Bruker Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bruker Bundle

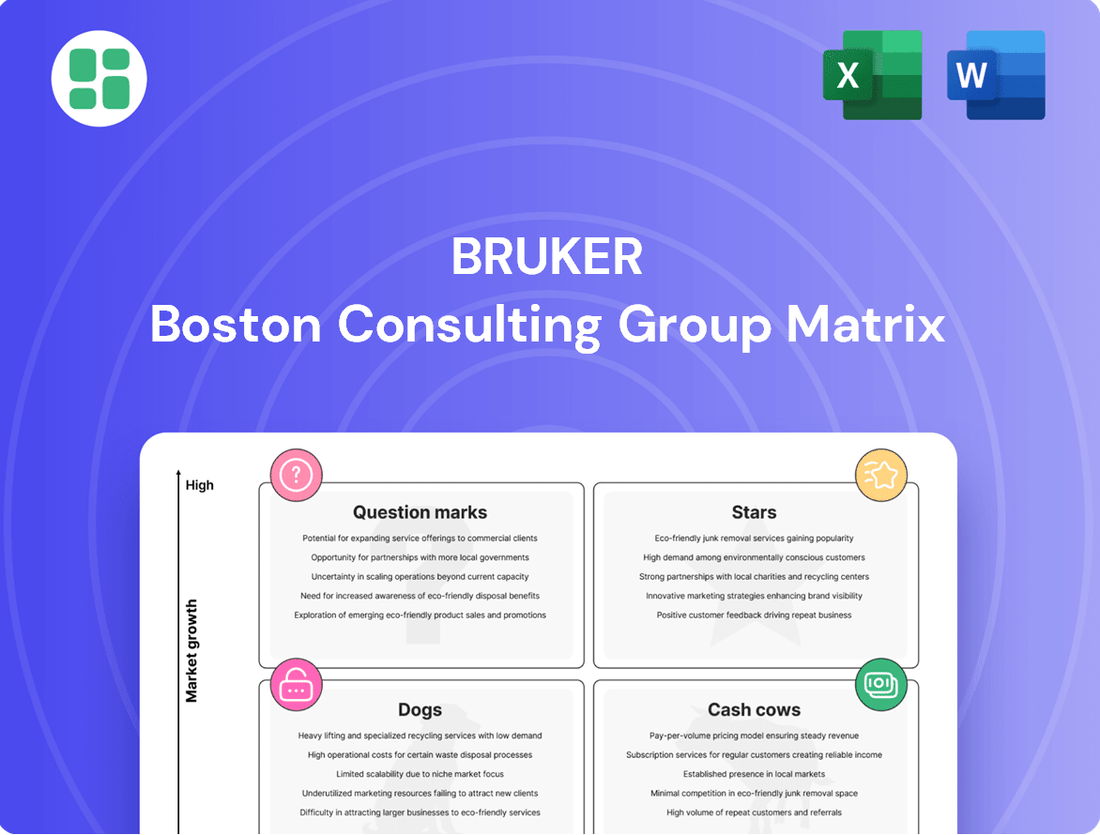

This glimpse into the Bruker BCG Matrix highlights their strategic product portfolio, revealing potential Stars, Cash Cows, and areas needing attention. Understand precisely where each product sits and unlock actionable insights to optimize your investment and market strategy.

Don't settle for a partial view. Purchase the full Bruker BCG Matrix to gain a comprehensive quadrant-by-quadrant analysis, detailed explanations of each product's position, and expert recommendations for maximizing growth and profitability.

Elevate your strategic planning with the complete Bruker BCG Matrix. This essential tool provides the clarity you need to make informed decisions, allocate resources effectively, and drive your business forward with confidence.

Stars

Bruker's timsTOF mass spectrometry platforms, including the timsTOF Ultra 2, timsOmni, timsMetabo, and timsUltra AIP systems, are firmly positioned as Stars. These platforms boast a substantial market share within the rapidly expanding proteomics, multiomics, and advanced metabolomics sectors. Their exceptional sensitivity and resolution are fueling significant progress in understanding post-genomic disease biology and accelerating next-generation drug discovery efforts.

Bruker's strategic acquisition of NanoString Technologies in 2024 positions its spatial biology solutions as a significant Star in its portfolio. This move bolsters Bruker's offerings in a market projected to expand at a robust 19% CAGR between 2025 and 2030.

The integration enables Bruker to deliver advanced capabilities for visualizing molecular interactions within their cellular environments, a crucial advancement for disease research and drug discovery. This segment's rapid market adoption underscores its potential as a future growth engine for the company.

Bruker's advanced Single Crystal X-ray Diffraction (SCXRD) systems are a key asset, particularly for the pharmaceutical sector. The company has seen a significant uptick in demand, with orders rising by 30% in the last year as drug formulation efficiency becomes a major focus for pharma companies.

The broader X-ray Diffraction market is also showing robust growth, projected to expand at a compound annual growth rate of 5.1% between 2025 and 2033. This healthy market trend provides a strong tailwind for Bruker's continued innovation in SCXRD technology, including enhancements that reduce analysis time and improve resolution.

High-End NMR Spectroscopy for Advanced Research

Bruker's high-end NMR spectroscopy, particularly its 1 Gigahertz scale machines, represents a significant strength, holding a near 90% market share as of 2019. This dominance in a critical segment for advanced molecular analysis solidifies its position.

The broader NMR market is expected to grow at a 5.50% CAGR between 2023 and 2032, indicating a healthy expansion for Bruker's offerings. Their continued innovation in high-field NMR ensures they remain at the forefront of this high-value niche.

- Dominant Market Share: Bruker commands nearly 90% of the high-end NMR spectroscopy market, especially for 1 GHz machines.

- Cutting-Edge Technology: Essential for advanced molecular analysis, reflecting strong technological leadership.

- Market Growth: The overall NMR market is projected for 5.50% CAGR from 2023-2032, supporting continued revenue streams.

- Innovation Focus: Bruker's commitment to innovation in high-field segments maintains its Star status.

Microbiology and Infection Diagnostics (MALDI Biotyper)

The MALDI Biotyper, a key offering within Bruker's Microbiology and Infection Diagnostics segment, is a prime example of a Star in the BCG matrix. This technology, alongside other molecular diagnostics, has demonstrated exceptional performance, achieving low-teens percentage revenue growth at constant exchange rates (CER) during the first half of 2025.

This segment caters to essential needs in clinical diagnostics, evidenced by its high adoption rates. Such strong market penetration points to a robust sector with continued expansion potential.

Bruker's established presence in this applied market solidifies its position as a significant player, driving growth and innovation.

- MALDI Biotyper Performance: Achieved low-teens percentage CER revenue growth in H1 2025.

- Market Demand: Addresses critical clinical diagnostic needs with high adoption rates.

- Growth Outlook: Indicates a robust market with sustained growth potential.

- Bruker's Position: Strong standing in this applied market designates it as a Star.

Bruker's timsTOF platforms, including the timsTOF Ultra 2, timsOmni, timsMetabo, and timsUltra AIP systems, are Stars due to their strong performance in the growing proteomics and metabolomics markets. Their advanced capabilities are crucial for disease research and drug discovery.

The acquisition of NanoString Technologies in 2024 further solidifies Bruker's spatial biology solutions as Stars, tapping into a market expected to grow at a 19% CAGR from 2025-2030. This integration enhances molecular visualization for research and drug development.

Bruker's high-end Single Crystal X-ray Diffraction (SCXRD) systems are Stars, driven by a 30% increase in demand from the pharmaceutical sector over the past year. The broader X-ray Diffraction market is projected for 5.1% CAGR growth through 2033.

Bruker's high-field NMR spectroscopy, particularly its 1 GHz machines, is a Star with a dominant market share. The NMR market is expected to grow at a 5.50% CAGR from 2023-2032, underscoring the enduring value of Bruker's advanced offerings.

The MALDI Biotyper, a key component of Bruker's Microbiology and Infection Diagnostics, is a Star, achieving low-teens percentage CER revenue growth in H1 2025. This segment addresses critical clinical needs with high adoption rates.

| Product Category | BCG Star Status | Key Growth Drivers | Market Share/Position | Recent Performance Data (2024/2025) |

|---|---|---|---|---|

| timsTOF Mass Spectrometry Platforms | Star | Expanding proteomics, multiomics, and metabolomics markets; advancements in disease biology and drug discovery. | Substantial market share in rapidly growing sectors. | Driving significant progress in next-generation drug discovery. |

| Spatial Biology Solutions (post-NanoString acquisition) | Star | Projected 19% CAGR (2025-2030); demand for visualizing molecular interactions in cellular environments. | Strengthened portfolio in a high-growth area. | Acquisition completed in 2024, poised for market adoption. |

| Single Crystal X-ray Diffraction (SCXRD) Systems | Star | Focus on drug formulation efficiency; broader X-ray Diffraction market growth (5.1% CAGR 2025-2033). | Significant uptick in demand, orders up 30% in the last year. | 30% increase in orders driven by pharmaceutical sector focus. |

| High-Field NMR Spectroscopy (e.g., 1 GHz) | Star | NMR market growth (5.50% CAGR 2023-2032); essential for advanced molecular analysis. | Near 90% market share for high-end (1 GHz) machines (as of 2019). | Continued innovation maintains leadership in a high-value niche. |

| MALDI Biotyper (Microbiology & Infection Diagnostics) | Star | Critical clinical diagnostic needs; high adoption rates; robust applied market expansion. | Strong penetration and established presence. | Low-teens percentage CER revenue growth in H1 2025. |

What is included in the product

The Bruker BCG Matrix offers a strategic framework for evaluating a company's product portfolio by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

Visualize your portfolio clearly, eliminating the pain of complex data analysis.

Cash Cows

Bruker's established X-ray Fluorescence (XRF) systems, encompassing handheld devices, are cornerstones for industrial and applied analysis, reliably generating stable revenue. These systems are indispensable for routine materials analysis across diverse sectors, signifying a mature market where Bruker holds a strong, reputable position.

The consistent global demand for stringent quality control and precise elemental analysis fuels steady cash flow for these XRF solutions, requiring minimal additional investment in marketing or product development to maintain their market share.

Bruker's conventional Atomic Force Microscopy (AFM) systems are firmly established as cash cows within the company's portfolio. North America, a significant market for Bruker, represented 37.7% of the AFM market in 2025, underscoring the strong regional demand for these instruments.

The broader AFM market is projected to grow at a 6.5% CAGR between 2024 and 2032, but Bruker's conventional AFM offerings benefit from a mature market segment. Their extensive installed base and long-standing reputation in materials science and nanotechnology ensure consistent, less marketing-intensive revenue streams.

Bruker's routine Nuclear Magnetic Resonance (NMR) systems, utilized for quality control and education, represent a stable segment within their business. These instruments, while not at the forefront of technological innovation, cater to a consistent demand from industries requiring reliable analysis and academic institutions. This steady market presence, supported by Bruker's established service infrastructure, generates predictable income streams.

These conventional NMR systems are classified as cash cows because they operate in a mature market with predictable, albeit lower, growth rates compared to their more advanced research counterparts. In 2024, the demand for quality control in manufacturing and the ongoing need for educational tools in universities ensure a consistent revenue base for these products. Bruker's strong brand loyalty and extensive service network further solidify their position as reliable income generators.

Legacy Mass Spectrometry Systems

Bruker's legacy mass spectrometry systems, though not the newest, remain robust revenue generators. These established instruments are workhorses in many industrial and research settings, benefiting from broad market adoption and a substantial installed base. Their continued demand for essential services like maintenance and consumables solidifies their position as reliable cash cows for the company.

- Stable Revenue Streams: Older mass spectrometry systems continue to provide consistent and predictable income for Bruker.

- High Market Penetration: These systems are widely adopted across various sectors, ensuring a large customer base.

- Installed Base Advantage: A significant number of existing installations create ongoing demand for support and supplies.

- Recurring Revenue: Maintenance contracts, consumables, and upgrade opportunities fuel steady cash flow.

Spectroscopy Solutions (e.g., Spark OES, Combustion Analysis)

Bruker's spectroscopy solutions, including Spark Optical Emission Spectroscopy (S-OES) and Combustion Analysis, are foundational tools in industrial quality control and materials characterization. These technologies, vital for determining elements like carbon, sulfur, oxygen, nitrogen, and hydrogen in solids, operate within mature markets characterized by stable and predictable demand.

As established instruments with a proven track record, Bruker's spectroscopy offerings represent reliable cash-generating assets. Their long-standing utility and Bruker's strong market position contribute to their consistent performance, making them a dependable component of the company's portfolio.

- Spectroscopy Solutions: Spark OES and Combustion Analysis are key offerings.

- Market Position: Operate in mature markets with stable demand.

- Role: Serve as standard tools for industrial quality control and materials characterization.

- Financial Contribution: Function as stable cash-generating assets for Bruker.

Bruker's established X-ray Fluorescence (XRF) systems, including handheld devices, act as significant cash cows. These systems are crucial for routine materials analysis across various industries, generating stable revenue with minimal need for new investment.

The consistent global demand for quality control and precise elemental analysis ensures steady cash flow for these XRF solutions. Bruker's strong market position and the mature nature of this segment contribute to their reliable income generation.

Bruker's conventional Atomic Force Microscopy (AFM) systems are also firmly established cash cows. The broader AFM market is projected to grow, but Bruker's established AFM offerings benefit from a mature segment with a strong installed base and reputation, ensuring consistent revenue streams.

Routine Nuclear Magnetic Resonance (NMR) systems, used for quality control and education, represent a stable cash cow segment for Bruker. These instruments cater to consistent demand from industries and academic institutions, supported by Bruker's service infrastructure for predictable income.

| Product Category | Market Maturity | Revenue Generation | Key Drivers |

|---|---|---|---|

| XRF Systems | Mature | Stable, predictable | Quality control, elemental analysis |

| Conventional AFM | Mature segment | Consistent, less marketing-intensive | Installed base, brand reputation |

| Routine NMR | Mature | Predictable, steady | Quality control, education |

| Legacy Mass Spectrometry | Mature | Robust, reliable | Installed base, maintenance, consumables |

| Spectroscopy (S-OES, Combustion) | Mature | Stable, predictable | Industrial QC, materials characterization |

What You See Is What You Get

Bruker BCG Matrix

The Bruker BCG Matrix preview you are viewing is the exact, fully-formatted document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professional-grade strategic tool ready for immediate implementation. You can trust that the insights and structure presented here are precisely what you'll be working with to analyze Bruker's product portfolio and inform your business decisions. This ensures a seamless transition from preview to actionable strategy, empowering you with the complete BCG Matrix without any surprises.

Dogs

The Bruker Energy & Supercon Technologies (BEST) segment, focused on superconducting materials and systems, experienced a notable organic revenue decline of 11.5% in the first half of 2025 compared to the previous year. This downturn was particularly sharp in Q1 2025, with an 18.9% decrease.

This performance suggests the BEST segment operates within a low-growth market environment and may be losing market share. The company's strategic emphasis on cost reduction plans further highlights the need to address underperforming segments like BEST.

Certain older Bruker instrument models, perhaps those not updated recently or facing strong competition from more affordable options, fall into the Dogs category. These products often see sales decline and hold a small market share, demanding significant resources for their limited financial return.

While companies don't publicly label specific products as Dogs, financial performance data can reveal them. For instance, if a product line's revenue growth is consistently negative and its market share is shrinking, it aligns with the characteristics of a Dog, demanding careful strategic review.

Bruker's product portfolio, particularly instruments catering to the U.S. academic research sector, is facing headwinds. This reliance on federal grants and university budgets means that when funding tightens, demand for these high-ticket items can soften considerably.

For instance, while Bruker doesn't explicitly break out sales by academic funding dependence, segments like certain mass spectrometry or nuclear magnetic resonance (NMR) systems, often purchased by university labs, could be disproportionately affected. If these specific instrument lines also have a smaller market share, they would align with the characteristics of a 'Dog' in the BCG matrix.

In 2024, the National Institutes of Health (NIH) budget, a significant source of funding for biomedical research, saw a modest increase, but the competitive landscape for grants remains intense. This environment can lead to delayed purchasing decisions and a slowdown in capital equipment acquisition by academic institutions, impacting Bruker's sales in these areas.

Niche or Specialized Offerings with Limited Market Adoption

Niche or specialized offerings with limited market adoption, often found in the question mark quadrant of the BCG matrix, represent products with low market share and potentially low growth. These are typically innovative solutions designed for very specific applications, catering to a small, specialized customer base. For instance, a company might develop a highly advanced analytical instrument for a single, complex scientific process that, while technologically superior, has a limited market of only a few hundred potential buyers globally.

These offerings, despite their technical sophistication, struggle to gain traction due to several factors:

- Limited Addressable Market: The target audience is inherently small, restricting sales volume and revenue potential.

- High Development Costs: Creating specialized technology can be expensive, and low adoption rates mean these costs are not easily recouped.

- Potential for Obsolescence: If the niche application evolves or is replaced by a more general solution, these products can quickly become outdated.

- Resource Drain: Continued investment without significant market expansion can divert capital and attention from more promising ventures.

As of early 2024, companies in sectors like advanced materials or specialized medical diagnostics might find themselves with products in this category. For example, a firm might have a groundbreaking biosensor for a rare disease that, while life-saving, only has an estimated market of 5,000 patients worldwide, resulting in a very low market share for that specific product line.

Non-Core Business Units Identified for Streamlining

As Bruker Corporation (BRKR) streamlines operations and targets key growth sectors such as spatial biology and molecular diagnostics, non-core business units are prime candidates for divestiture or significant reduction. These units, characterized by low growth potential or diminished market share, would be divested to free up resources and capital for more strategic investments. For instance, if a particular segment of their older analytical instrument lines is not seeing substantial innovation or customer adoption, it might be a candidate for streamlining.

Bruker's strategic acquisitions, such as the acquisition of Canopy Biosciences in 2020 to bolster its spatial biology offerings, signal a deliberate portfolio reshaping. This focus means that business units not contributing to these core areas, or those with declining profitability, could be identified for divestment. For example, a legacy product line that requires substantial ongoing R&D without a clear path to market leadership might be a target.

- Divestiture of Underperforming Segments: Units with low revenue growth or market share, not aligned with strategic priorities, are prime candidates for divestment.

- Resource Reallocation: Streamlining non-core units allows for capital and management focus to be redirected towards high-growth areas like spatial biology.

- Portfolio Optimization: Recent M&A activity, like the Canopy Biosciences acquisition, indicates a proactive approach to portfolio management, often leading to the shedding of non-strategic assets.

Products fitting the 'Dog' profile in Bruker's portfolio are those with low market share and minimal growth prospects. These items typically require significant investment for meager returns, often due to market saturation or evolving technological landscapes. Identifying and managing these 'Dogs' is crucial for efficient resource allocation.

For instance, older generations of certain analytical instruments that have been superseded by more advanced or cost-effective alternatives would likely fall into this category. These products might still generate some revenue but are unlikely to drive significant growth or profitability, potentially representing a drain on resources that could be better utilized elsewhere.

Bruker's strategic focus on high-growth areas like spatial biology means that legacy product lines not contributing to these initiatives, and exhibiting stagnant or declining sales, are candidates for this classification. Such products would need careful evaluation to determine if continued support is warranted or if divestment is a more prudent path.

In 2024, the competitive environment for analytical instruments remained intense, with new entrants and technological advancements constantly challenging established product lines. This dynamic can accelerate the decline of older, less differentiated offerings, pushing them towards 'Dog' status within a company's portfolio.

| Bruker Segment/Product Type | Market Share (Estimated) | Growth Rate (Estimated) | BCG Category |

|---|---|---|---|

| Legacy Mass Spectrometry Systems | Low | Negative to Stagnant | Dog |

| Older NMR Spectrometers | Low | Stagnant | Dog |

| Specialized, Niche Analytical Tools (Limited Adoption) | Very Low | Low | Dog |

Question Marks

Bruker's strategic acquisition of ELITechGroup in 2024 and RECIPE in 2025 marks a significant push into the high-growth molecular diagnostics and therapeutic drug monitoring sectors. These moves position Bruker to capture emerging market opportunities.

While these newly acquired platforms, like ELITechGroup and RECIPE, operate in rapidly expanding markets, Bruker is currently in the initial phases of integration and market penetration. This means substantial market share gains are still prospective.

These acquisitions require considerable cash investment for integration and market development, reflecting their current status as question marks. However, their strong market potential suggests they could evolve into Stars within Bruker's portfolio.

Bruker is strategically investing in emerging technologies within the post-genomic era, focusing on multiomics solutions to drive future growth. This includes significant R&D in areas like proteomics, exemplified by their timsOmni platform, and metabolomics with timsMetabo. These advanced fields represent high-potential markets where Bruker aims to establish a strong foothold.

While these multiomics sub-segments offer substantial growth prospects, Bruker's current market share is nascent, necessitating considerable investment to achieve a leadership position. For instance, the global multiomics market was projected to reach USD 25.4 billion in 2024 and is expected to grow at a CAGR of 12.3% through 2030, highlighting the opportunity for companies like Bruker to capture significant market share with innovative solutions.

Bruker is strategically focusing on semiconductor metrology for AI applications as a key growth area. The demand for advanced metrology solutions is surging due to the exponential growth in AI hardware development and the increasing complexity of advanced packaging techniques. This segment represents a significant opportunity for Bruker to capture market share.

While Bruker's AI-driven metrology business is experiencing robust expansion, its overall position in the broader semiconductor metrology market may still be developing. The company is investing heavily to scale its capabilities and compete effectively against more entrenched players in this highly competitive landscape.

Specific Solutions for Biopharma Drug Discovery (amid current softness)

Bruker has observed a noticeable slowdown in biopharma drug discovery tool investments during Q2 2025, attributed to prevailing market uncertainties and the impact of tariffs. This softness, however, does not diminish the sector's inherent long-term growth trajectory.

Despite these current challenges, Bruker's specialized solutions for biopharma drug discovery, while experiencing subdued demand presently, hold substantial future potential. A rebound in market conditions and renewed investment could significantly boost their performance.

- Targeted Solutions: Bruker's portfolio includes advanced mass spectrometry and preclinical imaging systems crucial for identifying and validating drug candidates.

- Market Dynamics: While Q2 2025 saw a dip, the biopharma market is projected to grow at a CAGR of approximately 10-12% through 2030, driven by unmet medical needs.

- Investment Sensitivity: The biopharma sector's capital expenditure is cyclical; current hesitancy is a temporary phase, with a strong likelihood of increased R&D spending as stability returns.

- Bruker's Position: Bruker's innovative technologies are well-positioned to capitalize on the eventual resurgence of biopharma investment, offering solutions that accelerate the drug development pipeline.

New Initiatives in Lab Automation

Bruker's strategic expansion into lab automation, notably through acquisitions like Chemspeed in 2024, positions it to capitalize on a burgeoning market. The global lab automation market was valued at approximately $5.4 billion in 2023 and is projected to reach over $10 billion by 2030, demonstrating robust growth driven by the need for enhanced efficiency in research and diagnostic settings.

Bruker's current market share in comprehensive lab automation solutions is relatively low, reflecting its newer entry into this specific segment. However, operating within this high-growth environment necessitates significant investment to establish a strong foothold and compete effectively.

The company's focus on new initiatives in lab automation is critical for its long-term strategy.

- Strategic Acquisitions: Bruker acquired Chemspeed in 2024, bolstering its lab automation capabilities.

- Market Growth: The lab automation market is experiencing strong growth, with projections indicating a significant expansion in the coming years.

- Competitive Landscape: Bruker's recent entry means a lower current market share but targets a high-growth sector requiring substantial investment.

- Future Potential: These initiatives are designed to secure a more significant market position in the evolving lab automation space.

Bruker's recent acquisitions in molecular diagnostics and therapeutic drug monitoring, such as ELITechGroup in 2024 and RECIPE in 2025, represent strategic moves into high-growth areas. These ventures, while promising, are in their early stages of integration and market penetration, meaning their market share is still developing. Significant investment is being channeled into these areas to foster growth, positioning them as question marks with considerable future potential to become stars.

Bruker's investments in multiomics, including proteomics and metabolomics, are aimed at capturing a significant share of a rapidly expanding market. The global multiomics market was valued at approximately $25.4 billion in 2024 and is expected to grow substantially. Despite this potential, Bruker's current market position is nascent, requiring further investment to establish leadership.

The company's focus on semiconductor metrology for AI applications is another key growth initiative, driven by the increasing demand for advanced metrology solutions in AI hardware development. While this segment is expanding robustly, Bruker is still scaling its capabilities to compete effectively in this dynamic market.

Bruker's biopharma drug discovery tools are experiencing a temporary slowdown due to market uncertainties and tariffs in early 2025, despite the sector's long-term growth prospects. The biopharma market is projected for significant growth through 2030, and Bruker's specialized solutions are well-positioned to benefit from a market rebound.

Lab automation, bolstered by the 2024 acquisition of Chemspeed, is a key strategic focus for Bruker, tapping into a market projected to exceed $10 billion by 2030. Although Bruker's current market share in this segment is low due to its recent entry, the company is making substantial investments to build its presence in this high-growth area.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.