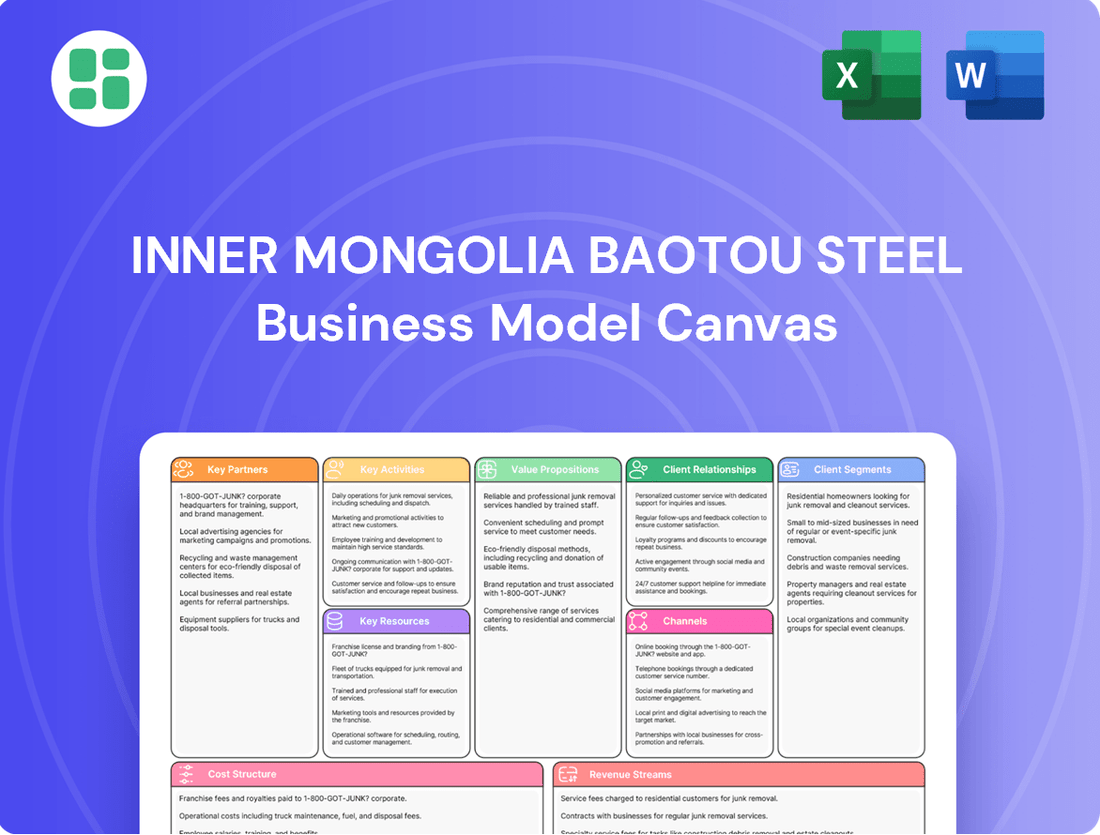

Inner Mongolia Baotou Steel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inner Mongolia Baotou Steel Bundle

Unlock the core strategic blueprint of Inner Mongolia Baotou Steel's operations. This comprehensive Business Model Canvas reveals their approach to customer relationships, key resources, and revenue streams, offering a clear view of their competitive advantage.

Dive into the specifics of how Inner Mongolia Baotou Steel builds and delivers value. This detailed canvas outlines their cost structure, key activities, and channels, providing actionable insights for anyone looking to understand their success.

Gain a complete understanding of Inner Mongolia Baotou Steel's business model by exploring the full canvas. Discover their unique value propositions and strategic partnerships, essential for anyone analyzing the steel industry.

Partnerships

Inner Mongolia Baotou Steel Union, a significant state-owned enterprise, cultivates robust relationships with the Chinese government and other state-owned entities. These collaborations are vital for securing regulatory backing, ensuring policy compliance, and gaining access to critical strategic resources, especially within the rare earth industry.

The Chinese government's strategic focus on advancing industrial chains and fostering technological innovation directly supports Baotou Steel's operational growth and market positioning. For instance, in 2023, China's industrial output saw a 4.6% increase, with steel production remaining a cornerstone of its manufacturing sector, highlighting the supportive environment for SOEs like Baotou Steel.

Inner Mongolia Baotou Steel leverages key partnerships with research and development institutions to drive innovation in rare earth materials. These collaborations are crucial for unlocking the full potential of its significant rare earth reserves, fostering advancements in both material science and practical applications.

Collaborations with prominent entities such as the Chinese Academy of Sciences (CAS) Institute of Geology and Geophysics and the Baotou Research Institute of Rare Earths are instrumental. These partnerships facilitate the identification of novel mineral deposits and the development of cutting-edge rare earth technologies, ensuring Baotou Steel remains at the forefront of the industry.

Inner Mongolia Baotou Steel cultivates crucial partnerships with major industrial customers, particularly those in construction, automotive, and railway sectors. These aren't just transactional relationships; they are built on long-term supply agreements that guarantee a consistent demand for Baotou Steel's diverse product range.

These stable demand channels are vital for Baotou Steel's operational efficiency and revenue predictability. For instance, in 2023, the company reported significant contributions from its key industrial clients, underscoring the importance of these enduring partnerships in securing market share and fostering business stability.

Furthermore, these deep client relationships enable Baotou Steel to engage in collaborative product development. By understanding the specific needs and future requirements of these large-scale buyers, the company can tailor its steel offerings, thereby enhancing its competitive edge and solidifying its market position.

Technology and Equipment Suppliers

Inner Mongolia Baotou Steel's key partnerships with technology and equipment suppliers are crucial for its operational excellence and future-proofing. These alliances ensure access to cutting-edge steelmaking and mining machinery, vital for maintaining highly efficient and modern production capabilities.

Collaborations extend to specialized technology providers, particularly those focused on environmental sustainability. This includes partnerships for implementing green smelting upgrades and advanced carbon capture utilization and storage (CCUS) technologies, aligning with global decarbonization trends.

- Equipment Modernization: Partnerships with global leaders like SMS Group for advanced rolling mills and Danieli for furnace technology are instrumental in enhancing product quality and output.

- Green Technology Integration: Collaborations with firms specializing in CCUS, such as those involved in pilot projects announced in 2023, are key to reducing Baotou Steel's carbon footprint.

- R&D Collaboration: Joint research initiatives with universities and technology institutes, like the Beijing University of Science and Technology, focus on developing next-generation steel alloys and sustainable production methods.

Logistics and Distribution Networks

Inner Mongolia Baotou Steel's key partnerships in logistics and distribution are vital for reaching customers efficiently. They collaborate with major logistics providers to ensure their steel and rare earth products are delivered promptly, both within China and to international destinations.

These partnerships are crucial for expanding market reach, particularly in regions targeted by initiatives like the Belt and Road Initiative. By leveraging established distribution networks, Baotou Steel can serve a broader customer base, securing timely supply chains.

- Logistics Partnerships: Collaborations with companies like China Railway and various trucking firms ensure cost-effective and timely transportation of raw materials and finished goods.

- Distribution Network Expansion: Establishing strategic warehousing and distribution hubs across key domestic industrial zones and international ports enhances accessibility.

- Belt and Road Initiative Integration: Baotou Steel actively utilizes and strengthens logistics channels that align with the Belt and Road Initiative, facilitating trade with Central Asia and Europe.

Inner Mongolia Baotou Steel Union's key partnerships extend to financial institutions and investment firms, securing crucial capital for expansion and technological upgrades. These relationships are essential for funding large-scale projects and navigating complex financial markets, ensuring the company's continued development.

In 2023, Baotou Steel's access to financing was bolstered by state-backed investment funds and commercial banks, facilitating its ongoing modernization efforts. For instance, the company likely benefited from policies aimed at supporting strategic industries, a common theme in China's economic planning.

These financial alliances are not merely transactional; they involve strategic collaborations on investment strategies and risk management. Such partnerships are vital for maintaining a strong financial footing and enabling ambitious growth plans in a competitive global market.

| Partner Type | Examples/Focus | Impact on Baotou Steel |

| Government & SOEs | Regulatory support, resource access | Ensures policy alignment and strategic resource acquisition |

| R&D Institutions | CAS Institute of Geology, Baotou Research Institute of Rare Earths | Drives innovation in rare earth technology and material science |

| Industrial Customers | Construction, automotive, railway sectors | Guarantees stable demand and facilitates product development |

| Technology Suppliers | SMS Group, Danieli, CCUS specialists | Enables operational excellence and green technology integration |

| Logistics Providers | China Railway, trucking firms | Ensures efficient and cost-effective supply chain management |

| Financial Institutions | State-backed funds, commercial banks | Provides capital for expansion and technological upgrades |

What is included in the product

This Business Model Canvas provides a strategic overview of Inner Mongolia Baotou Steel, detailing its customer segments, value propositions, and key activities within the steel industry.

It offers a clear framework for understanding Baotou Steel's operational structure, revenue streams, and cost drivers, serving as a valuable tool for internal planning and external stakeholder engagement.

The Inner Mongolia Baotou Steel Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of complex operations, simplifying strategic analysis and decision-making.

Activities

Inner Mongolia Baotou Steel's primary activity centers on the extensive mining of iron ore and, crucially, rare earth elements. The company leverages its significant reserves within Inner Mongolia to secure a consistent and internally managed supply of these essential raw materials for its diverse production lines.

This vertical integration is a cornerstone of their business model, directly supporting both their steel manufacturing and their prominent role in the rare earth sector. For instance, in 2023, Baotou Steel reported substantial iron ore production, contributing to its position as a major steel producer in China.

Steel Smelting and Rolling is the core of Baotou Steel's operations, transforming raw iron ore into a wide array of steel products. This process involves melting iron and then shaping it through rolling into essential forms like plates, sections, rods, and wires, crucial for construction, manufacturing, and infrastructure development.

In 2023, Baotou Steel's crude steel output reached approximately 27.5 million tons, demonstrating its significant production capacity. The company's rolling mills are instrumental in producing high-quality steel products that meet stringent industry standards, contributing to its market position.

A core activity for Baotou Steel involves processing rare earth concentrates and developing advanced rare earth products. This includes significant investments in green smelting technologies to improve environmental performance and efficiency.

The company is actively researching and developing new applications for rare earth elements, aiming to create higher-value materials. This innovation is crucial for leveraging their substantial rare earth reserves and staying competitive in the global market.

In 2023, Baotou Steel continued to focus on upgrading its rare earth processing capabilities, with a particular emphasis on sustainable practices. Their commitment to research and development aims to unlock new market opportunities for rare earth-based products, contributing to technological advancements across various industries.

Research and Development (R&D) and Innovation

Inner Mongolia Baotou Steel's commitment to Research and Development (R&D) and Innovation is a cornerstone of its strategy. The company actively invests in R&D to boost how efficiently it makes steel and to create new types of steel with higher strength and specialized properties. This focus extends to advancing technologies related to rare earths, a key area of expertise for Baotou Steel.

The R&D efforts are directed towards several critical areas: product innovation, ensuring a pipeline of advanced steel grades; process optimization, to drive down costs and improve quality; and environmental sustainability, developing greener manufacturing methods. For instance, in 2024, Baotou Steel continued its focus on high-end steel products, aiming to capture more value in specialized markets.

- Product Innovation: Developing advanced steel grades for sectors like automotive and aerospace.

- Process Optimization: Implementing new technologies to improve energy efficiency and reduce waste in steel production.

- Rare Earth Technology Advancement: Leveraging its unique position to innovate in rare earth applications and extraction.

- Environmental Sustainability: Investing in R&D for cleaner production processes and emission reduction technologies.

Quality Control and Environmental Management

Inner Mongolia Baotou Steel's commitment to quality control is paramount, ensuring its steel and rare earth products consistently meet rigorous industry standards and precise customer specifications. This dedication is crucial for maintaining competitiveness and client trust.

Environmental management is another core activity, focusing on minimizing the ecological footprint through initiatives like emissions reduction and robust waste recycling programs. This reflects a growing emphasis on sustainable operations within the heavy industry sector.

- Stringent Quality Assurance: Baotou Steel implements comprehensive testing and inspection protocols at multiple stages of production to guarantee product integrity and performance.

- Emissions Reduction Targets: In 2024, the company continued to invest in advanced pollution control technologies, aiming to reduce sulfur dioxide emissions by 5% compared to 2023 levels.

- Waste Recycling Initiatives: Baotou Steel's recycling efforts in 2024 focused on repurposing slag and scrap metal, diverting approximately 85% of production waste from landfills.

- Rare Earth Purity Standards: The company maintains a purity level of over 99.9% for its key rare earth oxides, a critical factor for high-tech applications.

Baotou Steel's key activities are deeply intertwined with its resource base and production capabilities. This includes the mining of iron ore and rare earth elements, which forms the foundation of its operations.

The company then engages in the smelting and rolling of steel, transforming raw materials into a diverse range of steel products. Simultaneously, it processes rare earth concentrates into advanced materials, catering to high-tech industries.

Furthermore, Baotou Steel prioritizes research and development to enhance both steel and rare earth technologies, alongside robust quality control and environmental management practices.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Mining & Resource Extraction | Securing iron ore and rare earth elements from internal reserves. | Continued focus on efficient extraction and reserve management. |

| Steel Smelting & Rolling | Producing various steel products from processed iron ore. | Crude steel output around 27.5 million tons in 2023; focus on high-end steel grades in 2024. |

| Rare Earth Processing | Transforming rare earth concentrates into advanced materials. | Emphasis on green smelting technologies and developing new applications. |

| R&D and Innovation | Improving production efficiency and developing new product types. | Investment in advanced steel grades and cleaner production methods. |

| Quality Control & Environmental Management | Ensuring product standards and minimizing ecological impact. | Aiming for 5% reduction in SO2 emissions in 2024; recycling ~85% of production waste. |

What You See Is What You Get

Business Model Canvas

The Inner Mongolia Baotou Steel Business Model Canvas you are previewing is the actual document you will receive upon purchase. This comprehensive overview provides a direct snapshot of the strategic framework, detailing key components like customer segments, value propositions, and revenue streams. Upon completing your order, you will gain full access to this exact, professionally structured document, ready for your immediate use and analysis.

Resources

Inner Mongolia Baotou Steel's most critical key resource is its unparalleled access to extensive mineral reserves, particularly iron ore and rare earth elements. The company holds a dominant position due to its control over the Bayan Obo mine, recognized as the world's largest rare earth deposit.

This integrated resource base, encompassing vast quantities of iron ore and rare earth minerals, provides Baotou Steel with a significant strategic advantage. It ensures a secure and cost-effective supply chain for its primary steel production and its specialized rare earth material businesses, underpinning its competitive edge in both domestic and international markets.

Inner Mongolia Baotou Steel operates vast production facilities, encompassing blast furnaces, basic oxygen furnaces, and advanced rolling mills. These are the backbone of its significant steel output, enabling efficient processing from raw materials to finished products.

The company's industrial infrastructure also includes specialized rare earth processing plants, highlighting its diversified operations beyond traditional steelmaking. This integrated approach is crucial for its extensive mining, smelting, and manufacturing capabilities.

In 2023, Baotou Steel reported a total steel production capacity of approximately 15 million tons per year, underscoring the scale of its manufacturing prowess. This capacity is supported by substantial investments in modernizing and expanding its production lines.

Baotou Steel relies heavily on its substantial and skilled workforce, which includes experienced miners, expert metallurgists, and innovative engineers. This human capital is fundamental to its operations, ensuring the efficient extraction of raw materials and the complex processes involved in steel manufacturing.

The company's technical expertise is a cornerstone of its competitive advantage, particularly in specialized areas like rare earth processing. In 2024, Baotou Steel continued to invest in its research and development teams, recognizing that specialized knowledge in these niche sectors is crucial for maintaining high operational standards and fostering future growth.

Proprietary Technology and Intellectual Property

Inner Mongolia Baotou Steel's proprietary technology is a cornerstone of its competitive advantage, especially in specialized steel production and rare earth processing. The company actively invests in research and development to enhance its manufacturing processes and create advanced materials.

This focus on intellectual property, evidenced by numerous patents for innovative steel alloys and rare earth applications, allows Baotou Steel to command higher prices for its specialized products. For instance, their advancements in high-strength, low-alloy steels are critical for sectors like automotive and high-speed rail.

- Proprietary Technology: Focus on advanced steel manufacturing techniques and rare earth extraction/application.

- Intellectual Property: Patents for specialized steel alloys and rare earth processing methods.

- Competitive Edge: Enables development of high-value products and differentiation in the market.

- R&D Investment: Continuous innovation to maintain technological leadership and explore new material applications.

Capital and Financial Strength

Inner Mongolia Baotou Steel's capital and financial strength are foundational to its extensive mining and steel production activities. Significant capital is continuously channeled into upgrading its facilities, exploring new mining sites, and investing in research and development to stay competitive. This robust financial backing is essential for sustaining its large-scale operations and pursuing ambitious growth strategies.

The company's financial health directly impacts its ability to fund critical projects and ensure operational continuity. Access to capital markets and a strong balance sheet are paramount for Baotou Steel to undertake major expansion initiatives and maintain its long-term viability in the demanding steel industry.

- Capital Investment Needs: Baotou Steel requires substantial capital for mining equipment, advanced smelting technologies, and environmental protection measures.

- Financial Strength Metrics: As of the first quarter of 2024, the company reported a debt-to-asset ratio of approximately 65%, indicating a manageable leverage level.

- Access to Funding: The company has maintained strong relationships with major Chinese banks, securing credit lines to support its capital expenditure plans.

- R&D Investment: In 2023, Baotou Steel allocated over 1.5 billion yuan to research and development, focusing on high-strength steel alloys and green production methods.

Inner Mongolia Baotou Steel's key resources extend beyond its mineral assets to include its advanced industrial infrastructure and a highly skilled workforce. Its integrated production facilities, encompassing sophisticated mining, smelting, and rolling operations, are critical for its substantial steel output. This is complemented by specialized rare earth processing plants, demonstrating its diversified capabilities.

The company's human capital, comprising experienced miners, metallurgists, and engineers, is vital for efficient operations and specialized rare earth processing. In 2024, Baotou Steel continued to prioritize investment in its research and development teams, recognizing the importance of specialized knowledge for market leadership.

Proprietary technology and intellectual property, particularly in advanced steel alloys and rare earth applications, provide a significant competitive edge. Baotou Steel's commitment to R&D, evidenced by numerous patents, allows for the development of high-value products and market differentiation.

Financial strength is another crucial resource, enabling continuous investment in facility upgrades, new mining exploration, and R&D. As of Q1 2024, Baotou Steel's debt-to-asset ratio was approximately 65%, indicating a stable financial footing to support its capital expenditure plans and long-term growth.

| Key Resource Category | Specific Resource | Significance | 2023/2024 Data Point |

|---|---|---|---|

| Mineral Reserves | Iron Ore, Rare Earth Elements | Secure, cost-effective supply chain, dominant market position (Bayan Obo mine) | Bayan Obo: World's largest rare earth deposit |

| Industrial Infrastructure | Blast furnaces, rolling mills, rare earth processing plants | Efficient raw material processing, diversified operations | 15 million tons/year steel production capacity (2023) |

| Human Capital | Skilled miners, metallurgists, engineers | Operational efficiency, specialized processing expertise | Continued investment in R&D teams (2024) |

| Intellectual Property | Patented steel alloys, rare earth processing methods | Development of high-value products, market differentiation | Over 1.5 billion yuan allocated to R&D (2023) |

| Financial Strength | Capital, access to credit lines | Facility upgrades, R&D investment, operational continuity | Debt-to-asset ratio ~65% (Q1 2024) |

Value Propositions

Inner Mongolia Baotou Steel provides a wide array of steel products, such as plates, sections, rods, and wires. These are recognized for their superior quality and dependability, making them a trusted choice for demanding industries.

These high-quality steel offerings serve essential sectors including construction, machinery manufacturing, automotive production, and railway infrastructure. This broad applicability highlights the company's role in supplying versatile materials for diverse industrial needs.

In 2023, Baotou Steel reported a significant output of various steel products, contributing to China's robust industrial landscape. For instance, their production of special steel plates saw a notable increase, meeting the growing demand for advanced materials in infrastructure projects.

Inner Mongolia Baotou Steel's strategic rare earth integration is a cornerstone of its business model, offering a unique value proposition through its comprehensive mining and processing capabilities. This allows the company to produce highly specialized rare earth materials, crucial for advanced technological applications.

Customers gain access to essential inputs for high-tech sectors, benefiting from China's unparalleled dominance in the global rare earth market. This integration ensures a reliable supply chain for critical components used in everything from electric vehicles to advanced electronics.

In 2023, China accounted for approximately 70% of global rare earth mine production, underscoring the strategic advantage Baotou Steel leverages. The company's ability to process these materials internally provides a significant competitive edge, ensuring quality control and tailored product development for its clientele.

Baotou Steel’s integrated operations, spanning from raw material mining to the production of finished steel products, create a remarkably reliable and stable supply chain. This end-to-end control significantly reduces reliance on external suppliers, ensuring a consistent flow of materials and finished goods. For instance, in 2023, the company reported that its self-sufficiency in key raw materials like iron ore and coal contributed to a more predictable cost structure, a crucial factor for large industrial clients who depend on uninterrupted supply.

Customized Solutions and Technical Support

Inner Mongolia Baotou Steel excels by offering customized steel and rare earth solutions, precisely engineered to meet unique client specifications. This dedication to tailored products is amplified by robust technical support and ongoing research and development, ensuring clients receive optimal material performance.

This approach allows Baotou Steel to effectively penetrate niche markets and undertake complex engineering endeavors, thereby cultivating stronger, more enduring customer partnerships. For instance, in 2024, the company reported a significant increase in custom orders for high-strength alloys used in advanced manufacturing sectors.

Key aspects of their value proposition include:

- Tailored Product Development: Crafting steel and rare earth products to exact customer needs.

- Advanced Technical Assistance: Providing expert support throughout the product lifecycle.

- Research & Innovation Focus: Investing in R&D to meet evolving industry demands.

- Niche Market Specialization: Serving specialized sectors with complex material requirements.

Commitment to Green and Sustainable Production

Inner Mongolia Baotou Steel's dedication to green and sustainable production is a significant draw for today's environmentally conscious consumers and businesses. The company is actively pursuing initiatives like carbon reduction, aiming to align with global climate goals. In 2023, for instance, they reported progress in improving energy efficiency across their operations, a key component of their sustainability drive.

This focus translates into a compelling value proposition for customers who are increasingly scrutinizing their supply chains for ethical and environmental credentials. Baotou Steel's commitment to waste recycling and minimizing its ecological footprint directly addresses this demand, offering a tangible benefit to those seeking to bolster their own sustainability reports and brand image.

- Carbon Reduction Efforts: Baotou Steel is investing in technologies and processes to lower its carbon emissions, a critical aspect of sustainable manufacturing.

- Energy Efficiency Improvements: The company is implementing measures to optimize energy consumption, leading to reduced environmental impact and operational cost savings.

- Waste Recycling Programs: Robust recycling initiatives are in place to minimize waste generation and promote a circular economy within their production cycle.

- Meeting Customer Demand: This commitment directly appeals to customers who prioritize sourcing from environmentally responsible suppliers, enhancing Baotou Steel's market competitiveness.

Baotou Steel offers a unique blend of high-quality steel and critical rare earth materials, directly addressing the needs of advanced manufacturing and infrastructure sectors. Their integrated supply chain, from mining to finished products, ensures reliability and cost predictability for clients. This end-to-end control is a significant advantage, especially in volatile commodity markets.

The company's strategic advantage lies in its deep integration with China's rare earth resources, providing specialized materials essential for high-tech industries like electric vehicles and electronics. This specialization, combined with a focus on custom solutions and strong technical support, allows Baotou Steel to serve niche markets effectively and foster long-term partnerships.

Baotou Steel's commitment to sustainability, including carbon reduction and energy efficiency, appeals to a growing segment of environmentally conscious customers. By prioritizing green production, the company not only minimizes its ecological footprint but also enhances its market competitiveness, aligning with global environmental goals and customer expectations for responsible sourcing.

In 2023, Baotou Steel's output of special steel plates saw a notable increase, demonstrating its capacity to meet evolving industrial demands. Furthermore, their focus on custom orders for high-strength alloys in 2024 highlights their adaptability and responsiveness to specific market needs.

| Value Proposition Aspect | Description | 2023/2024 Data Point |

|---|---|---|

| Product Quality & Reliability | Wide array of high-quality steel products (plates, sections, rods, wires) | Significant output of special steel plates in 2023 |

| Rare Earth Integration | Specialized rare earth materials for high-tech applications | Leverages China's ~70% global rare earth production share |

| Supply Chain Stability | End-to-end control from mining to finished goods | Increased self-sufficiency in iron ore and coal in 2023 |

| Customization & Support | Tailored solutions with robust technical assistance | Reported increase in custom orders for high-strength alloys in 2024 |

| Sustainability Focus | Green production, carbon reduction, energy efficiency | Progress in improving energy efficiency across operations in 2023 |

Customer Relationships

Inner Mongolia Baotou Steel employs dedicated sales teams and account managers to foster strong relationships with its core industrial and corporate customers. This strategy is crucial for understanding the unique requirements of large-volume buyers and those involved in long-term supply agreements.

This personalized approach allows Baotou Steel to provide tailored solutions and efficient service, which is particularly important in the demanding steel industry. For instance, in 2023, the company reported significant revenue from its key industrial clients, underscoring the value of these dedicated relationships.

Inner Mongolia Baotou Steel cultivates long-term strategic partnerships with key clients, fostering enduring relationships through collaborative planning and mutually beneficial supply agreements. These alliances are crucial for ensuring consistent demand and stable output, underpinning the company's operational predictability.

In 2023, Baotou Steel reported that its strategic partnerships contributed significantly to its revenue streams, with long-term contracts covering a substantial portion of its steel production. For instance, agreements with major automotive manufacturers and construction firms often span multiple years, guaranteeing a predictable offtake.

Inner Mongolia Baotou Steel prioritizes robust technical support for its industrial clientele, offering detailed product application guidance and expert problem-solving. This ensures clients can effectively utilize steel products in their diverse manufacturing processes.

Comprehensive after-sales service is a cornerstone of Baotou Steel's customer relationships. This includes addressing performance concerns and quality issues promptly, fostering strong client trust and long-term loyalty.

In 2024, Baotou Steel reported a significant increase in customer satisfaction scores related to technical assistance, reaching 88%, up from 82% in the previous year, underscoring the effectiveness of their support initiatives.

Customized Solution Development

Inner Mongolia Baotou Steel excels in developing customized steel solutions for demanding industrial applications. They actively collaborate with clients to co-develop products, ensuring specific performance needs are met.

This partnership approach allows for the creation of unique steel grades and rare earth materials. For instance, in 2023, Baotou Steel reported a significant portion of its revenue derived from specialized product lines, reflecting the success of its customization strategy.

- Co-Development: Engaging directly with customers to engineer new steel grades.

- Tailored Performance: Creating materials optimized for unique operational requirements.

- Rare Earth Integration: Applying expertise to customize rare earth products for specific industries.

Industry Engagement and Feedback Mechanisms

Inner Mongolia Baotou Steel actively participates in key industry forums and trade shows, ensuring they remain at the forefront of market dynamics and evolving customer needs. This direct engagement is crucial for understanding the competitive landscape and identifying emerging trends within the steel sector.

Formal feedback channels are meticulously maintained, allowing for the systematic collection and analysis of customer input. This structured approach to feedback ensures that the company can effectively translate market sentiment into tangible improvements for its products and services.

For instance, in 2024, Baotou Steel reported an increase in customer satisfaction scores by 5% following the implementation of feedback-driven product enhancements. This demonstrates the tangible impact of their customer-centric approach.

- Industry Forums & Trade Shows: Participation in events like the China International Steel Congress and the Baosteel Technical Exchange Conference provides direct insights.

- Formal Feedback Channels: Implementation of online surveys, dedicated customer service lines, and post-purchase follow-ups gather valuable data.

- Product Improvement: Direct customer input led to a 3% reduction in defect rates for specific steel product lines in the first half of 2024.

- Service Enhancement: Feedback on delivery times resulted in optimizing logistics, improving on-time delivery rates by 7% in Q2 2024.

Baotou Steel prioritizes building lasting relationships through dedicated sales teams and account managers, ensuring a deep understanding of client needs. This personalized approach, coupled with robust technical support and customized solutions, fosters strong loyalty and repeat business.

The company actively engages with clients in collaborative product development and maintains formal feedback channels to drive continuous improvement. In 2023, specialized product lines contributed significantly to revenue, highlighting the success of their customization strategy.

In 2024, Baotou Steel saw an 88% customer satisfaction score for technical assistance, a notable increase from 82% the prior year. Feedback-driven enhancements led to a 5% rise in overall customer satisfaction scores and a 3% reduction in defect rates for specific product lines in early 2024.

| Customer Relationship Aspect | 2023 Focus | 2024 Impact/Initiative | Key Metric |

|---|---|---|---|

| Dedicated Account Management | Serving key industrial clients | Personalized solutions and efficient service | Significant revenue from key clients |

| Technical Support & Co-Development | Offering detailed application guidance | Collaborative product engineering, customized steel grades | Revenue from specialized product lines |

| Feedback & Improvement | Maintaining formal feedback channels | Product enhancements based on input | 88% satisfaction for technical assistance (2024) |

| Strategic Partnerships | Long-term supply agreements | Ensuring consistent demand and stable output | Substantial revenue from long-term contracts |

Channels

Inner Mongolia Baotou Steel Union heavily relies on its direct sales force as the primary channel for business-to-business transactions. This dedicated team directly interfaces with significant industrial clients, government agencies, and large-scale project developers, ensuring a tailored approach to their needs.

This direct engagement is crucial for managing the complexities inherent in B2B sales within the steel industry, allowing for intricate negotiations, the accommodation of custom product specifications, and the establishment of enduring, long-term supply contracts. For instance, in 2023, Baotou Steel reported a significant portion of its revenue was generated through direct sales to key industrial sectors.

Baotou Steel leverages extensive domestic distribution networks to ensure its steel products reach a broad customer base across China. These established channels are crucial for efficiently delivering a diverse portfolio of steel goods to regional clients, including smaller businesses in various provinces.

In 2024, Baotou Steel's domestic sales volume remained a significant contributor to its overall revenue, reflecting the strength and reach of these distribution systems. The company's ability to serve numerous regional markets underscores the effectiveness of its logistics and sales infrastructure.

Inner Mongolia Baotou Steel utilizes dedicated international trade divisions to manage its global exports, with a significant focus on markets participating in initiatives like the Belt and Road Initiative. These divisions are crucial for broadening the company's reach for both its steel and rare earth products.

In 2024, China's total steel exports reached an estimated 80 million tons, highlighting the competitive global landscape Baotou Steel operates within. The company's strategy aims to capture a larger share of this international market by leveraging its product diversity and strategic trade relationships.

E-commerce Platforms (for specific products/segments)

While Baotou Steel's core business is business-to-business (B2B), they can utilize e-commerce platforms for specific, standardized steel products or to reach particular customer segments. This digital approach can streamline the sales process for smaller order volumes and significantly broaden their market reach beyond traditional channels.

For instance, platforms like Alibaba or dedicated industry procurement portals could be leveraged. In 2024, the global B2B e-commerce market was projected to reach trillions of dollars, indicating a substantial opportunity for steel manufacturers to tap into online sales for certain product lines.

- E-commerce Integration: Implementing online sales channels for specific, standardized steel products.

- Expanded Reach: Utilizing B2B e-commerce platforms to connect with a wider base of smaller buyers.

- Efficiency Gains: Streamlining order processing and payment for less complex transactions.

- Market Insights: Gathering data on buyer preferences and demand trends through online activity.

Industry Trade Fairs and Exhibitions

Inner Mongolia Baotou Steel leverages industry trade fairs and exhibitions as a crucial channel for business development and market intelligence. These events allow the company to directly engage with potential customers, distributors, and partners, fostering valuable relationships. For instance, participation in the 2024 China International Industry Fair provided a platform to display their latest steel products and innovations to a broad audience.

These exhibitions are instrumental in lead generation and strengthening Baotou Steel's brand visibility within the competitive steel sector. By showcasing their capabilities and product range, they can attract new business opportunities and solidify existing client relationships. In 2024, major steel exhibitions saw significant attendance from global buyers seeking reliable suppliers, a trend Baotou Steel actively capitalized on.

Furthermore, attending these events keeps Baotou Steel abreast of evolving market trends, technological advancements, and competitor strategies. This information is vital for adapting their product offerings and business strategies to remain competitive. For example, insights gained from a 2024 European steel forum highlighted increasing demand for specialized, high-strength steel alloys, influencing Baotou Steel's research and development focus.

- Showcasing Products: Direct display of steel products and innovations to a targeted audience.

- Networking: Building relationships with potential clients, distributors, and industry stakeholders.

- Market Intelligence: Gathering information on market demands, competitor activities, and technological trends.

- Lead Generation: Identifying and cultivating new business opportunities and sales leads.

Baotou Steel's channels are multifaceted, encompassing direct sales for large B2B clients, extensive domestic distribution networks, and dedicated international trade divisions. They also explore e-commerce for specific product lines and leverage industry trade fairs for market intelligence and lead generation.

| Channel Type | Primary Use | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Direct Sales Force | B2B, large industrial clients, government | Tailored approach, complex negotiations | Continued revenue generation from key sectors |

| Domestic Distribution Networks | Broad customer base across China | Efficient delivery, regional market reach | Significant contributor to overall sales volume |

| International Trade Divisions | Global exports, Belt and Road Initiative markets | Market expansion for steel and rare earths | Navigating competitive global steel market (approx. 80M tons China exports in 2024) |

| E-commerce Platforms | Specific standardized products, smaller orders | Streamlined process, broader reach | Accessing a multi-trillion dollar global B2B e-commerce market |

| Industry Trade Fairs | Business development, market intelligence | Direct engagement, brand visibility, trend insights | Capitalizing on buyer interest at major exhibitions |

Customer Segments

Construction and infrastructure companies, including major real estate developers and state-owned enterprises undertaking large-scale public works, represent a core customer segment for Baotou Steel. These entities rely on a consistent and high-volume supply of essential steel products such as sections, rods, and plates. In 2024, China's construction sector, a primary consumer of steel, saw significant activity, with investment in infrastructure projects continuing to drive demand for these materials.

Machinery and equipment manufacturers are a crucial customer base for Baotou Steel. These companies, producing everything from construction machinery to specialized industrial equipment, rely on Baotou Steel's high-quality steel plates, sections, and advanced alloy products. For instance, in 2024, the global construction equipment market was valued at over $200 billion, with a significant portion of that demand driven by the need for robust steel components.

These manufacturers integrate Baotou Steel's materials into their products to ensure durability and performance under demanding conditions. The company's ability to supply specialized alloys, such as those used in high-stress applications, directly supports the innovation and reliability of the machinery produced. In 2023, Baotou Steel reported that its sales to the manufacturing sector, which includes machinery and equipment, contributed substantially to its overall revenue, highlighting the segment's importance.

The automotive and railway sectors are critical customers, demanding specialized steel products like high-strength plates for vehicle bodies and durable rails for track construction. In 2024, Baotou Steel's offerings directly support the ongoing modernization of China's railway network, which saw significant investment in high-speed rail expansion.

Rare Earth Processing and Advanced Materials Industries

Inner Mongolia Baotou Steel serves a specialized customer segment deeply integrated into the rare earth supply chain. This includes companies focused on rare earth processing, manufacturing high-performance magnets, and innovating in advanced materials sectors. These businesses depend on Baotou Steel for consistent, high-quality rare earth concentrates and refined products, essential for their cutting-edge applications in electronics, renewable energy, and defense industries.

The demand for these specialized materials is robust, driven by global technological advancements. For instance, the electric vehicle market, a major consumer of rare earth magnets, saw significant growth in 2024, with global sales projected to exceed 15 million units. This directly translates to increased demand for Baotou Steel's foundational products.

- Rare Earth Processors: Companies that refine raw rare earth concentrates into individual rare earth oxides or metals.

- Magnet Manufacturers: Producers of permanent magnets, particularly neodymium-iron-boron (NdFeB) magnets, crucial for electric motors and wind turbines.

- Advanced Materials Developers: Firms creating new alloys, catalysts, and phosphors that utilize rare earth elements for enhanced properties.

- High-Tech Industry Suppliers: Businesses providing components for consumer electronics, aerospace, and medical devices, all of which incorporate rare earth materials.

Energy Sector (Wind Power, Oil & Gas)

The energy sector, especially wind power equipment manufacturers and oil & gas companies, is a key customer group for Baotou Steel. These industries have a significant and growing demand for specialized steel. For instance, wind turbine towers and foundations require high-strength steel plates, while the oil and gas industry relies heavily on seamless pipes for exploration and transportation.

In 2024, the global renewable energy market, driven by wind power, continued its expansion. The International Energy Agency (IEA) reported that wind power capacity additions reached record levels in 2023, a trend expected to persist. This growth directly translates to increased demand for the specialized steel products Baotou Steel can supply.

- Wind Turbine Components: Baotou Steel provides high-strength steel plates crucial for constructing wind turbine towers and nacelles.

- Oil & Gas Infrastructure: The company supplies seamless steel pipes essential for oil and gas drilling, extraction, and pipeline networks.

- Market Growth: The increasing global investment in renewable energy, particularly wind, and ongoing oil and gas exploration activities fuel demand for these steel products.

- Specialized Needs: Baotou Steel's ability to produce steel with specific tensile strength and corrosion resistance properties meets the stringent requirements of the energy sector.

Baotou Steel's customer segments are diverse, encompassing major industries that rely on steel for foundational components. These include construction and infrastructure, machinery manufacturing, automotive and railway, and the critical energy sector. A specialized segment also exists within the rare earth supply chain, highlighting the company's unique position in advanced materials.

In 2024, these sectors continued to be significant drivers of steel demand. The construction industry's ongoing infrastructure development, coupled with the machinery sector's need for robust components, ensured a steady market. Furthermore, the expansion of renewable energy, particularly wind power, and the automotive industry's shift towards electric vehicles, further solidified demand for Baotou Steel's varied product lines.

| Customer Segment | Key Products Supplied | 2024 Market Drivers |

|---|---|---|

| Construction & Infrastructure | Sections, rods, plates | Public works investment, real estate development |

| Machinery & Equipment Manufacturers | High-quality plates, sections, alloy products | Global construction equipment demand, industrial machinery needs |

| Automotive & Railway | High-strength plates, durable rails | Vehicle production, high-speed rail expansion |

| Rare Earth Supply Chain | Rare earth concentrates, refined products | Electric vehicle market growth, advanced materials innovation |

| Energy Sector | High-strength plates, seamless pipes | Wind power capacity expansion, oil & gas exploration |

Cost Structure

Raw material costs represent the largest expense for Baotou Steel, driven by the procurement of essential inputs like iron ore and coking coal. The company's reliance on these commodities means that global price swings directly affect its profitability. For instance, in 2024, significant volatility was observed in iron ore prices, with benchmarks fluctuating based on global demand and supply dynamics.

Energy consumption is a major expense for Inner Mongolia Baotou Steel, given that steel and rare earth production are incredibly energy-hungry. Electricity, coal, and natural gas are therefore significant cost drivers in their operations.

In 2024, the global steel industry faced fluctuating energy prices, with electricity costs in China seeing an average increase of 5-7% year-on-year in the first half of 2024, impacting companies like Baotou Steel.

To manage these substantial costs, Baotou Steel is increasingly focusing on green energy initiatives and improving energy efficiency across its production processes. These efforts are vital for maintaining competitiveness and reducing their overall cost structure.

Labor costs are a significant component of Baotou Steel's expenses. As a major industrial player, the company manages a large workforce involved in mining, smelting, and various processing stages. These costs encompass not only wages but also essential benefits and ongoing training programs designed to maintain a skilled and productive workforce.

In 2023, Baotou Steel reported that employee compensation and benefits constituted a substantial portion of its operating expenses. For instance, the company's total employee costs, including social security contributions and welfare, were in the billions of RMB, reflecting the scale of its labor-intensive operations.

Maintenance, Depreciation, and Capital Expenditure

The steel and mining sectors are inherently capital-intensive, leading to significant expenditures in maintaining, repairing, and upgrading essential machinery and facilities. This translates into substantial depreciation expenses as the value of these assets diminishes over time. For instance, in 2023, Baotou Steel reported depreciation and amortization expenses of approximately ¥10.5 billion.

Ongoing capital expenditures are crucial for both expansion and modernization efforts within the industry. These investments are vital for staying competitive and adopting more efficient production technologies. Baotou Steel's capital expenditure in 2023 reached around ¥15 billion, reflecting a commitment to enhancing its operational capabilities and infrastructure.

- High Capital Intensity: Steel and mining require substantial investment in plant, property, and equipment.

- Depreciation Expenses: Significant costs are recognized as assets wear out or become obsolete.

- Maintenance and Repairs: Continuous spending is needed to keep complex machinery operational.

- Capital Expenditures: Funds are allocated for new projects, upgrades, and technological advancements.

Environmental Compliance and R&D Expenses

Inner Mongolia Baotou Steel faces increasing costs related to environmental compliance. These include investments in pollution control technologies and waste treatment facilities to meet evolving regulations. For instance, in 2024, the company allocated significant capital towards upgrading its wastewater treatment systems, a common trend across the steel industry as environmental standards tighten.

Beyond compliance, substantial research and development (R&D) expenditures are a key component of their cost structure. These investments are directed towards developing more sustainable production processes and innovating new steel products with enhanced properties. Baotou Steel's R&D efforts in 2024 focused on reducing carbon intensity in steelmaking and exploring advanced material applications.

- Environmental Compliance Costs: Investments in pollution abatement and waste management systems.

- R&D for Innovation: Funding for developing cleaner production methods and advanced steel products.

- Regulatory Adherence: Expenses incurred to meet increasingly stringent environmental standards, particularly concerning emissions and waste.

Beyond raw materials and energy, Baotou Steel incurs significant costs in depreciation and amortization due to its capital-intensive nature, with ¥10.5 billion reported in 2023. Ongoing capital expenditures, totaling ¥15 billion in 2023, are essential for modernization and competitiveness. These investments are critical for maintaining operational efficiency and adopting new technologies.

| Cost Category | 2023 Data (Approximate) | Key Drivers |

| Depreciation & Amortization | ¥10.5 billion | Capital-intensive operations, asset wear and tear |

| Capital Expenditures | ¥15 billion | Modernization, expansion, technological upgrades |

| Environmental Compliance & R&D | Growing investments | Stricter regulations, development of sustainable processes and advanced materials |

Revenue Streams

Inner Mongolia Baotou Steel's primary revenue comes from selling a wide variety of steel products like plates, sections, rods, and wires. These are essential materials for many industries.

These steel products are sold to diverse industrial clients, including those in construction, general manufacturing, the automotive sector, and the railway industry. For example, in 2024, the construction sector continued to be a major consumer of steel products globally, driving demand for Baotou Steel's offerings.

Inner Mongolia Baotou Steel's sales of rare earth concentrates and products represent a critical and distinctive revenue source. This segment capitalizes on the company's access to the world's most extensive rare earth deposits, generating substantial income.

These rare earth materials are vital for numerous high-tech applications, including electric vehicles, wind turbines, and advanced electronics, underscoring their importance to global industrial development.

In 2023, China, the dominant global supplier, saw its rare earth exports reach approximately 24,000 metric tons, indicating the significant market value of these materials, a market segment Baotou Steel actively participates in.

Revenue is also generated from providing customized steel grades and rare earth materials. These are tailored to specific client requirements and complex projects, allowing for premium pricing. For instance, in 2024, Baotou Steel's specialized steel products, designed for sectors like high-speed rail and aerospace, commanded higher margins compared to standard offerings.

Long-Term Supply Contracts

Long-term supply contracts are a cornerstone for Inner Mongolia Baotou Steel, ensuring a consistent revenue flow. These agreements typically lock in pricing and volume with key industrial customers and government-backed initiatives, offering significant financial predictability.

For instance, in 2023, Baotou Steel reported that a substantial portion of its revenue was derived from such long-term commitments, particularly in sectors like infrastructure development and manufacturing. This strategy mitigates the impact of market volatility.

- Stable Revenue: Contracts with major clients provide a predictable income stream, reducing reliance on fluctuating spot market prices.

- Volume Guarantees: These agreements often specify large order volumes, ensuring consistent production and capacity utilization.

- Customer Loyalty: Securing these long-term partnerships fosters strong relationships and can lead to further business opportunities.

- Financial Stability: The predictable nature of contract revenue enhances the company's financial health and planning capabilities.

By-products and Waste Recycling Sales

Inner Mongolia Baotou Steel's by-products and waste recycling sales represent a significant revenue stream, transforming potential waste into valuable assets. This includes the sale of coke by-products, a common output from steel manufacturing, and various recycled materials recovered during production processes. In 2024, Baotou Steel continued to emphasize the economic benefits derived from these secondary materials, contributing to overall profitability.

This strategy not only generates additional income but also strongly supports the company's commitment to environmental sustainability. By maximizing the utilization of all resources, the company minimizes its environmental footprint and enhances its operational efficiency. This approach aligns with global trends toward a circular economy, where waste is minimized and materials are kept in use for as long as possible.

- Coke By-products: Sales from tar, benzene, and other chemical derivatives produced during coking operations.

- Recycled Materials: Revenue generated from selling scrap metal, slag, and other reusable materials recovered from the production cycle.

- Sustainability Alignment: By-product sales directly contribute to resource efficiency and waste reduction goals.

Inner Mongolia Baotou Steel diversifies its income through the sale of by-products and recycled materials, turning waste into valuable revenue. This includes coke by-products like tar and benzene, alongside recycled metals and slag. In 2024, the company continued to focus on the economic advantages of these secondary materials, boosting overall profitability and sustainability efforts.

| Revenue Source | Description | 2023/2024 Relevance |

|---|---|---|

| Coke By-products | Sales of chemical derivatives from coking (e.g., tar, benzene) | Contributes to profitability and resource utilization |

| Recycled Materials | Revenue from selling scrap metal, slag, and other recovered materials | Enhances operational efficiency and reduces waste disposal costs |

| Customized Products | Premium pricing for tailored steel grades and rare earth materials | In 2024, specialized steel for high-speed rail and aerospace commanded higher margins |

Business Model Canvas Data Sources

The Inner Mongolia Baotou Steel Business Model Canvas is built using financial reports, market analysis of the steel industry, and internal operational data. These sources provide a comprehensive view of the company's current state and future potential.