Bushveld Minerals PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bushveld Minerals Bundle

Bushveld Minerals operates within a dynamic global landscape, significantly influenced by political stability, economic fluctuations, and evolving social attitudes towards mining. Understanding these external forces is crucial for strategic planning and risk mitigation.

Our comprehensive PESTLE analysis delves deep into these factors, providing you with actionable intelligence to navigate the complexities of the mineral sector. Gain a competitive edge by anticipating market shifts and identifying emerging opportunities.

Don't be left behind; unlock the full potential of this analysis. Download the complete PESTLE report for Bushveld Minerals now and equip yourself with the insights needed to make informed decisions.

Political factors

The South African government's approach to mining policy, particularly the anticipated finalization of the Draft Mineral Resources Development Bill in 2025, creates a dynamic operating environment for Bushveld Minerals. While the intent is to foster greater certainty, specific clauses, such as the potential need for ministerial consent for significant shareholding shifts, could introduce complexities and potentially dampen investor appetite.

Navigating regulatory processes remains a critical factor, with ongoing concerns about the efficiency and timeliness of mining application approvals. Delays in obtaining necessary permits and licenses can directly impact project timelines and operational commencement, posing a tangible challenge for companies like Bushveld Minerals in realizing their development plans within the 2024-2025 period.

Global geopolitical shifts, especially concerning critical minerals, directly impact Bushveld Minerals' standing. The evolving international landscape and trade policies can create both opportunities and challenges for companies reliant on these vital resources.

South Africa's Critical Minerals Strategy, approved in May 2025, prioritizes domestic utilization over alignment with Western renewable energy mineral needs. This strategic focus may shape Bushveld Minerals' international collaborations and attract different types of investment.

Trade relations between South Africa, a major vanadium producer, and key global markets directly shape demand for its vanadium products. For instance, South Africa's trade volume with the United States, a significant market, is crucial for Bushveld Minerals' export strategy.

However, potential strategic omissions in South Africa's critical minerals list could affect future trade agreements. This is particularly relevant for minerals like vanadium, essential for the burgeoning energy storage sector, potentially impacting investment flows and market access for producers like Bushveld.

Political Stability and Local Governance

Political stability in South Africa is a crucial element for mining operations like Bushveld Minerals. Fluctuations in government policy or social unrest can significantly disrupt production and investment. The effectiveness of local governance, particularly in providing essential services like power, directly impacts operational efficiency.

Bushveld Minerals has explicitly highlighted the positive impact of stable power supply from local municipalities on its Vametco plant. This reliability is essential for maintaining consistent production schedules and managing operational costs effectively. For instance, in 2024, the consistent power provision allowed Vametco to achieve its production targets without significant interruptions, a stark contrast to periods of less reliable municipal service delivery.

- South Africa’s political landscape continues to evolve, with upcoming general elections in 2024 influencing policy direction.

- Municipal service delivery, particularly electricity, remains a key concern for industrial operations.

- Bushveld Minerals’ Vametco plant has benefited from improved power stability, contributing to consistent production in early 2024.

Support for Energy Transition Initiatives

Government backing for the global shift towards cleaner energy is a significant political driver. In 2024, numerous nations are solidifying their commitment through substantial financial incentives and policy frameworks aimed at accelerating renewable energy adoption and enhancing grid stability. This creates a favorable environment for technologies like vanadium redox flow batteries, a core focus for Bushveld Minerals.

Policies that actively encourage the integration of renewable energy sources and bolster grid resilience directly translate into increased demand for advanced energy storage solutions. For instance, the European Union's continued investment in green hydrogen and battery storage infrastructure, with significant portions allocated through the NextGenerationEU recovery fund, is expected to stimulate market growth for vanadium batteries through 2025 and beyond.

- Government Incentives: Many countries are offering tax credits, subsidies, and feed-in tariffs for renewable energy projects and associated storage.

- Renewable Energy Targets: Ambitious national targets for renewable energy penetration necessitate robust grid management and storage capabilities.

- Energy Security Policies: Governments are increasingly prioritizing energy independence, which supports the development of domestic battery manufacturing and supply chains.

- Infrastructure Investment: Public funding for grid modernization and expansion projects often includes provisions for energy storage integration.

The South African government's focus on domestic utilization of critical minerals, as outlined in its May 2025 strategy, may influence Bushveld Minerals' international partnerships and investment sources. Potential policy shifts, such as those anticipated with the finalization of the Draft Mineral Resources Development Bill in 2025, could introduce regulatory hurdles like ministerial consent for shareholding changes, potentially impacting investor confidence.

Delays in mining application approvals remain a significant concern, directly affecting project timelines and operational start-up for companies like Bushveld Minerals. Furthermore, the evolving global geopolitical landscape, particularly concerning critical minerals and trade policies, presents both opportunities and challenges for Bushveld's export strategy, with trade volumes with key markets like the United States being crucial.

Political stability within South Africa is paramount, as policy fluctuations or social unrest can disrupt operations and investment. The reliability of municipal services, especially electricity, directly impacts operational efficiency, as demonstrated by the positive contribution of stable power supply to Bushveld's Vametco plant's production targets in early 2024.

Government support for the global transition to cleaner energy, including financial incentives and policy frameworks for renewable energy adoption and grid stability, creates a favorable environment for vanadium redox flow batteries, a key area for Bushveld Minerals. For example, the European Union's substantial investments through the NextGenerationEU fund are expected to boost the market for vanadium batteries through 2025.

What is included in the product

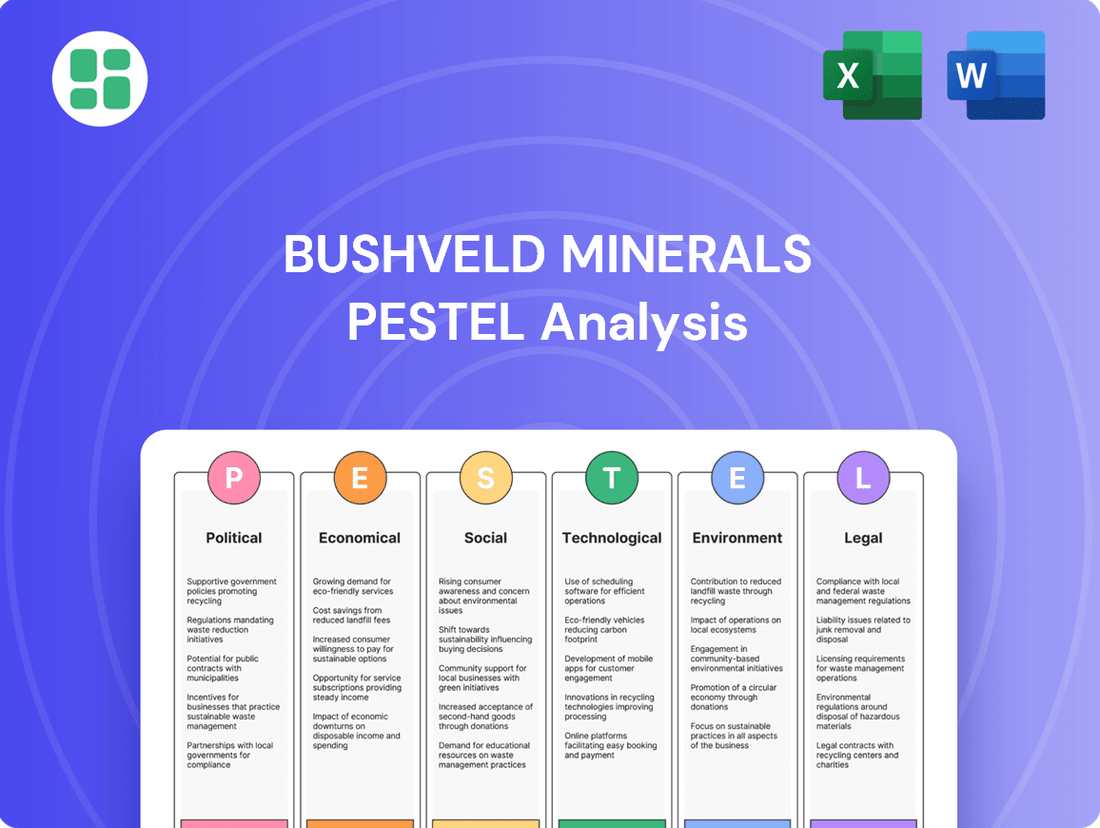

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Bushveld Minerals, detailing their impact across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats within the company's operating landscape.

Bushveld Minerals' PESTLE analysis offers a clear, summarized version of external factors, simplifying complex market dynamics for easy referencing during strategic planning meetings.

This PESTLE analysis provides a concise, easily shareable summary format, ideal for quick alignment across teams and departments on external risks and market positioning.

Economic factors

The global price of vanadium is a critical factor for Bushveld Minerals, directly influencing its revenue and profitability. The company has navigated periods of weak vanadium pricing, which has presented operational challenges.

Despite recent headwinds, Bushveld Minerals maintains an optimistic outlook for a market recovery. Their long-term average price forecast for vanadium remains in the $40/kg range, reflecting expectations of increased demand, particularly from the steel and battery sectors.

Bushveld Minerals has grappled with significant funding and liquidity issues, which have directly hampered its ability to operate at full capacity and meet production targets. These constraints have been a persistent challenge, forcing the company to navigate a difficult financial landscape.

To address these liquidity pressures, Bushveld Minerals has been actively pursuing new funding avenues. Concurrently, the company has been strategically divesting certain non-core assets. This approach aims to bolster its financial position and ensure the continuity of its core operations.

The global energy storage market is experiencing robust expansion, creating substantial economic avenues, especially for vanadium redox flow batteries (VRFBs). Bushveld Minerals is strategically positioned to become a major supplier in this burgeoning sector.

Demand for vanadium in VRFBs is projected for significant growth, with estimates suggesting a substantial increase by 2030. This trend is driven by the increasing need for grid-scale energy storage solutions to integrate renewable energy sources.

Operational Costs and Efficiency

Controlling production costs and enhancing operational efficiency are paramount for Bushveld Minerals' financial well-being. The company has actively pursued cost-reduction strategies, such as optimizing workforce levels and undertaking plant turnaround projects, to establish a resilient and cost-effective production base.

These initiatives are designed to bolster profitability and competitiveness in the global market. For instance, during the first half of 2024, Bushveld Minerals reported a significant reduction in its all-in sustaining costs (AISC) for its PGM operations, a key metric for mining profitability.

- AISC Reduction: Bushveld Minerals achieved a notable decrease in AISC for its PGM operations in H1 2024, demonstrating progress in cost management.

- Headcount Optimization: Strategic headcount adjustments were implemented to streamline operations and reduce labor-related expenses.

- Plant Turnaround Success: Successful completion of plant turnaround initiatives contributed to improved operational uptime and efficiency.

- Cost Benchmarking: The company aims to benchmark its operational costs against industry leaders to identify further areas for improvement.

Global Steel Industry Demand

Global steel industry demand is a critical driver for vanadium consumption, with infrastructure projects worldwide significantly influencing its trajectory. For instance, China's ongoing infrastructure build-out and its regulatory push for higher vanadium content in steel rebar, a policy implemented in recent years, directly boosts demand for vanadium. Bushveld Minerals strategically focuses its sales efforts on these higher-value segments within the steel and specialty alloy markets, aiming to capitalize on these trends.

The steel sector's health is intrinsically linked to global economic activity and construction pipelines. In 2024, projections for global steel demand indicated a modest increase, driven by sectors like automotive and infrastructure, though construction activity in some key regions showed varied performance. Bushveld Minerals' emphasis on specialty steel applications, such as high-strength low-alloy (HSLA) steels used in construction and infrastructure, positions it to benefit from these specific market drivers.

- Infrastructure Development: Global infrastructure spending, particularly in emerging economies, is a key determinant of steel demand.

- Regulatory Impact: Policies mandating increased vanadium content in steel, like those in China, directly enhance market opportunities.

- Specialty Alloys: Bushveld Minerals targets higher-value markets, including specialty alloys and advanced steel grades, which often command premium pricing.

- Market Focus: The company's strategy prioritizes sales into sectors where vanadium offers significant performance enhancements, aligning with evolving industry standards.

The global economic landscape significantly impacts Bushveld Minerals, particularly through commodity prices and demand cycles. While the company anticipates a recovery in vanadium prices, reaching an average of $40/kg, it has faced liquidity challenges that have affected its operational capacity. Bushveld is actively seeking new funding and divesting non-core assets to improve its financial standing.

The burgeoning energy storage market, driven by the demand for VRFBs, presents a substantial growth opportunity for Bushveld Minerals. Projections indicate a significant increase in VRFB demand by 2030, positioning Bushveld to capitalize on this trend. Cost control and operational efficiency remain paramount, with the company demonstrating success in reducing all-in sustaining costs (AISC) for its PGM operations, achieving a notable decrease in H1 2024.

Global steel demand, influenced by infrastructure projects and regulatory mandates such as China's push for higher vanadium content in steel rebar, is a key driver for Bushveld. The company strategically targets specialty steel applications and advanced alloys, where vanadium offers significant performance benefits. In 2024, global steel demand was projected for modest growth, with Bushveld's focus on HSLA steels aligning with infrastructure and automotive sector needs.

| Metric | Value | Period | Notes |

|---|---|---|---|

| Vanadium Price Forecast (Average) | $40/kg | Long-term | Reflects expected demand increase |

| AISC (PGM Operations) | Reduced | H1 2024 | Demonstrates cost management progress |

| VRFB Market Growth | Projected significant increase | By 2030 | Driven by grid-scale energy storage |

| Global Steel Demand Growth | Modest increase | 2024 (Projected) | Supported by automotive and infrastructure |

Preview the Actual Deliverable

Bushveld Minerals PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Bushveld Minerals delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook. Understand the key drivers shaping Bushveld Minerals' future.

Sociological factors

Bushveld Minerals actively engages in community relations, investing in socio-economic development through its Social & Labour Plans (SLPs) and Corporate Social Investment (CSI) programs. These initiatives, crucial for maintaining a positive operating environment, focus on tangible improvements in education, skills development, and local infrastructure, aiming to foster sustainable growth and shared value with its host communities.

In 2023, Bushveld Minerals reported significant contributions to its SLPs, with a substantial portion of its expenditure directed towards local employment and enterprise development. For instance, the company's efforts in the Limpopo province, where its key assets are located, saw a notable increase in local procurement, exceeding targets set for the period.

Bushveld Minerals prioritizes sourcing labor from its host municipalities, a strategy aimed at fostering local socio-economic development. This approach aligns with broader sociological trends emphasizing community benefit and local economic empowerment.

Recent operational adjustments in 2023 saw Bushveld Minerals undergo restructuring, which included a reduction in headcount. This was coupled with changes in management structures, reflecting evolving employment practices within the mining sector.

To mitigate the impact of these changes and build future capacity, the company has invested in human resource development. Initiatives like learnerships and bursaries are in place to enhance the skills and employment prospects of its workforce, a critical factor in maintaining positive labor relations.

Bushveld Minerals places a strong emphasis on health and safety, fostering a culture where safety is the top priority across all its operations. This commitment is demonstrated through proactive measures designed to minimize risks and ensure the well-being of its workforce.

The company has achieved notable progress in reducing its Total Recordable Injury Frequency Rate (TRIFR), a key metric for workplace safety. For instance, in 2023, Bushveld Minerals reported a TRIFR of 1.27, a significant decrease from previous periods, reflecting the effectiveness of their safety initiatives.

These improvements are largely attributed to the implementation of comprehensive safety diagnostic audits and a strategic focus on leading indicators, which help identify and address potential hazards before they result in incidents. This data-driven approach underscores Bushveld's dedication to continuous enhancement of its safety performance.

Stakeholder Engagement and Value Creation

Bushveld Minerals actively cultivates shared value by prioritizing engagement with a broad spectrum of stakeholders. This commitment extends to employees, local communities, governmental bodies, and shareholders, aiming for mutual benefit.

The company's strategy involves consistent dialogue and collaboration with diverse community groups, ensuring their perspectives are integrated into operations. This proactive approach is fundamental to building trust and fostering long-term relationships, even when navigating financial headwinds.

Bushveld Minerals' dedication to Environmental, Social, and Governance (ESG) principles underpins its stakeholder engagement. For instance, in its 2023 Integrated Report, the company highlighted community development initiatives and employee training programs, demonstrating tangible actions aligned with its ESG commitments.

- Community Investment: Bushveld Minerals reported R18.5 million in community investment during 2023, focusing on education and infrastructure projects.

- Employee Development: The company invested R12.2 million in employee training and development programs in 2023, aiming to enhance skills and career progression.

- Stakeholder Consultations: Over 50 formal consultation sessions with local communities were conducted in 2023 to address concerns and foster collaborative solutions.

- ESG Reporting: Bushveld Minerals aims for transparency in its ESG performance, with detailed reporting on social impact and governance practices.

Public Perception of Mining

The public's view of the mining sector, particularly concerning its social and environmental footprint, directly impacts Bushveld Minerals' ability to operate smoothly. Negative perceptions can lead to protests, regulatory hurdles, and difficulty securing funding.

Bushveld Minerals actively works to build trust and a positive image by emphasizing responsible mining practices and investing in community development programs. This proactive approach is crucial for maintaining its social license to operate.

- Community Engagement: Bushveld Minerals reported investing R10 million in community projects in 2023, focusing on education and local infrastructure, aiming to improve public perception.

- Environmental Stewardship: The company's sustainability reports highlight efforts to minimize its environmental impact, a key factor in public acceptance.

- Job Creation: In 2024, Bushveld Minerals' operations directly and indirectly supported an estimated 1,500 jobs, a positive economic contribution often viewed favorably by the public.

Societal expectations regarding corporate responsibility continue to shape Bushveld Minerals' operations. The company's commitment to its Social & Labour Plans, including R18.5 million invested in community development in 2023, directly addresses these expectations by focusing on education and infrastructure. Furthermore, the R12.2 million allocated to employee training in the same year highlights a dedication to workforce development, aligning with societal emphasis on skills enhancement and local employment.

Public perception of the mining industry significantly influences Bushveld Minerals' social license to operate. By investing R10 million in community projects in 2023 and emphasizing responsible practices, the company actively works to foster a positive image and build trust. The estimated 1,500 jobs directly and indirectly supported by Bushveld's operations in 2024 underscore its positive economic contribution, a factor that generally garners favorable public opinion.

Bushveld Minerals prioritizes stakeholder engagement, conducting over 50 formal consultation sessions with local communities in 2023 to address concerns and promote collaboration. This proactive approach, coupled with a strong emphasis on ESG principles as detailed in their 2023 Integrated Report, aims to build mutually beneficial relationships and ensure operational continuity, even amidst economic fluctuations.

Technological factors

Technological progress in Vanadium Redox Flow Batteries (VRFBs) is a major boost for Bushveld Minerals, as they are positioned to supply the high-purity vanadium needed for these advanced energy storage systems. The inherent benefits of VRFBs, including their extended operational life, ability to achieve 100% depth of discharge, and cost-effectiveness over their entire lifecycle, coupled with the inherent reusability of vanadium, are speeding up their market adoption.

Bushveld Minerals' commitment to technological advancement in mining and processing is paramount for driving down operational costs and boosting efficiency. By embracing new techniques, the company aims to solidify its competitive edge in the market.

A key focus for Bushveld Minerals in 2024 and 2025 is the optimization of its Vametco plant. This involves significant refurbishment and ongoing maintenance projects designed to ensure stable and sustainable production output, a critical factor for meeting market demand and achieving financial targets.

Bushveld Minerals, through its former subsidiary Bushveld Energy, is a player in the energy storage sector, specifically focusing on vanadium and electrolyte production. The company's involvement is crucial for the growth of the Vanadium Redox Flow Battery (VRFB) market, as the availability of high-purity vanadium electrolyte is a direct enabler for this technology.

The demand for VRFBs is projected to grow significantly. For instance, the global VRFB market was valued at approximately USD 450 million in 2023 and is expected to reach over USD 1.5 billion by 2030, growing at a compound annual growth rate of around 18%. This expansion directly translates to an increased need for efficient and cost-effective electrolyte production technologies.

Technological advancements in electrolyte production are critical for reducing costs and improving the performance of VRFBs. Innovations in purification processes and manufacturing techniques can lower the price of vanadium electrolyte, making VRFBs more competitive against other energy storage solutions like lithium-ion batteries, which currently dominate the market.

Automation and Digitalization in Operations

The mining sector, including companies like Bushveld Minerals, is increasingly adopting automation and digitalization to boost safety, efficiency, and data handling. This technological shift aims to streamline operations and improve overall performance.

Bushveld Minerals' commitment to operational excellence suggests a strategic integration of these advanced technologies. For instance, in 2024, the broader mining industry saw significant investment in AI-powered predictive maintenance, reducing downtime by an estimated 15-20% in some operations. Similarly, the use of autonomous haulage systems is becoming more prevalent, with deployments showing potential for a 10-15% increase in material moved per hour.

Key technological factors influencing Bushveld Minerals include:

- Enhanced Safety: Automation reduces human exposure to hazardous environments, a critical concern in mining.

- Improved Efficiency: Digital tools and automated processes can optimize resource allocation and production cycles.

- Data-Driven Decisions: Advanced analytics from digitized operations provide real-time insights for better management and forecasting.

- Cost Reduction: Automation can lead to lower labor costs and reduced operational waste, contributing to better financial outcomes.

Research and Development for New Applications

Continued investment in research and development (R&D) for novel vanadium applications is crucial for Bushveld Minerals. Exploring uses beyond traditional steel, such as in advanced batteries and catalysts, can significantly broaden the market for vanadium. For instance, the Vanadium Redox Flow Battery (VRFB) market is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 20% through 2030.

Bushveld Minerals' R&D efforts can unlock new revenue streams and de-risk its reliance on the steel sector. Emerging applications in areas like aerospace, high-strength low-alloy steels for infrastructure, and even in the medical field present exciting growth avenues. By focusing on these innovative uses, Bushveld Minerals can position itself to capitalize on future technological advancements and evolving industrial demands.

Key R&D focus areas for Bushveld Minerals should include:

- Vanadium Redox Flow Batteries (VRFBs): Enhancing energy density and reducing costs for grid-scale energy storage.

- Advanced Alloys: Developing new high-performance alloys for aerospace and automotive sectors, potentially increasing vanadium content per unit.

- Catalysis: Investigating vanadium's role in chemical processes and emissions control technologies.

- 3D Printing: Exploring vanadium’s properties for additive manufacturing of specialized components.

Technological advancements in mining, such as automation and digitalization, are enhancing safety and efficiency for companies like Bushveld Minerals. In 2024, the mining sector saw increased adoption of AI for predictive maintenance, potentially reducing downtime by up to 20%. Autonomous haulage systems are also gaining traction, with deployments showing a 10-15% increase in material moved per hour.

The growth of Vanadium Redox Flow Batteries (VRFBs) is a significant technological driver, with the global VRFB market projected to grow from approximately USD 450 million in 2023 to over USD 1.5 billion by 2030, at an 18% CAGR. Bushveld Minerals is well-positioned to supply the high-purity vanadium needed for these batteries, and ongoing R&D into VRFB performance and electrolyte production costs is crucial for market penetration.

Bushveld Minerals' focus on optimizing its Vametco plant in 2024-2025 involves technological upgrades to ensure stable production. This includes embracing new processing techniques to drive down operational costs and maintain a competitive edge. Research into novel vanadium applications, beyond traditional steel, such as in advanced alloys for aerospace and catalysis, is also a key R&D focus area.

Legal factors

Bushveld Minerals navigates a complex legal landscape in South Africa, primarily governed by the National Environmental Management Act (NEMA) and the Mineral and Petroleum Resources Development Act (MPRDA). These laws mandate strict adherence to environmental protection standards and responsible resource extraction. For example, in 2023, the Department of Forestry, Fisheries and the Environment reported that over 80% of new mining projects required comprehensive Environmental Impact Assessments.

Compliance involves securing various rights, permits, and environmental authorizations, alongside the implementation of detailed Environmental Management Plans. Failure to comply can lead to significant fines and operational disruptions, underscoring the critical importance of robust legal and environmental oversight for Bushveld Minerals' operations.

Bushveld Minerals must strictly adhere to South Africa's comprehensive labor laws, which govern everything from employment contracts and fair working conditions to lawful retrenchment procedures. This includes ensuring compliance with the Basic Conditions of Employment Act and the Labour Relations Act, fundamental to maintaining employee relations and avoiding legal disputes.

The company actively engages with recognized trade unions, a common practice in South Africa's mining sector, to foster constructive dialogue and manage industrial relations. Adherence to Social and Labour Plans (SLPs) is a key regulatory requirement, demonstrating commitment to community development and local employment, with progress often reported in annual reviews.

In 2023, South Africa's unemployment rate stood at approximately 32.9%, highlighting the sensitivity of labor regulations for companies like Bushveld Minerals. The company's commitment to fair labor practices and engagement with organized labor is therefore not just a legal necessity but also a crucial element for operational stability and social license to operate.

Bushveld Minerals' South African operations are currently under business rescue, a process governed by the Companies Act 71 of 2008. This legal framework aims to facilitate the financial restructuring and potential turnaround of distressed companies.

The ultimate holding company has also filed for liquidation, signaling a shift in the legal approach to managing the group's financial challenges. These proceedings directly impact the company's ability to manage its assets and liabilities, with significant implications for its future operations.

Competition Law and Mergers/Acquisitions

Bushveld Minerals' strategic maneuvers, like the sale of its Vanchem processing plant, are under the watchful eye of the South African Competition Tribunal. This regulatory body's approval is a critical hurdle, ensuring that such transactions do not stifle market competition. For instance, the sale of Vanchem to a new owner requires navigating these stringent competition law requirements.

Adherence to competition legislation is paramount for Bushveld Minerals, particularly when considering divestments or forming new partnerships. These legal frameworks are designed to safeguard fair market practices and prevent monopolistic tendencies. In 2023, the Tribunal reviewed numerous transactions, underscoring the active enforcement of these statutes across various sectors.

- Regulatory Approval: The sale of key assets, such as the Vanchem processing plant, necessitates approval from the South African Competition Tribunal.

- Fair Market Practices: Compliance with competition laws is essential for strategic divestments and partnerships to maintain a level playing field.

- Market Dynamics: The Tribunal's decisions influence market concentration and the overall competitive landscape in which Bushveld Minerals operates.

International Standards and Compliance Frameworks

Bushveld Minerals actively aligns its operations with globally recognized environmental and social benchmarks. This includes adherence to the International Finance Corporation's (IFC) Environmental and Social Performance Standards, which are crucial for attracting international capital. The company also maintains certification under ISO 14001:2015, demonstrating a robust environmental management system. This commitment to international standards is vital for building trust with stakeholders and ensuring sustainable business practices.

By integrating these international frameworks, Bushveld Minerals enhances its appeal to a global investor base increasingly focused on Environmental, Social, and Governance (ESG) criteria. For instance, in 2024, ESG investments globally are projected to reach substantial figures, making compliance with these standards a competitive advantage. This proactive approach to compliance not only mitigates regulatory risks but also positions the company favorably in a market where responsible resource development is paramount.

- IFC Performance Standards: Bushveld Minerals' commitment to these standards ensures responsible project development and management, addressing key risks related to environmental and social impacts.

- ISO 14001:2015 Certification: This certification validates the company's systematic approach to environmental management, aiming to reduce environmental impact and improve performance.

- Investor Appeal: Adherence to international standards is a key factor for institutional investors, particularly those with significant ESG mandates, enhancing access to capital.

- Reputational Risk Mitigation: Compliance with global benchmarks helps Bushveld Minerals avoid reputational damage associated with environmental or social non-compliance.

Bushveld Minerals operates under South Africa's stringent business rescue provisions, as outlined in the Companies Act 71 of 2008. This legal framework is designed to aid financially distressed companies through restructuring, directly impacting the company's asset management and future operational capacity. The ultimate holding company's liquidation filing further signifies a significant legal shift in addressing group-wide financial challenges.

Environmental factors

Bushveld Minerals is committed to robust environmental stewardship, with extensive programs covering water, land, waste, and air quality management. This dedication ensures strict adherence to both national and international environmental regulations.

The company's compliance is regularly validated through independent external audits, which rigorously assess adherence to its established Environmental Management Plans and all applicable legal mandates.

Bushveld Minerals has committed to achieving net-zero emissions for its Scope 1 and Scope 2 greenhouse gas (GHG) emissions by 2050. This ambitious target underscores the company's recognition of the critical need for decarbonization within the mining industry. While precise interim reduction targets are still being defined, this commitment aligns with global efforts to combat climate change and signals a proactive approach to environmental stewardship.

Bushveld Minerals prioritizes responsible water management and waste disposal to prevent pollution. This includes robust protocols for both mineral and non-mineral waste streams, crucial for minimizing environmental impact.

The company is actively investing in projects like solar-powered water provision systems for local communities, demonstrating a commitment to sustainable resource management and social responsibility. These initiatives directly address water scarcity and improve living conditions, aligning with broader environmental stewardship goals.

Land Rehabilitation and Biodiversity

Mining operations inherently require robust mine closure and land rehabilitation strategies to restore disturbed areas. Bushveld Minerals is committed to environmental stewardship, integrating plans to manage biodiversity impacts and ensure responsible land management throughout its project lifecycles.

The company’s approach includes detailed rehabilitation plans, aiming to return mined land to a state that supports ecological function and local biodiversity. For instance, in their 2023 sustainability report, Bushveld Minerals highlighted ongoing rehabilitation efforts at their Mokopane Tin project, with a focus on native vegetation re-establishment.

- Rehabilitation Planning: Bushveld Minerals develops site-specific closure and rehabilitation plans, often in consultation with regulatory bodies and local communities, to address land restoration post-mining.

- Biodiversity Management: The company aims to minimize the impact of its activities on local ecosystems and biodiversity, implementing measures to protect and, where possible, enhance habitats.

- Progress Reporting: Bushveld Minerals publicly reports on its environmental performance, including updates on rehabilitation progress and biodiversity initiatives, as demonstrated in their annual sustainability disclosures.

Sustainability of Vanadium and VRFBs

Vanadium's role in the low-carbon economy is significant, especially with Vanadium Redox Flow Batteries (VRFBs). These batteries offer a more sustainable energy storage option, boasting a 30% lower carbon footprint compared to traditional lithium-ion batteries. Furthermore, the vanadium electrolyte in VRFBs is 100% reusable, highlighting their long-term environmental benefits.

Bushveld Minerals is strategically positioned to capitalize on this trend. The company's focus on vanadium production directly supports the growth of VRFB technology, a key component in renewable energy infrastructure. This aligns Bushveld with global efforts towards decarbonization.

- Vanadium's Environmental Edge: VRFBs offer a 30% lower carbon footprint than Li-ion batteries.

- Electrolyte Reusability: The vanadium electrolyte in VRFBs is 100% reusable, reducing waste.

- Contribution to Green Future: Bushveld Minerals' vanadium production supports sustainable energy storage solutions.

- Market Growth Potential: The increasing demand for grid-scale energy storage favors VRFB technology.

Bushveld Minerals actively manages its environmental footprint, focusing on water, land, waste, and air quality. The company is committed to net-zero Scope 1 and 2 emissions by 2050, underscoring its dedication to decarbonization within the mining sector.

The company's environmental strategy includes robust rehabilitation plans, exemplified by efforts at the Mokopane Tin project to re-establish native vegetation. Bushveld also champions the environmental benefits of vanadium, particularly its use in Vanadium Redox Flow Batteries (VRFBs), which have a 30% lower carbon footprint than lithium-ion alternatives and 100% reusable electrolyte.

Bushveld Minerals' proactive approach to environmental stewardship is evident in its investment in solar-powered water systems for communities, addressing water scarcity and enhancing local living conditions.

| Environmental Focus | Key Initiatives/Data | Impact/Benefit |

|---|---|---|

| Emissions Reduction | Net-zero Scope 1 & 2 by 2050 | Alignment with global climate goals |

| Land Rehabilitation | Native vegetation re-establishment at Mokopane Tin | Restoration of mined land, biodiversity support |

| Sustainable Energy Storage | Vanadium for VRFBs | 30% lower carbon footprint than Li-ion, 100% reusable electrolyte |

| Water Management | Solar-powered water provision systems | Addressing water scarcity, community support |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bushveld Minerals is grounded in data from official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.