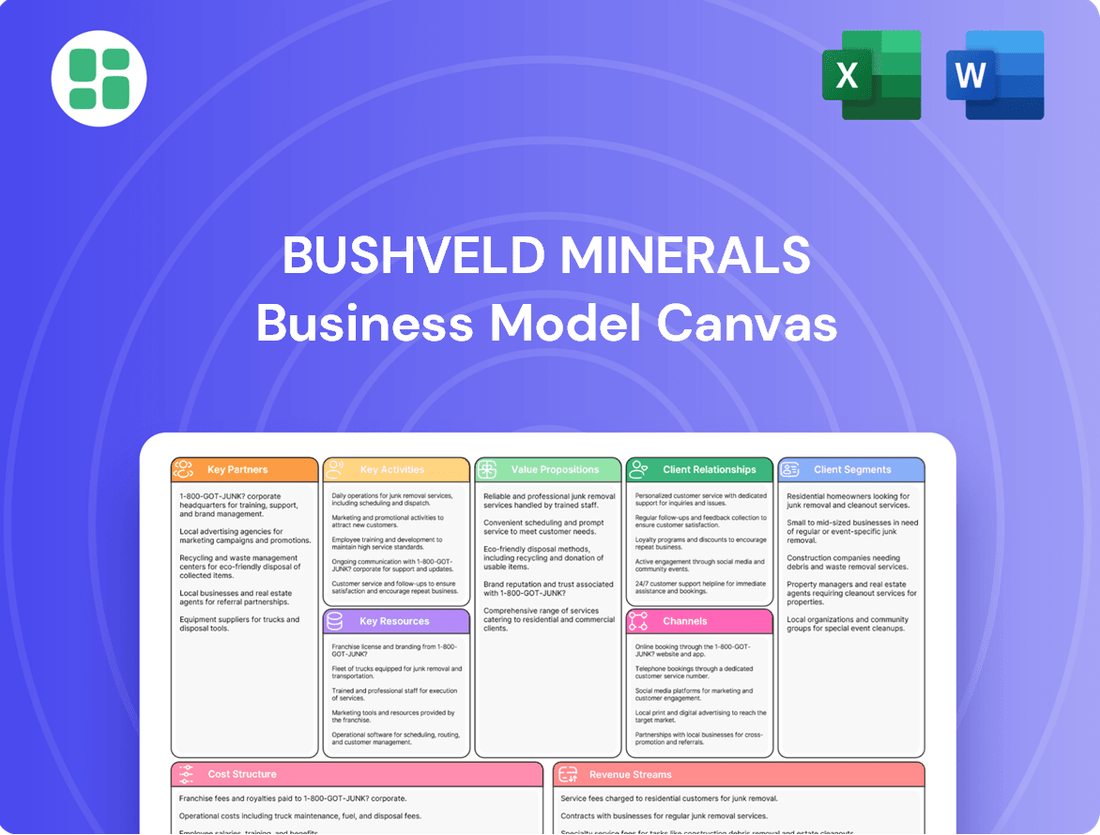

Bushveld Minerals Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bushveld Minerals Bundle

Unlock the strategic blueprint behind Bushveld Minerals's operations. This comprehensive Business Model Canvas details their value proposition, customer segments, and key resources, offering a clear view of their market approach. Ideal for anyone seeking to understand their success drivers.

Partnerships

Bushveld Minerals' strategic financial partners, historically including entities like Orion Mine Finance and Southern Point Resources, have been crucial for securing growth capital and facilitating debt restructuring.

In the challenging financial climate of 2024, these relationships are paramount for immediate liquidity and operational continuity, often manifesting as interim working capital facilities and negotiated deferrals of loan obligations.

Bushveld Minerals’ key partnerships with asset disposal counterparties are vital for its financial restructuring. The sale of Vanchem, for instance, was a significant step. In 2023, Bushveld Minerals announced the sale of its 50% stake in the Vametco mine, a core part of its vanadium operations, to a consortium led by the Industrial Development Corporation of South Africa. This move aims to bolster liquidity and reduce its debt burden.

Bushveld Minerals actively collaborates with South African governmental entities, including the Development Bank of South Africa (DBSA), to navigate regulatory landscapes and secure crucial debt restructuring support. This engagement is paramount for obtaining necessary approvals and facilitating strategic asset disposals, which are foundational to the company's ongoing financial health and operational continuity.

Key Suppliers and Creditors

Maintaining strong relationships with suppliers of essential raw materials, processing chemicals, and critical equipment is fundamental to the uninterrupted operation of Bushveld Minerals' Vametco facility. These partnerships ensure a consistent flow of inputs necessary for production.

Effective management of creditor relationships and the timely resolution of outstanding liabilities are critical priorities, especially during the ongoing business rescue proceedings. This focus is vital to prevent any disruptions or suspensions to the Vametco operations.

- Supplier Reliability: Securing dependable sources for vanadium-bearing materials and processing agents directly impacts production output and cost efficiency at Vametco.

- Creditor Engagement: Proactive communication and negotiation with creditors are essential to manage debt obligations and maintain financial stability during the business rescue phase.

- Equipment Maintenance: Partnerships with equipment suppliers for maintenance and spare parts are crucial for minimizing downtime and ensuring the longevity of operational assets.

Community and Labour Organisations

Bushveld Minerals actively engages with community and labour organisations to secure its social license to operate. This is particularly crucial during challenging times, such as operational slowdowns or cost-saving initiatives, which could necessitate workforce adjustments. For instance, in 2024, maintaining open dialogue with these groups was paramount for stability at the Vametco mine, especially as the company navigated market fluctuations.

Responsible engagement practices are key to mitigating social risks and ensuring a stable operating environment. Bushveld's commitment to these partnerships helps to build trust and foster a collaborative approach to managing potential impacts on local communities and employees.

- Community Engagement: Maintaining strong relationships with local communities is vital for long-term operational sustainability.

- Labour Union Relations: Collaborative dialogue with labour unions is essential for managing workforce relations, especially during periods of change.

- Social License to Operate: Proactive engagement ensures continued community and government support, critical for mining operations.

- Risk Mitigation: Responsible practices in these partnerships help to preempt and manage social risks, safeguarding operational continuity.

Bushveld Minerals' key partnerships extend to financial institutions and strategic investors, crucial for capital infusion and debt management. In 2024, securing liquidity through working capital facilities and negotiating loan deferrals with partners like Orion Mine Finance and Southern Point Resources remained a primary focus.

The company also relies on partnerships with counterparties for asset disposals to bolster its financial position. The sale of its 50% stake in the Vametco mine in 2023 to a consortium led by the Industrial Development Corporation of South Africa exemplifies this strategy, aimed at improving liquidity and reducing debt.

Collaborations with South African governmental bodies, such as the Development Bank of South Africa (DBSA), are vital for navigating regulatory hurdles and obtaining support for debt restructuring and asset disposals, ensuring operational continuity.

Furthermore, strong relationships with suppliers of essential raw materials, processing chemicals, and equipment are fundamental to maintaining uninterrupted production at facilities like Vametco, ensuring a consistent supply chain.

| Partner Type | Example Partners | 2024 Focus | Impact on Business |

|---|---|---|---|

| Financial Institutions | Orion Mine Finance, Southern Point Resources | Liquidity, Debt Restructuring | Operational Continuity, Financial Stability |

| Asset Disposal Counterparties | Industrial Development Corporation of South Africa (for Vametco stake) | Capital Generation, Debt Reduction | Improved Financial Health |

| Governmental Entities | Development Bank of South Africa (DBSA) | Regulatory Navigation, Debt Support | Facilitation of Strategic Moves |

| Suppliers | Raw Material, Chemical, Equipment Providers | Supply Chain Reliability | Uninterrupted Production |

What is included in the product

Bushveld Minerals' business model focuses on the sustainable extraction and processing of vanadium and platinum group metals, serving industrial customers and leveraging strategic partnerships for efficient operations and market access.

This model is structured around key resources like mining assets and processing facilities, with value propositions centered on reliable supply and product quality, supported by a robust cost structure and revenue streams from metal sales.

Bushveld Minerals' Business Model Canvas offers a clear, one-page snapshot of their strategy, simplifying complex operations to highlight how they alleviate pain points in the vanadium market by streamlining production and supply chains.

Activities

Vametco's primary activity is the responsible mining and processing of vanadium ore, making it Bushveld Minerals' central operational hub. The company is actively engaged in turnaround initiatives aimed at boosting production, enhancing operational stability, and improving overall efficiency, even while navigating cash flow limitations and ongoing maintenance requirements.

In 2024, Vametco's production capacity is targeted to reach 2,400 tonnes of vanadium equivalent per annum. This focus on increasing output is crucial for the company's financial health, especially considering the ongoing need for capital expenditure to address maintenance backlogs and upgrade processing capabilities.

Bushveld Minerals' key activities heavily involve financial restructuring and debt management to overcome significant liquidity challenges. This includes crucial negotiations with major creditors, such as Orion Mine Finance, to reschedule or reduce outstanding liabilities.

Securing additional funding is paramount for Bushveld. For instance, in early 2024, the company was actively seeking new investment to address its pressing need for working capital and to manage its debt obligations effectively, aiming to stabilize its financial position.

These efforts are directly aimed at improving the company's balance sheet, enabling it to meet its financial commitments and sustain ongoing mining operations. Successfully managing its debt burden is critical for Bushveld's long-term viability and future growth prospects.

Bushveld Minerals is strategically divesting non-core assets, including the Vanchem processing plant, Lemur Holdings, and BELCO. This move is crucial for reducing debt and generating much-needed cash. For instance, in 2023, Bushveld Minerals announced the sale of its 50% stake in the Mokopane Tin project, signaling a clear intent to streamline its portfolio.

These disposals are designed to enhance financial flexibility and allow the company to concentrate its resources on its primary vanadium mining activities. By shedding these peripheral operations, Bushveld aims to strengthen its balance sheet and improve its operational focus. The proceeds from these sales are earmarked for debt reduction and supporting core mining projects.

Cost Reduction and Operational Efficiency Initiatives

Bushveld Minerals focuses on aggressive cost reduction to navigate challenging market conditions and accelerate its return to profitability. This involves implementing stringent measures across its operations.

- Headcount Reduction: Strategic reductions in administrative staff at the head office are a key component of this initiative.

- Ore Sourcing Optimization: Implementing programs for more cost-effective ore sourcing ensures lower input costs for production.

- Operational Efficiency: Continuous efforts are made to enhance operational efficiency, reducing waste and improving productivity.

- Cost-Effectiveness Focus: The overarching goal is to achieve significant cost savings to bolster financial performance.

For instance, in its 2023 performance, Bushveld Minerals reported a significant reduction in operating costs, with efforts continuing into 2024 to further streamline expenditures and improve the company's financial standing.

Maintaining Regulatory Compliance and Safety

Bushveld Minerals actively maintains regulatory compliance and safety by rigorously adhering to environmental, social, and governance (ESG) standards. This commitment is fundamental to responsible mining operations and ensures sustained operational integrity, which is crucial for long-term business success.

A strong safety record is a cornerstone of this activity. For instance, Bushveld Minerals has demonstrated a focus on improving its safety performance, as evidenced by a reduction in its Total Recordable Injury Frequency Rate (TRIFR). This ongoing effort underscores the company's dedication to protecting its workforce and the communities in which it operates.

- Adherence to ESG Standards: Bushveld Minerals prioritizes compliance with evolving ESG regulations and best practices to ensure responsible resource management and stakeholder engagement.

- Safety Performance Improvement: The company actively works to enhance its safety protocols and performance, aiming for a consistently low Total Recordable Injury Frequency Rate (TRIFR).

- Operational Integrity: Maintaining a safe and compliant operational environment is paramount for Bushveld Minerals to safeguard its assets, reputation, and license to operate.

- Risk Mitigation: Proactive regulatory compliance and a strong safety culture help mitigate operational risks, preventing incidents that could lead to financial losses or reputational damage.

Bushveld Minerals' key activities revolve around the responsible extraction and processing of vanadium, with Vametco as its operational core. The company is actively pursuing production increases at Vametco, targeting 2,400 tonnes of vanadium equivalent per annum in 2024, while simultaneously managing significant debt and liquidity challenges through restructuring and seeking new investment. Strategic divestments of non-core assets, such as the sale of its stake in Mokopane Tin in 2023, are crucial for debt reduction and focusing resources on core vanadium operations. Furthermore, aggressive cost reduction measures, including headcount optimization and operational efficiency improvements, are being implemented to drive profitability, with notable cost reductions reported in 2023 and continued efforts in 2024. Maintaining rigorous adherence to ESG standards and improving safety performance, evidenced by efforts to lower its TRIFR, are fundamental to ensuring operational integrity and mitigating risks.

| Key Activity | Description | 2024 Focus/Data | Recent Performance/Data |

| Vanadium Mining & Processing | Responsible extraction and processing of vanadium ore at Vametco. | Target production: 2,400 tonnes V eq. p.a. | Turnaround initiatives to boost production and efficiency. |

| Financial Restructuring & Funding | Managing debt, negotiating with creditors, and securing new investment. | Actively seeking new investment for working capital and debt management. | Negotiations with Orion Mine Finance for debt rescheduling. |

| Asset Divestment | Selling non-core assets to reduce debt and generate cash. | Streamlining portfolio to focus on core vanadium assets. | Sold 50% stake in Mokopane Tin project (2023). |

| Cost Reduction | Implementing measures to lower operating expenses and improve profitability. | Continued focus on headcount reduction and operational efficiency. | Significant reduction in operating costs reported in 2023. |

| ESG & Safety Compliance | Adhering to environmental, social, governance standards and improving safety. | Prioritizing compliance with evolving ESG regulations. | Focus on improving safety performance and lowering TRIFR. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you'll download this exact file, ready for immediate use and strategic application.

Resources

The Vametco mine and its integrated processing plant are the bedrock of Bushveld Minerals' operations, serving as the primary source of vanadium. This asset is absolutely vital for the company's revenue generation. In 2024, Vametco continued to be a key focus for operational stability and efficiency improvements.

Bushveld Minerals holds substantial high-grade vanadium mineral reserves, primarily located in South Africa's Bushveld Complex. These reserves are crucial for the company's long-term operational viability and its position as a significant vanadium supplier.

The Vametco operations are particularly noteworthy, boasting a significant portion of these high-grade reserves. This resource base is foundational to Bushveld Minerals' strategy to become a leading primary vanadium producer, ensuring a consistent supply for future demand.

Bushveld Minerals' specialized processing technology and expertise are central to its business model, enabling the transformation of raw vanadium-bearing ore into valuable, high-purity products. This proprietary know-how in vanadium beneficiation is crucial for creating marketable materials used across various industrial sectors, from steel alloys to battery storage.

The company's operational expertise ensures efficient extraction and processing, a key differentiator in the competitive vanadium market. For instance, Bushveld's focus on its Vametco processing facility highlights its commitment to refining its technological capabilities, aiming to maximize yields and product quality.

Human Capital and Operational Workforce

Bushveld Minerals relies heavily on its human capital, comprising skilled mining engineers, metallurgists, and plant operators, to effectively manage and enhance its sophisticated mining and processing activities. This expertise is fundamental to ensuring operational efficiency and productivity.

Despite recent workforce adjustments, retaining essential talent remains a paramount concern for maintaining the continuity and smooth functioning of Bushveld's operations. The company's ability to keep its experienced personnel directly impacts its output and strategic goals.

For example, as of the first half of 2024, Bushveld Minerals reported a total workforce of approximately 900 employees. The company's strategic focus on retaining core competencies within its operational teams is crucial for navigating the complexities of mineral extraction and processing.

- Skilled Workforce: Expertise in mining engineering, metallurgy, and plant operations is essential for optimizing complex processes.

- Talent Retention: Maintaining key personnel is vital for operational continuity, even amidst workforce restructuring.

- Operational Continuity: The company's ability to retain experienced staff directly influences its production efficiency and strategic execution.

Limited Working Capital and Funding Facilities

Access to essential working capital and ongoing funding facilities, such as those provided by Orion Mine Finance and Southern Point Resources, represents a critical resource for Bushveld Minerals. These financial lifelines are indispensable for covering day-to-day operational expenses and effectively managing existing debt, particularly during periods of financial restructuring.

In 2024, Bushveld Minerals continued to rely on these facilities. For instance, the company’s ability to meet its financial obligations and maintain operational momentum was directly linked to the availability of these funding arrangements.

- Orion Mine Finance: A key provider of debt financing, enabling Bushveld to manage operational costs and capital expenditures.

- Southern Point Resources: Another significant funding partner, contributing to the company's liquidity and debt management strategies.

- Working Capital Management: The continuous flow of funds from these facilities is vital for ensuring smooth operations, from raw material procurement to employee salaries.

- Debt Servicing: These resources also play a crucial role in meeting the company's debt repayment schedules, maintaining financial stability.

Bushveld Minerals' key resources are anchored by its Vametco mine and processing plant, the core of its vanadium production. The company also possesses substantial high-grade vanadium reserves, predominantly in South Africa's Bushveld Complex, ensuring long-term supply capability. Crucially, Bushveld leverages specialized processing technology and deep operational expertise to transform ore into high-purity vanadium products, a significant competitive advantage.

The company's skilled workforce, including engineers and metallurgists, is fundamental to efficient operations. For instance, as of H1 2024, Bushveld Minerals employed around 900 individuals, underscoring the importance of human capital. Financial resources are also paramount, with ongoing reliance on facilities from Orion Mine Finance and Southern Point Resources to manage working capital and debt, as seen throughout 2024.

| Key Resource | Description | Significance |

|---|---|---|

| Vametco Mine & Processing Plant | Primary vanadium extraction and beneficiation facility. | Core operational asset, revenue generation hub. |

| Vanadium Reserves | High-grade vanadium mineral deposits in South Africa. | Ensures long-term operational viability and supply security. |

| Proprietary Processing Technology | Specialized methods for vanadium product creation. | Creates marketable, high-purity materials; competitive differentiator. |

| Skilled Workforce | Expertise in mining, metallurgy, and plant operations. | Drives operational efficiency and productivity. |

| Financial Facilities | Funding from Orion Mine Finance and Southern Point Resources. | Manages working capital, debt servicing, and operational continuity. |

Value Propositions

Bushveld Minerals' value proposition centers on delivering high-purity vanadium products, such as ferrovanadium and vanadium oxides. These products meet the stringent requirements of sectors like steel manufacturing and chemical production, where quality and consistency are paramount.

This commitment to purity makes Bushveld's vanadium essential for specialized applications, ensuring optimal performance and reliability for their customers. For instance, in 2024, the demand for high-grade vanadium for advanced alloys in aerospace and automotive sectors continued to grow, highlighting the importance of such specialized offerings.

Bushveld Minerals, as one of the world's few primary vanadium producers, provides a more direct and potentially stable supply chain for this critical metal. This direct sourcing is attractive to industrial customers who prioritize consistency and security for their manufacturing operations.

While the company's status as a primary producer offers a distinct advantage, recent operational hurdles have presented challenges to its supply reliability. For instance, in 2023, Bushveld Minerals reported production disruptions at its Vametco facility, impacting overall output volumes.

Bushveld Minerals' contribution to a low-carbon economy is central to its value proposition. Vanadium is a key enabler for reducing carbon emissions in steel manufacturing, a sector historically responsible for significant greenhouse gas output. By providing this essential element, Bushveld directly supports cleaner industrial practices.

Furthermore, vanadium is crucial for the advancement of large-scale energy storage. Vanadium redox flow batteries (VRFBs) offer a sustainable and efficient way to store renewable energy, making them vital for grid stability as countries transition away from fossil fuels. This positions Bushveld's products at the forefront of the global shift towards sustainability.

In 2023, the global steel industry accounted for approximately 7% of total anthropogenic CO2 emissions. By incorporating vanadium, steel producers can reduce their carbon footprint. For instance, using vanadium in rebar can lead to a 10-15% reduction in the embodied carbon of concrete structures.

Vertically Integrated Value Chain (Historical)

Historically, Bushveld Minerals' vertically integrated value chain, encompassing mining, processing, and downstream energy solutions, was designed to unlock cost efficiencies and ensure robust supply chain control. This integrated approach allowed the company to manage production from the raw material extraction phase all the way to the finished product.

This control over each stage of the production process was a significant differentiator, offering a competitive edge. For instance, in 2023, Bushveld Minerals reported that its operations, including its PGM processing facilities, contributed to a more streamlined and cost-effective production cycle.

- Cost Efficiencies: Direct control over mining and processing reduced reliance on third-party providers, potentially lowering operational expenditures.

- Supply Chain Security: Owning the entire value chain minimized risks associated with external supplier disruptions.

- Quality Control: Managing each step allowed for consistent quality assurance from mine to market.

- Value Capture: Retaining value at each stage of the production process, from raw material to refined product.

Cost-Effective Production Potential

Bushveld Minerals is actively pursuing operational excellence and implementing cost-saving measures at its Vametco operations. This strategic focus aims to establish a low-cost production platform, enhancing its competitive edge. For instance, in the first half of 2024, Bushveld reported a significant reduction in cash operating costs per pound of vanadium produced at Vametco compared to previous periods, demonstrating progress towards this objective.

This commitment to cost-effectiveness is crucial for positioning Bushveld Minerals to be competitive and potentially cash-generative. As the vanadium market continues its recovery, a lean cost structure becomes paramount. The company's efforts in 2024 have been geared towards optimizing processing and logistics to achieve this.

- Low-Cost Production Target: Bushveld Minerals is focused on reducing production costs at Vametco.

- Operational Excellence: Initiatives are in place to improve efficiency and cut expenses.

- Market Competitiveness: A lower cost base enhances the company's standing in a recovering vanadium market.

- Cash Generation Potential: Cost savings are key to generating positive cash flow.

Bushveld Minerals offers high-purity vanadium products, essential for advanced alloys in sectors like aerospace and automotive, where quality is critical. Their position as a primary producer provides a more secure and direct supply chain, appealing to industrial customers seeking consistency. The company's vanadium is also vital for the low-carbon economy, enabling emission reductions in steel manufacturing and supporting the growth of vanadium redox flow batteries for renewable energy storage.

| Value Proposition | Key Aspect | Supporting Data/Context |

|---|---|---|

| High-Purity Vanadium Products | Meeting stringent industry standards | Essential for advanced alloys in aerospace and automotive; demand for high-grade vanadium grew in 2024. |

| Secure & Direct Supply Chain | Primary producer advantage | Offers consistency and security for industrial customers; direct sourcing is attractive. |

| Enabler of Low-Carbon Economy | Supporting sustainability | Reduces carbon emissions in steel (7% of global CO2 in 2023); crucial for VRFBs in renewable energy storage. |

Customer Relationships

Bushveld Minerals cultivates direct sales and technical support channels with its industrial clientele, primarily within the steel and chemical industries. This direct approach ensures they can offer specialized solutions and gather immediate feedback on product usage.

In 2024, Bushveld Minerals continued to emphasize these direct customer interactions, recognizing their value in fostering loyalty and understanding evolving market needs. This strategy is crucial for their vanadium products, where technical application support is paramount.

Bushveld Minerals prioritizes long-term off-take agreements with its customers to secure consistent demand for its vanadium products. These agreements are crucial for providing revenue predictability and fostering stronger relationships, though the current market volatility might impact the negotiation or renewal of these contracts.

Bushveld Minerals, having historically been listed on AIM, places a high priority on investor relations and transparency, especially given its ongoing financial restructuring. This commitment is vital for managing expectations among shareholders and financial stakeholders.

The company regularly disseminates crucial information through RNS announcements and investor presentations. For instance, in its 2024 updates, Bushveld Minerals provided detailed progress reports on its production targets and financing initiatives, aiming to foster confidence amidst its strategic adjustments.

Industry Engagement and Market Development

Bushveld Minerals actively participates in industry associations such as Vanitec. This engagement is crucial for fostering market development and deepening the understanding of vanadium's diverse applications, especially within the burgeoning energy storage sector. These collaborative efforts help to expand the overall market for vanadium products.

Historically, through its subsidiary Bushveld Energy, the company has been instrumental in promoting vanadium's role in vanadium redox flow batteries (VRFBs). This direct involvement in the energy storage market not only builds valuable relationships but also directly contributes to creating demand for vanadium. For instance, in 2024, the global VRFB market was projected for significant growth, with estimates suggesting it could reach billions of dollars by the end of the decade, underscoring the importance of Bushveld's engagement.

- Industry Association Participation: Involvement in groups like Vanitec drives collaboration and knowledge sharing, benefiting the entire vanadium industry.

- Energy Storage Sector Engagement: Bushveld's historical work in VRFBs, a key growth area for vanadium, directly supports market expansion.

- Market Growth Contribution: By educating the market and showcasing vanadium's capabilities, Bushveld indirectly stimulates demand for its products.

Stakeholder Engagement during Restructuring

Bushveld Minerals' customer relationships are currently under significant strain due to its ongoing financial distress and business rescue proceedings. This situation necessitates proactive and transparent communication to maintain trust and mitigate potential client attrition.

The company must actively engage with its customer base, providing clear updates on operational status, potential supply chain impacts, and revised timelines. For instance, during periods of operational uncertainty, like those experienced in early 2024 when production levels were affected by equipment maintenance, timely information sharing becomes paramount.

- Proactive Communication: Regularly inform customers about operational stability and any potential disruptions stemming from the business rescue process.

- Expectation Management: Clearly outline revised delivery schedules and product availability to prevent misunderstandings and maintain customer confidence.

- Relationship Preservation: Focus on demonstrating commitment to fulfilling existing contracts where feasible and exploring flexible solutions to retain business.

- Future Outlook: Share updated strategic plans and progress on restructuring efforts to reassure customers about the company's long-term viability.

Bushveld Minerals' customer relationships are built on direct sales and technical support, particularly with industrial clients in steel and chemicals. The company prioritizes long-term off-take agreements to ensure revenue stability and foster stronger partnerships. In 2024, maintaining these relationships was critical amidst ongoing financial restructuring, requiring transparent communication regarding production and financing initiatives.

Channels

Bushveld Minerals leverages its dedicated internal sales force to directly connect with industrial clients worldwide, focusing on sectors like steel and chemicals. This direct engagement facilitates the transfer of specialized product knowledge and enables tailored sales strategies to meet specific customer needs.

In 2024, Bushveld Minerals' direct sales efforts were crucial in securing key contracts, reflecting the value of personalized customer relationships in the specialty minerals market.

Bushveld Minerals utilizes global commodity trading networks to extend its market reach, ensuring its vanadium products connect with diverse international demands. These networks act as crucial intermediaries, facilitating the distribution of vanadium beyond direct sales channels.

In 2024, the global vanadium market continued to see significant demand, particularly from the steel industry, which accounts for approximately 90% of vanadium consumption. Bushveld's participation in these networks allows them to tap into this widespread demand effectively.

These established networks provide access to a broader customer base and specific regional markets where direct engagement might be more challenging. This strategic approach helps Bushveld diversify its sales avenues and optimize the flow of its vanadium products across different continents.

Bushveld Minerals leverages its official website as a primary channel for investor and public relations. This platform serves as a central hub for disseminating crucial information such as news releases, quarterly and annual financial reports, and operational updates, ensuring transparency with stakeholders.

Furthermore, the company utilizes platforms like Investor Meet Company to engage directly with the investment community. These digital avenues facilitate direct communication, allowing for the sharing of detailed corporate information and fostering a more accessible dialogue with potential and existing investors.

In 2024, Bushveld Minerals continued to prioritize digital communication, with its website being a key resource for tracking its progress in the vanadium and battery materials sectors. For instance, updates on its Vametco and Mokopane projects are consistently made available, providing investors with real-time insights into production and development.

Industry Conferences and Exhibitions

Bushveld Minerals leverages industry conferences and exhibitions as a key channel for market visibility and networking. These events allow for direct engagement with potential customers and industry innovators, effectively promoting vanadium applications and the company's unique product offerings. For instance, participation in the 2024 Mining Indaba provided significant opportunities to showcase their capabilities and connect with a broad spectrum of stakeholders in the African mining sector.

These gatherings are crucial for understanding market trends and competitor activities. By presenting technical papers and engaging in discussions, Bushveld Minerals reinforces its position as a leader in the vanadium space. In 2024, the company actively participated in several international mining and metals forums, aiming to broaden its customer base and explore new market opportunities for its high-purity vanadium products.

- Market Visibility: Enhancing brand recognition within the global mining and materials sectors.

- Networking: Establishing and strengthening relationships with potential investors, customers, and strategic partners.

- Product Promotion: Showcasing the versatility and benefits of vanadium in various industrial applications, such as steel, batteries, and aerospace.

Regulatory News Services (RNS)

Regulatory News Services (RNS) act as a vital communication channel for Bushveld Minerals, ensuring all material information, from financial restructuring updates to asset sale details, is promptly and accurately shared with the investing public. This adherence to regulatory disclosure is paramount for a publicly listed entity.

For instance, in 2024, Bushveld Minerals has utilized RNS to communicate significant operational and financial milestones, maintaining transparency with its stakeholders. These announcements are crucial for market confidence and investor relations, particularly during periods of strategic adjustment.

- Timely Disclosure: RNS enables Bushveld Minerals to meet its obligations for immediate release of price-sensitive information.

- Market Transparency: It ensures all market participants receive the same information simultaneously, fostering a fair trading environment.

- Investor Relations: RNS is a primary tool for keeping investors informed about corporate actions, performance, and strategic direction.

- Compliance: Adherence to RNS requirements is a fundamental aspect of maintaining the company's listing status and regulatory compliance.

Bushveld Minerals utilizes a multi-faceted channel strategy, combining direct sales with global trading networks to reach its diverse customer base. This approach ensures both specialized client engagement and broad market access for its vanadium products.

In 2024, the company's direct sales were instrumental in securing key industrial contracts, highlighting the importance of tailored customer relationships. Concurrently, its participation in global commodity trading networks facilitated the distribution of vanadium, tapping into the approximately 90% of global demand that originates from the steel industry.

The company also leverages digital platforms, including its official website and investor engagement services, to maintain transparency and communicate with stakeholders. Industry conferences and regulatory news services further bolster market visibility and ensure timely dissemination of crucial information.

Customer Segments

Global steel manufacturers form Bushveld Minerals' core customer segment, representing the largest and most significant market. These companies utilize vanadium primarily as an alloying agent to enhance the strength and durability of steel, particularly for applications like rebar used in construction. In 2024, the global steel industry continued to be a major consumer of ferrovanadium, with demand driven by infrastructure development and manufacturing. For instance, rebar accounts for a substantial portion of steel consumption, and the addition of vanadium significantly improves its yield strength.

These manufacturers require high-purity ferrovanadium and vanadium oxides to achieve the desired material properties in their steel products. The precise composition of these alloys is critical for meeting stringent industry standards and performance requirements. The global market for ferrovanadium was estimated to be worth billions of dollars in 2024, with steel production being the dominant end-use sector.

Vanadium Redox Flow Battery (VRFB) manufacturers represent a pivotal customer segment for vanadium demand, particularly for large-scale energy storage. While this segment's emphasis may have shifted strategically, its long-term importance for the clean energy transition remains significant.

These manufacturers are critical drivers of future vanadium consumption, as the global energy storage market continues to expand. By 2024, the energy storage market is projected to see substantial growth, with flow batteries like VRFBs expected to capture a growing share of utility-scale projects.

The specialty chemical and aerospace industries represent a niche but high-value market for Bushveld Minerals. These sectors demand vanadium chemicals and high-purity vanadium for critical applications like catalysts, pigments, and specialized alloys used in aerospace components, leveraging vanadium's unique material properties.

In 2024, the global specialty chemicals market was projected to reach over $700 billion, with a significant portion driven by advanced materials. Aerospace, a key consumer of high-performance alloys, saw continued investment in new aircraft development, further underscoring the demand for specialized vanadium products.

Commodity Traders and Distributors

Commodity traders and distributors are key intermediaries for Bushveld Minerals, acting as vital conduits for its vanadium products. These entities purchase vanadium concentrate and other derivatives, then resell them to a diverse range of industrial consumers globally. Their expertise in navigating complex international markets and managing intricate supply chains significantly expands Bushveld's market penetration.

These partners are crucial for bridging the gap between Bushveld's production and the varied needs of end-users in sectors like steel, aerospace, and chemical manufacturing. They handle the logistics, warehousing, and often provide financing, allowing Bushveld to focus on its core mining and processing operations.

- Market Reach: Traders and distributors extend Bushveld's sales network, reaching customers who might be difficult to access directly.

- Logistics Management: They absorb the complexities of international shipping, customs, and local distribution, streamlining the supply chain.

- Financial Facilitation: These intermediaries can offer more flexible payment terms to end-users, aiding in sales volume.

- Risk Mitigation: By purchasing directly from Bushveld, traders assume some market price and inventory risks.

Institutional and Retail Investors

Bushveld Minerals views both institutional and retail investors as critical customer segments. While not direct consumers of its mineral products, their investment capital and ongoing confidence are essential for the company's financial stability and growth initiatives, especially during times of strategic realignment or when seeking further funding.

Institutional investors, such as pension funds, mutual funds, and hedge funds, often provide significant capital injections. For instance, in the first half of 2024, Bushveld Minerals continued to engage with these entities to support its operational and development plans. Retail investors, on the other hand, contribute through the purchase of shares on public exchanges, demonstrating broader market support and potentially increasing liquidity.

- Institutional Investors: These entities are key to securing large-scale funding rounds, crucial for projects like mine development and expansion.

- Retail Investors: Their participation bolsters share price stability and provides a diversified ownership base.

- Investor Confidence: Maintaining transparency and delivering on operational targets is paramount to retaining and attracting both investor types.

- Capital Needs: Bushveld Minerals' ability to access capital markets is directly tied to the perception of its long-term viability and management strategy.

Global steel manufacturers remain the primary customer base, demanding ferrovanadium for alloy enhancement. The energy storage sector, particularly VRFB manufacturers, represents a growing and strategically important segment. Specialty chemical and aerospace industries form a niche but high-value market, requiring specific vanadium compounds.

Commodity traders and distributors are crucial intermediaries, facilitating market access and managing complex supply chains for Bushveld's products. Investors, both institutional and retail, are also considered a key segment, providing essential capital for the company's operations and growth. In 2024, continued investment in infrastructure globally sustained demand from the steel sector.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Global Steel Manufacturers | High-purity ferrovanadium, vanadium oxides for steel alloys | Dominant consumer; demand driven by construction and manufacturing |

| VRFB Manufacturers | Vanadium electrolyte for energy storage | Growing importance for clean energy transition; market expansion projected |

| Specialty Chemical & Aerospace | Vanadium chemicals, high-purity vanadium for catalysts, aerospace alloys | Niche but high-value; driven by advanced materials and aircraft development |

| Commodity Traders & Distributors | Vanadium concentrate, derivatives for resale | Essential intermediaries for market reach and supply chain efficiency |

| Investors (Institutional & Retail) | Capital for operations and growth initiatives | Critical for financial stability and expansion plans; ongoing engagement in 2024 |

Cost Structure

Mining and processing operational costs represent the most substantial expenses for Bushveld Minerals, primarily driven by activities at their Vametco plant. These costs cover the entire journey from extracting ore to the final chemical processing stages.

Significant outlays are allocated to essential inputs like raw materials, the energy required for machinery and processing, and the skilled labor force. Maintenance of mining equipment and processing facilities also contributes heavily to this cost category.

For instance, in 2024, Bushveld Minerals reported that its Vametco operations incurred substantial costs related to these activities, reflecting the capital-intensive nature of ferrovanadium production. These expenditures are crucial for maintaining production capacity and efficiency.

Bushveld Minerals faces significant costs related to servicing its existing debt obligations. These expenses include regular interest payments, which are a substantial part of its financial outlays. Given the company's financial challenges, these servicing costs represent a critical component of its overall cost structure.

Furthermore, the ongoing business rescue proceedings and the potential for restructuring or liquidation incur considerable costs. These include fees for financial advisors who are guiding the process and legal professionals managing the complex legal aspects. These advisory and legal expenses are directly tied to navigating the company's financial distress.

Capital expenditure at Bushveld Minerals, particularly for sustaining operations at Vametco, remains crucial for maintaining plant and equipment efficiency. In 2024, the company continued to invest in these essential upgrades to ensure operational stability.

Historically, development capital expenditure has funded expansion and diversification initiatives. While this focus has been moderated recently, ongoing investments in capital assets are vital for the long-term viability and potential growth of the business.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent the overhead essential for running Bushveld Minerals, encompassing costs like head office salaries, administrative staff, legal counsel, auditing services, and marketing initiatives. These are the foundational costs of maintaining the corporate structure.

To manage these overheads, Bushveld Minerals undertook a strategic initiative involving significant headcount reductions. This move was designed to streamline operations and directly curtail escalating G&A expenditures, thereby improving the company's overall cost efficiency.

- Head Office Operations: Salaries for management and administrative personnel form a core component of G&A.

- Professional Services: Costs associated with legal, auditing, and consulting engagements are included.

- Marketing and Sales: Expenses related to promoting the company and its products fall under G&A.

- Cost Control Measures: Headcount reductions were implemented to directly address and reduce these overheads.

Environmental Compliance and Social Responsibility Costs

Bushveld Minerals incurs significant costs to meet stringent environmental regulations, ensuring sustainable mining practices. These expenses are crucial for maintaining their license to operate and mitigating ecological impact.

Rehabilitation of mining sites is a substantial part of their environmental compliance, involving restoration efforts post-extraction. This commitment extends to community development initiatives, fostering positive relationships and managing social impact.

- Environmental Compliance: Costs related to adhering to South Africa's National Environmental Management Act (NEMA) and other relevant legislation. This includes monitoring, reporting, and implementing pollution control measures.

- Rehabilitation: Funds allocated for the progressive rehabilitation of disturbed land and post-closure restoration, aiming to return mined areas to a stable and ecologically sound state.

- Social Responsibility: Investments in community development projects, local employment, and skills training programs as part of their Social and Labour Plans (SLPs), which are mandatory for mining rights in South Africa.

Bushveld Minerals' cost structure is heavily weighted towards operational expenses at its Vametco facility, encompassing raw materials, energy, and labor. Debt servicing and costs associated with business rescue proceedings, including advisory and legal fees, are also significant financial outlays. Capital expenditure for operational maintenance and environmental compliance, including site rehabilitation and social responsibility programs, further shape the company's cost base.

| Cost Category | Description | 2024 Focus/Impact |

|---|---|---|

| Operational Costs | Mining, ore processing, raw materials, energy, labor, equipment maintenance | Substantial outlays at Vametco, reflecting capital intensity of ferrovanadium production. |

| Debt Servicing | Interest payments on existing debt obligations | Critical component of financial outlays, particularly given financial challenges. |

| Business Rescue Costs | Fees for financial advisors and legal professionals | Directly tied to navigating financial distress and potential restructuring. |

| Capital Expenditure | Sustaining operations, plant and equipment efficiency | Continued investment in essential upgrades for operational stability at Vametco. |

| General & Administrative (G&A) | Head office salaries, professional services, marketing | Streamlined through headcount reductions to improve cost efficiency. |

| Environmental & Social | Compliance with regulations (NEMA), site rehabilitation, community development | Crucial for license to operate and social license, including mandatory SLPs. |

Revenue Streams

Bushveld Minerals' core revenue comes from selling high-purity ferrovanadium and different vanadium oxides. These are key ingredients for the global steel and chemical sectors. The company processes its vanadium ore at the Vametco facility to create these valuable products.

In 2024, the demand for vanadium remained robust, driven by its essential role in strengthening steel alloys, particularly for infrastructure and automotive applications. Bushveld Minerals' sales performance in this segment directly reflects these market dynamics and their ability to meet industry specifications.

Bushveld Minerals is actively generating revenue through the disposal of non-essential assets as part of its ongoing strategic repositioning. For instance, the sale of the Vanchem plant, Lemur Holdings, and Bushveld Electrolyte Company (BELCO) are key examples of this approach.

These asset disposals are not just about generating income; they are vital for bolstering the company's financial health. The proceeds are instrumental in enhancing liquidity and significantly reducing the company's existing debt burden.

Historically, Bushveld Minerals generated revenue from selling vanadium products, especially vanadium electrolyte, to the emerging energy storage sector for Vanadium Redox Flow Batteries (VRFBs). This was a key early revenue stream as the VRFB market began to develop.

While Bushveld is now shifting away from direct ownership of energy storage assets, vanadium itself remains a critical material for the growth of this sector. The company's continued production of vanadium means it still indirectly supports and benefits from the expansion of VRFB technology.

Exploration and Other Mineral Sales (Minor/Divested)

Historically, Bushveld Minerals' revenue streams included minor contributions from mineral exploration and sales of other mineral assets such as coal from its Lemur project or iron ore. These segments were not central to the company's strategy and are being divested as Bushveld sharpens its focus on its core vanadium operations.

For instance, in the fiscal year ending December 31, 2023, the company reported that its coal segment, Lemur, generated minimal revenue, reflecting its strategic shift. This divestment approach allows Bushveld to concentrate capital and management attention on its primary vanadium assets, aiming to maximize value from these core operations.

- Divestment of Non-Core Assets: Bushveld Minerals is actively divesting its coal (Lemur) and iron ore assets.

- Focus on Vanadium: The company's strategic priority is its vanadium production and development projects.

- Historical Minor Contributions: Exploration and other mineral sales represented a small portion of past revenues.

Financial Funding and Debt Restructuring Outcomes

Securing new funding and restructuring existing debt are crucial for Bushveld Minerals' operational continuity, acting as vital financial inflows that support ongoing business activities. These actions, while not direct sales revenue, significantly bolster the company's financial health and capacity to generate future product income.

- Financial Inflow: New funding facilities provide essential capital, enabling continued operations and investment in growth initiatives.

- Balance Sheet Improvement: Successful debt restructuring reduces financial burdens and improves the company's overall financial stability.

- Operational Sustainability: These financial maneuvers are paramount for maintaining operations and ensuring the company can continue to generate traditional product revenues.

Bushveld Minerals' primary revenue streams revolve around the sale of vanadium products, specifically ferrovanadium and vanadium oxides, crucial for the steel and chemical industries. The company's 2023 financial results highlighted a strategic shift, with significant proceeds generated from the divestment of non-core assets like the Vanchem plant and its interest in Bushveld Electrolyte Company (BELCO).

These asset sales are instrumental in strengthening Bushveld's financial position by improving liquidity and reducing debt. While historically the company also generated revenue from selling vanadium electrolyte for Vanadium Redox Flow Batteries (VRFBs), its current strategy focuses on vanadium production, indirectly supporting the growing VRFB market.

The company's revenue generation is also supported by financial inflows from new funding and debt restructuring, which are essential for operational continuity and future growth. For instance, the company secured a significant funding package in late 2023 to support its strategic objectives.

| Revenue Source | 2023 Status/Impact | Key Drivers |

|---|---|---|

| Vanadium Product Sales | Core revenue driver | Demand for steel alloys, V2O5 for chemicals |

| Asset Disposals (Vanchem, BELCO, Lemur) | Significant financial inflow | Debt reduction, enhanced liquidity |

| Financial Restructuring & Funding | Operational continuity support | Capital for operations and growth |

Business Model Canvas Data Sources

The Bushveld Minerals Business Model Canvas is built upon a foundation of comprehensive market research, detailed financial disclosures, and strategic operational data. These sources ensure each component of the canvas accurately reflects the company's current landscape and future potential.