Inner Mongolia Baotou Steel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inner Mongolia Baotou Steel Bundle

Inner Mongolia Baotou Steel faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers shaping its market landscape. Understanding these dynamics is crucial for navigating the steel industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Inner Mongolia Baotou Steel’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Steel production, including that of Inner Mongolia Baotou Steel, is significantly impacted by raw material volatility. Key inputs like iron ore and coking coal are subject to global supply and demand shifts and geopolitical events, directly affecting production costs.

The iron ore market is anticipated to grapple with fluctuating prices and stricter environmental regulations through 2025. Moody's projects iron ore prices to hover between $80 and $100 per tonne over the next 12 to 18 months, a trend influenced by subdued Chinese demand and robust global supply.

Inner Mongolia Baotou Steel holds a distinct advantage with its substantial rare earth reserves, notably from the Bayan Obo deposit, a site lauded for major geological exploration in 2024. This vertical integration for rare earth elements significantly reduces reliance on external suppliers for these crucial components.

The bargaining power of suppliers for rare earth elements is demonstrably high, as evidenced by China Northern Rare Earth and Inner Mongolia Baotou Steel Union implementing a 14.14% price increase for third-quarter 2025 rare earth concentrates over 2024 prices. This highlights the supplier leverage in this vital market segment.

Steelmaking is incredibly energy-hungry, meaning companies like Baotou Steel are heavily reliant on electricity and natural gas suppliers. These suppliers hold significant sway because their costs directly impact Baotou Steel's bottom line.

China's push for carbon reduction in 2024 and 2025 is a game-changer. Stricter energy efficiency mandates and potentially higher electricity prices for polluters will likely bolster the bargaining power of energy providers, especially those offering cleaner or more efficient sources.

Specialized Equipment & Technology

Suppliers of specialized steelmaking machinery, automation, and environmental technologies hold considerable sway. Their offerings are often highly technical and expensive, making it difficult for companies like Baotou Steel to switch easily. This specialized nature means suppliers can dictate terms, especially when their technology is critical for production efficiency and quality.

Baotou Steel's commitment to innovation underscores this reliance. For instance, their investment of RMB 321 million in 2024 into a rare earth magnet company highlights the need for cutting-edge suppliers to maintain a competitive edge. These investments are crucial for upgrading production processes and ensuring high-quality output, directly impacting Baotou Steel's operational capabilities.

- High Cost of Specialized Equipment: Advanced steelmaking machinery and automation systems represent significant capital expenditures, limiting the number of potential suppliers and increasing buyer dependency.

- Technological Dependency: Baotou Steel's pursuit of enhanced production efficiency and superior product quality necessitates reliance on suppliers providing state-of-the-art technology, such as advanced automation and environmental control systems.

- R&D Investment Link: The company's strategic investments, like the RMB 321 million in 2024 for a rare earth magnet firm, signal a direct need for specialized supplier capabilities to drive technological advancements and product differentiation.

- Supplier Market Concentration: In certain niche technology areas within steel production, the market may be dominated by a few key suppliers, further concentrating bargaining power in their hands.

Logistics & Transportation

The bargaining power of logistics and transportation suppliers significantly impacts Inner Mongolia Baotou Steel. The cost and availability of moving raw materials to plants and finished goods to customers are vital. In 2024, rising fuel costs and driver shortages in China continued to exert upward pressure on shipping rates, potentially increasing Baotou Steel's transportation expenses.

Given Inner Mongolia's landlocked geography, efficient logistics are paramount to mitigating the influence of transportation providers. The steel industry, in general, faces ongoing supply chain complexities, and Baotou Steel's reliance on these external services means that disruptions or price hikes from logistics firms can directly affect its operational costs and competitiveness.

- Rising Fuel Costs: Global oil prices, which influence diesel and other fuel costs, remained volatile throughout 2024, impacting freight charges.

- Driver Shortages: Labor availability in the trucking sector continued to be a concern, potentially leading to higher wages and reduced service capacity.

- Geographical Disadvantage: Baotou Steel's location necessitates longer haulage distances, increasing its dependence on and vulnerability to transportation supplier terms.

The bargaining power of suppliers for Inner Mongolia Baotou Steel is notably high across several key input categories. For essential raw materials like iron ore and coking coal, global market dynamics and China's environmental policies in 2024 and 2025 grant significant leverage to suppliers. This is further amplified by the concentration of rare earth element suppliers, who demonstrated their power with a 14.14% price increase for concentrates in Q3 2025 over 2024 prices.

Energy providers also wield considerable influence, especially with China's intensified focus on carbon reduction and energy efficiency mandates for 2024-2025, which could lead to higher costs for less efficient energy sources. Specialized machinery and technology suppliers hold strong positions due to the high cost and technical nature of their products, making Baotou Steel's reliance on their advanced solutions, such as the RMB 321 million invested in a rare earth magnet firm in 2024, a key factor.

Logistics and transportation suppliers also represent a significant cost driver, exacerbated by volatile fuel prices and driver shortages observed in China during 2024. Baotou Steel's landlocked location further intensifies its dependence on these providers.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Baotou Steel | Relevant Data/Trends (2024-2025) |

|---|---|---|---|

| Raw Materials (Iron Ore, Coking Coal) | Global supply/demand, geopolitical events, environmental regulations | Increased production costs, potential supply disruptions | Iron ore prices projected at $80-$100/tonne (Moody's); stricter environmental rules |

| Rare Earth Elements | Market concentration, supplier price adjustments | Higher input costs for specialized products | 14.14% price increase for concentrates (Q3 2025 vs. 2024) |

| Energy (Electricity, Natural Gas) | Carbon reduction policies, energy efficiency mandates | Potential for higher energy expenses | Increased scrutiny on energy efficiency and emissions |

| Specialized Machinery & Technology | High capital expenditure, technological dependency, R&D integration | Reliance on suppliers for efficiency and quality upgrades | RMB 321 million invested in rare earth magnet company (2024) |

| Logistics & Transportation | Fuel costs, driver availability, geographical location | Elevated transportation expenses, supply chain vulnerability | Rising fuel costs, driver shortages impacting freight rates |

What is included in the product

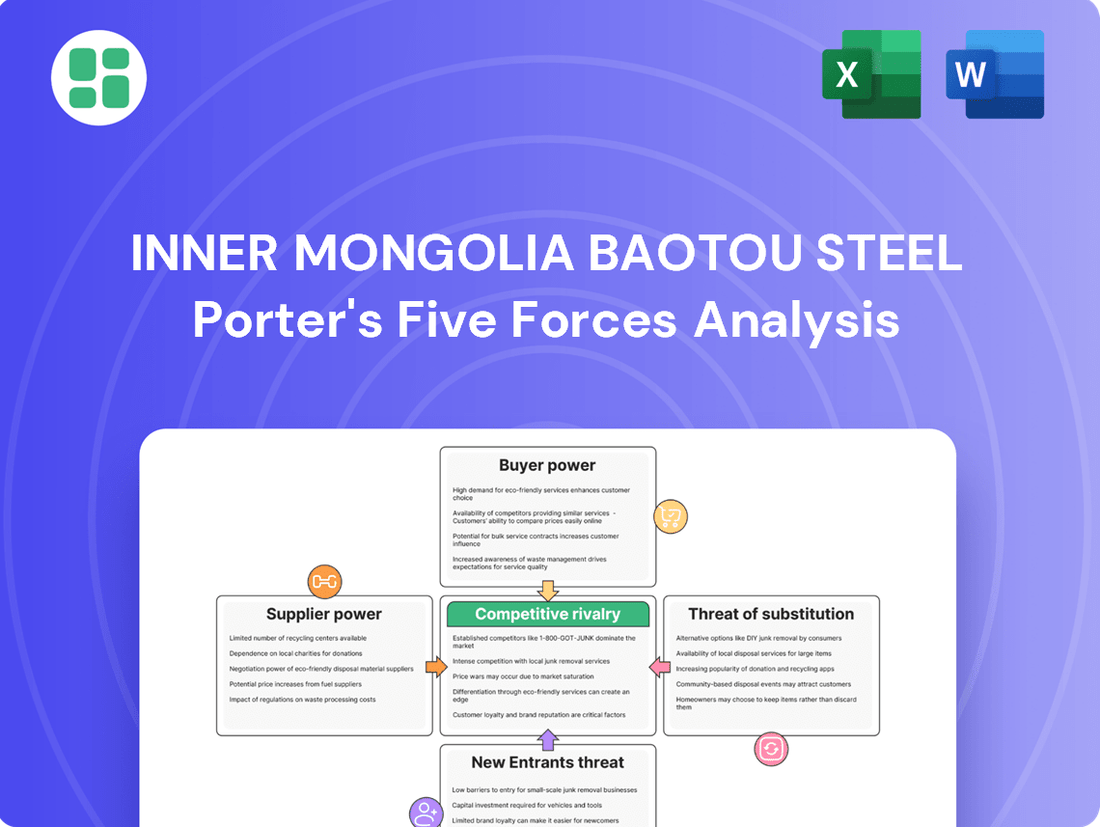

This analysis explores the competitive landscape for Inner Mongolia Baotou Steel, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its market position and profitability.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Baotou Steel, enabling proactive strategy adjustments.

Customers Bargaining Power

The bargaining power of customers for Inner Mongolia Baotou Steel is significantly influenced by the commoditized nature of its core products like plates, sections, rods, and wires. Customers can easily switch suppliers based on price and delivery terms, especially given the oversupplied Chinese steel market. In 2023, China's crude steel output reached approximately 1.02 billion tonnes, contributing to intense price competition.

Inner Mongolia Baotou Steel's diverse customer base, spanning construction, machinery, automotive, and railway sectors, inherently limits the bargaining power of any single customer segment. This broad reach helps to distribute customer risk, meaning no one industry or client holds a disproportionate amount of sway over pricing or terms. For instance, in 2024, the construction sector, a significant consumer of steel products, experienced a moderate growth rate, while the automotive industry saw shifts in demand due to evolving consumer preferences and production adjustments.

However, the sheer scale of major players within these key industries, such as large construction conglomerates or major automotive manufacturers, can still translate into considerable bargaining leverage. These entities, due to their volume purchases and strategic importance, can negotiate for more favorable pricing, extended payment terms, or specific product customizations, thereby exerting pressure on Baotou Steel's profit margins and operational flexibility.

Customers in sectors like construction and general manufacturing exhibit significant price sensitivity, actively seeking the most economical steel options. This makes them a powerful force, as they can easily switch suppliers if prices are not competitive.

The Chinese steel market has been grappling with persistent overcapacity, a situation that directly benefits buyers. In 2023, China's crude steel output reached a record 1.019 billion tonnes, contributing to an environment where supply often outstrips demand, thus increasing buyer leverage.

Furthermore, a notable increase in low-priced steel exports from China has intensified global price competition. This surge in affordable imports empowers domestic buyers, as they can often source steel from international markets at lower costs, putting downward pressure on domestic producers like Inner Mongolia Baotou Steel.

Backward Integration Potential

Major customers, especially those in automotive and heavy machinery, often have the financial clout and operational expertise to consider backward integration into steel production. This capability inherently strengthens their negotiating position with steel suppliers like Inner Mongolia Baotou Steel. For instance, in 2024, major automotive manufacturers continued to explore strategic partnerships and direct sourcing to secure their steel supply chains, potentially reducing reliance on individual domestic producers.

The availability of a broad spectrum of international steel suppliers also significantly enhances customer bargaining power. Customers can leverage global competition to secure more favorable pricing and terms. This global sourcing option means that Baotou Steel must remain competitive not just domestically but also against international benchmarks to retain its key clients.

- Customer Integration: Large downstream manufacturers can invest in their own steelmaking facilities, reducing their need for external suppliers.

- Global Sourcing: Access to international markets allows customers to play suppliers against each other, driving down prices.

- Supplier Concentration: If customers are concentrated in a few large industries, their collective demand gives them more leverage.

- Switching Costs: Low switching costs for customers to move to another steel supplier further amplify their bargaining power.

Quality and Specification Demands

For highly specialized sectors such as automotive manufacturing or railway infrastructure, clients often impose rigorous quality benchmarks and bespoke product specifications. Baotou Steel's commitment to innovation and superior product output can effectively counter this customer leverage in these specific market segments, especially if they are among a limited number of providers capable of fulfilling these exacting demands.

For instance, in 2024, the automotive industry's demand for advanced high-strength steel (AHSS) for lightweighting vehicles meant that suppliers meeting specific tensile strength and formability requirements held a stronger negotiating position. Baotou Steel’s reported investments in advanced rolling technologies in late 2023 position them to potentially meet such stringent automotive specifications, thereby reducing customer bargaining power.

- Automotive Sector: Stringent requirements for AHSS for vehicle lightweighting.

- Railway Sector: Demand for high-durability rails with specific wear resistance.

- Baotou Steel's Mitigation: Focus on technological advancements and quality control.

- Competitive Advantage: Ability to meet precise specifications differentiates from competitors.

The bargaining power of customers for Inner Mongolia Baotou Steel is substantial due to the commoditized nature of its products and the intense competition within the Chinese steel market. With China's crude steel output reaching approximately 1.02 billion tonnes in 2023, buyers can readily switch suppliers based on price and delivery, particularly as global supply increases.

While Baotou Steel serves a diverse range of industries, large-scale customers in sectors like construction and automotive can still exert significant leverage. These major players, by virtue of their volume purchases and potential for backward integration, can negotiate for more favorable terms, impacting Baotou Steel's pricing and margins.

The availability of international suppliers further empowers customers, allowing them to leverage global price competition. This necessitates Baotou Steel maintaining competitive pricing and quality standards to retain key business relationships.

| Factor | Impact on Baotou Steel | 2023/2024 Context |

| Product Commoditization | High customer switching likelihood | Steel plates, sections, rods are widely available. |

| Market Overcapacity | Increased buyer leverage | China's 2023 crude steel output: ~1.02 billion tonnes. |

| Customer Concentration | Potential for large buyers to dictate terms | Major construction firms and automotive manufacturers. |

| Global Sourcing | Pressure to match international prices | Increased low-priced steel exports from various regions. |

Preview Before You Purchase

Inner Mongolia Baotou Steel Porter's Five Forces Analysis

This preview showcases the complete Inner Mongolia Baotou Steel Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholder content. You can confidently download and utilize this comprehensive report to understand the strategic landscape affecting Baotou Steel.

Rivalry Among Competitors

China's steel industry, a global powerhouse, is characterized by intense competition, even as consolidation efforts are underway. Numerous large state-owned enterprises, alongside a growing number of private players, fiercely contest market share. This dynamic environment directly impacts Inner Mongolia Baotou Steel, placing it in direct rivalry with other significant Chinese steel manufacturers.

The Chinese steel market is notorious for its overcapacity, a persistent issue that fuels intense price competition. This environment directly squeezes profit margins for all players, including Baotou Steel.

Projections indicate Chinese crude steel output might dip below 1 billion tonnes in 2025. This anticipated reduction stems from weaker construction sector demand and restrictions on exports, which will likely escalate the fight for existing market share.

For many standard steel products, differentiation is a tough game. This means companies like Baotou Steel often find themselves battling it out mainly on price, how fast they can deliver, and the quality of their customer service. It's hard to stand out when the core product is largely the same across the board.

The global steel market in 2024 continues to feel the pressure from China's substantial steel output. This oversupply has led to a flood of low-priced Chinese steel exports, intensifying competition worldwide. Consequently, numerous anti-dumping investigations have been launched against Chinese steel products, highlighting the difficulty for companies to differentiate and maintain stable pricing in this environment.

Government Influence & SOE Competition

As a state-owned enterprise, Baotou Steel navigates a landscape shaped by extensive government influence. Policies on production quotas, environmental standards, and industry consolidation directly impact competitive dynamics across the Chinese steel sector. For instance, in 2024, China's steel production remained robust, with the National Bureau of Statistics reporting over 1 billion tonnes produced annually, underscoring the government's role in managing output levels.

These governmental interventions create a unique competitive environment for Baotou Steel and its rivals. Directives can favor or constrain specific companies, altering market share and profitability. The ongoing push for green steel production, for example, means companies investing in cleaner technologies may gain an advantage, while those slower to adapt face increased regulatory pressure.

- Government Policies: Production quotas and environmental regulations are key drivers of competition.

- SOE Advantages: State-owned enterprises may benefit from preferential policies or access to capital.

- Industry Restructuring: Government-led consolidation can reshape the competitive landscape.

- Market Impact: Policy changes directly influence pricing, output, and investment decisions for all steel producers.

Geographic Competition

Baotou Steel's regional advantage in Inner Mongolia is challenged by a broader competitive landscape. Major domestic steel producers across China, along with international manufacturers, exert significant pressure. This is especially true for commodity steel products where transportation costs are less of a barrier, leading to intense price competition.

The global steel market in 2024 saw continued overcapacity in certain segments, further intensifying geographic competition. For instance, while China remains a dominant producer, countries like India and Vietnam have been increasing their steel output, creating additional supply that impacts global pricing. Baotou Steel must navigate these international dynamics, particularly as export markets become crucial for absorbing excess production.

- Domestic Rivals: Competition from large Chinese steel enterprises such as Ansteel Group and HBIS Group, which also have significant production capacities and established distribution networks.

- International Market Dynamics: The influence of global steel prices, trade policies, and production levels in other major steel-producing nations on Baotou Steel's export opportunities and domestic market share.

- Product Segmentation: The impact of competition on different steel product types, with lower-value, high-volume items facing the most direct pressure from geographically dispersed producers.

- Logistical Factors: While Baotou Steel benefits from its location for certain regional markets, the overall cost-effectiveness of transporting steel products across vast distances remains a key competitive consideration.

Competitive rivalry within China's steel sector is fierce, driven by significant overcapacity and a fragmented market structure. Baotou Steel faces intense pressure from numerous domestic competitors, including large state-owned enterprises and emerging private players, all vying for market share. This rivalry is exacerbated by global market dynamics, where Chinese steel exports, often priced competitively due to oversupply, face scrutiny and anti-dumping measures.

The Chinese steel industry's output remains substantial, with over 1 billion tonnes produced annually in 2024, a figure that underscores the competitive intensity. This environment forces companies like Baotou Steel to compete on price, delivery speed, and customer service, as product differentiation for many standard steel products is challenging.

Government policies, such as production quotas and environmental regulations, play a crucial role in shaping the competitive landscape. These interventions can create advantages for some firms while constraining others, directly impacting market share and profitability for all participants, including Baotou Steel.

The global market in 2024 saw growing competition not only from China but also from emerging steel producers in countries like India and Vietnam, adding further pressure on pricing and export opportunities for Baotou Steel.

| Competitor Type | Key Characteristics | Impact on Baotou Steel | 2024 Market Context |

|---|---|---|---|

| Large Chinese SOEs | Significant production capacity, established distribution networks, potential government support | Direct competition for domestic market share and export opportunities | Continued dominance in output, facing consolidation pressures |

| Private Chinese Steel Producers | Agile operations, focus on niche markets, increasing market share | Intensified price competition, innovation in product offerings | Growing influence, particularly in specialized steel products |

| International Steel Producers | Varying production costs, trade policies, regional market focus | Competition in export markets, influence on global pricing benchmarks | Increased output from countries like India and Vietnam impacting global supply |

SSubstitutes Threaten

The construction industry, a primary consumer of Baotou Steel's products, is increasingly seeing demand shift towards alternative materials. Innovations in reinforced wood, advanced plastics like 2DPA-1, and bio-based options such as hemp rebar are gaining traction. These materials often boast superior sustainability profiles and competitive performance metrics, directly challenging steel's traditional role.

The automotive industry's shift towards lightweight materials presents a substantial threat to traditional steel producers like Baotou Steel. Advanced aluminum alloys, carbon fiber composites, and high-strength plastics are gaining traction, driven by the need for improved fuel economy and reduced environmental impact. For instance, by 2024, many major automakers are targeting significant increases in the use of aluminum and composites in their vehicle bodies.

In the machinery manufacturing and industrial sectors, plastics, ceramics, and advanced composites are increasingly posing a threat to traditional steel usage. These alternative materials often offer superior properties like reduced weight, enhanced corrosion resistance, and specialized performance characteristics that steel cannot match. For instance, by 2024, the global advanced composites market was projected to reach over $17 billion, demonstrating significant growth and adoption across various industries.

Cost-Benefit Analysis of Substitutes

The threat of substitutes for steel, particularly for Inner Mongolia Baotou Steel, is largely determined by the cost-effectiveness, performance advantages, and processing simplicity of alternative materials. While steel offers robust structural integrity, emerging substitutes are gaining traction by addressing specific limitations.

Fiber Reinforced Polymer (FRP), for example, presents a compelling long-term value proposition. Despite a higher upfront cost, its reduced maintenance needs, corrosion resistance, and lighter weight can translate to significant savings over the product lifecycle. In 2024, the global FRP market was valued at approximately $50 billion, with growth driven by demand in construction and infrastructure projects seeking durable and low-maintenance solutions.

- Cost-Effectiveness: While initial FRP prices can be higher, lifecycle cost analysis often favors it due to reduced maintenance and longer lifespan.

- Performance Benefits: FRP offers superior corrosion resistance and is significantly lighter than steel, impacting transportation and installation costs.

- Ease of Processing: Advancements in FRP manufacturing are making it increasingly competitive in terms of fabrication and integration into existing structures.

- Market Trends: The increasing focus on sustainability and reduced lifecycle costs in construction projects in 2024 continues to bolster the adoption of materials like FRP as viable steel substitutes.

Innovation in Steel Production

Inner Mongolia Baotou Steel's proactive approach to innovation, particularly in developing advanced high-strength steels and specialized alloys, directly addresses the threat of substitutes. By strategically investing in research and development, the company aims to create steel products with performance characteristics that are challenging for alternative materials to replicate.

For instance, Baotou Steel's leverage of its significant rare earth resources allows for the creation of unique steel compositions. This focus on high-value, differentiated products can reduce customer reliance on less advanced steel grades or entirely different materials.

- R&D Investment: Baotou Steel has consistently allocated resources to R&D, aiming to enhance steel properties.

- Rare Earth Synergy: The company utilizes its rare earth reserves to develop specialized alloys with superior performance.

- Product Differentiation: Innovations focus on creating high-strength and specialized steel grades that are difficult to substitute.

The threat of substitutes for Baotou Steel is significant, driven by innovations in materials across key industries. In construction, advanced plastics and bio-based options like hemp rebar are challenging steel's dominance due to their sustainability and performance. The automotive sector is increasingly adopting aluminum alloys and carbon fiber composites to meet fuel efficiency goals, with automakers targeting higher usage by 2024.

In machinery and industrial applications, plastics, ceramics, and composites offer advantages such as reduced weight and enhanced corrosion resistance, with the global advanced composites market projected to exceed $17 billion by 2024. Fiber Reinforced Polymer (FRP), despite higher initial costs, offers lifecycle savings through reduced maintenance and longer lifespan, with its market valued around $50 billion in 2024.

| Industry | Substitute Material | Key Advantages | 2024 Market Trend/Projection |

|---|---|---|---|

| Construction | Reinforced Wood, Advanced Plastics, Hemp Rebar | Sustainability, Competitive Performance | Growing adoption due to environmental focus |

| Automotive | Aluminum Alloys, Carbon Fiber Composites | Lightweight, Fuel Efficiency, Reduced Emissions | Targeted increase in vehicle body usage by automakers |

| Machinery & Industrial | Plastics, Ceramics, Advanced Composites | Reduced Weight, Corrosion Resistance, Specialized Properties | Global advanced composites market projected >$17 billion |

| General | Fiber Reinforced Polymer (FRP) | Lower Lifecycle Cost, Corrosion Resistance, Lighter Weight | Global FRP market valued ~$50 billion |

Entrants Threaten

The steel industry, including players like Inner Mongolia Baotou Steel, demands enormous upfront capital. Think billions of dollars for blast furnaces, rolling mills, and the necessary infrastructure. This massive financial hurdle significantly deters potential new competitors from even entering the market.

The Chinese government's strict environmental regulations and production quotas present a significant barrier to entry for new steel producers. These compliance costs, coupled with a government directive that prohibited new coal-based steelmaking projects in the first half of 2024, effectively curb conventional expansion and new entrants aiming for green transformation.

Established players like Inner Mongolia Baotou Steel benefit from secured access to essential raw materials, such as iron ore and coking coal, and unique rare earth deposits. In 2023, China's iron ore production reached approximately 1.12 billion tonnes, with major players having long-term supply contracts. New entrants would face significant hurdles and substantial upfront investment to replicate these established supply chains and distribution networks, making market entry costly.

Economies of Scale

Existing large-scale steel producers, like those in Inner Mongolia, benefit from significant economies of scale. This means they can produce steel at a much lower cost per ton than smaller operations. For instance, in 2023, major steelmakers often operated plants with capacities exceeding 10 million tons per year, allowing them to spread fixed costs over a vast output.

New entrants would find it incredibly difficult to match these cost efficiencies. To achieve comparable per-unit costs, a new player would need to invest heavily in massive production facilities and secure substantial market share from the outset, a daunting task given the entrenched positions of established players.

- Economies of Scale: Existing large players in Baotou benefit from lower per-unit costs due to high production volumes.

- High Initial Investment: New entrants require massive capital to build plants capable of achieving competitive scale.

- Cost Disadvantage: Smaller-scale new entrants would face a significant cost disadvantage against established giants.

- Market Penetration Challenge: Achieving the necessary production volume for scale economies demands overcoming existing market dominance.

Brand Loyalty & Customer Relationships

While steel might seem like a basic commodity, the reality for companies like Baotou Steel is that deep-seated brand loyalty and strong customer relationships create significant barriers. Years of demonstrated reliability and robust technical support build trust, making it tough for newcomers to lure away established clients. In 2024, for instance, major steel purchasers often renew contracts based on proven performance rather than solely on price, especially for specialized steel grades.

This loyalty means new entrants face an uphill battle. They would need a truly disruptive value proposition or a considerable cost advantage to even begin chipping away at the market share held by incumbents. For example, a new competitor might need to offer a 10-15% price reduction on comparable steel products to attract significant attention from large industrial buyers who prioritize consistent quality and supply chain stability.

- Customer Loyalty: Established steel producers benefit from long-term relationships built on trust and consistent delivery.

- Technical Support: Comprehensive after-sales service and application-specific expertise are key differentiators that new entrants struggle to replicate quickly.

- Reliability: For critical infrastructure and manufacturing, the perceived risk of a new, unproven supplier can outweigh potential cost savings.

- Market Share Barriers: Gaining traction requires either a substantial price undercut or a highly specialized product that existing players do not offer.

The threat of new entrants in the steel industry, impacting Inner Mongolia Baotou Steel, is generally low due to substantial barriers. These include immense capital requirements for facilities, stringent government regulations and production quotas, and the difficulty in securing raw material supply chains. Established players also benefit from economies of scale and strong customer loyalty, making market penetration challenging for newcomers.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

| Capital Requirements | Building a competitive steel plant requires billions of dollars. | Very High | Typical modern integrated steel plant costs range from $5 billion to $15 billion+. |

| Government Regulations | Environmental compliance and production limits are strict. | High | China's 2024 restrictions on new coal-based steelmaking projects. |

| Economies of Scale | Large producers have lower per-unit costs. | High | Major Chinese steelmakers in 2023 operated plants with capacities >10 million tons/year. |

| Raw Material Access | Securing iron ore and coal is critical and difficult for new players. | High | China's 2023 iron ore production was ~1.12 billion tonnes, with established supply contracts. |

| Customer Loyalty | Existing relationships are based on reliability and technical support. | Moderate to High | Large industrial buyers in 2024 often renew contracts based on proven performance. |

Porter's Five Forces Analysis Data Sources

Our Inner Mongolia Baotou Steel Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Baotou Steel's annual reports, industry-specific research from organizations like Mysteel and CRU Group, and government economic data from China.