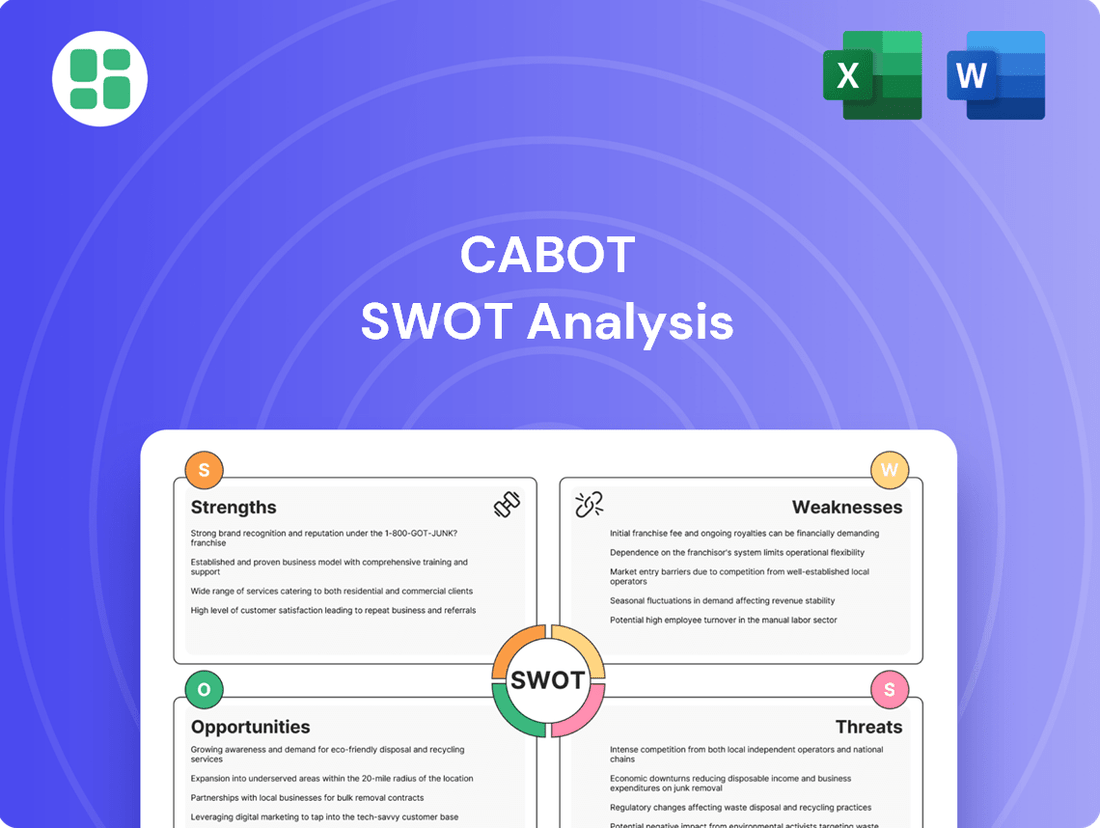

Cabot SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cabot Bundle

Cabot's strengths lie in its diversified portfolio and global reach, but understanding its vulnerabilities and emerging threats is crucial for sustained success. Our comprehensive SWOT analysis delves deep into these critical areas, providing you with the strategic foresight needed to navigate the competitive landscape.

Don't miss out on the actionable intelligence that can transform your investment or business strategy. Purchase the full Cabot SWOT analysis to unlock detailed insights, expert commentary, and an editable format ready for your strategic planning needs.

Strengths

Cabot Corporation commands a significant global presence, especially in carbon black and fumed silica markets, where it's a recognized leader. This strength is bolstered by a broad product range catering to essential sectors like automotive, construction, and electronics.

The company's robust market position is further solidified by its diversified portfolio, which ensures a stable revenue stream. In fiscal year 2023, Cabot reported net sales of $3.4 billion, demonstrating the scale and reach of its operations across its key segments.

Cabot's financial performance remains a significant strength, with fiscal Q3 2025 reporting a notable increase in net income and earnings per share, even amidst some revenue variability. The company has successfully maintained a strong gross profit margin, a testament to its operational efficiency and pricing power.

Furthermore, Cabot generated substantial operating cash flow during the same period, underscoring its ability to convert profits into readily available funds. This robust financial health equips Cabot with the necessary resilience to weather market volatility and allocate capital strategically towards innovation and expansion.

Cabot's dedication to sustainability is a significant strength, evidenced by achieving nine of its 2025 Sustainability Goals ahead of schedule. This proactive approach includes a substantial reduction in Scope 1 and Scope 2 greenhouse gas emissions, demonstrating a tangible commitment to environmental stewardship. The company's consistent Platinum EcoVadis rating for five consecutive years further solidifies its position as a leader in corporate responsibility, a critical differentiator in today's market.

Innovation in Advanced Materials

Cabot's commitment to innovation in advanced materials is a significant strength, underscored by substantial investments in research and development. This focus has led to the introduction of cutting-edge products designed to meet the demands of rapidly growing sectors.

For instance, the launch of LITX® 95F specifically targets the energy storage market, a key area for growth. Additionally, REPLASBLAK® universal circular black masterbatches, featuring certified sustainable content, highlight their dedication to environmentally conscious solutions.

Cabot's strategic emphasis on battery materials, including carbon nanotubes and conductive additive dispersions, places them in a prime position to capitalize on the global energy transition. This forward-thinking approach fosters market differentiation and directly addresses evolving customer requirements.

- R&D Investment: Cabot consistently allocates resources to R&D, driving product development.

- Key Product Launches: Introduction of LITX® 95F for energy storage and REPLASBLAK® for sustainable applications.

- Strategic Focus: Leadership in battery materials like carbon nanotubes and conductive additives.

- Market Responsiveness: Innovation directly addresses evolving customer needs and market trends.

Strategic Acquisitions and Enhanced Capacity

Cabot's strategic acquisitions bolster its global production capabilities. The recent agreement to acquire Bridgestone's carbon manufacturing plant in Mexico is a prime example, significantly expanding Cabot's reinforcing carbon capacity. This move reinforces their leadership in the carbon black market and cultivates deeper relationships with key clients, offering enhanced operational agility.

These strategic expansions are vital for ensuring consistent, long-term supply chains and facilitating future growth initiatives. For instance, Cabot's reinforcing carbons are critical components for the tire industry, a sector that saw global tire production reach approximately 1.4 billion units in 2024. By increasing its manufacturing footprint, Cabot is better positioned to meet this demand.

- Acquisition of Bridgestone's Mexico plant: Enhances global reinforcing carbon production capacity.

- Market Leadership: Strengthens Cabot's position as a top producer of carbon black.

- Customer Partnerships: Deepens relationships with key clients through expanded supply.

- Operational Flexibility: Provides greater agility in meeting market demands.

Cabot's strong market leadership in key segments like carbon black and fumed silica, coupled with a diversified product portfolio, provides a stable foundation for revenue generation. This is evident in their fiscal 2023 net sales of $3.4 billion, reflecting their significant global operational scale.

The company demonstrates robust financial health, with fiscal Q3 2025 showing increased net income and EPS, alongside strong gross profit margins, indicating efficient operations and pricing power. Substantial operating cash flow further enhances their financial resilience and capacity for strategic capital allocation.

Cabot's commitment to sustainability is a notable strength, with many 2025 environmental goals achieved early, including significant GHG emission reductions. Their consistent Platinum EcoVadis rating for five years highlights their leadership in corporate responsibility, a crucial market differentiator.

Innovation in advanced materials, particularly for the growing energy storage market with products like LITX® 95F and sustainable REPLASBLAK® masterbatches, positions Cabot favorably. Their focus on battery materials such as carbon nanotubes and conductive additives directly addresses the global energy transition and evolving customer needs.

Strategic acquisitions, like the recent agreement to acquire Bridgestone's carbon manufacturing plant in Mexico, significantly expand Cabot's reinforcing carbon capacity. This move strengthens their market leadership and enhances supply chain reliability to meet demand, such as the approximately 1.4 billion global tire units produced in 2024.

| Strength Category | Key Aspect | Supporting Data/Example |

|---|---|---|

| Market Leadership | Global presence in carbon black and fumed silica | Recognized leader in key segments. |

| Financial Performance | Strong profitability and cash flow | Fiscal Q3 2025: Increased net income and EPS; strong gross profit margin. |

| Sustainability Commitment | Early achievement of environmental goals | Nine of nine 2025 Sustainability Goals achieved ahead of schedule; consistent Platinum EcoVadis rating. |

| Innovation in Advanced Materials | Focus on energy storage and sustainable solutions | Launch of LITX® 95F; REPLASBLAK® sustainable masterbatches. |

| Strategic Expansion | Increased production capacity through acquisitions | Agreement to acquire Bridgestone's Mexico plant to boost reinforcing carbon capacity. |

What is included in the product

Delivers a strategic overview of Cabot’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential roadblocks into opportunities for growth.

Weaknesses

Cabot's Reinforcement Materials segment is susceptible to dips in global volume, as seen with recent declines in Asia Pacific and the Americas. This vulnerability stems directly from broader economic challenges. For instance, in the first quarter of 2024, the company noted that lower volumes in its Reinforcement Materials segment were a key factor impacting its financial results, with specific mention of weaker demand in automotive and industrial sectors impacted by economic slowdowns.

These volume reductions are primarily driven by diminished customer demand, a consequence of prevailing global macroeconomic uncertainties. Factors such as ongoing trade tariffs and a general weakening of economic conditions worldwide directly translate into reduced sales opportunities and can put pressure on Cabot's overall profitability. The company's performance is therefore closely tied to the health of the global economy and its ability to navigate these external pressures.

Cabot's profitability is significantly impacted by the volatile costs of key raw materials like carbon black and fumed silica. For instance, in the fiscal year 2023, the company experienced fluctuations in these input prices, which directly affected its cost of goods sold. This sensitivity means that any upward price movements in these essential components can put pressure on Cabot's margins.

Furthermore, broader inflationary trends in 2024 and into 2025 are increasing operational expenses. This includes higher costs for labor, routine maintenance, and other production-related activities. Supply chain disruptions also continue to add to these expenditures, forcing Cabot to consider passing these increased costs onto customers through price adjustments to protect its profitability.

Cabot faces a crowded specialty chemicals landscape, with both large global corporations and nimble regional competitors vying for market share. This intense rivalry means Cabot must constantly innovate and differentiate its offerings to stay ahead. For instance, in 2023, the specialty chemicals sector saw significant investment in research and development, with companies allocating substantial portions of revenue to new product pipelines, a trend expected to continue through 2025.

Sustaining market leadership and pricing power hinges on Cabot's ability to consistently deliver superior technology and optimize its cost structures. The threat isn't just from established players but also from emerging companies emphasizing sustainable and eco-friendly chemical solutions. As of early 2024, there's a noticeable shift in customer preference towards greener alternatives, potentially impacting demand for traditional products if Cabot doesn't adapt quickly.

Operational Challenges in Specific Geographies

Cabot Corporation, like many global manufacturers, encounters significant operational hurdles in specific international markets. For instance, in China, the company has experienced disruptions due to government mandates aimed at improving air quality. These curtailments can be sudden, impacting production schedules and overall output.

These unpredictable regulatory interventions create a challenging environment for maintaining consistent manufacturing operations. Navigating diverse and sometimes rapidly changing governmental policies in regions like China adds a layer of complexity to Cabot's global supply chain management.

- Geographic Operational Risks: Cabot faces unique operational risks in countries like China.

- Governmental Curtailments: Production operations can be impacted by government-imposed curtailments, often related to environmental concerns, such as air quality.

- Unpredictable Disruptions: These events can occur with little notice, disrupting production schedules and negatively affecting manufacturing output.

- Regulatory Complexity: Navigating such regulatory environments adds complexity to global operations and supply chain planning.

Dependency on Specific End-Market Performance

Cabot's performance is significantly tied to the health of specific end markets. For instance, the Performance Chemicals segment experienced reduced volumes in auto-related applications during 2024, directly impacting its results. This illustrates a key vulnerability where broader economic shifts affecting particular industries can disproportionately affect the company's revenue streams.

Furthermore, the Reinforcement Materials segment faces its own set of market-specific challenges. Fluctuations in tire imports and regional variations in tire demand, critical drivers for this segment, can introduce volatility. This reliance on niche market dynamics means that even with diversification, certain business units are exposed to uneven performance based on industry-specific trends.

- Auto Sector Sensitivity: Reduced demand in automotive applications impacted Performance Chemicals volumes in 2024.

- Tire Market Volatility: Reinforcement Materials performance is susceptible to tire import levels and regional demand shifts.

- Segmental Performance Disparity: These end-market dependencies can lead to inconsistent financial results across Cabot's different business units.

Cabot's reliance on key raw materials like carbon black and fumed silica makes it vulnerable to price volatility. In fiscal year 2023, fluctuations in these input costs directly impacted the cost of goods sold, with upward price movements pressuring margins. This sensitivity is expected to persist into 2024 and 2025, exacerbated by broader inflationary trends increasing operational expenses for labor and maintenance.

The company operates in a highly competitive specialty chemicals market, facing pressure from both large global players and agile regional rivals. This intense rivalry necessitates continuous innovation and differentiation, especially as customer preferences shift towards sustainable and eco-friendly solutions, a trend gaining momentum through 2025.

Cabot also encounters significant operational risks in specific international markets, such as China, where government mandates for air quality can lead to unpredictable production curtailments. These disruptions can impact manufacturing schedules and overall output, adding complexity to global supply chain management.

Furthermore, Cabot's performance is closely tied to the health of specific end markets, with reduced volumes in automotive applications impacting Performance Chemicals in 2024. The Reinforcement Materials segment, in turn, is susceptible to tire import levels and regional demand shifts, leading to potential performance disparities across business units.

| Weakness Category | Specific Issue | Impact Example (2023-2025 Outlook) | Data Point/Trend |

|---|---|---|---|

| Raw Material Cost Volatility | Fluctuations in carbon black and fumed silica prices | Pressured margins due to increased cost of goods sold in FY23; ongoing inflationary pressures on operational expenses in 2024-2025. | Inflationary trends expected to continue impacting input and operational costs through 2025. |

| Intense Market Competition | Rivalry from global and regional specialty chemical companies | Need for constant innovation to differentiate; threat from emerging eco-friendly solutions impacting demand for traditional products. | Significant R&D investment by competitors in 2023, a trend expected to continue through 2025. |

| Geographic Operational Risks | Governmental curtailments in key markets (e.g., China) | Disruptions to production schedules and output due to environmental mandates; complexity in global supply chain management. | Government mandates for air quality improvements impacting manufacturing operations. |

| End Market Dependence | Sensitivity to automotive and tire industry demand | Reduced volumes in auto-related applications (Performance Chemicals) in 2024; volatility in Reinforcement Materials due to tire import levels and regional demand. | Automotive sector slowdown impacting Performance Chemicals volumes in Q1 2024. |

Same Document Delivered

Cabot SWOT Analysis

The preview you see is the actual Cabot SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Cabot SWOT analysis.

You’re viewing a live preview of the actual Cabot SWOT analysis file. The complete version becomes available after checkout, providing comprehensive insights.

Opportunities

The accelerating adoption of electric vehicles and the expansion of energy storage systems are creating a robust demand for Cabot's specialized battery materials, such as conductive carbons and carbon nanotubes. This global transition towards electrification is fueling the need for advanced materials essential for lithium-ion batteries. For instance, the global EV market is projected to reach over $800 billion by 2025, with energy storage systems following a similar upward trajectory.

Cabot is actively capitalizing on this trend by strategically increasing its production capacity for these critical battery components. The company's investments are aimed at meeting the escalating demand from battery manufacturers worldwide, positioning Cabot as a key supplier in this rapidly evolving sector.

Growing environmental awareness and stricter regulations are fueling demand for sustainable materials and circular economy approaches. Cabot's EVOLVE® Sustainable Solutions platform, featuring products like REPLASBLAK® masterbatches that utilize recycled content, is well-positioned to capitalize on this shift. This commitment to eco-friendly innovation offers a significant avenue for new revenue generation and enhanced customer loyalty.

Cabot's established global footprint, spanning Europe, the Middle East, Africa, the Americas, and Asia Pacific, provides a significant advantage for penetrating emerging markets. This extensive network allows for the efficient deployment of resources and the leveraging of existing customer relationships to accelerate growth in new territories.

By strategically targeting emerging economies with expanding industrial sectors, Cabot can tap into substantial demand for its products, such as fumed silica. This diversification across geographies not only fuels future growth but also mitigates risks associated with over-reliance on any single market.

The Asia-Pacific region, specifically, presents a compelling opportunity, with projections indicating strong growth in the fumed silica market. For instance, the market in this region is expected to grow at a compound annual growth rate (CAGR) of over 5% through 2027, driven by increased demand from electronics and construction sectors.

Infrastructure Development and Alternative Energy Applications

Global infrastructure spending is a significant tailwind, projected to reach $15 trillion by 2029, according to some industry forecasts. This expansion directly fuels demand for Cabot's materials, particularly in sectors like construction and renewable energy.

The accelerating shift towards alternative energy, especially wind power, presents a substantial opportunity. Cabot's fumed silica, for example, is a key component in the high-performance adhesives essential for manufacturing robust wind turbine blades. Furthermore, its use in wire and cable insulation for energy transmission networks solidifies its role in this growth area.

This burgeoning demand translates into stable, long-term growth prospects for Cabot's Performance Chemicals segment. The company's ability to supply critical materials for these expanding industries positions it well for sustained revenue generation.

- Infrastructure Boom: Global infrastructure investment is on a strong upward trajectory, creating a vast market for specialized chemicals.

- Renewable Energy Demand: The wind energy sector, in particular, relies on advanced adhesives and materials where Cabot's fumed silica plays a vital role.

- Wire and Cable Applications: The electrification of infrastructure and the expansion of renewable energy grids increase the need for high-quality wire and cable components.

- Performance Chemicals Growth: These macro trends directly support the growth and profitability of Cabot's Performance Chemicals division.

Government Support for Domestic Supply Chains

Government support for domestic supply chains presents a significant opportunity for Cabot. Initiatives like the U.S. Department of Energy's $50 million grant aimed at bolstering the domestic battery supply chain directly benefit companies involved in critical material production. This kind of financial backing empowers Cabot to invest in upgrading its facilities, particularly for battery-grade materials.

These investments are crucial for reducing dependence on foreign sources and stimulating regional economies. By revitalizing and retrofitting existing plants, Cabot can enhance its capacity to produce these vital components domestically.

- Government funding boosts domestic production capabilities.

- U.S. Department of Energy grants, like the $50 million for battery supply chains, provide direct financial impetus.

- Cabot can leverage this support to upgrade facilities for critical battery-grade materials.

- This strategy aims to decrease import reliance and foster local economic development.

The global shift towards electric vehicles and advanced energy storage is a major growth driver, with the EV market alone anticipated to exceed $800 billion by 2025. Cabot's specialized battery materials, such as conductive carbons, are essential for this transition, and the company is expanding its production capacity to meet this escalating demand. Furthermore, increasing environmental consciousness and stricter regulations are boosting the market for sustainable materials, a trend Cabot is addressing with its EVOLVE® Sustainable Solutions platform, creating new revenue streams.

| Opportunity Area | Key Driver | Cabot's Relevance | Market Projection/Data Point |

|---|---|---|---|

| Electrification & Energy Storage | EV adoption, energy storage expansion | Demand for conductive carbons, carbon nanotubes | Global EV market > $800 billion by 2025 |

| Sustainability & Circular Economy | Environmental awareness, regulations | EVOLVE® Sustainable Solutions, recycled content products | Growing demand for eco-friendly materials |

| Global Market Penetration | Emerging economies, industrial expansion | Leveraging global footprint, existing relationships | Asia-Pacific fumed silica market CAGR > 5% through 2027 |

| Infrastructure Development | Global infrastructure spending | Materials for construction, renewable energy (wind turbines) | Global infrastructure investment projected to reach $15 trillion by 2029 |

| Government Support for Domestic Supply Chains | Policy initiatives, grants | Upgrading facilities for battery-grade materials | U.S. DOE $50 million grant for battery supply chains |

Threats

Ongoing global macroeconomic uncertainties, including persistent inflation and the potential for interest rate hikes in major economies through 2025, present a significant threat. Tariffs and trade disputes, particularly between the US and China, continue to create unpredictable cost structures and market access challenges for companies like Cabot.

Geopolitical instability, such as the protracted conflict in Ukraine and ongoing tensions in the Middle East, directly impacts global supply chains, increasing logistics costs and lead times. This instability can also dampen consumer and business confidence, leading to reduced demand for discretionary goods and services, which could affect Cabot's sales volume.

The International Monetary Fund (IMF) projects global growth to moderate in 2024 and 2025, underscoring the weaker global economic environment. This slowdown, coupled with specific regional conflicts, creates a complex operating landscape, potentially leading to fluctuating customer demand and increased operational complexity for Cabot.

The unpredictable nature of energy and raw material prices poses a significant threat to Cabot. Global supply chain disruptions and rising inflation in 2024 and early 2025 have intensified this volatility. While Cabot can pass on some costs through price adjustments, prolonged spikes in input prices, such as those seen in natural gas or specialty chemicals, could still squeeze profit margins and impact its ability to offer competitive pricing.

Cabot operates in a specialty chemicals market that is intensely competitive, with many companies vying for dominance. This high level of competition can put pressure on pricing and market share, requiring constant strategic adaptation.

The threat of substitute materials is significant. For instance, precipitated silica is gaining traction in applications traditionally served by Cabot's products, potentially impacting demand for its core offerings. This highlights the need for ongoing research and development to stay ahead.

To counter these competitive pressures and the risk of substitution, Cabot must prioritize continuous innovation and maintain cost efficiency. For example, in 2023, the company invested heavily in R&D to develop new, high-performance materials, a strategy crucial for maintaining its competitive edge.

Increasing Environmental Regulations and Compliance Costs

Stricter environmental regulations worldwide, especially concerning greenhouse gas emissions and industrial waste, are presenting significant compliance costs and operational hurdles. While Cabot has demonstrated a commitment to sustainability, the dynamic nature of these regulations, particularly those targeting silica dust emissions, may necessitate considerable investments in new technologies and processes. This could potentially affect the company's profitability in the coming years.

For instance, the U.S. Environmental Protection Agency (EPA) has been increasingly focused on regulating particulate matter, including silica. Companies in the construction and industrial sectors, like those Cabot serves, face growing pressure to adopt advanced dust suppression and control technologies. A report from the National Academies of Sciences, Engineering, and Medicine in 2024 highlighted the substantial capital expenditures required for such upgrades across industries. Cabot's proactive stance on sustainability is a strength, but the evolving regulatory landscape, especially in 2024 and 2025, demands continuous adaptation and financial planning to meet these environmental mandates without compromising financial performance.

- Stricter Emission Controls: Anticipated tightening of regulations on silica dust and other particulate matter emissions, potentially requiring new abatement technologies.

- Increased Compliance Costs: Higher operational expenses associated with monitoring, reporting, and adhering to evolving environmental standards.

- Investment in Technology: Potential need for substantial capital investment in advanced processes and equipment to meet new environmental performance benchmarks.

Market Oversupply and Demand Fluctuations in Key Segments

Cabot's Reinforcement Materials segment, particularly its carbon black business, faces the threat of market oversupply. For instance, the broader battery market experienced oversupply in 2024, leading to price pressures that could similarly affect carbon black if capacity outpaces demand.

Demand for Cabot's products can also fluctuate due to shifts in key end markets. While electric vehicle (EV) adoption continues to rise, regional differences in growth rates and potential policy changes, such as the rollback of certain EV incentives in some markets, could create unpredictable demand patterns for tire and automotive components, impacting Cabot's sales volumes.

- Carbon Black Overcapacity: The carbon black market, a core area for Cabot, is susceptible to periods of oversupply, mirroring trends seen in other industrial materials markets in 2024.

- EV Demand Volatility: Despite overall growth, EV demand exhibits regional variations and is sensitive to policy shifts, potentially causing uneven demand for reinforcement materials.

- Impact on Reinforcement Materials: Fluctuations in EV adoption rates and broader automotive market sentiment directly affect the performance of Cabot's Reinforcement Materials segment.

Global macroeconomic headwinds, including persistent inflation and potential interest rate hikes through 2025, coupled with geopolitical instability and trade disputes, create a challenging operating environment. The IMF's projected moderation in global growth for 2024 and 2025 further underscores these economic uncertainties, impacting consumer and business confidence and potentially dampening demand for Cabot's products.

The threat of substitute materials, such as precipitated silica, poses a risk to Cabot's market share, necessitating ongoing innovation. Intense competition within the specialty chemicals sector also exerts pricing pressure, requiring continuous strategic adaptation and cost efficiency measures. For instance, in 2023, Cabot significantly boosted its R&D investment to develop advanced materials, a crucial strategy to maintain its competitive edge.

Evolving environmental regulations, particularly concerning silica dust and greenhouse gas emissions, present compliance costs and operational hurdles. Stricter standards, like those being considered by the EPA for particulate matter, may require substantial capital investment in new technologies and processes, potentially impacting profitability. A 2024 report from the National Academies of Sciences, Engineering, and Medicine highlighted the significant capital expenditures needed for such industrial upgrades.

Market oversupply in core segments like carbon black, mirroring trends in other industrial materials during 2024, could lead to price pressures. Furthermore, volatility in electric vehicle (EV) demand, influenced by regional adoption rates and policy shifts, creates unpredictable demand patterns for reinforcement materials, directly affecting Cabot's Reinforcement Materials segment performance.

SWOT Analysis Data Sources

This analysis leverages a robust combination of data sources, including Cabot's official financial statements, comprehensive market research reports, and insights from industry experts to provide a well-rounded and actionable SWOT assessment.