Inner Mongolia Baotou Steel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inner Mongolia Baotou Steel Bundle

Inner Mongolia Baotou Steel's SWOT analysis reveals a powerful player in the steel industry, leveraging its vast resource base and established infrastructure. However, it also navigates evolving market demands and environmental regulations.

Want the full story behind Baotou Steel's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Inner Mongolia Baotou Steel Union Co., Ltd. boasts a significant competitive advantage through its fully integrated operations, encompassing everything from mining raw materials to smelting and rolling finished steel products. This end-to-end control over the value chain allows for enhanced supply chain management and quality consistency. For instance, in 2023, the company reported significant production volumes, underscoring its large-scale capabilities which translate into substantial economies of scale, a key strength in the competitive steel market.

Inner Mongolia Baotou Steel's dominant rare earth resource holdings are a significant strength. The company controls substantial reserves, notably from the Bayan Obo mine, recognized as one of the planet's largest rare earth deposits.

This unparalleled access to critical rare earth elements, such as neodymium and praseodymium, places Baotou Steel in a commanding position within a market vital for advanced technologies. These elements are indispensable for manufacturing components used in electric vehicles, wind turbines, and sophisticated electronics.

In 2023, China, Baotou Steel's home country, accounted for approximately 70% of global rare earth mine production, underscoring the strategic importance of domestic resource control.

Baotou Steel boasts a wide array of steel products, encompassing plates, sections, rods, and wires. This extensive range allows the company to serve a variety of critical industries, including construction, machinery manufacturing, automotive, and railways.

This diversification is a significant strength, as it spreads risk across different market segments. By not relying on a single industry, Baotou Steel can better weather economic downturns or shifts in demand within any one sector, ensuring more stable revenue streams.

Commitment to Technological Innovation

Inner Mongolia Baotou Steel's commitment to technological innovation, driven by its parent Baogang Group, is a significant strength. This focus spans both the steel and rare earth industries, positioning the company for future growth in specialized markets.

Recent initiatives highlight this commitment. The company has introduced new steel products tailored for high-demand sectors, such as wind power steel and high-speed rail tracks. These advancements reflect a strategic pivot towards higher-value, specialized materials.

- Accelerated Innovation: Baotou Steel, via Baogang Group, is actively pushing technological boundaries in steel and rare earth production.

- New Product Development: Launches include wind power steel and high-speed rail tracks, catering to growing infrastructure and renewable energy needs.

- Rare Earth Advancements: Progress in rare earth separation technology signals a move into more sophisticated material applications.

Established Export Market Presence

Baotou Steel benefits from a well-established export market presence, solidifying its global reach. Its international reputation is on the rise, especially within nations participating in the Belt and Road Initiative.

In 2023, the company achieved significant export volumes, shipping 1.38 million metric tons of steel to 46 different countries. This success is driven by a strategic focus on high-value products, including specialized pipelines, automotive steel, and rails, underscoring its competitive edge in international trade.

- Growing Global Footprint: Expanding reach into 46 countries in 2023.

- Belt and Road Initiative Focus: Strong engagement with key markets along the BRI.

- High-Value Product Exports: Specialization in competitive segments like pipelines and automotive steel.

- Volume Achievement: Exported 1.38 million metric tons in 2023, showcasing market demand.

Baotou Steel's integrated operations, from mining to finished products, provide exceptional supply chain control and quality assurance. Its vast production capabilities, demonstrated by significant 2023 output figures, translate into strong economies of scale, a crucial advantage in the steel sector.

The company's ownership of extensive rare earth reserves, particularly from the Bayan Obo mine, is a paramount strength. China's 2023 dominance in global rare earth production, accounting for roughly 70%, highlights the strategic value of Baotou Steel's resource control for advanced technology sectors.

Baotou Steel offers a diverse product portfolio, including plates, sections, rods, and wires, serving multiple industries like construction and automotive. This diversification mitigates risk by reducing reliance on any single market segment, leading to more stable revenue.

A commitment to technological innovation, fostered by the Baogang Group, drives advancements in both steel and rare earth production. The introduction of specialized products like wind power steel and high-speed rail tracks in recent years positions the company for growth in high-value markets.

What is included in the product

Delivers a strategic overview of Inner Mongolia Baotou Steel’s internal and external business factors, examining its competitive position and market challenges.

Offers a clear, actionable roadmap by highlighting Inner Mongolia Baotou Steel's competitive advantages and areas for improvement.

Weaknesses

Inner Mongolia Baotou Steel Union Co., Ltd. experienced a notable downturn in its financial results for 2024. The company's net income saw a substantial year-on-year decrease of 48.64%, signaling a significant hit to its profitability.

Adding to these concerns, the company's revenue also contracted, declining by 3.51% during the same period. This dual decline in both income and revenue points to considerable operational and market challenges impacting Baotou Steel's overall financial health.

Baotou Steel operates within China's steel sector, which has been grappling with significant overcapacity. In 2023, China's crude steel output reached a record high of 1.019 billion tonnes, yet domestic demand has struggled to absorb this volume, leading to a surplus. This persistent imbalance exerts considerable downward pressure on steel prices, directly impacting Baotou Steel's profitability margins and revenue streams.

The overcapacity issue often necessitates government intervention, including mandated production cuts. For instance, in late 2023 and early 2024, various regions in China implemented production curbs to manage environmental concerns and reduce output. Such measures, while aimed at stabilizing the market, can directly curtail Baotou Steel's production volumes and, consequently, its financial performance, creating a significant operational vulnerability.

Baotou Steel's rare earth segment faces considerable risk due to the inherent price fluctuations in the global rare earth market. This susceptibility was starkly evident in 2024, a year marked by a significant downturn in rare earth prices, leading to considerable pressure on the company's rare earth concentrate sales and, consequently, its financial performance.

Environmental Management and Decarbonization Gaps

Baotou Steel confronts significant environmental hurdles, notably the management and projected growth of its extensive toxic tailings lake, a byproduct of its rare earth mining activities. This poses a considerable risk if not handled with the utmost care.

The company's current position is further complicated by the absence of a publicly available low-carbon transition strategy or concrete emissions reduction goals. This lack of transparency could lead to future regulatory scrutiny and damage its reputation among environmentally conscious stakeholders.

- Environmental Challenges: Management of a large toxic tailings lake from rare earth mining operations.

- Decarbonization Strategy: Lack of a publicly disclosed low-carbon transition plan.

- Emissions Targets: No specific, publicly announced emissions reduction targets.

- Future Risks: Potential for regulatory penalties and reputational damage due to environmental and decarbonization gaps.

Impact of Sluggish Construction Sector Demand

While Baotou Steel has diversified its product offerings, a significant portion of its demand remains linked to China's construction industry. This sector has been facing a considerable downturn, which is expected to persist into 2025.

This continued retreat in construction demand is projected to negatively impact overall steel consumption in 2025, directly affecting Baotou Steel's domestic sales volume. For instance, China's fixed-asset investment growth, a key driver for construction, slowed to approximately 4.0% in the first half of 2024, down from previous years, signaling ongoing weakness.

- Construction Sector Slowdown: China's construction industry, a major consumer of steel, has experienced a significant slowdown, with growth projections for 2025 remaining subdued.

- Impact on Steel Demand: This downturn directly translates to reduced demand for steel products, Baotou Steel's core output.

- Domestic Sales Volume Reduction: Consequently, the company anticipates a negative impact on its domestic sales volumes for the fiscal year 2025.

Baotou Steel's financial performance in 2024 was significantly impacted by a 48.64% year-on-year drop in net income and a 3.51% revenue contraction, highlighting operational and market challenges.

The company operates in an oversupplied Chinese steel market, with 2023 output reaching 1.019 billion tonnes, leading to price pressures and reduced profitability. Mandated production cuts, seen in late 2023 and early 2024, further limit output and financial performance.

The rare earth segment is vulnerable to price volatility, as evidenced by a significant downturn in 2024, affecting concentrate sales. Environmental concerns, particularly the management of a large toxic tailings lake from rare earth mining, pose a substantial risk.

A lack of a public low-carbon transition strategy and specific emissions reduction targets could lead to future regulatory issues and reputational damage. The company's reliance on China's construction sector, which is experiencing a slowdown with subdued 2025 growth projections, also impacts domestic sales volumes, further complicated by a 4.0% slowdown in China's fixed-asset investment growth in the first half of 2024.

| Financial Metric | 2024 Performance | Impact |

|---|---|---|

| Net Income | -48.64% YoY | Significant profitability hit |

| Revenue | -3.51% YoY | Market and operational challenges |

| Crude Steel Output (China) | 1.019 billion tonnes (2023) | Market oversupply and price pressure |

| Fixed-Asset Investment Growth (China) | ~4.0% (H1 2024) | Reduced construction demand |

What You See Is What You Get

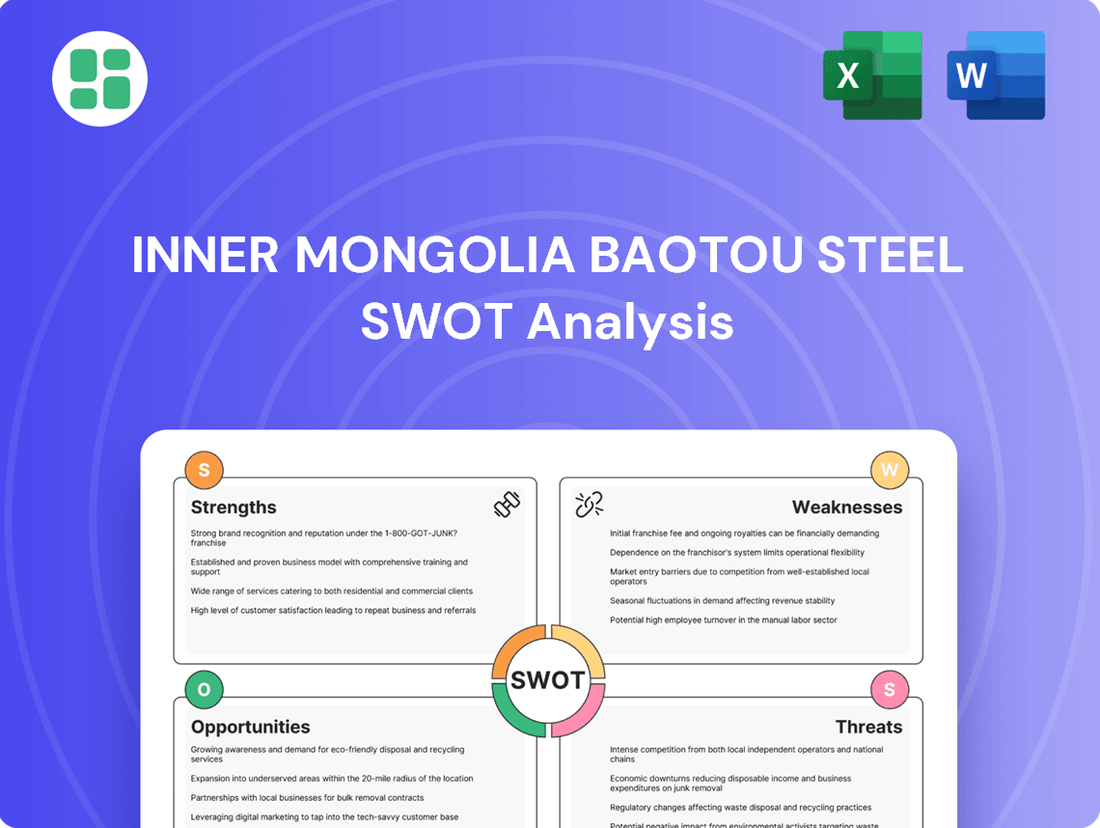

Inner Mongolia Baotou Steel SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Inner Mongolia Baotou Steel SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the full, in-depth report.

Opportunities

The global rare earth elements market is experiencing robust expansion, with projections indicating continued growth through 2030. This surge is fueled by escalating demand from critical sectors like electric vehicles, renewable energy (wind turbines), and sophisticated electronics. For instance, the EV market alone is expected to drive significant rare earth consumption.

Baotou Steel, possessing substantial rare earth reserves, is strategically positioned to leverage this market trend. By enhancing its production and refining capacities for sought-after rare earth products, the company can significantly increase its market share and revenue streams in this burgeoning industry.

Baotou Steel has a significant opportunity to expand its product offerings into high-value specialty steel and advanced materials, particularly those leveraging rare earth elements. This strategic shift could significantly boost profitability. For instance, the global market for specialty steel is projected to reach $250 billion by 2027, offering substantial growth potential.

By investing in areas like wind power steel, which is crucial for the expanding renewable energy sector, and marine pipeline steel for offshore infrastructure projects, Baotou Steel can tap into lucrative, high-demand markets. Furthermore, exploring rare earth applications in textiles and medical products presents a novel avenue for diversification, potentially capitalizing on the growing demand for advanced functional materials.

Investing in green technologies like advanced energy efficiency and carbon capture offers Baotou Steel a significant opportunity to slash its environmental footprint and operational expenses. For instance, by implementing state-of-the-art energy management systems, the company could potentially see a reduction in energy consumption by 10-15% in its production processes, as observed in similar industrial upgrades globally.

Aligning with the growing global demand for sustainability can bolster Baotou Steel's brand reputation and unlock access to green financing, which is becoming increasingly crucial. Companies with strong ESG (Environmental, Social, and Governance) credentials have seen their cost of capital decrease, with some studies indicating a 0.5% to 1% advantage in borrowing costs, making it easier to fund future initiatives.

Furthermore, embracing sustainable practices proactively positions Baotou Steel to navigate and potentially benefit from tightening environmental regulations expected in the coming years, ensuring its long-term viability and competitiveness in the market.

Strategic Partnerships and Industry Consolidation

Inner Mongolia Baotou Steel can significantly enhance its market position through strategic collaborations. Partnering with downstream industries, such as automotive manufacturers or construction firms, would create more stable demand for its steel and rare earth products. This approach is particularly relevant given the global push for electric vehicles, a key consumer of rare earths.

The rare earth sector, often characterized by fragmentation, presents a prime opportunity for consolidation. By engaging in mergers or acquisitions, Baotou Steel could bolster its control over the market and improve its ability to influence pricing. For instance, in 2024, China continued to consolidate its rare earth assets, aiming to create larger, more competitive entities.

- Securing Demand: Partnerships with sectors like electric vehicle manufacturing can guarantee off-take for rare earths.

- Market Control: Consolidation in the rare earth industry can lead to greater pricing power for major players.

- Synergistic Benefits: Collaborations can unlock operational efficiencies and technological advancements.

- Competitive Advantage: Strategic alliances can help Baotou Steel navigate global market volatility and competition.

Digital Transformation and Smart Manufacturing

Inner Mongolia Baotou Steel has a significant opportunity to enhance its operations by embracing digital transformation and smart manufacturing. This includes implementing advanced automation and intelligent processes across its mining, smelting, and rolling facilities. Such a move can dramatically boost efficiency, increase output, and improve the quality of its steel products.

By adopting these technologies, the company can minimize human error, leading to more consistent production. Furthermore, smart manufacturing allows for better resource management, optimizing the use of raw materials and energy. This strategic shift is projected to strengthen Baotou Steel's competitive edge in the global market.

- Increased Efficiency: Digitalization in manufacturing can lead to a 15-20% improvement in operational efficiency for steel producers.

- Productivity Gains: Automation in smelting and rolling processes can boost productivity by up to 25%.

- Quality Enhancement: Smart manufacturing systems can reduce product defects by 10-15% through precise control.

- Cost Reduction: Optimized resource utilization through AI and IoT can lead to a 5-10% reduction in operating costs.

Baotou Steel can capitalize on the booming global rare earth market, driven by demand from electric vehicles and renewable energy. By expanding its rare earth production and refining capabilities, the company can secure a larger market share and boost revenue.

The company has a prime opportunity to diversify into high-value specialty steel and advanced materials, particularly those incorporating rare earth elements, which could significantly enhance profitability. Investing in sectors like wind power steel and marine pipeline steel taps into lucrative, high-demand markets.

Embracing digital transformation and smart manufacturing presents a chance to dramatically improve operational efficiency, increase output, and enhance product quality. This strategic adoption of automation and intelligent processes is projected to strengthen Baotou Steel's competitive edge.

Strategic collaborations and potential market consolidation within the fragmented rare earth sector offer avenues for Baotou Steel to secure demand, gain pricing power, and achieve synergistic benefits.

| Opportunity Area | Market Driver | Potential Impact | Key Data Point (2024/2025) |

|---|---|---|---|

| Rare Earth Market Expansion | EVs, Renewable Energy | Increased Revenue, Market Share | Global rare earth market projected to grow significantly through 2030. |

| Specialty Steel & Advanced Materials | High-Value Applications | Enhanced Profitability | Global specialty steel market to reach $250 billion by 2027. |

| Digital Transformation & Smart Manufacturing | Efficiency, Quality Improvement | Strengthened Competitive Edge | Potential 15-20% improvement in operational efficiency for steel producers. |

| Strategic Collaborations & Consolidation | Market Stability, Pricing Power | Secured Demand, Synergies | China's ongoing consolidation of rare earth assets in 2024. |

Threats

Persistent Chinese steel overcapacity continues to be a major threat, creating fierce competition and squeezing profit margins for companies like Baotou Steel. Despite efforts to curb production, this oversupply is expected to linger, potentially driving down steel prices and creating a challenging market. For instance, in early 2024, China's steel output remained robust, contributing to global oversupply concerns.

China's commitment to environmental protection is intensifying, with its emissions trading system (ETS) set to encompass the steel sector. This means Baotou Steel will face direct financial implications from stricter environmental laws. For instance, by the end of 2023, China's national ETS had already covered over 6.5 billion tonnes of carbon emissions, and its expansion to heavy industries like steel is anticipated to drive up compliance costs.

Meeting these new regulations will likely require substantial capital expenditure on advanced pollution control equipment and cleaner production technologies. Furthermore, the operational expenses for Baotou Steel could rise as it may need to purchase carbon credits within the ETS framework to offset its emissions, impacting overall profitability.

The increasing implementation of anti-dumping duties and tariffs by major trading partners against Chinese steel products poses a significant risk to Baotou Steel's international revenue streams. For instance, the European Union's continued scrutiny and potential imposition of new trade defense measures in 2024 could directly impact the company's export competitiveness in a key region.

These escalating trade barriers not only threaten to shrink Baotou Steel's overseas sales volumes but also intensify pressure on its domestic market. With global demand uncertainties and a potentially saturated home market, a reduction in export opportunities could lead to oversupply domestically, impacting pricing and profitability.

Economic Slowdown in Key End-Use Sectors

A significant downturn in China's crucial real estate market presents a substantial threat to Baotou Steel. This sector is a primary driver of steel demand, and its continued struggles directly impact the company's sales volume. For instance, in 2023, China's property investment saw a notable decline, impacting construction activity and, consequently, steel consumption.

Beyond real estate, a broader economic slowdown across various manufacturing sectors could further dampen overall steel demand. While certain industries might exhibit resilience, a widespread deceleration would inevitably affect Baotou Steel's revenue streams and profitability. This economic climate poses a risk to the company's ability to maintain consistent sales and pricing power.

- Real Estate Sector Slowdown: China's property market, a key steel consumer, continues to face challenges, impacting demand.

- Broad Economic Deceleration: A general economic slowdown could reduce overall steel consumption across various industries.

- Revenue Impact: Reduced demand directly translates to lower sales volumes and potential pressure on Baotou Steel's revenue.

Volatility of Raw Material Prices

The steel industry, including Baotou Steel, faces significant risks from fluctuating raw material prices. For instance, iron ore prices saw considerable swings in 2023, with benchmarks like the Platts IO62% CFR China index trading between $100-$130 per tonne, impacting production costs. Similarly, coking coal prices can be highly volatile, influenced by supply disruptions and demand from major steel-producing nations.

These price fluctuations directly affect Baotou Steel's profitability. When the cost of essential inputs like iron ore and coking coal rises sharply, the company's profit margins can be squeezed if it cannot pass these increased costs onto its customers. This makes financial planning and cost management a constant challenge.

- Iron Ore Price Volatility: In 2023, the average price for iron ore (62% Fe, CFR China) hovered around $115 per tonne, with significant monthly variations impacting cost structures.

- Coking Coal Market Instability: Coking coal prices experienced upward pressure in late 2023 due to supply concerns in key exporting regions, directly affecting steel production expenses.

- Impact on Margins: Unpredictable input costs create a challenging environment for maintaining stable profit margins, requiring agile procurement strategies.

Geopolitical tensions and trade protectionism continue to pose a threat to Baotou Steel's global market access. For example, in early 2024, ongoing trade disputes between major economies could lead to further restrictions on steel imports, impacting export volumes. These international trade dynamics create uncertainty for companies reliant on global sales.

Additionally, Baotou Steel faces the threat of technological disruption. Innovations in steelmaking processes or the development of alternative materials could reduce demand for traditional steel products. Staying competitive requires continuous investment in research and development to adopt new, more efficient, and environmentally friendly production methods.

| Threat Category | Specific Risk | Impact on Baotou Steel | 2024/2025 Data/Trend |

|---|---|---|---|

| Geopolitical & Trade | Trade Protectionism | Reduced export opportunities, increased tariffs | EU and US continued to review trade defense measures on steel imports in early 2024. |

| Technological Disruption | Alternative Materials | Potential decrease in demand for conventional steel | Growing investment in advanced materials like composites and high-strength alloys across various industries. |

SWOT Analysis Data Sources

This SWOT analysis for Inner Mongolia Baotou Steel is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary. These sources ensure a robust and data-driven assessment of the company's strategic position.