Bruker PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bruker Bundle

Unlock a strategic advantage with our comprehensive PESTLE analysis of Bruker. Understand the political, economic, social, technological, legal, and environmental forces shaping their market. Equip yourself with critical insights to refine your own business strategy and anticipate future challenges. Download the full report now for actionable intelligence.

Political factors

Government funding for scientific research is a critical driver for Bruker's business, especially in areas like life sciences and clinical diagnostics. For instance, the U.S. National Institutes of Health (NIH) budget, a key source for academic research, faced a projected slowdown in real terms for fiscal year 2024, potentially impacting demand for advanced instrumentation.

Conversely, while China has signaled intentions for stimulus in high-end research equipment, actual deployment and timing remain crucial. Delays in these allocations, as observed in past cycles, can create headwinds for instrument sales in that significant market.

Changes in global trade policies, particularly the imposition of tariffs, directly impact Bruker's cost structure. For instance, tariffs on imported components and raw materials can escalate expenses, potentially squeezing profit margins and forcing price adjustments on their sophisticated scientific instruments. This dynamic creates a significant headwind for companies like Bruker.

Bruker itself acknowledged the impact of tariffs, noting them as a factor affecting its operating margin and overall profitability. In their outlook for 2025, the company specifically cited these trade policy shifts as a challenge they are navigating, underscoring the real-world financial consequences of such global economic adjustments.

Government healthcare policies and regulations, particularly those impacting medical devices and diagnostics, significantly influence Bruker's clinical diagnostics business. For instance, evolving reimbursement policies for diagnostic tests can directly affect revenue streams. The implementation of new regulatory frameworks, such as the EU's In Vitro Diagnostic Regulation (IVDR) and Medical Device Regulation (MDR), presents both compliance challenges and potential avenues for market expansion for companies like Bruker.

Geopolitical Stability

Global geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, can significantly disrupt Bruker's supply chains and impact its international research collaborations. These instabilities create market uncertainty, potentially affecting sales and operational efficiency across its diverse global markets.

Bruker's extensive international footprint, with operations in over 90 countries, makes it particularly susceptible to regional political shifts and trade policy changes. For instance, export control regulations or tariffs imposed by major economies could directly influence the cost and accessibility of Bruker's advanced scientific instruments.

- Supply Chain Vulnerability: The conflict in Ukraine, for example, has led to increased shipping costs and potential material shortages for various industries, which could indirectly affect Bruker's component sourcing.

- Market Access: Geopolitical friction between major trading blocs can lead to trade barriers, impacting Bruker's ability to freely export its high-value scientific equipment to key research hubs.

- Investment Climate: Heightened geopolitical risk can deter investment in research and development by universities and corporations in affected regions, potentially slowing demand for Bruker's analytical and diagnostic solutions.

Intellectual Property Protection

The strength and enforcement of intellectual property (IP) laws are paramount for Bruker, safeguarding its advanced technologies in areas like NMR and mass spectrometry. Countries with robust IP protection allow Bruker to confidently invest in research and development, knowing its innovations are secure. For instance, in 2023, the global IP market continued to grow, with significant investments in patent filings for scientific instruments, reflecting the increasing importance of IP in this sector.

Conversely, weak IP protection poses a substantial risk, potentially leading to unauthorized replication of Bruker's cutting-edge products or the misuse of its patented technologies. This can directly impact market share and profitability. Reports from 2024 indicate that industries relying heavily on technological innovation, such as scientific instrumentation, are particularly vulnerable to IP theft, with estimated global losses in the billions annually.

Bruker's strategy likely involves actively monitoring and adapting to varying IP landscapes worldwide. This includes:

- Securing patents for new technologies in key markets to establish legal protection.

- Monitoring for infringement and pursuing legal action when necessary to defend its IP rights.

- Collaborating with governments and industry bodies to advocate for stronger IP enforcement globally.

- Implementing internal controls to protect proprietary information and trade secrets.

Government funding for scientific research remains a key influencer for Bruker, particularly in life sciences and diagnostics. The U.S. National Institutes of Health (NIH) budget, a significant funding source, saw a projected real-term slowdown for fiscal year 2024, potentially impacting demand for advanced instrumentation.

Trade policies and tariffs directly affect Bruker's cost structure, with tariffs on imported components escalating expenses and potentially squeezing profit margins. Bruker itself acknowledged these trade policy shifts as a challenge they are navigating in their 2025 outlook.

Government healthcare policies and regulations, such as the EU's In Vitro Diagnostic Regulation (IVDR) and Medical Device Regulation (MDR), present both compliance challenges and market expansion opportunities for Bruker's diagnostics business.

Geopolitical tensions can disrupt Bruker's global supply chains and impact international research collaborations, creating market uncertainty. Bruker's presence in over 90 countries makes it susceptible to regional political shifts and trade policy changes.

What is included in the product

The Bruker PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, offering a comprehensive view of the external landscape.

This analysis provides actionable insights for strategic decision-making by identifying potential opportunities and threats arising from these macro-environmental factors.

The Bruker PESTLE Analysis provides a structured framework, alleviating the pain of unstructured brainstorming by offering clear categories for identifying and analyzing external factors that impact business strategy.

Economic factors

Global spending on research and development, particularly within the life sciences sector, is a critical economic factor influencing Bruker's performance. Pharmaceutical and biotechnology companies, along with academic research institutions, are major consumers of Bruker's advanced analytical and diagnostic instruments.

While the biopharmaceutical industry has seen robust R&D investment in recent years, projections for 2025 indicate a potential slowdown in the growth rate of R&D expenditures. For instance, some industry analyses anticipate a more moderate increase in global R&D spending for 2025 compared to the double-digit growth seen in prior years, which could present a headwind for Bruker's sales volumes.

Bruker, as a global entity, faces inherent risks from currency exchange rate fluctuations. These movements can significantly affect how its revenues and profits are reported when translated into its reporting currency, the US Dollar.

For instance, in its 2025 financial outlook, Bruker has explicitly acknowledged that foreign currency translation could act as both a tailwind, boosting reported results, and a headwind, dampening them, depending on the prevailing exchange rates throughout the year.

This volatility means that even if underlying operational performance remains strong, a strengthening US Dollar against other major currencies like the Euro or Swiss Franc could lead to lower reported revenue and earnings for Bruker.

Rising inflation and escalating costs for essential inputs like raw materials, energy, and labor directly impact Bruker's profitability by squeezing gross margins and increasing operational expenditures. For instance, in the first quarter of 2024, Bruker reported that while net sales grew, the cost of goods sold also saw an increase, reflecting these persistent cost pressures.

In response to these financial headwinds, Bruker has implemented targeted cost-cutting initiatives. These measures are designed to offset the impact of inflation and maintain operational efficiency, as evidenced by their focus on optimizing supply chains and managing overheads throughout 2024.

Economic Growth and Investment Climate

General economic growth, especially in major markets such as the U.S., Europe, and Asia, directly impacts the investment capacity of Bruker's diverse customer base, which includes academic institutions, healthcare providers, and private sector companies. For instance, a robust global GDP growth forecast for 2024, projected by the IMF to be around 3.2%, generally supports increased R&D spending and capital equipment acquisition.

A cautious investment climate or a noticeable economic slowdown can significantly affect Bruker's sales cycle, potentially leading to postponed or deferred purchases of its high-value scientific instruments. For example, if key markets experience a contraction, such as a projected slowdown in European industrial production in late 2024, customers might re-evaluate their capital expenditure plans, impacting demand for sophisticated analytical solutions.

- Global Economic Outlook: The International Monetary Fund (IMF) projects global growth to remain steady at 3.2% in both 2024 and 2025, providing a generally stable backdrop for investment.

- Key Market Performance: The U.S. economy, a significant market for Bruker, has shown resilience, with GDP growth expected to moderate but remain positive through 2025, supporting customer spending.

- Impact of Inflation: Persistent inflation in some regions can erode purchasing power and increase the cost of capital, potentially delaying large instrument purchases by research institutions and corporations.

- Geopolitical Factors: Ongoing geopolitical tensions can create economic uncertainty, influencing investment decisions and supply chain stability for companies like Bruker.

Acquisition and Integration Costs

Bruker's strategic acquisition approach, while fostering growth, inherently involves substantial integration costs. These expenses can temporarily impact operating margins and dilute earnings per share in the short term. For instance, the integration of acquired companies often necessitates investments in IT systems, rebranding, and workforce alignment, all contributing to these upfront costs.

Managing these financial implications is crucial for Bruker's long-term value creation. While acquisitions are a key driver of revenue expansion, the successful assimilation of these businesses requires careful financial planning and execution to mitigate the dilutive effects.

- Integration Expenses: Costs associated with merging IT infrastructure, aligning operational processes, and harmonizing employee benefits following acquisitions.

- Dilutive Impact: Short-term reduction in earnings per share (EPS) due to the expenses of integration and the initial performance of acquired entities before full synergy realization.

- Synergy Realization: The timeline for achieving cost savings and revenue enhancements from acquisitions, which directly influences when the dilutive impact subsides.

- Strategic Value: The long-term benefits of acquisitions, such as expanded market reach and enhanced technological capabilities, must outweigh the immediate integration costs.

Global R&D spending, particularly in life sciences, directly fuels demand for Bruker's analytical instruments. While growth was strong, projections for 2025 suggest a moderation in R&D investment increases, potentially impacting sales volumes.

Currency fluctuations pose a risk, as a strengthening US Dollar could reduce reported revenues and profits, even with strong operational performance. For instance, Bruker's 2025 outlook acknowledges this potential headwind.

Inflationary pressures in 2024 increased Bruker's cost of goods sold, impacting margins, leading to cost-cutting initiatives to maintain efficiency.

Overall economic growth, like the IMF's projected 3.2% global GDP for 2024 and 2025, generally supports customer investment in capital equipment, though economic slowdowns can lead to deferred purchases.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on Bruker | Notes |

| Global GDP Growth | IMF: 3.2% | IMF: 3.2% | Supports R&D investment and capital expenditure | Stable global outlook |

| Life Sciences R&D Spending | Robust growth | Moderate growth anticipated | Potential slowdown in instrument demand | Shift from prior high-growth years |

| Inflation | Persistent in some regions | Likely to remain a concern | Increases operating costs, squeezes margins | Affects purchasing power |

| Currency Exchange Rates | Volatile | Volatile | Impacts reported revenue and profit | Strengthening USD can be a headwind |

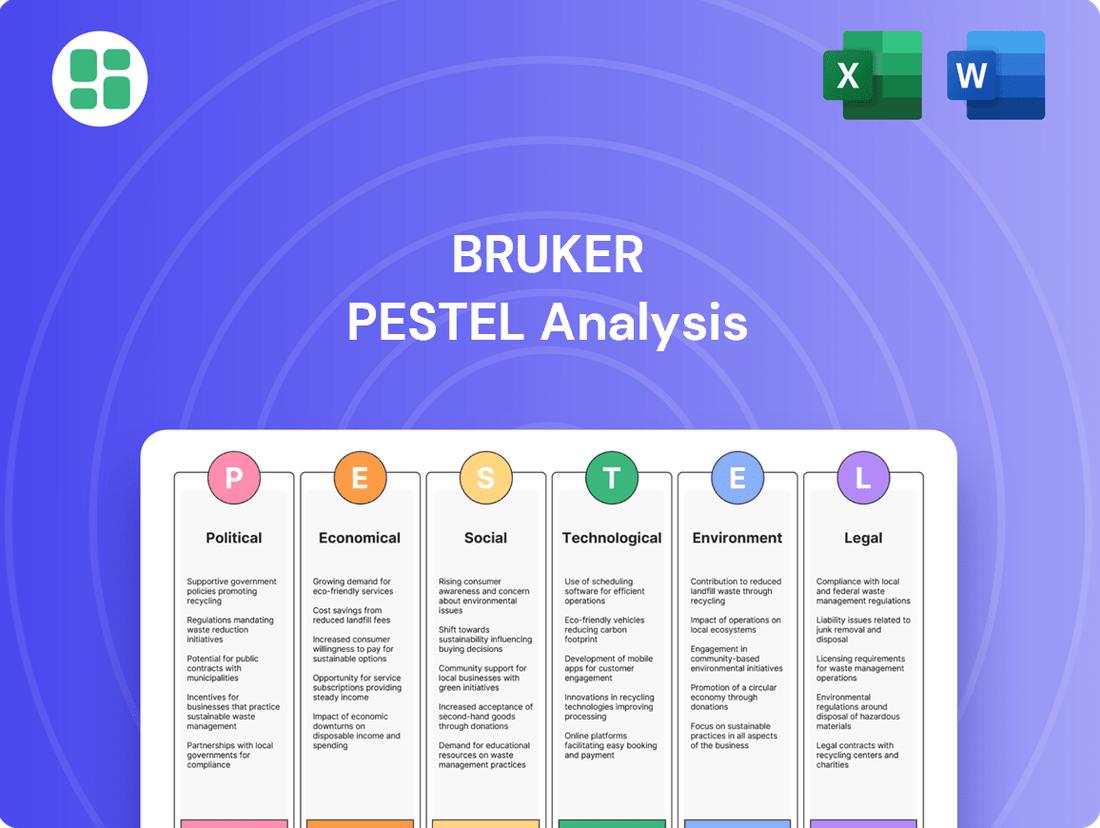

Preview the Actual Deliverable

Bruker PESTLE Analysis

The preview shown here is the exact Bruker PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of the external factors impacting Bruker.

The content and structure shown in the preview is the same Bruker PESTLE Analysis document you’ll download after payment, offering actionable insights.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, nearly one in six people globally will be 65 years or older. This demographic shift, coupled with a rising incidence of chronic diseases like diabetes and cardiovascular conditions, significantly boosts the demand for sophisticated diagnostic tools and life science research equipment. Bruker is well-positioned to capitalize on this trend, as their advanced analytical instruments are crucial for understanding disease mechanisms and developing innovative treatments.

Shifting public health priorities significantly impact demand for Bruker's analytical solutions. For instance, the heightened global focus on infectious disease surveillance and rapid diagnostics, amplified by recent pandemics, drives investment in technologies like mass spectrometry for pathogen identification. This trend is supported by a projected 7.1% CAGR for the global infectious disease diagnostics market from 2023 to 2030, reaching an estimated $60.1 billion by 2030.

Furthermore, the burgeoning fields of personalized medicine and advanced therapeutic areas such as oncology and immunology are creating substantial opportunities for Bruker. The increasing complexity of biological research in these domains necessitates sophisticated analytical tools for drug discovery, biomarker identification, and patient stratification. The global oncology market alone was valued at approximately $250 billion in 2023 and is expected to grow substantially, creating a direct demand for Bruker's advanced imaging and spectroscopic technologies.

Bruker's reliance on highly specialized talent, such as scientists and engineers for its advanced instrumentation, means that the availability of these professionals is a key sociological factor. The U.S. Bureau of Labor Statistics projected a 5% growth for engineers between 2022 and 2032, indicating a steady but competitive talent pool.

Demographic shifts, like an aging workforce in some developed nations, could potentially constrain the supply of experienced technical staff. Conversely, increasing global access to higher education, particularly in STEM fields, offers opportunities to tap into new talent reservoirs for Bruker's research and development needs.

Ethical Considerations in Research

Societal views on research ethics, particularly concerning genetic technologies and data privacy in diagnostics, significantly shape regulatory policies and market adoption. Bruker's engagement with these evolving ethical standards is crucial for sustained trust and market penetration.

For instance, heightened public concern over AI in healthcare diagnostics, a sector Bruker serves, has led to increased calls for transparent algorithms and robust data protection measures. In 2024, surveys indicated that over 70% of consumers expressed reservations about the use of AI in medical decision-making without clear human oversight.

- Public Scrutiny: Growing awareness of data privacy in diagnostic tools, especially with advancements in genomic sequencing, requires companies like Bruker to implement stringent ethical protocols.

- Regulatory Impact: Ethical debates directly influence the development of new regulations, potentially affecting the approval timelines and market access for innovative diagnostic and life science technologies.

- Trust and Acceptance: Bruker's commitment to ethical research and development practices is paramount for maintaining consumer and scientific community confidence, impacting its brand reputation and long-term viability.

Global Health Equity and Access

Societal emphasis on global health equity is intensifying, prompting a closer look at how advanced diagnostic and research tools are distributed. This growing awareness could shape market demand for Bruker's technologies, potentially spurring the development of more cost-effective or widely accessible solutions. For instance, in 2024, the World Health Organization continued its push for equitable access to health technologies, a trend that directly impacts companies like Bruker.

This societal shift presents opportunities for Bruker to innovate by creating solutions specifically designed for emerging markets or broader public health initiatives. The increasing recognition of health disparities globally means that demand for reliable and affordable diagnostic tools will likely rise, influencing product development strategies.

- Growing Demand for Accessible Diagnostics: Public health organizations are prioritizing wider access to diagnostic tools, potentially increasing demand for Bruker's more affordable product lines or service models.

- Emerging Market Opportunities: As developing nations invest more in healthcare infrastructure, there's a growing market for advanced scientific instruments, creating avenues for Bruker's expansion.

- Corporate Social Responsibility (CSR) Influence: Companies are increasingly evaluated on their CSR efforts, which can include making technologies available in underserved regions, potentially influencing Bruker's strategic partnerships and product pricing.

- Impact of Global Health Initiatives: Major global health initiatives, often funded by governments and NGOs, can create demand for specific types of research and diagnostic equipment, aligning with Bruker's product portfolio.

Societal trends like the increasing global focus on mental health and wellness are driving demand for advanced neuroscience research tools. Bruker's magnetic resonance imaging (MRI) and other neuroimaging technologies are essential for understanding brain function and developing new treatments, with the global neuroscience market projected to reach over $100 billion by 2030.

The growing emphasis on sustainability and environmental consciousness influences R&D priorities and manufacturing processes. Bruker's commitment to developing energy-efficient instruments and supporting green chemistry research aligns with these societal values, potentially enhancing its brand reputation and market appeal.

Consumer demand for personalized health solutions and preventative care is expanding the market for diagnostic technologies. Bruker's analytical instruments play a crucial role in biomarker discovery and personalized medicine, supporting the development of tailored health interventions.

The increasing digital literacy and comfort with technology across age groups facilitates the adoption of advanced scientific instruments and data-driven health solutions. This trend supports the integration of Bruker's high-performance analytical systems into various research and clinical settings.

Technological factors

The scientific instrument market is a hotbed of innovation, meaning Bruker must consistently pour resources into research and development to stay ahead. This commitment is crucial for maintaining its competitive edge in a fast-evolving landscape.

Key areas driving Bruker's product development include breakthroughs in spatial biology, which allows for the study of biological processes within their native tissue context, and significant leaps in mass spectrometry and Nuclear Magnetic Resonance (NMR) technologies. These advancements are central to the company's future product offerings and market position.

For instance, Bruker's investment in mass spectrometry, a field that saw significant growth in the early 2020s with applications expanding across proteomics and drug discovery, directly fuels its innovation pipeline. The company reported R&D expenses of $447.5 million in 2023, underscoring its dedication to technological progress.

Bruker is increasingly embedding AI and data analytics into its scientific instruments. This integration significantly boosts the instruments' ability to process, interpret, and automate complex data sets. For example, AI-powered algorithms in Bruker’s mass spectrometry and microscopy platforms are designed to accelerate discovery and improve the accuracy of results, directly impacting research efficiency and output.

Miniaturization in scientific instrumentation is a significant technological driver for Bruker. The company's development of smaller, more portable instruments, such as handheld Raman spectrometers, makes advanced analytical capabilities accessible in diverse field settings, broadening their application base beyond traditional labs. For instance, Bruker's Sci-Spec series exemplifies this trend, offering compact solutions for material identification.

Automation is another key technological factor, streamlining laboratory processes and increasing throughput. Bruker's integrated systems, which combine automated sample handling with advanced detection technologies, allow for more efficient data generation. This is crucial for sectors like pharmaceutical drug discovery, where high-throughput screening is essential, and Bruker's automated systems can process a significantly higher volume of samples compared to manual methods.

Convergence of Technologies

The convergence of analytical technologies, such as Nuclear Magnetic Resonance (NMR) and mass spectrometry, is a significant technological factor for Bruker. This integration allows for more comprehensive solutions to complex research problems, especially in rapidly growing areas like metabolomics and multiomics. Bruker's strategy involves actively pursuing acquisitions and internal innovations to bolster these combined capabilities, aiming to provide researchers with powerful, synergistic tools.

This technological convergence directly impacts Bruker's product development and market positioning. For instance, the company's investments in platforms that combine different analytical techniques enhance its ability to address multifaceted scientific inquiries. In 2024, Bruker reported a robust performance in its Life Science division, which heavily benefits from such integrated solutions, indicating strong market adoption of these advanced analytical approaches.

- NMR and Mass Spectrometry Integration: Bruker is enhancing its offerings by combining NMR and mass spectrometry, providing deeper insights into complex biological samples.

- Metabolomics and Multiomics Focus: The convergence is particularly beneficial for research in metabolomics and multiomics, areas experiencing significant growth and demand for sophisticated analytical tools.

- Strategic Acquisitions and Innovation: Bruker actively pursues acquisitions and develops new technologies to integrate these diverse analytical capabilities, strengthening its competitive edge.

- Market Demand for Comprehensive Solutions: The increasing complexity of scientific research drives demand for integrated analytical platforms, a trend Bruker is well-positioned to capitalize on.

Intellectual Property and Patent Landscape

Bruker must actively manage its intellectual property portfolio, which includes securing patents for new technologies and navigating the existing patent landscape held by competitors. This is crucial for protecting its innovations and maintaining a competitive edge in areas like mass spectrometry and advanced materials analysis.

The company’s patent strategy directly impacts its product development roadmap and can create significant barriers to market entry for rivals. For instance, in 2023, Bruker was granted numerous patents across its various segments, reinforcing its position in high-growth markets.

- Patent Filings: Bruker consistently invests in patent filings to safeguard its technological advancements in areas such as cryo-EM, preclinical imaging, and process analytical technologies.

- Licensing Agreements: The company engages in licensing agreements, both for inbound and outbound technologies, to leverage external innovations and monetize its own intellectual property.

- Freedom to Operate: A key aspect is ensuring freedom to operate, which involves thorough analysis of competitor patents to avoid infringement and inform strategic R&D direction.

- Market Exclusivity: Patents grant Bruker market exclusivity for its proprietary technologies, enabling premium pricing and a stronger competitive advantage.

Technological advancements are fundamentally reshaping the scientific instrument market, compelling Bruker to maintain a robust R&D pipeline. The company's strategic focus on areas like spatial biology, mass spectrometry, and Nuclear Magnetic Resonance (NMR) technologies is paramount for its continued market leadership. Bruker's 2023 R&D expenditure of $447.5 million highlights its commitment to driving innovation in these critical fields.

Bruker is actively integrating artificial intelligence (AI) and advanced data analytics into its instrument platforms. This integration enhances data processing and interpretation capabilities, accelerating scientific discovery. For example, AI-powered algorithms in their mass spectrometry and microscopy systems are designed to improve research efficiency and the accuracy of results.

The miniaturization of scientific instruments is a key trend, enabling broader applications beyond traditional laboratory settings. Bruker's development of portable solutions, such as handheld spectrometers, expands the accessibility of advanced analytical tools. Automation also plays a crucial role, streamlining workflows and increasing sample throughput, particularly vital for high-demand sectors like pharmaceutical drug discovery.

The convergence of analytical technologies, such as NMR and mass spectrometry, offers synergistic benefits for complex research challenges, especially in rapidly growing fields like metabolomics and multiomics. Bruker's market performance in its Life Science division in 2024 reflects the strong demand for these integrated analytical solutions.

| Technology Area | Bruker's Focus | Impact | 2023 R&D Spend (Millions USD) |

|---|---|---|---|

| Mass Spectrometry | Advancements in proteomics, drug discovery | Enhanced analytical power, faster results | 447.5 |

| NMR Spectroscopy | Structural biology, metabolomics | Deeper molecular insights | 447.5 |

| Spatial Biology | In-situ analysis of biological processes | Understanding cellular context | 447.5 |

| AI & Data Analytics | Automated data interpretation, workflow optimization | Increased efficiency, improved accuracy | 447.5 |

| Miniaturization & Automation | Portable instruments, high-throughput screening | Expanded applications, increased productivity | 447.5 |

Legal factors

Bruker's clinical diagnostics operations face rigorous oversight from bodies like the FDA and the EU's MDR/IVDR. These regulations cover everything from manufacturing quality systems to ensuring product safety and obtaining necessary pre-market approvals. For instance, the transition to the EU Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) has presented significant compliance challenges for many companies, requiring substantial investment in revalidation and documentation.

Navigating these complex and often changing regulatory landscapes is paramount for Bruker's continued market access and product distribution. Failure to adhere to evolving standards, such as those mandating increased clinical evidence or post-market surveillance, can lead to delays in product launches, market withdrawal, and substantial financial penalties. In 2024, companies across the medical device sector reported increased costs associated with regulatory compliance, often impacting R&D budgets and time-to-market for new innovations.

Intellectual property laws, covering patents, trademarks, and trade secrets, are crucial for Bruker, safeguarding its advanced scientific instrument technologies. The company's innovation pipeline relies heavily on this protection against unauthorized use.

Bruker actively manages its intellectual property portfolio, pursuing patent filings to secure new inventions. For instance, in 2023, Bruker reported an increase in its patent filings, reflecting ongoing R&D investment and a commitment to protecting its technological edge.

The company is also subject to the risk of intellectual property litigation, both as a plaintiff enforcing its rights and potentially as a defendant. Such legal challenges can impact operational costs and market access.

Bruker must navigate a complex web of data privacy and security regulations globally. With the explosion of data from its scientific instruments and diagnostic solutions, adherence to rules like the EU's General Data Protection Regulation (GDPR) and the US Health Insurance Portability and Accountability Act (HIPAA) is paramount. This is particularly critical when dealing with sensitive patient or research information, necessitating substantial investment in robust data management and cybersecurity infrastructure.

Anti-Corruption and Trade Compliance Laws

Bruker, as a global entity, navigates a complex web of anti-corruption and trade compliance laws. These regulations, such as the U.S. Foreign Corrupt Practices Act (FCPA) and various international export control regimes, are critical for maintaining operational integrity. Failure to comply can lead to severe repercussions, including substantial fines and reputational damage. For instance, in 2023, companies globally faced billions in penalties for trade compliance violations, underscoring the importance of robust internal controls.

Adherence to these legal frameworks is paramount for Bruker's continued international business activities. This includes ensuring all transactions and interactions with foreign officials or entities are transparent and lawful. The company must also meticulously manage its supply chain to prevent involvement with sanctioned individuals or countries, a factor that has become increasingly stringent with evolving geopolitical landscapes.

- FCPA and Global Anti-Bribery Laws: Bruker must ensure all employees and agents comply with anti-bribery provisions, preventing illicit payments to foreign officials.

- Export Controls and Sanctions: Strict adherence to regulations governing the export of sensitive technologies and adherence to international sanctions lists is mandatory.

- Due Diligence: Implementing rigorous due diligence on third-party partners and distributors is essential to mitigate compliance risks.

- Financial Penalties: Non-compliance can result in significant fines, potentially impacting financial performance and market access.

Product Liability and Safety Standards

Bruker Corporation, like any manufacturer of scientific instruments, is subject to stringent product liability laws and safety standards. This means the company bears responsibility for ensuring its products are safe and perform as intended. Failure to meet these obligations can lead to significant legal and financial repercussions.

Navigating these legal factors requires Bruker to implement robust quality control processes and thorough product testing throughout the design and manufacturing stages. For instance, in 2023, the global product liability market was valued at approximately $100 billion, highlighting the substantial financial risks involved. Adherence to industry-specific standards, such as those set by ISO or specific regulatory bodies relevant to their instrument categories, is paramount.

- Product Safety Compliance: Bruker must ensure its instruments meet all applicable national and international safety regulations, preventing harm to users and the environment.

- Quality Assurance: Rigorous testing and validation are essential to guarantee instrument reliability and performance, minimizing the likelihood of product defects.

- Post-Market Surveillance: Ongoing monitoring of product performance and customer feedback after sales allows for early detection and mitigation of potential safety issues.

- Intellectual Property Protection: Safeguarding proprietary technologies and designs through patents and other legal means is crucial in the competitive scientific instrumentation market.

Bruker's operations are heavily influenced by a complex legal environment. Regulatory compliance, particularly in clinical diagnostics with FDA and EU MDR/IVDR, demands significant investment and impacts time-to-market, with companies reporting increased compliance costs in 2024. Intellectual property laws are vital for protecting Bruker's innovations, as evidenced by their increased patent filings in 2023.

Data privacy laws like GDPR and HIPAA necessitate robust cybersecurity infrastructure, especially given the sensitive data handled by Bruker's instruments. Furthermore, global anti-corruption and trade compliance laws, including the FCPA, require meticulous adherence to avoid substantial penalties, with global trade compliance violations costing companies billions in 2023.

Product liability laws also impose responsibility for instrument safety and performance, with the global product liability market valued at approximately $100 billion in 2023, underscoring the financial risks of non-compliance. Bruker must maintain rigorous quality control and post-market surveillance to mitigate these risks.

| Legal Factor | Impact on Bruker | Key Considerations | 2023/2024 Data Point |

|---|---|---|---|

| Regulatory Compliance (Diagnostics) | Market access, product approval timelines, R&D budget allocation | FDA, EU MDR/IVDR adherence, clinical evidence requirements | Increased compliance costs reported by medical device sector in 2024 |

| Intellectual Property | Protection of technology, competitive advantage, litigation risk | Patent filings, trade secret protection, enforcement strategies | Increase in Bruker's patent filings in 2023 |

| Data Privacy & Security | Customer trust, operational integrity, infrastructure investment | GDPR, HIPAA compliance, cybersecurity measures | Growing investment in data management and cybersecurity |

| Anti-Corruption & Trade Compliance | Reputational risk, financial penalties, operational continuity | FCPA adherence, export controls, sanctions screening | Billions in penalties for global trade compliance violations in 2023 |

| Product Liability | Financial exposure, product development processes, quality assurance | Product safety standards, rigorous testing, post-market surveillance | Global product liability market valued at ~$100 billion in 2023 |

Environmental factors

Bruker navigates a complex web of global environmental regulations, impacting everything from its manufacturing processes to waste disposal and the handling of hazardous materials like those covered by the Restriction of Hazardous Substances (RoHS) directive. For instance, in 2024, companies like Bruker are increasingly scrutinized for their supply chain's environmental footprint, pushing for greater transparency and accountability beyond their direct operations.

The company's commitment to environmental stewardship is often demonstrated through adherence to internationally recognized standards such as ISO 14001. This framework guides Bruker in establishing and maintaining an effective environmental management system, aiming to minimize its ecological impact and ensure continuous improvement in environmental performance, a trend that gained further momentum throughout 2024 as sustainability reporting became more standardized.

Bruker's manufacturing and operation of sophisticated scientific instruments, particularly those requiring advanced cooling, can be energy-intensive. The company is actively pursuing strategies to mitigate this, such as designing instruments with reduced cryogen needs, which directly supports their environmental sustainability objectives.

Bruker's operations involve managing electronic waste (e-waste) and potentially hazardous materials from its scientific instruments. Proper disposal and recycling are paramount to meeting stringent environmental regulations. For instance, in 2024, the global e-waste generation was projected to reach 65.4 million metric tons, highlighting the scale of this challenge and the importance of responsible handling.

Supply Chain Environmental Impact

Bruker's extensive global supply chain, encompassing everything from the extraction of raw materials to the final delivery of its sophisticated scientific instruments, carries a significant environmental footprint. This includes energy consumption, waste generation, and greenhouse gas emissions at various stages. For instance, the transportation of components and finished goods across continents contributes to carbon emissions, a key concern for companies aiming for sustainability.

The company is increasingly scrutinizing its suppliers to ensure they meet environmental standards. This involves assessing their practices regarding resource management, pollution control, and waste disposal. Bruker's commitment to sustainable procurement aims to mitigate the ecological impact associated with its sourcing activities, encouraging a shift towards more environmentally conscious partners.

In 2023, Bruker reported a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating progress in its operational efficiency. The company also aims to increase the use of recycled materials in its packaging by 25% by 2025, further underscoring its focus on reducing environmental impact throughout its value chain.

- Supply Chain Emissions: Bruker's global operations involve significant logistics, contributing to its carbon footprint.

- Supplier Environmental Audits: The company actively evaluates suppliers on their environmental performance and sustainability initiatives.

- Sustainable Procurement Goals: Bruker is working to integrate eco-friendly practices into its sourcing strategies to minimize ecological impact.

- Progress in Emission Reduction: By 2023, Bruker achieved a 15% reduction in Scope 1 and Scope 2 emissions from its 2020 levels.

Resource Scarcity and Material Sourcing

Bruker's reliance on specific materials for its advanced scientific instruments, like helium for its Nuclear Magnetic Resonance (NMR) systems, presents a significant environmental factor. The availability and cost of such critical resources can fluctuate, impacting production and profitability. For instance, helium prices saw considerable increases in recent years due to supply chain disruptions and increased demand from various sectors, directly affecting manufacturers like Bruker.

In response to these concerns, Bruker is actively investing in technological innovation to mitigate its dependence on scarce resources. Their advancements in magnet technology are specifically designed to reduce helium consumption in NMR systems. This strategic move not only addresses potential resource scarcity but also positions Bruker favorably in a market increasingly focused on sustainability and resource efficiency.

- Helium Dependence: Bruker's NMR systems require helium, a finite resource whose supply can be volatile.

- Price Volatility: Global demand and supply chain issues can lead to significant price swings for critical materials like helium.

- Technological Mitigation: Bruker is developing and implementing new magnet technologies to decrease helium usage.

- Sustainability Focus: These efforts align with broader industry trends toward resource conservation and environmental responsibility.

Bruker is actively addressing its environmental impact by focusing on reducing greenhouse gas emissions and enhancing resource efficiency. The company reported a 15% reduction in Scope 1 and Scope 2 emissions by 2023 compared to a 2020 baseline. Furthermore, Bruker aims to increase the use of recycled materials in its packaging by 25% by 2025, demonstrating a commitment to circular economy principles.

The company's operational footprint is also influenced by its reliance on critical resources like helium for its NMR systems. To counter potential supply volatility and price increases, Bruker is investing in innovative magnet technologies designed to significantly reduce helium consumption. This strategic initiative not only addresses resource scarcity but also aligns with the growing market demand for sustainable scientific instrumentation.

Bruker's commitment to environmental stewardship is further evidenced by its adherence to ISO 14001 standards, guiding its environmental management systems. The company is also intensifying scrutiny on its global supply chain, evaluating suppliers for their environmental performance and promoting sustainable procurement practices to minimize its overall ecological footprint.

The challenge of electronic waste (e-waste) is significant, with global e-waste generation projected to reach 65.4 million metric tons in 2024. Bruker must manage the responsible disposal and recycling of its instruments, a critical aspect of its environmental compliance and corporate responsibility.

PESTLE Analysis Data Sources

Our PESTLE Analysis draws from a comprehensive suite of data, including reports from international organizations like the World Economic Forum, government statistical agencies, and leading market research firms. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors.