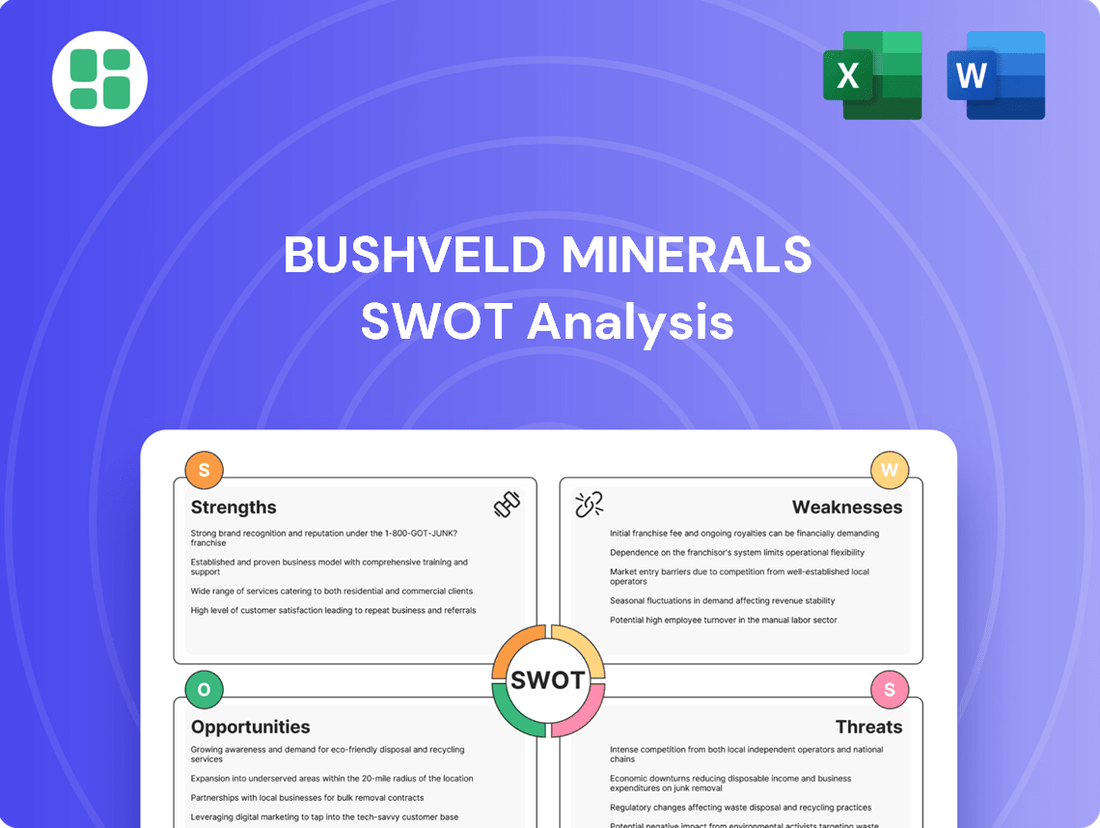

Bushveld Minerals SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bushveld Minerals Bundle

Bushveld Minerals boasts significant strengths in its project pipeline and strategic partnerships, but also faces challenges related to market volatility and operational scaling. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on the burgeoning critical minerals sector.

Want the full story behind Bushveld Minerals' competitive advantages, potential threats, and expansion opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

Bushveld Minerals' vertically integrated production model is a significant strength, controlling the entire vanadium value chain from mining to processing. This comprehensive oversight fosters enhanced efficiency and stringent quality control, crucial for producing high-purity vanadium products. Historically, this integration placed Bushveld among a select group of only three primary vanadium producers worldwide.

Bushveld Minerals boasts access to a significant high-grade vanadium resource base within South Africa's renowned Bushveld Complex. This substantial geological advantage ensures a long-term, reliable supply, a critical factor for its ambition to become a leading global vanadium producer.

Bushveld Minerals' strategic focus on the burgeoning energy storage sector, specifically through its subsidiary Bushveld Energy, is a significant strength. This positions the company to capitalize on the increasing demand for vanadium, a key component in Vanadium Redox Flow Batteries (VRFBs).

The global energy storage market is projected for substantial growth, with the VRFB segment expected to expand rapidly. Bushveld aims to be a primary supplier in this evolving market, leveraging its vanadium resources to meet future energy needs.

Operational Turnaround Initiatives

Bushveld Minerals has been actively pursuing operational turnaround initiatives, focusing on cost reduction and efficiency gains. These efforts are crucial for making its core assets, like the Vametco plant, cash-generative despite recent market headwinds.

Significant progress has been observed in optimizing operations. For instance, the company reported improved production stability and volume increases in its recent operational updates, demonstrating the early impact of these strategic changes.

- Cost Optimization: Implementation of rigorous cost-cutting measures across operations.

- Efficiency Improvements: Focus on enhancing productivity and operational stability, particularly at Vametco.

- Asset Rationalization: Strategic review and adjustment of asset portfolio to streamline operations.

- Workforce Adjustments: Targeted changes to optimize staffing levels and improve operational effectiveness.

Commitment to ESG Principles

Bushveld Minerals' dedication to Environmental, Social, and Governance (ESG) principles is a significant strength, underpinning its approach to sustainable mining. The company actively works to integrate these values across its operations, from extraction to processing.

This commitment is further evidenced by specific targets, such as the planned assessment of climate change transition risks and the implementation of TCFD recommendations by the end of 2024. This proactive stance is vital for building long-term stakeholder trust and ensuring responsible resource management.

- Sustainable Operations: Bushveld prioritizes environmentally sound mining and mineral processing.

- ESG Integration: The company aims to embed sustainability throughout its organizational structure.

- Climate Risk Preparedness: Plans are in place to assess climate transition risks and adopt TCFD recommendations by 2024.

Bushveld Minerals' vertically integrated model provides robust control over its vanadium production, enhancing efficiency and product quality. This integration, historically positioning them among a few global primary producers, is further supported by substantial high-grade vanadium resources in South Africa's Bushveld Complex, ensuring long-term supply security.

The company's strategic focus on the growing energy storage market through Bushveld Energy is a key strength. This positions them to benefit from the increasing demand for vanadium in Vanadium Redox Flow Batteries (VRFBs), a sector projected for significant expansion in the coming years.

Operational turnaround initiatives are yielding positive results, with reported improvements in production stability and volume increases. These efforts are crucial for enhancing the cash-generative capabilities of assets like the Vametco plant, demonstrating progress in cost reduction and efficiency gains.

Bushveld's commitment to ESG principles is a notable strength, guiding its approach to sustainable mining and resource management. The company is actively working to integrate these values, with plans to assess climate transition risks and adopt TCFD recommendations by the end of 2024, fostering stakeholder trust.

| Metric | 2023 (Actual/Estimate) | 2024 (Guidance/Estimate) |

|---|---|---|

| Vanadium Production (t) | ~2,400 | ~2,600 - 2,800 |

| ESG Target Achievement | Ongoing | TCFD Recommendations Assessment by end of 2024 |

| Energy Storage Market Share (VRFB) | Emerging | Targeting significant supplier role |

What is included in the product

This analysis maps Bushveld Minerals's internal strengths, such as its established mining operations and product diversification, against external opportunities like growing demand for vanadium and the company's potential for expansion. It also identifies weaknesses, including operational cost efficiencies and potential financing challenges, alongside threats like commodity price volatility and regulatory changes.

Offers a clear, actionable framework for identifying and mitigating Bushveld Minerals' strategic challenges.

Weaknesses

Bushveld Minerals is grappling with severe liquidity issues and significant financial distress. The company reported a substantial net loss of $45 million for the first half of 2024, coupled with an increase in net debt, painting a picture of a precarious financial standing.

These financial constraints are directly impacting operational efficiency, preventing the company from running its assets at optimal levels. The constrained cash flow and ongoing losses have forced Bushveld Minerals into a controlled slowdown of production activities.

A significant weakness for Bushveld Minerals is the placement of key South African entities into business rescue in November 2024, a direct consequence of severe liquidity challenges and operational hurdles. This critical development highlights the company's precarious financial standing and the substantial risk of ongoing operational suspensions unless new funding is successfully obtained.

Further compounding these operational issues, the Vametco plant experienced an extended shutdown, lasting until March 2025, ostensibly for necessary maintenance. This prolonged closure, coupled with the business rescue proceedings, severely impacts production capacity and revenue generation, creating a substantial drag on the company's overall performance and financial recovery prospects.

Bushveld Minerals faces a significant weakness due to its heavy reliance on delayed funding and asset sales, which has severely strained its working capital. For instance, in early 2024, the company was still navigating delays in expected funds from partners like Southern Point Resources (SPR) and Acacia, impacting its ability to maintain smooth operations.

These funding shortfalls, compounded by a partner's breach of terms, have directly hampered production levels and forced Bushveld to seek immediate additional financing simply to keep its operations afloat. The protracted nature of these issues highlights a critical vulnerability in the company's financial management and operational planning.

Weak Vanadium Prices and Market Volatility

Bushveld Minerals faces significant headwinds due to the weak vanadium price environment. The year-to-date decline in vanadium prices, estimated between 10% and 17% in early 2024, directly erodes the company's revenue streams and squeezes profitability margins.

This price weakness, coupled with the inherent volatility of commodity markets, places considerable financial pressure on Bushveld.

Consequently, achieving positive cash generation becomes a substantial hurdle, even with ongoing cost-reduction initiatives.

- Vanadium Price Decline: Early 2024 saw a 10-17% year-to-date drop in vanadium prices.

- Revenue Impact: This price weakness directly reduces Bushveld's top-line financial performance.

- Profitability Squeeze: Lower prices significantly impact the company's ability to generate profits.

- Cash Generation Challenge: Volatility and low prices make achieving positive cash flow difficult despite cost-cutting.

Suboptimal ESG Performance Metrics

Bushveld Minerals' commitment to ESG is evident, yet its reported carbon emissions in 2022 reached approximately 147,024,000 kg CO2e. Furthermore, its DitchCarbon score of 14 places it below 84% of industry averages, highlighting a significant area for improvement in measurable sustainability. The absence of specific Scope 1, 2, or 3 emissions disclosures suggests a need for more granular and transparent reporting to benchmark against competitors effectively.

This suboptimal ESG performance can be further detailed:

- High Carbon Footprint: The 2022 figure of 147,024,000 kg CO2e indicates a substantial environmental impact.

- Below Industry Average: A DitchCarbon score of 14 positions Bushveld Minerals unfavorably compared to 84% of its industry peers.

- Lack of Reporting Detail: The company has not disclosed specific Scope 1, 2, or 3 emissions, hindering detailed analysis of its environmental performance.

Bushveld Minerals faces significant operational challenges stemming from its financial distress. The company's inability to secure timely funding has led to production slowdowns and extended plant shutdowns, such as the Vametco plant's closure until March 2025, directly impacting revenue and cash flow.

The company's reliance on delayed funding from partners like Southern Point Resources and Acacia in early 2024 underscores a critical weakness in its financial planning and execution, forcing it to seek immediate additional financing to maintain operations.

The declining vanadium price environment, with a 10-17% year-to-date drop in early 2024, severely impacts Bushveld's revenue and profitability, making positive cash generation a substantial hurdle despite cost-reduction efforts.

Furthermore, Bushveld Minerals' environmental, social, and governance (ESG) performance is a notable weakness. With 2022 carbon emissions at approximately 147,024,000 kg CO2e and a DitchCarbon score of 14, placing it below 84% of industry averages, the company needs to improve its sustainability practices and reporting transparency.

| Metric | Value | Period | Implication |

|---|---|---|---|

| Net Loss | $45 million | H1 2024 | Indicates significant financial strain and inability to generate profit. |

| Vametco Plant Shutdown | Until March 2025 | Extended Period | Severely impacts production capacity and revenue. |

| Vanadium Price Change | -10% to -17% | Early 2024 (YTD) | Directly reduces revenue and profitability. |

| Carbon Emissions | 147,024,000 kg CO2e | 2022 | Highlights a substantial environmental footprint. |

| DitchCarbon Score | 14 | N/A | Places the company below 84% of industry averages for sustainability. |

What You See Is What You Get

Bushveld Minerals SWOT Analysis

This is a real excerpt from the complete Bushveld Minerals SWOT analysis. Once purchased, you’ll receive the full, editable version, offering a comprehensive overview of the company's strategic position.

Opportunities

The global market for Vanadium Redox Flow Batteries (VRFBs) is experiencing robust expansion, with projected compound annual growth rates (CAGRs) between 15.5% and 19.7% leading up to 2030. This surge is primarily fueled by the escalating need for effective large-scale energy storage systems.

Bushveld Minerals, through its subsidiary Bushveld Energy, is strategically positioned as a key vanadium supplier with a dedicated focus on the VRFB sector. This specialization allows the company to directly benefit from the increasing adoption of this technology.

This growing demand from the VRFB market presents a significant opportunity for increased vanadium consumption, offering a substantial avenue for growth that is distinct from the traditional demand drivers in the steel industry.

Global vanadium demand in the steel sector is projected to climb, bolstered by an increased intensity of use. This growth is particularly notable due to new regulations in China mandating higher vanadium content in steel rebar, a key driver for the market.

This sustained demand from the steel industry offers a robust base for Bushveld Minerals' core product. It effectively underpins the company's operations while simultaneously supporting the development of its newer energy storage applications.

Despite recent price weakness, there are encouraging signs of a market rebound on the horizon for vanadium. Long-term average prices are forecast to be significantly higher than current levels, with some analysts projecting a return to over $10 per pound by 2025.

A recovery in vanadium prices would directly improve Bushveld Minerals' revenue and profitability. For instance, if vanadium prices were to reach $12 per pound, it could significantly boost Bushveld's earnings before interest, taxes, depreciation, and amortization (EBITDA) from its Vametco operations, potentially alleviating some of its current financial pressures.

Streamlined Business Model Post-Vanchem Sale

The conditional sale of the Vanchem processing plant marks a significant strategic pivot for Bushveld Minerals, moving towards a more focused, pure upstream mining operation centered on Vametco. This asset rationalization is designed to cultivate a robust, cash-generating, and cost-efficient production base.

This streamlining is anticipated to sharpen operational focus and bolster long-term financial stability. For instance, Bushveld Minerals reported that the sale of Vanchem, if completed, would reduce its capital expenditure requirements. In 2023, the company's capex was primarily allocated to its mining and processing operations, with a significant portion directed towards Vametco's expansion projects.

- Focus on Vametco: The sale allows for concentrated investment and operational expertise at the Vametco asset.

- Reduced Capex: Divesting Vanchem lowers the overall capital expenditure burden, freeing up resources.

- Improved Financial Profile: A leaner operational structure can lead to better cash flow generation and financial health.

Technological Advancements in VRFB Efficiency

Ongoing research and development are significantly enhancing Vanadium Redox Flow Battery (VRFB) efficiency and reducing their cost. For instance, advancements in electrolyte chemistry and membrane technology are key areas of focus, aiming to improve energy density and cycle life. This technological maturation is crucial for making VRFBs a more attractive and cost-competitive energy storage solution.

As VRFB technology becomes more affordable and performant, its widespread adoption is expected to accelerate. This increased adoption directly translates into higher demand for vanadium electrolyte, a core component of VRFBs. Integrated producers like Bushveld Minerals are well-positioned to capitalize on this growing market, as they can supply the essential vanadium feedstock.

- Efficiency Gains: Research aims to boost VRFB energy density by 20-30% by 2025 through novel electrolyte formulations and improved membrane designs.

- Cost Reduction: Projected cost reductions for VRFB systems could reach $200/kWh by 2026, making them competitive with lithium-ion alternatives for grid-scale storage.

- Market Growth: The global VRFB market is forecast to grow from approximately $500 million in 2024 to over $2 billion by 2030, driven by renewable energy integration.

The burgeoning demand for Vanadium Redox Flow Batteries (VRFBs) presents a significant growth avenue for Bushveld Minerals, with the VRFB market projected to expand considerably. This expansion is driven by the increasing need for grid-scale energy storage solutions to support renewable energy integration.

Bushveld's strategic focus on supplying vanadium for VRFBs positions it to capitalize on this trend. Advancements in VRFB technology are making them more efficient and cost-effective, with projected cost reductions to $200/kWh by 2026, enhancing their competitiveness.

The global VRFB market is expected to see substantial growth, potentially reaching over $2 billion by 2030 from approximately $500 million in 2024. This upward trajectory directly translates into increased demand for vanadium electrolyte, a key component supplied by companies like Bushveld.

The steel industry continues to be a robust market for vanadium, with new regulations in China mandating higher vanadium content in steel rebar. This increased intensity of use is projected to drive global vanadium demand higher, providing a stable foundation for Bushveld's operations.

| Market Segment | 2024 Projection | 2030 Projection | CAGR (2024-2030) |

|---|---|---|---|

| VRFB Market | ~$0.5 billion | ~$2+ billion | ~15.5%-19.7% |

| Steel Rebar (China) | Steady Growth | Increased Intensity of Use | N/A |

Threats

Bushveld Minerals is facing a severe risk of liquidation and delisting from the London Stock Exchange's AIM market. The company's board has openly admitted to liabilities that it cannot meet and a lack of resources to sustain ongoing operations. This precarious financial situation places the company in significant jeopardy.

The ongoing business rescue proceedings for Bushveld's South African entities suggest a probable sale of these assets. If this occurs, any proceeds are likely to be allocated exclusively to secured creditors. Consequently, there is a high probability that ordinary shareholders will receive no benefit from such a sale, effectively wiping out their investment.

The sustained weakness and volatility in vanadium prices present a significant threat to Bushveld Minerals. For instance, vanadium prices experienced a substantial decline from peaks seen in 2021, trading at approximately $8.50 per pound in early 2024, down from over $10 per pound in some periods of 2023. This slump directly impacts Bushveld's revenue generation capabilities.

If vanadium prices fail to recover or continue their downward trend, Bushveld Minerals will struggle to achieve profitability. Even with aggressive internal cost management, the company's ability to generate sufficient cash flow to service its debt and fund future operations will be severely hampered by persistently low commodity prices.

Bushveld Minerals faces a significant threat from its ongoing struggle to secure vital funding and settle disputes with its financial partners. The company's very ability to continue its operations hinges on successfully navigating these financial challenges and resolving these critical disagreements.

Recent reports highlight that delays in receiving anticipated funds from crucial deals have already had a detrimental impact on Bushveld's production levels. This has consequently pushed the company into a precarious working capital situation, raising the immediate risk of operational suspension.

Competition and Alternative Energy Storage Technologies

While Vanadium Redox Flow Batteries (VRFBs) are gaining traction, the energy storage landscape is intensely competitive. Lithium-ion batteries, for instance, dominated the global energy storage market in 2023, accounting for an estimated 95% of new capacity additions, according to BloombergNEF. This widespread adoption of established technologies presents a significant challenge for VRFBs.

The cost of vanadium itself can be a hurdle for VRFB deployment. While the vanadium market has seen price volatility, with prices for vanadium pentoxide fluctuating significantly, high raw material costs can make VRFBs less economically appealing compared to alternatives, especially for smaller-scale applications. This cost factor could constrain the market penetration of VRFBs and, consequently, limit growth opportunities for vanadium producers like Bushveld Minerals.

- Lithium-ion dominance: Lithium-ion batteries held an estimated 95% of new global energy storage capacity additions in 2023.

- Cost barrier: The price of vanadium can be a significant factor impacting the competitiveness of VRFBs against other storage solutions.

- Market segmentation: Alternative battery chemistries may prove more cost-effective for certain market segments, potentially limiting VRFB market share.

Operational Instability and Production Disruptions

Bushveld Minerals has faced significant operational instability, notably at its Vametco plant. Escalating equipment failures necessitated extended maintenance shutdowns, directly impacting production volumes. For instance, during the first half of 2023, Vametco's production was affected by these challenges.

These operational hurdles were compounded by cash flow constraints, leading to delayed payments to suppliers. This financial strain further hampered the company's ability to procure necessary parts and services, creating a cycle of production slowdowns and uncertainty. The inability to secure consistent operational uptime directly affected Bushveld's capacity to meet its planned production targets for 2024.

- Vametco Production Impact: Extended maintenance shutdowns in 2023 led to a reduction in vanadium production compared to initial forecasts.

- Supplier Relations: Cash flow issues resulted in a backlog of overdue supplier payments, threatening the continuity of essential services and material supply.

- Revenue Uncertainty: Production disruptions directly translate to missed sales opportunities and a less predictable revenue stream for the company in the 2024 fiscal year.

Bushveld Minerals faces significant threats from its precarious financial standing, including the risk of liquidation and delisting. The company's admitted inability to meet liabilities and lack of operating resources means any asset sales from business rescue proceedings are likely to benefit only secured creditors, leaving ordinary shareholders with no return. Furthermore, persistent weakness and volatility in vanadium prices, which fell to around $8.50 per pound in early 2024 from over $10 per pound in 2023, directly undermine revenue and profitability, making debt servicing and future operations challenging even with cost controls.

SWOT Analysis Data Sources

This Bushveld Minerals SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a reliable basis for understanding the company's current position and future prospects.