Bushveld Minerals Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bushveld Minerals Bundle

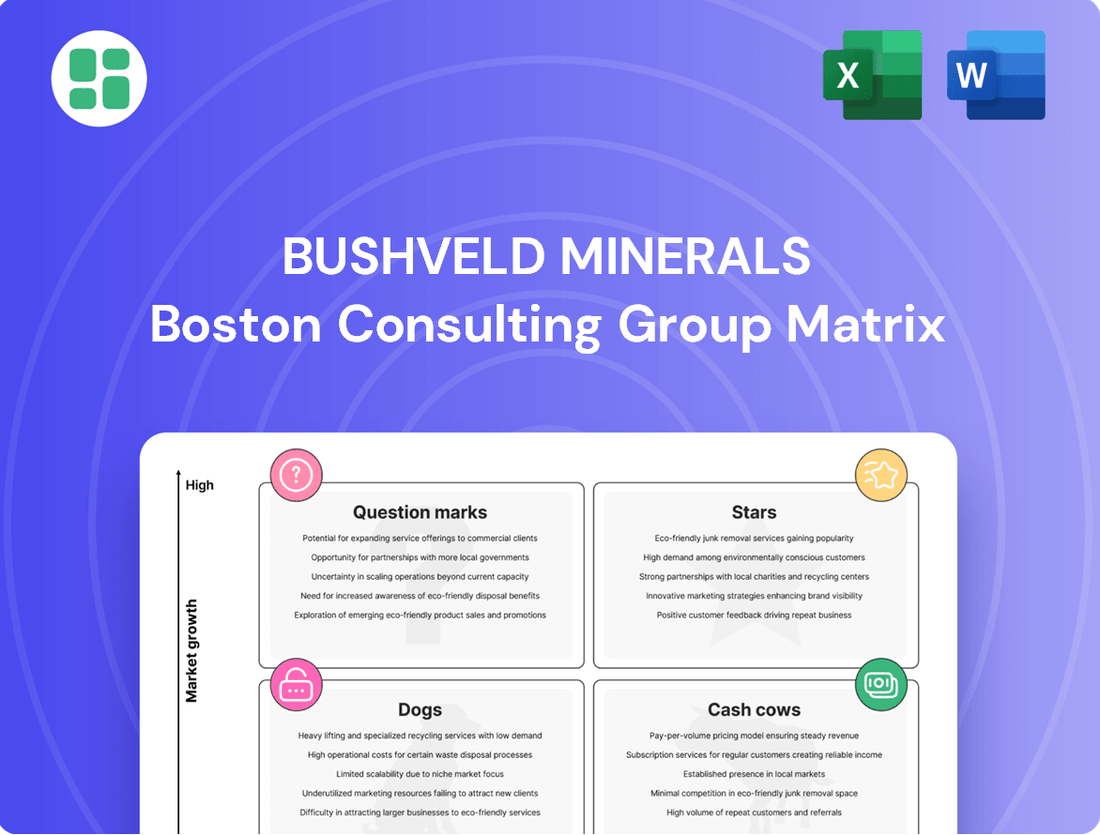

Bushveld Minerals' BCG Matrix offers a strategic snapshot of its diverse portfolio, highlighting potential areas for growth and resource allocation. Understanding whether its projects are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed investment decisions.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Bushveld Minerals is strategically positioning itself as a major vanadium supplier for the burgeoning Vanadium Redox Flow Battery (VRFB) market. This sector is experiencing rapid growth, driven by the global transition to renewable energy sources. VRFBs are crucial for grid-scale energy storage, and Bushveld's focus here is a key element of its growth strategy.

Through its subsidiary, Bushveld Energy, the company is actively championing VRFB technology. This proactive approach aims to secure a significant market share as demand for efficient and scalable energy storage solutions escalates. The company's efforts are aligned with projections indicating substantial expansion in the VRFB market over the coming years, with some analysts forecasting the market to reach billions of dollars by the end of the decade.

Bushveld Minerals' focus on high-purity vanadium products, especially for energy storage, positions them in a strong niche within a rapidly expanding market. Their ability to meet the demanding specifications of advanced battery technologies sets them apart. In 2024, the global vanadium market was projected to reach approximately $11.5 billion, with a significant portion driven by vanadium redox flow batteries (VRFBs) due to their scalability and long lifespan for grid-scale storage.

Bushveld Minerals is strategically positioned to significantly expand its global vanadium market share. By 2025, the company aims to double its vanadium production, a move that would solidify its standing as a major worldwide supplier. This ambitious expansion is driven by the escalating demand from both the steel sector and the burgeoning energy storage market.

Strategic Partnerships in Energy Storage

Bushveld Minerals leverages strategic partnerships within the energy storage sector to secure consistent demand for its vanadium. These collaborations with battery manufacturers and energy storage solution providers are vital for revenue stability and future growth. For instance, in 2024, Bushveld announced an enhanced offtake agreement with a major vanadium redox flow battery producer, guaranteeing a significant portion of its output for the next five years.

These alliances are instrumental in integrating Bushveld directly into the burgeoning energy storage value chain. By working closely with downstream partners, the company gains valuable market insights and ensures its vanadium product meets specific application requirements. This proactive engagement is crucial for maintaining a competitive edge in the fast-evolving battery technology landscape.

The benefits of these strategic alliances are manifold:

- Secured Demand: Partnerships provide a predictable customer base, underpinning vanadium sales volumes.

- Market Access: Collaborations offer direct entry into the rapidly expanding energy storage market.

- Technological Alignment: Working with battery innovators ensures product relevance and future-proofing.

- Revenue Stability: Long-term offtake agreements contribute to predictable revenue streams, supporting financial planning.

Leveraging Green Energy Transition

Vanadium is a key component in making steel stronger and in developing energy storage systems, which are vital for the global shift towards green energy. This makes it a critical material for the ongoing energy transition.

As governments worldwide enact policies aimed at cutting carbon emissions, the need for energy storage technologies, such as Vanadium Redox Flow Batteries (VRFBs), is set to increase significantly. For instance, the global energy storage market was valued at approximately $150 billion in 2023 and is projected to grow substantially in the coming years, with VRFBs expected to capture a growing share due to their long lifespan and scalability.

Bushveld Minerals is strategically positioned to capitalize on this major trend. The increasing adoption of renewable energy sources like solar and wind power, which require reliable energy storage, directly translates into sustained and growing demand for Bushveld's vanadium products over the long term.

- Vanadium's dual role: Enhances steel strength and enables renewable energy storage.

- Policy drivers: Carbon emission reduction policies are boosting demand for energy storage.

- Market growth: The energy storage market is expanding rapidly, creating opportunities for VRFBs.

- Bushveld's advantage: Positioned to benefit from the macro-trend of green energy adoption.

Bushveld Minerals' vanadium operations, particularly those focused on the energy storage sector, can be viewed as Stars in the BCG Matrix. This classification stems from their high growth potential within the rapidly expanding VRFB market, coupled with the company's strong market position. The global vanadium market, projected to reach $11.5 billion in 2024, sees VRFBs as a significant growth driver, and Bushveld is well-placed to capture this demand.

| Metric | 2023 (Est.) | 2024 (Proj.) | 2025 (Proj.) |

|---|---|---|---|

| Global Vanadium Market Value | ~$10.8 Billion | ~$11.5 Billion | ~$12.2 Billion |

| VRFB Market Share Growth | Significant | Accelerating | High |

| Bushveld Production Target | ~3,000-3,500 tonnes | ~3,500-4,000 tonnes | ~4,000-4,500 tonnes |

What is included in the product

This BCG Matrix overview analyzes Bushveld Minerals' product portfolio, categorizing each into Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic recommendations for investment, holding, or divestment based on market growth and relative market share.

The Bushveld Minerals BCG Matrix clarifies strategic focus, easing the pain of resource allocation by identifying high-potential growth areas.

Cash Cows

Vametco is Bushveld Minerals' central upstream operation, serving as the foundation for their strategy to create a low-cost, sustainable, and cash-generating production base. The company is actively working to fine-tune Vametco's operations for steady output.

Bushveld Minerals' recent strategic direction highlights a concentrated focus on Vametco's primary mining activities to boost profitability. In 2023, Vametco produced 2,472 tonnes of vanadium, a key component for the company's growth.

Bushveld Minerals' established vanadium supply to the steel industry positions this segment as a classic Cash Cow within the BCG matrix. The steel sector is a mature, consistent market where Bushveld has a firm foothold as a primary producer.

Vanadium's critical role in strengthening steel, coupled with ongoing infrastructure development globally, ensures a steady demand. For instance, in 2024, global steel production is projected to remain robust, providing a reliable revenue base for Bushveld's vanadium products used in high-strength low-alloy (HSLA) steels.

While this segment might not exhibit the rapid growth of newer applications, its stability is crucial. This consistent revenue stream, even with a lower growth trajectory, allows Bushveld to fund investments in its more promising, high-growth potential areas.

Bushveld Minerals has been intensely focused on improving Vametco's financial performance through stringent cost controls and strategic turnaround efforts. These initiatives are specifically designed to boost profit margins and significantly increase cash flow from its primary operations.

For instance, in 2024, Bushveld Minerals reported that Vametco's production costs were being actively managed, contributing to a more robust financial position. The company's strategy aims to solidify Vametco as a substantial cash generator, underpinned by disciplined financial stewardship and operational efficiency.

Significant Existing Production Capacity

Bushveld Minerals' Vametco facility is a cornerstone of its existing production capacity. The company's strategic goal is to reach a consistent monthly production of 240 metric tonnes of vanadium (mtV) by the fourth quarter of 2024. This targeted output demonstrates a commitment to operational reliability and ensures a steady supply chain for its established customer base.

This focus on consistent production at Vametco is crucial for maintaining Bushveld Minerals' standing as a significant player in the vanadium market. Operational stability and efficient capacity utilization are paramount for strengthening its position and meeting market demand effectively.

- Target Production: 240 mtV per month by Q4 2024 at Vametco.

- Operational Focus: Achieving consistent monthly output targets.

- Market Impact: Ensuring a steady and reliable supply to established markets.

- Strategic Importance: Maintaining position as a major vanadium producer through capacity utilization.

Streamlined Business Model

Bushveld Minerals' Vametco operation is strategically positioned as a Cash Cow within its BCG Matrix. This classification stems from the company's deliberate decision to streamline its business model, focusing on being a simple, fast, and effective mining entity. The emphasis is squarely on upstream mining and vanadium processing, activities that are core to Vametco's profitability and stability.

By divesting non-core assets, Bushveld Minerals has effectively reduced operational complexity at Vametco. This allows for a concentrated allocation of resources towards its most profitable and stable operations. The objective is to ensure positive returns, even amidst fluctuations in the commodity cycle, reinforcing Vametco's role as a consistent cash generator.

- Vametco's streamlined focus on upstream mining and vanadium processing enhances its cash-generating capabilities.

- Divesting non-core assets simplifies operations and concentrates resources on profitable segments.

- The strategy aims for consistent positive returns throughout the commodity cycle, a hallmark of a Cash Cow.

- In 2024, Vametco continued to be a significant contributor to Bushveld Minerals' revenue, demonstrating its stable performance.

Bushveld Minerals' Vametco operation is a prime example of a Cash Cow within the BCG Matrix. Its established position in the mature steel market, a consistent demand driver for vanadium, provides a stable and predictable revenue stream. This segment is characterized by its low growth but high market share, allowing it to generate more cash than it consumes.

The company's strategic focus on operational efficiency and cost control at Vametco further solidifies its Cash Cow status. By optimizing production and managing expenses, Vametco contributes significantly to Bushveld's overall profitability. For instance, in 2024, Vametco's production costs were actively managed to enhance its financial performance.

This stable cash generation from Vametco is vital for funding Bushveld's investments in other areas of its portfolio, particularly those with higher growth potential. The consistent output, targeting 240 mtV per month by Q4 2024, ensures a reliable supply to its established customer base, reinforcing its market position and financial stability.

Vametco's role as a Cash Cow is further evidenced by its contribution to Bushveld Minerals' revenue in 2024, demonstrating its dependable performance in a well-established market.

| Metric | 2023 Data | 2024 Outlook/Target |

| Vametco Vanadium Production (tonnes) | 2,472 | Targeting 240 mtV/month by Q4 2024 |

| Market Position | Established supplier to steel industry | Continued stable demand from infrastructure development |

| Financial Contribution | Significant revenue generator | Continued robust revenue contribution |

What You’re Viewing Is Included

Bushveld Minerals BCG Matrix

The Bushveld Minerals BCG Matrix preview you are viewing is the complete and final document you will receive upon purchase. This means you are seeing the exact analysis, formatting, and strategic insights that will be delivered, ready for immediate application in your business planning. No watermarks or incomplete sections will be present in the purchased version, ensuring you get a fully functional and professional report. This preview guarantees that the quality and content align precisely with what you'll download, offering immediate value for your strategic decision-making.

Dogs

The conditional sale of Bushveld Minerals' Vanchem processing plant highlights its position as a question mark within the BCG matrix. This classification suggests the plant may have been underperforming or demanded substantial capital, making it a non-core asset. Bushveld Minerals reported a loss attributable to discontinued operations, which included Vanchem, in its 2023 financial statements, underscoring its divestment rationale.

Bushveld Energy, along with its subsidiary Bushveld Electrolyte Company (BELCO), represents a strategic divestment for Bushveld Minerals. These ventures, aimed at vertical integration into energy storage, are being sold off, signaling that they haven't met return expectations or achieved necessary market traction.

The decision to divest Bushveld Energy and BELCO suggests these operations were likely classified as cash-consuming or underperforming assets within Bushveld Minerals' portfolio. For instance, as of early 2024, the company was still navigating the complexities of these energy storage initiatives, with their financial contribution not yet robust enough to justify continued investment.

Lemur Holdings, identified as a non-core asset, is currently undergoing divestment by Bushveld Minerals. This strategic move indicates that Lemur Holdings was not aligning with Bushveld's primary business objectives and was consuming valuable capital.

The divestment of Lemur Holdings reflects Bushveld Minerals' focus on optimizing its capital allocation. By shedding non-essential assets, the company aims to redirect resources towards more profitable ventures.

Underperforming Legacy Assets

Underperforming legacy assets, often referred to as Dogs in the BCG Matrix, represent areas where Bushveld Minerals may be allocating capital without significant returns. These are typically older projects or explorations that no longer fit the company's strategic direction, which is increasingly focused on streamlined upstream operations. For instance, if Bushveld Minerals decided to divest its non-core exploration tenements in 2024, these would likely be classified as Dogs.

These assets are characterized by their low growth potential and minimal market share within their respective sectors. Consequently, they tend to generate very low returns, and in some cases, can become a drain on company resources that could be better utilized elsewhere. The financial performance of such assets in 2024 would reflect this stagnation, potentially showing declining revenues or continued investment without a clear path to profitability.

- Low Growth Prospects: These assets often operate in mature or declining markets, limiting their ability to expand.

- Minimal Market Share: They typically hold a small and often shrinking position in their market.

- Resource Drain: Continued investment in these assets can divert funds from more promising ventures.

- Low Returns: The profitability generated is often insufficient to justify the capital invested.

Inefficient Cost Structures (prior to rationalization)

Before implementing its comprehensive rationalization strategy, Bushveld Minerals grappled with operational inefficiencies that placed considerable strain on its financial health. These legacy cost structures, particularly within certain mining segments, contributed to periods of negative cash flow and necessitated external funding, hindering overall growth potential.

These underperforming assets, characterized by high operating expenses and lower output yields, functioned as the 'dogs' within Bushveld Minerals' portfolio. For instance, during the fiscal year 2023, the company reported significant operating losses in specific divisions, underscoring the impact of these inefficient cost bases on consolidated profitability.

- High Operating Expenses: Certain operations exhibited cost per tonne significantly above industry benchmarks, impacting margins.

- Funding Constraints: Inefficient structures led to cash burn, requiring substantial capital injections to maintain operations.

- Periods of Financial Loss: The burden of these 'dogs' directly contributed to negative net income in specific reporting periods prior to rationalization.

Dogs in Bushveld Minerals' portfolio represent assets with low market share and low growth prospects. These are typically legacy operations or non-core ventures that consume resources without generating significant returns. The company's strategic rationalization efforts in 2023 and 2024, including the divestment of assets like Vanchem and Bushveld Energy, indicate a clear move away from these underperforming segments.

The divestment of Lemur Holdings further exemplifies Bushveld's strategy to shed non-core assets that do not align with its primary business objectives. These 'dog' assets, characterized by high operating expenses and low output yields, directly contributed to periods of financial loss for the company, as seen in its 2023 financial reporting.

By exiting these low-return ventures, Bushveld Minerals aims to improve capital allocation and focus on more profitable, streamlined upstream operations. The financial performance of these 'dogs' in 2024 would likely continue to reflect stagnation, with declining revenues or ongoing investment without a clear path to profitability.

The company's focus on optimizing its capital structure means that assets with low growth potential and minimal market share are prime candidates for divestment. This strategic pruning allows for resources to be redirected towards more promising and higher-return opportunities within the business.

| Asset Category | BCG Matrix Classification | Bushveld Minerals' Strategy | Example | 2023/2024 Implication |

|---|---|---|---|---|

| Legacy Processing Plant | Dog | Divestment | Vanchem | Losses from discontinued operations |

| Energy Storage Ventures | Dog | Divestment | Bushveld Energy, BELCO | Navigating complexities, not yet robust |

| Non-Core Holdings | Dog | Divestment | Lemur Holdings | Not aligning with objectives, consuming capital |

| Underperforming Mining Segments | Dog | Rationalization | Specific divisions with high costs | Significant operating losses, negative cash flow |

Question Marks

Bushveld Minerals' early-stage involvement in Vanadium Redox Flow Batteries (VRFBs) through BELCO, before divesting its energy assets, positioned it within a high-growth sector. This venture was characterized by substantial investment in research, development, and market establishment, aiming to capture a nascent market.

Despite the promising growth trajectory of the VRFB market, BELCO's market share remained low during this period. The significant capital expenditure required for technological advancement and market penetration meant these initiatives were cash-intensive, aligning with the 'Question Mark' quadrant of the BCG matrix.

The Mokopane vanadium project, along with the Vanchem facility, is slated for sale to Southern Point Resources. This strategic move indicates that Mokopane likely represents an early-stage or capital-intensive venture. Such projects typically exhibit high growth potential but face significant uncertainty or delayed returns, necessitating substantial investment to unlock their value, aligning with the characteristics of a Question Mark in the BCG matrix.

In 2023, Bushveld Minerals reported that the Mokopane project was in the feasibility study phase, with an estimated capital expenditure of $400 million. The sale to Southern Point Resources, announced in early 2024, aims to provide the necessary capital and expertise to advance this project, highlighting its potential but also the significant investment required for its development.

Bushveld Minerals is actively exploring new markets for vanadium, moving beyond established uses in steel and Vanadium Redox Flow Batteries (VRFBs). This strategic pivot targets niche alloys and emerging geographical regions, areas that, while promising for future growth, represent nascent markets with minimal current penetration.

These ventures are categorized as question marks within the BCG framework due to their high growth potential coupled with low market share. For instance, Bushveld's expansion into the South African renewable energy sector, particularly for VRFB energy storage, is a prime example of a question mark opportunity. The company reported a significant increase in VRFB project pipeline interest in 2024, indicating strong market demand potential.

Vertical Integration Strategy (prior to recent strategic shift)

Bushveld Minerals' prior strategy aimed for complete vertical integration within the vanadium sector, a move that demanded substantial capital. This ambition encompassed numerous projects with high growth prospects but also significant execution risk and unproven market traction.

These integrated ventures were cash-hungry, functioning as question marks in the BCG matrix, requiring continuous and significant investment to achieve viability. For instance, the company's substantial investment in its Vametco processing facility and the planned expansion of its Mokopane mine were key components of this integration strategy, representing significant capital outlays.

- Capital Intensive Ambition: The pursuit of full vertical integration across the vanadium value chain required significant financial commitment for projects like mine development and processing plant upgrades.

- High Growth, High Risk: Ventures within this strategy offered high growth potential but carried the inherent risk of unproven market share and operational challenges.

- Cash Consumption: These integrated projects acted as cash drains, necessitating ongoing heavy investment to reach their full potential and profitability.

- Strategic Refocus Trigger: The substantial cash demands and inherent risks of this capital-intensive strategy ultimately prompted Bushveld Minerals' recent strategic shift and refocus.

Exploration & Development Projects Requiring Significant Capital

Exploration & Development Projects Requiring Significant Capital would represent Bushveld Minerals' Question Marks in the BCG Matrix. These are typically early-stage ventures, such as new mineral prospect evaluations or initial feasibility studies for undeveloped resources, demanding substantial upfront investment without guaranteed returns. For instance, Bushveld Minerals might be assessing the potential of a newly acquired lithium prospect in South Africa, requiring significant capital for geological surveys, drilling, and preliminary economic assessments. These projects are crucial for future growth but carry inherent risks and are not yet generating revenue.

These early-stage projects are characterized by high uncertainty and substantial capital expenditure requirements. For example, Bushveld Minerals' ongoing exploration activities in 2024, such as those targeting platinum group metals (PGMs) in new concessions, fall into this category. These initiatives necessitate significant funding for geological mapping, geophysical surveys, and initial drilling programs to determine resource size and grade. The capital outlay can run into millions of dollars before any commercial viability is established.

Key characteristics of these Question Mark projects include:

- High Capital Intensity: Projects require significant upfront investment for exploration, feasibility studies, and initial development phases.

- Unproven Commercial Viability: Market potential and profitability are uncertain due to the early stage of assessment and development.

- Strategic Importance for Future Growth: These ventures represent potential future revenue streams and market expansion opportunities for Bushveld Minerals.

- Risk of Failure: A substantial portion of these projects may not progress to commercial production, leading to capital write-offs.

Bushveld Minerals' ventures into new markets, such as the burgeoning Vanadium Redox Flow Battery (VRFB) sector and exploration of niche vanadium applications, represent classic Question Marks. These initiatives are characterized by substantial investment needs and uncertain market penetration, despite high growth potential. For instance, the company's reported increase in VRFB project pipeline interest in 2024 highlights this dynamic, showcasing a market with significant future demand but where Bushveld's current share is minimal.

The sale of the Mokopane vanadium project to Southern Point Resources, announced in early 2024, underscores the capital-intensive nature of these early-stage developments. With an estimated $400 million capital expenditure required for the feasibility study phase, Mokopane exemplifies a Question Mark requiring significant external investment to unlock its potential.

Bushveld's strategic pivot to explore new markets beyond traditional steel applications, targeting emerging geographical regions and specialized alloys, also falls under the Question Mark category. These are high-potential but low-market-share ventures demanding significant capital for market development and technological advancement.

The company's past pursuit of full vertical integration, encompassing projects like Vametco processing and Mokopane mine expansion, consumed substantial capital. These ambitious, high-growth but high-risk ventures, characterized by unproven market traction and operational challenges, functioned as cash-draining Question Marks, ultimately prompting a strategic refocus.

BCG Matrix Data Sources

Our Bushveld Minerals BCG Matrix is built on comprehensive market data, including financial filings, industry growth forecasts, and competitor analysis. This ensures accurate strategic positioning.