Inner Mongolia Baotou Steel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inner Mongolia Baotou Steel Bundle

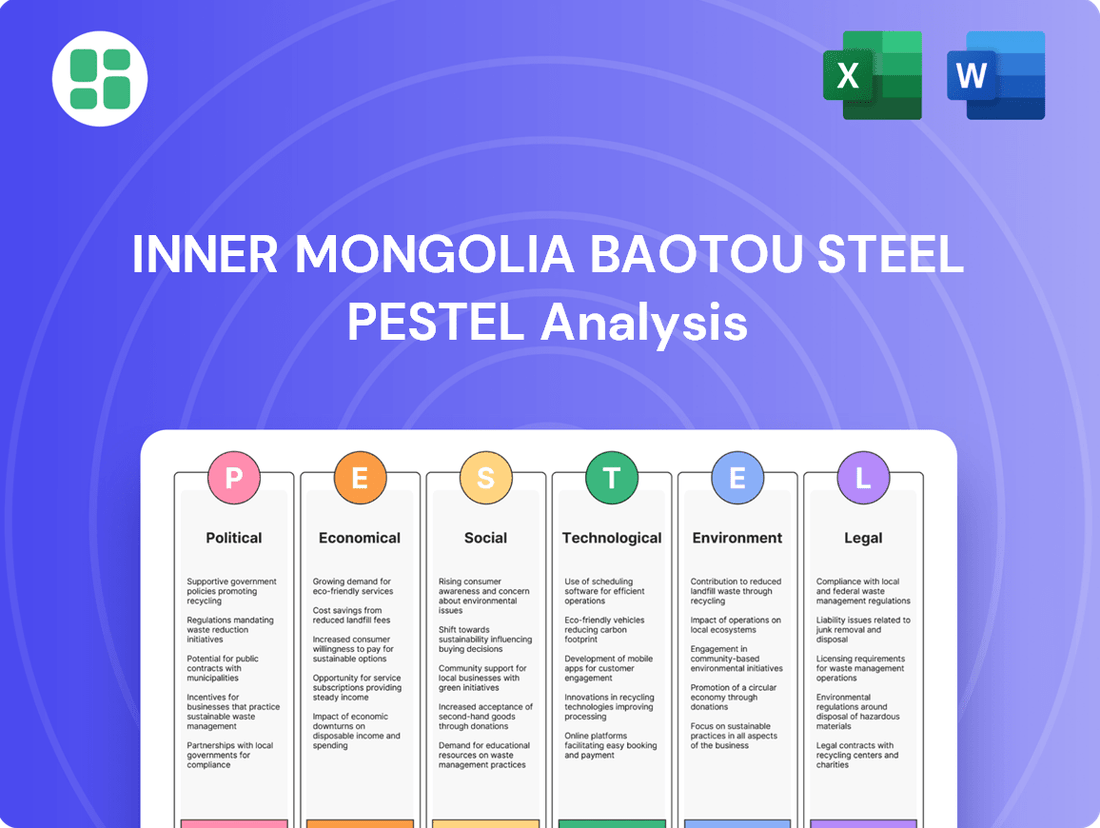

Navigate the complex external forces shaping Inner Mongolia Baotou Steel's future with our comprehensive PESTEL analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for this key player in the steel industry. Gain the strategic clarity needed to make informed decisions and secure your competitive advantage.

Unlock actionable intelligence on Inner Mongolia Baotou Steel's operating environment. Our PESTEL analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting the company. Equip yourself with the insights to anticipate market changes and refine your business strategy. Download the full report now for immediate access to expert analysis.

Political factors

The Chinese government's industrial policies significantly shape Baotou Steel's operating environment, particularly concerning steel production and rare earth mining. Beijing's directives focus on reducing excess steel capacity and pushing for technological advancements and environmental compliance, impacting Baotou Steel's output quotas and operational standards. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes green development and industrial upgrades, which translates to stricter environmental regulations for steelmakers.

Simultaneously, Baotou Steel benefits from government backing for its rare earth segment, recognized as a strategic national resource. This dual influence means Baotou Steel must balance compliance with steel production controls, such as those aimed at curbing emissions and overcapacity which saw crude steel output growth slow in 2024, with leveraging government support for its critical rare earth operations.

Global trade relations remain a critical factor for Baotou Steel. Persistent trade tensions between major economies, including the US and the EU, can directly affect the company's ability to export its steel products. For instance, in early 2024, ongoing discussions around potential new tariffs on imported steel products from China by the US could impact Baotou Steel's market access and profitability in that key region.

As a significant state-owned enterprise, Baotou Steel likely benefits from substantial government backing. This support often translates into preferential access to capital, with SOEs frequently receiving favorable loan terms or direct government funding. For instance, China's central government has continued to prioritize support for key industrial sectors, including steel, through various stimulus packages and infrastructure spending initiatives that indirectly benefit major players like Baotou Steel. This financial cushion is crucial for a capital-intensive industry, enabling Baotou Steel to undertake large-scale projects and navigate market volatility more effectively than privately held competitors.

Rare Earth Strategic Resource Control

The Chinese government's designation of rare earth elements as strategic resources significantly impacts companies like Baotou Steel. This classification leads to stringent government oversight on mining, processing, and export activities. Baotou Steel, holding substantial rare earth reserves, operates within this centralized framework, adhering to production quotas and export licensing dictated by national policy.

This strategic positioning places Baotou Steel at the forefront of China's national rare earth strategy, influencing its operational decisions and market access. For instance, in 2023, China accounted for approximately 70% of global rare earth mine production, underscoring the nation's dominance and the importance of its control mechanisms.

- Strategic Resource Control: China's government maintains tight regulation over rare earth mining and processing.

- Baotou Steel's Role: The company functions as a key entity within China's national rare earth strategy, subject to state-dictated quotas.

- Market Dominance: China's significant share of global rare earth production highlights the impact of its strategic resource policies.

Regional Government Stability

The stability of the Inner Mongolia autonomous region's government plays a significant role in Baotou Steel's operations. Recent regional government initiatives, such as the 2024 development plan focusing on advanced manufacturing and green industrial upgrades, directly influence Baotou Steel's strategic direction and investment in new technologies.

Local policies, including those related to environmental protection and resource utilization, are critical. For instance, Inner Mongolia's commitment to reducing carbon emissions by 15% by 2025, as outlined in its 2024 environmental action plan, could necessitate increased capital expenditure for Baotou Steel to upgrade its facilities.

- Regional Economic Growth Targets: Inner Mongolia's GDP growth target of 6% for 2024 provides a backdrop for demand in steel products.

- Infrastructure Investment: Government-led infrastructure projects in the region, such as railway expansions, can boost demand for steel.

- Resource Management Policies: Regulations concerning the extraction and pricing of raw materials like iron ore directly affect Baotou Steel's input costs.

Government policies are paramount for Baotou Steel, influencing both its steel and rare earth operations. China's 14th Five-Year Plan (2021-2025) prioritizes green development and industrial upgrades, imposing stricter environmental standards on steel production. For example, the government aims to cap crude steel output growth, impacting Baotou Steel's production volume. Conversely, the state designates rare earths as strategic resources, granting Baotou Steel preferential treatment and oversight within national rare earth strategies.

Baotou Steel's status as a state-owned enterprise (SOE) means it benefits from significant government backing, including preferential access to capital. This support is vital for a capital-intensive industry, enabling large-scale projects and resilience against market fluctuations. China's continued investment in infrastructure projects, such as the 2024 railway expansion plans in Inner Mongolia, directly boosts demand for steel products, benefiting companies like Baotou Steel.

Inner Mongolia's regional government also plays a key role, with its 2024 development plan focusing on advanced manufacturing and green industrial upgrades. The region's commitment to reducing carbon emissions by 15% by 2025, as outlined in its environmental action plan, will likely require Baotou Steel to invest in facility upgrades. Inner Mongolia's GDP growth target of 6% for 2024 further signals a supportive economic environment for steel demand.

| Policy Area | Government Focus | Impact on Baotou Steel | 2024/2025 Data/Target |

|---|---|---|---|

| Industrial Policy | Green development, capacity control, technological advancement | Stricter environmental regulations, potential production limits | 14th Five-Year Plan (2021-2025) emphasizes green development. Crude steel output growth slowed in 2024. |

| Strategic Resources | National rare earth strategy, resource control | Government oversight, production quotas, export licensing | China accounted for ~70% of global rare earth mine production in 2023. |

| SOE Support | Financial backing, preferential capital access | Enhanced financial stability, ability to undertake large projects | Continued government stimulus and infrastructure spending initiatives. |

| Regional Development | Advanced manufacturing, green upgrades, infrastructure | Demand boost from infrastructure, need for facility upgrades | Inner Mongolia's 2024 GDP growth target: 6%. Carbon emission reduction target: 15% by 2025. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Inner Mongolia Baotou Steel, focusing on how Political, Economic, Social, Technological, Environmental, and Legal forces create distinct opportunities and threats for the company.

This PESTLE analysis for Inner Mongolia Baotou Steel provides a clear, summarized version of external factors, serving as a pain point reliever by offering easy referencing during meetings and presentations.

It helps support discussions on external risks and market positioning during planning sessions by presenting a concise overview of the political, economic, social, technological, environmental, and legal landscape impacting Baotou Steel.

Economic factors

Domestic and global steel demand significantly impacts Baotou Steel's performance. China's real estate slowdown is a concern, but manufacturing and infrastructure projects, including new urbanization, are projected to maintain stable or slightly growing steel demand in 2024 and 2025. For instance, China's steel production for the first quarter of 2024 reached 259.4 million tonnes, a 1.9% increase year-on-year, indicating resilient demand despite property sector headwinds.

The cost of essential inputs like iron ore and coking coal directly influences Baotou Steel's operational expenses and profitability. Fluctuations in global commodity prices, such as the projected slight increase in iron ore prices for 2024, can create significant cost pressures.

For instance, a 10% rise in iron ore prices, a common benchmark, could impact Baotou Steel's cost of goods sold substantially. Efficient sourcing and hedging strategies are crucial to navigate this volatility and maintain competitive pricing.

The prices and demand for rare earth elements, crucial for Baotou Steel's operations, are heavily influenced by global trends in sectors like electric vehicles, wind turbines, and consumer electronics. The rare earth market experienced significant price fluctuations, but a projected recovery in demand from these key industries is expected to bring greater stability by 2025.

For instance, the global electric vehicle market is forecast to reach approximately 20 million units sold in 2025, a substantial increase that directly drives demand for rare earth magnets used in EV motors. Similarly, the renewable energy sector's expansion, with wind turbine installations projected to add over 300 GW globally by the end of 2025, further underpins the need for these critical materials, potentially stabilizing prices.

Chinese Economic Growth Rate

China's economic trajectory is a critical determinant for Baotou Steel, directly impacting the demand for its core products. A robust GDP growth rate fuels activity in construction, automotive manufacturing, and heavy machinery, all significant consumers of steel. For 2024, China has set an economic growth target of approximately 5%, a figure that suggests continued, albeit moderate, expansion. This target is anticipated to sustain demand for steel through ongoing fixed asset investments and the modernization of industrial equipment.

The anticipated 5% GDP growth for China in 2024 is a crucial data point for Baotou Steel. This growth is expected to translate into tangible demand for steel products across multiple industries:

- Construction Sector: Infrastructure projects and real estate development will continue to be major drivers of steel consumption.

- Automotive Industry: As consumer spending and manufacturing output rise, so too will the demand for steel in vehicle production.

- Machinery and Equipment: Industrial upgrades and new manufacturing capacity require significant amounts of steel for machinery fabrication.

Inflation and Monetary Policy

Inflationary pressures in China, while moderating, remain a key consideration. The People's Bank of China (PBOC) has maintained a relatively accommodative monetary policy stance to support economic growth. For instance, the PBOC kept its benchmark Loan Prime Rate (LPR) unchanged in early 2024, reflecting a balance between managing inflation and stimulating activity.

These policies directly influence Baotou Steel's cost of capital. Lower interest rates can reduce borrowing expenses, making investments more affordable. Conversely, any resurgence in inflation could prompt the PBOC to tighten policy, potentially increasing financing costs for the company and affecting the purchasing power of its industrial customers.

Government stimulus measures, including potential infrastructure spending or tax incentives, are designed to boost aggregate demand. These initiatives can lead to increased demand for steel products from downstream sectors like construction and manufacturing, indirectly benefiting Baotou Steel.

- Inflation Rate: China's consumer price index (CPI) saw a modest increase in early 2024, indicating controlled inflationary pressures.

- PBOC Policy Rate: The PBOC's benchmark lending rates have remained stable, signaling a supportive monetary environment.

- Economic Growth Targets: Government economic targets for 2024 aim for robust growth, which is expected to drive demand for industrial commodities.

China's economic growth, targeting approximately 5% for 2024, underpins steel demand in construction and manufacturing. Stable monetary policy, with the PBOC keeping benchmark rates unchanged in early 2024, supports borrowing costs for companies like Baotou Steel.

Government stimulus, such as infrastructure investment, is expected to boost demand for steel. China's steel production in Q1 2024 rose 1.9% year-on-year to 259.4 million tonnes, reflecting this sustained demand.

The rare earth market, crucial for Baotou Steel, anticipates price stabilization by 2025 due to increased demand from EVs and renewable energy. Global EV sales are projected to hit 20 million units in 2025, and wind power installations are expected to exceed 300 GW by the end of the same year.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on Baotou Steel |

|---|---|---|---|

| China GDP Growth | ~5% target | Continued growth | Sustains demand for steel products |

| China Steel Production (Q1 2024) | 259.4 million tonnes (+1.9% YoY) | Indicates resilient domestic demand | |

| Rare Earth Demand Drivers | EV market growth, renewable energy | EV sales ~20 million units; Wind power >300 GW installed | Stabilizes rare earth prices, supports operations |

| Monetary Policy | PBOC benchmark rates unchanged (early 2024) | Maintains favorable borrowing costs |

Full Version Awaits

Inner Mongolia Baotou Steel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Inner Mongolia Baotou Steel provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain critical insights into the external forces shaping its operations and strategic decisions.

Sociological factors

China's ongoing urbanization and ambitious infrastructure development plans are major drivers for steel demand. Projects like the expansion of high-speed rail networks and new urban construction directly translate into significant consumption for steel producers like Baotou Steel. For instance, China's fixed asset investment in infrastructure saw a notable increase in early 2024, signaling continued robust demand.

Inner Mongolia's labor market presents a mixed picture for Baotou Steel. While the region has a substantial population, the availability of highly skilled labor for specialized steel production roles can be a challenge, potentially increasing recruitment and training costs. Wage levels in the region, though generally lower than in major coastal cities, are influenced by national economic trends and the demand for labor in resource-based industries, impacting Baotou Steel's operational expenses.

Labor regulations, including those pertaining to working hours, safety standards, and social security contributions, directly affect Baotou Steel's compliance and overall labor costs. In 2024, China's focus on worker welfare and safety is likely to reinforce these regulations, requiring Baotou Steel to maintain rigorous standards to ensure workforce stability and avoid operational disruptions. Securing a consistent pool of qualified workers for mining, smelting, and rolling is paramount for the company's production efficiency and competitive edge.

As a major industrial player, Baotou Steel's operations are under constant public observation regarding their environmental impact and commitment to social responsibility. This scrutiny is amplified by China's growing emphasis on green development and corporate accountability.

Securing and maintaining a social license to operate is paramount for Baotou Steel, requiring demonstrable progress in sustainable practices and active community engagement. For instance, reports from 2024 indicate increased public demand for transparency in industrial emissions, a trend Baotou Steel must actively address.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for Baotou Steel's Corporate Social Responsibility (CSR) are intensifying, pushing beyond basic legal adherence. There's a clear demand for proactive engagement in community development, robust worker welfare programs, and transparent, ethical supply chain management. These efforts are increasingly seen as crucial for building a positive brand image and attracting skilled employees.

For instance, in 2024, reports indicated that over 60% of consumers consider a company's social and environmental impact when making purchasing decisions. This trend directly impacts large industrial players like Baotou Steel, who face scrutiny regarding their environmental footprint and community relations. Meeting these evolving expectations can translate into tangible benefits.

- Enhanced Brand Reputation: Demonstrating strong CSR can significantly boost public perception and trust.

- Talent Acquisition and Retention: Companies with robust CSR programs are more attractive to top talent, with studies showing a 15% higher retention rate for employees who feel their company has a positive social impact.

- Risk Mitigation: Proactive CSR can help avoid negative publicity and regulatory issues stemming from social or environmental oversights.

- Community Relations: Investing in local communities fosters goodwill and can lead to smoother operational approvals and support.

Demographic Shifts and Consumer Trends

China's demographic landscape is evolving, with an aging population and shifting consumer tastes presenting both challenges and opportunities for steel demand. For instance, the declining birth rate and increasing life expectancy, a trend that continued into 2024, could temper long-term growth in sectors like residential construction, a major steel consumer. Simultaneously, rising middle-class incomes and a preference for higher-quality goods are influencing demand for specialized steel products in the automotive and appliance industries.

Baotou Steel must stay attuned to these societal changes. By 2025, it's projected that China's elderly population (60 and above) will exceed 300 million people, a significant increase that could alter consumption patterns. Therefore, adapting product offerings to meet the needs of an older demographic, perhaps through lighter-weight materials or specialized construction steel for infrastructure catering to seniors, will be crucial for sustained market relevance.

- Aging Population: China's population aged 65 and over reached approximately 21.1% of the total population in 2023, a figure expected to climb further by 2025.

- Urbanization Rate: While urbanization continues, the pace might slow, impacting the scale of new housing projects. China's urbanization rate was around 66.16% at the end of 2023.

- Consumer Preferences: A growing emphasis on sustainability and advanced manufacturing in China is driving demand for higher-grade, specialized steel products.

Societal expectations for Baotou Steel's Corporate Social Responsibility (CSR) are intensifying, pushing beyond basic legal adherence towards proactive community engagement and ethical supply chain management. By 2025, over 60% of consumers consider a company's social and environmental impact, making strong CSR vital for brand image and talent acquisition. This includes a focus on robust worker welfare and transparent operations, as public demand for accountability in industrial emissions grew significantly in 2024.

Technological factors

Innovation in steelmaking, such as hydrogen metallurgy and flash ironmaking, presents significant opportunities for Baotou Steel. These advancements can boost efficiency, cut costs, and reduce environmental impact, aligning with global sustainability trends. For instance, the development of low-carbon steelmaking technologies is a key focus for many industry leaders aiming to meet stringent environmental regulations.

Technological advancements in rare earth extraction and processing are paramount for Baotou Steel, given its significant rare earth operations. Innovations in these areas directly impact recovery rates, with new methods potentially boosting yields by 5-10% compared to traditional techniques. This efficiency gain is crucial for reducing operational costs and enhancing the competitiveness of its rare earth products in the global market.

Furthermore, these technological leaps are key to lowering the environmental footprint of rare earth processing, a sector often associated with significant waste and pollution. Developing cleaner separation and purification processes can reduce hazardous byproducts by up to 20%, aligning with stricter environmental regulations and corporate sustainability goals. The ability to produce higher-purity rare earth materials, exceeding 99.99% purity, also opens doors to high-value applications in advanced electronics and defense, areas where demand is projected to grow substantially through 2025.

The integration of automation, big data, and AI is revolutionizing mining, smelting, and rolling. Baotou Steel can boost productivity and quality by implementing these technologies. For instance, in 2024, the global mining automation market was projected to reach $13.5 billion, demonstrating a significant trend toward smart operations.

Research and Development in Advanced Materials

Baotou Steel's investment in research and development for advanced materials, including high-strength steel, specialized alloys, and composite materials, is crucial for meeting the evolving needs of industries like automotive and renewable energy. This focus on innovation allows the company to create value-added products with enhanced properties. For instance, in 2024, the global advanced materials market was projected to reach over $1.3 trillion, highlighting the significant growth potential.

Developing these superior materials can unlock new market opportunities and provide Baotou Steel with a competitive edge. By differentiating its product portfolio, the company can command premium pricing and secure long-term contracts. The automotive sector, in particular, is increasingly demanding lighter and stronger materials to improve fuel efficiency and safety, a trend expected to continue through 2025.

- R&D Investment: Baotou Steel is channeling resources into developing next-generation steel and alloy formulations.

- Market Demand: Growth in electric vehicles and wind turbine manufacturing fuels the need for advanced materials.

- Competitive Advantage: Superior material properties offer differentiation and potential for higher profit margins.

- Industry Trends: The push for lightweighting and increased durability in manufacturing sectors is a key driver for R&D.

Carbon Capture and Utilization (CCUS) Technologies

Carbon Capture and Utilization (CCUS) technologies are becoming increasingly vital for heavy industries like steel manufacturing. For Baotou Steel, a significant emitter, adopting these solutions is key to navigating stricter environmental regulations and achieving its carbon reduction goals. The company is exploring ways to capture CO2 from its production processes, aiming to transform these emissions into valuable products.

The global push for decarbonization is driving innovation in CCUS. For instance, by 2024, China has set ambitious targets for reducing carbon intensity, making Baotou Steel’s investment in CCUS a strategic imperative. The potential for CCUS to not only mitigate emissions but also create new revenue streams through CO2 utilization is a significant technological factor influencing the company's green transition strategy.

- CCUS Investment: Global investment in CCUS projects is projected to reach billions by 2030, indicating a strong market signal for adoption.

- CO2 Utilization Markets: Emerging markets for CO2-derived products, such as building materials and chemicals, offer economic incentives for CCUS implementation.

- Technological Advancements: Ongoing research is improving the efficiency and cost-effectiveness of various CCUS methods, making them more accessible for industrial players.

Technological advancements in steelmaking, like hydrogen-based metallurgy, offer Baotou Steel significant efficiency gains and cost reductions. Innovations in rare earth processing are also critical, with new methods potentially boosting recovery yields by 5-10% and lowering hazardous byproducts by up to 20%.

The integration of automation and AI in mining and smelting is a key trend, with the global mining automation market projected to reach $13.5 billion in 2024. Baotou Steel's focus on R&D for advanced materials, such as high-strength steel, is vital as the global advanced materials market was expected to exceed $1.3 trillion in 2024.

Investments in Carbon Capture and Utilization (CCUS) are becoming essential for steel manufacturers to meet decarbonization targets. Global investment in CCUS projects is anticipated to reach billions by 2030, signaling a strong market push for adoption.

| Technological Factor | Impact on Baotou Steel | Relevant Data/Projections |

| Hydrogen Metallurgy | Increased efficiency, cost reduction, lower environmental impact | Focus of industry leaders for sustainability |

| Rare Earth Processing Innovations | Improved recovery rates (5-10% potential increase), reduced waste (up to 20%) | Enables higher purity (99.99%+) for advanced applications |

| Automation & AI in Operations | Boosted productivity and quality | Global mining automation market projected at $13.5 billion (2024) |

| Advanced Materials R&D | Value-added products, competitive edge | Global advanced materials market projected over $1.3 trillion (2024) |

| Carbon Capture & Utilization (CCUS) | Environmental compliance, new revenue streams | Global CCUS investment projected to reach billions by 2030 |

Legal factors

China's tightening environmental regulations, particularly ultra-low emissions standards for the steel sector, present a significant compliance challenge for Baotou Steel. These rules mandate substantial capital expenditure on advanced pollution abatement systems. The national target is for 80% of steel capacity to achieve these ultra-low emission upgrades by the close of 2025, a benchmark Baotou Steel must strive to meet to avoid penalties and maintain operational viability.

Baotou Steel must strictly adhere to China's national and regional labor laws, encompassing worker safety, minimum wage requirements, and overall employment conditions. For instance, the national minimum wage standards, which are regularly updated, directly impact labor costs. Compliance is crucial to avoid penalties and ensure operational continuity.

Adherence to these legal frameworks is vital for preventing industrial accidents, which can lead to significant downtime and financial liabilities. In 2023, China's Ministry of Emergency Management reported a reduction in workplace fatalities across many sectors, underscoring the government's focus on safety. Baotou Steel's commitment to these regulations supports a stable workforce, minimizing the risk of labor disputes that could disrupt production.

Baotou Steel, as a significant entity in both steel and rare earth sectors, is subject to China's stringent anti-monopoly and competition laws. These regulations are designed to foster fair market competition and prevent any single company from wielding undue market power. For instance, China's Anti-Monopoly Law, last amended in 2022, imposes strict rules on monopolistic agreements, abuse of market dominance, and concentrations of undertakings, with significant penalties for violations.

These legal frameworks directly impact Baotou Steel's operational strategies, particularly concerning pricing decisions and how it engages with its customers and competitors. The State Administration for Market Regulation (SAMR) actively monitors market conduct, ensuring that companies do not engage in practices that could stifle competition or harm consumer interests. In 2023, SAMR continued its efforts to enforce these laws across various industries, demonstrating a commitment to maintaining a level playing field.

Rare Earth Export Controls and Licensing

China's stringent export controls on rare earth elements significantly impact Baotou Steel's global sales. These regulations, which have been progressively tightened, dictate the types and quantities of rare earths that can be shipped abroad, requiring Baotou Steel to meticulously adhere to licensing procedures. For instance, in 2023, China announced quotas for rare earth exports that were 20% lower than the previous year, reflecting a continued trend of tighter control.

Navigating this complex regulatory landscape is crucial for Baotou Steel's international market access. The company must stay abreast of evolving policies that determine market access and pricing for its rare earth products. This includes understanding the specific conditions tied to various rare earth types, some of which may face more restrictive export policies than others.

- Export Quotas: China's annual rare earth export quotas, such as the 102,000 metric ton allocation for 2023, directly limit Baotou Steel's international sales volume.

- Licensing Requirements: Companies like Baotou Steel must obtain specific export licenses, a process that can be time-consuming and subject to government discretion.

- Strategic Resource Management: The controls underscore rare earths' status as strategic resources, influencing global supply chains and Baotou Steel's competitive positioning.

Resource and Mining Regulations

Resource and mining regulations in Inner Mongolia directly shape Baotou Steel's access to and exploitation of vital minerals, including rare earths. These laws govern mining rights, land use, and operational permits, with a significant emphasis on environmental impact assessments. For instance, China's updated Mineral Resources Law, effective from 2020, continues to set the framework for resource exploration and development, requiring stringent compliance for companies like Baotou Steel.

The regulatory landscape mandates thorough environmental protection measures. Companies must adhere to national and regional environmental standards, often requiring detailed impact studies before new mining projects can commence or existing ones can expand. This focus on sustainability is increasingly critical, with the Chinese government prioritizing ecological civilization and green development, which translates into stricter oversight of mining activities and waste management practices.

Key regulatory aspects impacting Baotou Steel include:

- Mining Rights and Licensing: Baotou Steel must secure and maintain valid mining licenses for its resource extraction operations, subject to government approval and periodic review.

- Environmental Impact Assessments (EIAs): All significant mining projects require comprehensive EIAs to evaluate and mitigate potential environmental damage, a process that has become more rigorous in recent years.

- Resource Exploitation Quotas: The state may impose quotas on the extraction of certain strategic minerals, including rare earths, influencing production volumes and market availability.

Baotou Steel operates under China's evolving environmental legal framework, which mandates significant upgrades for ultra-low emissions by the end of 2025, with 80% of steel capacity targeted. The company must also comply with national labor laws, including updated minimum wage standards, to avoid penalties and ensure smooth operations. Adherence to safety regulations is paramount, as evidenced by the Ministry of Emergency Management's focus on reducing workplace fatalities, which helps prevent disruptions and labor disputes.

Environmental factors

China's commitment to peaking carbon emissions before 2030 and achieving carbon neutrality by 2060 significantly impacts heavy industries like steel. Baotou Steel, as a major player, faces direct pressure to decarbonize its operations.

To meet these national targets, Baotou Steel is expected to increase its reliance on electric arc furnaces, which are generally less carbon-intensive than blast furnaces. Furthermore, a reduction in coal consumption, a primary fuel source in traditional steelmaking, is imperative.

In 2023, China's steel sector accounted for approximately 15% of its total CO2 emissions, highlighting the scale of the challenge. Baotou Steel's strategic alignment with these environmental goals will be crucial for its long-term sustainability and regulatory compliance.

Steel production, including Baotou Steel's operations, is notoriously water-intensive, consuming vast amounts for cooling, dust suppression, and processing. This high demand, coupled with the generation of wastewater laden with heavy metals and other contaminants from mining and smelting, places significant pressure on local water resources and ecosystems.

In 2023, China's Ministry of Ecology and Environment continued to tighten regulations on industrial wastewater discharge, pushing companies like Baotou Steel to invest heavily in advanced water treatment and recycling technologies. Failure to comply can result in substantial fines and operational disruptions.

Baotou Steel has been actively implementing closed-loop water systems and investing in membrane filtration and desalination technologies to reduce its freshwater intake and minimize pollutant discharge. These efforts are crucial for meeting increasingly stringent environmental standards and maintaining its social license to operate in a region facing water scarcity.

Effective management of industrial waste, particularly slag and by-products from steel and rare earth processing, is a significant environmental challenge for Baotou Steel. The company faces increasing pressure to adopt advanced waste reduction, reuse, and recycling technologies to align with China's broader circular economy initiatives. For instance, in 2023, China's Ministry of Ecology and Environment emphasized stricter regulations on industrial solid waste, pushing companies like Baotou Steel towards more sustainable practices.

Land Degradation and Reclamation

Mining activities, especially those related to rare earth extraction, have historically caused considerable land degradation in regions like Inner Mongolia. Baotou Steel, as a major player in this sector, faces the imperative to address these impacts through robust land reclamation and rehabilitation initiatives. This is crucial not only for environmental compliance but also to showcase a commitment to ecological responsibility.

The company's efforts in land restoration are vital for mitigating the long-term effects of mining. This includes re-vegetation, soil stabilization, and the restoration of biodiversity in affected zones. For instance, by 2024, China's Ministry of Natural Resources reported that over 3 million hectares of degraded land had been reclaimed nationwide, indicating a broader national focus that Baotou Steel must align with.

- Land Degradation: Mining, particularly for rare earths, can severely damage soil structure and fertility.

- Reclamation Mandates: Baotou Steel is obligated to undertake extensive land restoration projects following mining operations.

- Environmental Stewardship: Successful reclamation demonstrates adherence to environmental regulations and promotes ecological recovery.

- National Context: China's commitment to land reclamation, with millions of hectares targeted by 2024, sets a benchmark for companies like Baotou Steel.

Compliance with Green Manufacturing Standards

China's intensifying focus on green manufacturing standards compels Baotou Steel to integrate cleaner production methods and invest in energy-efficient technologies throughout its facilities. This strategic shift is crucial for maintaining operational continuity and pursuing expansion opportunities.

A key regulatory hurdle is the requirement for new and expansion projects to achieve an A-level environmental protection performance rating. This stringent standard underscores the government's commitment to sustainable industrial development, directly impacting Baotou Steel's investment decisions and operational planning.

- Regulatory Mandates China's Ministry of Ecology and Environment has been progressively tightening environmental regulations, with a particular emphasis on heavy industries like steel production.

- Investment in Technology Baotou Steel's capital expenditure plans for 2024-2025 likely include significant allocations towards upgrading equipment and processes to meet these green manufacturing benchmarks.

- Operational Impact Failure to comply with A-level environmental performance standards could lead to production halts or restrictions, directly affecting output and revenue projections for the 2024-2025 period.

Baotou Steel faces increasing pressure to reduce its carbon footprint, aligning with China's 2030 carbon peak and 2060 carbon neutrality goals. This necessitates a shift towards less carbon-intensive production methods, such as electric arc furnaces, and a significant reduction in coal usage. The steel sector's substantial contribution to China's CO2 emissions, around 15% in 2023, underscores the critical need for Baotou Steel to adapt its operations for long-term sustainability and regulatory compliance.

Water management is a critical environmental concern, with steel production being highly water-intensive. Baotou Steel must invest in advanced water treatment and recycling to meet tightening regulations on wastewater discharge, as exemplified by stricter measures from China's Ministry of Ecology and Environment in 2023. The company's adoption of closed-loop systems and advanced filtration technologies is vital for minimizing freshwater consumption and pollutant release, especially in water-scarce regions.

The company must also address industrial waste, particularly slag from steel and rare earth processing, by embracing circular economy principles. China's emphasis on waste reduction and recycling, reinforced by Ministry of Ecology and Environment directives in 2023, pushes Baotou Steel towards more sustainable waste management practices. Furthermore, land degradation from mining operations requires robust reclamation efforts, with national targets by 2024 indicating a broader commitment to ecological recovery that Baotou Steel must mirror.

PESTLE Analysis Data Sources

Our PESTLE analysis for Inner Mongolia Baotou Steel is built on data from official Chinese government statistics, industry-specific reports from major steel associations, and reputable economic and environmental research institutions. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.