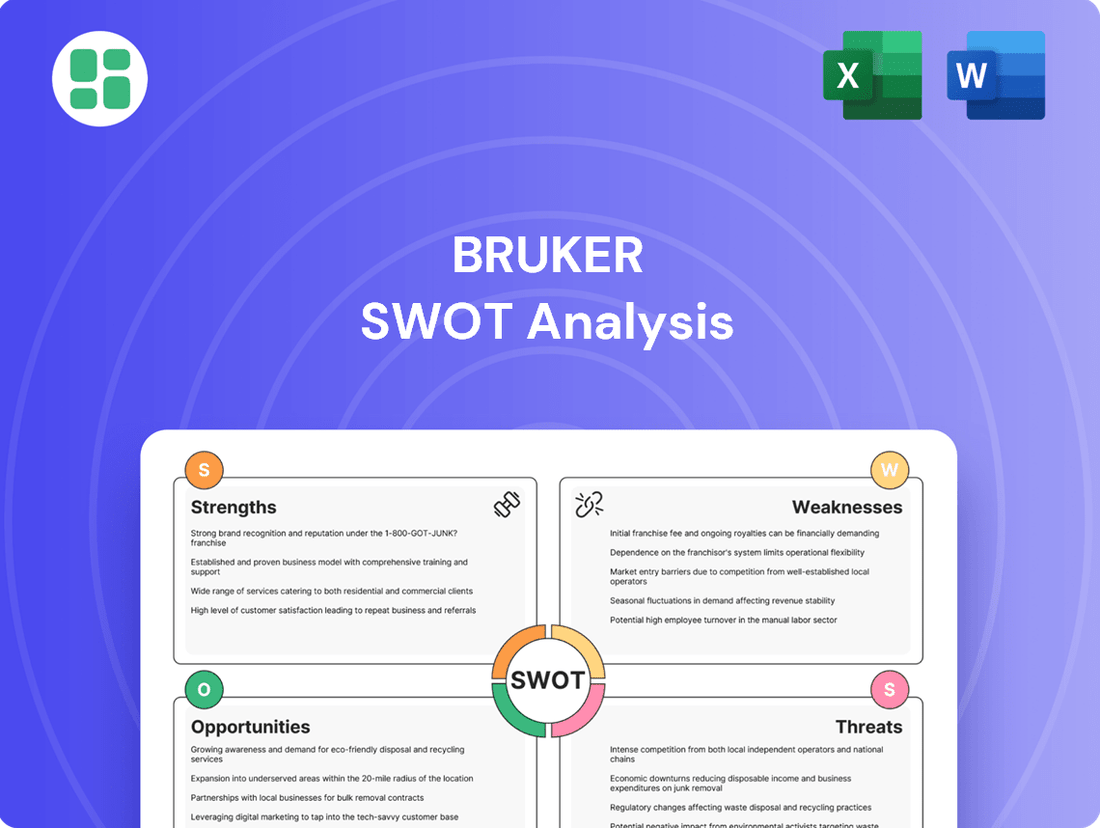

Bruker SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bruker Bundle

Bruker's innovative technology and strong R&D pipeline are clear strengths, but market competition and regulatory hurdles present significant challenges. Understanding these dynamics is crucial for any investor or strategist.

Discover the complete picture behind Bruker's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Bruker boasts an impressive and diverse technology portfolio, encompassing high-performance scientific instruments like NMR, mass spectrometry, X-ray, and atomic force microscopy. This broad and specialized technological foundation enables Bruker to address a wide array of research and analytical requirements across numerous scientific fields, solidifying its position as a leader in high-value analytical technologies.

The company's commitment to continuous innovation is evident with recent advancements, including the introduction of the timsOmni™ mass spectrometer and the Fourier 80 multinuclear benchtop FT-NMR spectrometer in 2025. These developments further enhance Bruker's technological advantage and market competitiveness.

Bruker boasts over 55 years of industry experience, solidifying its position as a market leader in high-value analytical technologies. Its brand is synonymous with innovation, quality, and cutting-edge solutions, especially within the life sciences and applied markets. This deep-rooted reputation fosters significant customer loyalty and provides a robust competitive edge.

Bruker's dedication to research and development is a significant strength, consistently channeling around 11% of its revenue back into innovation. This substantial investment fuels a continuous stream of cutting-edge products and solutions. For instance, the launch of the timsTOF Ultra 2 and the neofleX™ MALDI-TOF mass spectrometry imaging system in 2024 highlights this commitment.

Strategic Acquisitions Expanding Market Reach

Bruker's strategic acquisitions in 2024 and 2025 have significantly broadened its market reach. The integration of ELITechGroup, NanoString, and Chemspeed bolstered its presence in high-growth areas like molecular diagnostics, spatial biology, and laboratory automation.

These moves have unlocked access to substantial addressable markets characterized by strong, long-term growth trends. For instance, the spatial biology market, significantly enhanced by the NanoString acquisition, is projected to grow substantially in the coming years, offering considerable revenue potential.

The company's diversified portfolio, a direct result of these strategic additions, now caters to a wider array of scientific and clinical needs. This diversification not only mitigates risk but also positions Bruker to capitalize on emerging opportunities across multiple life science segments.

- Market Expansion: Acquisitions like ELITechGroup and NanoString have opened doors to new, rapidly expanding markets.

- Capability Enhancement: The company has strengthened its offerings in molecular diagnostics, spatial biology, and lab automation.

- Revenue Growth Driver: These strategic integrations are expected to contribute significantly to Bruker's revenue in the 2024-2025 period and beyond.

- Portfolio Diversification: Bruker's product and service portfolio is now more robust and less reliant on single market segments.

Resilience in Key Growth Segments

Bruker's CALID Group, a significant contributor to its life science and diagnostics offerings, has shown remarkable resilience. In the first half of 2025, this segment achieved strong revenue growth, outpacing broader market headwinds. This performance underscores the company's strategic positioning in areas with consistent demand.

The CALID Group's success is largely attributable to its microbiology and infection diagnostics businesses. Key drivers include the continued strong adoption of its MALDI Biotyper system and the robust performance of its ELITech Molecular Diagnostics portfolio. These product lines are vital in addressing critical healthcare needs.

- CALID Group revenue growth in H1 2025.

- MALDI Biotyper's contribution to microbiology diagnostics.

- ELITech Molecular Diagnostics' impact on infection diagnostics.

- Demonstrated ability to leverage stable demand areas.

Bruker's extensive and varied technology portfolio, including NMR, mass spectrometry, and X-ray technologies, positions it as a leader in high-value analytical solutions. Recent product launches like the timsOmni™ mass spectrometer and Fourier 80 FT-NMR spectrometer in 2025 underscore its commitment to innovation and market competitiveness.

The company's strategic acquisitions of ELITechGroup, NanoString, and Chemspeed in 2024-2025 have significantly expanded its market reach into high-growth areas such as molecular diagnostics and spatial biology. These integrations are expected to drive substantial revenue growth and diversify its offerings across multiple life science segments.

Bruker's CALID Group demonstrated strong performance in the first half of 2025, with its microbiology and infection diagnostics businesses, particularly the MALDI Biotyper and ELITech Molecular Diagnostics portfolios, showing robust growth. This highlights the company's ability to capitalize on areas with consistent demand.

| Strength | Description | Supporting Data/Examples |

| Diverse Technology Portfolio | Broad range of high-performance scientific instruments. | NMR, mass spectrometry, X-ray, atomic force microscopy. |

| Continuous Innovation | Ongoing development of cutting-edge products. | timsOmni™ mass spectrometer and Fourier 80 FT-NMR spectrometer (2025). |

| Strategic Acquisitions | Expansion into new and growing markets. | ELITechGroup, NanoString, Chemspeed acquisitions (2024-2025). |

| Strong CALID Group Performance | Resilience and growth in life science and diagnostics. | Strong revenue growth in H1 2025; MALDI Biotyper and ELITech Molecular Diagnostics success. |

What is included in the product

Provides a comprehensive assessment of Bruker's internal strengths and weaknesses alongside external opportunities and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

Bruker's reliance on academic and government research funding presents a notable weakness. For instance, the company has cited uncertainty in U.S. academic funding as a factor affecting its performance. This dependence means that shifts in governmental research budgets or priorities can directly impact Bruker's sales pipeline and revenue streams, creating a degree of unpredictability in its financial results.

Further compounding this vulnerability, delays in stimulus packages for high-end research instrumentation in key markets like China can also dampen demand. Such external funding dynamics, outside of Bruker's direct control, can lead to significant volatility in the company's bookings and overall financial performance, making forecasting more challenging.

Bruker's growth is susceptible to the ripple effects of global tariffs and persistent geopolitical friction, especially concerning U.S.-China relations. These trade barriers and political uncertainties translate into higher operating expenses and can stall crucial investments in vital sectors like biopharma and industrial research equipment.

This environment directly pressures Bruker's ability to achieve robust organic revenue growth and maintain healthy operating margins. For instance, in Q1 2024, while Bruker reported a 2.5% increase in net sales to $620.4 million, the broader economic climate, influenced by these tensions, presents a significant headwind to sustained expansion in key markets.

Bruker is facing challenges with its organic revenue growth. For instance, the second quarter of 2025 saw a 7.0% organic decline. The company’s outlook for the full fiscal year 2025 anticipates a further organic decline, projected to be between 2% and 4%.

This slowdown in organic growth, combined with anticipated margin pressures, is impacting profitability. Factors such as strategic acquisitions, the effects of tariffs, and foreign exchange fluctuations are contributing to a decrease in non-GAAP operating margin and earnings per share (EPS).

High Initial Costs of Instruments and Maintenance

Bruker's sophisticated scientific instruments, while cutting-edge, present a significant hurdle due to their high initial purchase prices. This can be a major deterrent for smaller research institutions or those operating with limited financial resources, particularly in emerging markets. For instance, a state-of-the-art mass spectrometer could easily run into hundreds of thousands of dollars.

Beyond the acquisition, the ongoing maintenance and service contracts for these complex systems add substantial recurring expenses. These costs can strain budgets, making it difficult for some organizations to fully leverage Bruker's advanced technology. This financial barrier can restrict market penetration for their most advanced offerings.

- High Capital Outlay: Many of Bruker's core technologies, such as advanced NMR or mass spectrometry systems, require initial investments that can exceed $500,000, impacting accessibility for smaller entities.

- Ongoing Maintenance Expenses: Annual service and maintenance agreements for these instruments can represent 5-10% of the initial purchase price, adding significant operational overhead.

- Limited Market Access: Budgetary constraints in certain academic departments or developing regions can limit the adoption of Bruker's high-end solutions, potentially capping market share growth.

Intense Competition in the Analytical Instrumentation Market

Bruker faces significant challenges from well-established players such as Thermo Fisher Scientific, which boasts a broader product portfolio and extensive market reach. This intense rivalry, characterized by competitors offering comparable analytical instrumentation and services, directly affects Bruker's ability to capture market share and maintain pricing flexibility. The need to constantly innovate and adapt to competitive offerings places pressure on Bruker's revenue growth and profitability.

The analytical instrumentation sector is crowded with both large, diversified companies and niche specialists, creating a dynamic and demanding environment. For instance, in 2024, the global analytical instruments market was valued at approximately $65 billion, with significant growth driven by research and development across various industries. This competitive landscape means Bruker must continually invest in R&D to stay ahead, as rivals often introduce similar technologies, potentially eroding Bruker's competitive edge.

- Market Saturation: Many segments of the analytical instrumentation market are mature, leading to intense price competition.

- Technological Parity: Competitors frequently develop comparable technologies, diminishing the impact of unique product features.

- Acquisition Strategies: Larger competitors can acquire smaller, innovative companies, quickly integrating new technologies and expanding their offerings.

- Customer Loyalty: While customer loyalty exists, it can be challenged by aggressive pricing or superior bundled solutions from competitors.

Bruker's dependence on government and academic funding creates a vulnerability, as shifts in research budgets can impact sales. For example, uncertainty in U.S. academic funding has been cited by the company as a performance factor. Delays in stimulus packages for research instrumentation in markets like China also dampen demand, leading to revenue volatility.

The company's organic revenue growth has faced headwinds, with a reported 7.0% organic decline in Q2 2025. The full fiscal year 2025 outlook projects a further organic decline of 2% to 4%. This slowdown, coupled with anticipated margin pressures from factors like tariffs and foreign exchange, is impacting profitability and EPS.

The high cost of Bruker's sophisticated instruments, often exceeding $500,000 for systems like advanced mass spectrometers, limits accessibility for smaller institutions. Additionally, annual maintenance and service contracts, typically 5-10% of the initial purchase price, add significant recurring expenses, potentially capping market share growth in budget-constrained regions.

Bruker operates in a highly competitive analytical instrumentation market, estimated at $65 billion in 2024. Established players like Thermo Fisher Scientific offer broader portfolios and extensive reach. This intense rivalry, with competitors frequently introducing comparable technologies, pressures Bruker's ability to grow revenue and maintain pricing flexibility.

Preview the Actual Deliverable

Bruker SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're getting a genuine glimpse into the comprehensive SWOT analysis for Bruker. Once purchased, you'll unlock the entire, detailed report.

Opportunities

The life sciences and biotechnology sectors are booming, with a significant increase in the need for sophisticated tools. This surge is fueled by advancements in areas like genomics, proteomics, and molecular diagnostics, creating a fertile ground for companies like Bruker.

Bruker is well-positioned to benefit from this expansion, particularly as precision-medicine assays and next-generation sequencing technologies continue to gain traction. The company’s AI-driven laboratory automation solutions further enhance its appeal in this rapidly evolving market.

In 2024, the global life science tools market was projected to reach approximately $100 billion, with a compound annual growth rate (CAGR) expected to exceed 7% through 2029, according to industry reports.

Bruker can significantly broaden its reach by targeting emerging markets, with the Asia-Pacific region showing immense promise. This area is anticipated to be the leading growth engine for scientific instrumentation in the coming years.

Substantial government funding for biotechnology initiatives and infrastructure development in key Asian economies like China, India, South Korea, and Singapore offers a fertile ground for Bruker's expansion. These investments are creating a robust demand for advanced scientific tools.

The life science and diagnostics industries are increasingly seeking integrated instrument, software, and service packages to streamline workflows. This trend is fueled by advancements in areas like advanced microscopy, gene editing, and next-generation sequencing (NGS), creating a significant opportunity for companies offering comprehensive solutions. Bruker is well-positioned to capitalize on this by further embedding AI and automation into its existing and future platforms.

By integrating AI and automation, Bruker can significantly boost the effectiveness and accuracy of data analysis across its product lines. This not only enhances the value proposition for customers by providing more precise and actionable insights but also allows Bruker to offer more holistic, end-to-end solutions that address complex research and diagnostic challenges. For instance, in 2023, Bruker reported strong growth in its Life Science division, with revenue increasing by 10% year-over-year, indicating a positive market reception to its integrated offerings.

Strategic Acquisitions and Partnerships for Portfolio Enhancement

Bruker's robust financial health, evidenced by its consistent revenue growth and strong cash flow generation, positions it advantageously for strategic acquisitions. Recent moves, such as the acquisition of Canopy Biosciences in spatial biology and the expansion into molecular diagnostics, highlight this strategy. These acquisitions are designed to bolster its existing portfolio and tap into emerging, high-growth market segments. The company's commitment to inorganic growth is a key opportunity for expanding its technological capabilities and market penetration.

Furthermore, Bruker can leverage strategic partnerships to accelerate its innovation and market access. Collaborations can provide entry into new geographic regions or application areas, complementing its organic growth initiatives. These alliances can also de-risk the development of new technologies and speed up their commercialization, ensuring Bruker remains at the forefront of scientific instrumentation.

- Strategic Acquisitions: Bruker's strong balance sheet supports targeted acquisitions to expand its product lines in areas like molecular diagnostics and spatial biology, a trend observed in its recent investment activities.

- Partnership Acceleration: Collaborations can unlock new distribution channels and expedite entry into rapidly expanding markets, enhancing market share and revenue streams.

- Portfolio Enhancement: By integrating acquired technologies and fostering strategic alliances, Bruker can offer more comprehensive solutions to its diverse customer base.

- Market Reach Expansion: Acquisitions and partnerships are crucial for broadening Bruker's global footprint and strengthening its competitive position in key scientific research and clinical markets.

Increased Focus on Clinical Diagnostics and Personalized Healthcare

The healthcare sector is experiencing robust growth, driven by a global push towards personalized medicine and early disease detection. This trend significantly benefits companies like Bruker, whose advanced analytical and diagnostic solutions are critical for identifying illnesses and tailoring treatments. The increasing prevalence of chronic diseases worldwide further amplifies the demand for these sophisticated diagnostic tools.

Bruker's offerings are perfectly positioned to capitalize on this expanding market. For instance, the global in-vitro diagnostics market was valued at approximately $82.6 billion in 2023 and is projected to reach over $130 billion by 2030, demonstrating substantial growth. This expansion is fueled by advancements in areas like mass spectrometry and molecular diagnostics, where Bruker holds a strong presence.

- Growing Demand for Early Disease Detection: As healthcare shifts towards preventative measures, the need for precise and rapid diagnostic tools increases.

- Advancements in Personalized Medicine: Bruker's technologies support the development of targeted therapies by enabling detailed molecular analysis of patient samples.

- Rising Chronic Disease Burden: The increasing incidence of conditions like cancer and diabetes necessitates sophisticated diagnostic solutions for effective management and monitoring.

- Technological Integration: Bruker's ability to integrate various analytical techniques provides comprehensive insights crucial for complex diagnostic challenges.

Bruker is poised to capitalize on the burgeoning demand for advanced life science tools, particularly with the global life science tools market projected to exceed $100 billion in 2024 and grow at over 7% annually through 2029. The company's strategic focus on AI-driven automation and integrated solutions aligns perfectly with market trends favoring precision medicine and next-generation sequencing. Furthermore, the significant government investment in biotechnology infrastructure across Asia-Pacific presents a substantial opportunity for market expansion, with this region expected to lead growth in scientific instrumentation. Bruker's ability to integrate AI and automation into its platforms enhances data analysis and offers end-to-end solutions, as evidenced by its Life Science division's 10% year-over-year revenue growth in 2023.

Bruker's financial strength supports strategic acquisitions, such as its recent moves into spatial biology and molecular diagnostics, which bolster its portfolio and tap into high-growth segments. These inorganic growth strategies, coupled with potential partnerships, are key to expanding technological capabilities and market penetration. The healthcare sector's increasing reliance on early disease detection and personalized medicine further amplifies the demand for Bruker's advanced analytical and diagnostic solutions, a market valued at approximately $82.6 billion in 2023 for in-vitro diagnostics alone.

| Opportunity | Key Drivers | Bruker's Position | Market Data (2023/2024 Estimates) |

| Growth in Life Sciences & Biotechnology | Genomics, proteomics, molecular diagnostics, precision medicine | AI-driven automation, integrated solutions, strong portfolio | Life Science Tools Market: ~$100 billion (2024), 7%+ CAGR through 2029 |

| Emerging Markets Expansion | Government funding for biotech, infrastructure development | Targeting Asia-Pacific growth engine | Asia-Pacific leading growth for scientific instrumentation |

| Healthcare Sector Demand | Early disease detection, personalized medicine, chronic disease management | Mass spectrometry, molecular diagnostics expertise | In-Vitro Diagnostics Market: ~$82.6 billion (2023) |

| Strategic Acquisitions & Partnerships | Portfolio expansion, new market access, technology integration | Strong balance sheet, history of strategic investments | Consistent revenue growth and cash flow generation |

Threats

Global economic uncertainties, including the persistent threat of recession, cast a long shadow over sectors crucial to Bruker's revenue. Academic institutions, biopharmaceutical companies, and government research agencies, all significant customers, are likely to tighten their belts, leading to reduced spending on high-value scientific instruments. This directly translates to lower bookings and revenue streams for Bruker.

Bruker operates in a highly competitive environment, facing strong rivals like Thermo Fisher Scientific, Agilent Technologies, and Danaher Corporation. These companies offer extensive product ranges and vie for market share across multiple scientific instrument segments.

This intense rivalry often translates into significant pricing pressures, which can directly affect Bruker's profit margins and its ability to grow its market presence. For instance, in the life science research tools market, where Bruker is a key player, price competition is a constant factor influencing purchasing decisions.

Ongoing global supply chain fragilities continue to pose a significant threat, with inflationary pressures driving up manufacturing costs for Bruker. For instance, the semiconductor shortage experienced throughout 2023 and into early 2024 has impacted the availability of critical components for complex scientific instruments, potentially delaying production schedules.

These disruptions can directly affect Bruker's operational efficiency and gross margins. Higher input costs, coupled with potential shipping delays, squeeze profitability and can hinder the company's ability to meet robust customer demand, thereby impacting overall financial performance in the 2024-2025 period.

Rapid Technological Obsolescence and Need for Continuous Innovation

The scientific instrument market is a hotbed of innovation, meaning Bruker faces constant pressure to upgrade its offerings. For instance, advancements in artificial intelligence and machine learning are rapidly changing analytical capabilities, requiring significant R&D investment to integrate these into new instruments.

Bruker's ability to consistently launch next-generation products is crucial for maintaining its edge. A failure to keep pace with these technological shifts, such as the increasing demand for portable and miniaturized analytical devices, could see its current product lines become outdated quickly.

- Market Volatility: The pace of technological change in scientific instrumentation can render existing products obsolete within a few years, demanding substantial and ongoing R&D expenditures.

- Competitive Landscape: Competitors are also investing heavily in new technologies, potentially leapfrogging Bruker if its innovation pipeline falters.

- Customer Expectations: End-users in research and industry expect continuous improvements in sensitivity, speed, and data analysis capabilities, making incremental updates insufficient.

Regulatory Changes and Policy Headwinds

Regulatory shifts, like increased FDA scrutiny on laboratory-developed tests, present a significant threat by potentially increasing compliance burdens and costs. Policy changes, such as unexpected tariff announcements, can directly impact Bruker's operational expenses and influence market demand for its products.

Bruker itself acknowledged these challenges, citing U.S. policy adjustments and tariff headwinds as contributing factors to its adjusted FY 2025 financial outlook. These external policy factors can create uncertainty and necessitate strategic adjustments to mitigate financial impacts.

- Increased Compliance Costs: Stricter regulations, particularly in areas like diagnostics, can lead to higher R&D and operational expenses for Bruker.

- Market Access Barriers: Policy changes could potentially affect international market access or increase the cost of goods sold through tariffs.

- Uncertainty in Financial Planning: The dynamic nature of regulatory and policy environments makes long-term financial forecasting more challenging.

Bruker faces intense competition from established players like Thermo Fisher Scientific and Agilent Technologies, who also invest heavily in innovation and market expansion. This rivalry can lead to pricing pressures, impacting profit margins, especially in dynamic segments like life science research tools. Furthermore, the rapid pace of technological advancement necessitates continuous, substantial R&D investment to prevent product obsolescence and meet evolving customer demands for higher sensitivity and speed.

| Threat Category | Specific Threat | Impact on Bruker (2024-2025 Outlook) |

|---|---|---|

| Economic Uncertainty | Reduced customer spending (academic, biopharma) | Lower bookings and revenue |

| Competition | Pricing pressure from rivals | Margin erosion |

| Technological Obsolescence | Need for continuous R&D investment | Increased operational costs, risk of product irrelevance |

| Supply Chain Fragility | Component shortages, inflation | Production delays, higher manufacturing costs |

| Regulatory & Policy Shifts | Increased compliance, tariffs | Higher operating expenses, market access challenges |

SWOT Analysis Data Sources

This Bruker SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry evaluations to ensure a thorough and accurate assessment.