Cabot Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cabot Bundle

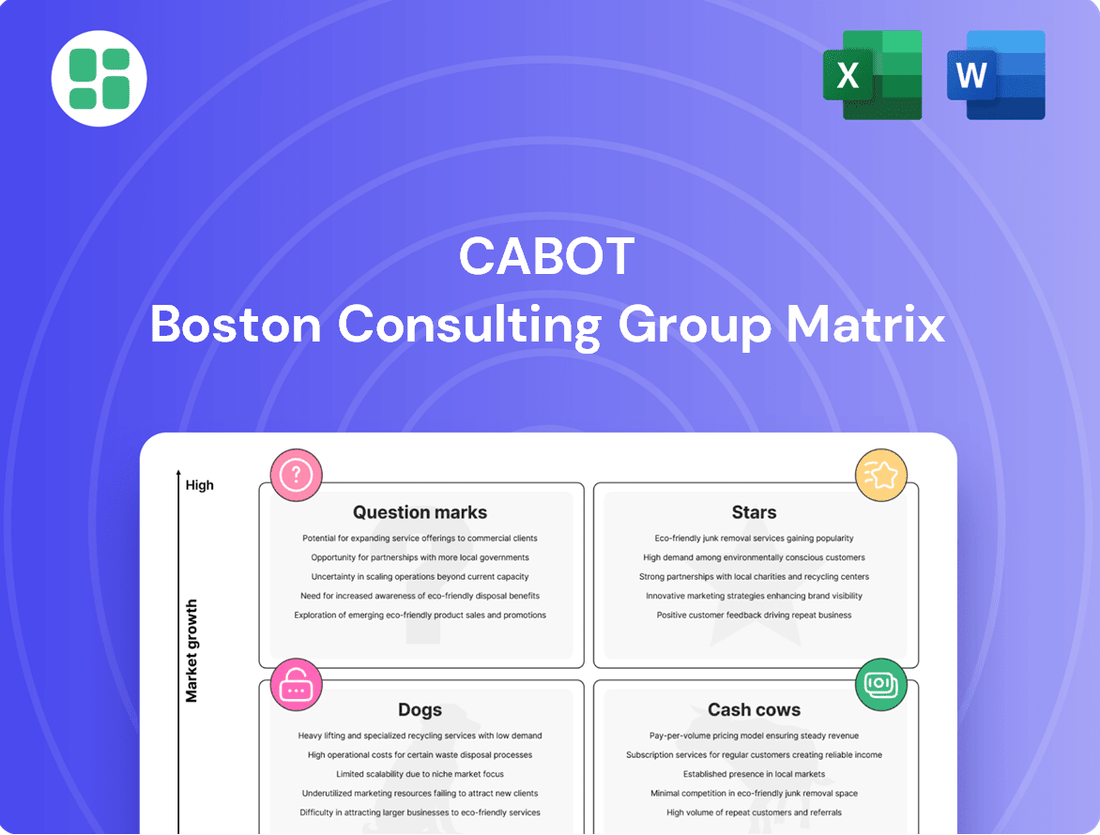

The BCG Matrix is a powerful tool for analyzing a company's product portfolio, categorizing offerings into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. Understanding these classifications is crucial for informed strategic decision-making.

This preview offers a glimpse into the strategic positioning of key products. To truly unlock the potential of your portfolio and guide your investment strategy with precision, dive into the complete BCG Matrix.

Purchase the full BCG Matrix now for a comprehensive breakdown of each quadrant, actionable insights, and a clear roadmap to optimizing your product mix for maximum profitability and growth.

Stars

Cabot's battery materials, including conductive additives and carbon nanotubes (CNTs), represent a booming segment for the company, attracting substantial investment. Through the first three quarters of fiscal year 2025, this division saw its contribution margin climb by 20%, a clear indicator of its success in meeting the surging demand from electric vehicles (EVs) and energy storage markets.

Further solidifying its position, Cabot secured a $50 million grant from the U.S. Department of Energy. This funding is earmarked for establishing the nation's inaugural commercial-scale facility dedicated to producing battery-grade CNTs and conductive additive dispersions, underscoring a strategic commitment to this rapidly evolving and high-potential market.

EVOLVE® Sustainable Solutions is Cabot's answer to the increasing need for eco-friendly materials, fitting squarely into the Stars category of the BCG matrix due to its high growth potential and strong market position in sustainability. This technology platform is all about Cabot's commitment to a greener future, producing sustainable reinforcing carbons and other performance materials that are ready for widespread use.

The core of EVOLVE® lies in its use of circular value chains and recycled materials, like tire pyrolysis oils. This approach directly addresses the market's growing appetite for environmentally conscious products. In 2024, the demand for sustainable materials in the automotive and industrial sectors continued to surge, with many manufacturers setting ambitious recycled content targets.

By championing these sustainable practices, Cabot is positioning itself as a frontrunner in reducing the carbon footprint of supply chains. This aligns perfectly with their broader 'Creating for Tomorrow' strategy, which is designed to drive growth by focusing on innovative and sustainable solutions. The company sees significant opportunities for advantaged growth in markets prioritizing decarbonization.

Cabot Corporation's Performance Chemicals segment, featuring fumed metal oxides crucial for semiconductor manufacturing, is a star performer. The segment's Earnings Before Interest and Taxes (EBIT) saw significant increases in both the second and third quarters of fiscal year 2025.

This impressive growth is directly tied to escalating demand for fumed metal oxides in semiconductor applications. The semiconductor industry's robust expansion in 2024 and projected continued growth into 2025 creates a powerful market opportunity for Cabot's specialized materials, positioning them as a key player in a high-growth sector.

Specialty Carbons for Advanced Electronics

Cabot's specialty carbons are pivotal for advanced electronics, extending beyond general battery materials. These advanced materials are crucial for the development of next-generation electronic devices, positioning Cabot as a leader in a rapidly expanding, high-value market. The company's ongoing advancements within its Performance Chemicals division are designed to unlock new revenue opportunities and solidify its competitive advantage in these niche sectors.

In 2024, the market for advanced electronic materials, including specialty carbons, saw significant growth driven by demand for faster, more efficient devices. Cabot's focus on innovation in this area is reflected in its investment in research and development, aiming to capture a larger share of this lucrative market.

- Enabling Next-Generation Devices Cabot's specialty carbons are integral to the performance of advanced semiconductors and display technologies.

- High-Growth Market Focus The company is strategically targeting the burgeoning market for advanced electronic components, where material innovation is key.

- Performance Chemicals Segment Growth In the first half of fiscal year 2024, Cabot's Performance Chemicals segment reported a notable increase in revenue, partly driven by demand from specialty electronics applications.

- Competitive Edge Through R&D Continuous investment in research and development ensures Cabot remains at the forefront of material science for advanced electronics.

Fumed Silica for Alternative Energy (Wind Turbine Blades)

Cabot's fumed silica plays a vital role in the booming alternative energy sector, specifically in the production of wind turbine blades. This material is a key component in the adhesives that bond these massive structures together, ensuring their durability and performance. The demand for this application is directly tied to the global push for renewable energy sources.

The growth trajectory for Cabot's fumed silica in wind turbine blade manufacturing is impressive, reflecting broader market trends. For instance, through fiscal year 2025, Cabot reported an 8% increase in volumes for this specific application. This surge highlights the company's robust market position and its ability to capitalize on the expanding renewable energy landscape.

- Key Application: Fumed silica is a critical ingredient in adhesives used for wind turbine blade assembly.

- Market Driver: Global investment in alternative energy generation fuels demand for this fumed silica application.

- Performance Metric: Cabot experienced an 8% volume increase in this segment through fiscal year 2025.

- Sector Significance: This growth underscores Cabot's strong presence and expansion within the renewable energy market.

Cabot's EVOLVE® Sustainable Solutions and its specialty carbons for advanced electronics are prime examples of Stars in the BCG matrix. These segments exhibit high growth and strong market positions, driven by increasing demand for sustainable materials and next-generation electronic components. The company's strategic investments and technological advancements in these areas are positioning it for continued success.

| Product/Technology | Market Growth | Cabot's Market Share | Strategic Importance |

| EVOLVE® Sustainable Solutions | High | Growing | Addresses demand for eco-friendly materials, circular economy focus. |

| Specialty Carbons (Advanced Electronics) | High | Strong | Enables next-generation devices, critical for semiconductor and display tech. |

| Fumed Silica (Wind Turbine Blades) | High | Strong | Supports renewable energy growth, key in adhesives for durability. |

What is included in the product

The Cabot BCG Matrix categorizes business units based on market share and growth, guiding investment decisions.

Eliminate strategic guesswork by clearly visualizing your portfolio, turning complex data into actionable insights.

Cash Cows

Reinforcing carbons, a core component in conventional tire manufacturing, represent a significant and stable revenue stream for Cabot. The company maintains a leading market position in this segment, which consistently generates substantial cash flow.

While Q3 fiscal year 2025 saw some volume shifts due to macroeconomic conditions, the overall market for reinforcing carbons is mature and predictable. Cabot's high market share and strong, long-standing customer relationships ensure a reliable cash flow from this business. The recent acquisition of Bridgestone's carbon black plant in Mexico is a strategic move that further solidifies Cabot's dominance in this essential market.

Cabot's standard carbon black for general industrial products represents a classic Cash Cow. This segment, extending beyond tires to include mechanical rubber goods and industrial coatings, benefits from established demand in mature markets.

The reliable cash flow generated by these applications is a testament to its foundational role across various industries. While growth is modest, the consistent demand ensures a steady stream of revenue for Cabot.

Cabot's hydrophilic fumed silica for established coatings and adhesives represents a classic Cash Cow within the BCG framework. This segment benefits from widespread adoption in mature industries like paints and coatings, where its thickening and anti-settling properties are highly valued.

The market for these applications, while experiencing a respectable CAGR of approximately 5.4% as of 2024, is considered well-established. Cabot's deep customer relationships and robust technical support in this area translate into strong profitability and reliable cash flow generation.

Masterbatches and Conductive Compounds for Traditional Plastics

Cabot's masterbatches and conductive compounds for traditional plastics represent a cornerstone of their business, fitting squarely into the Cash Cow quadrant of the BCG Matrix. These products are integral to a wide array of established plastic applications, a testament to Cabot's deep-rooted presence and significant market share in these mature segments. The consistent and predictable demand from these foundational industries provides a stable and substantial stream of cash flow for the company, underpinning its financial strength.

The reliability of these offerings is crucial. For instance, in 2024, the global masterbatch market was valued at approximately $45 billion, with traditional plastics forming a substantial portion of this. Cabot's established position within this market, often characterized by high barriers to entry due to technical expertise and long-standing customer relationships, allows them to generate consistent profits with relatively low investment needs. This stability is a key indicator of a Cash Cow, where the business unit generates more cash than it consumes.

- Established Market Position: Cabot holds a significant market share in traditional plastics, benefiting from decades of experience and trust.

- Stable Demand: Foundational plastic applications provide a consistent, predictable revenue stream, crucial for cash flow generation.

- Profitability: The mature nature of these markets allows for efficient operations and strong profit margins, contributing significantly to overall company earnings.

- Low Investment Needs: As mature products, these segments require minimal reinvestment to maintain their market position, freeing up capital for other strategic initiatives.

Certain Fumed Metal Oxides for Mature Industrial Applications

Certain fumed metal oxides are key to Cabot's Performance Chemicals segment, acting as cash cows. While some fumed metal oxides target fast-growing sectors like semiconductors, a significant portion of this product line is dedicated to mature industrial applications. These established uses, separate from high-growth markets, ensure steady demand and bolster the segment's consistent profitability.

Cabot's strong operational efficiency and deep-rooted market presence in these mature industrial sectors are crucial for maintaining robust cash flow. For instance, in 2024, the global market for fumed silica, a primary fumed metal oxide, was projected to reach approximately $3.5 billion, with mature applications like coatings and adhesives representing a substantial share of this value.

- Mature Industrial Applications: These include uses in coatings, adhesives, sealants, and construction materials, providing a stable revenue base.

- Consistent Profitability: The mature nature of these applications allows for predictable demand and pricing, contributing to reliable cash generation.

- Operational Efficiency: Cabot leverages its established manufacturing processes and supply chains to ensure cost-effective production in these segments.

- Market Presence: A long-standing reputation and strong customer relationships in these industrial sectors solidify Cabot's position and cash flow generation.

Cabot's reinforcing carbons and hydrophilic fumed silica for established coatings and adhesives exemplify Cash Cows. These segments benefit from mature markets with consistent demand, ensuring stable revenue streams and strong profitability for Cabot. The company's leading market positions and deep customer relationships in these areas underscore their reliable cash flow generation, requiring minimal reinvestment.

| Product Segment | BCG Category | Key Characteristics | 2024 Market Insight |

|---|---|---|---|

| Reinforcing Carbons (Tires) | Cash Cow | Mature market, high market share, stable demand, significant cash flow | Global carbon black market valued at ~$20 billion in 2024, with tires being a primary driver. |

| Hydrophilic Fumed Silica (Coatings/Adhesives) | Cash Cow | Established applications, steady growth (approx. 5.4% CAGR), strong customer relationships, reliable profitability | Global fumed silica market projected to reach ~$3.5 billion in 2024, with coatings and adhesives representing a large share. |

Preview = Final Product

Cabot BCG Matrix

The preview you see is the exact, fully formatted Cabot BCG Matrix report you will receive upon purchase. This comprehensive document, designed by strategic planning experts, is ready for immediate use in your business analysis and decision-making processes.

Dogs

Certain commodity-grade carbon blacks in niche industrial markets, lacking growth drivers like electrification or sustainability, might be categorized here. These products likely face tough price competition and diminishing demand due to industry shifts or outdated technology.

While Cabot doesn't explicitly label these, such sub-segments within their Reinforcement Materials could be showing weaker performance. For instance, if a particular industrial application for carbon black, like in certain older tire technologies, is seeing a significant decline, its market share and profitability would likely be impacted.

The global carbon black market, valued at approximately $16.5 billion in 2023, is projected to grow at a CAGR of around 4.5% through 2030, but this growth is heavily driven by tire and specialty applications. Niche, declining segments would fall outside this positive trend, potentially experiencing negative growth rates.

Within Cabot's diverse chemical offerings, certain legacy products might see reduced R&D focus. This often happens when these items are in mature, slow-growth markets, contributing minimally to the company's expansion. For instance, a product line established decades ago, facing intense competition from newer materials, could fall into this category.

These products are typically maintained for their existing customer base or to ensure smooth operations within integrated manufacturing processes. While they might not be growth drivers, their continued availability can be crucial for customer loyalty and operational stability. Their contribution to overall revenue might be modest, but they serve a purpose in the broader portfolio.

Products in regions experiencing prolonged economic contraction or facing trade barriers can be categorized as Dogs within the BCG Matrix. For instance, Reinforcement Materials in certain Asia Pacific and Americas markets faced significant headwinds in 2024 due to tariffs and a generally weaker macroeconomic climate.

This persistent economic weakness led to sustained low volumes and less favorable pricing for these product lines in their respective localized markets. Such conditions indicate a struggle to either gain or maintain market share, a hallmark of Dog products.

Older Generation Chemical Additives in Phasing-Out Technologies

As industries advance, older generation chemical additives tied to phasing-out technologies often see a decline in demand. Cabot, with its extensive history, may possess legacy products that no longer fit contemporary industrial needs or advanced material specifications. These are typically characterized by low market share and limited growth potential.

These legacy additives, while once vital, now represent a smaller portion of the market. For instance, consider additives for older plastics manufacturing that are being replaced by newer, more sustainable alternatives. In 2023, the global market for specialty chemicals saw significant growth, but segments catering to obsolete technologies experienced stagnation.

- Declining Demand: Additives for technologies like older PVC formulations are seeing reduced uptake as newer materials gain prominence.

- Low Market Share: These legacy products often represent less than 5% of a company's total product portfolio in terms of revenue.

- Minimal Growth Prospects: The market for these additives is projected to contract by an average of 2-3% annually over the next five years.

- Strategic Divestment: Companies like Cabot may consider divesting or discontinuing these products to focus resources on higher-growth areas.

Less Specialized Aerogel Applications in Saturated or Commoditized Markets

While aerogel technology offers exciting growth avenues, some early-stage or less specialized aerogel products might find themselves in markets that have become quite crowded or where prices are already very low. In these situations, Cabot's presence might be modest, facing stiff competition. This could mean slower growth and tighter profit margins for these particular aerogel offerings.

For instance, if an aerogel product is used as a general insulator in a market where many other effective and cheaper insulation materials already exist, Cabot's market share could be minimal. The intense competition in such commoditized sectors often makes it difficult to gain significant traction or command premium pricing, even with the inherent benefits of aerogel. This necessitates a careful review of the strategic direction for these products.

- Market Saturation: Identifying aerogel applications where demand has plateaued due to the availability of numerous alternatives.

- Low Market Share: Assessing instances where Cabot's competitive position in a specific aerogel segment is weak.

- Intense Competition: Analyzing markets where numerous players offer similar or substitute products, driving down prices.

- Strategic Re-evaluation: Considering divestment, repositioning, or significant innovation for aerogel products in commoditized markets.

Products categorized as Dogs within Cabot's portfolio are those with low market share and low growth prospects. These often include legacy products in mature or declining industries, or those facing intense competition in commoditized markets. For instance, certain industrial carbon blacks for older tire technologies or additives for obsolete plastics manufacturing would fit this description.

These segments contribute minimally to overall revenue and often see reduced R&D focus. Their continued production is usually for existing customer bases or to maintain operational continuity rather than for expansion. In 2024, some of Cabot's Reinforcement Materials in specific Asia Pacific and Americas markets experienced sustained low volumes due to macroeconomic headwinds and trade barriers, indicative of Dog status.

The strategic approach for such products typically involves careful management, potential divestment, or a focus on niche, high-margin applications if possible. The global carbon black market, while growing, shows that segments outside of tire and specialty applications may be stagnant or declining, highlighting the potential for Dog classifications within those areas.

Cabot's portfolio may also contain older generation chemical additives tied to phasing-out technologies, which have low market share and limited growth potential. These legacy additives represent a smaller portion of the market, with segments catering to obsolete technologies experiencing stagnation, as seen in 2023 specialty chemical market trends.

Question Marks

Cabot's exploration into new frontier battery materials, like solid-state electrolytes or advanced cathode/anode technologies, positions them in potential future high-growth markets. These emerging chemistries, while not yet dominant, represent the next wave of energy storage innovation beyond current lithium-ion dominance.

Currently, Cabot's market share in these nascent battery material sectors is likely negligible, reflecting their early-stage development or limited commercialization. Significant capital expenditure will be essential to scale production and capture substantial market share, transforming these into potential future Stars in their portfolio.

The broader inkjet colorants market is experiencing robust growth, projected at a 6% compound annual growth rate. However, truly advanced applications such as printed electronics, 3D printing, and novel textile printing are carving out distinct, high-growth niches within this market.

Within these specialized emerging fields, Cabot likely holds a relatively low market share at present. These areas represent new frontiers for inkjet technology, and establishing a significant presence requires dedicated focus and investment.

Capturing substantial market share in these advanced sectors necessitates significant investment in both research and development (R&D) and targeted marketing efforts. Companies like Cabot must innovate and build brand recognition to compete effectively in these evolving digital printing landscapes.

Highly specialized fumed silica for biomedical and pharmaceutical applications represents a burgeoning, high-margin segment within the broader fumed silica market. This niche is characterized by stringent purity standards and specific performance attributes, crucial for applications like drug delivery systems and excipients. The global fumed silica market was valued at approximately $3.3 billion in 2023 and is projected to reach around $5.1 billion by 2030, with specialized segments showing even faster growth.

While Cabot Corporation is a significant player in the overall fumed silica market, its market share within these highly specialized biomedical and pharmaceutical sub-segments might be relatively smaller. Penetrating these regulated areas requires substantial investment in research and development, as well as navigating complex approval processes. However, the potential for high returns and market leadership in these emerging applications makes them attractive targets for strategic growth.

Novel Aerogel Applications for Sustainable Building and Construction

Cabot's aerogel technology shows promise beyond conventional insulation, potentially entering high-growth markets like advanced composites and eco-daylighting systems. These areas align with the increasing demand for sustainable building solutions. For instance, the global green building materials market was valued at approximately $270 billion in 2023 and is projected to reach over $400 billion by 2027, indicating significant expansion opportunities.

While Cabot's market share in these novel applications might currently be small, strategic investment could foster scalability. Developing aerogel-enhanced facade panels or transparent aerogel for natural lighting could capture a segment of this expanding market. The company's focus on these niche, but rapidly growing, segments positions them for future market penetration.

- Emerging Markets: Exploration into advanced composites and eco-daylighting systems.

- Market Growth: Driven by a strong global green building trend.

- Strategic Investment: Necessary to scale market share in nascent applications.

- Potential: Capturing segments of a market projected for substantial growth.

Early-stage 'EVOLVE® Sustainable Solutions' Products with Limited Scale

Early-stage EVOLVE® Sustainable Solutions products, despite being part of a high-growth market, might initially exhibit limited market share. These nascent offerings, needing substantial investment to scale production and build customer awareness, are categorized as Question Marks within the BCG framework. For instance, a new biodegradable packaging solution from EVOLVE®, launched in 2024, might be targeting the rapidly expanding sustainable packaging sector, which is projected to grow by over 7% annually through 2030.

These products require significant capital infusion to overcome initial hurdles and transition into Stars. The focus is on market penetration and establishing a strong foothold. For example, in 2024, the global market for sustainable chemicals, a key area for EVOLVE®, reached an estimated $190 billion, presenting a clear growth opportunity but also intense competition for new entrants.

- Low Market Share: New EVOLVE® sustainable products often begin with a small percentage of the total market.

- High Market Growth: They operate within rapidly expanding sectors, such as renewable energy components or eco-friendly materials.

- High Investment Needs: Significant funding is necessary for R&D, manufacturing capacity, and marketing to gain traction.

- Strategic Decision: Companies must decide whether to invest heavily to turn them into Stars or divest if they show little promise.

Question Marks in Cabot's portfolio represent areas with high growth potential but currently low market share. These are typically new products or technologies that require substantial investment to gain traction and become market leaders. The company must carefully evaluate which of these to nurture into Stars and which to potentially divest.

For instance, Cabot's venture into advanced battery materials, such as solid-state electrolytes, falls into this category. While the electric vehicle battery market is projected for significant expansion, Cabot's current share in these specific next-generation materials is likely minimal. Similarly, their specialized fumed silica for biomedical applications, though in a high-margin niche, requires significant R&D and regulatory navigation to build market presence.

The success of these Question Marks hinges on strategic investment in innovation, production scaling, and market development. Without this commitment, they risk remaining underdeveloped opportunities. For example, the global market for advanced battery materials alone was estimated to be worth over $60 billion in 2024 and is expected to see a compound annual growth rate exceeding 15% through 2030.

| Business Unit / Product Area | Market Growth Rate | Market Share | Investment Recommendation |

|---|---|---|---|

| Advanced Battery Materials (e.g., Solid-State Electrolytes) | High | Low | Invest |

| Specialized Fumed Silica (Biomedical) | High | Low | Invest |

| Aerogel for Advanced Composites | High | Low | Invest |

| EVOLVE® Sustainable Solutions (New Products) | High | Low | Invest/Divest (Evaluate) |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial statements, market share reports, and industry growth projections, to provide an accurate strategic overview.