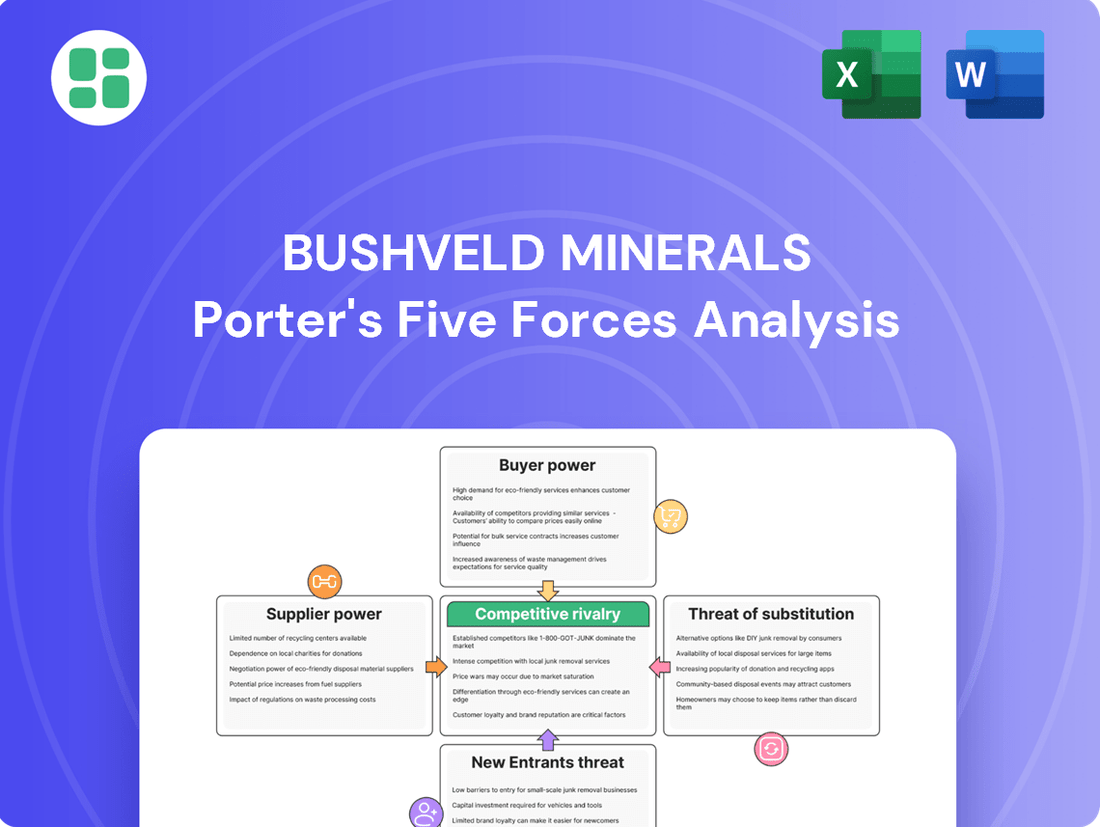

Bushveld Minerals Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bushveld Minerals Bundle

Bushveld Minerals faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers being key considerations. Understanding these dynamics is crucial for any stakeholder looking to navigate the complex ferroalloys market.

The complete report reveals the real forces shaping Bushveld Minerals’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bushveld Minerals' strategic move into vertical integration, specifically mining its own vanadium ore, significantly curtails the bargaining power of external raw material suppliers for this critical input. This integration shields the company from the volatility of spot prices and potential supply chain disruptions originating from independent ore producers.

However, this direct control over vanadium ore does not extend to other essential operational inputs. For these secondary materials and services, suppliers can still exert considerable influence, potentially impacting Bushveld's costs and operational efficiency. For instance, in 2023, the global average price for key industrial chemicals used in mineral processing saw an increase of approximately 5-8%, a factor Bushveld would still need to manage with its suppliers of these components.

Bushveld Minerals, while mining its own vanadium ore, still depends on outside companies for crucial, specialized mining equipment and processing chemicals. This reliance means certain suppliers, especially those with unique or patented products, can hold significant power over pricing and when deliveries happen. For instance, a delay in receiving specialized flotation reagents could directly slow down their processing capabilities.

Energy supply, especially electricity, is a make-or-break factor for mining and processing. Bushveld Minerals has faced issues with 'stabilised power supply from the local municipality,' highlighting the critical role of energy providers. These suppliers often hold considerable sway because their service is indispensable and viable alternatives are scarce. For instance, in 2023, electricity prices in South Africa, where Bushveld operates, saw an average increase of 18.45% from Eskom, directly impacting operational costs.

Labor Market Dynamics and Skilled Workforce

The availability and cost of a skilled workforce in South Africa's mining and processing sectors can significantly influence supplier power. A scarcity of specialized talent or robust union presence can drive up wage expectations and potentially create operational hurdles.

For instance, in 2024, the mining sector in South Africa continued to grapple with skills shortages in critical areas like geological engineering and specialized equipment operation. This dynamic can empower labor unions to negotiate for higher compensation and better working conditions, directly impacting Bushveld Minerals' operational costs and production schedules.

- Skills Shortages: Specific technical roles in mining and metallurgy often face a limited pool of qualified candidates in South Africa.

- Union Influence: Strong labor unions in the mining sector can leverage collective bargaining to increase labor costs.

- Productivity Impact: A stable, skilled workforce is crucial for maintaining consistent output and efficiency in mineral processing.

- Wage Pressures: In 2024, reports indicated a general upward trend in wages across various sectors, including mining, due to inflation and demand for skilled labor.

Impact of Financial Health on Supplier Relations

Bushveld Minerals' recent financial strains, including liquidity challenges and a controlled production slowdown, could significantly shift the balance of power towards its key suppliers. For instance, if a critical supplier of specialized mining equipment faces its own operational pressures, Bushveld's reduced purchasing volume or delayed payments might lead that supplier to seek more favorable terms from other clients.

This dynamic could see suppliers demanding upfront payments or shorter credit periods from Bushveld to safeguard their own cash flow. Such demands would directly impact Bushveld's working capital, potentially forcing it to allocate more cash to procurement, thereby intensifying its existing financial pressures and complicating efforts to maintain operational continuity.

- Increased Supplier Demands: Suppliers may leverage Bushveld's financial situation to negotiate higher prices or stricter payment terms.

- Working Capital Strain: Upfront payments or reduced credit lines from suppliers can further deplete Bushveld's already tight liquidity.

- Operational Risk: A strained relationship with critical suppliers could lead to disruptions in the supply chain, impacting production schedules.

While Bushveld Minerals mines its own vanadium ore, its reliance on external suppliers for specialized equipment, processing chemicals, and energy remains a significant factor. Suppliers of unique or patented inputs, as well as essential energy providers like Eskom, can exert considerable bargaining power due to scarcity and indispensability. For example, Eskom's electricity price hikes in South Africa, averaging 18.45% in 2023, directly increased Bushveld's operational costs.

Furthermore, skills shortages in South Africa's mining sector, particularly for specialized roles, empower labor unions. This can lead to increased wage pressures and potential operational disruptions, impacting Bushveld's cost structure and production efficiency. Reports in 2024 indicated a general upward trend in wages across sectors due to inflation and demand for skilled labor.

Bushveld's financial challenges, including liquidity issues and production slowdowns, further amplify supplier bargaining power. Suppliers may respond by demanding upfront payments or shorter credit terms, exacerbating Bushveld's working capital constraints and increasing operational risks due to potential supply chain disruptions.

| Supplier Category | Key Dependencies for Bushveld | Potential Bargaining Power Factors | Impact on Bushveld | Illustrative 2023/2024 Data |

|---|---|---|---|---|

| Specialized Mining Equipment | Unique machinery, spare parts | Patented technology, limited manufacturers | Higher purchase prices, delivery delays | N/A (specific contracts) |

| Processing Chemicals | Reagents for mineral extraction | Product specialization, supply chain logistics | Price volatility, potential shortages impacting production | Global industrial chemical price increase of 5-8% (2023) |

| Energy (Electricity) | Power for mining and processing | Monopoly of national provider, essential service | Increased operational costs, potential supply interruptions | Eskom electricity price increase of 18.45% (2023) |

| Skilled Labor | Geological engineers, specialized operators | Skills shortages, union representation | Wage inflation, potential labor disputes affecting output | Upward wage trend in mining sector (2024) |

What is included in the product

Bushveld Minerals' Porter's Five Forces Analysis reveals the intense competitive rivalry, moderate buyer and supplier power, and significant barriers to entry within the vanadium and platinum group metals market.

Instantly understand the competitive landscape for Bushveld Minerals by visualizing the intensity of each of Porter's Five Forces, aiding in strategic planning and risk mitigation.

Customers Bargaining Power

The steel industry's immense appetite for vanadium, consuming around 90% of global supply, positions it as a dominant force in dictating terms for producers like Bushveld Minerals. This high market concentration among steel manufacturers grants them significant leverage, as their substantial purchase volumes can sway vanadium prices and overall market demand.

The burgeoning energy storage sector, especially manufacturers of vanadium redox flow batteries (VRFBs), is becoming a significant customer for Bushveld Minerals' high-purity vanadium. This segment, though nascent, is experiencing rapid expansion, making it increasingly influential in the market. As VRFB production volumes rise, key manufacturers could indeed leverage their growing demand to negotiate more favorable terms, thereby increasing their bargaining power.

Customers generally face moderate costs when switching between primary vanadium producers, primarily due to the need for supply chain adjustments and ensuring quality assurance. While these factors exist, switching is typically a manageable process for most buyers.

Bushveld Minerals attempts to mitigate customer bargaining power through product differentiation, particularly by offering high-purity vanadium. This specialization can reduce customer leverage in specific niche markets where this purity is a critical requirement, such as in advanced battery technologies or specialized alloys.

However, for standard vanadium products, the market is more commoditized, meaning customers have greater power as they can more easily substitute one producer for another based on price. For instance, in 2024, the global vanadium market continued to see price fluctuations influenced by supply and demand dynamics, highlighting the importance of product differentiation for producers like Bushveld.

Global Supply Alternatives for Buyers

Customers possess significant bargaining power due to the availability of global supply alternatives for vanadium. Major producing nations such as China, Russia, and Brazil offer readily accessible sources, diminishing Bushveld Minerals' leverage. This competitive landscape allows buyers to negotiate more favorable pricing and contract terms.

- Global Vanadium Sources: Buyers can source vanadium from established producers in China, Russia, and Brazil, creating a competitive global market.

- Price Negotiation Leverage: The existence of multiple suppliers empowers customers to negotiate for better prices and more favorable payment terms.

- Reduced Dependence: Access to these alternatives reduces buyer dependence on any single supplier, including Bushveld Minerals.

Impact of Company Performance on Buyer Confidence

The bargaining power of customers is significantly influenced by a company's performance. Recent reports indicating Bushveld Minerals' financial challenges and operational pressures due to funding delays could make customers wary. This instability might embolden buyers to negotiate for lower prices or more favorable payment terms.

For instance, if a major customer relies on a consistent supply of Bushveld's products, news of production disruptions or financial strain could prompt them to explore alternative suppliers. This shift in leverage is critical for maintaining robust, long-term customer relationships and ensuring continued demand.

- Customer Hesitancy: Reports of financial and operational challenges can lead customers to seek more stable suppliers.

- Negotiating Power: Buyer confidence erodes with company instability, potentially leading to demands for discounts or flexible terms.

- Relationship Impact: Such pressures can strain long-term customer relationships, necessitating proactive engagement and reassurance.

The significant demand from the steel industry, which accounts for about 90% of vanadium consumption, gives steel manufacturers substantial bargaining power over producers like Bushveld Minerals. This concentrated customer base can influence pricing and demand through their large-volume purchases.

The growing vanadium redox flow battery (VRFB) sector is also increasing its influence. As VRFB manufacturers scale up production, their expanding demand for high-purity vanadium allows them to negotiate more favorable terms, enhancing their bargaining power.

Bushveld Minerals counters customer bargaining power by differentiating its products, particularly with high-purity vanadium, which is crucial for niche markets like advanced battery technologies. However, for standard vanadium products, the market is more commoditized, giving customers greater leverage to switch suppliers based on price, as seen in the price fluctuations of 2024.

The availability of global vanadium supply from major producers like China, Russia, and Brazil further strengthens customer bargaining power. Buyers can easily source alternatives, reducing their dependence on any single supplier and enabling them to negotiate better pricing and contract terms.

Full Version Awaits

Bushveld Minerals Porter's Five Forces Analysis

This comprehensive Porter's Five Forces analysis for Bushveld Minerals, as previewed, is the exact document you will receive immediately after purchase, offering a detailed examination of competitive forces within the mineral sector. You're looking at the actual, professionally formatted document; once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into the industry's landscape. No mockups, no samples – the document you see here is exactly what you’ll be able to download after payment, ready for your strategic planning.

Rivalry Among Competitors

The global vanadium market is highly concentrated, with production largely controlled by a few major players situated in China, Russia, and South Africa. Bushveld Minerals, as a South African producer, faces direct competition from these established giants, intensifying the struggle for market dominance.

This limited number of significant producers means that competition for market share is often fierce. For instance, in 2024, China remained the world's largest vanadium producer, accounting for a substantial portion of global supply, alongside significant contributions from Russia and South Africa.

The vanadium market is notoriously sensitive to price fluctuations, with periods of weak pricing and softer consumption rates impacting producers. This inherent volatility fuels intense competition among suppliers, who often resort to price-based strategies to maintain sales volumes and market share.

Bushveld Minerals' financial performance is inextricably linked to these market dynamics; for instance, in 2023, the company reported a significant drop in revenue, partly attributed to lower vanadium prices, underscoring the direct impact of market volatility on its profitability.

While vanadium is primarily traded as a commodity, there's a growing niche for differentiation based on purity and specific product forms, especially for the burgeoning energy storage sector. Bushveld Minerals, for instance, focuses on achieving consistent quality and developing tailored product offerings to stand out.

However, the vast majority of vanadium demand comes from the steel industry, where quality standards are more standardized. This uniformity intensifies competition, often leading to price-driven battles among producers, a dynamic Bushveld Minerals must navigate.

Cost Structures and Operational Efficiency

Competitive rivalry within the mineral sector, including for Bushveld Minerals, is significantly shaped by how efficiently companies manage their costs and operations. Producers with leaner cost structures and highly optimized operations naturally gain a competitive edge, especially when market prices fluctuate. This is a crucial factor in determining who thrives and who struggles.

Bushveld Minerals itself recognizes this dynamic and is actively engaged in implementing strategic measures. The company is focusing on 'cost-cutting initiatives' and 'turnaround initiatives' with the clear objective of enhancing its cost position and moving towards profitability. These efforts are designed to make their operations more streamlined and cost-effective.

- Cost Structure Impact: Companies with lower production costs are better positioned to absorb price downturns and maintain profitability, giving them a distinct advantage in a volatile market.

- Bushveld's Initiatives: Bushveld Minerals is actively pursuing cost-cutting and turnaround initiatives to improve its operational efficiency and financial standing.

- Efficiency as a Differentiator: In a competitive landscape, superior operational efficiency directly translates to a stronger competitive position and greater resilience.

Strategic Moves by Competitors

Bushveld Minerals faces a dynamic competitive landscape where rivals are actively enhancing their capabilities. For instance, Largo Inc. has been focused on increasing its vanadium production, aiming to capture a larger market share.

AMG Vanadium’s strategic acquisition of processing technologies further intensifies this rivalry, signaling a push for greater efficiency and potentially lower production costs among competitors.

These aggressive moves by major players directly influence market dynamics and can significantly alter Bushveld's standing.

- Largo Inc. Production Boost: Competitors like Largo are actively increasing their output, directly impacting supply-side pressures.

- AMG Vanadium Technology Acquisition: The acquisition of advanced processing technologies by AMG Vanadium suggests a move towards enhanced operational efficiency and cost competitiveness.

- Market Impact: Such strategic actions by rivals necessitate continuous monitoring and adaptation by Bushveld Minerals to maintain its competitive edge.

The global vanadium market is characterized by intense competition, primarily driven by a few dominant producers in China, Russia, and South Africa. Bushveld Minerals, operating within this concentrated environment, contends with these established players for market dominance, where price-based strategies are common due to market volatility.

Producers with lower operational costs and greater efficiency hold a significant advantage, especially during periods of price decline. Bushveld Minerals is actively implementing cost-reduction and turnaround initiatives to bolster its competitive position.

Competitors like Largo Inc. are increasing production, and AMG Vanadium's investment in advanced processing technologies signals a broader industry trend towards enhanced efficiency and cost competitiveness, directly impacting Bushveld Minerals.

| Competitor | Key Action/Focus | Impact on Rivalry |

| China | Largest global producer, significant supply control | Intensifies price competition due to scale |

| Russia | Major producer, stable supply | Contributes to market concentration and rivalry |

| Largo Inc. | Increasing production output | Adds to supply-side pressure, potentially impacting prices |

| AMG Vanadium | Acquiring advanced processing technologies | Drives efficiency and cost competitiveness, raising industry standards |

SSubstitutes Threaten

While vanadium is prized for its steel-strengthening properties, other alloying elements such as niobium and titanium present themselves as viable partial substitutes in specific steel applications. This offers steel manufacturers a degree of flexibility to pivot towards alternatives should vanadium prices escalate significantly or if supply chains experience disruptions. For instance, in high-strength low-alloy (HSLA) steels, niobium is often used, and in 2024, its price has remained relatively stable, presenting a cost-effective alternative for certain structural steel grades where vanadium's impact is not critically essential.

Lithium-ion batteries represent a significant threat of substitutes for vanadium redox flow batteries (VRFBs) in the energy storage market. Currently, lithium-ion technology boasts lower upfront costs and a much more established global supply chain and manufacturing base, making it the default choice for many applications.

The widespread adoption of lithium-ion batteries means that consumers and businesses are already familiar with their performance and integration, creating a barrier for newer technologies like VRFBs. For instance, the global lithium-ion battery market was valued at approximately $65 billion in 2023 and is projected to grow substantially, indicating its strong market position.

Emerging battery technologies beyond the dominant lithium-ion are rapidly advancing, posing a significant threat to established players and potentially impacting demand for materials like vanadium. Innovations in sodium-ion, iron-air, and solid-state batteries are actively being pursued to overcome current limitations in cost, safety, and energy density. For example, sodium-ion battery costs are projected to be significantly lower than lithium-ion, with some estimates suggesting a potential 30-40% reduction in material costs by 2030, which could disrupt the market.

These alternative chemistries are not just theoretical; companies are making substantial investments and achieving milestones. By 2024, several pilot production lines for sodium-ion batteries are expected to be operational, with some analysts predicting a market share of up to 10% in certain segments by 2028. This rapid development cycle means that the threat of substitution is not a distant concern but a present and evolving challenge for sectors reliant on current battery technology, including energy storage solutions that might otherwise utilize vanadium.

Cost-Performance Trade-offs of Substitutes

The threat of substitutes for Vanadium Redox Flow Batteries (VRFBs) is largely influenced by the cost-performance trade-offs available in alternative energy storage solutions. While VRFBs excel in long-duration applications, the persistent high cost of vanadium, a key component, acts as a substantial hurdle for broader market penetration.

If competing technologies can deliver comparable performance metrics, particularly in terms of energy density and cycle life, at a more attractive price point, they are likely to capture market share from VRFBs. For instance, lithium-ion batteries, despite their limitations in very long-duration storage, continue to see cost reductions. In 2024, the average cost of lithium-ion battery packs for energy storage systems was reported to be around $300-$400 per kWh, whereas VRFB systems can still range from $500-$1000 per kWh or more, depending on scale and specific configurations.

- Vanadium Cost Barrier: The high price of vanadium metal directly impacts VRFB system costs, making them less competitive against substitutes when long-duration capabilities are not the primary driver.

- Lithium-Ion Competitiveness: Lithium-ion batteries, while typically suited for shorter durations, offer a lower cost per kilowatt-hour, posing a significant threat in applications where rapid energy discharge and recharge cycles are more critical than extended storage periods.

- Performance vs. Price: The market will favor substitutes that offer a better balance between performance characteristics and upfront capital expenditure, especially as energy storage demands evolve.

Limited Substitutes in Niche Applications

While many commodities face a constant barrage of potential substitutes, vanadium, particularly in its high-purity forms, exhibits a lower threat in certain specialized sectors. For instance, its exceptional strength-to-weight ratio and high melting point make it difficult to replace in critical aerospace alloys and specific nuclear applications where performance is paramount. This niche resilience offers Bushveld Minerals a degree of protection in these high-value, albeit smaller, market segments.

The demand for vanadium in these specialized areas is driven by performance requirements that substitutes struggle to meet. For example, in aerospace, vanadium alloys contribute to fuel efficiency and structural integrity. While research into alternative materials is ongoing, the established performance and safety certifications for vanadium-based components in these demanding fields create significant barriers to entry for potential substitutes.

Bushveld Minerals' focus on supplying high-quality vanadium for these applications allows it to capitalize on this limited substitutability. The company's production of vanadium pentoxide (V2O5), a key precursor for ferrovanadium and vanadium alloys, positions it to serve these demanding end-users. In 2024, the global aerospace market, a key consumer of high-performance alloys, was projected to continue its recovery and growth, underscoring the continued relevance of materials like vanadium.

- Niche Applications: Aerospace components and nuclear uses rely on vanadium's unique properties, making substitution difficult.

- Performance Driven: The high-performance demands in these sectors create a strong barrier for alternative materials.

- Market Insulation: This limited substitutability provides a degree of market insulation for producers like Bushveld Minerals in specific segments.

While vanadium is prized for its steel-strengthening properties, other alloying elements such as niobium and titanium present themselves as viable partial substitutes in specific steel applications. This offers steel manufacturers a degree of flexibility to pivot towards alternatives should vanadium prices escalate significantly or if supply chains experience disruptions. For instance, in high-strength low-alloy (HSLA) steels, niobium is often used, and in 2024, its price has remained relatively stable, presenting a cost-effective alternative for certain structural steel grades where vanadium's impact is not critically essential.

Lithium-ion batteries represent a significant threat of substitutes for vanadium redox flow batteries (VRFBs) in the energy storage market. Currently, lithium-ion technology boasts lower upfront costs and a much more established global supply chain and manufacturing base, making it the default choice for many applications. The widespread adoption of lithium-ion batteries means that consumers and businesses are already familiar with their performance and integration, creating a barrier for newer technologies like VRFBs. For instance, the global lithium-ion battery market was valued at approximately $65 billion in 2023 and is projected to grow substantially, indicating its strong market position.

Emerging battery technologies beyond the dominant lithium-ion are rapidly advancing, posing a significant threat to established players and potentially impacting demand for materials like vanadium. Innovations in sodium-ion, iron-air, and solid-state batteries are actively being pursued to overcome current limitations in cost, safety, and energy density. By 2024, several pilot production lines for sodium-ion batteries are expected to be operational, with some analysts predicting a market share of up to 10% in certain segments by 2028. This rapid development cycle means that the threat of substitution is not a distant concern but a present and evolving challenge for sectors reliant on current battery technology, including energy storage solutions that might otherwise utilize vanadium.

The threat of substitutes for Vanadium Redox Flow Batteries (VRFBs) is largely influenced by the cost-performance trade-offs available in alternative energy storage solutions. While VRFBs excel in long-duration applications, the persistent high cost of vanadium, a key component, acts as a substantial hurdle for broader market penetration. If competing technologies can deliver comparable performance metrics, particularly in terms of energy density and cycle life, at a more attractive price point, they are likely to capture market share from VRFBs. For instance, lithium-ion batteries, despite their limitations in very long-duration storage, continue to see cost reductions. In 2024, the average cost of lithium-ion battery packs for energy storage systems was reported to be around $300-$400 per kWh, whereas VRFB systems can still range from $500-$1000 per kWh or more, depending on scale and specific configurations.

While many commodities face a constant barrage of potential substitutes, vanadium, particularly in its high-purity forms, exhibits a lower threat in certain specialized sectors. For instance, its exceptional strength-to-weight ratio and high melting point make it difficult to replace in critical aerospace alloys and specific nuclear applications where performance is paramount. This niche resilience offers Bushveld Minerals a degree of protection in these high-value, albeit smaller, market segments. The demand for vanadium in these specialized areas is driven by performance requirements that substitutes struggle to meet. For example, in aerospace, vanadium alloys contribute to fuel efficiency and structural integrity. By 2024, the global aerospace market, a key consumer of high-performance alloys, was projected to continue its recovery and growth, underscoring the continued relevance of materials like vanadium.

| Substitute Type | Application Area | Key Substitute Material | 2024 Cost/Performance Factor | Threat Level for Vanadium |

|---|---|---|---|---|

| Alloying Element | Structural Steel (HSLA) | Niobium | Stable pricing, good partial substitute | Medium |

| Energy Storage Technology | Grid-scale Storage | Lithium-ion Batteries | Lower upfront cost ($300-$400/kWh vs. $500-$1000+/kWh for VRFBs) | High |

| Emerging Battery Tech | Grid-scale Storage | Sodium-ion Batteries | Projected 30-40% lower material costs than Li-ion | Medium to High (evolving) |

| High-Performance Alloys | Aerospace, Nuclear | Titanium, Specialty Steels | Performance paramount, difficult to match vanadium's specific properties | Low |

Entrants Threaten

The primary vanadium production industry demands exceptionally high capital expenditure for exploration, mine development, and integrated processing facilities. This substantial upfront investment acts as a significant barrier, deterring most potential new entrants from establishing primary vanadium operations.

For instance, bringing a new vanadium mine and processing plant online can easily cost hundreds of millions, if not billions, of dollars. Bushveld Minerals itself has navigated these significant capital requirements for its projects, highlighting the scale of investment needed to compete.

The concentration of high-grade vanadium ore in a few specific geographic locations presents a significant barrier for new entrants. Major reserves are primarily found in countries like South Africa, Russia, and China, making global access to these finite resources a critical hurdle for any company looking to enter the market.

Securing economically viable and high-quality vanadium deposits is a substantial challenge. For instance, South Africa alone held approximately 5.7 million tonnes of vanadium reserves as of 2023, representing a significant portion of the global supply, according to the U.S. Geological Survey. This scarcity naturally limits the number of potential new producers that can realistically establish operations.

The significant technological expertise and operational complexity inherent in vanadium mining and processing, particularly for vertically integrated models like Bushveld Minerals, present a substantial barrier to new entrants. Developing the necessary skills and understanding for efficient extraction and refining is a lengthy and capital-intensive undertaking. For instance, Bushveld’s 2023 operational update highlighted the ongoing optimization of its smelting and refining processes, underscoring the deep technical knowledge required to achieve cost-effective production.

Regulatory Hurdles and Environmental Compliance

The mining sector, especially for vital minerals like those Bushveld Minerals focuses on, faces rigorous environmental regulations and lengthy permitting procedures. These complex requirements significantly increase the time, expense, and uncertainty for any new player looking to enter the market, acting as a substantial barrier.

For instance, in 2024, the average time to obtain mining permits in many jurisdictions can extend to several years, with costs often running into millions of dollars due to environmental impact assessments, public consultations, and ongoing monitoring requirements. This lengthy and costly process deters potential new entrants who may lack the capital or patience to navigate such a landscape.

- Stringent Environmental Regulations: Mining operations are heavily scrutinized for their environmental impact, requiring extensive studies and mitigation plans.

- Complex Permitting Processes: Obtaining the necessary licenses and approvals involves multiple government agencies and can be a protracted affair.

- High Entry Costs: Compliance with regulations and the permitting process itself represent significant upfront investments for new companies.

- Increased Risk and Uncertainty: The possibility of delays or outright denial of permits adds a layer of risk that can discourage new market participants.

Established Market Players and Supply Chains

Established market players, including major lithium producers, benefit significantly from deep-rooted relationships with suppliers and customers. For instance, in 2024, major automotive manufacturers secured long-term supply agreements with established lithium miners, effectively locking in a substantial portion of available output and creating barriers for new entrants. These existing players also leverage economies of scale, which allow them to produce at a lower cost per unit, making it difficult for newcomers to match their pricing.

The development of robust and reliable supply chains is a critical hurdle for any new entrant. Building out the necessary infrastructure, from extraction and processing to logistics and distribution, requires substantial capital investment and time. For example, in 2024, the average lead time for establishing a new mine-to-market supply chain for critical minerals was estimated to be between 5 to 7 years, a significant deterrent for those looking for quicker market entry.

- Established market players possess strong existing relationships with key suppliers and downstream customers.

- New entrants face considerable challenges in replicating the economies of scale enjoyed by incumbent firms.

- Building reliable and cost-effective supply chains represents a significant capital and time investment for new companies.

- In 2024, long-term supply agreements by major auto manufacturers further solidified the market position of established lithium producers.

The threat of new entrants in the primary vanadium production industry, as exemplified by Bushveld Minerals' operational landscape, is significantly mitigated by several formidable barriers. These include exceptionally high capital expenditure requirements for mine development and processing facilities, often running into hundreds of millions or even billions of dollars. Furthermore, the geographic concentration of high-grade vanadium ore, primarily in South Africa, Russia, and China, limits global access to essential resources.

Technological complexity and the need for specialized expertise in vanadium extraction and refining also deter new players. Bushveld Minerals' ongoing process optimization highlights the deep technical knowledge required. Stringent environmental regulations and complex, multi-year permitting processes, which can cost millions in 2024, further increase the time, expense, and uncertainty for market newcomers.

| Barrier Type | Description | Example/Impact |

| Capital Expenditure | High upfront investment for mining and processing. | Hundreds of millions to billions of dollars needed to establish operations. |

| Resource Availability | Geographic concentration of high-grade ore. | South Africa's 5.7 million tonnes of reserves (2023) illustrate scarcity. |

| Technological Expertise | Complex extraction and refining processes. | Bushveld's process optimization underscores the need for deep technical knowledge. |

| Regulatory Hurdles | Stringent environmental laws and lengthy permitting. | Permit acquisition in 2024 can take years and cost millions. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bushveld Minerals is built upon a foundation of publicly available company disclosures, including annual reports and investor presentations, alongside industry-specific market research and reports from reputable mining consultancies.