Inner Mongolia Baotou Steel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inner Mongolia Baotou Steel Bundle

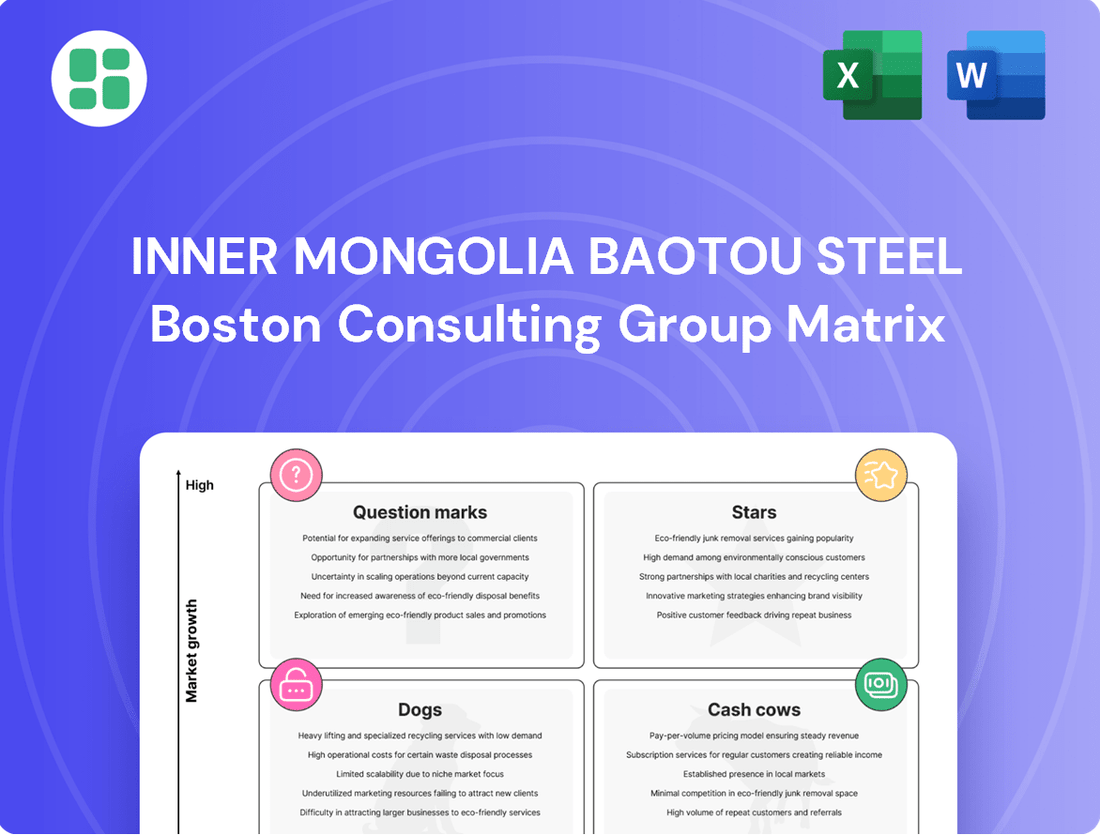

Curious about Inner Mongolia Baotou Steel's market standing? This preview offers a glimpse into their product portfolio's potential, highlighting where they might be excelling and where challenges lie. To truly grasp their strategic positioning and unlock actionable insights, dive into the complete BCG Matrix.

Gain a comprehensive understanding of Inner Mongolia Baotou Steel's product lifecycle and market share. The full BCG Matrix report provides the detailed quadrant analysis and strategic recommendations needed to make informed investment and resource allocation decisions.

Don't miss out on the full picture of Inner Mongolia Baotou Steel's competitive landscape. Purchase the complete BCG Matrix for a detailed breakdown of their Stars, Cash Cows, Dogs, and Question Marks, empowering you with the clarity to navigate their market presence effectively.

Stars

Baotou Steel's high-performance rare earth steel is a standout product, boasting superior strength and durability. This makes it a prime candidate for industries experiencing rapid expansion, such as high-end automotive manufacturing and wind power generation. The unique properties of this steel are in high demand as these sectors push for more advanced materials.

The company's integrated rare earth resources, combined with specialized production techniques, give it a significant edge in the market. This integrated approach likely translates to a substantial market share for its rare earth steel. In 2023, the global demand for rare earth elements, crucial for these advanced steels, saw continued growth, with China remaining the dominant producer, further solidifying Baotou Steel's strategic advantage.

The automotive steel market is booming, especially with the surge in electric vehicle production. Baotou Steel's commitment to supplying high-quality steel for this sector positions it as a star performer.

By developing advanced materials specifically for new energy vehicles (NEVs), Baotou Steel is well-placed to secure a substantial portion of this fast-growing market. This segment's need for cutting-edge steel alloys perfectly matches Baotou Steel's product innovation goals. In 2023, global NEV sales surpassed 10 million units, a significant increase from previous years, highlighting the immense potential for specialized steel suppliers like Baotou Steel.

The global transition to renewable energy is fueling a booming market for wind power equipment, and specialized steel is a critical component. Baotou Steel has seen its high-quality steel products for this sector grow, reflecting its strong market standing. In 2023, China's wind power installations reached a record 75.95 GW, underscoring the immense demand Baotou Steel is poised to meet.

Rare Earth Concentrates (Strategic Supply)

Rare Earth Concentrates, a core component of Baotou Steel's portfolio, are strategically positioned as Stars within the BCG matrix. China's near-monopoly in rare earth production, accounting for approximately 60% of global output in 2024, coupled with its export restrictions on medium and heavy rare earths, highlights the critical nature of Baotou Steel's supply.

The demand for these elements is robust, driven by burgeoning sectors such as electric vehicles (EVs) and advanced electronics, which rely heavily on rare earth magnets. For instance, the global rare earth market was valued at approximately $4.5 billion in 2023 and is projected to grow significantly.

- Market Dominance: China controlled around 85% of the world's rare earth refining capacity in 2024, making Baotou Steel a key player in a globally essential but sensitive supply chain.

- Growing Demand: The increasing adoption of EVs, where rare earth magnets are crucial for motor efficiency, and the expansion of consumer electronics ensure sustained and rising demand for rare earth concentrates.

- Strategic Importance: Due to their indispensable role in advanced technologies and national security applications, rare earth elements are considered strategic commodities, further solidifying the Star status of Baotou Steel's production.

High-Strength Structural Steel for Key Infrastructure

High-strength structural steel for key infrastructure is a promising segment for Baotou Steel, even as the broader Chinese construction steel market moderates. This specialized steel is crucial for large-scale projects, especially those tied to the Belt and Road Initiative (BRI), an area where Baotou Steel has actively increased its export presence.

Baotou Steel's capability to deliver high-quality, specialized steel for these significant, often government-supported infrastructure undertakings solidifies its market position. This strategic emphasis on premium segments within the infrastructure sector offers a clear path for growth.

- Market Niche: High-strength structural steel for BRI infrastructure projects.

- Growth Driver: Baotou Steel's expanded exports to BRI nations.

- Competitive Advantage: Supply of specialized, high-quality steel for large-scale projects.

- Strategic Focus: Targeting premium segments within infrastructure for growth.

Baotou Steel's rare earth concentrates are firmly positioned as Stars in the BCG matrix due to their high market share in a rapidly growing industry. China's dominant role in global rare earth production, controlling approximately 60% of output in 2024, provides Baotou Steel with a significant strategic advantage, especially given export restrictions on certain rare earth types.

The demand for rare earths is robust, fueled by critical sectors like electric vehicles and advanced electronics, with the global market valued around $4.5 billion in 2023. Baotou Steel's position is further strengthened by China's 85% control over global rare earth refining capacity in 2024, making its concentrates indispensable for advanced technologies and national security applications.

| Product Segment | Market Growth | Baotou Steel's Position | BCG Category |

|---|---|---|---|

| Rare Earth Concentrates | High (driven by EVs, electronics) | High Market Share (leveraging China's dominance) | Star |

| High-Performance Rare Earth Steel | High (driven by automotive, wind power) | Strong (integrated resources, advanced production) | Star |

| High-Strength Structural Steel (BRI) | Moderate to High (niche infrastructure projects) | Growing (expanded exports, specialized supply) | Question Mark/Star (potential to become Star) |

What is included in the product

This BCG Matrix overview of Baotou Steel details its product portfolio's market share and growth potential.

It provides strategic recommendations for investment, divestment, or holding across Stars, Cash Cows, Question Marks, and Dogs.

The Inner Mongolia Baotou Steel BCG Matrix offers a clear, one-page overview, relieving the pain of understanding complex portfolio performance.

Cash Cows

Baotou Steel's General Construction Steel Products, including plates and sections, are firmly positioned as Cash Cows. These are fundamental building blocks for China's vast construction sector, a market that, while mature and experiencing low growth, still demands significant volumes. Baotou Steel's considerable production capacity and long-standing market presence likely secure it a dominant share in this segment.

The commodity nature of these steel products means they generate steady, predictable cash flows with minimal need for heavy promotional spending. In 2023, China's crude steel output reached a staggering 1.019 billion tonnes, underscoring the sheer scale of the market Baotou Steel operates within. This consistent demand, coupled with Baotou Steel's established operational efficiencies, allows these products to act as reliable cash generators for the company.

Traditional railway steel represents a significant Cash Cow for Baotou Steel, leveraging its established market dominance and expertise. The company's long history in this sector, coupled with its ability to meet stringent international quality standards, particularly for markets like Central Asia, solidifies its position.

While the global growth rate for new traditional railway infrastructure may be moderate, the consistent demand driven by maintenance, upgrades, and replacement cycles ensures a stable revenue stream. Baotou Steel's competitive edge in this niche, often secured through long-term supply agreements, translates into predictable and substantial cash flow generation.

Wire rods and bars for standard applications are Baotou Steel's cash cows. These are essentially commodity steel products used across many industries, from construction to general manufacturing. Their demand is stable and predictable because these sectors are well-established.

Baotou Steel's large production capacity for these items suggests they hold a significant chunk of the market. This strong market position, combined with the low growth nature of these products, means they don't need much new investment to keep their sales steady. This allows them to be consistent money-makers for the company.

Basic Iron Ore Mining Operations

Baotou Steel's basic iron ore mining operations are a quintessential cash cow. As a large-scale iron and steel enterprise, these mines are the bedrock, supplying essential raw materials for its extensive steel production. This internal supply chain grants Baotou Steel significant cost efficiencies and a reliable source of income, even in a mature market.

The iron ore segment likely boasts a high internal market share, ensuring consistent cash flow generation. This stability is crucial for funding other ventures within the Baotou Steel conglomerate. For instance, in 2023, Baotou Steel reported that its mining segment contributed substantially to its overall financial performance, with iron ore production volumes remaining robust.

- Stable Production: Iron ore mining provides a consistent input for steel manufacturing.

- Cost Advantage: High internal market share offers significant cost savings in steel production.

- Cash Generation: Acts as a primary and reliable source of cash for the enterprise.

- Foundation: Underpins the financial health and operational stability of Baotou Steel.

Steel for Home Appliances

Steel for home appliances represents a significant cash cow for Baotou Steel. This sector in China exhibits robust and stable demand, consistently requiring diverse steel grades for manufacturing. In 2023, China's home appliance market saw retail sales reach approximately 850 billion yuan, underscoring the sector's substantial size.

Baotou Steel benefits from strong, long-standing supply chain partnerships within the home appliance industry. Its capacity to precisely meet the stringent quality and specification demands for appliance-grade steel likely translates into a dominant market position. This established presence ensures consistent order volumes and a high market share.

The mature nature of the home appliance market, coupled with steady demand, allows Baotou Steel to generate reliable cash flow from this segment. Consequently, significant reinvestment for aggressive growth is not necessary, reinforcing its classification as a cash cow. For instance, the production of cold-rolled steel, a key component for appliances, is a mature process for Baotou Steel, yielding predictable margins.

- Market Stability: The Chinese home appliance market is large and stable, providing consistent demand.

- High Market Share: Baotou Steel's established relationships and product quality ensure a strong position.

- Reliable Cash Generation: Steady demand in a mature market means predictable profits without heavy investment.

- Key Product Focus: Cold-rolled steel, essential for appliances, is a mature and profitable product line for the company.

Baotou Steel's general construction steel products, encompassing plates and sections, are firmly established as cash cows. These are essential components for China's extensive construction sector, a market characterized by mature, low growth but still significant volume demand. Baotou Steel's substantial production capacity and established market presence likely ensure a leading share in this segment.

The commodity nature of these steel products generates steady, predictable cash flows with minimal need for extensive promotional spending. In 2023, China's crude steel output reached 1.019 billion tonnes, highlighting the vast scale of Baotou Steel's operating market. This consistent demand, combined with Baotou Steel's operational efficiencies, makes these products reliable cash generators.

| Product Segment | BCG Category | Key Characteristics | 2023 Market Insight | Baotou Steel's Position |

| General Construction Steel (Plates & Sections) | Cash Cow | Mature market, high volume, low growth, commodity nature | China's crude steel output: 1.019 billion tonnes | Dominant market share due to capacity and presence |

| Wire Rods & Bars (Standard Applications) | Cash Cow | Stable demand across multiple industries, established sectors | Consistent demand from construction and manufacturing | Large production capacity, significant market share |

| Steel for Home Appliances | Cash Cow | Robust and stable demand, precise quality requirements | China home appliance retail sales: ~850 billion yuan | Strong supply chain partnerships, dominant position |

What You’re Viewing Is Included

Inner Mongolia Baotou Steel BCG Matrix

The Inner Mongolia Baotou Steel BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously prepared by industry experts, offers a clear strategic overview of Baotou Steel's business units, ready for immediate integration into your planning processes.

Dogs

Baotou Steel's commodity steel exports are struggling in saturated markets, facing a double whammy of rising anti-dumping duties and increased local production in key regions like Southeast Asia. This protectionist environment, coupled with intense competition, means Baotou Steel's standard steel products are likely seeing sluggish growth and a shrinking market share.

The financial implications are stark: these exports are probably generating minimal profits and, worse, are tying up valuable capital that could be deployed more effectively. For instance, in 2023, global steel prices saw significant volatility, with some Asian markets experiencing oversupply, directly impacting export profitability for companies like Baotou Steel.

Older, less efficient steel production lines at Baotou Steel, likely producing basic steel products, would be categorized as Dogs in the BCG Matrix. These segments face challenges with low market share due to higher production costs and inferior quality compared to advanced competitors. The market for these older steel products is typically characterized by low or even negative growth.

Inner Mongolia Baotou Steel's steel products heavily tied to China's residential real estate are facing a challenging environment. The sector's significant downturn, marked by a contraction in new housing starts and a slowdown in property sales, directly impacts demand for construction-grade steel. For instance, China's property investment saw a decline of 9.5% year-on-year in the first two months of 2024, signaling continued weakness.

If Baotou Steel's product mix is heavily skewed towards this segment without strong diversification, it likely translates to a low market share in a contracting market. This situation positions these specific steel products as potential 'Dogs' in a BCG matrix analysis, indicating low growth and low relative market share, thus requiring careful strategic consideration for resource allocation.

Non-Core, Underperforming Subsidiaries

Non-core, underperforming subsidiaries, especially those acquired in less dynamic sectors, represent potential 'Dogs' in Baotou Steel's BCG Matrix. These units often tie up capital and management attention without contributing substantially to revenue growth or market leadership. For instance, if Baotou Steel acquired a small mining operation in a region with declining mineral reserves, this subsidiary might fall into the Dog category.

Such subsidiaries may require significant investment to turn around or could be prime candidates for divestiture. Divesting these underperforming assets allows the company to reallocate resources towards its Stars and Cash Cows, thereby enhancing overall financial health and strategic focus. In 2024, many industrial conglomerates are actively reviewing their portfolios to shed non-essential or low-return businesses.

Consider the following characteristics of Baotou Steel's potential 'Dogs':

- Low Market Share: Subsidiaries operating in niche or declining markets with limited competitive advantage.

- Low Growth Prospects: Businesses in industries experiencing stagnation or contraction, offering little potential for future expansion.

- Resource Drain: Entities that consistently require capital injections or operational support without generating commensurate profits or strategic value.

- Acquisition Misfits: Subsidiaries acquired for diversification that have failed to integrate effectively or achieve projected synergies.

Standard Sections and Rods Facing Intense Domestic Competition

Standard sections and rods, representing a significant portion of the Chinese steel industry, are caught in a fierce domestic battle. In 2024, China's crude steel output reached approximately 1.02 billion tonnes, highlighting the sheer volume and intense competition within these basic product categories. Without unique features or a distinct cost advantage, Baotou Steel's generic products in this segment are likely to face challenges in securing substantial market share or achieving strong profitability. This positions them as potential 'Dogs' in the BCG matrix – low growth and low market share.

The commoditized nature of standard steel sections and rods means that price often dictates purchasing decisions. Baotou Steel's performance in these areas is heavily influenced by broader market dynamics, including fluctuating raw material costs and the output of numerous domestic competitors. For instance, the average price of rebar in China saw considerable volatility throughout 2024, impacting margins for all producers of standard construction steel.

- Intense Price Pressure: The commoditized market for standard sections and rods leads to significant price competition among numerous domestic producers.

- Low Differentiation: Lack of unique product features or specialized applications makes it difficult for Baotou Steel to command premium pricing.

- Market Oversupply: China's massive steel production capacity, exceeding 1 billion tonnes annually, creates an oversupplied environment for basic steel products.

- Profitability Challenges: The combination of intense competition and price sensitivity can limit the profitability of Baotou Steel's offerings in these segments.

Baotou Steel's older, less efficient production lines churning out basic steel products are prime examples of 'Dogs' in the BCG Matrix. These segments likely suffer from low market share due to higher costs and inferior quality, operating in markets with minimal or negative growth. For example, the global steel market in 2024 continued to grapple with overcapacity, particularly in basic steel products, impacting profitability for less competitive producers.

Products heavily reliant on China's struggling residential real estate sector, such as construction-grade steel, also fall into the 'Dog' category. With China's property investment declining, as seen with a 9.5% year-on-year drop in the first two months of 2024, demand for these steel types is contracting, leading to low market share and growth prospects.

Underperforming, non-core subsidiaries, particularly those in less dynamic sectors or poorly integrated acquisitions, can also be classified as 'Dogs'. These units often drain capital and management focus without contributing meaningfully, prompting many conglomerates in 2024 to divest such assets to optimize portfolios.

| Baotou Steel Product Segment | BCG Category | Market Characteristics | Strategic Implication |

|---|---|---|---|

| Basic Steel Sections & Rods | Dog | Low market share, intense price competition, oversupply (China's crude steel output ~1.02 billion tonnes in 2024) | Divestiture or significant cost reduction required |

| Steel for Residential Real Estate | Dog | Contracting market due to property downturn (China property investment down 9.5% Jan-Feb 2024) | Reduce exposure, explore diversification |

| Commodity Steel Exports (Saturated Markets) | Dog | Low growth, shrinking market share due to anti-dumping duties and local production | Focus on niche markets or exit |

Question Marks

The market for advanced materials, particularly specialized steel and rare earth components crucial for robotics and other high-tech industries, is poised for substantial long-term expansion. For instance, the global advanced materials market was valued at approximately $230 billion in 2023 and is anticipated to grow significantly in the coming years, driven by demand from sectors like aerospace, automotive, and robotics.

If Baotou Steel is actively developing or has recently launched products tailored for these emerging, high-growth industries, its current market share might be relatively small. However, the potential for rapid growth is immense, positioning these ventures as potential Stars within the BCG matrix, albeit requiring substantial investment to capitalize on this potential.

Baotou Steel's cutting-edge green steel products are positioned within a rapidly expanding global market driven by sustainability mandates. As of 2024, the demand for low-carbon steel is surging, with projections indicating continued robust growth. While these innovative products represent a significant opportunity, their current market share may be relatively low due to their nascent stage of adoption and the substantial investments required for scaling production and market penetration.

For Inner Mongolia Baotou Steel, venturing into new international markets for high-value steel products, where its current footprint is minimal, represents a Question Mark. These strategic moves demand substantial investment and carry inherent risks, yet offer the tantalizing prospect of substantial market share expansion.

Rare Earth Downstream Processing for Niche Applications

Venturing into downstream rare earth processing for niche applications would position Baotou Steel's activities in this area as potential Stars within the BCG matrix. These specialized products, like high-performance magnets for electric vehicles or advanced electronics, offer significant growth potential but likely start with a smaller market share as the company develops its capabilities and market penetration.

- High Growth Potential: The global market for specialized rare earth magnets is projected to grow significantly, driven by demand in sectors like renewable energy and advanced manufacturing. For instance, the market for Neodymium-Iron-Boron (NdFeB) magnets, crucial for electric vehicle motors and wind turbines, is expected to see a compound annual growth rate (CAGR) of over 8% in the coming years.

- Low Current Market Share: While the potential is high, Baotou Steel's current market share in these highly specialized downstream products might be nascent. Building the necessary technological expertise and establishing strong customer relationships in these niche markets takes time and investment.

- Strategic Importance: Developing these downstream capabilities allows Baotou Steel to capture more value along the rare earth supply chain, moving beyond raw material extraction and basic processing. This strategic shift can enhance profitability and reduce reliance on volatile commodity prices.

- Investment Focus: As a potential Star, these downstream processing activities would warrant continued investment in research and development, advanced manufacturing technologies, and targeted marketing efforts to solidify market position and capitalize on the high growth trajectory.

Digitalization and Smart Manufacturing Solutions

Baotou Steel is actively investing in digitalization and smart manufacturing to boost operational efficiency. These efforts could lead to new, high-growth market opportunities if they result in novel smart steel solutions for customers or the licensing of advanced manufacturing technologies. As of 2024, the company's commitment to Industry 4.0 principles is evident in its pilot programs for automated production lines and AI-driven quality control systems, aiming to capture a nascent market segment.

These digital initiatives, while promising significant future growth, currently represent a low market share. Baotou Steel's foray into smart manufacturing solutions requires substantial capital expenditure to scale effectively and achieve widespread market adoption. For instance, developing and deploying IoT-enabled supply chain management tools for steel products is a key area, but one where early-stage investment is critical to establish a competitive foothold.

- Investment in Digitalization: Baotou Steel is channeling resources into smart manufacturing to enhance production processes.

- New Market Opportunities: Digitalization may yield innovative smart steel solutions or licenseable advanced manufacturing technologies.

- Growth Potential: These new offerings represent high-growth potential but currently hold a low market share.

- Capital Requirements: Significant investment is necessary to scale these digital solutions and secure market adoption.

Baotou Steel's exploration of new international markets for specialized steel products, where its current presence is minimal, exemplifies a Question Mark. These ventures demand considerable financial commitment and carry inherent risks, yet they hold the potential for substantial market share expansion.

The company's strategic entry into advanced downstream rare earth processing for niche applications also falls into the Question Mark category. These specialized products, such as high-performance magnets for electric vehicles, offer significant growth prospects but start with a limited market share as Baotou Steel builds its expertise and market penetration.

Similarly, Baotou Steel's investments in digitalization and smart manufacturing, aiming to create novel smart steel solutions or license advanced technologies, represent Question Marks. These initiatives require substantial capital to scale and achieve widespread adoption, but they target nascent market segments with high growth potential.

| Business Area | Market Growth Rate | Relative Market Share | BCG Category |

|---|---|---|---|

| New International Markets for Specialized Steel | High | Low | Question Mark |

| Downstream Rare Earth Processing (e.g., Magnets) | High | Low | Question Mark |

| Digitalization & Smart Manufacturing Solutions | High | Low | Question Mark |

BCG Matrix Data Sources

Our Inner Mongolia Baotou Steel BCG Matrix leverages official company financial statements, industry growth forecasts, and comprehensive market research reports to provide a robust strategic overview.