Bruker Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bruker Bundle

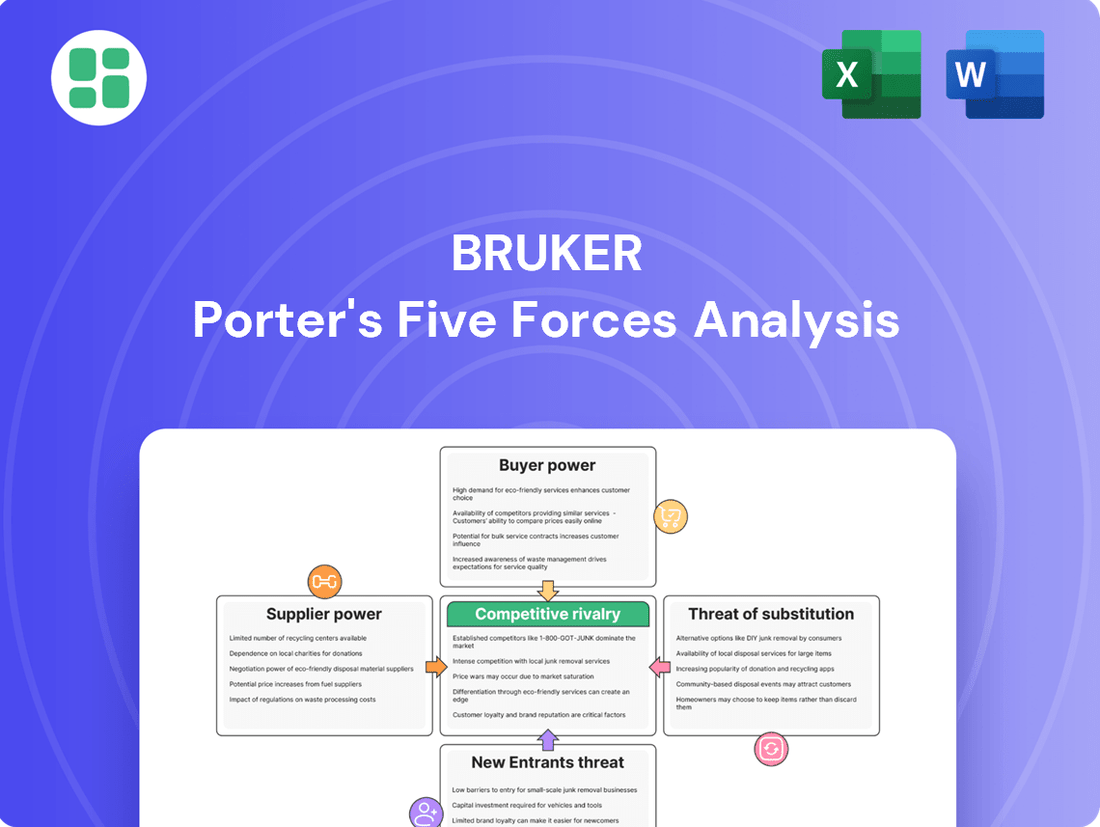

Bruker operates in a dynamic market shaped by the interplay of five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry. Understanding these forces is crucial for navigating Bruker's competitive landscape. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bruker’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Bruker's reliance on suppliers for highly specialized components, such as advanced detectors for its mass spectrometers or unique magnets for its NMR systems, significantly shapes supplier bargaining power. The proprietary nature of many of these critical parts means few, if any, alternative suppliers exist. This can translate into higher costs for Bruker; for instance, in fiscal year 2023, Bruker reported cost of revenue as $1.65 billion, a figure heavily influenced by the pricing of such specialized inputs.

Suppliers who offer proprietary technology or intellectual property that is integral to Bruker's high-performance instruments can leverage this uniqueness to command premium pricing. This exclusivity fosters a dependency for Bruker, as alternative solutions would likely necessitate costly redesigns and lengthy re-qualification processes, impacting production timelines and product development.

For instance, in 2024, the semiconductor industry, a key market for advanced analytical instruments, saw significant investment in next-generation lithography technologies, often protected by patents. Companies supplying critical components for these advanced systems, similar to those Bruker might rely on, often experience strong bargaining power due to the specialized nature and limited availability of their innovations.

Bruker faces significant bargaining power from its suppliers due to high switching costs. When suppliers provide highly integrated or customized components for Bruker's sophisticated scientific instruments, the expense of transitioning to a new supplier becomes considerable. This often involves substantial re-engineering of existing products, rigorous re-testing of new components, and the lengthy process of re-certifying instruments to meet industry standards. For instance, in the life sciences and diagnostics sectors where Bruker operates, product certification can take months or even years and incur millions in development costs, making a switch economically unviable even if a supplier increases prices. This situation grants entrenched suppliers considerable leverage, as Bruker is often reluctant to incur these substantial costs and disruptions.

Limited Supplier Base for Niche Materials

For highly specialized materials and sub-assemblies crucial to Bruker's advanced scientific instruments, the supplier landscape is often constrained. This limited pool of qualified manufacturers means fewer options for sourcing, directly impacting Bruker's leverage in negotiations. For instance, in the realm of high-purity rare earth magnets or specialized semiconductor components, there might only be a handful of global producers capable of meeting stringent quality and performance standards.

This scarcity inherently strengthens the bargaining power of these few suppliers. They face less pressure from competing suppliers vying for Bruker's business, allowing them to dictate terms more assertively. This dynamic can translate into higher input costs for Bruker, as suppliers can command premium pricing for their unique offerings. In 2024, the global market for certain advanced materials used in scientific instrumentation saw price increases of up to 15% due to supply chain bottlenecks and increased demand from the semiconductor industry, directly affecting companies like Bruker.

- Limited Supplier Options: Few manufacturers can produce the highly specialized components and materials Bruker requires.

- Supplier Pricing Power: Reduced competition among suppliers allows them to demand higher prices for their niche products.

- Strategic Sourcing Needs: Bruker may need to form long-term agreements or strategic alliances to ensure consistent and reliable access to these critical inputs.

- Impact on Costs: Higher input costs from these suppliers can affect Bruker's overall profitability and product pricing strategies.

Impact of Supplier's Forward Integration

If a supplier were to integrate forward into instrument manufacturing, it would present a significant competitive threat to Bruker. This move would allow them to capture more of the value chain, potentially offering complete solutions rather than just components.

While less frequent for basic component providers, suppliers of critical modules or sub-systems possess the technical know-how to directly compete with Bruker. This capability inherently strengthens their negotiating position during current supply discussions.

- Forward Integration Threat: Suppliers entering instrument manufacturing directly challenge Bruker's market position.

- Leveraging Expertise: Suppliers of key modules can use their specialized knowledge to compete.

- Enhanced Bargaining Power: The potential for forward integration bolsters supplier leverage in price and terms negotiations.

Bruker's suppliers, particularly those providing highly specialized components like advanced detectors or proprietary magnets, wield significant bargaining power. This strength stems from the limited number of qualified manufacturers and the high switching costs associated with integrating new suppliers into Bruker's complex instrument designs. For instance, in 2024, the ongoing demand for advanced materials in scientific instrumentation, coupled with supply chain constraints, led to price increases of up to 15% for certain critical inputs, directly impacting Bruker's cost of revenue, which was $1.65 billion in fiscal year 2023.

| Factor | Impact on Bruker | 2024 Context/Data |

|---|---|---|

| Supplier Specialization | Limited alternatives increase supplier leverage. | High demand for advanced materials in scientific instruments. |

| Switching Costs | Expensive and time-consuming to change suppliers. | Product re-qualification in life sciences can take months/years. |

| Supplier Concentration | Few global producers for critical components. | Price increases up to 15% for some advanced materials. |

| Forward Integration Risk | Suppliers could enter instrument manufacturing. | Suppliers of key modules possess technical expertise to compete. |

What is included in the product

Analyzes the intensity of competition, buyer and supplier power, threat of new entrants and substitutes impacting Bruker's market position.

Effortlessly visualize competitive intensity across all five forces with an intuitive, interactive dashboard, instantly highlighting areas needing strategic attention.

Customers Bargaining Power

Bruker's customer base, particularly large pharmaceutical companies, biotechnology firms, academic institutions, and government research labs, wields significant bargaining power. These entities often procure instruments in substantial volumes, enabling them to negotiate for better pricing and customized solutions.

The sheer scale of these institutional buyers allows them to exert considerable influence over suppliers. For instance, a major pharmaceutical company purchasing multiple high-value mass spectrometry systems can leverage its commitment to secure more favorable terms than a smaller research lab buying a single unit.

In 2024, Bruker's revenue from its Life Science division, which serves many of these large institutional buyers, was a significant contributor to its overall financial performance, underscoring the importance of managing these relationships effectively.

Scientific instruments are major purchases, often costing hundreds of thousands or even millions of dollars. This high purchase value means customers, like research institutions or large pharmaceutical companies, scrutinize every detail. They are naturally price-sensitive and will conduct thorough evaluations, comparing offerings from various manufacturers. For instance, a university's core research facility might invite multiple vendors to demonstrate their mass spectrometry systems before committing to a purchase that could exceed $500,000.

Because these instruments represent such a significant capital investment, buyers have considerable bargaining power. They are more likely to solicit competitive bids, negotiate aggressively on price, and demand value-added services such as extended warranties, training, or specialized support. This makes it harder for manufacturers like Bruker to dictate terms, as customers can easily switch to a competitor offering a better overall package for their substantial outlay.

Customers also expect long-term reliability and consistent performance from these high-cost instruments. Their substantial investments are tied to the equipment's ability to deliver accurate and reproducible results over many years. This expectation further empowers them, as they can leverage potential issues with performance or support to negotiate better terms or demand upgrades, ensuring their capital is well-spent.

Bruker's customers, particularly those in academic and government research, often face rigid budget cycles and are keenly aware of price. This means that changes in research funding, like potential cuts in government grants in 2024, can significantly influence their ability to purchase high-value scientific instruments, directly impacting Bruker's pricing power.

Availability of Alternative Vendors

Bruker faces significant customer bargaining power due to the availability of alternative vendors. Major competitors like Thermo Fisher Scientific, Agilent Technologies, and Danaher Corporation offer comparable scientific instruments and solutions. This competitive landscape allows customers to readily compare product offerings, pricing, and service levels. For instance, the global laboratory equipment market, estimated to reach over $70 billion by 2024, highlights the breadth of choices available to buyers.

The presence of multiple reputable suppliers directly diminishes a customer's reliance on any single company, including Bruker. Customers can leverage this by negotiating better terms or switching to a competitor if their needs are not adequately met. This dynamic is particularly potent in segments where technological advancements are rapid, enabling new entrants or existing players to offer compelling alternatives.

- Competitive Landscape: Bruker competes with major players like Thermo Fisher Scientific, Agilent Technologies, and Danaher Corporation.

- Customer Choice: The existence of multiple vendors provides customers with options to compare products, pricing, and services.

- Reduced Dependence: This availability reduces customer dependence on any single supplier, increasing their bargaining power.

- Market Size: The global laboratory equipment market, projected to exceed $70 billion in 2024, underscores the competitive environment.

Demand for Integrated Solutions and Services

Customers are increasingly seeking integrated solutions, expecting instruments, software, consumables, and services to work seamlessly for optimized workflows. This shift empowers them to negotiate better terms for bundled packages and ongoing support.

Bruker's ability to provide these comprehensive offerings directly influences its customers' bargaining power. For instance, in 2024, many customers in the life sciences and advanced materials sectors expressed a preference for single-vendor solutions to simplify procurement and ensure compatibility, thereby increasing their leverage.

- Demand for integrated solutions: Customers want a complete package, not just individual products.

- Workflow optimization: Integrated offerings help customers improve their operational efficiency.

- Negotiating leverage: Bundled deals and comprehensive support packages give customers more power.

- Competitive pressure: Bruker needs to meet these complex needs to retain customers who might otherwise look to more holistic providers.

Bruker's customers, especially large institutions, possess significant bargaining power due to the substantial cost of scientific instruments. These buyers, often spending hundreds of thousands or millions on equipment, meticulously compare offerings and negotiate aggressively for better pricing and bundled services.

The availability of numerous reputable competitors, such as Thermo Fisher Scientific and Agilent Technologies, further amplifies customer leverage. In the vast global laboratory equipment market, projected to exceed $70 billion in 2024, buyers can easily switch suppliers, reducing their dependence on any single vendor and demanding more favorable terms.

Furthermore, customers increasingly demand integrated solutions, expecting instruments, software, and services to function seamlessly. This preference for comprehensive, single-vendor packages, a trend noted by many life science customers in 2024, empowers them to negotiate better deals for bundled offerings and ongoing support.

| Customer Segment | Bargaining Power Drivers | Impact on Bruker |

|---|---|---|

| Large Pharmaceutical/Biotech | High volume purchases, price sensitivity, demand for customization | Price pressure, need for tailored solutions |

| Academic/Government Labs | Budget constraints, grant funding dependency, price scrutiny | Sensitivity to pricing, need for cost-effective solutions |

| All Customers | Availability of alternatives, demand for integrated solutions, long-term reliability expectations | Need for competitive pricing, strong service/support, product innovation |

Same Document Delivered

Bruker Porter's Five Forces Analysis

This preview shows the exact Bruker Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It thoroughly examines the competitive landscape for Bruker, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive analysis is professionally formatted and ready for your strategic decision-making.

Rivalry Among Competitors

The scientific instrument market is a battleground for giants. Companies like Thermo Fisher Scientific, Agilent Technologies, Danaher Corporation, and Waters Corporation are major global players, boasting vast product lines, robust distribution, and substantial research and development budgets. This intense competition means Bruker, even as a leader in specific high-end analytical tools, faces significant challenges across all its business areas.

The competitive landscape for companies like Bruker is intensely shaped by a relentless drive for innovation, fueled by significant investments in research and development. This R&D spending is not just about creating new products; it’s about enhancing the performance of existing instruments and developing groundbreaking technologies that can redefine scientific capabilities. For instance, in 2023, Bruker reported R&D expenses of $548.5 million, a substantial commitment to staying at the forefront of scientific instrumentation.

This constant pursuit of technological advancement means that competitors are also aggressively investing in their own R&D efforts. They are all in a race to introduce the next generation of scientific tools, whether it's more sensitive mass spectrometers or advanced microscopy systems. This dynamic creates a continuous innovation cycle where companies must consistently allocate capital to research and development to maintain or improve their market position, demanding strategic foresight and ongoing financial commitment.

The scientific instrument market is booming, with life sciences, biotech, and clinical diagnostics showing particularly robust expansion, fueling intense rivalry among players. Bruker is well-positioned within these dynamic sectors, yet its competitors are aggressively pursuing growth through acquisitions and innovative product introductions. This heightened competition for market share is a significant factor for Bruker.

Strategic Acquisitions and Portfolio Expansion

Major players in the life science tools and diagnostics market, including Bruker, actively pursue strategic acquisitions to bolster their technology offerings, broaden market access, and solidify their competitive standing. This trend is evident in Bruker's recent moves, such as its acquisition of NanoString Technologies for approximately $830 million, completed in early 2024, and its acquisition of ELITechGroup, a significant player in molecular diagnostics. These transactions are designed to enhance Bruker's capabilities, particularly in the rapidly growing fields of molecular diagnostics and spatial biology, thereby reshaping the competitive dynamics and demanding constant strategic adjustments from all participants.

The impact of such mergers and acquisitions (M&A) activity on competitive rivalry cannot be overstated. By integrating new technologies and expanding their product portfolios, companies like Bruker can rapidly gain market share and create significant barriers to entry for smaller or less acquisitive competitors. This ongoing consolidation necessitates that other firms either keep pace through their own M&A strategies or focus on intense organic innovation to remain competitive. For example, the life science tools market saw significant M&A activity throughout 2023 and into 2024, with a total deal value exceeding billions of dollars, underscoring the strategic importance of portfolio expansion.

- Strategic Acquisitions: Bruker's acquisition of NanoString for ~$830 million in early 2024 exemplifies the drive for portfolio expansion.

- Market Reach Enhancement: Acquiring companies like ELITechGroup allows Bruker to expand its presence in molecular diagnostics.

- Competitive Landscape Reshaping: Such M&A activity intensifies rivalry and necessitates continuous adaptation by competitors.

- Focus on Growth Areas: Acquisitions are strategically targeted at high-growth segments like spatial biology and diagnostics.

Differentiated Product Offerings and Niche Leadership

Companies in this space actively differentiate their products by focusing on superior performance, distinctive features, and specialized applications. This is crucial for carving out market share and commanding premium pricing. For instance, Bruker's dominance in high-performance nuclear magnetic resonance (NMR) and mass spectrometry instruments highlights this strategy.

Bruker's market leadership in areas like NMR, where it offers advanced solutions for molecular analysis, is a testament to its product differentiation. However, competitors are not standing still; they are increasingly targeting specific niche markets within the broader scientific instrumentation landscape. This necessitates Bruker's continuous effort to showcase the unique value and technological superiority of its offerings to retain its competitive advantage.

- Bruker's NMR systems, such as the AVANCE NEO, are recognized for their high field strengths and advanced cryoprobe technology, enabling detailed molecular structure elucidation.

- Competitors like Thermo Fisher Scientific and Agilent Technologies also offer sophisticated mass spectrometry platforms, often targeting specific analytical workflows in pharmaceutical research and clinical diagnostics.

- The demand for specialized applications, like single-cell analysis or advanced materials characterization, creates opportunities for both Bruker and its rivals to innovate and differentiate.

Competitive rivalry in the scientific instrument market is fierce, driven by innovation and strategic acquisitions. Bruker, a leader in high-end analytical tools, faces intense competition from major players like Thermo Fisher Scientific and Agilent Technologies, who are also investing heavily in R&D and expanding their portfolios through M&A. For example, Bruker's 2023 R&D expenditure reached $548.5 million, reflecting the significant resources required to stay competitive.

The market is characterized by a constant drive for technological advancement, with companies differentiating themselves through superior performance and specialized applications. Bruker's strength in NMR and mass spectrometry is a prime example, but competitors are actively targeting niche markets. This dynamic necessitates continuous innovation and strategic adaptation to maintain market share.

| Company | 2023 R&D Expenditure (Millions USD) | Key Market Segments |

|---|---|---|

| Bruker | $548.5 | Life Sciences, Diagnostics, Materials Research |

| Thermo Fisher Scientific | $2,500 (approximate, across all segments) | Life Sciences, Clinical Diagnostics, Analytical Instruments |

| Agilent Technologies | $775 (approximate, across all segments) | Life Sciences, Diagnostics, Applied Chemical Markets |

SSubstitutes Threaten

The threat of substitutes for Bruker's analytical instruments is primarily driven by alternative scientific methods and technologies that can yield comparable research or diagnostic results. For instance, sophisticated computational modeling or more cost-effective laboratory techniques might decrease the demand for certain high-end physical instruments.

However, when it comes to achieving high precision and conducting complex analyses, direct substitutes that offer equivalent data quality are often scarce. For example, while advanced spectroscopy techniques exist, they may not always replicate the detailed elemental or structural information provided by Bruker's mass spectrometry or NMR systems, particularly in specialized fields like pharmaceutical research or materials science.

The market is seeing a rise in simpler, more affordable instruments, often miniaturized and portable. While these might not match the precision of Bruker's high-end systems, they can serve applications where top-tier accuracy isn't the primary need. This trend could chip away at demand for Bruker's more sophisticated products by offering a viable alternative for a specific market segment.

Research institutions and smaller businesses might bypass the need for costly Bruker instruments by utilizing outsourced analytical services from Contract Research Organizations (CROs) or specialized laboratories. This approach grants them access to cutting-edge technology without the substantial upfront capital expenditure and ongoing upkeep costs associated with owning such equipment. The expanding outsourcing sector, valued at over $60 billion globally in 2023, represents a growing indirect substitute threat to instrument manufacturers.

Advancements in Data Science and AI

The rapid advancements in data science and artificial intelligence (AI) present a potential threat of substitutes for traditional scientific instrumentation. AI and machine learning algorithms are increasingly capable of analyzing vast datasets to generate predictive models, potentially reducing the reliance on certain types of physical experimentation. For instance, in drug discovery, AI platforms can simulate molecular interactions, offering an alternative to extensive laboratory testing. This shift could impact the demand for hardware-centric solutions as companies explore AI-driven insights as a more efficient or cost-effective path to innovation.

This evolving landscape means that companies like Bruker, which specialize in high-performance scientific instruments, need to consider how AI can augment, rather than replace, their offerings. The market for AI-powered data analysis tools is projected for significant growth. For example, the global AI in healthcare market, a key area for scientific instrumentation, was valued at approximately $15.4 billion in 2023 and is expected to grow substantially in the coming years. This indicates a growing appetite for data-driven solutions that may offer alternatives or complements to traditional instrument usage.

- AI-driven predictive modeling can offer alternative pathways to scientific discovery, potentially reducing the need for some traditional instrument-based experimentation.

- The global AI in healthcare market, a sector heavily reliant on scientific instrumentation, was valued at around $15.4 billion in 2023, signaling a growing trend towards data-centric solutions.

- While often complementary, the increasing sophistication of AI could, in certain applications, diminish the demand for purely hardware-centric solutions by providing alternative methods for data generation and analysis.

Shifting Research Paradigms

The threat of substitutes for Bruker's offerings is influenced by evolving research methodologies. A significant pivot in scientific inquiry, for example, away from traditional mass spectrometry applications, could lessen the demand for instruments specialized in those areas.

Bruker proactively addresses this by broadening its product portfolio and investing in growth sectors such as spatial biology, which represents a new frontier in biological research.

- Shifting Research Paradigms: Emerging scientific priorities can render existing instrument types less relevant.

- Impact on Demand: A move away from specific analytical techniques could decrease demand for related instruments.

- Bruker's Mitigation Strategy: Diversification of product lines and investment in new research areas like spatial biology are key.

The threat of substitutes for Bruker's analytical instruments is multifaceted, encompassing alternative technologies, outsourcing, and evolving research methodologies. While high-precision instruments like Bruker's mass spectrometry and NMR systems have few direct substitutes for equivalent data quality, the market is seeing a rise in simpler, more affordable alternatives for less demanding applications. Furthermore, the growing trend of outsourcing analytical services, with the global market exceeding $60 billion in 2023, offers a cost-effective alternative to instrument ownership for many research institutions and businesses.

The increasing sophistication of AI and data science also presents a potential substitute. AI platforms can increasingly analyze data and simulate experiments, potentially reducing reliance on certain physical instrumentation, particularly in fields like drug discovery. The global AI in healthcare market, a key area for scientific instrumentation, was valued at approximately $15.4 billion in 2023, highlighting the growth of these data-centric solutions. Bruker's strategy to mitigate this threat involves expanding its portfolio into new growth areas like spatial biology, ensuring relevance in evolving scientific landscapes.

| Threat of Substitutes | Description | Impact on Bruker | Mitigation Strategies |

| Alternative Technologies | Simpler, more affordable instruments for less demanding tasks; computational modeling. | Potential erosion of demand for high-end systems in certain segments. | Focus on high-precision, specialized applications where substitutes are weak. |

| Outsourcing Services | Contract Research Organizations (CROs) and specialized labs offer access to technology without capital expenditure. | Reduced direct sales of instruments to smaller entities or those with fluctuating needs. | Develop service offerings or partnerships to capture value in the outsourcing ecosystem. |

| AI and Data Science | AI-driven predictive modeling and data analysis can reduce reliance on some physical experimentation. | Potential decrease in demand for hardware-centric solutions if AI becomes a primary data generation tool. | Integrate AI into instrument offerings; invest in data analytics capabilities. |

| Shifting Research Paradigms | Changes in scientific focus can make existing instrument types less relevant. | Risk of obsolescence for instruments tied to declining research areas. | Diversify product portfolio; invest in emerging research fields like spatial biology. |

Entrants Threaten

The scientific instrument industry, especially for sophisticated systems like Bruker's, requires massive upfront investment in research, development, and cutting-edge manufacturing. New players would need deep pockets just to get started, making it tough for smaller companies to jump in and directly compete with established giants like Bruker.

Developing advanced scientific instruments demands substantial investment in research and development, coupled with a strong intellectual property (IP) foundation. Bruker, a leader in this space, possesses a significant patent portfolio, safeguarding its innovative technologies and creating a high barrier for newcomers.

New entrants must either replicate Bruker's technological advancements or find ways to circumvent its extensive patent protections, a costly and time-consuming endeavor. For instance, in 2023, Bruker reported R&D expenses of $369.3 million, highlighting the significant resources required to maintain its competitive edge.

Bruker's established brand reputation, cultivated over 55 years, is a formidable barrier to new entrants. This long history has fostered deep customer loyalty among researchers and institutions who rely on precision and reliability.

Newcomers face a significant challenge in replicating Bruker's credibility and trust in a market where performance is critical. The company's strong brand equity, built on consistent innovation and quality, directly deters potential competitors.

Complex Regulatory and Certification Processes

The scientific instrument market, particularly for clinical diagnostics and pharmaceuticals, is heavily regulated. Companies must navigate complex approval processes from bodies like the FDA in the US or the EMA in Europe. For instance, the FDA's premarket approval (PMA) process for high-risk medical devices can take years and cost millions, significantly deterring new entrants.

These intricate and time-consuming regulatory hurdles demand substantial financial investment and specialized expertise. Newcomers often lack the established relationships and understanding of compliance requirements, making it difficult to bring products to market efficiently. This barrier directly impacts the cost and timeline for new product introductions.

- Significant Investment: Navigating regulatory pathways can cost millions of dollars in testing, documentation, and legal fees.

- Extended Timelines: Approval processes can stretch for several years, delaying revenue generation for new companies.

- Specialized Expertise Required: Companies need dedicated teams with deep knowledge of regulatory affairs and quality management systems.

- High Failure Rate: Inadequate preparation or unforeseen regulatory challenges can lead to product rejection, resulting in sunk costs.

Economies of Scale and Distribution Networks

Existing players like Bruker leverage significant economies of scale in their operations, from sourcing raw materials to producing complex scientific instruments. This allows them to spread fixed costs over a larger output, resulting in lower per-unit costs. For instance, in 2023, Bruker reported revenues of $2.7 billion, indicating a substantial operational footprint that new entrants would find difficult to match.

Building out the necessary global distribution and service networks is a formidable barrier. New entrants would face immense challenges in establishing the widespread sales channels, technical support infrastructure, and customer relationships that incumbents have cultivated over decades. This established infrastructure creates a significant competitive disadvantage for newcomers attempting to enter the market.

- Economies of Scale: Lower per-unit costs for established players due to high production volumes.

- Distribution Networks: Extensive global sales and service infrastructure of incumbents.

- Procurement Power: Existing firms benefit from bulk purchasing discounts.

- Brand Reputation: Long-standing customer trust and recognition built over time.

The threat of new entrants for Bruker is generally low due to substantial capital requirements for R&D and manufacturing, coupled with a strong intellectual property portfolio. Bruker's significant investment in innovation, exemplified by its $369.3 million R&D spending in 2023, creates a high barrier. Furthermore, established brand loyalty and complex regulatory landscapes, requiring years and millions for approvals, deter potential new competitors.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment in R&D, manufacturing, and technology. | Significant financial hurdle for new players. |

| Intellectual Property | Extensive patent portfolio protecting proprietary technologies. | Costly and time-consuming to circumvent or replicate. |

| Brand Reputation & Customer Loyalty | Long-standing trust and reliance on precision and reliability. | Difficult for newcomers to establish credibility and market share. |

| Regulatory Hurdles | Complex and lengthy approval processes (e.g., FDA, EMA). | Requires substantial investment, expertise, and time, delaying market entry. |

Porter's Five Forces Analysis Data Sources

Our Bruker Porter's Five Forces analysis is built upon a robust foundation of data, including Bruker's own annual reports, investor presentations, and press releases. We supplement this with industry-specific market research reports and analyses from reputable financial institutions to provide a comprehensive view of the competitive landscape.