Cabot Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cabot Bundle

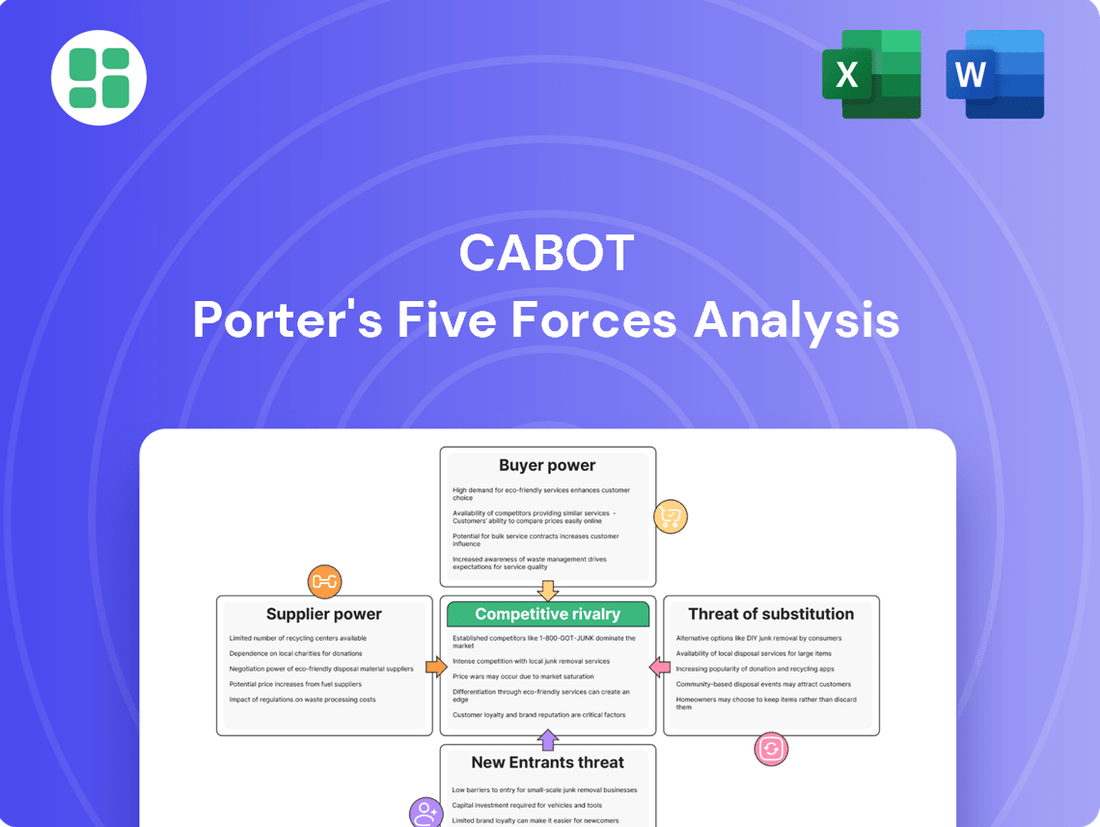

Cabot's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for any strategic decision-maker. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cabot’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Cabot's significant reliance on a limited number of suppliers for crucial feedstocks, such as specific crude oil derivatives for carbon black production or silicon tetrachloride for fumed silica, can significantly amplify supplier bargaining power. For example, if only a few companies can reliably produce the specialized petrochemicals Cabot needs, those suppliers hold considerable sway over pricing and availability.

The bargaining power of these suppliers is directly correlated with the number of viable alternative suppliers and their respective production capacities. In 2024, the global supply chain for many specialty chemicals remained tight, with disruptions impacting production. Cabot's ability to secure competitive pricing and consistent supply hinges on the availability of multiple, capable suppliers, a factor that can be constrained by industry consolidation or geopolitical events affecting raw material extraction and processing.

The volatility of raw material prices significantly influences the bargaining power of suppliers for companies like Cabot. Prices for essential inputs, such as the petrochemicals used in carbon black production, are often tied to global energy markets and can experience sharp fluctuations. For instance, crude oil prices, a key driver for many chemical feedstocks, saw considerable swings throughout 2023 and early 2024, impacting the cost of raw materials for Cabot. This price instability can empower suppliers who can then pass on increased costs, directly affecting Cabot's production expenses and overall profitability.

Cabot's suppliers can exert significant bargaining power if switching to an alternative involves substantial costs. These costs might include the expense and time required to re-qualify materials to meet Cabot's stringent quality standards, the need for retooling manufacturing processes to accommodate different supplier specifications, or navigating lengthy approval procedures for new vendors.

The financial implications for Cabot can be considerable. For instance, a sudden need to switch suppliers could lead to unexpected capital expenditures for new equipment or process modifications. In 2023, the specialty chemicals sector, where Cabot operates, saw an average increase in capital expenditure for process upgrades of around 8%, highlighting the potential financial burden of such transitions.

Furthermore, the disruption to Cabot's supply chain during a supplier change can impact production schedules and lead times, potentially affecting customer relationships and revenue. Contractual obligations with existing suppliers, which may include penalties for early termination, also contribute to the switching costs and, consequently, the suppliers' leverage.

Forward Integration Threat by Suppliers

Suppliers of critical raw materials or components can exert significant influence if they possess the inclination or capacity to move into downstream production, such as specialty chemical manufacturing. This forward integration strategy by suppliers can directly challenge existing players by increasing competition and potentially capturing a larger share of the value chain. While this threat is generally lower for highly specialized or proprietary inputs where supplier capabilities are distinct, its presence can still amplify their overall bargaining leverage.

In 2024, the specialty chemicals sector, valued at over $700 billion globally, saw varied supplier integration efforts. For instance, some upstream petrochemical producers explored opportunities in higher-margin derivatives, directly impacting chemical manufacturers reliant on their feedstocks. This trend is partly driven by a desire to capture more value and diversify revenue streams in a competitive market.

- Forward Integration Threat: Suppliers can integrate into specialty chemical production, increasing their market power.

- Impact on Leverage: This integration enhances suppliers' bargaining power over downstream producers.

- Specialty Materials: The threat is less pronounced for highly specialized inputs but still a factor.

- Market Dynamics: In 2024, upstream players in the $700+ billion specialty chemicals market showed increased interest in downstream integration.

Uniqueness of Supplied Inputs

The uniqueness of supplied inputs significantly impacts supplier bargaining power. When a supplier offers raw materials or specialized services that are difficult for Cabot to replicate or source elsewhere, their leverage increases. For instance, if Cabot relies on a specific, high-purity grade of a chemical that only a few producers can reliably supply, those suppliers gain considerable influence over pricing and terms.

Cabot's dependence on inputs with very specific grades or purity levels directly limits its pool of potential suppliers. This scarcity of alternatives strengthens the bargaining position of the few suppliers who can meet these stringent requirements. In 2024, the demand for high-performance materials, often with specialized chemical compositions, continued to grow across various industries, putting pressure on companies like Cabot to secure these unique inputs.

- Proprietary Inputs: Suppliers holding patents or unique manufacturing processes for essential inputs can command higher prices and dictate terms due to limited substitutability.

- Specialized Services: If a supplier provides critical technical support or customized logistics that are integral to Cabot's operations, this specialization enhances their bargaining power.

- Limited Supplier Base: A concentrated market for a specific input, where only a handful of companies operate, naturally gives those suppliers more sway in negotiations.

- Input Quality & Purity: For industries like advanced materials, the exact specifications and consistency of raw materials are paramount, making suppliers who meet these exacting standards highly valuable and powerful.

Suppliers can wield significant power when they are concentrated, essential to Cabot's operations, and when switching costs are high.

In 2024, the specialty chemicals market, a key area for Cabot, experienced supply chain constraints for certain high-purity inputs, potentially increasing supplier leverage.

The uniqueness of inputs, such as proprietary chemical formulations or specific processing capabilities, further amplifies supplier bargaining power by limiting alternative sourcing options for Cabot.

This dynamic can lead to increased raw material costs for Cabot, impacting its profitability, especially when suppliers can pass on rising energy or production expenses.

| Factor | Impact on Cabot | 2024 Context |

|---|---|---|

| Supplier Concentration | Higher concentration increases supplier leverage. | Limited number of producers for specialized petrochemicals used in carbon black. |

| Switching Costs | High costs for Cabot to change suppliers. | Re-qualification of materials and process adjustments can be costly and time-consuming. |

| Input Uniqueness | Scarcity of specific grades or purity levels strengthens supplier position. | Growing demand for high-performance materials with specialized compositions. |

| Supplier Forward Integration | Potential for suppliers to enter Cabot's market. | Upstream petrochemical firms exploring higher-margin derivatives in the $700+ billion specialty chemicals sector. |

What is included in the product

Analyzes the competitive intensity and profitability potential within Cabot's industry by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Quickly identify and address competitive threats with a visual, easy-to-understand breakdown of Porter's Five Forces.

Customers Bargaining Power

Cabot's bargaining power of customers is significantly influenced by the concentration and volume of its major clients. In sectors like automotive, where tire manufacturers represent substantial purchasers, a few key accounts can dictate pricing and contract terms due to their sheer purchasing might. These large customers typically employ advanced procurement strategies, further amplifying their leverage.

If customers find it easy and inexpensive to switch away from Cabot's offerings, their ability to negotiate better terms, like lower prices or improved service, significantly grows. This ease of switching is directly tied to how standardized Cabot's products are and how little disruption occurs during a changeover. For instance, if a customer can readily source a similar material from another supplier without significant retooling or requalification processes, their leverage is high.

The criticality of Cabot's material to the customer's end product also plays a crucial role. If the material is a small component with readily available substitutes, switching costs are low, amplifying customer power. Conversely, if Cabot's materials are integral to a complex manufacturing process where alternatives require extensive validation, switching becomes more costly, thereby reducing customer bargaining power.

In 2024, industries with high product interchangeability, such as certain commodity chemicals or basic materials, often see customers leveraging low switching costs. For example, a plastics manufacturer using a standard polymer might switch suppliers with minimal impact if pricing is the primary driver. This contrasts with specialized materials where integration and performance are paramount, leading to higher switching costs for the customer.

Customers hold significant bargaining power when they can easily switch to alternative products or materials that serve a similar purpose. This is particularly true if Cabot's offerings are not perceived as unique or if comparable solutions are widely available in the market. For instance, in 2024, the specialty chemicals market, where Cabot operates, is characterized by a growing number of suppliers offering advanced materials, intensifying the need for Cabot to highlight its product differentiation.

Customer's Price Sensitivity

Customer price sensitivity is a critical factor in assessing the bargaining power of customers. When customers face numerous alternatives or when the cost of Cabot's products significantly impacts their overall expenses, they become more attuned to pricing. This heightened sensitivity often translates into stronger demands for price reductions and more favorable contract terms.

For instance, in 2024, industries with high competition, such as consumer electronics or apparel, often see customers actively seeking the lowest prices. If Cabot's specialty chemicals or materials constitute a substantial percentage of a customer's manufacturing cost, that customer will naturally push for better deals. This is particularly true if switching suppliers is relatively easy.

- High Competition Impact: In 2024, industries characterized by intense competition, like the automotive aftermarket, often exhibit elevated customer price sensitivity.

- Cost Significance: When Cabot's materials represent over 10% of a customer's total production cost, their leverage to negotiate lower prices increases significantly.

- Switching Costs: Low switching costs for customers mean they can more readily shift to competitors if Cabot's pricing is not perceived as competitive.

- Information Availability: The widespread availability of price comparison tools in 2024 empowers customers to easily identify and demand better pricing from suppliers.

Threat of Backward Integration by Customers

The threat of backward integration by customers poses a significant challenge, particularly for large buyers with substantial chemical manufacturing expertise. These entities might explore producing key inputs, such as carbon black or fumed silica, in-house. This would directly diminish their need for external suppliers like Cabot, thereby increasing customer bargaining power.

For instance, a major tire manufacturer, a significant consumer of carbon black, could invest in its own carbon black production facilities. This move would grant them greater control over supply and pricing, potentially impacting Cabot's market share and profitability in that segment.

- Customer Control: Large customers can leverage their scale to produce critical raw materials, reducing dependency on suppliers.

- Cost Reduction Incentive: Backward integration offers potential cost savings and greater supply chain stability for the customer.

- Market Impact: If several large customers pursue this strategy, it can significantly erode a supplier's customer base and pricing power.

Customers wield significant power when they can easily switch suppliers, especially if Cabot's products are standardized or readily available elsewhere. This power is amplified if the cost of Cabot's materials represents a large portion of the customer's total production expenses, as seen in 2024 with industries facing intense competition where price sensitivity is high. For example, if Cabot's materials account for over 10% of a customer's manufacturing costs, their leverage to negotiate lower prices increases substantially, particularly when switching costs are minimal.

| Factor | Impact on Customer Bargaining Power | 2024 Example/Data |

|---|---|---|

| Customer Concentration | High for few, large buyers | Major tire manufacturers are key clients for carbon black. |

| Switching Costs | High when product is integrated/customized | Low for commodity chemicals with many suppliers. |

| Product Differentiation | Lowers power if products are similar | Specialty chemicals market in 2024 sees more suppliers, increasing customer options. |

| Price Sensitivity | Increases with competition and cost impact | Customers in competitive sectors like automotive aftermarket push for better pricing if materials exceed 10% of production cost. |

| Backward Integration Threat | Significant for large, capable customers | Potential for tire makers to produce carbon black in-house. |

Preview the Actual Deliverable

Cabot Porter's Five Forces Analysis

The document you see here is the actual, comprehensive Cabot Porter's Five Forces Analysis you will receive immediately after purchase. This preview accurately reflects the content, formatting, and insights contained within the full document, ensuring you know exactly what you're getting. You can confidently proceed with your purchase, knowing you'll gain instant access to this professionally prepared strategic tool.

Rivalry Among Competitors

The global specialty chemicals and performance materials market is quite crowded, with many companies vying for position. Cabot Corporation operates in an environment populated by both massive, diversified chemical giants and smaller, highly specialized firms, all competing for market share.

This high number and varied strength of competitors directly fuels intense rivalry. For instance, in 2023, the global specialty chemicals market was valued at approximately $685 billion, a figure expected to grow, indicating significant competition for these substantial revenues.

In mature or slow-growing segments of the specialty chemicals market, competitive rivalry often heats up. Companies then focus on taking market share from each other instead of benefiting from a rapidly expanding market. This can lead to more aggressive pricing strategies and increased marketing efforts.

Conversely, in high-growth areas of the specialty chemicals sector, direct price competition might be less intense. For instance, the global specialty chemicals market was projected to grow at a compound annual growth rate (CAGR) of around 5.5% from 2023 to 2030, according to some market research. This expansion provides opportunities for multiple players to grow without necessarily engaging in cutthroat competition.

Cabot's strength in differentiating its carbon black, fumed silica, and other specialty materials through superior performance and tailored solutions directly combats intense price-based rivalry. For instance, in 2024, Cabot continued to emphasize its advanced battery materials, a segment where performance is paramount and customization is key, allowing them to command premium pricing and reduce direct competition.

However, the risk of commoditization remains a significant factor. If competitors successfully replicate Cabot's innovations or if market demand shifts towards more standardized offerings, the competitive landscape intensifies, leading to increased price pressures. This was evident in certain segments of the tire industry in 2024 where, despite Cabot's efforts, some customers sought more cost-effective, albeit less differentiated, carbon black options.

High Fixed Costs and Exit Barriers

The specialty chemicals sector is characterized by immense capital outlays for production facilities and ongoing research and development. For instance, building a new specialty chemical plant can easily cost hundreds of millions of dollars, with significant ongoing investment in process innovation.

These substantial fixed costs, coupled with assets that are highly specialized and difficult to repurpose, erect formidable exit barriers. This means companies often find themselves compelled to continue operating and competing intensely, even when market demand softens or profitability declines, to avoid the crippling costs associated with shutting down operations.

- High Capital Investment: Specialty chemical plants require significant upfront investment, often in the hundreds of millions of dollars.

- Specialized Assets: Equipment and facilities are often tailored to specific chemical processes, limiting resale value or alternative uses.

- Compelled Competition: High fixed costs incentivize companies to maintain production and market share, even during economic downturns, to cover operational expenses.

Strategic Stakes and Aggressive Competition

Competitors often engage in aggressive tactics to capture or defend market share. This can manifest as price wars, significant investments in research and development, or rapid expansion of production capabilities.

These strategic moves, aimed at achieving long-term competitive advantages, inevitably intensify the rivalry within the industry. For instance, in the semiconductor industry, companies like TSMC and Intel are locked in a fierce battle for technological supremacy and manufacturing dominance, leading to substantial R&D expenditures that exceeded tens of billions of dollars annually in recent years.

- Aggressive Pricing: Companies may lower prices to attract customers, even at the expense of short-term profitability.

- Increased R&D Spending: A surge in innovation investment to develop superior products or processes.

- Capacity Expansion: Building new facilities or increasing output to meet anticipated demand or outmaneuver rivals.

- Strategic Acquisitions: Merging with or acquiring competitors to consolidate market position and eliminate rivals.

Cabot Corporation operates in a competitive landscape marked by numerous players, ranging from large, diversified chemical conglomerates to niche specialists. In 2023, the global specialty chemicals market was valued at approximately $685 billion, highlighting the substantial revenue streams that fuel intense competition. This rivalry can escalate in mature market segments, where companies focus on gaining market share through aggressive pricing and marketing, as seen in certain carbon black applications within the tire industry in 2024.

However, growth opportunities in areas like advanced battery materials, where Cabot is active, can temper direct price competition due to the emphasis on performance and customization. For instance, Cabot's focus on these high-value segments in 2024 allowed them to command premium pricing, mitigating some of the pressure from more commoditized offerings.

The industry's high capital investment requirements, with new specialty chemical plants costing hundreds of millions of dollars, create significant exit barriers. This financial commitment compels companies to remain competitive even during market downturns, leading to persistent rivalry as they strive to cover fixed costs and maintain market presence.

Competitors frequently employ aggressive strategies such as price wars, accelerated R&D, and capacity expansions to gain an edge. For example, the semiconductor industry, a related high-tech sector, sees annual R&D expenditures in the tens of billions of dollars as companies like TSMC and Intel battle for technological leadership.

| Competitive Tactic | Description | Example Industry Impact (Approximate Figures) |

|---|---|---|

| Price Wars | Reducing prices to gain market share | Can lead to profit margin compression for all players. |

| R&D Investment | Developing new products or improving existing ones | Semiconductor R&D spending exceeding $50 billion annually (recent years). |

| Capacity Expansion | Increasing production volume | Can lead to oversupply if demand forecasts are inaccurate. |

| Strategic Acquisitions | Buying competitors to consolidate market position | Reduces the number of direct competitors. |

SSubstitutes Threaten

The threat of substitutes for Cabot Corporation's products, particularly its specialty carbons and performance materials, is a significant factor. This threat emerges when other materials or technologies can perform the same core function as Cabot's offerings, even if they are chemically distinct. For instance, in the tire industry, where Cabot is a major supplier of reinforcing carbons, other types of fillers or even advanced rubber compounds could potentially reduce the reliance on carbon black. Similarly, in coatings and plastics, alternative opacifiers or performance additives might present a substitute for Cabot's specialty carbons.

Customers will readily shift to substitute products or services if they present a more attractive price-performance balance. For instance, in the smartphone market, a device priced at $400 offering 80% of the performance of a $1000 flagship model might capture a significant segment of budget-conscious consumers. Conversely, premium substitutes, even at a higher cost, can attract users prioritizing cutting-edge features and superior capabilities, potentially commanding a price premium if the added performance justifies it.

Customer willingness to switch to substitutes is a significant factor in assessing the threat of substitutes. If customers find it easy and cost-effective to switch, the threat is higher. For instance, in the smartphone market, the relatively low switching costs and the rapid evolution of technology mean consumers are quite willing to adopt new brands or operating systems if offered compelling features or pricing.

The maturity of substitute technology plays a key role. For example, the increasing efficiency and decreasing cost of solar energy have made it a more viable substitute for traditional electricity sources. In 2023, global solar capacity additions reached a record high, demonstrating a growing customer willingness to adopt this substitute technology, driven by environmental concerns and falling prices.

Re-qualification processes and perceived risks also influence switching. In industries like aerospace or pharmaceuticals, the rigorous testing and regulatory hurdles for new materials or components make switching a slow and costly process. This significantly lowers the threat of substitutes, as companies are less likely to risk established safety and performance standards for unproven alternatives.

Technological Advancements and Innovation

Technological advancements continuously introduce potential substitutes that could challenge Cabot's established product lines. Ongoing research and development in materials science, for instance, might yield breakthrough alternatives that offer superior cost-effectiveness, enhanced performance, or a reduced environmental footprint. This presents a significant threat, as such innovations could rapidly disrupt existing markets for Cabot's offerings.

Consider the rapid evolution in advanced polymers and composite materials. In 2024, the global advanced composites market was valued at approximately $25 billion, with a projected compound annual growth rate (CAGR) of over 6% through 2030. This growth is largely driven by innovation in material properties and manufacturing processes, directly creating potential substitutes for traditional materials used in various industries that Cabot serves.

- Emerging Materials: Development of novel materials with comparable or superior properties at lower costs.

- Sustainability Focus: Rise of bio-based or recycled materials offering environmental advantages.

- Technological Obsolescence: Existing product lines becoming outdated due to new, more efficient technologies.

- Performance Enhancements: Substitutes offering significant improvements in durability, weight, or functionality.

Regulatory and Environmental Pressures

Increasing environmental regulations and sustainability mandates are a significant threat. For instance, the European Union's Green Deal initiatives are pushing industries to adopt greener materials, potentially substituting traditional chemical products. This trend is evident in the automotive sector, where there's a growing demand for bio-based plastics and recycled materials, even if their initial performance characteristics differ from conventional options.

These pressures can accelerate the development and adoption of alternative materials. By 2024, global investment in sustainable materials research and development is projected to reach new heights, driven by both consumer demand and regulatory compliance. Companies that fail to adapt may find their existing product lines becoming obsolete as greener substitutes gain market traction.

Consider the impact on the chemical industry:

- Growing demand for biodegradable polymers: Replacing petroleum-based plastics with alternatives derived from corn starch or algae.

- Stricter emissions standards: Forcing manufacturers to use less volatile organic compounds (VOCs) in paints and coatings.

- Circular economy initiatives: Encouraging the use of recycled content in manufacturing processes.

- Water usage restrictions: Driving innovation in water-efficient chemical processes and products.

The threat of substitutes arises when alternative products or technologies can fulfill the same customer needs, potentially impacting demand for Cabot's offerings. This is particularly relevant in markets where performance and cost-effectiveness are key drivers for customer choice.

Customers will switch to substitutes if they offer a better price-performance ratio. For example, in the tire industry, advancements in filler materials or tire compound technology could reduce the need for traditional carbon black, impacting Cabot's market share.

The ease and cost of switching are critical. If switching to a substitute is simple and inexpensive, the threat is amplified. Conversely, high switching costs, often due to rigorous testing or regulatory requirements in sectors like aerospace, can significantly mitigate this threat.

Technological advancements are continuously introducing new substitutes. For instance, the global advanced composites market, valued at approximately $25 billion in 2024, is growing due to innovations that offer alternatives to traditional materials used across various industries.

| Industry Segment | Cabot Product Example | Potential Substitute | Key Driving Factor for Substitute Adoption |

|---|---|---|---|

| Tires | Carbon Black | Silica, advanced polymer compounds | Improved fuel efficiency, reduced rolling resistance |

| Coatings | Specialty Carbons | Titanium Dioxide, alternative pigments | Cost reduction, specific performance enhancements (e.g., UV resistance) |

| Plastics | Performance Additives | Advanced polymers, bio-based materials | Sustainability, enhanced material properties |

Entrants Threaten

Establishing manufacturing facilities for specialty chemicals, such as carbon black or fumed silica, demands substantial capital. For instance, a new carbon black plant can cost upwards of $100 million to build, encompassing specialized reactors, material handling systems, and environmental controls.

This significant upfront investment, often running into hundreds of millions of dollars for state-of-the-art facilities, creates a formidable barrier. Newcomers must secure extensive financing and navigate complex regulatory approvals, making entry exceptionally challenging.

Existing players in the industry, such as Cabot, often possess significant economies of scale. This means they can produce goods or services at a lower cost per unit due to their large production volumes, bulk purchasing power, and established R&D infrastructure. For example, if Cabot's production costs are 15% lower than a potential new entrant's due to scale, it creates a substantial barrier.

New entrants would find it incredibly difficult to immediately replicate these cost efficiencies. They would likely face higher per-unit costs from the outset, making it challenging to compete on price with established, scaled-up competitors. This cost disadvantage can deter many potential new companies from even entering the market.

Cabot's substantial investment in research and development, evidenced by its robust patent portfolio covering specialized chemical formulations and advanced manufacturing processes, significantly deters new entrants. For instance, in 2023, Cabot reported R&D expenses of $314.7 million, highlighting the commitment required to innovate in this space. Aspiring competitors would need to either replicate this level of investment or incur substantial licensing fees, creating a formidable financial hurdle.

Established Distribution Channels and Customer Relationships

Established distribution channels and deep-rooted customer relationships represent a formidable barrier for potential new entrants. Companies that have spent years, even decades, building trust and forging strong, long-term connections with major industrial clients, such as those in the automotive or electronics sectors, possess a significant competitive advantage.

Newcomers would find it exceptionally difficult to penetrate these established networks and win over customers who are already satisfied with existing suppliers. For instance, in the semiconductor industry, where long lead times and rigorous qualification processes are standard, securing a place in a major automotive manufacturer's supply chain can take several years and considerable investment.

Consider the automotive sector's reliance on just-in-time delivery and stringent quality control. A new entrant would not only need to match the product quality and reliability of incumbents but also demonstrate the capacity to integrate seamlessly into complex, established supply chains. This integration often involves significant upfront investment in logistics, inventory management, and customer support infrastructure, making market entry exceedingly challenging.

The threat of new entrants is therefore significantly mitigated by:

- High switching costs for customers: Existing relationships often involve integrated systems and processes that make it costly and disruptive for customers to switch to a new supplier.

- Brand loyalty and reputation: Decades of reliable service and quality build strong brand loyalty, making it hard for new, unproven companies to gain traction.

- Exclusive supplier agreements: Many established players secure long-term, exclusive contracts with key customers, effectively locking out new competitors.

- Economies of scale in distribution: Incumbents often benefit from established, efficient distribution networks that new entrants cannot replicate without substantial investment.

Stringent Regulatory and Environmental Compliance

The chemical industry faces significant hurdles for new players due to stringent regulatory and environmental compliance. For instance, in 2024, the European Chemicals Agency (ECHA) continued to enforce REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, requiring extensive data submission and safety assessments for new substances, a process that can cost millions of euros per chemical.

Navigating these complex requirements acts as a substantial barrier to entry. New entrants must invest heavily in understanding and adhering to these mandates, which cover everything from manufacturing processes to product labeling and waste disposal. This upfront investment can deter potential competitors.

- High Compliance Costs: New chemical companies must budget for extensive testing and documentation to meet global standards.

- Evolving Regulations: Staying abreast of changing environmental and safety laws, such as those related to PFAS, adds ongoing expense and complexity.

- Capital Intensive Infrastructure: Building facilities that meet current environmental and safety standards requires significant capital outlay, often exceeding $100 million for a medium-sized plant.

- Risk of Non-Compliance Penalties: Failure to comply can result in hefty fines and operational shutdowns, further discouraging new entrants.

The threat of new entrants in the specialty chemicals sector, like that occupied by Cabot, is significantly diminished by substantial capital requirements for manufacturing, estimated at over $100 million for a new carbon black plant. This high initial investment, coupled with established players' economies of scale—where production costs can be 15% lower—creates a formidable barrier.

Furthermore, extensive R&D investments, exemplified by Cabot's $314.7 million in 2023 R&D spending and a robust patent portfolio, necessitate either comparable investment or costly licensing fees for newcomers. The difficulty in replicating established distribution networks and deep customer relationships, which can take years to build and involve complex qualification processes, also deters potential competitors.

Stringent regulatory compliance, such as adhering to REACH regulations which can cost millions per chemical, adds another layer of complexity and expense. These combined factors—high capital needs, economies of scale, R&D intensity, established relationships, and regulatory burdens—collectively create a high barrier to entry.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | Cost to establish manufacturing facilities. | New carbon black plant: >$100 million. |

| Economies of Scale | Cost advantage for large-volume producers. | Incumbents' production costs potentially 15% lower. |

| R&D Investment | Cost of innovation and patent protection. | Cabot's 2023 R&D expenses: $314.7 million. |

| Distribution & Relationships | Penetrating established supply chains and customer loyalty. | Years to secure place in automotive supply chains. |

| Regulatory Compliance | Costs associated with meeting environmental and safety standards. | REACH compliance: millions of euros per chemical. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from company annual reports, industry-specific market research, and government economic indicators to provide a comprehensive view of competitive pressures.