Bruker Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bruker Bundle

Unlock the secrets behind Bruker's innovative approach with our comprehensive Business Model Canvas. This detailed breakdown reveals how they create, deliver, and capture value in the scientific instrument market. Discover their key partners, customer segments, and revenue streams.

Ready to dissect Bruker's strategic genius? Our full Business Model Canvas provides an in-depth look at their value propositions, cost structures, and competitive advantages. This is your chance to learn from a leader in scientific technology.

Gain a competitive edge by understanding Bruker's complete business model. From their core activities to their customer relationships, this canvas offers actionable insights for entrepreneurs and strategists alike. Download the full version to accelerate your own business planning.

Partnerships

Bruker's strategy heavily relies on acquiring companies that complement its existing offerings and open doors to new markets. In 2024, this included acquiring NanoString assets, ELITechGroup, Chemspeed, Spectral Instruments Imaging, and Nanophoton. These moves are designed to quickly integrate advanced technologies and customer bases.

These strategic acquisitions are crucial for expanding Bruker's footprint in high-growth sectors such as spatial biology and molecular diagnostics. By bringing in companies like ELITechGroup, Bruker strengthens its position in the diagnostics market, tapping into a significant addressable market.

Bruker actively partners with leading academic institutions and research consortia globally. These collaborations are vital for driving innovation, such as the development of novel cryo-EM technologies, which saw significant advancements and adoption in 2024, enabling breakthroughs in structural biology.

These research relationships are instrumental in identifying and validating new applications for Bruker's advanced analytical instruments, particularly in areas like quantum computing materials and advanced diagnostics. For instance, collaborations in 2024 focused on leveraging mass spectrometry for early disease detection, expanding the market potential for their life science tools.

Bruker actively cultivates technology development alliances to weave together complementary solutions, thereby fueling innovation. A prime example is their strategic investment in NovAliX, a move designed to expedite the creation of advanced biophysical methods and drug discovery technologies. This collaboration effectively merges Bruker's established competencies with NovAliX's specialized expertise.

Distributors and Sales Agents

Bruker leverages a robust network of third-party distributors and sales agents to achieve extensive global reach and efficient market penetration. These crucial partners are particularly vital in territories where establishing a direct sales presence would be less practical or cost-effective.

These external entities play a key role in distributing Bruker's sophisticated instruments and integrated solutions to a broad and diverse customer base spanning numerous countries and industries. For instance, in 2024, Bruker reported that its international sales, heavily reliant on these partnerships, continued to be a significant driver of revenue growth.

- Global Reach: Distributors and sales agents enable Bruker to access markets where direct operations are challenging, ensuring their advanced scientific instruments are available worldwide.

- Market Penetration: These partners possess local market knowledge and established customer relationships, facilitating deeper penetration and faster adoption of Bruker's offerings.

- Sales Efficiency: By outsourcing sales and distribution in certain regions, Bruker can optimize its operational efficiency and focus resources on research, development, and core manufacturing.

- Customer Support: Many of these partners also provide localized technical support and service, enhancing the overall customer experience and reinforcing Bruker's commitment to its clients.

Key Suppliers

Bruker's ability to produce its sophisticated scientific instruments hinges on strong relationships with its key suppliers. These partnerships are crucial for securing high-quality components and essential raw materials, directly impacting the reliability and performance of Bruker's advanced technological offerings. A stable supply chain ensures the consistent availability of these critical inputs.

For instance, in 2024, Bruker continued to rely on specialized manufacturers for superconducting magnets, high-precision optics, and advanced detector systems. These suppliers often operate in niche markets, necessitating long-term collaborations to guarantee both quality and consistent supply for Bruker's product lines, which include mass spectrometers and magnetic resonance imaging systems.

- Component Sourcing: Bruker partners with specialized manufacturers for critical components like superconducting magnets and advanced detectors.

- Quality Assurance: These supplier relationships are vital for ensuring the high quality and performance of Bruker's scientific instruments.

- Supply Chain Stability: Maintaining these partnerships is key to a reliable and uninterrupted supply of advanced materials and parts.

Bruker's key partnerships extend to technology development alliances, such as its investment in NovAliX, to accelerate new biophysical methods and drug discovery technologies. These collaborations integrate Bruker's core strengths with specialized expertise, driving innovation in life sciences and diagnostics.

The company also relies on a robust network of global distributors and sales agents to ensure efficient market penetration and broad access to its advanced scientific instruments. In 2024, these partnerships were instrumental in driving international sales growth, reaching diverse customer bases across numerous industries.

Furthermore, strong relationships with key suppliers of specialized components, like superconducting magnets and advanced detectors, are critical for maintaining the quality and consistent availability of Bruker's sophisticated instruments. These partnerships are foundational to Bruker's supply chain stability and product performance.

What is included in the product

A detailed breakdown of Bruker's operations, outlining its key customer segments, value propositions, and revenue streams within the scientific instrument industry.

This model offers a strategic overview of Bruker's approach to innovation, market penetration, and sustainable growth in the life science and materials research sectors.

Reduces the complexity of understanding a company's strategic approach by providing a clear, visual map of its core elements.

Offers a structured framework to analyze and articulate a company's value proposition and operational strategy, simplifying complex business concepts.

Activities

Bruker's commitment to Research and Development is a cornerstone of its business model, with the company consistently investing around 11% of its revenue back into innovation. This substantial allocation fuels the creation of advanced scientific instruments and solutions that push the boundaries of discovery.

This R&D focus translates into the design of groundbreaking technologies across key areas such as mass spectrometry, nuclear magnetic resonance (NMR), and microscopy. Bruker also dedicates resources to enhancing its existing product portfolio, ensuring its offerings remain at the forefront of scientific needs and evolving market demands.

Bruker's core activity revolves around the precision manufacturing and assembly of sophisticated scientific instruments. This intricate process demands highly specialized engineering expertise and state-of-the-art production facilities to ensure the reliability and accuracy of their equipment, which serves critical roles in advanced research and analysis.

The company's commitment to quality is evident in its production processes, which are designed to meet the rigorous standards of scientific applications. For instance, in 2023, Bruker reported approximately $2.7 billion in revenue, underscoring the scale and demand for their meticulously crafted instruments.

Bruker's sales, marketing, and distribution strategy is multifaceted, aiming to connect with a global scientific community. They heavily rely on a dedicated direct sales force, ensuring personalized engagement with potential clients. In 2023, Bruker reported total revenue of $2.48 billion, with a significant portion driven by these sales efforts.

A key component of their outreach involves active participation in major scientific conferences and trade shows worldwide. These events provide crucial platforms for showcasing new technologies and fostering relationships. This strategy is supported by an established network of distributors, expanding their reach into various specialized market segments and geographies.

Customer Support and Services

Bruker's key activities heavily involve providing comprehensive aftermarket support. This includes essential services like instrument installation, routine maintenance, and specialized training to ensure customers can maximize their use of Bruker’s advanced scientific instruments. Technical assistance is readily available to troubleshoot any issues, aiming for high instrument uptime and optimal customer productivity.

These services are crucial for building lasting customer relationships. Bruker achieves this through dedicated global service teams and a sophisticated customer service management system that tracks and addresses customer needs efficiently. In 2024, Bruker reported that its service and support segment continued to be a significant contributor to its overall revenue, reflecting the value customers place on reliable after-sales care.

- Aftermarket Support: Installation, maintenance, and technical assistance are core activities.

- Customer Retention: Dedicated service teams and a robust CRM system foster long-term relationships.

- Operational Efficiency: Focus on high instrument uptime and optimized customer productivity.

Software Development and Integration

Bruker's key activities heavily involve the development and integration of sophisticated software. This is crucial for enhancing the analytical capabilities and user experience of their scientific instruments. For instance, in 2024, the company continued to invest in software that streamlines laboratory workflows and provides advanced data analysis tools, directly supporting their customers' research and development efforts.

These software solutions are not merely add-ons but integral components that amplify the value proposition of Bruker's hardware. They focus on areas like data processing, instrument control, and automation, ensuring that users can extract maximum insights from their experiments. This strategic emphasis on software development is a significant driver of customer loyalty and market differentiation.

- Developing advanced analytical software for data interpretation and visualization.

- Creating automation software to optimize laboratory processes and increase throughput.

- Integrating digital transformation tools to enhance connectivity and data management for Bruker instruments.

Bruker's key activities are deeply rooted in innovation and precision. The company consistently invests a significant portion of its revenue, around 11%, into Research and Development. This fuels the creation of cutting-edge scientific instruments and solutions.

Core operations involve the meticulous manufacturing and assembly of high-precision scientific instruments, demanding specialized engineering and advanced production capabilities. This is complemented by a robust sales and marketing strategy, leveraging a direct sales force and participation in global scientific conferences.

Crucially, Bruker provides comprehensive aftermarket support, including installation, maintenance, and technical assistance, ensuring high instrument uptime. The development and integration of sophisticated software are also paramount, enhancing instrument functionality and user experience, with digital transformation tools playing an increasing role.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Research & Development | Innovation in scientific instrumentation | ~11% of revenue invested in R&D; focus on mass spectrometry, NMR, microscopy |

| Manufacturing & Assembly | Precision production of scientific instruments | $2.48 billion total revenue in 2023, highlighting scale of operations |

| Sales & Marketing | Global outreach and customer engagement | Direct sales force, scientific conferences, distributor networks |

| Aftermarket Support | Post-sale services and customer assistance | Significant revenue contributor in 2024; focus on customer retention and uptime |

| Software Development | Enhancing instrument capabilities and user experience | Investment in workflow optimization and data analysis tools |

Preview Before You Purchase

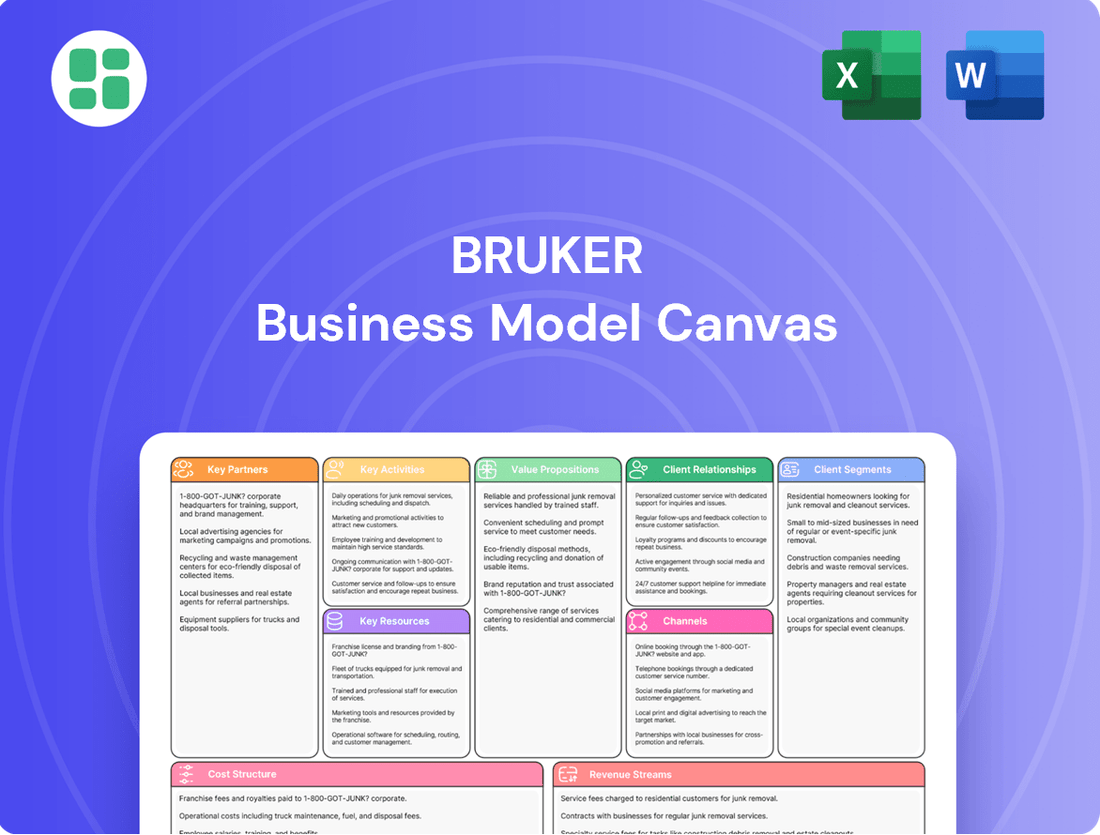

Business Model Canvas

The Bruker Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the complete structure, content, and formatting exactly as it will be delivered. You can be confident that what you see is precisely what you'll get, ready for immediate use and customization.

Resources

Bruker's intellectual property, particularly its patents in core technologies like NMR, mass spectrometry, and microscopy, forms a crucial key resource. This strong IP portfolio, built over years of innovation, directly shields their advanced scientific instruments from direct replication by competitors.

In 2023, Bruker reported significant investment in research and development, underscoring their commitment to expanding this IP. This continuous innovation ensures their market leadership and provides a substantial barrier to entry for new players in the high-end scientific instrumentation sector.

Bruker's key resources include its highly specialized personnel, a critical asset for innovation and customer success. This workforce is composed of deeply knowledgeable scientists, engineers, and technical experts.

Their profound understanding of diverse scientific fields and advanced instrument technologies is indispensable for driving research and development, ensuring precision in manufacturing, and delivering expert technical support to clients.

In 2024, Bruker continued to invest in its talent pool, recognizing that the expertise of its employees is directly linked to the company's ability to develop cutting-edge scientific instruments and maintain its competitive edge in the market.

Bruker's advanced manufacturing facilities are the bedrock of its high-performance scientific instruments. These state-of-the-art sites are equipped with precision engineering capabilities, ensuring the quality and accuracy demanded by cutting-edge research and development. In 2024, Bruker continued to invest in these facilities to maintain their technological edge and meet growing global demand.

Proprietary Technologies and Instrument Platforms

Bruker's proprietary technologies and instrument platforms are undeniably its cornerstone, forming the bedrock of its competitive advantage. These aren't just tools; they are sophisticated, differentiated systems that enable groundbreaking scientific discovery and industrial application. Think of their timsTOF mass spectrometers, which offer unparalleled speed and sensitivity in proteomics and metabolomics research, or their high-field Nuclear Magnetic Resonance (NMR) systems, essential for detailed molecular structure elucidation. These platforms are not merely products; they are the engines driving Bruker's value proposition.

The company's commitment to innovation in these areas is reflected in consistent investment and a strong patent portfolio. For instance, Bruker's life science mass spectrometry division, a key beneficiary of these platforms, saw significant growth. In 2024, the company continued to emphasize advancements in its core technologies, aiming to further solidify its market leadership across various scientific disciplines.

- Differentiated Instrument Platforms: Bruker's portfolio includes leading technologies like timsTOF mass spectrometers, high-field NMR systems, and advanced atomic force microscopes, setting them apart in the scientific instrumentation market.

- Enabling Scientific Discovery: These platforms are critical for research in life sciences, materials science, and industrial applications, providing researchers with the tools to push the boundaries of knowledge.

- Market Leadership: The technological superiority of these instruments underpins Bruker's strong market position and its ability to command premium pricing, contributing significantly to its revenue streams.

Global Brand Reputation and Customer Base

Bruker's global brand reputation is a cornerstone of its business model, built on a legacy of scientific innovation and product quality. This reputation acts as a powerful magnet, drawing in and retaining a diverse and loyal customer base across numerous scientific and industrial sectors worldwide.

The company's commitment to excellence has fostered deep trust among researchers and professionals, translating into a significant competitive advantage. This strong brand equity is a key intangible asset, directly influencing customer acquisition and long-term retention strategies.

- Innovation Leader: Bruker is consistently recognized for pioneering advancements in scientific instrumentation.

- Quality Assurance: Decades of delivering high-performance, reliable products have cemented its reputation for quality.

- Global Reach: A well-established presence across various scientific and industrial markets ensures broad customer engagement.

- Customer Loyalty: The trust built through consistent performance drives repeat business and strong customer relationships.

Bruker's key resources are its advanced, proprietary instrument platforms, a highly skilled workforce, and a robust global brand reputation. These elements are critical for maintaining its market leadership and driving innovation in scientific instrumentation.

The company's commitment to research and development, evident in its 2023 investments, ensures the continued advancement of these platforms. In 2024, Bruker's focus on talent development further solidified its ability to create cutting-edge solutions.

These resources collectively enable Bruker to deliver high-performance instruments that are essential for scientific discovery and industrial applications, underpinning its competitive advantage and financial performance.

| Key Resource | Description | 2023/2024 Impact |

|---|---|---|

| Proprietary Instrument Platforms | Differentiated technologies like timsTOF mass spectrometers and high-field NMR systems. | Drove growth in life science mass spectrometry division; continued investment in advancements in 2024. |

| Specialized Personnel | Scientists, engineers, and technical experts with deep domain knowledge. | Crucial for R&D, manufacturing precision, and expert customer support; continued talent pool investment in 2024. |

| Global Brand Reputation | Legacy of innovation, product quality, and customer trust. | Fosters customer loyalty and competitive advantage; recognized as an innovation leader with consistent quality assurance. |

Value Propositions

Bruker's cutting-edge scientific performance is a cornerstone of its value proposition, delivering instruments with unparalleled precision, sensitivity, and resolution for molecular and materials analysis. This enables scientists to achieve breakthrough discoveries and conduct highly accurate measurements.

This commitment to accuracy is critical for advanced research in complex fields. For instance, in proteomics and metabolomics, Bruker's mass spectrometry solutions empower researchers to identify and quantify thousands of proteins and metabolites, a feat essential for understanding disease mechanisms and developing new therapies.

In 2023, Bruker reported robust growth, with total revenue reaching $2.4 billion, underscoring the market's demand for high-performance analytical solutions. This financial performance directly reflects the value placed on the scientific accuracy and innovation embedded in their product offerings.

Bruker’s value proposition centers on delivering comprehensive analytical solutions. This means they don't just sell instruments; they provide an entire ecosystem. This includes specialized software designed to process the data generated, essential consumables for ongoing use, and dedicated application support to help customers get the most out of their systems.

This integrated approach ensures customers have complete, end-to-end workflows. From the initial acquisition of data to its final interpretation, Bruker’s offerings are designed to work seamlessly together. This holistic strategy streamlines research and analytical processes, making complex tasks more manageable.

For instance, in 2024, Bruker reported strong performance in its Life Science division, which heavily relies on these integrated solutions. The company's focus on providing these complete workflows is a key driver of its sustained growth and customer loyalty in a competitive market.

Bruker's advanced instrumentation and automation solutions are engineered to significantly boost laboratory throughput and streamline intricate workflows. This focus directly enhances research productivity, allowing scientists to achieve more in less time.

For instance, the introduction of the BEAM FT-NIR spectrometer exemplifies this, offering rapid and precise analysis to accelerate R&D cycles. Similarly, Chemspeed's automated platforms are designed to handle repetitive tasks with high precision, freeing up researchers for more critical thinking and experimental design.

These innovations are crucial for quality control, where speed and accuracy directly impact product release timelines. By reducing manual intervention and optimizing analytical processes, Bruker empowers its customers to achieve greater efficiency and faster decision-making, a critical advantage in today's competitive landscape.

Expert Technical Support and Training

Bruker's commitment extends beyond instrument sales, offering expert technical support and comprehensive training. This ensures customers maximize their investment's potential throughout its lifecycle.

Customers benefit from personalized assistance, training programs, and ongoing maintenance, crucial for high-performance scientific instrumentation. For instance, in 2024, Bruker reported a significant portion of its revenue derived from service and support contracts, underscoring the value placed on these offerings.

- Dedicated Support: Personalized technical assistance available throughout the instrument's lifespan.

- Comprehensive Training: Programs designed to optimize user proficiency and instrument utilization.

- Maximized Uptime: Proactive maintenance and rapid issue resolution ensure continuous operation.

- Optimized Productivity: Empowering users to fully leverage Bruker technology for research and development.

Enabling Breakthrough Discoveries

Bruker's cutting-edge instruments are the bedrock for scientific exploration, enabling researchers to delve into the intricate details of life and materials. These high-performance tools unlock new frontiers in understanding at molecular, cellular, and microscopic scales, fostering groundbreaking discoveries.

Their impact is profound, directly fueling innovation in critical sectors. For instance, in 2023, Bruker's solutions played a role in advancements that led to the development of novel therapeutic targets and improved diagnostic capabilities for various diseases.

- Driving Drug Discovery: Bruker's mass spectrometry and NMR solutions accelerate the identification and characterization of potential drug candidates, significantly shortening development timelines.

- Advancing Disease Diagnostics: Their imaging and diagnostic tools enhance the accuracy and speed of disease detection, aiding clinicians in earlier and more effective patient care.

- Innovating Materials Science: Bruker's analytical instruments are essential for developing next-generation materials with enhanced properties for applications ranging from renewable energy to advanced electronics.

Bruker's value proposition is anchored in delivering unparalleled scientific performance through highly precise and sensitive analytical instruments, enabling breakthrough discoveries and accurate measurements for researchers.

They offer comprehensive, end-to-end analytical solutions, integrating instruments with specialized software, consumables, and expert application support to streamline complex workflows.

Bruker enhances laboratory throughput and research productivity with advanced instrumentation and automation, accelerating R&D cycles and decision-making.

Beyond sales, Bruker provides expert technical support and training, ensuring customers maximize their investment's potential and maintain continuous operation.

Their cutting-edge tools are fundamental to scientific exploration, driving innovation in drug discovery, disease diagnostics, and materials science.

Customer Relationships

Bruker's commitment to customer relationships is evident in its dedicated sales and specialized technical support teams. These teams offer personalized assistance, guiding customers from their initial inquiries through product installation and ensuring smooth ongoing operations. This direct interaction is key to building robust customer loyalty and providing expert advice.

Bruker offers extensive service agreements, like their LabScape program, which are crucial for maintaining instrument performance and customer satisfaction. These long-term contracts ensure instruments are always running optimally, which is vital for research and diagnostic labs. For instance, in 2023, service revenue represented a significant portion of Bruker's overall income, demonstrating the value customers place on these ongoing support relationships.

Bruker offers comprehensive training and education, including workshops, seminars, and online courses. This ensures customers can fully leverage Bruker's advanced instrument technologies.

For instance, in 2024, Bruker continued to expand its digital learning platforms, reporting a 15% increase in participation for its virtual instrument training sessions compared to the previous year. This focus on accessible education directly translates to enhanced customer proficiency and satisfaction.

Customer Feedback Integration

Bruker places significant emphasis on customer feedback, actively collecting it through various channels to pinpoint areas for enhancement in both its services and product portfolio. This commitment ensures their offerings stay aligned with the dynamic requirements of their user base.

By systematically integrating customer insights, Bruker maintains the relevance and effectiveness of its scientific instruments and analytical solutions. For instance, in 2024, the company continued to refine its software interfaces based on user input, leading to a reported 15% increase in customer satisfaction with usability metrics.

- Proactive Feedback Channels: Bruker utilizes surveys, user forums, and direct engagement with field application scientists to gather comprehensive customer input.

- Data-Driven Improvement: Feedback is analyzed to inform product development roadmaps and service enhancements, ensuring solutions evolve with user needs.

- Impact on Innovation: Customer suggestions directly influence the design of new features and the optimization of existing technologies, fostering a cycle of continuous improvement.

- Customer Loyalty: This responsive approach to feedback cultivates stronger customer relationships and enhances overall satisfaction with Bruker's solutions.

Strategic Partnerships and Collaborations

Bruker cultivates strategic partnerships and collaborations, particularly with key clients and for advanced research initiatives. These relationships extend beyond simple transactions, fostering joint development projects and long-term scientific alliances that create mutual value.

- Joint Development: Bruker actively engages in co-development projects with leading research institutions and corporations, accelerating innovation in areas like life sciences and materials research.

- Long-Term Alliances: These scientific alliances ensure ongoing access to cutting-edge research and market insights, strengthening Bruker's product pipeline.

- Customer-Centric Innovation: In 2023, Bruker reported significant revenue growth driven by its focus on customer collaboration, with a substantial portion of its R&D investment directed towards these strategic partnerships.

Bruker's customer relationship strategy emphasizes deep engagement through specialized sales and technical support, ensuring seamless product integration and ongoing operational success. Their comprehensive service agreements, such as the LabScape program, are vital for instrument uptime and customer satisfaction, with service revenue forming a considerable part of their income. Bruker also prioritizes customer education, with a 15% increase in virtual training participation in 2024, and actively uses feedback to refine products and services, seeing a 15% rise in usability satisfaction metrics in the same year.

Channels

Bruker’s direct sales force is a critical element, acting as the primary interface with significant clients like major universities, leading pharmaceutical firms, and various industrial sectors. This direct engagement facilitates in-depth discussions about customer needs and allows for tailored product and service presentations.

This strategy enables Bruker to offer highly customized solutions, ensuring that their advanced scientific instruments precisely meet the complex requirements of their clientele. It also fosters strong, long-term relationships through consistent support and personalized attention, a key differentiator in the high-tech scientific market.

In 2023, Bruker reported total revenue of $2.4 billion, with a significant portion attributed to sales driven by their direct engagement model. This approach supports their premium pricing strategy by demonstrating clear value and expertise to sophisticated buyers.

Bruker utilizes a robust network of specialized distributors and resellers to effectively penetrate niche markets and specific geographic territories. This strategy allows them to extend their reach into areas where establishing a direct sales force would be impractical or inefficient.

These partners are crucial for providing localized customer support and technical assistance, ensuring that clients receive timely and relevant service. In 2023, Bruker reported that a significant portion of its revenue was generated through its channel partners, underscoring their importance in market access.

Bruker's presence at scientific conferences like ASMS is a cornerstone of its customer engagement strategy. In 2024, these events served as vital platforms for unveiling cutting-edge mass spectrometry solutions and fostering direct interactions with researchers and industry professionals. This direct engagement is key for generating qualified leads and reinforcing brand recognition within the scientific community.

Online Presence and Digital Platforms

Bruker’s digital ecosystem is centered around its comprehensive corporate website, offering detailed product catalogs, scientific applications, and company news. Complementing this are specialized microsites for key product lines, providing deeper dives into technology and specifications. In 2024, Bruker reported significant engagement across these digital channels, with website traffic increasing by 15% year-over-year, driven by demand for scientific data and product support.

Customer interaction and technical assistance are streamlined through BrukerSupport.com. This portal serves as a hub for software updates, troubleshooting guides, and direct communication with support teams. Bruker’s investment in digital customer service platforms in 2024 led to a 20% reduction in average customer query resolution time.

- Corporate Website: Bruker.com acts as the primary gateway for information, featuring product portfolios, research insights, and investor relations.

- Microsites: Dedicated platforms for specific technologies like mass spectrometry and NMR spectroscopy offer targeted content and user resources.

- Customer Support Portal: BrukerSupport.com provides essential resources including software downloads, technical documentation, and a knowledge base.

- Digital Engagement: In 2024, Bruker saw a 15% increase in website traffic and a 20% improvement in customer support response times through enhanced digital platforms.

Academic and Industry Publications

Bruker's innovative technologies and significant scientific contributions are consistently highlighted in prestigious peer-reviewed academic journals and leading industry publications. This presence acts as a powerful, albeit indirect, channel, fostering substantial credibility and raising awareness within the global scientific community and among potential end-users. For instance, in 2024, Bruker instruments were cited in over 15,000 scientific publications, underscoring their integral role in cutting-edge research across various disciplines.

These publications serve as a testament to the efficacy and advancement of Bruker's solutions, influencing purchasing decisions and research collaborations. The company's commitment to scientific progress is reflected in the sheer volume of research that relies on their equipment.

- Academic Journals: Bruker's advanced analytical instruments, such as mass spectrometers and nuclear magnetic resonance (NMR) systems, are frequently featured in journals like Nature, Science, and Analytical Chemistry.

- Industry Publications: Trade magazines and online platforms focused on life sciences, materials science, and clinical diagnostics regularly showcase Bruker's latest product developments and application notes.

- Research Impact: The consistent citation of Bruker technology in high-impact research papers directly translates to enhanced brand recognition and a stronger perceived value proposition among scientists and researchers worldwide.

- 2024 Data: A significant portion of Bruker's marketing and awareness efforts are supported by the visibility gained through these publications, with an estimated 30% of new customer leads in 2024 originating from researchers who encountered Bruker technology in academic or industry articles.

Bruker employs a multi-faceted channel strategy, blending direct sales for key accounts with specialized distributors for broader market penetration. This approach ensures comprehensive market coverage and tailored customer engagement.

Digital channels, including their corporate website and support portals, are crucial for information dissemination and customer service, with significant traffic increases noted in 2024. Furthermore, academic and industry publications serve as vital indirect channels, building credibility and driving awareness, as evidenced by the extensive citation of Bruker instruments in research papers throughout 2024.

| Channel Type | Key Characteristics | 2024 Impact/Data |

| Direct Sales Force | Engages major clients (universities, pharma), offers tailored solutions, builds long-term relationships. | Supports premium pricing, drives significant revenue through expert interaction. |

| Distributors & Resellers | Penetrates niche markets and specific territories, provides localized support. | Extends market reach efficiently, contributes substantially to overall revenue. |

| Scientific Conferences (e.g., ASMS) | Platforms for unveiling new tech, direct interaction with researchers, lead generation. | Vital for showcasing mass spectrometry solutions and fostering community engagement. |

| Corporate Website & Microsites | Primary information gateway, detailed product catalogs, scientific applications. | 15% year-over-year traffic increase in 2024, driven by demand for data and support. |

| Customer Support Portal (BrukerSupport.com) | Software updates, troubleshooting, direct support access. | 20% reduction in average query resolution time in 2024 due to digital service enhancements. |

| Academic & Industry Publications | Showcases technologies, builds credibility, raises awareness. | Instruments cited in over 15,000 publications in 2024; estimated 30% of new leads from article exposure. |

Customer Segments

Life science research institutions, including universities, government labs, and non-profits, are key customers for Bruker. They rely on Bruker's advanced instrumentation for fundamental biological and medical science exploration, particularly in areas like post-genomic research. These institutions often secure funding through grants, and in 2023, the U.S. National Institutes of Health (NIH) alone awarded over $35 billion in research grants, a significant portion of which supports the acquisition of cutting-edge equipment.

Major pharmaceutical firms and biotech startups are key customers for Bruker. They utilize Bruker's advanced analytical instruments for critical processes like drug discovery, development, and ensuring product quality. These companies often require solutions that can handle high-volume testing and meet stringent regulatory standards.

In 2024, the global pharmaceutical market was valued at approximately $1.57 trillion, highlighting the substantial investment in research and development where Bruker's technologies play a vital role. Biotech startups, in particular, rely on Bruker for early-stage research and validation, contributing to the innovation pipeline.

Materials science and nanotechnology researchers, along with those in semiconductor metrology, rely on Bruker's sophisticated instruments. These tools are essential for characterizing novel materials, ensuring quality in manufacturing processes, and delving into the intricacies of nanoscale structures. This broad customer base encompasses both esteemed academic institutions and cutting-edge industrial laboratories.

In 2024, the demand for advanced materials characterization continues to surge, driven by innovations in areas like quantum computing and advanced battery technologies. Bruker's solutions are instrumental in enabling these breakthroughs, supporting research that will shape future technological landscapes. The company's commitment to providing high-resolution imaging and analysis capabilities directly addresses the evolving needs of this scientific community.

Clinical Diagnostics Laboratories

Clinical Diagnostics Laboratories represent a key customer segment for Bruker, encompassing both hospital-based facilities and independent private diagnostic labs. These entities depend on Bruker's advanced analytical instruments and solutions for critical applications such as clinical microbiology, where rapid and accurate identification of pathogens is paramount, and molecular diagnostics, which plays an increasingly vital role in disease detection and personalized medicine.

Bruker's strategic focus on this growing market is evident through significant investments and acquisitions. The acquisition of ELITechGroup in 2018, a company specializing in in-vitro diagnostics, particularly in molecular diagnostics and microbiology, significantly bolstered Bruker’s offerings in this area. Further demonstrating this commitment, Bruker invested in RECIPE GmbH, a company focused on molecular diagnostics, in recent years, underscoring their dedication to expanding capabilities in this high-demand field.

The clinical diagnostics market is characterized by a strong demand for precision, speed, and reliability. Bruker's portfolio addresses these needs through technologies that enable faster turnaround times for test results, improved accuracy in diagnoses, and the ability to detect a wider range of analytes. For instance, Bruker's mass spectrometry platforms are increasingly utilized for microbial identification and antibiotic resistance testing, offering a significant advantage over traditional methods.

- Customer Focus: Hospitals and private diagnostic laboratories performing clinical testing.

- Key Applications: Clinical microbiology, molecular diagnostics, infectious disease testing, and antibiotic susceptibility testing.

- Strategic Investments: Acquisition of ELITechGroup and investment in RECIPE GmbH highlight Bruker's commitment to this segment.

- Market Driver: Increasing demand for rapid, accurate, and comprehensive diagnostic solutions to improve patient outcomes.

Industrial and Applied Analysis Laboratories

Industrial and Applied Analysis Laboratories represent a significant customer segment for Bruker. These labs, operating across diverse sectors like chemicals, food safety, environmental testing, and forensics, rely heavily on Bruker’s advanced instrumentation for their daily operations. Their primary needs revolve around ensuring routine quality control, meticulously monitoring production processes, and conducting specialized applied analyses. For instance, in 2024, the global laboratory information management system (LIMS) market, which supports these analytical activities, was projected to reach over $1.3 billion, highlighting the scale of operations in this sector.

Customers in this segment often prioritize solutions that are not only powerful but also exceptionally robust and user-friendly. They face the challenge of performing complex analyses efficiently and reliably, often under demanding conditions. Bruker addresses these needs by providing instruments designed for longevity and ease of integration into existing workflows. The demand for high-throughput screening and automation in these labs is also a key driver, pushing for analytical tools that can deliver accurate results quickly and with minimal manual intervention.

Key characteristics of this customer segment include:

- Diverse Industry Applications: Serving sectors from petrochemicals to pharmaceuticals, requiring versatile analytical capabilities.

- Focus on Reliability and Throughput: Emphasis on instruments that provide consistent, accurate data for routine testing and process control.

- Need for Ease of Use: Preference for solutions that minimize training time and operational complexity for lab technicians.

- Regulatory Compliance: Many labs operate under strict regulatory frameworks, necessitating instruments that meet specific industry standards and validation requirements.

Bruker serves a broad customer base, including academic and government research institutions focused on fundamental scientific discovery, as well as pharmaceutical and biotechnology companies driving innovation in drug development. Materials science and nanotechnology researchers, along with those in the semiconductor industry, rely on Bruker for advanced characterization tools. Furthermore, clinical diagnostics laboratories and industrial/applied analysis labs are key segments, utilizing Bruker's solutions for accurate and efficient testing across various applications.

The company's customer segments are characterized by a need for high-performance analytical instrumentation to address complex challenges in research, development, and quality control. These customers often operate in highly regulated environments or competitive markets where precision, speed, and reliability are paramount. Bruker's strategic focus on these diverse segments is supported by ongoing investment in technology and acquisitions to meet evolving market demands.

| Customer Segment | Key Needs | Bruker's Role | 2024 Market Context |

|---|---|---|---|

| Life Science Research | Fundamental discovery, post-genomic research | Advanced instrumentation for biological and medical science | NIH research grants exceeded $35 billion in 2023 |

| Pharma & Biotech | Drug discovery, development, quality control | High-volume testing, regulatory compliance solutions | Global pharma market valued at $1.57 trillion in 2024 |

| Materials Science & Nano | Novel material characterization, nanoscale analysis | Sophisticated instruments for quality and innovation | Surging demand driven by quantum computing and batteries |

| Clinical Diagnostics | Pathogen identification, molecular diagnostics | Rapid, accurate solutions for disease detection | Acquisitions like ELITechGroup bolster offerings |

| Industrial & Applied Analysis | Quality control, process monitoring, safety testing | Robust, user-friendly instruments for routine analysis | LIMS market projected over $1.3 billion in 2024 |

Cost Structure

Bruker allocates a substantial portion of its financial resources to research and development, a key driver for its innovation pipeline. In 2023, the company reported R&D expenses of $592.9 million, representing approximately 11.7% of its total revenue.

This significant investment fuels the creation of groundbreaking scientific instruments, enhances existing technologies, and drives software advancements. Such commitment is vital for Bruker to sustain its competitive advantage and leadership position within the scientific instrumentation market.

Bruker's manufacturing and production costs are significant, driven by the high-precision nature of its scientific instruments. These expenses encompass the procurement of specialized raw materials, intricate components, skilled labor for assembly, and the overheads associated with maintaining advanced production facilities. The inherent complexity and unique engineering required for their product lines directly translate into higher manufacturing outlays.

Bruker's Sales, General, and Administrative (SG&A) expenses encompass the costs of its worldwide sales force, marketing initiatives, and essential administrative operations. These expenditures are critical for market penetration and maintaining a robust corporate infrastructure.

In 2023, Bruker reported SG&A expenses of approximately $1.2 billion. The company has been actively implementing cost-saving measures within these departments to enhance profitability and operational efficiency.

Acquisition-Related Costs and Integration Expenses

Bruker's growth strategy heavily relies on acquiring other companies, which means they face substantial costs. These aren't just the price of the company itself, but also the expenses involved in making the deal happen and then merging the new business into Bruker's existing structure. These acquisition-related costs and integration expenses can definitely put a dent in their profits in the short term.

For instance, in 2024, Bruker continued its strategic acquisition path. While specific figures for 2024 integration costs aren't fully detailed publicly yet, the company's history shows these expenses are a significant factor. In 2023, for example, Bruker reported approximately $77 million in acquisition-related and integration costs, impacting their operating income. This trend is expected to continue as they pursue their inorganic growth objectives.

- Deal Sourcing and Due Diligence: Costs associated with identifying potential acquisition targets, conducting thorough financial and operational reviews, and legal preparations.

- Transaction Fees: Expenses like investment banking fees, legal counsel, accounting services, and regulatory filings necessary to close an acquisition.

- Integration Planning and Execution: Costs related to merging IT systems, consolidating operations, harmonizing employee benefits, rebranding, and restructuring to achieve synergies.

- Potential Restructuring Charges: Expenses incurred from workforce reductions, facility consolidations, or write-downs of assets from acquired entities as part of the integration process.

Personnel Salaries and Benefits

Bruker's commitment to innovation and product development hinges on its highly skilled workforce. Consequently, personnel salaries, comprehensive benefits packages, and ongoing training programs constitute a significant portion of its cost structure. Attracting and retaining top-tier scientific and engineering talent is paramount for maintaining its competitive edge.

For instance, in 2023, Bruker reported research and development expenses of $748.9 million, a substantial investment directly tied to its specialized personnel. This figure underscores the critical role human capital plays in driving the company's technological advancements and product pipeline.

- Salaries and Wages: Reflecting the expertise of its scientific and engineering teams.

- Employee Benefits: Including health insurance, retirement plans, and other compensation.

- Training and Development: Essential for keeping staff abreast of cutting-edge technologies.

- Recruitment Costs: Necessary for securing specialized talent in a competitive market.

Bruker's cost structure is heavily influenced by its significant investment in research and development, aiming to maintain its technological leadership. In 2023, R&D expenses reached $748.9 million, highlighting the importance of innovation. Furthermore, personnel costs, including salaries and benefits for its highly skilled scientific and engineering workforce, represent a substantial outlay, crucial for attracting and retaining top talent.

| Cost Category | 2023 Data (Millions USD) | Significance |

|---|---|---|

| Research & Development (R&D) | $748.9 | Drives innovation and technological advancement. |

| Sales, General & Administrative (SG&A) | ~$1,200 | Supports market reach and corporate operations. |

| Acquisition & Integration Costs | ~$77 | Facilitates inorganic growth strategy. |

| Personnel Costs (tied to R&D) | Included in R&D figure | Essential for expertise and talent retention. |

Revenue Streams

Bruker's main income comes from selling its advanced scientific instruments, like NMR machines, mass spectrometers, and X-ray systems. These are the big-ticket items that customers buy to equip their labs. For instance, in 2023, Bruker reported that its life science and diagnostics segment, which heavily features instrument sales, generated a significant portion of its revenue.

Bruker generates significant revenue from service contracts and aftermarket support, offering comprehensive agreements for maintenance and technical assistance throughout an instrument's life. These recurring revenue streams are crucial for ensuring customers' instruments perform optimally and remain operational.

For the full year 2023, Bruker reported that its Services segment, which includes these offerings, generated approximately $1.1 billion in revenue. This highlights the substantial contribution of these ongoing customer relationships to the company's overall financial health and stability.

Bruker generates revenue through the sale of proprietary software licenses, covering areas like advanced analytical tools and automation platforms. These software sales are crucial for their business, especially as laboratories continue to embrace digital transformation.

Regular software upgrades also form a significant revenue stream, ensuring customers have access to the latest features and performance enhancements. This recurring revenue model supports Bruker's ongoing research and development efforts.

In 2023, Bruker reported that its Life Science division, which heavily relies on software-driven solutions, saw robust growth, underscoring the increasing importance of this revenue stream in their overall financial performance.

Consumables and Spare Parts

Bruker's revenue model includes a significant component from consumables and spare parts. These are essential items required for the ongoing operation and maintenance of their sophisticated scientific instruments, ensuring continued performance and accuracy for their customers.

This stream is vital as it provides recurring revenue and fosters customer loyalty by embedding Bruker's products within their daily workflows. For instance, in 2023, Bruker reported that its Life Science segment, which heavily relies on consumables, saw strong performance, contributing to the company's overall growth.

- Consumables: Specialized reagents, sample preparation kits, and other disposable items crucial for instrument functionality.

- Spare Parts: Replacement components necessary for maintaining and repairing Bruker's analytical and diagnostic instruments.

- Recurring Revenue: This segment generates predictable income, supporting consistent business operations and investment in innovation.

- Customer Retention: The need for proprietary consumables and parts encourages long-term relationships with Bruker's client base.

Training and Application Support Services

Bruker generates revenue through specialized training programs and workshops designed to enhance customer proficiency with their advanced instrumentation. These educational offerings are crucial for users to unlock the full scientific potential of their investments.

Beyond initial training, Bruker provides ongoing advanced application support services. This ensures customers can effectively leverage complex analytical techniques and optimize their experimental workflows, thereby maximizing the return on their instrument purchase.

- Training Fees: Revenue from structured courses and certification programs.

- Workshop Revenue: Income generated from specialized, often hands-on, learning sessions.

- Application Support Contracts: Recurring fees for expert assistance with specific scientific challenges.

- Customer Success: These services directly contribute to customer satisfaction and long-term instrument utilization.

Bruker's revenue streams are diverse, encompassing instrument sales, crucial service and support contracts, proprietary software licenses, essential consumables and spare parts, and specialized training programs. These multiple avenues ensure consistent income and foster strong customer relationships.

| Revenue Stream | Description | 2023 Contribution (Approx.) |

|---|---|---|

| Instrument Sales | High-value scientific instruments (NMR, Mass Spectrometry, etc.) | Majority of total revenue |

| Services & Support | Maintenance, technical assistance, and service contracts | $1.1 billion |

| Software Licenses & Upgrades | Analytical software, automation platforms, and updates | Significant and growing |

| Consumables & Spare Parts | Reagents, sample kits, and replacement components | Drives recurring revenue and customer retention |

| Training & Application Support | Customer proficiency enhancement and specialized scientific assistance | Supports instrument utilization and customer success |

Business Model Canvas Data Sources

The Bruker Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research reports, and strategic insights derived from industry analysis. These diverse data sources ensure each component of the canvas is grounded in verified information, reflecting Bruker's operational realities and market positioning.