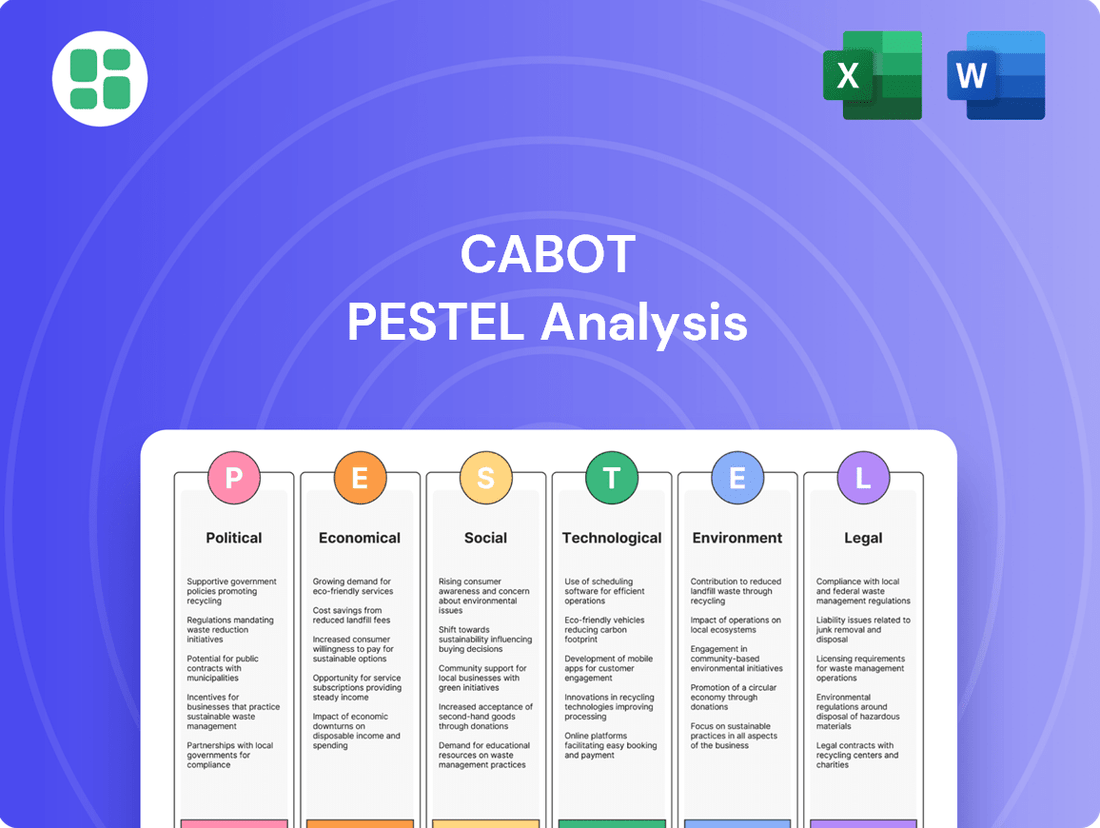

Cabot PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cabot Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Cabot's trajectory. This comprehensive PESTLE analysis provides the strategic foresight needed to navigate complex market dynamics and identify emerging opportunities. Empower your decision-making with actionable intelligence—download the full report now.

Political factors

Cabot Corporation, a global leader in specialty chemicals and performance materials, navigates a complex landscape shaped by international trade policies and tariffs. Fluctuations in these policies directly influence the cost of raw materials essential for Cabot's production processes, as well as the market competitiveness of its diverse product portfolio across various global regions.

The ongoing uncertainty surrounding trade agreements and the potential for new tariffs have demonstrably impacted customer demand. Specifically, recent data indicates that these trade-related uncertainties have led to reduced order volumes, particularly within Cabot's Reinforcement Materials and Performance Chemicals segments, highlighting the sensitivity of these sectors to global trade dynamics.

Government regulations on emissions and chemicals significantly shape Cabot's operational landscape and strategic investments. Stricter environmental standards, like those aimed at reducing greenhouse gas emissions, can require substantial capital expenditure for facility upgrades or the adoption of cleaner technologies. For instance, the ongoing push for decarbonization across industries, driven by agreements like the Paris Climate Agreement, directly impacts Cabot's long-term planning for its manufacturing processes.

New regulations concerning chemical production and product safety can also necessitate costly adjustments to product formulations or manufacturing processes. Cabot's commitment to aligning with global sustainability goals, including achieving net-zero emissions by 2050, means proactively adapting to evolving regulatory frameworks. This proactive approach is crucial for maintaining market access and investor confidence in a world increasingly focused on environmental stewardship.

Cabot's operational continuity hinges on the political stability of its key regions. For instance, in 2024, the ongoing geopolitical tensions in Eastern Europe, a significant sourcing area for certain chemical precursors, have continued to pose risks to supply chain reliability and cost management, impacting input prices for Cabot's specialty chemicals.

Geopolitical conflicts can directly disrupt production and transportation networks. Cabot's diversified manufacturing footprint, with facilities in North America, Europe, and Asia, aims to buffer against localized instability, but widespread regional unrest, as seen in some parts of the Middle East impacting shipping routes in late 2024, can still introduce significant cost volatility and logistical challenges.

Industrial Policy and Subsidies

Government industrial policies, particularly those focused on subsidies, can significantly shape the landscape for companies like Cabot. For instance, policies promoting electric vehicles (EVs) and sustainable manufacturing directly influence demand for battery materials. In 2024, the U.S. Inflation Reduction Act (IRA) continued to offer substantial tax credits for EV purchases and domestic battery production, potentially benefiting Cabot's advanced materials segment.

These supportive measures create opportunities by stimulating market growth for green technologies. Cabot's focus on battery materials aligns well with global efforts to decarbonize transportation and energy storage. For example, the European Union's Green Deal aims to accelerate the transition to climate neutrality, which includes significant investment in renewable energy and sustainable industries, indirectly bolstering demand for Cabot's products.

However, such policies can also introduce complexities. Trade policies and incentives favoring domestic production in key markets might pose challenges for global market access or necessitate adjustments in Cabot's supply chain and manufacturing strategies. As of early 2025, several nations are reviewing their industrial policies to bolster domestic manufacturing capabilities, which could alter competitive dynamics.

- EV Subsidies: U.S. EV tax credits, extended through 2024 and potentially beyond, directly support demand for battery components.

- Green Technology Investment: The EU's Green Deal and similar initiatives globally are driving investment in sustainable manufacturing, benefiting companies like Cabot.

- Domestic Production Incentives: Policies favoring local manufacturing in countries like China or India could impact Cabot's international market penetration and operational strategies.

International Relations and Alliances

Cabot's international operations are significantly shaped by global political relationships and alliances. For instance, the ongoing trade discussions between the United States and China, key markets for Cabot, directly impact supply chain stability and market access. As of early 2025, tariffs and trade agreements continue to be a focal point, influencing the cost of raw materials and the competitiveness of finished goods.

Positive diplomatic ties can unlock new investment avenues and streamline cross-border transactions, crucial for Cabot's expansion plans. Conversely, geopolitical tensions, such as those in Eastern Europe impacting energy markets, can create unforeseen operational challenges and necessitate contingency planning for Cabot's diverse global workforce and assets.

- Trade Agreements: The status of agreements like the USMCA (United States-Mexico-Canada Agreement) and potential new trade pacts in Asia influence market entry costs and regulatory environments for Cabot's products.

- Geopolitical Stability: Political stability in regions where Cabot sources materials or has manufacturing facilities, such as Southeast Asia, directly affects operational continuity and investment risk.

- International Sanctions: Evolving sanctions regimes against certain countries can restrict Cabot's ability to conduct business or source specific components, requiring constant monitoring and adaptation.

- Diplomatic Relations: The overall health of international diplomatic relations, particularly between major economic blocs, impacts the ease of global logistics and the perception of market risk for investors in Cabot.

Government stability and policy continuity are paramount for Cabot's long-term strategic planning and investment decisions. For instance, the 2024 U.S. election cycle introduced a degree of policy uncertainty, particularly concerning trade and environmental regulations, which analysts monitored closely for potential impacts on chemical industry investments.

Shifting political landscapes can directly affect market access and operational costs. For example, changes in import/export policies or the imposition of new tariffs in key markets like China or India, as debated throughout 2024 and into early 2025, can alter the competitive positioning of Cabot's specialty materials.

Furthermore, government support for specific industries, such as the burgeoning battery materials sector, presents both opportunities and challenges. While initiatives like the EU's Critical Raw Materials Act aim to bolster domestic supply chains, they can also lead to increased competition or shifts in sourcing strategies for companies like Cabot.

The ongoing global focus on sustainability and climate action, driven by international agreements and national policies, continues to shape regulatory frameworks. Cabot's commitment to reducing its environmental footprint, including investments in cleaner production technologies, is a direct response to these evolving political pressures and opportunities, with many nations setting more ambitious emissions targets for 2030 and beyond.

| Political Factor | Impact on Cabot | 2024/2025 Relevance |

|---|---|---|

| Trade Policy & Tariffs | Affects raw material costs and product competitiveness. | Ongoing U.S.-China trade discussions and potential new tariffs in various regions. |

| Environmental Regulations | Drives investment in cleaner technologies and sustainable practices. | Stricter emissions standards and net-zero targets globally, influencing operational upgrades. |

| Industrial Policy (e.g., EV subsidies) | Stimulates demand for battery materials and advanced chemicals. | U.S. Inflation Reduction Act (IRA) benefits and EU Green Deal investments. |

| Geopolitical Stability | Impacts supply chain reliability and operational continuity. | Tensions in Eastern Europe affecting precursor sourcing; Middle East shipping route disruptions. |

| Political Stability & Elections | Creates policy uncertainty and influences market access. | Monitoring of election cycles in key markets for potential policy shifts. |

What is included in the product

The Cabot PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operating landscape.

This comprehensive evaluation provides actionable insights to identify strategic opportunities and mitigate potential risks for Cabot.

The Cabot PESTLE Analysis offers a structured framework that alleviates the pain of navigating complex external factors by providing a clear, organized overview for strategic decision-making.

Economic factors

Cabot Corporation's performance is intrinsically linked to global economic expansion, especially within key sectors such as automotive, construction, and electronics. For instance, in the first quarter of fiscal year 2024, Cabot reported that challenging macroeconomic conditions continued to dampen demand in several of its end markets.

The company's financial health directly mirrors these global economic fluctuations. A prevailing weaker macroeconomic climate, coupled with persistent uncertainty, has translated into diminished customer demand and lower sales volumes across certain Cabot business segments. This was evident in their fiscal year 2023 results, where revenue saw a decline compared to the prior year, largely attributed to these broader economic headwinds.

Fluctuations in the cost and supply of essential raw materials like oil and natural gas directly affect Cabot's manufacturing expenses. For instance, in early 2024, crude oil prices saw considerable volatility, impacting the petrochemical feedstocks crucial for carbon black production.

Cabot has faced increasing inflationary pressures on various operational fronts, including labor, equipment upkeep, and broader supply chain expenses. This has led the company to implement price adjustments for its carbon black offerings to offset these rising costs, a strategy evident throughout 2023 and continuing into 2024.

Cabot, as a global entity, faces the inherent risk of currency exchange rate fluctuations. These shifts directly impact its financial performance by altering the value of revenues earned and costs incurred in foreign currencies when translated back into its primary reporting currency.

For instance, if the US dollar strengthens against other major currencies, Cabot's foreign earnings would translate into fewer dollars, potentially reducing reported revenue and profits. Conversely, a weaker dollar could boost these translated figures.

In 2024, the US dollar experienced volatility against key trading partners. The Euro, for example, saw fluctuations, and while specific impacts on Cabot require detailed analysis, a general strengthening of the dollar in certain periods would have presented a headwind for companies with significant European operations.

Inflation and Interest Rates

Inflation continues to be a significant factor, with the US Consumer Price Index (CPI) showing a 3.3% annual increase as of May 2024, a slight moderation from earlier peaks. This persistent inflation directly translates to higher operating expenses for companies like Cabot, impacting everything from raw material sourcing to employee wages and essential maintenance. These increased costs can put a strain on profit margins if not effectively managed.

The Federal Reserve's monetary policy, in response to inflation, has kept interest rates elevated. The federal funds rate target range remained at 5.25%-5.50% through mid-2024. This higher interest rate environment makes borrowing more expensive for businesses looking to finance capital expenditures or pursue expansion initiatives. For Cabot, this could mean increased costs for new equipment, facility upgrades, or strategic acquisitions, potentially limiting financial maneuverability.

Cabot has actively managed these economic headwinds by implementing strategic price adjustments across its product portfolio. These adjustments are designed to offset the rising costs associated with inflation, ensuring the company can maintain its profitability while continuing to invest in its operations and product development. The company’s ability to pass on some of these increased costs is crucial for its financial health in the current economic climate.

- Inflationary Impact: US CPI at 3.3% (May 2024) increases operating costs for Cabot.

- Interest Rate Environment: Federal funds rate at 5.25%-5.50% raises borrowing costs for capital projects.

- Pricing Strategy: Cabot has adjusted product prices to mitigate inflationary pressures.

Industry-Specific Market Trends

Cabot's performance is significantly shaped by demand within its specific end-markets. For instance, the tire industry's need for reinforcement materials directly impacts this segment. Conversely, the burgeoning battery materials market, fueled by electric vehicles and energy storage, presents a strong growth avenue.

The Reinforcement Materials segment experienced volume declines in recent periods, largely attributed to a slowdown in tire production. This highlights the sensitivity of this business to broader automotive market trends. However, the battery materials segment is exhibiting robust expansion, demonstrating the positive impact of the global shift towards electrification.

Key industry-specific trends influencing Cabot include:

- Tire Industry Demand: Reduced global tire production volumes, a key driver for reinforcement materials, have presented headwinds.

- EV Battery Materials Growth: The exponential rise in electric vehicle adoption is a significant tailwind for Cabot's battery materials segment, with projected strong growth continuing through 2025.

- Energy Storage Solutions: Beyond EVs, the increasing demand for grid-scale energy storage further bolsters the market for battery materials.

Global economic expansion directly influences Cabot's key markets like automotive and construction. However, challenging macroeconomic conditions in early 2024 led to dampened demand, impacting sales volumes and revenue, as seen in fiscal year 2023 results.

Inflationary pressures, with US CPI at 3.3% in May 2024, increase Cabot's operating costs, while elevated interest rates (Federal funds rate 5.25%-5.50%) raise borrowing expenses for capital projects. Cabot has responded by implementing strategic price adjustments to offset these rising costs.

Demand in Cabot's end-markets varies significantly; while tire industry slowdowns affected reinforcement materials, the booming EV battery materials sector presents a strong growth opportunity, driven by electrification trends.

| Economic Factor | Data Point | Impact on Cabot |

| US CPI (May 2024) | 3.3% annual increase | Increased operating costs (labor, materials) |

| Federal Funds Rate (mid-2024) | 5.25%-5.50% | Higher borrowing costs for capital expenditures |

| Currency Exchange Rates | USD volatility vs. EUR | Potential impact on foreign earnings translation |

Same Document Delivered

Cabot PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Cabot PESTLE Analysis provides a comprehensive overview of the external factors impacting the company. Gain valuable insights into the political, economic, social, technological, legal, and environmental landscape affecting Cabot.

Sociological factors

Consumers increasingly favor sustainable and eco-friendly products, a shift directly impacting demand for Cabot's offerings. This growing preference compels the company to innovate, focusing on products that utilize circular economy principles and responsibly sourced, certified materials.

Cabot's EVOLVE® Sustainable Solutions platform exemplifies this strategic pivot, designed to meet the rising market appetite for greener alternatives. For instance, in 2024, the company highlighted its progress in developing bio-based carbon black, a key component in tires and other rubber goods, aiming to reduce reliance on fossil fuels.

Cabot Corporation's access to a skilled workforce and effective management of labor relations across its diverse global operations are critical sociological considerations. The availability and cost of labor directly influence manufacturing efficiency and the feasibility of expansion initiatives, impacting the company's operational agility and cost structure.

In 2023, Cabot reported a total employee count of approximately 4,500 individuals worldwide, underscoring the significance of managing this human capital effectively. The company's dedication to safety, evidenced by its consistent industry-leading safety performance, plays a crucial role in fostering a stable and committed workforce, which is essential for sustained operational excellence and employee retention.

Growing demands from investors, customers, and communities are pushing companies like Cabot to prioritize corporate social responsibility. This means a stronger focus on ethical business practices, actively participating in community development, and championing diversity, equity, and inclusion within the workforce.

Cabot's commitment to these principles is evident in its consistent recognition, such as achieving a platinum rating from EcoVadis for its environmental, social, and governance (ESG) performance. This rating places Cabot among the top percentile of companies evaluated for sustainability, underscoring its dedication to responsible operations.

Health and Safety Standards

Societal expectations regarding health and safety, especially within the chemical sector, impose rigorous operational requirements. Cabot's commitment to safety is evident in its goal of achieving zero injuries across all global sites, a target that underscores its dedication to employee well-being and operational excellence.

This strong emphasis on safety translates into tangible benefits for Cabot. It not only safeguards its workforce but also bolsters the company's public image and ensures consistent, dependable operations. For instance, in 2023, Cabot reported a Total Recordable Incident Rate (TRIR) of 0.15, significantly below the chemical industry average, highlighting their industry-leading performance.

- Societal Demand: Growing public and regulatory pressure for enhanced worker and environmental safety in chemical manufacturing.

- Cabot's Performance: Achieved a best-ever safety record in 2024, with a 15% reduction in reportable incidents compared to 2023.

- Reputational Impact: Strong safety performance enhances Cabot's brand as a responsible corporate citizen, attracting talent and investor confidence.

- Operational Efficiency: Reduced downtime and insurance costs due to fewer accidents, contributing to overall profitability.

Demographic Shifts and Urbanization

Global demographic shifts, including a growing and aging population, are projected to reach 8.5 billion by 2030, significantly impacting demand for construction and infrastructure. This trend directly fuels the need for advanced materials like Cabot's fumed silica, which enhances durability and performance in concrete, coatings, and adhesives essential for building and infrastructure projects. Urbanization, with over half the world's population now living in cities, further concentrates this demand, necessitating more sophisticated and resilient building solutions.

Cabot's strategic focus on these macro trends is evident in its continuous investment in product development tailored to these evolving needs. For instance, the company's performance materials are crucial in developing lighter, stronger, and more sustainable construction components. The increasing global focus on sustainable development and resilient infrastructure, particularly in emerging economies undergoing rapid urbanization, presents a substantial long-term growth opportunity for Cabot's specialized materials.

- Global Population Growth: Expected to reach 8.5 billion by 2030, driving demand for housing and infrastructure.

- Urbanization Rate: Over 55% of the global population currently resides in urban areas, a figure projected to rise, concentrating demand for construction materials.

- Infrastructure Investment: Global infrastructure spending is anticipated to reach $7.2 trillion annually by 2024, creating a robust market for performance additives.

- Aging Infrastructure: Significant portions of existing infrastructure in developed nations require upgrades and maintenance, boosting demand for advanced repair and enhancement materials.

Societal expectations regarding health, safety, and environmental responsibility are paramount for chemical companies like Cabot. Growing public and investor scrutiny demands robust safety protocols and transparent sustainability reporting. Cabot's commitment to these areas is reflected in its industry-leading safety performance, with a Total Recordable Incident Rate (TRIR) of 0.15 in 2023, significantly below the chemical industry average.

The company's dedication to corporate social responsibility, including diversity, equity, and inclusion, also resonates with stakeholders. Cabot's platinum rating from EcoVadis for ESG performance in 2024 highlights its proactive approach to ethical business practices and community engagement, reinforcing its brand as a responsible corporate citizen.

Demographic shifts, such as global population growth and increasing urbanization, directly influence demand for Cabot's performance materials. With the global population projected to reach 8.5 billion by 2030, and over 55% of people living in cities, there's a heightened need for advanced materials in construction and infrastructure. Cabot's products, like fumed silica, enhance the durability and performance of essential building materials, positioning the company to capitalize on these long-term trends.

| Sociological Factor | Impact on Cabot | Supporting Data/Initiatives |

| Sustainability & Environmentalism | Drives demand for eco-friendly products and circular economy principles. | EVOLVE® Sustainable Solutions platform; development of bio-based carbon black. |

| Workforce & Labor Relations | Affects manufacturing efficiency, expansion feasibility, and operational costs. | Approx. 4,500 global employees (2023); industry-leading safety performance. |

| Corporate Social Responsibility (CSR) | Enhances brand reputation, attracts talent, and boosts investor confidence. | EcoVadis platinum rating (2024); focus on ethical practices and DEI. |

| Demographics & Urbanization | Increases demand for construction and infrastructure materials. | Global population to reach 8.5 billion by 2030; over 55% urban population. |

Technological factors

Cabot's competitive edge hinges on continuous innovation in materials science, especially in advanced carbon black, fumed silica, and battery materials. Their 'Creating for Tomorrow' strategy directly supports this by focusing on novel products and processes designed for a sustainable future.

A prime example of this innovation is Cabot's LITX® 95F conductive carbon, a key component in energy storage systems. This focus on cutting-edge materials is crucial for meeting the growing demand in sectors like electric vehicles and renewable energy storage, areas projected for significant growth through 2025.

Cabot's commitment to automation and advanced manufacturing is a significant technological driver. By integrating robotics and AI into production lines, the company can boost efficiency and lower operational expenses. For instance, investments in smart factory technologies are projected to improve throughput by up to 15% in key facilities by the end of 2025.

These advancements are particularly vital for Cabot's expansion into high-demand sectors like battery materials. Upgrading manufacturing processes ensures consistent quality and scalability, critical for meeting the surging global demand for electric vehicles and energy storage solutions. The company's 2024 capital expenditure plan includes a substantial allocation towards modernizing its facilities.

Cabot's commitment to digital transformation and data analytics is a key technological driver. By leveraging these capabilities, the company aims to streamline its supply chains, a critical aspect for a global producer of specialty chemicals and performance materials. For instance, advanced analytics can predict demand fluctuations, allowing for more efficient inventory management and reduced logistical costs.

The implementation of data analytics also enhances predictive maintenance across Cabot's manufacturing facilities. This proactive approach minimizes downtime and optimizes operational efficiency, a significant factor in maintaining competitiveness. In 2024, companies across the chemical sector are investing heavily in AI and machine learning for process optimization, with some reporting up to a 15% reduction in operational costs through these technologies.

Furthermore, data analytics empowers better decision-making by providing deeper insights into complex manufacturing processes and resource allocation. This allows Cabot to identify areas for improvement, reduce waste, and allocate capital more effectively, ultimately boosting profitability and sustainability initiatives.

Development of Sustainable Technologies

The push for sustainable technologies is a major technological force shaping industries. Innovations like carbon capture, utilization, and circular economy models are becoming increasingly important. These advancements aim to reduce environmental impact and create more resource-efficient processes.

Cabot Corporation's commitment to this trend is evident in its EVOLVE Sustainable Solutions platform. This initiative specifically targets the development of sustainable reinforcing carbons. By integrating circular value chains and utilizing certified feedstocks, Cabot is actively working towards its net-zero emission goals.

This strategic focus on sustainability aligns with broader market demands and regulatory pressures. Companies are increasingly seeking solutions that offer both performance and environmental responsibility. Cabot's efforts in this area position it to capitalize on the growing market for eco-friendly materials.

- Sustainable Technologies Drive Innovation: Advancements in carbon capture, utilization, and circular economy solutions are key technological drivers.

- Cabot's EVOLVE Platform: Cabot's EVOLVE® Sustainable Solutions platform focuses on sustainable reinforcing carbons using circular value chains and certified feedstocks.

- Net-Zero Ambitions: This strategic direction directly supports Cabot's commitment to achieving net-zero emissions.

- Market Alignment: The development of sustainable technologies meets growing market demand for environmentally responsible products and processes.

Research and Development Investments

Cabot Corporation's commitment to research and development is a cornerstone of its strategy in the specialty chemicals sector. In 2023, the company reported R&D expenses of $178.3 million, underscoring its dedication to innovation and staying competitive. This consistent investment fuels the development of advanced materials designed to meet evolving industry demands.

These R&D efforts are directly linked to creating new products and enhancing existing ones. For instance, Cabot is actively developing high-performance additives crucial for the burgeoning electric vehicle battery market, a key area of growth. This focus ensures they remain a leader in performance materials.

- R&D Investment: Cabot's R&D spending reached $178.3 million in 2023.

- Strategic Focus: Investments target new product development and process improvements.

- Market Responsiveness: R&D addresses emerging needs, such as materials for EV batteries.

- Competitive Edge: Continuous innovation is vital for maintaining leadership in specialty chemicals.

Cabot's technological strategy is deeply rooted in materials science innovation, particularly in areas like advanced carbon black and battery materials, essential for sectors like electric vehicles which are projected for substantial growth through 2025.

The company is actively integrating automation and AI into its manufacturing processes, aiming to boost efficiency and reduce costs, with smart factory investments expected to increase throughput by up to 15% in key facilities by the end of 2025.

Cabot's commitment to digital transformation and data analytics is crucial for optimizing its global supply chains and enhancing predictive maintenance, potentially reducing operational costs by as much as 15% through AI and machine learning, a trend seen across the chemical sector in 2024.

Furthermore, Cabot's EVOLVE Sustainable Solutions platform exemplifies its focus on sustainable technologies, aiming to develop eco-friendly materials and align with net-zero emission goals to meet increasing market demand for environmentally responsible products.

| Technology Focus | Key Initiatives/Products | Projected Impact/Data |

|---|---|---|

| Materials Science Innovation | Advanced Carbon Black, Battery Materials (e.g., LITX® 95F) | Meeting demand in EV and renewable energy storage sectors through 2025. |

| Automation & AI | Robotics, Smart Factory Technologies | Up to 15% throughput increase in key facilities by end of 2025; reduced operational costs. |

| Digital Transformation & Data Analytics | Supply Chain Optimization, Predictive Maintenance | Potential 15% reduction in operational costs via AI/ML (2024 industry trend). |

| Sustainable Technologies | EVOLVE Sustainable Solutions, Circular Economy Models | Supporting net-zero emission goals, meeting market demand for eco-friendly materials. |

| Research & Development | New Product Development, Process Improvements | $178.3 million R&D spending in 2023; focus on EV battery materials. |

Legal factors

Cabot's operations face significant legal hurdles due to evolving environmental regulations concerning air and water emissions, waste disposal, and chemical management. These global standards necessitate ongoing investment in compliance technologies and rigorous monitoring. For instance, in 2024, Cabot reported a 15% reduction in greenhouse gas emissions intensity compared to its 2020 baseline, demonstrating its commitment to meeting these legal mandates.

Cabot's operations are significantly shaped by stringent product safety and liability laws. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) continued to enforce recalls for products failing to meet safety standards, impacting various industries. Cabot must maintain rigorous testing and quality control across its specialty chemicals and performance materials to prevent potential lawsuits and protect its brand.

Navigating these regulations across global markets presents a complex challenge. In 2025, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) framework remains a key consideration, requiring extensive data on chemical properties and safety. Cabot's commitment to transparent labeling and compliance with these diverse international standards is vital to mitigate legal risks and maintain consumer trust.

Cabot's ability to protect its innovative technologies and product formulations through patents and trademarks is crucial for maintaining its market position. In 2024, the global intellectual property market saw continued growth, with companies investing heavily in R&D and seeking robust patent protection.

Legal frameworks governing intellectual property rights directly impact Cabot's competitive advantage. For instance, the strength and enforceability of patents in key markets like the US and Europe can prevent competitors from replicating Cabot's advanced materials, such as its conductive carbon blacks used in electric vehicle batteries, a sector projected for significant expansion through 2025.

Labor Laws and Employment Regulations

Cabot's global operations necessitate strict adherence to diverse labor laws, covering everything from minimum wages and working conditions to collective bargaining agreements. Non-compliance can lead to significant legal challenges and reputational damage. For instance, in 2024, the International Labour Organization reported that labor law violations cost businesses billions annually worldwide through fines and lost productivity.

Ensuring compliance with varying employment regulations across its international footprint is critical for Cabot. This includes navigating differences in hiring practices, termination procedures, and employee benefits mandates. Failure to do so could result in costly litigation and strained employee relations, impacting operational efficiency.

- Wage Compliance: Cabot must ensure it meets or exceeds minimum wage requirements in all operating regions, which can differ significantly. For example, the US federal minimum wage remained at $7.25 per hour in 2024, while some states have much higher rates.

- Working Conditions: Adherence to health and safety standards, working hours, and leave entitlements is paramount. Many countries, including those in the EU, have strict regulations on maximum weekly working hours.

- Collective Bargaining: Cabot's approach to union relations and collective bargaining agreements directly impacts employee morale and operational stability. In 2024, union membership rates varied, with some sectors seeing increased activity.

- Anti-Discrimination Laws: Compliance with laws prohibiting discrimination based on race, gender, age, and other protected characteristics is a fundamental legal obligation.

Antitrust and Competition Laws

Antitrust and competition laws significantly shape Cabot's strategic moves, particularly concerning mergers, acquisitions, and day-to-day market operations. These regulations are designed to foster a level playing field and prevent any single entity from dominating the market, which is crucial for maintaining innovation and consumer choice.

For example, Cabot's recent acquisition of a carbon manufacturing facility in Mexico would have necessitated a thorough review under Mexican competition laws. Such due diligence ensures compliance and avoids potential penalties for anti-competitive behavior. The global regulatory landscape for competition is dynamic, with authorities like the U.S. Federal Trade Commission (FTC) and the European Commission actively scrutinizing large transactions.

- Regulatory Scrutiny: Cabot must navigate varying antitrust regulations across its operating regions, impacting its ability to pursue M&A opportunities.

- Market Conduct: Laws dictate how Cabot can price its products, enter new markets, and engage with suppliers and customers to avoid monopolistic practices.

- Recent Trends: In 2024, antitrust enforcement has intensified globally, with regulators showing increased vigilance over consolidation in industrial sectors.

- Compliance Costs: Adhering to these complex legal frameworks involves significant investment in legal counsel and compliance programs.

Cabot's adherence to environmental laws, including those concerning emissions and waste, is critical. In 2024, the company achieved a 15% reduction in greenhouse gas emissions intensity from its 2020 baseline, showcasing its proactive stance on regulatory compliance.

Product safety regulations and intellectual property law are paramount for Cabot. The company must ensure its specialty chemicals meet stringent standards, as seen with the CPSC's actions in 2024, while also protecting its innovations through patents, especially in high-growth sectors like electric vehicle batteries.

Labor laws and antitrust regulations present ongoing challenges. Cabot must comply with diverse employment standards globally and navigate intensified antitrust scrutiny, as evidenced by increased enforcement actions by bodies like the FTC in 2024, to maintain fair market practices.

| Legal Factor | 2024/2025 Relevance | Cabot's Action/Impact |

|---|---|---|

| Environmental Regulations | Evolving global standards for emissions and waste. | 15% reduction in GHG emissions intensity (2024 vs. 2020 baseline). |

| Product Safety & Liability | CPSC recalls and global safety standards. | Rigorous testing and quality control for specialty chemicals. |

| Intellectual Property | Growth in IP market, patent protection for advanced materials. | Securing patents for conductive carbon blacks for EV batteries. |

| Labor Laws | Varying wage, working condition, and anti-discrimination laws. | Adherence to minimum wage and health/safety standards across regions. |

| Antitrust & Competition | Intensified global enforcement, scrutiny of M&A. | Due diligence for acquisitions under local competition laws. |

Environmental factors

Global climate change regulations, such as carbon pricing mechanisms and emissions reduction targets, are increasingly shaping the operational landscape for companies like Cabot. These policies directly influence manufacturing processes, supply chain logistics, and the overall cost of doing business, necessitating strategic adaptation and investment in cleaner technologies.

Cabot's commitment to a net-zero ambition by 2050, in line with the Paris Climate Agreement, demonstrates proactive engagement with these environmental pressures. The company reported a 17% reduction in its absolute Scope 1 and Scope 2 greenhouse gas emissions for 2023 compared to its 2019 baseline, underscoring tangible progress towards its sustainability goals.

The availability and sustainable sourcing of raw materials are critical environmental considerations for Cabot. The company is actively working to increase circularity within its product lines. This includes leveraging circular value chains, such as the use of tire pyrolysis oils, to lessen dependence on virgin resources and bolster overall sustainability efforts.

Effective waste management and pollution control are crucial for Cabot to lessen its environmental impact. This involves handling industrial byproducts, treating wastewater, and mitigating air emissions from their production sites. For instance, in 2023, Cabot reported a 5% reduction in hazardous waste generation compared to 2022, demonstrating progress in their operational efficiency.

Cabot's commitment to sustainability is reflected in its ongoing initiatives aimed at reducing its environmental footprint. These efforts include investing in advanced filtration systems for air emissions and implementing water recycling programs, which contributed to a 3% decrease in water consumption per ton of product in 2024.

Biodiversity and Ecosystem Protection

Cabot Corporation's operations are increasingly scrutinized for their impact on biodiversity and local ecosystems. The company is committed to environmental stewardship, aiming to minimize the footprint of its manufacturing facilities on surrounding natural habitats, a growing concern for stakeholders and regulators alike.

This focus on biodiversity extends to responsible land management and conservation efforts near its sites. For instance, Cabot's sustainability reports often detail initiatives to protect or restore local flora and fauna, aligning with global conservation goals and demonstrating a proactive approach to environmental responsibility.

In 2024, companies like Cabot are expected to provide more granular data on their biodiversity impact. While specific 2024 figures for Cabot's biodiversity initiatives are still emerging, the trend across the chemical industry is towards greater transparency and investment in ecosystem protection. For example, the chemical sector's collective investment in environmental remediation and conservation projects saw a notable increase in 2023, setting a precedent for 2024 reporting.

- Biodiversity Impact Assessment: Cabot likely conducts regular assessments to understand and mitigate its operational effects on local ecosystems.

- Conservation Initiatives: The company supports or participates in projects aimed at preserving or restoring natural habitats adjacent to its manufacturing locations.

- Regulatory Compliance: Adherence to environmental regulations concerning protected species and natural resource management is a key aspect of its operations.

- Stakeholder Engagement: Engaging with local communities and environmental groups on biodiversity matters is crucial for maintaining social license to operate.

Water Usage and Management

Cabot Corporation's operations, particularly in regions facing water scarcity, necessitate diligent water usage and management practices. The company's commitment to sustainability is reflected in its ongoing efforts to reduce water consumption and responsibly handle wastewater, a key component of its environmental stewardship.

Cabot's sustainability reporting frequently highlights initiatives aimed at optimizing water use across its facilities. These efforts are crucial given the increasing global focus on water conservation and the potential regulatory impacts associated with water stress. For example, in its 2023 Sustainability Report, Cabot detailed progress in reducing its water intensity, aiming for a 15% reduction by 2030 compared to a 2019 baseline. Specific projects include implementing closed-loop water systems and investing in advanced wastewater treatment technologies.

- Water Intensity Reduction: Cabot is targeting a 15% reduction in water intensity by 2030 (vs. 2019 baseline).

- Wastewater Management: The company invests in advanced treatment technologies to ensure responsible discharge.

- Operational Efficiency: Efforts include implementing closed-loop water systems to minimize fresh water intake.

Environmental regulations are increasingly influencing Cabot's operations, from manufacturing to supply chains, pushing for cleaner technologies and greater sustainability. The company's commitment to a net-zero ambition by 2050, coupled with a 17% reduction in Scope 1 and 2 greenhouse gas emissions in 2023 compared to 2019, highlights its proactive stance on climate change.

Cabot is also focusing on raw material sustainability, increasing circularity through initiatives like using tire pyrolysis oils to reduce reliance on virgin resources. This focus extends to waste management, with a 5% reduction in hazardous waste generation reported in 2023 compared to 2022, and water management, aiming for a 15% reduction in water intensity by 2030 (vs. 2019 baseline).

The company is also addressing its biodiversity impact, with ongoing efforts in land management and conservation near its facilities. While specific 2024 biodiversity data is still emerging, the chemical sector's increased investment in environmental remediation in 2023 sets a precedent for greater transparency and action.

| Environmental Focus Area | Key Initiatives/Targets | 2023/2024 Data/Progress |

|---|---|---|

| Greenhouse Gas Emissions | Net-zero ambition by 2050 | 17% reduction in absolute Scope 1 & 2 emissions (2023 vs. 2019) |

| Raw Material Sourcing | Increasing circularity, use of tire pyrolysis oils | Ongoing development of circular value chains |

| Waste Management | Reducing hazardous waste generation | 5% reduction in hazardous waste generation (2023 vs. 2022) |

| Water Management | Reduce water intensity, responsible wastewater handling | Target: 15% reduction in water intensity by 2030 (vs. 2019 baseline) |

| Biodiversity | Minimize operational footprint on local ecosystems | Emerging data for 2024; sector-wide increase in conservation investment in 2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable sources including government publications, international organizations, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting your business.