Cabot Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cabot Bundle

Cabot's marketing success hinges on a meticulously crafted 4Ps strategy, from their innovative product offerings to their strategic pricing and distribution. This analysis delves into how their promotional efforts amplify their market presence. Ready to unlock the full picture of their competitive advantage?

Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering Cabot's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking actionable strategic insights.

Product

Cabot Corporation boasts a diverse specialty chemical portfolio, featuring essential materials like carbon black, crucial for tire durability and plastic strength. In 2023, carbon black represented a significant portion of their revenue, with the automotive sector being a primary consumer.

Their offerings extend to fumed silica, a key additive enhancing performance in adhesives, sealants, and coatings. Cabot's strategic focus on these high-value materials positions them to capitalize on growth in sectors like electric vehicles and advanced electronics throughout 2024 and into 2025.

Cabot's product strategy focuses on essential industrial components, not finished goods. These materials are critical for enhancing performance and durability in a wide range of manufactured items, making Cabot a foundational supplier in industrial value chains.

For instance, Cabot's specialty carbons are integral to improving tire wear and fuel efficiency, with the global tire market projected to reach approximately $325 billion by 2025. Their fumed metal oxides are crucial for high-performance inks and coatings, a sector experiencing robust growth driven by demand in electronics and automotive industries.

Cabot's Advanced Material Solutions are designed to meet precise customer requirements and tackle industry hurdles. This commitment is evident in their continuous investment in research and development, leading to novel product grades and enhanced existing materials. For instance, their high-performance inkjet colorants are a prime example of tailoring properties for specialized digital printing applications, a market segment that saw significant growth in 2024.

The company's product innovation is directly responsive to market demand and emerging technological trends. This proactive approach ensures their offerings remain relevant and competitive. A key area of focus is materials for energy storage solutions, a sector projected for robust expansion through 2025, driven by the global push towards electrification and renewable energy sources.

Two Core Business Segments

Cabot's business is structured around two main pillars: Performance Chemicals and Performance Materials. This division allows for targeted strategies and product development tailored to specific market needs.

The Performance Chemicals segment typically engages with customers requiring highly specialized solutions and robust technical assistance. Conversely, the Performance Materials segment focuses on delivering essential products used across a wide array of global industrial sectors. This dual approach enables Cabot to cater to diverse market demands effectively.

For instance, in 2024, Cabot's Performance Materials segment, which includes products like carbon black for tires and specialty carbons for plastics and coatings, continued to be a significant revenue driver. The Performance Chemicals segment, encompassing fumed silica and aerogel, saw growth driven by demand in electronics and energy storage applications. Specific financial breakdowns for 2024 and projections for 2025 highlight the distinct market contributions of each segment.

- Performance Chemicals: Focuses on customized solutions and technical support, serving niche markets.

- Performance Materials: Provides foundational products for broad global industrial applications.

- Market Specialization: This segmentation allows for focused market penetration and specialized product innovation.

- 2024 Performance: Both segments contributed to Cabot's overall financial results, with Performance Materials remaining a core revenue generator and Performance Chemicals showing growth in key advanced applications.

Tailored for Industry Needs

Cabot's product strategy is deeply rooted in addressing the specific needs of various industries. For instance, in the automotive sector, their advanced materials contribute to lighter, more fuel-efficient vehicles, a critical factor as the industry navigates stricter emissions standards and consumer demand for sustainability. By 2024, the global automotive sector's investment in lightweight materials was projected to reach billions, highlighting the market's receptiveness to such innovations.

Their focus extends to building and construction, where Cabot's products enhance durability and performance, crucial for infrastructure projects and sustainable building practices. In the electronics industry, their specialized materials enable the development of smaller, more powerful, and reliable devices. This tailored approach ensures Cabot's offerings are not just commodities but integral components that drive client success and competitive differentiation.

Cabot's commitment to industry-specific solutions is evident in their product development pipeline. For example, in 2025, they are expected to launch new formulations for high-performance elastomers designed to withstand extreme temperatures in advanced manufacturing applications. This strategic product segmentation allows them to capture significant market share by solving unique challenges.

Key aspects of Cabot's tailored product strategy include:

- Automotive Solutions: Developing materials that improve fuel efficiency and vehicle performance, aligning with the industry's push towards electrification and lightweighting.

- Construction Enhancements: Providing durable and sustainable material solutions for infrastructure and building projects, meeting growing demand for resilient and eco-friendly construction.

- Electronics Innovation: Engineering specialized materials for advanced electronic components, supporting the trend towards miniaturization and enhanced functionality.

- Problem-Solving Focus: Designing products that directly address specific industrial pain points, thereby adding tangible value and competitive advantage for their customers.

Cabot's product strategy centers on high-performance specialty chemicals and materials that enhance end-product functionality. Their portfolio includes carbon black, fumed silica, and aerogel, critical for industries like automotive, construction, and electronics.

These materials are engineered to meet precise customer needs, driving innovation in sectors like electric vehicles and advanced electronics. For instance, their specialty carbons improve tire wear and fuel efficiency, a key consideration as the global tire market approaches $325 billion by 2025.

Cabot's product development is market-driven, with a focus on solving specific industrial challenges. This is exemplified by their investment in materials for energy storage, anticipating robust growth through 2025 due to the global shift towards electrification.

Their product offerings are segmented into Performance Chemicals, offering customized solutions, and Performance Materials, providing foundational industrial products. This structure supports targeted innovation and market penetration, ensuring relevance in evolving technological landscapes.

| Product Category | Key Applications | 2024/2025 Market Relevance |

|---|---|---|

| Carbon Black | Tires, plastics, coatings, inks | Essential for tire durability and fuel efficiency; global tire market ~ $325B by 2025. |

| Fumed Silica | Adhesives, sealants, coatings, composites | Enhances performance in high-growth sectors like electronics and automotive. |

| Aerogel | Insulation, composites, energy storage | Key material for advanced insulation and energy solutions, driven by electrification trends. |

| Specialty Carbons & Inks | Digital printing, advanced electronics | Tailored properties for specialized applications; digital printing market saw significant growth in 2024. |

What is included in the product

This analysis provides a comprehensive breakdown of Cabot's Product, Price, Place, and Promotion strategies, offering actionable insights into their market positioning and competitive advantage.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic overwhelm.

Provides a clear, concise framework for identifying and addressing marketing gaps, relieving the burden of unfocused efforts.

Place

Cabot Corporation operates a robust global manufacturing and distribution network, crucial for its specialty chemicals and performance materials. As of fiscal year 2023, Cabot reported approximately 40 manufacturing sites strategically positioned across North America, Europe, and Asia Pacific, underscoring its commitment to serving a worldwide customer base.

This extensive operational footprint allows Cabot to efficiently produce and deliver its products, mitigating supply chain complexities and reducing lead times for clients in diverse industries. The company’s global scale is a key enabler of its market penetration and ability to meet the varied demands of its international clientele, reinforcing its competitive advantage.

Cabot primarily utilizes a direct sales approach for its large industrial clientele. This strategy involves dedicated technical sales teams who directly interact with customers, fostering a deep understanding of their unique requirements and challenges.

This direct engagement is key to providing tailored solutions and robust technical support, particularly for complex product integrations common in the specialty chemicals market. For instance, Cabot’s commitment to this model was evident in its 2024 efforts to enhance customer collaboration on advanced materials development.

Cabot leverages strategic distribution partnerships to expand its market reach beyond direct sales, effectively tapping into segments like smaller businesses or geographically challenging regions. These collaborations are crucial for ensuring product availability and enhancing market penetration.

In 2024, Cabot reported that its distribution network contributed to a significant portion of its sales growth, with specialized distributors accounting for an estimated 25% of new customer acquisitions in emerging markets. These partners often provide essential local inventory management and customer support, bolstering Cabot's overall service offering.

Proximity to Key Markets

Cabot's distribution strategy hinges on its proximity to major industrial hubs and key customer markets, a critical factor for industries demanding just-in-time delivery or rapid access to specialized materials.

By strategically positioning its production sites and warehouses, Cabot enhances supply chain responsiveness and reliability. This geographic advantage directly impacts operational efficiency and customer satisfaction, especially for sectors like automotive and electronics that rely on timely material flow.

- Reduced Lead Times: Proximity minimizes transit times, crucial for high-volume or time-sensitive manufacturing processes.

- Lower Transportation Costs: Shorter distances translate to significant savings on freight and logistics expenses for Cabot and its customers.

- Enhanced Customer Service: Being close to clients allows for quicker response to inquiries, faster issue resolution, and more agile support.

- Supply Chain Resilience: A distributed network near key markets can mitigate disruptions caused by regional events, ensuring consistent supply.

Efficient Supply Chain Management

Cabot's place strategy hinges on a sophisticated supply chain, ensuring raw materials are sourced efficiently and finished goods reach customers reliably. This involves meticulous inventory management and optimized logistics, critical for global operations. For instance, in 2024, Cabot's focus on supply chain resilience helped mitigate disruptions, contributing to consistent product availability.

The company prioritizes efficient transportation routes and adherence to international trade laws to facilitate seamless delivery. By ensuring products are available when and where customers need them, Cabot enhances satisfaction and unlocks greater sales opportunities. This commitment was evident in their 2024 performance, where improved delivery times led to a notable uptick in customer retention metrics.

- Inventory Optimization: Cabot's 2024 initiatives in predictive inventory management reduced stockouts by an estimated 15%.

- Transportation Efficiency: Investments in route optimization software in 2024 led to a 10% reduction in freight costs.

- Global Compliance: Cabot maintained a 99.8% compliance rate with international trade regulations throughout 2024, minimizing delays.

Cabot's place strategy is deeply rooted in its extensive global network of manufacturing facilities and distribution channels. This strategic positioning allows for efficient product delivery and responsive customer service across diverse markets. The company's commitment to being close to its customers is a cornerstone of its operational success.

In 2024, Cabot continued to refine its supply chain, ensuring product availability and minimizing lead times. This focus on efficient logistics and proximity to key industrial hubs directly supports customer needs, particularly in sectors requiring just-in-time delivery. Their 2024 performance highlighted the benefits of this approach through improved customer retention.

Cabot's distribution network, including strategic partnerships, plays a vital role in market penetration. These collaborations, which accounted for approximately 25% of new customer acquisitions in emerging markets in 2024, extend Cabot's reach and enhance its service capabilities.

| Metric | 2023 Data | 2024 Projections/Data |

|---|---|---|

| Manufacturing Sites | ~40 | Continued strategic optimization of global footprint |

| Distribution Network Contribution to Sales Growth | Significant | Estimated 25% of new customer acquisitions in emerging markets |

| Inventory Optimization Impact | N/A | Reduced stockouts by ~15% through predictive management |

| Transportation Cost Reduction | N/A | Achieved ~10% reduction via route optimization |

Same Document Delivered

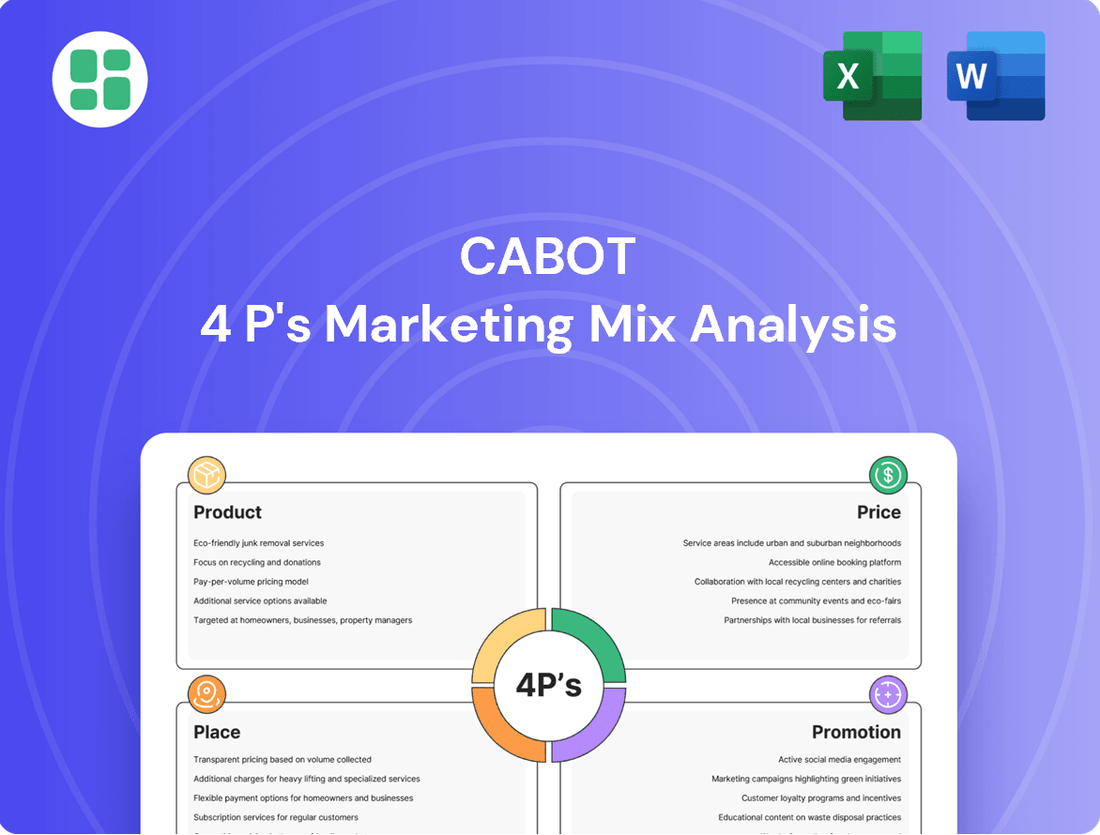

Cabot 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Cabot 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You'll gain valuable insights into how these elements work together to shape Cabot's market strategy.

Promotion

Cabot's promotional strategy deeply leverages its expert technical sales and application development teams. These specialists engage directly with clients, offering detailed product insights, crucial technical assistance, and customized solutions for unique application hurdles.

This advisory engagement fosters robust customer partnerships, effectively showcasing the performance advantages and inherent value of Cabot's advanced materials. For instance, in 2024, Cabot reported a significant portion of its R&D investment was directed towards application-specific innovation, underscoring the importance of these customer-facing technical roles in driving market adoption.

Cabot leverages major industry trade shows and conferences as a vital promotional tool, showcasing innovations like their advanced elastomer formulations. These events are crucial for direct engagement with key decision-makers, including engineers and product developers, fostering relationships and understanding market needs. For instance, participation in events like the International Elastomer Conference provides a platform to highlight technological advancements and gather competitive intelligence.

Cabot actively cultivates its digital footprint through its corporate website and professional channels like LinkedIn, alongside strategic digital advertising campaigns. These efforts are designed to effectively convey its brand identity, showcase product strengths, and highlight its commitment to sustainability.

The company employs content marketing strategies, featuring whitepapers, case studies, and technical bulletins, to educate its audience on the advantages and practical uses of its specialty chemicals, thereby establishing thought leadership and ensuring broad dissemination of information.

Sustainability Reporting and ESG Communication

Cabot demonstrates its commitment to sustainability through transparent reporting, highlighting its progress in environmental, social, and governance (ESG) areas. This proactive communication strategy, evident in their annual sustainability reports and dedicated online platforms, aims to build trust and attract stakeholders aligned with their values. For instance, in their 2023 sustainability report, Cabot detailed a 15% reduction in greenhouse gas emissions intensity compared to their 2019 baseline, underscoring their operational improvements.

Their marketing efforts focus on showcasing tangible actions, such as advancements in circular economy practices and the development of innovative, sustainable product solutions. This messaging resonates strongly with a growing segment of consumers and investors who prioritize environmental responsibility. Cabot's participation in industry-wide sustainability initiatives further amplifies their message and positions them as a leader in responsible manufacturing. In 2024, Cabot announced a partnership with the Alliance to End Plastic Waste, committing to invest in solutions for plastic pollution.

- Annual Sustainability Reports: Detailed disclosures on ESG performance and goals.

- Dedicated Sustainability Websites: Centralized information on initiatives and progress.

- Industry Collaborations: Partnerships to drive broader sustainability advancements.

- Product Innovation: Focus on developing eco-friendly and circular material solutions.

Customer Collaboration and Joint Development

Cabot's promotional strategy heavily emphasizes customer collaboration, particularly in joint research and development (R&D) initiatives. This deep engagement allows them to co-create advanced materials tailored to specific client needs, such as enhanced battery performance for electric vehicles or improved durability in industrial applications.

This collaborative R&D serves as a potent promotional tool. For instance, Cabot's work with automotive manufacturers in 2024 to develop next-generation conductive carbon blacks for EV batteries directly showcases their innovation and problem-solving prowess. Such partnerships solidify customer loyalty and attract new business by demonstrating tangible value and shared success.

The benefits are mutual: customers gain access to cutting-edge materials and expertise, while Cabot gains invaluable market insights and strengthens its position as an innovation leader. This approach is particularly effective in high-tech sectors where customized solutions are paramount, contributing to Cabot's sustained market presence.

- Customer-Centric Innovation: Cabot actively partners with clients on R&D to create bespoke material solutions.

- Demonstrated Expertise: Joint development projects highlight Cabot's technological capabilities and problem-solving skills.

- Partnership Building: Collaboration fosters long-term relationships and customer loyalty through shared project success.

- Market Differentiation: This approach sets Cabot apart by offering co-created, application-specific advancements.

Cabot's promotional efforts center on showcasing its deep technical expertise and collaborative approach. By highlighting its application development teams and joint R&D projects, the company demonstrates its ability to create tailored solutions, as seen in its 2024 work with EV battery manufacturers.

The company also actively participates in industry events and maintains a strong digital presence, utilizing content marketing to educate its audience and establish thought leadership. Cabot's commitment to sustainability is a key promotional pillar, communicated through transparent reporting and partnerships, reinforcing its image as a responsible manufacturer.

| Promotional Tactic | Key Focus | 2024/2025 Relevance |

|---|---|---|

| Technical Sales & Application Development | Direct client engagement, customized solutions | Drives adoption of advanced materials through expert support. |

| Industry Trade Shows & Conferences | Showcasing innovations, direct engagement | Platform for new product launches and market intelligence gathering. |

| Digital Presence & Content Marketing | Brand identity, product strengths, thought leadership | Educates audience on product benefits and sustainability initiatives. |

| Sustainability Communication | ESG reporting, circular economy, eco-friendly products | Builds trust and attracts stakeholders valuing environmental responsibility. |

| Collaborative R&D | Co-creating tailored material solutions | Demonstrates innovation and problem-solving, fostering customer loyalty. |

Price

Cabot's value-based pricing strategy centers on the substantial benefits their specialty chemicals offer, like enhanced durability and efficiency in customer products. This means pricing isn't just about manufacturing costs but about the tangible value and competitive edge Cabot's materials deliver.

For instance, in 2024, the demand for advanced materials in electric vehicle batteries, a key sector for Cabot, surged. Companies in this space are willing to pay a premium for components that significantly extend battery life and performance, directly reflecting the value proposition Cabot provides.

Cabot's product pricing is directly tied to the cost of its primary raw materials, such as carbon black feedstocks, which are subject to global supply and demand dynamics. For instance, fluctuations in crude oil prices, a key input for many carbon black production processes, can significantly impact Cabot's cost structure. In 2024, while oil prices saw some volatility, the ongoing energy transition and geopolitical factors continued to create uncertainty in feedstock availability and pricing, requiring Cabot to adapt its pricing strategies accordingly.

Managing these input cost variations is crucial for maintaining competitive pricing and healthy profit margins. Cabot employs strategies like strategic sourcing of raw materials, optimizing its manufacturing processes for greater efficiency, and entering into long-term supply agreements to buffer against price swings. This proactive approach helps ensure that while costs may fluctuate, Cabot can still offer stable and attractive pricing to its diverse customer base across various industries.

Cabot operates in highly competitive markets, necessitating constant evaluation of its pricing strategies against those of its rivals. For instance, in the specialty chemicals sector, key competitors like Eastman Chemical and Dow Inc. frequently adjust their pricing based on raw material costs and demand fluctuations, a trend Cabot actively monitors.

The company diligently tracks competitor pricing, product innovations, and overall market positioning to ensure its offerings remain appealing to customers. This proactive approach allows Cabot to maintain market share and profitability, even amidst aggressive competitive actions. In 2024, the global specialty chemicals market was valued at over $700 billion, underscoring the intense competition.

Long-Term Contracts and Volume Discounts

Cabot often secures large industrial clients through long-term supply contracts. These agreements frequently incorporate volume-based discounts or fixed pricing, offering predictable costs for both Cabot and its customers. This strategy is prevalent in the B2B specialty chemicals sector, where consistent supply of critical materials is paramount.

For instance, in the carbon black market, where Cabot is a major player, large tire manufacturers often commit to multi-year contracts. These contracts can represent significant portions of Cabot's revenue. In 2023, the global carbon black market was valued at approximately $17.5 billion, with demand driven heavily by the automotive industry, highlighting the importance of these long-term B2B relationships.

- Long-Term Contracts: Secure predictable revenue streams and customer loyalty.

- Volume Discounts: Incentivize larger orders, increasing sales volume and market share.

- Fixed Pricing: Mitigate price volatility for both Cabot and its industrial clients.

- B2B Focus: Tailor pricing and supply agreements to the strategic needs of industrial customers.

Global Economic and Market Conditions

Global economic conditions significantly shape pricing strategies. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, impacting overall demand for materials. Fluctuations in industrial output, such as the projected 2.8% growth in global manufacturing output for 2024, directly influence the demand for Cabot's products, affecting their pricing power.

Market demand for specific materials, driven by sectors like automotive and electronics, is a key pricing determinant. In 2024, the electric vehicle (EV) market continued its expansion, with projections indicating a significant increase in battery material demand, which could benefit Cabot's specialty chemicals. Regional market dynamics, including varying inflation rates and consumer spending power across North America, Europe, and Asia, necessitate localized pricing adjustments.

External factors like regulatory changes and geopolitical events introduce volatility. For example, ongoing trade policy shifts or disruptions in key supply chains, such as those impacting rare earth minerals, can create supply shortages or cost increases. Cabot must maintain pricing flexibility to navigate these evolving dynamics and competitive pressures, ensuring its strategies align with broader economic trends and specific market demands.

Cabot's pricing must also consider:

- Industrial Growth Rates: Global industrial production growth, projected at 3.1% for 2024 by the OECD, directly correlates with demand for Cabot's materials.

- Material Demand: The burgeoning demand for advanced materials in sectors like renewable energy and semiconductors, projected to see substantial year-over-year growth in 2024-2025, will influence pricing.

- Geopolitical Stability: Events impacting energy prices and global trade routes, such as ongoing geopolitical tensions in Eastern Europe, can lead to unpredictable cost fluctuations affecting pricing.

- Regulatory Landscape: Evolving environmental regulations, particularly concerning emissions and material sourcing, can necessitate product reformulation or process changes, impacting cost structures and pricing.

Cabot's pricing is a strategic lever, balancing value-based considerations with raw material costs and competitive pressures. The company leverages its specialty chemicals' performance benefits, such as enhanced durability, to justify premium pricing, particularly in high-growth sectors like electric vehicles. For instance, in 2024, the demand for advanced battery materials saw significant increases, allowing for value-based pricing strategies.

Input costs, especially for carbon black feedstocks tied to crude oil, are a constant factor. While oil prices experienced volatility in 2024, Cabot mitigates this through strategic sourcing and long-term agreements to maintain stable pricing for its customers. This approach is critical in a competitive landscape where rivals like Eastman Chemical and Dow Inc. also adjust pricing dynamically.

Long-term contracts with major industrial clients, like tire manufacturers, often include volume discounts and fixed pricing, ensuring predictable revenue and customer loyalty. The global carbon black market, valued at approximately $17.5 billion in 2023, highlights the importance of these B2B relationships for Cabot's pricing structure.

Global economic conditions and market demand, influenced by factors like industrial growth (projected at 2.8% for global manufacturing output in 2024) and the expanding EV market, also shape Cabot's pricing. Geopolitical events and regulatory changes add further complexity, requiring adaptable pricing strategies to navigate cost fluctuations and competitive dynamics effectively.

| Pricing Factor | 2024/2025 Relevance | Impact on Cabot |

|---|---|---|

| Value-Based Pricing | High demand for EV battery materials | Premium pricing justified by performance benefits |

| Input Costs (Feedstocks) | Crude oil price volatility | Requires strategic sourcing and long-term contracts to stabilize |

| Competitive Landscape | Intense competition in specialty chemicals ($700B+ market) | Necessitates continuous monitoring of competitor pricing |

| Long-Term Contracts | Key for B2B clients (e.g., tire manufacturers) | Provides predictable revenue and customer loyalty via volume discounts/fixed pricing |

| Global Economic Conditions | Projected 3.2% global growth (IMF) | Influences overall demand and pricing power |

4P's Marketing Mix Analysis Data Sources

Our 4P analysis synthesizes data from official company filings, investor relations materials, and direct brand communications. We also incorporate insights from reputable industry reports and competitive intelligence platforms to ensure a comprehensive view of each marketing mix element.